NextEnergy Solar Fund Limited Scrip Reference Price (4895X)

24 November 2017 - 11:47PM

UK Regulatory

TIDMNESF

RNS Number : 4895X

NextEnergy Solar Fund Limited

24 November 2017

NextEnergy Solar Fund Limited ("NESF")

Scrip Reference Price

The reference price of a new Ordinary Share under the scrip

dividend alternative for the interim dividend for the quarter ended

30 September 2017 has been set at 107.026p. This is the average of

the middle market prices of the Company's shares derived from the

London Stock Exchange Daily Official List for the ex-dividend date

and the four subsequent dealing days. The final date for receiving

elections on the scrip is 4 December 2017.

The process for electing to receive Scrip Shares or making

changes to an existing Scrip Dividend Mandate is detailed in the

Scrip Circular dated 21 August 2017.

If you wish to receive this interim dividend in cash on the

whole of your holding, and do not have a Scrip Dividend Mandate in

place, you do not need to take any further action.

If you already have a Scrip Dividend Mandate in place and you

wish to continue to receive Scrip Shares, you do not need to take

any further action.

The Scrip Circular dated 21 August 2017 can be viewed and/or

downloaded from the Investor Relations part of the NextEnergy Solar

Fund Limited's website . Copies of these documents can also be

obtained from the Company Secretary.

For further information:

NextEnergy Capital Limited 020 3893 1500

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe 020 7894 7667

Sue Inglis

Fidante Capital 020 7832 0900

Robert Peel

Justin Zawoda-Martin

Shore Capital 020 7408 4090

Anita Ghanekar

Macquarie Capital (Europe)

Limited 020 3037 2000

Nick Stamp

MHP Communications 020 3128 8100

Andrew Leach

Ipes (Guernsey) Limited 01481 713 843

Nick Robilliard

Notes to Editors:

NESF is a specialist investment company that invests primarily

in operating solar power plants in the UK. It is able to invest up

to 15% of its Gross Asset Value in operating solar power plants in

OECD countries outside the UK. The Company's objective is to secure

attractive shareholder returns through RPI-linked dividends and

long-term capital growth. The Company achieves this by acquiring

solar power plants on agricultural, industrial and commercial

sites.

NESF has raised equity proceeds of GBP591.9m since its initial

public offering on the main market of the London Stock Exchange in

April 2014. It also has credit facilities of GBP226m in place

(GBP150m from a syndicate including MIDIS, NAB and CBA; MIDIS:

GBP54.3m and NIBC: GBP21.7m).

NESF is differentiated by its access to NextEnergy Capital Group

(NEC Group), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division and over the course of its activities has been providing

operating asset management, monitoring, technical due diligence and

other services to over 1,300 utility-scale solar power plants with

an installed capacity in excess of 1.9 GW.

Further information on NESF, NEC Group and WiseEnergy is

available at www.nextenergysolarfund.com, www.nextenergycapital.com

and www.wise-energy.eu.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUSSURBUAAUAA

(END) Dow Jones Newswires

November 24, 2017 07:47 ET (12:47 GMT)

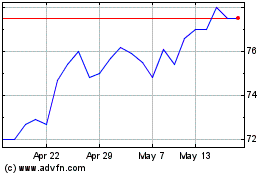

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Apr 2024 to May 2024

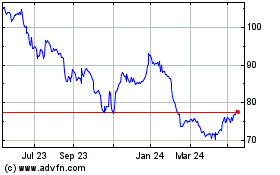

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From May 2023 to May 2024