TIDMPANR

Pantheon Resources PLC

27 September 2023

27 September 2023

Pantheon Resources plc

Commencement of Operations - Re-entry of Alkaid-2

Pantheon Resources plc (AIM: PANR) ("Pantheon" or the "Company"

or the "Group"), the oil and gas company with a 100% working

interest in the Kodiak and Ahpun projects, collectively spanning

193,000 contiguous acres in close proximity to pipeline and

transportation infrastructure on Alaska's North Slope, is pleased

to advise that operations for the re-entry at Alkaid-2 have now

commenced.

Objectives

The Alkaid-2 re-entry has three primary objectives:

(i) to gather the best possible reservoir fluid samples for

pressure-volume temperature ("PVT") analysis;

(ii) to determine initial reservoir pressure; and

(iii) test the improvements in the frac design discussed in

recent Company webinars

The objective of the operations at Alkaid-2 is not to target

maximum flow rates. Pantheon will deliberately restrict the flow

rates to minimise gas production into the well bore and allow

optimum data collection.

Re-entry to assess SMD

The Alkaid-2 well was positioned to target the Zone of Interest

("ZOI") in the optimum location and is on the edge of the mapped

SMD reservoir. Notwithstanding the thinner SMD interval at this

location when compared to the core of the Ahpun Field, the well

encountered encouraging hydrocarbon indications en route to the

deeper ZOI.

The programme of operations to achieve the three primary

objectives includes:

1. Make well safe in preparation for operations

2. Run a plug to isolate the Alkaid ZOI below the SMD horizon

3. Perforate a limited section to ensure injection pressures are

high enough to propagate the frac lobes horizontally as desired

4. Pump 11,000 bbls of water and 400,000 lbs of 100 mesh sand

5. Flow back slowly to prevent or limit gas flashing in the

reservoir (i.e. exsolving from solution in an uncontrolled manner)

in order to gather the most representative fluid samples

possible

6. Monitor pressures throughout to assess frac efficiency and original reservoir pressure.

Jay Cheatham, CEO, said: "We are pleased that operations for the

re-entry at Alkaid-2 have now begun. As stated, we are not

targeting maximum flow rates, instead, this programme is designed

to allow for as much data gathering as possible. Whilst the

location of the Alkaid-2 well is not ideal for the shallower SMD

horizon, the Company was pleasantly surprised to have logged oil

pay when drilling through the SMD en route to the primary target,

the ZOI. This has provided a low cost option to assess both the

productivity of the shallower horizon and test our improved frac

design."

Background

The Alkaid-2 well was drilled in 2022 and was positioned to

prioritise testing of the primary target (or 'zone of interest',

"ZOI"), being the oil zone successfully flow tested in the Alkaid-1

well in 2019. Testing of the ZOI was compromised in Alkaid-2 as a

result of wellbore blockages, necessitating a number of cleanout

and other remedial operations. Ultimately, the ZOI produced an IP30

production rate of c.505 barrels per day ("BPD") of marketable

liquid hydrocarbons consisting of oil, condensate and NGLs, as well

as natural gas.

As previously announced, extensive analysis has been undertaken

on the Alkaid-2 ZOI results with the data supporting a commercial

development based upon 10,000ft lateral development wells, a

doubling of the frac efficiency to 40% and assuming no improvement

in reservoir quality. The data indicates that well productivity has

the potential to improve materially based upon better frac design.

Tony Beilman, Pantheon's recently appointed Senior VP of

Engineering, and an expert in fracking in North America, believes

that with iterative optimisation, Pantheon has the potential to

meet typical performance benchmarks, a 4x improvement upon that

achieved in the ZOI. One of the primary objectives of the upcoming

Shelf Margain Deltaic test is to assess the efficacy of an updated

frac design.

-ENDS-

Further information, please contact:

+44 20 7484

Pantheon Resources plc 5361

David Hobbs, Executive Chairman

Jay Cheatham, CEO

Justin Hondris, Director, Finance and Corporate

Development

Canaccord Genuity plc (Nominated Adviser and

broker)

+44 20 7523

Henry Fitzgerald-O'Connor, Gordon Hamilton 8000

BlytheRay

+44 20 7138

Tim Blythe, Megan Ray, Matthew Bowld 3204

Notes to Editors

Pantheon Resources plc is an AIM listed Oil & Gas company

focused on developing the Ahpun and Kodiak fields located on state

land on the Alaska North Slope ("ANS"), onshore USA where it has a

100% working interest in 193,000 acres. Management estimates these

fields to produce Expected Ultimate Recovery of contingent

resources amounting to some 2 billion barrels of marketable liquids

to be delivered through the Trans Alaska Pipeline System

("TAPS").

Pantheon's stated objective is to demonstrate sustainable market

recognition of a value of $5-$10/bbl of recoverable resources by

end 2028. This will require targeting Final Investment Decision

("FID") on the Ahpun field by the end of 2025, building production

to 20,000 barrels per day of marketable liquids into the TAPS main

oil line, and applying the resultant cashflows to support the FID

on the Kodiak field by the end of 2028.

A major differentiator to other ANS projects is the close

proximity to existing roads and pipelines which offers a

significant competitive advantage to Pantheon, allowing for

materially lower infrastructure costs and the ability to support

the development with a significantly lower pre-cashflow funding

requirement than is typical in Alaska.

The Company's project portfolio has been endorsed by world

renowned experts. Netherland, Sewell & Associates ("NSAI")

estimate a 2C contingent recoverable resource in the Kodiak project

that total 962.5 million barrels of marketable liquids and 4,465

billion cubic feet of natural gas. NSAI is currently working on

estimates for the Ahpun Field.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAZZGZLRVDGFZM

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

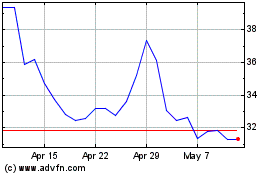

Pantheon Resources (LSE:PANR)

Historical Stock Chart

From Apr 2024 to May 2024

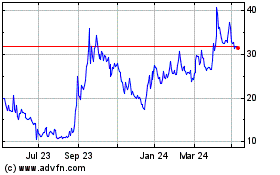

Pantheon Resources (LSE:PANR)

Historical Stock Chart

From May 2023 to May 2024