TIDMNAH

RNS Number : 6792A

NAHL Group PLC

24 January 2024

Prior to publication, the information contained within this

announcement was deemed by the Group to constitute inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310. With the publication of

this announcement, this information is now considered to be in the

public domain.

24 January 2024

NAHL Group PLC

("NAHL" or the "Group")

Year End Trading Update

Continued progress and significant reduction in net debt

The Board of NAHL (AIM: NAH), a leading UK marketing and

services business focused on the UK consumer legal market, is

pleased to provide an update on trading for the financial year

ended 31 December 2023 (the "Period").

Highlights

-- Continued growth in Group revenues and profit before tax

-- 73% increase in cash received from settlements, reflecting

92% more claims settled in the Group's fully integrated law firm,

National Accident Law ("NAL")

-- Over 35,000 new enquiries generated by National Accident

Helpline, continuing its growth in market share

-- Strong performance from Bush & Co., achieving 11% growth

in revenue and operating profit margin increase of 400 bps to

30%

-- Net debt reduced by 27% to GBP9.7m (31 December 2022: GBP13.3m)

Group results

Based on unaudited results, the Board expects to report revenues

for the Period of approximately GBP42.2m (2022: GBP41.4m), 2% ahead

of the prior year. Operating profit is expected to be slightly

ahead of market expectations at approximately GBP4.1m (2022:

GBP4.8m) and reflects the planned investment in scaling NAL for

greater returns in the medium to long term.

Profit before tax ("PBT") for the Period is expected to be in

line with market expectations at approximately GBP0.6m (2022:

GBP0.6m). These statutory PBT figures include approximately GBP0.8m

of amortisation of intangible assets related to business

combinations. This amortisation will conclude in the current year

to 31 December 2024.

The Group continued to generate strong levels of cash flow

through the second half of the year and as a result has been able

to significantly reduce net debt, ahead of market expectation. Net

debt at 31 December 2023 was GBP9.7m, down 16% from GBP11.5m at 30

June 2023 and down 27% from GBP13.3m at 31 December 2022. The

market expectation was GBP10.3m at 31 December 2023.

Divisional performance

Revenues in the Consumer Legal Services division are expected to

be 2% lower than last year at approximately GBP27.6m (2022:

GBP28.3m) and operating profit 33% lower at GBP2.8m (2022:

GBP4.2m). This performance was anticipated due to the continued

investment in scaling NAL alongside a reduction in revenue and

operating profit from the joint ventures and a reduction in revenue

from Residential Property following the disposal of Homeward Legal

in April 2023. The personal injury business remained profitable

after deducting members' non-controlling interests in LLPs.

The personal injury market has remained subdued but National

Accident Helpline has continued to grow market share, generating

over 35,000 enquiries in the Period, which is 2% higher than the

prior year(2) .

The Group distributed 8,518 new enquiries into NAL in the

Period. Whilst this is slightly less than the prior year (2022:

8,760), these enquiries comprise a richer mix than 2022 and so are

anticipated to generate a higher return on settlement. The firm

ended the year processing 9,983 ongoing claims (31 December 2022:

10,860) and NAL significantly increased cash from settlements by

73% to GBP6.0m (2022: GBP3.5m), demonstrating the growing maturity

of the firm and contributing to the Group's overall reduction in

net debt.

The division continued to utilise its flexible placement model

and enjoyed ongoing demand for enquiries from its panel of

third-party law firms, benefitting cash flow. The Group's mature

joint venture partnerships performed well, generating GBP4.4m of

cash (2022: GBP3.3m), after deducting drawings to LLP members.

In the Group's Critical Care division, Bush & Co. had a very

strong year. Revenues are expected to be 11% higher than last year

at approximately GBP14.6m (2022: GBP13.2m) and operating profit is

expected to be 29% ahead at approximately GBP4.4m (2022:

GBP3.4m).

These results reflect an excellent year for expert witness

services, in which revenues grew by 35% due to an increase in the

volume and value of reports issued to customers. Case management

revenues for the Period were in line with the prior year and Bush

& Co. Care Solutions grew revenues by 39%. To support this

growth, Bush & Co. increased the number of case managers and

expert witnesses it works with by 23%.

James Saralis, CEO of NAHL, commented:

"2023 represented another year of solid progress and I am

delighted to be reporting a strong financial performance for

NAHL.

"Whilst the personal injury market remained subdued, we have

successfully completed our transformation into an integrated law

firm with improved cash generation and NAL increased cash from

settlements by 73% to GBP6.0m. Critical Care has delivered a strong

financial and operational performance and there is an exciting

opportunity to deliver further market share growth.

"The Group continued to generate high levels of cash and this

led to a 27% reduction in net debt to GBP9.7m, which was well ahead

of market expectations. The steps we have taken in recent years to

enhance the Group have borne fruit and NAHL ended its financial

year in a robust position with cause to be optimistic for the

future."

Notes:

1) All full year 2023 numbers remain subject to audit.

2) Like-for-like enquiry numbers exclude tariff-only road

traffic accident claims, which the Group ceased to process in

February 2022.

For further information:

NAHL Group PLC via FTI Consulting

James Saralis (CEO) Tel: +44 (0) 20 3727 1000

Chris Higham (CFO)

Allenby Capital (AIM Nominated Adviser & Broker) Tel: +44 (0) 20 3328 5656

Jeremy Porter/Liz Kirchner (Corporate Finance)

Amrit Nahal/Stefano Aquilino (Sales & Corporate

Broking)

FTI Consulting (Financial PR) Tel: +44 (0) 20 3727 1000

Alex Beagley NAHL@fticonsulting.com

Eleanor Purdon

Amy Goldup

Notes to Editors

NAHL Group plc (AIM: NAH) is a leader in the Consumer Legal

Services market. The Group provides services and products to

individuals and businesses in the through its two divisions:

-- Consumer Legal Services provides outsourced marketing

services to law firms through National Accident Helpline and claims

processing services to individuals through National Accident Law,

Law Together and Your Law. In addition, it also provides property

searches through Searches UK.

-- Critical Care provides a range of specialist services in the

catastrophic and serious injury market to both claimants and

defendants through Bush & Co.

More information is available at www.nahlgroupplc.co.uk , www.national-accident-helpline.co.uk , www.national-accident-law.co.uk and www.bushco.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPURPGUPCGRW

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

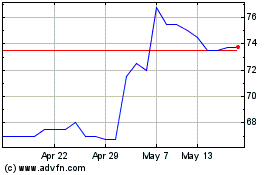

Nahl (LSE:NAH)

Historical Stock Chart

From Jan 2025 to Feb 2025

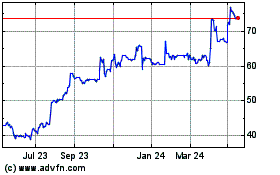

Nahl (LSE:NAH)

Historical Stock Chart

From Feb 2024 to Feb 2025