TIDMORPH

Open Orphan PLC

13 April 2022

Open Orphan plc

("Open Orphan" or the "Company")

Proposal to purchase Poolbeg Pharma shares from distribution in

specie shareholders

New Investors offer to purchase distribution in specie shares

ahead of end of lock-up period

Open Orphan plc (AIM: ORPH), a rapidly growing specialist

contract research organisation (CRO) and world leader in testing

infectious and respiratory disease products using human challenge

clinical trials, notes the announcement dated 11 April 2022 from

Poolbeg Pharma plc ("Poolbeg"), regarding a number of new investors

("New Investors") having expressed interest in acquiring up to

GBP1.6m of Poolbeg which are currently locked-up and held in trust

by Croft Nominees Limited as a result of the distribution in specie

from Open Orphan on 18 June 2021.

As part of these proposals, the New Investors have committed to

purchase up to GBP1.6m of the distribution in specie shares on or

around 26 April 2022 at a price of 5.9 pence per share, the closing

market price on Friday 8 April 2022. The New Investors have shown

great interest in the Poolbeg story, its significant progress since

IPO in July 2021, and its capabilities in developing novel products

utilising its unique cost-effective model in the fast-growing

infectious disease market which is expected to be worth in excess

of $250bn by 2025. This is a clear vote of confidence in Poolbeg's

prospects as it enters an extremely exciting phase of its

development with its first LPS human challenge clinical trial due

to commence in June 2022 with multiple value inflection points

expected in 2022 and beyond.

This process will allow the locked-up distribution in specie

shareholders in Poolbeg the opportunity to sell part or all of

their shareholding, should they wish to do so, prior to receiving

the shares once the lock-up period ends on 20 April 2022. The

distribution in specie shareholders will receive a letter setting

out the New Investors' proposal and a Form of Election informing

them how to participate should they wish to sell some or all of

their shares prior to the lock-up ending on 20 April 2022. These

proposals are open to all distribution in specie shareholders but

participation is at each distribution in specie shareholder's

discretion. For those shareholders who do not participate, the

title to their distribution in specie shares will be transferred to

them on or around 26 April 2022. If more than GBP1.6m is offered by

way of valid Forms of Election, then the distribution in specie

shareholders will be scaled back on a pro-rata basis.

The distribution in specie shares are exempt from income tax for

UK resident shareholders due to the advance clearance obtained by

the Company from HMRC for a statutory demerger. As such, there

should be no UK income tax liabilities for UK resident shareholders

on receipt of these shares. The only time that UK resident

shareholder will be subject to tax on these shares will be in the

event that the shareholder sells them, and in that event there will

be a capital gains tax payment due on any chargeable gain. The base

cost for capital gains calculation purposes will be 1% of the

original cost base of the Open Orphan shares which will be close to

nil (0), therefore nearly the full consideration will be subject to

capital gains tax. The above comments are intended only as a

general guide, shareholders are encouraged and recommended to seek

their own financial and tax advice.

Open Orphan plc and Poolbeg Pharma plc ordinary shares are ISA

qualifying investments. Open Orphan understands that any

distribution in specie shares held in an ISA should be treated in a

similar way to any other income generated from ISA qualifying

investments.

A copy of the letter to distribution in specie shareholders can

be found on Poolbeg's website here and an FAQ is available here

.

Cathal Friel, Executive Chairman of Open Orphan, said: "We were

delighted to see that despite the presently turbulent market that

Poolbeg has successfully managed to bring in fresh investors to

purchase up to GBP1.6m at 5.9p, the market price on Friday 8 April

2022. The new investors have shown great interest in the Poolbeg

story and its significant progress since IPO, its capabilities in

developing novel infectious disease products utilising its unique

cost-effective model. Poolbeg is well capitalised, with c. GBP20.9m

at year end 2021, so importantly it is not raising any new funds as

part of this process and, as such, there will be no dilution of

existing shareholders.

"This arrangement has followed significant efforts to help widen

the Poolbeg investor base and increase future liquidity, in order

to ensure that the dividend in specie remains as beneficial as

possible to shareholders of both Open Orphan and Poolbeg in the

long-term.

"Due to the nature of the lock-up period, which was designed to

allow for an orderly market following Poolbeg's admission to AIM,

prospective investors looking to build more substantial stakes were

unable to do so. These proposals ensure that any potential shares

sold will be going to quality, long-term holders, whilst giving

distribution in specie shareholders the option to sell shares prior

to the end of the lock-up period, if they choose to do so. In

addition, there will be substantially greater liquidity in our

shares once the distribution in specie shares have been distributed

after 26 April 2022 and we believe this will certainly help us to

attract in even more new shareholders."

Footnote

The distribution in specie shares were issued to all Open Orphan

shareholders on the share register at close of business on 17 June

2021, following this, Poolbeg successfully listed on the London

Stock Exchange AIM market on 19 July 2021. While the underlying

shareholders retain the beneficial ownership of the shares, the

distribution in specie shares are currently held in trust by Croft

during a lock-up period of nine calendar months from Poolbeg's

admission to AIM, to contribute to the creation of an orderly

market. This lock-up period will end on 20 April 2022 and on or

around 26 April 2022, shareholders will be sent a share certificate

for the distribution in specie shares. Shareholders will then have

the option to dematerialise and hold the shares via CREST. If any

Open Orphan shares that gave rise to the entitlement to the

distribution in specie shares are held in a nominee account, the

share certificate will be sent to the shareholders' broker.

The New Investors' proposals are not open for participation by

persons interested in shares who are residents or citizens of or

who have an address in, or who otherwise appear to the Company or

SLC Registrars to be connected to, the United States (or any of its

territories or possessions), Canada, Australia, Japan, Belarus or

Russia.

For further information please contact:

Open Orphan plc +353 (0) 1 644 0007

Cathal Friel, Executive Chairman

Yamin Khan, Chief Executive Officer

Arden Partners plc (Nominated Adviser

and Joint Broker) +44 (0) 20 7614 5900

John Llewellyn-Lloyd / Louisa Waddell

finnCap plc (Joint Broker) +44 (0) 20 7220 0500

Geoff Nash / James Thompson / Richard

Chambers

Davy (Euronext Growth Adviser and

Joint Broker) +353 (0) 1 679 6363

Anthony Farrell

Walbrook PR (Financial PR & IR) +44 (0)20 7933 8780 or openorphan@walbrookpr.com

Paul McManus / Sam Allen / Louis +44 (0)7980 541 893 / +44 (0) 7502 558

Ashe-Jepson 258 / +44 (0)

7747 515393

Notes to Editors

Open Orphan plc

Open Orphan plc (London and Euronext: ORPH) is a rapidly growing

contract research company that is a world leader in testing

infectious and respiratory disease products using human challenge

clinical trials. The Company provides services to Big Pharma,

biotech, and government/public health organisations.

The Company has a leading portfolio of human challenge study

models for infectious and respiratory diseases, including the

recently established COVID-19 model, and is developing a number of

new models, such as Malaria, to address the dramatic growth of the

global infectious disease market. The Paris and Breda offices have

over 25 years of experience providing drug development services

such as biometry, data management, statistics CMC, PK and medical

writing to third party clients as well as supporting the

London-based challenge studies.

Open Orphan runs challenge studies in London from its

Whitechapel quarantine clinic, its state-of-the-art QMB clinic with

its highly specialised on-site virology and immunology laboratory,

and its newly opened clinic in Plumbers Row. To recruit volunteers

/ patients for its studies, the Company leverages its unique

clinical trial recruitment capacity via its FluCamp volunteer

screening facilities in London and Manchester. The newly opened

facilities have expanded the scope of the business to enable the

offering of Phase I and Phase II vaccine field trials, PK studies,

bridging studies, and patient trials as part of large international

multi-centre studies.

Building upon its many years of challenge studies and virology

research, the Company is developing an in-depth database of

infectious disease progression data. Based on the Company's Disease

in Motion(R) platform, this unique dataset includes clinical,

immunological, virological, and digital (wearable) biomarkers.

About Poolbeg Pharma

Poolbeg Pharma is a clinical stage infectious disease

pharmaceutical company, with a capital light clinical model which

aims to develop multiple products faster and more cost effectively

than the conventional biotech model. The Company, headquartered in

London, is led by a team with a track record of creation and

delivery of shareholder value and aspires to become a "one-stop

shop" for Big Pharma seeking mid-stage products to license or

acquire.

The Company is targeting the growing infectious disease market.

In the wake of the COVID-19 pandemic, infectious disease has become

one of the fastest growing pharma markets and is expected to exceed

$250bn by 2025.

With its initial assets from Open Orphan plc , an industry

leading infectious disease and human challenge trials business,

Poolbeg has access to knowledge, experience, and clinical data from

over 20 years of human challenge trials. The Company is using these

insights to acquire new assets as well as reposition clinical stage

products, reducing spend and risk. Amongst its portfolio of

exciting assets, Poolbeg has a small molecule immunomodulator for

severe influenza (POLB 001); a first-in-class, intranasally

administered RNA-based immunotherapy for respiratory virus

infections (POLB 002); and a vaccine for Melioidosis (POLB 003).

The Company is also developing an oral vaccine delivery platform

and is progressing two artificial intelligence (AI) drug discovery

programmes to accelerate the power of its human challenge model

data and biobank.

For more information, please go to www.poolbegpharma.com or

follow us @PoolbegPharma

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRABKBBPFBKDNQD

(END) Dow Jones Newswires

April 13, 2022 02:01 ET (06:01 GMT)

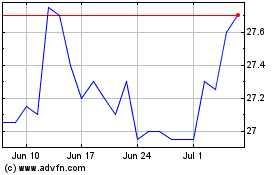

Hvivo (LSE:HVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

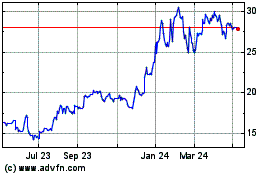

Hvivo (LSE:HVO)

Historical Stock Chart

From Apr 2023 to Apr 2024