TIDMMEX

RNS Number : 4347O

Tortilla Mexican Grill PLC

03 October 2023

3(rd) October 2023

Tortilla Mexican Grill plc

("Tortilla", "the Group")

Interim Results

Resilient trading supports FY 2023 expectations

Tortilla Mexican Grill plc, the largest and most successful

fast-casual Mexican restaurant business in the UK, today announces

its unaudited interim results for the 26 weeks ended 2 July 2023

("H1 FY23", "the Period"). All numbers are shown on an IFRS basis

unless otherwise stated.

Financial highlights

-- Revenue growth of 22% to GBP32.7m (H1 FY22: GBP26.9m).

-- Like-for-like ("LFL") revenue growth(1) of +5.0%, ahead of

the industry CGA Peach Coffer Tracker(2) benchmark average of 4.6%.

LFL revenue growth on a VAT-adjusted basis was 8.4%.

-- Adjusted EBITDA (pre-IFRS 16)(3) of GBP1.8m (H1 FY22:

GBP2.5m), trading in-line with market expected financial

performance(5) , noting that the prior year amount benefitted from

GBP1.1m of Government support.

-- Loss before tax of GBP0.6m (H1 FY22: profit before tax GBP0.3m).

-- Strong balance sheet with net debt (4) of GBP1.6m at Period

end (H1 FY22: GBP3.2m net cash), in line with expectations, and a

further GBP7m of liquidity available from the Group's existing debt

facilities.

Operational and strategic highlights

-- Good progress on UK new store openings with three opened in

H1 FY22, including our first site in Northern Ireland, plus a

further two sites since. Remain ahead of IPO aim of 45 new sites in

5 years.

-- Successful integration of Chilango business and realisation of investment case.

-- Growing confidence in the UK and international franchising

opportunity with record profits following the return to normalised

trading post-Covid.

-- Cost pressures easing along with favourable contracts negotiated with key suppliers.

-- Successfully implemented two major technology projects - our

first kiosk-only site delivering positive early results and a

nationwide roll out of delivery order-aggregation software.

-- Enhanced promotional calendar - "Tortilla Sunsets" project

developed and launched in mid-September to drive evening sales.

-- Currently assessing a number of European opportunities

through franchising or strategic acquisitions.

-- Strengthened Board of Directors with the appointment of Keith

Down as NED. Andy Naylor, CFO, promoted to Managing Director.

Current trading and full year outlook

Since the Period end, we have opened a further two sites:

Belfast and Bracknell in July and August respectively and both are

trading well, with Belfast doubling the opening revenue

expectations. A further three sites are expected to open in H2

FY23, taking the total to eight new sites in the year as we

continue to deliver our stated roll-out plans.

The summer was unsurprisingly quiet, as seen in the wider

market, with an increased demand for overseas holidays, ongoing

industrial strike-action on the train network and uninspiring

weather. Nonetheless, the Group delivered LFL growth for this

period.

We are seeing the benefit of self-help management initiatives,

particularly in supply chain, energy and productivity. The benefit

of these initiatives fell towards the end of the Period and as

such, will collectively drive a further1.3 percentage point

improvement in Adjusted EBITDA margin in H2 FY23 (compared to H1

FY23).

We continue to improve our offer through significant menu

development, providing a more consistent and higher quality product

whilst offering utility cost savings that also support our ESG

strategy. We have worked hard to look for ways to drive customer

footfall through targeted events and promotions, most notably

through the launch of Tortilla Sunsets in September to enhance our

evening offer through a great value dine-in experience.

Considering the secured upside from our cost hedging, the

exciting initiatives launched to drive evening trade and the

resilient trading performance of the Group, we remain confident of

being broadly in line with our targeted Adjusted EBITDA for FY23

and we expect to see the full year benefit of these initiatives

next year.

Richard Morris, CEO of Tortilla, commented:

"Despite the challenging economic backdrop, during the first

half Tortilla demonstrated its resilience and showed consistent

progress, with revenue growth of more than 20% . We continued to

expand our store estate and have successfully embedded the Chilango

acquisition. We have also enhanced our food offer and secured

significant improvement in our costs structure while making

technology upgrades which will improve and quicken customer service

at peak trading times.

We are very excited by the launch of our Tortilla Sunsets

initiative earlier this month, which has had a very positive

customer response so far. We believe there is a significant

opportunity to enhance our evening sales by offering a great-value,

dine-in experience including beers and margarita cocktails for just

GBP2.50 as well as a number of delicious new menu additions.

With our outstanding food offer, excellent value for money and

great service, alongside our adaptable and resilient business

model, we remain well placed to continue expanding our UK network

whilst taking the brand into new markets, particularly in

Europe."

(1) defined as the percentage change in like-for-like sales

compared to H1 FY22

(2) defined as the average of the data reported for restaurants

by CGA Peach for the period.

(3) defined as statutory operating profit before interest, tax,

depreciation and amortisation (before application of IFRS 16 and

excluding exceptional costs) and reflects the underlying trading

performance of the Group. The reconciliation to profit from

operations is presented in the financial review.

(4) defined as net debt / cash before lease liabilities arising

from application of IFRS 16.

(5) based off company-compiled consensus: FY23: Adjusted EBITDA:

GBP5.0m.

ENQUIRIES

Tortilla Mexican Grill PLC Via Hudson Sandler

Richard Morris, CEO

Andy Naylor, CFO

Liberum Capital Limited (Nominated Adviser, Tel: 020 3100 2222

Sole Broker)

Andrew Godber

Edward Thomas

Nikhil Varghese

Hudson Sandler (Public Relations) Tel: 020 7796 4133

Alex Brennan tortilla@hudsonsandler.com

Wendy Baker

Charlotte Cobb

For further information visit tortillagroup.co.uk

About Tortilla Mexican Grill plc

Tortilla is the largest and most successful fast-casual Mexican

restaurant group in the UK specialising in the sale of freshly made

Californian-inspired Mexican cuisine. The Group had 85 sites

worldwide as of 3 July 2023, comprising 67 sites in the UK operated

by the Group, five sites franchised to SSP Group in the UK, five

sites franchised to Compass Group UK & Ireland and eight

franchised sites in the Middle East.

The Group was founded in 2007 by Brandon Stephens, originally

from California who, upon his arrival in London in 2003, found it

difficult to satisfy his desire for quality burritos and tacos. As

a result, Brandon established Tortilla with a mission of offering

customers freshly prepared, customisable, and authentic

Californian-inspired Mexican food.

The brand is synonymous with an energetic, vibrant culture, and

with providing a great value-for-money proposition. It embraces

fast-growing sector trends (including eating out, healthy eating,

provenance, ethnic cuisine, delivery) across a variety of

locations, through a differentiated product offering which is

popular with a broad customer base, and a clearly defined

multi-channel marketing strategy. It benefits from flexible site

locations and formats, and a scalable central infrastructure.

BUSINESS REVIEW

Growth

Last year was a record year of growth for the Group and we have

again made good progress on new site rollouts this year to date. In

the first half of the year, we opened new sites in Derby and

Greenwich and our franchise partner SSP opened in Manchester

Piccadilly railway station. Since then, we have opened our first

site in Northern Ireland, in Belfast, and a site in Bracknell. We

anticipate a further three new sites opening this year, taking the

total to eight.

We remain ahead of our IPO aspiration to open 45 sites over five

years but felt that it was right to aim for the lower end of

projections in FY23 as we wanted to focus attention on: (1)

finishing the refurbishment plans for Chilango and ensuring the

conversion was a success; and (2) assessing the full impact of the

cost-of-living crisis and the changing dynamics of the UK

commercial property rental market to get the best-possible

deals.

The FY24 pipeline looks strong, with one site already legally

completed, two midway through legals and one further offer

submitted. The UK commercial property market remains favourable

with rent percentage of revenue improving further. W e remain w ell

positioned for expansion opportunities, as our flexible model

enables us to take a range of site formats, including former retail

units (since we do not need to install expensive cooking-extraction

equipment). We therefore expect to continue our UK rollout at a

rate of 8-12 company-owned stores per annum from FY24 onwards.

Franchising

The Group's proposition and operating model is perfectly suited

to franchising mainly due to: (1) our site format flexibility and

simplicity of kitchen setup which allows us to access a wide range

of units and (2) our central production food model provides

consistency of food quality and enables the franchisees to quickly

train employees.

We have a very healthy franchise network with quality franchise

partners performing well, including SSP and Compass Group in the UK

and Eathos in the Middle East. The travel network of franchise

sites has performed incredibly well with sales records achieved in

every unit this year and a LFL sales growth in H1 FY23 of greater

than 30%. The Middle East business is also very strong, generating

LFL sales growth of c.15% and is more profitable than ever

before.

We continue to seek quality franchise locations with these

existing partners in the UK.

European opportunity

We are by far the largest fast-casual Californian-inspired

Mexican business in Europe and we remain firmly committed to

exploring European opportunities for the Group. We believe our

business model and food-quality is stronger than the competition

and are keen to explore opportunities, predominantly via

franchising considering the suitability of the brand to this style

of rollout. Acquisition opportunities may also exist and

considering the success of the conversion of Chilango

post-acquisition, we are confident that similar success could be

replicated elsewhere.

UK profitability

We have been heavily focused on improving the profitability of

UK operations and are delighted to have secured some favourable

supply arrangements towards the end of H1 FY23. These will

collectively deliver a further 1.3 percentage point improvement in

profitability at the Adjusted EBITDA (pre IFRS 16) level in the

second half of FY23.

The utility market continues to be volatile, however the Group

has hedged utility prices at rates significantly lower than FY22

comparative rates until March 2024 to provide greater certainty in

this area. Internal KPIs are in place to ensure usage is monitored,

with usage mitigating actions taken where identified. Meanwhile,

inflation appears to have plateaued and is now gradually reducing,

and we expect that a more normalised cost environment will prevail

in the coming months.

Chilango update

In May 2022 the Group made the strategic acquisition of eight

Chilango sites. Five were converted to Tortilla branded stores and

these have since traded far ahead of expectations, with average

weekly sales in H1 FY23 being 32% higher than the pre-conversion

average.

At one of these conversions, Croydon BoxPark, we have deployed a

'virtual kitchen' operating under the Chilango brand on delivery

platforms only. This has resulted in 35% incremental growth,

showing a very positive case for further deployment of virtual

kitchens where Chilango brand awareness is high.

We have kept the three remaining sites continuing to trade under

the Chilango brand.

Digital strategy

In H1 FY23 we recruited a new management role, Andrew Brook as

Head of IT, to drive growth and efficiencies through the use of

technology. We have successfully launched a nationwide rollout of

delivery order-aggregation software, Deliverect, to simplify the

management of multi-platform delivery channels at every store and

to maximise the speed and accuracy of delivery order

fulfilment.

Post Period-end we launched a trial of our first digital concept

site, by refurbishing our London Wall site and installing kiosks.

This was designed to maximise customer throughput at peak times,

and early signs are encouraging. Our hourly sales record increased

by 37%, and the peak-day average lunch period (12-2pm) sales

increased from GBP2,200 to GBP2,600. This proof-of-concept is

promising and indicates the kiosk-only approach may be a viable

solution for sites with significant volume demand that cannot

currently be fully met.

Food and marketing

We have launched several key product and marketing campaigns,

which we believe will drive significant improvements.

Firstly, we have enhanced our loyalty scheme to provide a more

generous offer for the consumer who now gets a free burrito after

five purchases. The scheme has seen a 6% increase in adoption since

the change, to more than 300,000 customers. Average spend among

these customers is also up 12% vs the Group average.

Secondly, in August 2023 we improved our chicken product, the

Group's best-seller. The new product, chicken pibil, is more

flavoursome and consistent than the prior product. This improvement

has additionally reduced labour costs in our sites and enabled us

to remove grills from numerous sites, resulting in lower energy

usage. Other recent changes include a refreshed Salsa Verde recipe,

and the removal of one of the rice options to minimise waste and

improve the quality of having a single rice option.

Lastly, in September 2023 we launched a series of "Tortilla

Sunsets" promotions. We have adopted a low-price alcohol model to

give a very generous "Happy Hour" offering, designed to drive

evening sales in student-dense areas. We have also launched

exciting new evening menu items with crockery & cutlery

provided to give customers more of a "casual dining" feel.

Environmental, Social and Governance ("ESG")

ESG remains a key consideration for the Group, and we are

pleased to confirm that we intend to install a renewable energy

source at our central production kitchen which should be

operational in FY24. The central production kitchen is our single

biggest consumer of electricity and so this will bring a

significant positive environmental impact.

The new chicken pibil product has also helped us reduce our

utility cost expenditure further helping the business to lower its

carbon footprint.

We continue to offer a menu containing 70% plant-based

ingredients, are a signatory to the Better Chicken Commitment and

serve only higher welfare meats. We partner with a business called

Too Good To Go, to reduce food waste, with almost 58,000 meals

saved in the last twelve months.

Board and people

We have an experienced senior Management team who remain very

passionate about the brand and implementing our growth strategy.

Post Period end, Keith Down joined as a new Non-Executive Director.

Keith brings with him a wealth of experience in the sector and we

are very excited to have him strengthen our Board.

Andy Naylor, CFO, has been promoted to Managing Director. Andy

has been in the business for six years and in recent years has

taken on a broader role, including building the UK franchise

partnerships and leading the development of the technology and

facilities functions.

FINANCIAL REVIEW

Revenue

Revenue increased by 22% to GBP32.7m (H1 FY22: GBP26.9m), driven

by additional contribution from new stores as well as the continued

LFL sales growth of our existing estate. Our mature stores have

continued to trade above the restaurant industry average, with LFL

sales growth in H1 FY23 of 5.0% vs an average CGA Peach Coffer

benchmark of 4.6%.

After adjusting for the benefit of the lower VAT rate prevailing

in Q1 FY22, our LFL sales growth for H1 FY23 was 8.4%.

Gross profit margin

Gross profit margin was consistent at 77.0% in both periods,

which is a good result considering that the prior year number

benefitted from:

-- The lower VAT rate in Q1 FY22 which lifted gross profit margin by 0.7 percentage points; and

-- Q1 FY22 benefitted from materially lower food costs,

particularly proteins, which rose sharply in late March FY22

following the start of the Ukraine war in February of that

year.

This favourable trend was driven by competitive tenders on our

supply contracts, and results in our prices being secured on 76% of

products until December FY23, with 46% then secured until April

FY24.

Across gross profit margin and administrative expenses, we

expect to deliver a further 1.3 percentage point improvement in our

Adjusted EBITDA (pre-IFRS 16) margin in H2 FY23 compared to H1 FY23

(in addition to the normal seasonality weighting of EBITDA).

Administrative expenses

Administrative expenses increased by 25% to GBP25.0m (H1 FY22:

GBP20.0m), in line with revenue growth. However as a percentage of

revenue, administrative expenses were 76.3% in H1 FY23, improved

versus 76.7% in H1 FY22 after adjusting for the Q1 FY22 VAT

benefit. Despite the high inflationary environment, costs were well

controlled, and savings found. The utilities market has been highly

volatile, however we hedged fixed prices at a favourable rate to

mitigate this until March FY24.

Adjusted EBITDA (pre-IFRS 16)

Adjusted EBITDA (pre-IFRS 16) is the key performance metric that

the Group utilises to assess the underlying trading performance. A

reconciliation of this measure compared to profit from operations

is as follows:

H1 FY23 H1 FY22

GBPm GBPm

Adjusted EBITDA (pre-IFRS

16) 1.8 2.5

Pre-opening costs (0.3) (0.3)

Share option expense (0.2) (0.2)

Depreciation and amortisation (1.9) (1.5)

Exceptional items (0.1) (0.3)

IFRS 16 adjustment 0.9 0.7

Profit from operations 0.2 0.9

Adjusted EBITDA (pre-IFRS 16) of GBP1.8m was generated in H1

FY23 which was GBP0.7m lower than H1 FY22. The year-on-year

decrease is entirely due to a total of GBP1.1m in Government

support which benefitted the prior year number. Of this support,

GBP0.8m related to the lower VAT rate in Q1 FY22 and GBP0.3m

related to business rates support provided as part of the

Government's COVID support package.

Good progress has been made by the Group in FY23 to recover

profitability and this collectively contributed a net GBP0.4m

increase in Adjusted EBITDA (pre-IFRS 16) in the first half of the

year. These cost improvements were largely weighted towards the end

of the Period and will contribute more meaningfully in H2 FY23. We

therefore expect H2 FY23 Adjusted EBITDA (pre-IFRS 16) to be 1.3

percentage points higher than H1 FY23 from these improvements

alone, on top of the normal seasonality of EBITDA generation.

Share-based payments

Share-based payment expenses of GBP0.2m were recognised in the

Period (H1 FY22: GBP0.2m) relating to the Group's Long Term

Incentive Plan ("LTIP").

Finance expense

Finance expense of GBP0.9m is comprised of GBP0.8m of interest

charged in relation to Right of Use assets (a consequence of the

accounting treatment of leases under IFRS 16) and GBP0.1m of

interest for the debt facility that the Group has in place.

Cash flow and net cash

The Group closed the Period with a net debt position of GBP1.6m.

Drawn debt remains unchanged from the end of the FY22 financial

year at GBP2.9m. A reconciliation of the movement in net debt

between the start and end of the period is as follows:

Opening balance (GBP0.5m)

Adjusted EBITDA (pre-IFRS 16) GBP1.8m

Capital expenditure for new stores (GBP1.4m)

Maintenance capital expenditure (GBP0.8m)

Interest paid (GBP0.1m)

Pre-opening and exceptional costs (GBP0.4m)

Working capital movement (GBP0.2m)

Closing balance (GBP1.6m)

The Group's closing net debt position of GBP1.6m represents a

low level of leverage which is important considering the recent

increases in the Bank of England base rate. The Group's efforts to

recover profitability this year and going forward will enable the

business to get back to the aim of funding expansion capital

requirements from operationally generated cash.

Dividend

The Board did not recommend an interim dividend for FY23. In

line with the previously stated policy, the Group's capital will be

focused on growth over the coming years with the dividend policy

subject to re-assessment going forward.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period ended 2 July 2023

Unaudited Unaudited

26 weeks 26 weeks

ended ended

2 July 3 July

2023 2022

Note GBP GBP

Revenue 32,745,623 26,898,368

Cost of sales (7,534,184) (6,184,070)

============= =============

Gross profit 25,211,439 20,714,298

Other operating income 3 - 211,310

Administrative expenses (24,970,307) (20,004,021)

============= =============

Profit from operations 4 241,132 921,587

Finance income 5 12,914 276

Finance expense 5 (869,153) (657,811)

------------- -------------

Profit before tax (615,107) 264,052

Tax charge (3,402) (107,531)

============= =============

Profit for the period and comprehensive

income attributable to equity holders

of the parent company (618,509) 156,521

============= =============

Earnings per share for profit attributable

to the owners of the parent during

the period

Basic and diluted (pence) 6 (1.6) 0.4

============= =============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 2 July 2023

Unaudited Unaudited Audited

At At At

2 July 3 July 1 January

2023 2022 2023

Note GBP GBP GBP

Non-current assets

Intangible assets 7 2,629,623 2,604,279 2,632,205

Right-of-use assets 8 30,836,951 29,603,290 31,035,358

Property, plant and equipment 9 14,073,657 10,933,689 13,721,101

Total non-current assets 47,540,231 43,141,258 47,388,664

Current assets

Inventories 376,641 442,693 397,083

Trade and other receivables 10 2,775,126 2,369,919 2,193,877

Cash and cash equivalents 1,327,470 6,083,998 2,375,800

Total current assets 4,479,237 8,896,610 4,966,760

Total assets 52,019,468 52,037,868 52,355,424

============ ============ ============

Current liabilities

Trade and other payables 11 9,334,177 8,982,415 9,110,069

Lease liabilities 8 5,762,578 5,329,676 5,614,340

Loans and borrowings - - -

Corporation tax liability - 1,008,221

Total current liabilities 15,096,755 15,320,312 14,724,409

Non-current liabilities

Lease liabilities 8 30,801,995 29,591,636 31,109,551

Loans and borrowings 2,939,751 2,921,208 2,930,481

Total non-current liabilities 33,741,746 32,512,844 34,040,032

Total liabilities 48,838,501 47,833,156 48,764,441

============ ============ ============

Net assets 3,180,967 4,204,712 3,590,983

============ ============ ============

Equity attributable to equity

holders of the company

Called up share capital 386,640 386,640 386,640

Share premium account 4,433,250 4,433,250 4,433,250

Merger reserve 4,793,170 4,793,170 4,793,170

Share based payment reserve 661,028 271,521 452,535

Retained earnings (7,093,121) (5,679,869) (6,474,612)

Total equity 3,180,967 4,204,712 3,590,983

============ ============ ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the period ended 2 July 2023

Share Share Merger Share-based Retained Total

capital premium reserve payment earnings

reserve

GBP GBP GBP GBP GBP GBP

Equity at 2 January

2022 386,640 4,433,250 4,793,170 90,507 (5,836,390) 3,867,177

Profit for the

period - - - - 156,521 156,521

Share-based payments 181,014 - 181,014

Equity at 3 July

2022 386,640 4,433,250 4,793,170 271,521 (5,679,869) 4,204,712

========= ========== ========== ============ ============ ==========

Loss for the period - - - - (794,743) (794,743

Newly issued equity

shares - - - - - -

Cost of issue of

equity shares - - - - - -

Share-based payments - - - 181,014 - 181,014

Equity at 1 January

2023 386,640 4,433,250 4,793,170 452,535 (6,474,612) 3,590,983

========= ========== ========== ============ ============ ==========

Profit for the

period - - - - (618,509) (618,509)

Share-based payments - - - 208,493 - 208,493

Equity at 2 July

2023 386,640 4,433,250 4,793,170 661,028 (7,093,121) 3,180,967

========= ========== ========== ============ ============ ==========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the period ended 2 July 2023

Unaudited Unaudited

26 weeks 26 weeks

ended ended

3 July 2022 3 July 2022

Note GBP GBP

Operating activities

Profit after tax (618,509) 156,521

Adjustments for:

Share based payments 208,493 181,014

Net finance expense 5 105,303 79,405

Finance cost on lease liabilities 5 750,936 578,130

Corporation tax charge - 107,531

Amortisation of intangible assets 7 2,582 2,275

Loss on disposal of intangible

assets 7 - 6,825

Depreciation of right to use

assets 8 2,177,598 1,502,348

Depreciation of property, plant

and equipment 9 1,812,912 1,420,657

Loss on disposal of property,

plant and equipment 9 - 6,834

Increase in inventories 20,442 (64,788)

Decrease in trade and other receivables (581,249) 296,992

Increase in trade and other payables 224,105 358,064

Cash generated from operations 4,102,613 4,631,808

============ ============

Investing activities

Interest received 5 12,914 276

Purchase of property, plant and

equipment 9 (2,165,468) (2,958,549)

Acquisitions, net of cash acquired - (1,687,365)

Net cash used by investing activities (2,152,554) (4,645,638)

============ ============

Financing activities

Payments made in respect of lease

liabilities 8 (2,889,443) (3,484,931)

Interest paid (108,946) (70,413)

Net cash used by financing activities (2,998,389) (3,555,344)

============ ============

Net (decrease)/increase in cash

and cash equivalents (1,048,330) (3,569,174)

============ ============

Cash and cash equivalents at

the beginning of period 2,375,800 9,653,172

Cash and cash equivalents at

the end of period 1,327,470 6,083,998

============ ============

NOTES TO THE CONSOLIDATED FINANCIAL INFORMATION

1. General information

Tortilla Mexican Grill plc, the "Company" together with its

subsidiaries, "the Group", is a public limited company whose shares

are publicly traded on the Alternative Investment Market ("AIM")

and is incorporated and domiciled in the United Kingdom and

registered in England and Wales.

The registered address of Tortilla Mexican Grill plc and all

subsidiaries is 142-144 New Cavendish Street, London, W1W 6YF,

United Kingdom.

The Group's principal activity is the operation and management

of restaurants trading under the Tortilla brand both within the

United Kingdom and the Middle East and under the Chilango brand in

the United Kingdom.

2. Accounting policies

Basis of preparation

The consolidated interim financial information has been prepared

in accordance with International Financial Reporting Standards,

International Accounting Standards and Interpretations

(collectively IFRSs), as adopted by UK international accounting

standards.

The Group's Annual Report and Accounts for the period ended 31

December 2023 are expected to be prepared under IFRS.

The comparative financial information for the period ended 1

January 2023 in this interim report does not constitute statutory

accounts for that period under 435 of the Companies Act 2006.

Statutory accounts for the period ended 1 January 2023 have been

delivered to the Registrar of Companies.

The auditors' report on the statutory accounts for 1 January

2023 was unqualified, did not draw attention to any matters by way

of emphasis, and did not contain a statement under 498(2) or 498(3)

of the Companies Act 2006.

Significant accounting policies

The consolidated interim financial information has been prepared

in accordance with accounting policies that are consistent with the

Group's Annual Report and Accounts for the period ended 1 January

2023 which is published on the Tortilla website, located at

www.tortillagroup.co.uk. At the date of authorisation of this

financial information, certain new standards, amendments and

interpretations to existing standards applicable to the Group have

been published but are not yet effective and have not been adopted

early by the Group. The impact of these standards is not expected

to be material.

In adopting the going concern basis for preparing these

financial statements, the Directors have considered the business

model and strategies, as well as taking into account the current

cash position and facilities.

Based on the Group's cash flow forecasts, the Directors are

satisfied that the Group will be able to operate within the level

of its current facilities for the foreseeable future, a period of

at least twelve months from the date of this report. In making this

assessment, the Directors have made a specific analysis of the

impact of both the inflationary pressures currently affecting the

industry as well as consumers, and the impact of a potential

recession.

Accordingly, the Directors consider it appropriate for the Group

to adopt the going concern basis in preparing these financial

statements.

3. Other operating income

Unaudited Unaudited

------------- ------------

26 weeks 26 weeks

ended ended

2 July 2023 3 July 2022

GBP GBP

Other government grants - 211,310

============ ============

(1) I ncludes Retail Leisure Hospitality Grants, Local

Restriction Support Grants, Restart Grants and Omicron Grants

4. Profit from operations

Profit from operations is stated after charging:

Unaudited Unaudited

------------ ------------

26 weeks 26 weeks

ended ended

2 July 2023 3 July 2022

GBP GBP

Depreciation and amortisation 3,993,091 2,923,005

Loss on disposal of fixed and

intangible assets - 13,660

Variable lease payments 229,485 548,421

Inventories - amounts charged

as an expense 7,534,184 6,184,070

Staff costs 10,815,498 8,810,841

Share option expense 208,493 181,014

Pre-opening costs 175,942 287,580

Exceptional items 125,544 306,866

Bank arrangement fee amortisation 9,270 9,270

Pre-opening costs

Unaudited Unaudited

------------ ------------

26 weeks 26 weeks

ended ended

2 July 2023 3 July 2022

GBP GBP

Pre-opening costs 175,942 287,580

Number of site openings in period 4 6

============ ============

The Group reports costs incurred prior to the opening of a site

as a separate expense and excludes these from the calculation of

adjusted EBITDA. This approach is in line with the standard

industry practice and the methodology used by the Group's bank for

the purposes of assessing covenant compliance. The Directors view

this as a better way to analyse the underlying performance of the

Group since it excludes costs which are not trading related.

5. Finance income and expenses

Unaudited Unaudited

------------ ------------

26 weeks 26 weeks

ended ended

2 July 2023 3 July 2022

GBP GBP

Finance income

Bank interest income 12,914 276

============ ============

Finance expense

Bank loan interest expense 118,217 79,681

Finance cost on lease liabilities 750,936 578,130

869,153 657,811

============ ============

6. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to equity shareholders by the weighted average number

of shares outstanding during the period.

Unaudited Unaudited

------------ ------------

26 weeks 26 weeks

ended ended

2 July 2023 3 July 2022

GBP GBP

Profit

Profit used in calculating basic

and diluted profit (618,509) 156,521

Number of shares

Weighted average number of shares

for the purpose of basic and diluted

earnings per share 38,664,031 38,664,031

Basic and diluted earnings per

share (p) (1.6) 0.4

============ ============

Due to the nature of the options granted under the long-term

incentive plan, they are considered to be contingently issuable

shares and therefore have no dilutive effect.

7. Intangible assets

Computer Goodwill Total

Software

GBP GBP GBP

Cost

At 1 January 2023 15,500 2,624,886 2,640,386

Additions - - -

Disposals - - -

At 2 July 2023 (unaudited) 15,500 2,624,886 2,640,386

=================================== ========== ==========

Amortisation

At 1 January 2023 8,181 - 8,181

Amortisation charge 2,582 - 2,582

On disposals - - -

At 2 July 2023 (unaudited) 10,763 - 10,763

=================================== ========== ==========

Net book value

At 2 July 2023 (unaudited) 4,737 2,624,886 2,629,623

=================================== ========== ==========

At 1 January 2023 7,319 2,624,886 2,632,205

=================================== ========== ==========

8. Leases

Right-of-use assets GBP Lease liabilities GBP

At 2 January 2022 24,939,614 At 2 January 2022 (31,662,090)

Additions 4,491,185 Additions (4,491,185)

Acquisition 2,671,192 Acquisition (2,671,192)

Depreciation (1,502,348) Interest expense (578,130)

Impairment - Lease payments 3,484,931

Disposals (996,353) Disposals 996,354

At 3 July 2022 (unaudited) 29,603,290 At 3 July 2022 (unaudited) (34,921,312)

============ =============

At 1 January 2023 31,035,358 At 1 January 2023 (36,723,889)

Additions 2,196,406 Additions (2,196,406)

Depreciation (2,177,598) Interest expense (750,936)

Impairment - Lease payments 2,889,443

Disposals (217,215) Disposals 217,215

At 2 July 2023 (unaudited) 30,836,951 At 2 July 2023 (unaudited) (36,564,573)

============ =============

9. Property, plant and equipment

Furniture,

Leasehold Plant and fittings

Improvements machinery and equipment Total

GBP GBP GBP GBP

Cost

At 1 January 2023 16,049,266 5,128,645 6,692,407 27,870,318

Additions 837,047 550,900 777,521 2,165,468

Disposals - - - -

At 2 July 2023 (unaudited) 16,886,313 5,679,545 7,469,928 30,035,786

------------- ------------ -------------- -----------

Depreciation

At 1 January 2023 8,068,909 3,269,990 2,810,318 14,149,217

Charge for year 577,253 303,570 932,089 1,812,912

On disposals - - - -

At 2 July 2023 (unaudited) 8,646,162 3,573,560 3,742,407 15,962,129

------------- ------------ -------------- -----------

Net book value

At 2 July 2023

(unaudited) 8,240,151 2,105,985 3,727,521 14,073,657

============= ============ ============== ===========

At 1 January 2023 7,980,357 1,858,655 3,882,089 13,721,101

============= ============ ============== ===========

10. Trade and other receivables

Unaudited Unaudited

------------ ------------

At At

2 July 2023 3 July 2022

GBP GBP

Trade debtors 868,124 678,955

Other debtors 1,249,845 873,759

Prepayments and accrued income 657,157 817,205

2,775,126 2,369,919

============ ============

Trade debtors primarily relate to sales due from third party

delivery providers and these are settled the week immediately

following the week in which the sale was recorded. There are also

amounts owed by the Group's franchise partners, which are due

within 30 days of the end of the period.

Other debtors consists of deposits held by third parties,

generally landlords, and amounts accrued but not yet invoiced to

third parties. These amounts not invoiced are franchise income and

produce from the Group's central kitchen which is sold and bought

back to the Group's main food supplier, who provides the

distribution across the Group's estate.

The Group held no collateral against these receivables at the

balance sheet dates. The Directors consider that the carrying

amount of receivables are recoverable in full and that any expected

credit losses are immaterial.

11. Trade and other payables

Unaudited Unaudited

------------ ------------

At At

2 July 2023 3 July 2022

GBP GBP

Trade payables 2,483,656 3,542,647

Other taxation and social security 1,929,037 2,024,514

Other payables 891,460 583,870

Accruals and deferred income 4,030,024 2,831,384

9,334,177 8,982,415

============ ============

The carrying value of trade and other payables classified as

financial liabilities measured at amortised, which the Directors

consider equal to fair value.

12. IFRS Comparison to UK GAAP

The Group applied IFRS for the first time in the 52-week period

ending 2 January 2022. The Group applied IFRS 16 using the modified

retrospective approach, with the date of initial application of 1

January 2018 and has restated its results for comparative period as

if the Group had always applied the new standard.

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

------------- ------------ ------------- ------------- ------------ -------------

UK GAAP IFRS UK GAAP IFRS

26 weeks IFRS 26 weeks 26 weeks IFRS 26 weeks

ended 16 ended ended 16 ended

2 July 2 July 3 July 3 July

2023 Transition 2023 2022 Transition 2022

GBP GBP GBP GBP GBP GBP

Revenue 32,745,623 - 32,745,623 26,898,368 - 26,898,368

Cost of sales (7,534,184) - (7,534,184) (6,184,070) - (6,184,070)

Gross profit 25,211,439 - 25,211,439 20,714,298 - 20,714,298

Other operating

income - - - 211,310 - 211,310

Administrative

expenses (25,869,027) 788,851 (24,970,307) (20,712,692) 708,671 (20,004,021)

Profit/(loss)

from operations (657,588) 788,851 241,132 212,916 708,671 921,587

Adjusted EBITDA 1,773,722 2,979,750 4,753,472 2,508,013 2,134,969 4,642,982

Pre-opening

costs (266,104) 90,162 (175,942) (354,288) 66,708 (287,580)

Share based

payments (208,493) - (208,493) (181,014) - (181,014)

Depreciation

and amortisation (1,821,899) (2,171,192) (3,993,091) (1,443,659) (1,493,006) (2,936,665)

Exceptional

items (125,544) - (125,544) (306,866) - (306,866)

Non-trading

costs (9,270) - (9,270) (9,270) - (9,270)

(657,588) 898,720 241,132 212,916 708,671 921,587

------------- ------------ ------------- ------------- ------------ -------------

Finance income 12,914 - 12,914 276 - 276

Finance expense (118,217) (750,936) (869,153) (79,681) (578,130) (657,811)

Profit/(loss)

before tax (762,891) 147,784 (615,107) 133,511 130,541 264,052

Tax charge (3,402) - (3,402) (107,531) - (107,531)

Profit/(loss)

for the period

and comprehensive

income attributable

to equity holders

of the parent

company (766,293) 147,784 (618,509) 25,980 130,541 156,521

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

------------- ------------ ------------ ------------ ------------ ------------

UK GAAP IFRS UK GAAP IFRS

26 weeks IFRS 26 weeks 26 weeks IFRS 26 weeks

ended 16 ended ended 16 ended

2 July 2 July 3 July 3 July

2023 Transition 2023 2022 Transition 2022

GBP GBP GBP GBP GBP GBP

Non-current

assets

Intangible assets 2,629,623 - 2,629,623 2,604,279 - 2,604,279

Right-of-use

assets - 30,836,951 30,836,951 - 29,603,290 29,603,290

Property, plant

and equipment 13,379,173 694,484 14,073,657 10,109,347 824,342 10,933,689

Total non-current

assets 16,008,796 31,531,435 47,540,231 12,713,626 30,427,632 43,141,258

Current assets

Inventories 376,641 - 376,641 442,693 - 442,693

Trade and other

receivables 4,013,124 (1,237,998) 2,775,126 3,632,953 (1,263,034) 2,369,919

Cash and cash

equivalents 1,327,470 - 1,327,470 6,083,998 - 6,083,998

Total current

assets 5,717,235 (1,237,998) 4,479,237 10,159,644 (1,263,034) 8,896,610

Total assets 21,726,031 30,293,437 52,019,468 22,873,270 29,164,598 52,037,868

============= ============ ============ ============ ============ ============

Current liabilities

Trade and other

payables 11,186,622 (1,852,445) 9,334,177 10,763,355 (1,780,940) 8,982,415

Lease liabilities - 5,762,578 5,762,578 - 5,329,676 5,329,676

Loans and borrowings - - - - - -

Corporation tax

liability - - - 1,008,221 - 1,008,221

Total current

liabilities 11,186,622 3,910,133 15,096,755 11,771,576 3,548,736 15,320,312

Non-current

liabilities

Lease liabilities - 30,801,995 30,801,995 - 29,591,636 29,591,636

Loans and borrowings 2,939,751 - 2,939,751 2,921,208 - 2,921,208

Total non-current

liabilities 2,939,751 30,801,995 33,741,746 2,921,208 29,591,636 32,512,844

Total liabilities 14,126,373 34,712,128 48,838,501 14,692,784 33,140,372 47,833,156

============= ============ ============ ============ ============ ============

Net assets /

(liabilities) 7,599,658 (4,418,691) 3,180,967 8,180,486 (3,975,774) 4,204,712

============= ============ ============ ============ ============ ============

Equity attributable to

equity holders of the company

Called up share

capital 386,640 - 386,640 386,640 - 386,640

Share premium

account 4,433,250 - 4,433,250 4,433,250 - 4,433,250

Share merger

reserve 4,793,170 - 4,793,170 4,793,170 - 4,793,170

Share based payment

reserve 661,028 - 661,028 271,521 - 271,521

Retained earnings (2,674,430) (4,418,691) (7,093,121) (1,704,095) (3,975,774) (5,679,869)

------------- ------------ ------------ ------------ ------------ ------------

Total equity 7,599,658 (4,418,691) 3,180,967 8,180,486 (3,975,774) 4,204,712

============= ============ ============ ============ ============ ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QLLFBXBLLFBZ

(END) Dow Jones Newswires

October 03, 2023 02:00 ET (06:00 GMT)

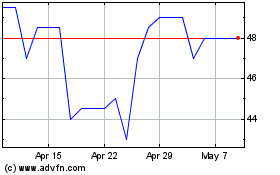

Tortilla Mexican Grill (LSE:MEX)

Historical Stock Chart

From Apr 2024 to May 2024

Tortilla Mexican Grill (LSE:MEX)

Historical Stock Chart

From May 2023 to May 2024