TIDMLDG

RNS Number : 3943H

Logistics Development Group PLC

06 April 2022

6 April 2022

Logistics Development Group plc

("LDG" or the "Company")

Final Results for year ended 30 November 2021

Logistics Development Group plc, the AIM listed investing

company, announces its audited final results for the year ended 30

November 2021.

Full Year 2021 Results Summary

-- It was an exciting year for the Company, which culminated in

the successful disposal of Marcelos' investment in GreenWhiteStar

Acquisitions Limited ("GWSA") and its subsidiaries Eddie Stobart,

The Pallet Network, iForce, Eddie Stobart Europe and The Logistics

People (together the "Eddie Stobart Businesses") to Culina Group

Limited, one of the UK's leading logistics companies, which is

owned by the German Müller family.

-- The Company had a cash balance of GBP131.9m at the end of the

year, following the disposal of the Company's 49% shareholding in

GWSA and the GBP6.0m PIK Loan note held by the Company which

generated a cash inflow of GBP125.2m.

-- The Company reported strong results for the year ended

November 2021, with an underlying EBIT(1) of GBP84.6m (2020: loss

of GBP11.3m) before exceptional income of GBP0.1m (2020:

exceptional income of GBP3.4m) and a profit before tax of GBP84.7m

(2020: loss before tax of GBP7.9m).

-- The Company now has no financial debt and a cash balance of

GBP131.9m or approximately GBP0.19 per ordinary share.

-- The proceeds from the disposal will be used twofold. Most of

the funds will be deployed in investments identified by our

investment manager, DBAY. As you might be aware, post period end

during a general meeting held on 31 January 2022, shareholders

approved a broadening of the investing policy. This will allow DBAY

to invest in opportunities outside the logistics sector, broadening

the opportunity set available to LDG. On 10 March 2022, the Company

announced its first investment under the new investing policy, as

amended after the General Meeting held on 31 January 2022 (the

"General Meeting"), investing GBP6.3m in Caretech Holdings PLC for

approximately 0.88% of Caretech's issued share capital. On 1 April

2022, the Company announced that it had acquired further shares in

Caretech Holdings Plc for a further consideration of GBP6.8m. As a

result the Company now owns 1.74% of Caretech's issued share

capital.

-- Secondly, since LDG's share price has consistently been

trading at a discount to the Company's cash per share, the Board

decided to initiate a share buyback program to narrow the discount

over time. This has also been approved by shareholders at the

General Meeting and the Company has since commenced the buyback

programme which should allow the Company to narrow the discount to

net asset value at which LDG's ordinary shares currently trade.

(1) Underlying EBIT is an alternative performance measure (see

Note 3) and is defined as profit/loss before interest and tax

adding back exceptional items.

A copy of the full year results are also available to be viewed

on, or downloaded from, the Company's corporate website at

www.ldgplc.com

For enquiries:

Logistics Development Group Via FTI Consulting

plc

FTI Consulting

Nick Hasell

Alex Le May

Cally Billimore +44 (0) 20 3727 1340

Strand Hanson Limited

(Financial and Nominated Adviser)

James Spinney

James Dance

Abigail Wennington +44 (0) 20 7409 3494

Investec Bank plc

(Broker)

Gary Clarence

Harry Hargreaves +44 (0) 20 7597 5970

Letter from Chairman

Dear Shareholders

I am pleased to present the annual report and the audited

financial statements for Logistics Development Group plc ("LDG",

"the Company") for the year ended 30 November 2021.

It was an exciting year for the Company, which culminated in the

successful disposal of Marcelos's investment in GreenWhiteStar

Acquisitions Limited ("GWSA") and its subsidiaries Eddie Stobart,

The Pallet Network, iForce, Eddie Stobart Europe and The Logistics

People (together the "Eddie Stobart Businesses") to Culina Group

Limited, one of the UK's leading logistics companies, which is

owned by the German Müller family.

During the 17 months period under the control of DBAY Advisors

Limited ("DBAY"), our investment manager, GWSA's profitability was

increased from an EBITDA (pre IFRS 16) of GBP4.2m in 2019 to

GBP47.8m by the end of the 2020 financial year, while net financial

debt had been reduced from GBP221.7m to GBP144.5m. On the back of

this outstanding performance, the disposal of our 49% shareholding

in GWSA and the GBP6.0m PIK Loan note held by LDG generated a cash

inflow of GBP125.2m, meaning the Company had a cash balance of

GBP131.9m or approximately GBP0.19 per share at the year end. LDG's

share price was GBP0.06 at the time when DBAY took control of GWSA,

implying a money multiple of approximately 3x over the 17 month

period during which DBAY controlled GWSA and its subsidiaries.

I believe DBAY have found a good home for the Eddie Stobart

Businesses in Culina Group. Culina's management has a deep

understanding of the UK transport and logistics landscape, as well

as the financial resources to allow the Eddie Stobart Businesses to

continue its long-standing successful heritage.

Driven by the disposal of GWSA, your Company reported strong

results for the year ended November 2021, with an underlying

EBIT(1) of GBP84.6m (2020: loss of GBP11.3m) before exceptional

income of GBP0.1m (2020: exceptional income of GBP3.4m) and a

profit before tax of GBP84.7m (2020: loss before tax of

GBP7.9m).

Including income received from additional deferred consideration

from the GWSA disposal, the Company now has no financial debt and a

cash balance of GBP131.9m or approximately GBP0.19 per ordinary

share. These results are discussed in detail in the Business and

Financial Review and in the notes to the financial statements.

The proceeds from the disposal will be used twofold. Most of the

funds will be deployed in investments identified by our investment

manager, DBAY. As you might be aware, post period end during a

general meeting held on 31 January 2022, shareholders approved a

broadening of the investing policy. This will allow DBAY to invest

in opportunities outside the logistics sector, broadening the

opportunity set available to LDG. On 10 March 2022, the Company

announced its first investment under the new investing policy, as

amended after the General Meeting held on 31 January 2022 (the

"General Meeting"), investing GBP6.3m in Caretech Holdings PLC for

approximately 0.88% of Caretech's issued share capital. On 1 April

2022, the Company announced that it had acquired further shares in

Caretech Holdings Plc for a further consideration of GBP6.8m. As a

result the Company now owns 1.74% of Caretech's issued share

capital.

Secondly, since LDG's share price has consistently been trading

at a discount to the Company's cash per share, the Board decided to

initiate a share buyback program to narrow the discount over time.

This has also been approved by shareholders at the General Meeting

and the Company has since commenced the buyback programme which

should allow the Company to narrow the discount to net asset value

at which LDG's ordinary shares currently trade.

Over the last year, we had the opportunity to welcome two new

Directors to the Board of LDG. Peter Nixon is an experienced

chartered accountant and was appointed to the Board from 9 December

2021, replacing Saki Riffner. David Facey, also an experienced

chartered accountant and CFO of AIM-listed companies operating

within the financial sector, was appointed to the Board and as

chair of the Audit Committee from 1 April 2021.

The Company is now in the fortunate position that it has only

made a small acquisition and as such has a clean canvas to work

with and a broader investing policy. I have every confidence that

DBAY as our investment manager will make good use of the funds to

invest in companies which will reward all shareholders. In the 50

years I have been following stock markets I have never encountered

such an extraordinary set of circumstances which the world now

faces. The tragic events in the Ukraine, which are unfolding before

our very eyes need little embellishment from me, excepting that I

would never have thought I would be part of the pre-war generation!

Following on from the well documented dysfunctional damage that the

COVID outbreak has caused to the world, it has been a very grim

start to the 21(st) century, but let us hope that we can move into

sunnier times sometime soon.

Finally, I would like to thank shareholders, old and new, for

their continued support.

Adrian Collins

Chairman

(1) Underlying EBIT is an alternative performance measure (see

Note 3) and is defined as profit/loss before interest and tax

adding back exceptional items.

Business and financial review for the year ended 30 November

2021

Review of the year

Transition to AIM Investing Company, appointment of DBAY as

investment manager, and fund-raising

On 31 December 2020, following a successful fund-raising through

a subscription, placing and open offer generating GBP16.2m (net

GBP14.5m), the Company's shares were re-admitted to trading on AIM,

completing its transition to an AIM-listed Investing Company.

Initially, the investing policy was focused on the logistics sector

and DBAY was appointed as the Company's investment manager.

DBAY is an asset management firm with offices in London and the

Isle of Man. Its core team has been working together for over 20

years and combines a diversified set of skills from financial and

operational backgrounds, with deep insight into a number of

industry sectors. The team worked together on their first

investment vehicle in 2008, and formed DBAY in 2011. Additional

information on DBAY is set out on page 6 of this report.

New investments during the period

Following the fund-raising, in May 2021, LDG, under the guidance

of our investment manager DBAY, invested GBP6.0m to acquire an

indirect 10.9% equity interest in an 18% PIK Loan note with

indirect exposure to the performance of GWSA and its subsidiaries.

This principal plus accrued interest was repaid upon the disposal

of GWSA on 1 July 2021.

Turnaround and disposal of GWSA

On 30 March 2021, GWSA advised LDG of its audited consolidated

results for the year ended 30 November 2020. After a year under the

control of DBAY, GWSA and the Eddie Stobart Businesses had

delivered a strong turnaround, with EBITDA (excluding the impact of

IFRS 16), increasing to GBP47.8m vs. GBP4.2m in the prior year. In

addition, the net financial debt of GWSA reduced by GBP77m to

GBP145m in the period, deleveraging substantially and putting the

Eddie Stobart Businesses back on a sustainable funding

structure.

The turnaround was achieved with DBAY's active operational

involvement and included a significant number of value creation

activities.

GWSA's performance confirms our belief that DBAY was best placed

to transform and turnaround the Eddie Stobart Businesses after a

difficult period, and we expect similarly successful value creation

initiatives in future investments DBAY will enter into on behalf of

LDG.

The sale of GWSA, including Eddie Stobart Businesses, to Culina

Group Limited was announced and completed on 1 July 2021. From the

combination of LDG's 49% indirect interest in GWSA and the PIK Loan

note, the transaction generated a cash inflow of GBP125.2m for LDG,

leaving the Company debt free and with a cash balance of

approximately GBP0.19 per share. The implied money multiple over

the 17 months holding period is approximately 3x compared to the

share price of GBP0.06 in December 2019, the time when LDG sold

it's 51% controlling stake in GWSA and the Eddie Stobart Businesses

to DBAY.

Changes to the Board

Peter Nixon, an experienced chartered accountant, was appointed

to the Board from 9 December 2021, replacing Saki Riffner. David

Facey, also an experienced chartered accountant and CFO of

AIM-listed financial sector companies, was appointed to the Board

and as chair of the Audit Committee from 1 April 2021.

Subsequent events - New investment policy and agreement, share

buyback and cancellation of share premium account

Following the disposal of GWSA, the Board, in conjunction with

DBAY, have reviewed a number of investment opportunities and we

have come to the conclusion that there are more attractive

opportunities to create shareholder value outside of the logistics

focused investing policy adopted in December 2020.

Accordingly, after seeking shareholder approval at the General

Meeting held on 31 January 2022, shareholders have agreed to a new

and wider investing policy. The revised investing policy provides

for investments primarily in undervalued companies. Further details

are set out on page 6 and 7 of the Annual Report and Accounts.

At the same meeting, the Board received approval from

shareholders to implement a share buyback programme. As the

Company's shares have been trading at a significantly discounted

level to the amount of available cash per Ordinary Share, the

Company has obtained shareholder approval to acquire up to 20% of

the issued share capital as at the date of the General Meeting.

This should result in the reduction of the observed discount to net

asset value per Ordinary Share and provide an exit opportunity for

shareholders who do not wish to retain their investment in the

Company. The Company received approval from the High Court of

England and Wales to proceed with a Capital Reduction and create

distributable reserves on 22 February 2022, which will also create

flexibility to make future distributions.

Financial performance

The results for the current year reflect the group structure as

at 30 November 2021. As the Company does not have any majority

owned or controlled subsidiaries at the reporting date, there is no

requirement for consolidation and the audited financial statements

in this report reflect the standalone results of the Company for

the current and comparative periods.

The Company still has an exposure to the intermediate holding

companies which held the GWSA investments, and expects further

potential cash inflows from the final purchase price adjustments

for up to 24 months post closing of the GWSA disposal transaction.

LDG measures these investments at fair value through the profit and

loss account. The election is taken based on the investment being a

'venture capital' investment under IAS 28 'Investments in

Associates and Joint Ventures'.

At the reporting date the fair value ascribed to the investments

is GBP2.2m (2020: GBP35.8m) which reflects the current value at the

reporting date in respect of guaranteed expected future cash flows

(2020: valuation basis reflected the value of the investment in

GWSA based on the market capitalisation of the Company). The

Directors have reviewed this valuation approach and consider it to

be appropriate.

Administrative expenses before exceptional items are

significantly lower in the reporting year at GBP1.1m (2020:

GBP2.2m) as the Company no longer incurs any share-based payment

charges, has lower insurance costs, lower audit fees and general

expenses.

The Company's underlying EBIT(1) in the year was a profit of

GBP84.6m (2020: loss of GBP11.3m) before exceptional income of

GBP0.1m (2020: exceptional income of GBP3.4m) and statutory profit

before tax was GBP84.7m (2020: loss before tax of GBP7.9m). The

exceptional income of GBP0.1m during the year comprised of a refund

of VAT in relation to historic transaction costs relating to the

2019 GWSA disposal. During the prior year, the Company recognised

an exceptional income of GBP3.4m comprising a refund of transaction

costs of GBP2.8m associated with the disposal of GWSA and

2019-related audit fees of GBP0.6m. The costs were ultimately borne

by GWSA.

Net debt

As at the reporting date, the Company has cash and cash

equivalents of GBP131.9m (2020: GBP0.7m) principally resulting from

the disposal of GWSA, with the remainder from an equity fund

raising in December 2020, where the Company successfully raised

GBP16.2m in aggregate (pre fundraise costs of GBP1.5m). The fund

raise enabled the Company to satisfy the requirements for

re-admission to AIM as an Investing Company. Related party

borrowings amounted to GBPNil (2020: GBP1.2m).

Exceptional items

During the year, the Company recognised exceptional income in

relation to a VAT refund of GBP0.1m associated with the disposal of

GWSA.

During the prior year, the Company recognised income in relation

to a refund of transaction costs of GBP2.8m associated with the

disposal of GWSA and 2019-related audit fees of GBP0.6m. These

costs were ultimately borne by GWSA in accordance with the DBAY

transaction arrangements.

Further details of exceptional costs are included in note 5.

Tax

For the years ended 30 November 2021 and 2020, the Company

incurred tax losses. The deferred tax asset of GBP0.3m (2020:

GBP0.2m) was not recognised as the Directors do not consider that

there is sufficient certainty over its recovery. The unrecognised

asset can be carried forward indefinitely.

Dividends

The Company did not pay an interim dividend (2020: GBPNil) and

no final dividend is being recommended (2020: GBPNil).

Earnings per share

Underlying basic and diluted earnings per share are both 12.0p

(2020: underlying basic and diluted loss per share were both 3.0p).

Statutory basic and diluted earnings per share are both 12.1p

(2020: statutory basic and diluted loss per share were both 2.1p).

See note 3 and 9 to the Financial Statements.

Information about the Investment Manager

DBAY is an Isle of Man-based asset management firm with offices

in London and Douglas, Isle of Man. Founded in 2011, DBAY is owned

by its partners and is licensed by the Isle of Man Financial

Services Authority. The firm follows a value investing approach and

invests in listed equities across Europe, as well as in private

equity style control investments. The core DBAY team, which have

worked together for 20 years, have developed a diversified set of

skills from financial and operational backgrounds, with deep

insight into a number of industry sectors. DBAY comprises a team of

12 investment and operating professionals. Capital is managed on

behalf of institutional investors, trusts, foundations, family

offices and pension funds.

DBAY currently has a controlling interest in companies that have

a combined turnover in excess of GBP810 million and employ more

than 7,000 staff. The DBAY team previously worked at Laxey

Partners, a hedge fund, where they managed an investment portfolio,

and at DouglasBay Capital plc, an AIM listed investment company. In

2008, under the DBAY team's management, DouglasBay Capital plc took

private and successfully restructured TDG, the logistics company.

During this period (2006 - 2011), the DBAY team generated returns

including a gross money multiple ("MM") of 2.7x and a gross

internal rate of return ("IRR") of 36%. In 2015, DBAY raised DBAY

Fund II, which is currently performing with a gross MM of 1.9x and

14% gross IRR on a stand-alone basis as at 30 September 2021 (and

an estimated gross MM of 3.2x and 44% gross IRR if the cash returns

to co-investors are included). In 2019, DBAY raised DBAY Fund III,

which is currently valued at a gross MM of 2.0x and 48% gross IRR

on a standalone basis as at 30 September 2021.

Investment Policy and Strategy

The investment objective of the Company is to provide

shareholders with attractive total return achieved through capital

appreciation and, when prudent, shareholder distributions or

dividends. The Directors believe that opportunities exist to create

significant value for shareholders through the acquisition of, and

the implementation of substantial operational improvements in,

businesses in the sectors outlined in the Company's Investing

Policy.

The new investing policy can be found on the website www.ldgplc

.com .

DBAY is tasked with full authority to manage the Company's

assets to deliver the investment strategy set out below in

accordance with its investing policy, reporting to the Board on a

regular basis.

The Investing Policy, approved by shareholders on 31 January

2022, states that the Company will seek to achieve its investment

objectives by making investments within the following

parameters:

-- Characteristics : investment primarily in undervalued

companies, with a focus on companies that generate or have the

potential to generate significant cash flows, where there is a high

degree of revenue visibility and a strong and distinctive market

position;

-- Investment Type : investment in equity and equity related

products, in both quoted and unquoted companies, and in the DBAY

Investment Funds;

-- Sectors : a broader range of sectors, such as business

services including, amongst others, logistics, distribution,

technology services, security and manufacturing, or in funds

managed by DBAY which invest in the aforementioned sectors;

-- Geography : there is no geographical restriction but expected

to be primarily within the United Kingdom or the European

Union;

-- Ownership : will range from a minority position to 100%, non-operating ownership; and

-- Restrictions : a maximum of 50% of the Company's Net Asset

Value ("NAV") at the time the relevant investment is made, using

the latest available management accounts of the Company, can be

invested in DBAY Investment Funds. Investments made outside of the

DBAY Investment Funds will be limited to 10% of NAV per investment

(on the same basis), unless approved by the Board.

In addition, DBAY has agreed that it will fund the Company's

reasonable corporate costs going forward.

Investment Management agreement amendments

The original investment management agreement was approved by

shareholders on 29 December 2020, in order to effect the revised

investment policy several changes were made to the investment

management agreement being:

-- DBAY will not receive management or performance fees from LDG

in respect of funds committed to the DBAY Investment Funds by the

Company. Fees will only be charged by the fund, to ensure there

will be no double charging;

-- DBAY have made a commitment to ensure that any DBAY

Investment Funds in which the Company invests will retain

investment policies that are substantially the same as the new

investing policy of the Company;

-- DBAY has made a commitment that it will provide the Company

with an amount which is equal to the Company's reasonable corporate

expenses in the given year, provided that such amount shall not

exceed the lower of: (i) GBP800,000: or (ii) the management fees in

respect of investments made and/or amounts committed by the Company

which are received by DBAY in the relevant year; and

-- DBAY will ensure that there is at all times a contingency

amount of at least GBP2 million on the Company's balance sheet to

cover any exceptional expenses that may arise in the future.

Annual general meeting

The Company intends to hold its Annual General Meeting on 12 May

2022 in London. Further details will be set out in the Notice of

Meeting to be sent to shareholders in due course and published on

our website www.ldgplc.com.

(1) Underlying EBIT is an alternative performance measure (see

Note 3) and is defined as profit/loss before interest and tax

adding back exceptional items.

Company Statement of Comprehensive Income

for the year ended 30 November 2021

Year ended Year ended

30 November 30 November

2021 2020

Note GBP'000 GBP'000

--------------------------------------------- ----- ------------- -------------

Gain/(loss) on investments measured

at fair value through profit or loss

- net 10 85,665 (9,152)

Administrative expenses: before exceptional

items (1,100) (2,162)

Administrative expenses: exceptional

items 5 90 3,415

--------------------------------------------- ----- ------------- -------------

Total administrative expenses (1,010) 1,253

Profit/(loss) before tax 84,655 (7,899)

--------------------------------------------- ----- ------------- -------------

Income tax charge 7 - -

Profit/(loss) and total comprehensive

income/(expense) for the year 84,655 (7,899)

----- ------------- -------------

Earnings/(loss) per share

Basic 9 12.1p (2.1p)

Diluted 9 12.1p (2.1p)

--------------------------------------------- ----- ------------- -------------

The accompanying notes form part of the financial

statements.

Company Statement of Financial Position

as at 30 November 2021

30 November 30 November

2021 2020

Note GBP'000 GBP'000

------------------------------------------ ----- -------------- --------------

Assets

Non-current assets

Investments at fair value through profit

or loss 10 2,218 35,848

2,218 35,848

------------------------------------------ ----- -------------- --------------

Current assets

Other receivables 11 114 28

Cash and cash equivalents 11 131,902 652

------------------------------------------ ----- -------------- --------------

132,016 680

------------------------------------------ ----- -------------- --------------

Total assets 134,234 36,528

------------------------------------------ ----- -------------- --------------

Current liabilities

Amounts owed to related undertakings 11 - (1,235)

Other payables 11 (290) (2,184)

------------------------------------------ ----- -------------- --------------

(290) (3,419)

------------------------------------------ ----- -------------- --------------

Total liabilities (290) (3,419)

------------------------------------------ ----- -------------- --------------

Net assets 133,944 33,109

------------------------------------------ ----- -------------- --------------

Equity

Called up share capital 12 7,022 3,793

Share premium account 12 157,476 146,002

Own treasury shares 12 (857) (2,611)

Retained earnings 12 (29,697) (114,075)

------------------------------------------ ----- -------------- --------------

Total shareholders' funds 133,944 33,109

------------------------------------------ ----- -------------- --------------

The accompanying notes form part of the financial

statements.

The Company Financial Statements on pages 27 to 44 were approved

by the Board of Directors on 5 April 2022 and were signed on its

behalf by:

Adrian Collins

Director

Company number 08922456

Company Statement of Changes in Equity

for the year ended 30 November 2021

Share

Share Share Merger options Own treasury Retained

capital premium reserve reserves shares earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- --------- ---------- ------------- ---------- --------

Balance at 1 December

2019 3,793 146,002 7,950 4,218 (2,700) (117,269) 41,994

------------------------- --------- --------- --------- ---------- ------------- ---------- --------

Loss for the year - - - - - (7,899) (7,899)

Share based payment

charges - - - 491 - - 491

Transfer of shares from

the trust - - - - 89 (89) -

Transfers - - (7,950) (4,709) - 12,659 -

Fund raise costs (note

12) - - - - - (1,477) (1,477)

Balance at 30 November

2020 3,793 146,002 - - (2,611) (114,075) 33,109

------------------------- --------- --------- --------- ---------- ------------- ---------- --------

Profit for the year - - - - - 84,655 84,655

Issue of share capital 3,229 12,951 - - - - 16,180

Transfers - fund raise

costs 2020 (note 12) - (1,477) - - - 1,477 -

Transfers (note 12) - - - - 1,754 (1,754) -

Balance at 30 November

2021 7,022 157,476 - - (857) (29,697) 133,944

------------------------- --------- --------- --------- ---------- ------------- ---------- --------

The accompanying notes form part of the financial

statements.

Company Cash Flow Statement

for the year ended 30 November 2021

Year ended Year ended

30 November 30 November

2021 2020

Note GBP'000 GBP'000

------------------------------------------- ----- ------------- -------------

Cash flows from operating activities

Profit/(loss) for the year 84,655 (7,899)

Adjustments for:

Equity settled share-based payment

expenses 12 - 491

(Gain)/loss on investments measured

at fair value through profit or

loss - net 10 (85,665) 9,152

Changes in:

Increase in Other receivables 11 (86) 53,492

Decrease in Other payables 11 (1,652) (54,838)

Net cash (outflow)/inflow from operating

activities (2,748) 398

------------------------------------------- ----- ------------- -------------

Cash flows from investing activities

Dividends received 10 125,295 -

Purchase of investment 10 (6,000) -

------------------------------------------- ----- ------------- -------------

Net cash inflow/(outflow) from investing

activities 119,295 -

------------------------------------------- ----- ------------- -------------

Cash flows from financing activities

Issuing share capital and share

premium 12 16,180 -

Share issue costs paid 12 (1,477) (108)

Net cash inflow/(outflow) from financing

activities 14,703 (108)

------------------------------------------- ----- ------------- -------------

Net increase in cash and cash equivalents 131,250 290

Cash and cash equivalents at the

start of the financial year 652 362

Cash and cash equivalents at the

end of the financial year 131,902 652

------------------------------------------- ----- ------------- -------------

The accompanying notes form part of the financial

statements.

Notes to the Company Financial Statements

for the year ended 30 November 2021

1. Basis of accounting

Logistics Development Group plc (the "Company") is a public

company limited by shares and incorporated and domiciled in

England, United Kingdom. Its registered address is 4th Floor, 3

More London Riverside, London, SE1 2AQ.

Basis of preparation

The Financial Statements were prepared in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006 ("IFRS").

The Financial Statements are presented in pounds sterling,

rounded to the nearest thousand, unless otherwise stated.

As at 30 November 2021, the Company has no subsidiaries and, as

such, no consolidated financial statements have been presented. The

Financial Statements therefore present Company only information for

the current and comparative periods.

The Financial Statements were prepared under the historical cost

convention, except for financial assets recognised at fair value

through profit or loss, which have been measured at fair value. The

Company is not registered for VAT and therefore all expenses are

recorded inclusive of VAT.

Significant holdings in undertakings other than subsidiary

undertakings

As at 30 November 2021 the Company had a significant holding in

Marcelos Limited ("Marcelos"), incorporated in the Isle of Man.

Marcelos has 100 GBP1 ordinary shares in issue, of which the

Company held 49 shares. Its registered address is First Names

House, Victoria Road, Douglas, Isle of Man IM2 4DF.

Going concern

The Directors have a reasonable expectation that the Company has

sufficient resources to continue in operation for the foreseeable

future, a period of at least 12 months from the date of this

report. The Directors have prepared a cash flow forecast for a

period of 3 years which indicates that available funds

significantly exceed anticipated expenditure. Consequently, the

Directors of the Company continue to adopt the going concern basis

of accounting in preparing the annual financial statements.

2. Significant accounting policies

(a) Investments in associates - associates are all entities over

which the Company has significant influence but not control or

joint control. Investments in associates are initially recognised

at fair value and subsequently measured at fair value through

profit or loss.

(b) Fair value measurement - the fair value measurement of the

Company's investments utilises market observable inputs and data as

far as possible. Inputs used in determining fair value measurements

are categorised into different levels based on how observable the

inputs used in the valuation technique utilised are (the 'fair

value hierarchy'):

- Level 1: Quoted prices in active markets for identical items

(unadjusted);

- Level 2: Observable direct or indirect inputs other than Level

1 inputs;

- Level 3: Unobservable inputs (i.e. not derived from market

data and may include using multiples of trading results or

information from recent transactions).

The classification of an item into the above levels is based on

the lowest level of the inputs used that has a significant effect

on the fair value measurement of the item. Transfers of items

between levels are recognised in the period they occur.

(c) Financial instruments

- Financial assets - other receivables and amounts owed to

related undertakings. Such assets are recognised initially at fair

value plus any directly attributable transaction costs. Subsequent

to initial recognition, such assets are measured at amortised cost

using the effective interest method, less any impairment

losses.

- Cash and cash equivalents - in the Statement of Financial

Position, cash includes cash and cash equivalents excluding bank

overdrafts. No expected credit loss provision is held against cash

and cash equivalents as the expected credit loss is negligible.

- Financial liabilities - other payables and amounts owed to

related undertakings. Such liabilities are initially recognised on

the date that the Company becomes party to contractual provisions

of the instrument. The Company derecognises a financial liability

when its contractual obligations are discharged, cancelled or

expire. Such financial liabilities are recognised initially at fair

value less any directly attributable transaction costs. Subsequent

to initial recognition, these financial liabilities are measured at

amortised cost using the effective interest method.

- Share capital - Ordinary shares are classified as equity.

Incremental costs directly attributable to the issue of ordinary

shares are recognised as a deduction from equity, net of any tax

effects.

(d) Exceptional items - items that are material in size or

nature and non-recurring are presented as exceptional items in the

Statement of Comprehensive Income. The Directors are of the opinion

that the separate recording of exceptional items provides helpful

information about the Company's underlying business performance.

Events which may give rise to the classification of items as

exceptional include restructuring of business units and the

associated legal and employee costs, costs associated with business

acquisitions, impairments and other significant gains or

losses.

(e) Alternative performance measures (APMs) - APMs, such as

underlying results, are used in the day-to-day management of the

Company, and represent statutory measures adjusted for items which,

in the Directors' view, could influence the understanding of

comparability and performance of the Company year on year. These

items include non-recurring exceptional items and other material

unusual items.

(f) Tax - tax expense comprises current and deferred tax.

Current tax and deferred tax are recognised in profit or loss

except to the extent that it relates to items recognised directly

in equity or in other comprehensive income. Deferred tax assets are

recognised only to the extent that it is probable that future

taxable profit will be available against which the temporary

differences can be utilised.

(g) Operating segments - the Company has a single operating

segment on a continuing basis, namely investment in a portfolio of

assets.

(h) Fund raise costs - transaction costs incurred in

anticipation of an issuance of equity instruments are recorded as a

deduction from the retained earnings reserve in accordance with IAS

32 and the Companies Act 2006.

(i) Own shares reserve - transfer of shares from the trust to

employees is treated as a realised loss and recognised as a

deduction from the retained earnings reserve.

New and amended standards adopted by the Company

There are no IFRS standards or IFRIC interpretations that are

mandatory for the year ended 30 November 2021 that have a material

impact on the financial statements of the Company.

Critical judgements in applying the Company's accounting

policies

In applying the Company's accounting policies, the Directors

have made the following judgements that have the most significant

effect on the amounts recognised in the financial statements (apart

from those involving estimations, which are dealt with below) and

have been identified as being particularly complex or involve

subjective assessments.

(i) Measurement of the investments - during the prior year, the

Company elected to measure its investment in Marcelos, the

intermediate holding company of the GWSA Group, at fair value

through profit and loss. The election is taken on the basis of the

investment being a 'venture capital' investment under IAS 28

'Investments in Associates and Joint Ventures'.

The strategy of the Company as an Investing Company is to

generate value though holding investments for the short to medium

term. Therefore, the Directors believe that the fair value method

of accounting for the investments is in line with the strategy of

the Company.

Had the election not been made, the investment in Marcelos would

have been subject to equity accounting that involves recognition of

the investment at cost and subsequent measurement at cost plus a

share of profits and losses of the GWSA Group, less dividends

received.

(ii) Fair value of the investments - the Directors have recorded

the investment in Marcelos at fair value. The fair value at the

period end was calculated on the basis of the net assets of

Marcelos, and represents the guaranteed expected future cashflows

relevant to the Company. The fair value at the prior period end was

calculated on the basis of the market capitalisation of the

Company, which was considered to be the most suitable valuation

methodology as at 30 November 2020. The Directors reviewed other

valuation metrics such as peer group trading multiples. Based on

these metrics the valuation was justifiable, albeit at the lower

end of the range of possible values. The Directors believed that

this valuation approach represented the price of the Company that

would be received in an orderly transaction between market

participants.

Key sources of estimation in applying the Company's accounting

policies

The Directors believe that there are no key assumptions

concerning the future, and other key sources of estimation

uncertainty at the balance sheet date that have a significant risk

of causing a material adjustment to the carrying amounts of assets

and liabilities within the next financial year.

3. Alternative performance measures reconciliations

Alternative performance measures (APMs), such as underlying

results, are used in the day-to-day management of the Company, and

represent statutory measures adjusted for items which, in the

Directors' view, could influence the understanding of comparability

and performance of the Company year on year. The reconciliation of

APMs to the reported results is detailed below:

2021 2020

GBP'000 GBP'000

---------------------------------------------- ------------ ------------

Profit/(Loss) before tax 84,655 (7,899)

Exceptional income 90 3,415

Underlying EBIT 84,565 (11,314)

----------------------------------------------- ------------ ------------

2021 2020

(in (in

thousands) thousands)

---------------------------------------------- ------------ ------------

Weighted average number of Ordinary Shares

- Basic 702,206 379,347

----------------------------------------------- ------------ ------------

Weighted average number of Ordinary Shares

- Diluted 702,206 379,347

----------------------------------------------- ------------ ------------

Underlying Basic earnings/(loss) per share

for total operations 12.0p (3.0p)

----------------------------------------------- ------------ ------------

Underlying Diluted earnings/(loss) per share

for total operations 12.0p (3.0p)

----------------------------------------------- ------------ ------------

4. Employees and Directors

Staff costs and the average number of persons (including

Directors) employed by the Company during the year are detailed

below:

2021 2020

GBP'000 GBP'000

------------------------------------------ -------- --------

Staff and Director costs for the Company

during the year

Wages and salaries 250 292

Social security costs 19 26

269 318

------------------------------------------- -------- --------

Average monthly number of employees and

Directors

Employees and Directors 4 4

-------------------------------------------- -------- --------

A summary of Directors' remuneration (key management personnel)

is detailed below:

2021 2020

GBP'000 GBP'000

---------------------------------------- -------- --------

Emoluments, bonus and benefits in kind 194 245

Total Directors' remuneration 194 245

----------------------------------------- -------- --------

Remuneration of the highest paid Director is detailed below:

2021 2020

GBP'000 GBP'000

---------------------------------------- -------- --------

Emoluments, bonus and benefits in kind 93 64

----------------------------------------- -------- --------

5. Exceptional items

During the year, the Company recognised exceptional income in

relation to a VAT refund of GBP90,000 associated with the disposal

of GWSA.

During the prior year, the Company recognised exceptional income

in relation to reimbursed transaction costs of GBP2,845,000

associated with the disposal of GWSA and 2019-related audit fees of

GBP570,000. The costs were incurred by the Company in 2019 and

ultimately borne by GWSA upon completion of the transaction in

accordance with deal arrangements.

6. Audit fees

During the year, the Company obtained the following services

from the Company's auditors, the costs of which (inclusive of VAT

as the Company is not registered for VAT) are detailed below:

2021 2020

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Fees payable for the audit of the Company's annual

financial statements 119 114

Audit-related assurance services - 96

Other assurance services (fund raise expenses) - 554

----------------------------------------------------- -------- --------

Total fees payable to Company's

auditors 119 764

------------------------------------------------------ -------- --------

7. Income tax charge

The Company did not recognise current and deferred income tax

charge or credit (2020: nil). In 2021, the deferred tax asset of

GBP412,050 (2020: GBP219,000) was not recognised as the Directors

do not consider that there is sufficient certainty over its

recovery. The underlying tax losses can be carried forward

indefinitely.

The income tax charge for the year included in the statement of

comprehensive income can be reconciled to loss before tax

multiplied by the standard rate of tax as follows:

2021 2020

GBP'000 GBP'000

--------------------------------------------------- --------- --------

Profit/(loss) before tax 84,655 (7,899)

---------------------------------------------------- --------- --------

Expected tax charge/(credit) based on

a corporation tax rate of 19% (2020: 19%) 16,084 (1,501)

---------------------------------------------------- --------- --------

Effect of expenses not deductible in determining

taxable profit 98 1,282

---------------------------------------------------- --------- --------

Effect of income not taxable in determining

taxable profit (16,276) -

---------------------------------------------------- --------- --------

Unused tax losses for which no deferred

tax asset has been recognised 94 219

---------------------------------------------------- --------- --------

Effect of a change in future corporation tax rate

on the deferred tax asset - -

----------------------------------------------------- --------- --------

Income tax charge - -

----------------------------------------------------- --------- --------

The current effective UK corporation tax rate for the financial

year is 19%. The UK corporation tax rate will remain at 19% until

31 March 2022. On 3 March 2021, it was announced that the main rate

of corporation tax will increase to 25% from 1 April 2023. As a

result, the deferred tax asset has been calculated using the 25%

rate.

8. Dividends

At the date of approving these Financial Statements, no final

dividend has been approved or recommended by the Directors (2020:

GBPNil).

9. Earnings per share

Basic earnings per share amounts are calculated by dividing

profit/(loss) for the period attributable to ordinary equity

holders of the Company by the weighted average number of ordinary

shares outstanding during the 12 months to the period end.

Diluted earnings per share amounts are calculated by dividing

the profit/(loss) attributable to ordinary equity holders of the

Company by the weighted average number of ordinary shares

outstanding during the year plus the weighted average number of

ordinary shares that would be issued on conversion of all the

potentially dilutive instruments into ordinary shares. The Company

has no dilutive instruments to be included in the calculation.

2021 2020

GBP'000 GBP'000

------------------------------------------------- ------------ ------------

Profit/(loss) attributed to equity shareholders 84,655 (7,899)

-------------------------------------------------- ------------ ------------

2021 2020

(in (in

thousands) thousands)

------------------------------------------------- ------------ ------------

Weighted average number of Ordinary Shares

- Basic 702,206 379,347

-------------------------------------------------- ------------ ------------

Weighted average number of Ordinary Shares

- Diluted 702,206 379,347

-------------------------------------------------- ------------ ------------

Basic earnings/(loss) per share for total

operations 12.1p (2.1p)

Diluted earnings/(loss) per share for

total operations 12.1p (2.1p)

-------------------------------------------------- ------------ ------------

10. Investments at fair value through profit or loss

GreenWhiteStar

Acquisitions Alpha Persei Marcelos

Limited Limited Limited Total investments

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------------- ------------- ---------- ------------------

1 December 2019 45,000 - - 45,000

--------------------------- --------------- ------------- ---------- ------------------

Disposals during the year (45,000) - - (45,000)

Additions during the year - - 45,000 45,000

Change in fair value - - (9,152) (9,152)

--------------------------- --------------- ------------- ---------- ------------------

30 November 2020 - - 35,848 35,848

--------------------------- --------------- ------------- ---------- ------------------

Additions during the year - 6,000 - 6,000

Change in fair value - 287 85,378 85,665

Dividends - (6,287) (119,008) (125,295)

--------------------------- --------------- ------------- ---------- ------------------

30 November 2021 - - 2,218 2,218

--------------------------- --------------- ------------- ---------- ------------------

During the year, the Company acquired for GBP6.0 million a 10.9%

equity interest in Alpha Persei Limited which held an 18% PIK Loan

note with indirect exposure to the performance of GWSA.

During the year, the Company announced the disposal of its

interest in GWSA Group, held through its investments in Marcelos

and Marcelos' wholly owned subsidiary Alpha Cassiopeiae

Limited.

The disposal resulted in the Company receiving a dividend of

GBP6,287,000 from Alpha Persei Limited and a dividend of

GBP119,008,000 from Marcelos. These dividends were considered to be

a return of capital and have been offset against the carrying value

of the investment.

As at 30 November 2021, the Company's investment in Marcelos was

revalued to GBP2,218,000 as a result of a dividend proposed to be

paid to the Company from Marcelos during the next financial

year.

11. Financial assets and liabilities

2021 2020

GBP'000 GBP'000

-------------------------------------- -------- --------

Financial assets at fair value

through the profit or loss

Investments in associate (see

note 10) 2,218 35,848

Financial assets at amortised

cost

Other receivables 114 28

---------------------------------------- -------- --------

Total financial assets 2,332 35,876

---------------------------------------- -------- --------

Financial liabilities at amortised

cost

Amounts owed to related undertakings

(see note 13) - (1,235)

Other payables (290) (2,184)

---------------------------------------- -------- --------

Total financial liabilities (290) (3,419)

---------------------------------------- -------- --------

Cash and cash equivalents 131,902 652

Net funds 131,902 652

---------------------------------------- -------- --------

All financial assets and liabilities mature within one year. The

fair value of those assets and liabilities approximates their book

value.

Other receivables represent prepayments. Other payables include

accruals of GBP216,000 (2020: GBP2,122,000 with GBP1,369,000

relating to the accrued fund raise costs).

The Company's overall risk management programme focuses on

reducing financial risk as far as possible and therefore seeks to

minimise potential adverse effects on the Company's financial

performance. The policies and strategies for managing specific

financial risks are summarised as follows:

Liquidity risk

The Company finances its operations by equity. The Company

undertakes short-term cash forecasting to monitor its expected cash

flows against its cash availability. The Company also undertakes

longer-term cash forecasting to monitor its expected funding

requirements in order to meet its current business plan.

Credit risk

The Company's principal exposure to credit risk is in the

amounts owed by related undertakings. There are no related

undertakings in the current year.

Capital management

Capital comprises share capital of GBP7.0m (2020: GBP3.8m) and

share premium of GBP157.5m (2020: GBP146.0m).

12. Capital and reserves

Called up Share

No of share premium

shares capital account

'000 GBP'000 GBP'000

------------------------------------- -------- ---------- ---------

Ordinary shares of 1p each in issue

at 30 November 2020 379,347 3,793 146,002

------------------------------------- -------- ---------- ---------

Ordinary shares of 1p each in issue

at 30 November 2021 702,206 7,022 157,477

------------------------------------- -------- ---------- ---------

All of the ordinary shares in issue referred to in the table

above were authorised and are fully paid.

During the prior year, costs in relation to the fund raise of

GBP1.5m in December 2020 were deducted from the retained earnings

reserve. During the year, these costs were reclassified from

retained earnings to be offset against share premium.

Own treasury shares

Included in the total number of ordinary shares outstanding

above are 535,440 (2020: 1,634,304) ordinary shares held by the

Company's employee benefit trust. The ordinary shares held by the

trustee of the Company's employee benefit trust pursuant to the SIP

are treated as Own shares in the Company's Balance Sheet in

accordance with IAS 32 . During the year, 1,098,864 (2020: 55,696)

shares were transferred to employees of the GWSA Group.

13. Related party transactions

During the year, the Company settled the amount due to related

party GWSA as at the prior year end, for the value GBP1,235,000.

The Company did not enter into any other related party

transactions.

During the prior year, from the date of the disposal of the

investment in its subsidiary, GWSA, the Company entered into

commercial transactions with GWSA as follows:

Amounts owed to related parties

GBP'000

------------------------------------ --------------------------------

9 December 2019 -

------------------------------------ --------------------------------

Purchases from related parties 385

Reimbursement from related parties 850

------------------------------------- --------------------------------

30 November 2020 1,235

------------------------------------- --------------------------------

14. Capital commitments

At 30 November 2021, the Company had no commitments (2020:

GBPNil).

15. Contingent liabilities

At 30 November 2021, the Company had no contingent liabilities

(2020: GBPNil).

16. Subsequent events

On 14 January 2022, the Company received a dividend from

Marcelos Limited of GBP2,218,000.

Following shareholders' approval by a special resolution on 31

January 2022, the Court approved a reduction of the Company's share

premium on 22 February 2022 of GBP157,477,000 to distributable

reserves. The distributable reserve will allow the Company to

proceed with an on-market purchase of up to 20% of the Company's

issued share capital.

On 10 March 2022, the Company announced that it had acquired

1,000,000 ordinary shares in Caretech Holdings PLC at GBP6.335 per

share, for a total consideration of GBP6.3m. This was its first

investment since becoming an Investing Company and is consistent

with its investing policy as amended after the General Meeting held

on 31 January 2022.

On 1 April 2022, the Company announced that it had acquired a

further 974,130 shares in Caretech Holdings Plc at an average price

of GBP6.95 per share, for a total consideration of

GBP6,769,069.

GLOSSARY

Term Definition

Accounts The financial statements of the Company

Admission The admission of the issued ordinary shares

in the Company admitted to trading on AIM

that became effective on 31 December 2020

AGM Annual general meeting of the Company

AIM Alternative Investment Market of the London

Stock Exchange

AIM Rules T he AIM Rules for Companies published by

the London Stock Exchange from time to time

(including, without limitation, any guidance

notes or statements of practice) which govern

the rules and responsibilities of companies

whose shares are admitted to trading on AIM

AIM Investing Company An Investing Company as defined by the AIM

rules.

APMs Alternative Performance Measures

Board The B oard of Directors of the Company

CAGR Compound annual growth rate

CGU Cash Generating Unit

Company Logistics Development Group plc, a public

limited company incorporated in England and

Wales with registered number 08922456

DBAY DBAY Advisors Limited and/or any fund(s) or

entity(ies) managed or controlled by DBAY

Advisors Limited as appropriate in the relevant

context

DBAY Transaction On 9 December 2019 DouglasBay Capital III

Fund LP, a fund managed by DBAY Advisors Limited

completed the acquisition of an indirect 51%

equity stake in GreenWhiteStar Acquisitions

Limited.

Directors The Directors of the Company as at the date

of this document, as identified on page 10

EBITDA Earnings before interest, tax, depreciation

and amortisation

Eddie Stobart Businesses Eddie Stobart, The Pallet Network, iForce,

Eddie Stobart Europe and The Logistics People

EPS Earnings per share

FY20 Financial Year ended 30 November 2020

FY21 Financial Year ended 30 November 2021

GWSA GreenWhiteStar Acquisitions Limited, the operational

holding company of the Eddie Stobart trading

entities; Eddie Stobart Limited, iForce Limited,

The Pallet Network Limited and The Logistic

People Limited.

GWSA Group GreenWhiteStar Acquisitions Limited and all

of its subsidiaries from time to time

HY20 Six month period ended 31 May 2020

HY21 Six month period ended 31 May 2021

IAS International Accounting Standards

IFRS International Financial Reporting Standards

Investment Management An investment management agreement entered

Agreement into between the Company and DBAY, pursuant

to which DBAY has been appointed as the Company's

investment manager

Investing Policy The Company's investing policy more particularly

set out on pages 6 and 7

LTIP The Long Term Incentive Plan

Marcelos Marcelos Limited, a company incorporated on

the Isle of Man (company no. 016829v), whose

registered office is at First Names House,

Victoria Road, Douglas, Isle of Man, IM2 4DF

Ordinary Shares/Shares Ordinary shares of GBP0.01 each in the capital

of the Company

PIK Loan note Loan of GBP55m used to effect the DBAY transaction,

which carries interest at 18% compounding

quarterly, maturing in November 2025.

PWC PricewaterhouseCoopers LLP - the Company's

auditors

QCA Quoted Companies Alliance

QCA Governance Code QCA Corporate Governance Code for Small and

Mid-Size Quoted Companies published by the

QCA

SIP Share Incentive Plan

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR IAMPTMTAMBLT

(END) Dow Jones Newswires

April 06, 2022 02:01 ET (06:01 GMT)

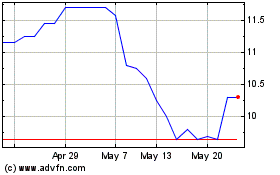

Logistics Development (LSE:LDG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Logistics Development (LSE:LDG)

Historical Stock Chart

From Nov 2023 to Nov 2024