Royal Bank of Scotland Group PLC Director/PDMR Shareholding (8674V)

12 August 2015 - 11:00PM

UK Regulatory

TIDMRBS

RNS Number : 8674V

Royal Bank of Scotland Group PLC

12 August 2015

The Royal Bank of Scotland Group plc

12 August 2015

NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL

RESPONSIBILITY ("PDMRs") IN ACCORDANCE WITH DTR3.1.2R AND DTR

3.1.4R

1. The Royal Bank of Scotland Group plc (the "Company")

announces that ordinary shares of GBP1 each in the Company

("Shares") were delivered to the PDMRs on 12 August 2015, as set

out below.

The Shares delivered represent payment of a fixed share

allowance for the six month period ended 30 June 2015.

The number of Shares delivered, the number of Shares sold to

meet associated tax liabilities and the number of Shares retained

by each PDMR is as follows:-

PDMR No. of Shares No. of Shares No. of

delivered sold to satisfy Shares

associated retained

tax liability

Elaine Arden 41,691 19,625 22,066

Mark Bailie 140,243 66,014 74,229

Chris Marks 140,243 66,014 74,229

Leslie Matheson 79,756 37,542 42,214

Ross McEwan 145,012 68,259 76,753

Simon McNamara 87,006 40,955 46,051

Jonathan Pain 43,504 20,478 23,026

Alison Rose 87,006 40,955 46,051

David Stephen 90,632 42,662 47,970

Ewen Stevenson 116,009 54,607 61,402

The market price used to determine the number of Shares

delivered was GBP3.448. Shares retained after payment of associated

tax liabilities are held on behalf of PDMRs in the Computershare

Retained Share Nominee account and will be released in instalments

over a five year retention period.

In February 2015, Mr McEwan confirmed that he did not intend to

benefit from his 2015 fixed share allowance. In light of this

commitment, he will transfer the net of tax shares retained to

charity when they are released over the course of the five year

retention period.

2. The Company also announces the vesting of 95,318 Shares to Mr

McEwan arising from a conditional share award under the RBS 2010

Long Term Incentive Plan. This award was granted on 30 August 2012

on Mr McEwan's appointment as CEO of UK Retail to replace awards

which he forfeited on leaving Commonwealth Bank of Australia. The

award was subject to RBS performance conditions measured over a

three year period to 31 December 2014.

A total of 44,867 Shares have been sold at GBP3.403 per share to

meet the immediate tax liabilities arising on vesting. Mr McEwan

has retained the remaining 50,451 vested Shares, which are subject

to a six month retention period following vesting.

For further information contact:-

RBS Media Relations - +44(0)131 523 4205

Person responsible for making notification:-

Aileen Taylor, Company Secretary

This information is provided by RNS

The company news service from the London Stock Exchange

END

RDSLLFSFTRIFLIE

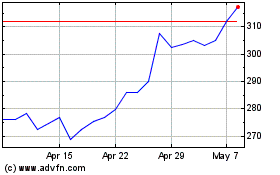

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2024 to May 2024

Natwest (LSE:NWG)

Historical Stock Chart

From May 2023 to May 2024