RNS Number:1707S

Petaling Tin Berhad

28 February 2002

PETALING TIN BERHAD

(Incorporated in Malaysia)

REPORTS AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31ST OCTOBER, 2001

CONTENTS

********

1. Directors' Report

7. Statement by Directors

7. Statutory Declaration

8. Report of the Auditors to the Members

10. Balance Sheets

12. Income Statements

13. Statements of Changes in Equity

15. Cash Flow Statements

18. Notes to the Financial Statements

Company No: 324-H

PETALING TIN BERHAD

(Incorporated in Malaysia)

DIRECTORS' REPORT

The Directors have pleasure in submitting their report and the audited financial

statements of the Group and of the Company for the year ended 31st October,

2001.

PRINCIPAL ACTIVITIES

The Company is principally engaged in the business of investment holding and

provision of management services. The principal activities of the subsidiary

companies are disclosed in note 3 to the financial statements. There have been

no significant changes in the nature of these activities during the year.

RESULTS

GROUP COMPANY

RM RM

Profit/(Loss) for the year 588,661 (4,020,108)

DIVIDENDS

No dividend has been paid, declared or proposed since the end of the Company's

previous financial year.

RESERVES AND PROVISIONS

There were no material transfers to or from reserves or provisions during the

year other than those mentioned in the financial statements.

BAD AND DOUBTFUL DEBTS

Before the income statements and balance sheets of the Group and of the Company

were made out, the Directors took reasonable steps to ascertain that action had

been taken in relation to the writing off of bad debts and the making of

provisions for doubtful debts, and have satisfied themselves that there were no

known bad debts and that adequate provision had been made for doubtful debts.

-1-

At the date of this report, the Directors of the Company are not aware of any

circumstances which would require the writing off of bad debts, or the amount of

the provision for doubtful debts in the financial statements of the Group and of

the Company inadequate to any substantial extent.

CURRENT ASSETS

Before the income statements and balance sheets of the Group and of the Company

were made out, the Directors took reasonable steps to ensure that any current

assets which were unlikely to realise in the ordinary course of business their

values as shown in the accounting records of the Group and of the Company have

been written down to an amount which they might be expected so to realise.

At the date of this report, the Directors are not aware of any circumstances

which would render the values attributed to the current assets in the financial

statements of the Group and of the Company misleading.

VALUATION METHODS

At the date of this report, the Directors are not aware of any circumstances

which have arisen which render adherence to the existing method of valuation of

assets or liabilities of the Group and of the Company misleading or

inappropriate.

CONTINGENT AND OTHER LIABILITIES

At the date of this report there does not exist:-

(i) any charge on the assets of the Group or of the Company which has arisen

since the end of the financial year which secures the liabilities of any

other person, or

(ii) any contingent liability in respect of the Group or of the Company which

has arisen since the end of the financial year.

No contingent liability or other liability of the Group or of the Company has

become enforceable, or is likely to become enforceable within the period of

twelve months after the end of the financial year which, in the opinion of the

Directors, will or may substantially affect the ability of the Group or of the

Company to meet their obligations as and when they fall due.

CHANGE OF CIRCUMSTANCES

At the date of this report, the Directors are not aware of any circumstances,

not otherwise dealt with in this report or the financial statements of the Group

and of the Company which would render any amount stated in the financial

statements misleading.

-2-

ITEMS OF AN UNUSUAL NATURE

In the opinion of the Directors:-

(i) the results of the operations of the Group and of the Company for the

financial year were not substantially affected by any item, transaction or

event of a material and unusual nature.

(ii) there has not arisen in the interval between the end of the financial year

and the date of this report any item, transaction or event of a material

and unusual nature likely to affect substantially the results of the

operations of the Group and of the Company for the financial year in which

this report is made.

ISSUE OF SHARES

During the year, the following issues of shares were made by the Company:-

Date of Issue Class Number Terms And Purpose of Issue

5.3.2001 and Ordinary RM1/- 73,577,586 and Conversion of Irredeemable

4.9.2001 72,801,724 respectively Convertible Unsecured

Loan Stocks 2000/2010

CONVERSION OF IRREDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS 2000/2010 ("ICULS")

The particulars of the conversion of the ICULS up to the end of the current

financial year are as follows:-

(a) on 5th March, 2001, RM85,350,000/- nominal value of ICULS were converted

into 73.577,586 fully paid ordinary shares of RM1/- each of the Company at a

conversion price of RM1.16 each; and

(b) on 4th September, 2001, RM84,450,000/- nominal value of ICULS were converted

into 72,801,724 fully paid ordinary shares of RM1/- each of the Company at a

conversion price of RM1.16 each.

The terms of issue of the ICULS are as disclosed in note 20 to the financial

statements.

DETACHABLE WARRANTS 2000/2010 ("WARRANTS")

There were no warrants exercised during the financial year.

-3-

DIRECTORS OF THE COMPANY

The Directors in office since the date of the last report are:-

DATUK HAJI JAAFAR BIN ABU BAKAR

TAN SRI DR. CHEN LIP KEONG

WONG SWEE MIN (Resigned on 31.10.01)

LAI GIN NYAP

CHIN YIT KONG

DATUK WAN KASSIM BIN AHMED (Appointed on 2.7.01)

CHONG KOK KONG (Appointed on 31.10.01)

DIRECTORS' INTEREST IN SHARES, ICULS AND WARRANTS

Particular of Directors' interest in the shares, ICULS and warrants of the

Company during the financial year according to the registers required to be kept

under Section 134 of the Companies Act, 1965 are as follows:-

Number of Ordinary Shares of RM1/- Each

At At

1.11.00 Bought Sold 31.10.01

Direct Interest

Datuk Haji Jaafar bin Abu Bakar 5,000 - - 5,000

Tan Sri Dr. Chen Lip Keong 20,435,096 *48,362,068 - 68,797,164

Lai Gin Nyap 5,000 - - 5,000

Chin Yit Kong 1,000 - - 1,000

Indirect Interest

Tan Sri Dr. Chen Lip Keong 5,097,524 *22,060,345 - 27,157,869

*Conversion of ICULS

Amount of ICULS At Nominal Value of RM1/- Each

At Converted/ At

1.11.00 Acquired Transferred 31.10.01

Direct Interest

Tan Sri Dr. Chen Lip Keong 93,499,999 - (56,100,000) 37,399,999

Indirect Interest

Tan Sri Dr. Chen Lip Keong 85,300,001 - (51,180,000) 34,120,001

-4-

Number of Warrants

At At

1.11.00 Allotted Sold 31.10.01

Direct Interest

Datuk Haji Jaafar bin Abu Bakar 2,000 - - 2,000

Tan Sri Dr. Chen Lip Keong 10,217,048 - - 10,217,048

Lai Gin Nyap 2,000 - - 2.000

The conversion price of ICULS and the exercise price of Warrants have been

determined at RM1.16 for each new ordinary shares of RM1/- of the Company.

In accordance with the existing Articles 77 and 79(c) of the Company's Articles

of Association and paragraph 7.28 (2) of the Listing Requirements of the Kuala

Lumpur Stock Exchange, Mr. Chin Yit Kong, Datuk Wan Kassim bin Ahmed, Mr. Chong

Kok Kong and Tan Sri Dr. Chen Lip Keong retire from the board at the forthcoming

annual general meeting and being eligible offer themselves for re-election.

DIRECTORS' BENEFITS

Since the end of the previous financial year, no director of the Company has

received or become entitled to receive any benefit (other than the Directors'

remuneration disclosed in note 23 to the financial statements) by reason of a

contract made by the Company or a related corporation with the Director or with

a firm of which the Director is a member, or with a company in which the

Director has a substantial financial interest.

Neither during nor at the end of the financial year, was the Company a party to

any arrangements whose object is to enable the Directors to acquire benefits by

means of the acquisition of shares in or debentures of the Company or any other

body corporate.

SIGNIFICANT EVENTS

(a) On 20th November, 2000, a subsidiary company, Golden Domain Holdings Sdn.

Bhd., subscribed 249,998 ordinary shares of RM1/- each in its subsidiary

company, Lembah Langat Development Sdn. Bhd., for a total cash consideration

of RM249,998/-.

(b) On 5th March, 2001, RM85,350,000/- nominal value of ICULS were converted

into 73,577,586 fully paid ordinary shares of RM1/- each of the Company at a

conversion price of RM1.16 each. The new shares rank pari passu with the

existing shares.

As a result of the conversion, the issued and fully paid share capital of

the Company was increased from RM100,844,060/- to RM174,421,646/- as at 5th

March, 2001.

-5-

(c) The Company executed a share sale agreement on 11th September, 2000 for the

proposed acquisition of 62,400,000 ordinary shares of HKD1/- each

representing 80% equity interest in Naga Resorts & Casinos Limited from

Sharpwin International Limited for a purchase consideration of

RM1,307,200,000/- (equivalent to USD344,000,000/-based on the exchange rate

of RM3.80 per USD1/-) to be satisfied by the issuance of 1,233,207,547 new

ordinary shares of RM1/- each in the Company at an issue price of RM1.06 per

share, subject to approval from the relevant authorities. The above

application to the relevant authorities has been withdrawn on 23rd July,

2001 and therefore the conditional share sale agreement was aborted.

(d) On 4th September, 2001, RM84,450,000/- nominal value of ICULS were converted

into 72,801,724 fully paid ordinary shares of RM1/- each of the Company at a

conversion price of RM1.16 each. The new shares rank pari passu with the

existing shares.

As a result of the conversion, the issued and fully paid share capital of

the Company was increased from RM174,421,646/- to RM247,223,370/- as at 4th

September, 2001.

(e) On 30th October, 2001, the Company acquired 2 ordinary shares of RM1/- each

representing 100% of the issued and paid-up share capital of Petaling

Ventures Sdn. Bhd. (formerly known as Intensive Strategies Sdn. Bhd.), a

company incorporated in Malaysia, for a cash consideration of RM2/-.

AUDITORS

The auditors, Messrs. Moore Stephens, have expressed their willingness to

continue in office.

On Behalf of the Board

DATUK HAJI JAAFAR BIN ABU BAKAR

LAI GIN NYAP

-6-

STATEMENT BY DIRECTORS

We, the undersigned, being two of the Directors of the Company, state that in

the opinion of the Directors, the accompanying financial statements as set out

on pages 10 to 42, are drawn up in accordance with the provisions of the

Companies Act, 1965 and applicable approved accounting standards in Malaysia so

as to give a true and fair view of the state of affairs of the Group and of the

Company as at 31st October, 2001 and of the results of the operations, changes

in equity and cash flows of the Group and of the Company for the year ended on

that date.

On Behalf of the Board

DATUK HAJI JAAFAR BIN ABU BAKAR

LAI GIN NYAP

KUALA LUMPUR

STATUTORY DECLARATION

I, Lai Gin Nyap, NRIC No.: 680731-08-5493, being the Director primarily

responsible for the financial management of the Company, do solemnly and

sincerely declare that the financial statements as set out on pages 10 to 42 are

to the best of my knowledge and belief, correct and I make this solemn

declaration conscientiously believing the same to be true and by virtue of the

provisions of the Statutory Declarations Act, 1960.

Subscribed and solemnly declared at

Kuala Lumpur in the Federal Territory

this 25th day of February 2002

Before me

LAI GIN NYAP

-7-

LETTER TO: PETALING TIN BERHAD

REPORT OF THE AUDITORS TO THE MEMBERS OF

PETALING TIN BERHAD

(Incorporated in Malaysia)

We have audited the financial statements set out on pages 10 to 42.

The preparation of the financial statements are the responsibility of the

Company's Directors. Our responsibility is to express an opinion on the

financial statements based on our audit.

We conducted our audit in accordance with the approved standards on auditing in

Malaysia. These standards require that we plan and perform the audit to obtain

all the information and explanations, which we considered necessary to provide

us with sufficient evidence to give reasonable assurance that the financial

statements are free of material misstatement. Our audit includes examining, on a

test basis, evidence relevant to the amounts and disclosures in the financial

statements. Our audit includes an assessment of the accounting principles used

and significant estimates made by the Directors as well as evaluating the

overall adequacy of the presentation of information in the financial statements.

We believe our audit provides a reasonable basis for our opinion.

In our opinion:-

(a) the financial statements which have been prepared under the historical cost

convention, are properly drawn up in accordance with the provisions of the

Companies Act, 1965 and applicable approved accounting standards in Malaysia

so as to give a true and fair view of:-

(i) the matters required by Section 169 of the Companies Act, 1965, to be

dealt with in the financial statements of the Group and of the Company;

and

(ii) the state of affairs of the Group and of the Company as at 31st October,

2001 and of the results of the operations, changes in equity and cash

flows of the Group and of the Company for the year ended on that date;

and

(b) the accounting and other records and the registers required by the Companies

Act, 1965, to be kept by the Company and its subsidiary companies of which

we have acted as auditors have been properly kept in accordance with the

provisions of the said Act.

We are satisfied that the financial statements of the subsidiary companies that

have been consolidated with the Company's financial statements are in form and

content appropriate and proper for the purposes of the preparation of the

consolidated financial statements and we have received satisfactory information

and explanations required by us for these purposes.

-8-

Our auditors' reports on the financial statements of the subsidiary companies

were not subject to any qualification and did not include any comment made under

Section 174(3) of the Companies Act, 1965.

KUALA LUMPUR

25 FEB 2002

LETTER FROM: MOORE STEPHENS

-9-

BALANCE SHEETS AS AT 31ST OCTOBER, 2001

GROUP COMPANY

2001 2000 2001 2000

NOTE RM RM RM RM

NON-CURRENT ASSETS

Property, plant and equipment 2 14,259,520 16,630,276 410,384 246,495

Investment in subsidiary companies 3 - - 187,555,004 188,013,207

Interest in associated company 4 - - - -

Investment properties 5 87,638,700 87,638,700 - -

Deferred land and development expenditure 6 161,564,689 161,485,197 - -

263,462,909 265,754,173 187,965,388 188,259,702

CURRENT ASSETS

Land and development expenditure 6 127,697,868 119,825,869 - -

Inventories 7 15,658,252 18,225,092 - -

Short term investments 8 372,982 372,982 371,001 371,001

Trade debtors 9 38,668,957 30,096,479 - -

Other debtors, deposits and prepayments 10 1,110,557 3,385,836 163,041 1,294,951

Amount owing by subsidiary companies 11 - - 184,050,661 153,792,051

Deposits with licensed banks 12 484,500 33,724,000 50,000 33,285,000

Cash and bank balances 13 2,335,165 4,857,535 319,238 1,011,386

186,328,281 210,487,793 184,953,941 189,754,389

-10-

GROUP COMPANY

2001 2000 2001 2000

NOTE RM RM RM RM

CURRENT LIABILITIES

Trade creditors 14 8,112,231 5,882,354 7,091 19,109

Other creditors and accruals 15 17,853,431 46,316,551 4,107,274 5,214,018

Hire purchase creditors 16 63,630 70,728 13,619 26,718

Term loan - secured 17 1,032,206 3,662,206 - -

Taxation 10,614,352 8,169,622 - -

37,675,850 64,101,461 4,127,984 5,259,845

NET CURRENT ASSETS 148,652,431 146,386,332 180,825,957 184,494,544

412,115,340 412,140,505 368,791,345 372,754,246

CAPITAL AND RESERVES

Share capital 18 247,223,370 100,844,060 247,223,370 100,844,060

Reserves 19 9,867,289 (14,142,062) 6,798,930 (12,601,652)

SHAREHOLDERS' EQUITY 257,090,659 86,701,998 254,022,300 88,242,408

NON-CURRENT LIABILITIES

Hire purchase creditors 16 69,045 54,608 69,045 11,838

Irredeemable Convertible

Unsecured Loan Stocks 20 114,700,000 284,500,000 114,700,000 284,500,000

Deferred taxation 21 40,255,636 40,883,899 - -

155,024,681 325,438,507 114,769,045 284,511,838

412,115,340 412,140,505 368,791,345 372,754,246

The annexed notes form an integral part of,

and should be read in conjunction with, these financial statements.

-11-

INCOME STATEMENTS

FOR THE YEAR ENDED 31ST OCTOBER, 2001

GROUP COMPANY

2001 2000 2001 2000

NOTE RM RM RM RM

OPERATING REVENUE 22 23,826,851 40,440,822 1,349,536 933,829

COST OF SALES (12,947,842) (29,460,476) - -

GROSS PROFIT 10,879,009 10,980,346 1,349,536 933,829

OTHER OPERATING REVENUE 1,212,596 1,327,319 709,772 849,267

DISTRIBUTION COSTS (82,717) (74,032) (21,883) (33,934)

ADMINISTRATIVE COSTS (5,636,521) (3,624,592) (3,506,261) (2,431,716)

OTHER OPERATING COSTS (3,820,401) (952,522) (2,534,916) (869,000)

(9,539,639) (4,651,146) (6,063,060) (3,334,650)

PROFIT/(LOSS) FROM OPERATIONS 2,551,966 7,656,519 (4,003,752) (1,551,554)

FINANCE COSTS (46,091) (345,995) (16,356) (10,179)

PROFIT/(LOSS) BEFORE TAXATION 23 2,505,875 7,310,524 (4,020,108) (1,561,733)

TAXATION 24 (1,917,214) (2,979,073) - -

PROFIT/(LOSS) FOR THE YEAR 588,661 4,331,451 (4,020,108) (1,561,733)

EARNINGS PER SHARE (SEN) 25

- Basic 0.36 5.3

- Fully diluted 0.17 1.9

The annexed notes form an integral part of,

and should be read in conjunction with, these financial statements.

-12-

STATEMENTS OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31ST OCTOBER, 2001

TOTAL

SHARE SHARE ACCUMULATED SHAREHOLDERS'

CAPITAL PREMIUM RESERVES LOSSES EQUITY

RM RM RM RM RM

GROUP

At 1.11.99 20,168,412 11,171,411 2,583,709 (25,769,839) 8,153,693

Allotted during the year 80,673,648 - - - 80,673,648

Warrants exercised during the year 2,000 320 - - 2,320

Expenses in connection with the

issue of shares - (6,459,114) - - (6,459,114)

Net profit for the year - - - 4,331,451 4,331,451

At 31.10.00 100,844,060 4,712,617 2,583,709 (21,438,388) 86,701,998

Conversion of Irredeemable

Convertible Unsecured Loan

Stocks 146,379,310 23,420,690 - - 169,800,000

Net profit for the year - - - 588,661 588,661

At 31.10.01 247,223,370 28,133,307 2,583,709 (20,849,727) 257,090,659

-13-

TOTAL

SHARE SHARE ACCUMULATED SHAREHOLDERS'

CAPITAL PREMIUM RESERVES LOSSES EQUITY

RM RM RM RM RM

COMPANY

At 1.11.99 20,168,412 11,171,411 3,363,987 (19,116,523) 15,587,287

Allotted during the year 80,673,648 - - - 80,673,648

Warrants exercised during the year 2,000 320 - - 2,320

Expenses in connection with the

issue of shares - (6,459,114) - - (6,459,114)

Net loss for the year - - - (1,561,733) (1,561,733)

At 31.10.00 100,844,060 4,712,617 3,363,987 (20,678,256) 88,242,408

Conversion of Irredeemable

Convertible Unsecured Loan

Stocks 146,379,310 23,420,690 - - 169,800,000

Net loss for the year - - - (4,020,108) (4,020,108)

At 31.10.01 247,223,370 28,133,307 3,363,987 (24,698,364) 254,022,300

The annexed notes form an integral part of,

and should be read in conjunction with, these financial statements.

-14-

CASH FLOW STATEMENTS

FOR THE YEAR ENDED 31ST OCTOBER, 2001

GROUP COMPANY

2001 2000 2001 2000

NOTE RM RM RM RM

CASH FLOWS FROM

OPERATING ACTIVITIES

Profit/(Loss) Before Taxation 2,505,875 7,310,524 (4,020,108) (1,561,733)

Adjustments for:-

Bad debts written off - 287,229 - 287,229

Depreciation of property, plant and equipment 1,878,172 1,838,956 143,527 64,635

Dividend revenue (19,786) (10,561) (19,520) (10,281)

Gain on disposal of property,

plant and equipment (66,807) (80,608) (66,807) -

Loss on disposal of quoted shares - 3,905 - 3,905

Impairment loss on property, plant and

equipment 800,000 - - -

Interest expenses 43,181 342,580 13,446 8,334

Interest revenue (664,955) (544,533) (457,958) (531,932)

Preliminary expenses written off - 5,833 - -

Pre-operating expenses written off - 26,959 - -

Write down inventories to net realisable value 93,973 - - -

Provision for diminution in value of quoted

shares - 129,164 - 129,164

Provision for doubtful debts 141,325 - 56,873 -

Provision for doubtful debts no

longer required - (37,327) - (37,327)

Operating Profit/(Loss) Before

Working Capital Changes 4,710,978 9,272,121 (4,350,547) (1,648,006)

Decrease/(Increase) in inventories 2,472,867 (18,213,083) - -

(Increase)/Decrease in debtors (6,443,562) (24,695,571) 1,069,999 (430,989)

(Decrease)/Increase in creditors (25,722,964) 29,602,787 (660,557) 1,221,528

Increase in amount owing by

subsidiary companies - - (30,258,610) (39,646,490)

Increase in land and development expenditure (8,409,696) (22,815,363) - -

Cash Used In Operations Carried Down (33,392,377) (26,849,109) (34,199,715) (40,503,957)

-15-

GROUP COMPANY

2001 2000 2001 2000

NOTE RM RM RM RM

Cash Used In Operations

Brought Down (33,392,377) (26,849,109) (34,199,715) (40,503,957)

Interest paid (43,181) (342,580) (13,446) (8,334)

Interest received 664,955 544,533 457,958 531,932

Tax (paid)/refunded (147,783) (26,312) 5,038 -

Net Cash Used In Operating Activities (32,918,386) (26,673,468) (33,750,165) (39,980,359)

CASH FLOWS FROM INVESTING ACTIVITIES

Acquisition of subsidiary companies, net

of cash acquired 26 - 1,998 - -

Deferred expenditure incurred - (5,708) - -

Dividend received 19,786 10,561 19,520 10,281

Proceeds from disposal of property,

plant and equipment 90,250 217,000 90,250 -

Proceeds from disposal of quoted shares - 1,750 - 1,750

Purchase of property, plant and equipment 27 (246,859) (63,881) (246,859) (63,881)

Placement of fixed deposits (434,500) - - -

Purchase of investment - - (2) (2)

Net Cash (Used In)/Generated From

Investing Activities (571,323) 161,720 (137,091) (51,852)

(33,489,709) (26,511,748) (33,887,256) (40,032,211)

CASH FLOWS FROM FINANCING ACTIVITIES

Expenses in connection with the

issue of shares - (6,459,114) - (6,459,114)

Proceeds from issuance of share capital - 80,675,968 - 80,675,968

Repayment to hire purchase creditors (76,661) (215,140) (39,892) (30,916)

Term loan repayment (2,630,000) (9,316,629) - -

Net Cash (Used In)/Generated From

Financing Activities (2,706,661) 64,685,085 (39,892) 74,185,938

NET (DECREASE)/INCREASE IN CASH AND

CASH EQUIVALENTS CARRIED DOWN (36,196,370) 38,173,337 (33,927,148) 34,153,727

-16-

GROUP COMPANY

2001 2000 2001 2000

NOTE RM RM RM RM

NET (DECREASE)/INCREASE IN CASH AND CASH

EQUIVALENTS BROUGHT DOWN (36,196,370) 38,173,337 (33,927,148) 34,153,727

CASH AND CASH EQUIVALENTS AT BEGINNING OF

THE YEAR 38,531,535 358,198 34,246,386 92,659

CASH AND CASH EQUIVALENTS AT END OF THE

YEAR 28 2,335,165 38,531,535 319,238 34,246,386

The annexed notes form an integral part of,

and should be read in conjunction with, these financial statements.

-17-

NOTES TO THE FINANCIAL STATEMENTS - 31ST OCTOBER, 2001

The financial statements of the Group and of the Company have been prepared in

accordance with the provisions of the Companies Act, 1965 and applicable

approved accounting standards in Malaysia.

1. ACCOUNTING POLICIES

(a) Basis of Accounting

The financial statements of the Group and of the Company have been

prepared under the historical cost convention other than those

mentioned in note 7 to the financial statements. Certain development

properties of the subsidiary companies are stated in the Group's

financial statements at values reflecting the effective acquisition

costs to the Group (Group cost) of these assets.

(b) Basis of Consolidation

The consolidated financial statements include the financial statements

of the Company and its subsidiary companies made up to the balance

sheet date. The results of subsidiary companies acquired during the

year are included in the consolidated income statement from the date of

their acquisition. All intercompany balances and significant

transactions have been eliminated on consolidation.

All subsidiary companies are consolidated using the acquisition

accounting method. The results of subsidiary companies acquired or

disposed of during the financial year are included in the consolidated

income statements from the date of their acquisition or up to the date

of their disposal.

At the date of acquisition, the fair values of the subsidiary

companies' net assets are determined and these values are incorporated

in the consolidated financial statements. Any difference between the

cost of investment and the fair value of the net assets of the

subsidiary companies that remains is shown in the balance sheet as

goodwill or reserve on consolidation.

(c) Investments

Investment in subsidiary companies and associated company are stated at

cost and provision is made for any permanent diminution in value

determined on an individual basis.

-18-

Investment in quoted and unquoted shares held as long term investments

are stated at cost and are only written down when the Directors

consider that there is a permanent diminution in the value of the

investments.

Short term investments in quoted shares are stated at lower of cost and

market value on an aggregate basis.

(d) Investment Properties

Investment properties comprises properties which are held for

investment potential. It is the Group's policy to maintain these

properties in a high standard and condition. As such, these properties

maintain their residual value of not less than their respective book

value such that depreciation would be negligible. In view of this, no

depreciation is provided for these properties. The related maintenance

expenditure is dealt with in the income statement. It is the Group's

policy to appraise the investment properties once in every five years

by independent professional valuation based on open market values.

Any surplus or deficit therefrom will be dealt with in the revaluation

surplus account.

(e) Associated Companies

An associated company is defined as a company, not being a subsidiary

company, in which the Group has a long term equity interest of between

20% to 50% and in whose financial and operating decisions, the Group

exercises significant influence.

The consolidated income statement includes the Group's share of the

associated companies' profits less losses based on the audited or

management accounts of the associated companies after adjustments for

depreciation of depreciable assets stated at fair values to the Group

and amortisation or write down of goodwill or reserve on acquisition of

the associated companies. The share of losses of associated companies

are limited to the carrying value of the investment determined on an

individual basis.

(f) Property, Plant and Equipment and Depreciation

Property, plant and equipment are stated at cost less accumulated

depreciation and impairment loss except for freehold land which is not

amortised.

Leasehold land and mines' development costs are amortised on a straight

line basis over the expected working lives of the mines. Since the

cessation of the mining operations in 1997, all mines' development costs

have been fully amortised to the income statement.

Dredge is depreciated on a straight line basis so as to write down its

cost to its estimated net residual value by the end of its expected

useful life.

-19-

Fully depreciated property, plant and equipment are retained in the

financial statements at a nominal value of RM1/- each until they are no

longer in use and no further charge for depreciation is made in respect

of these assets.

All other property, plant and equipment are depreciated on the straight

line method to write off the cost of the assets over their estimated

useful lives.

The principal annual rates used for this purpose are:-

Buildings 2%

Plant and equipment 10% - 33%

Motor vehicles 20%

The carrying amounts of property, plant and equipment are reviewed at

each balance sheet date to determine whether there is any indication of

impairment. If such an indication exists, the asset's recoverable amount

is estimated. An impairment loss is recognised whenever the carrying

amount of an item of property, plant and equipment exceeds its

recoverable amount.

An impairment loss is recognised as an expenses in the income statement.

However, an impairment loss on a revalued asset will be treated as a

revaluation deficit to the extent that the loss does not exceed the

amount held in the revaluation reserve account in respect of the same

asset.

Any subsequent increase in recoverable amount due to a reversal of

impairment loss is restricted to the carrying amount that would have

been determined (net of accumulated depreciation) had no impairment loss

been recognised in prior years. The reversal of impairment loss is

recognised as revenue in the income statement. However, the reversal

of impairment loss on a revalued asset will be treated as a revaluation

surplus.

(g) Land and Development Expenditure

Land and development expenditure consists of land, stated at cost to the

Group which is currently under active development and it is expected to

be completed within the normal operating cycles, and development

expenditure incurred to date including borrowing costs and a proportion

of estimated profit attributable to development work performed to date,

less progress payments received and receivable.

Group cost arising from acquisition of property development subsidiary

companies is amortised over the period of development by reference to

the percentage of completion of the development properties.

Where foreseeable losses on development projects are anticipated, full

provision for these losses is made in the financial statements.

Deferred land and development expenditure comprise land held for future

development, are stated at Group cost.

-20-

(h) Inventories

Inventories are stated at the lower of cost and net realisable value and

are determined on the weighted average basis. Costs include the actual

cost of materials and incidental in bringing the inventories into store

and for finished goods, they include labour and an appropriate proportion

of production overheads.

In arriving at net realisable value, due allowance has been made for all

obsolete and slow-moving inventories.

Inventories of completed unsold properties are stated at the lower of

cost or net realisable value. Cost comprise attributable land and

development expenditure incurred up to completion of the properties.

(i) Debtors

Known bad debts are written off and specific provision is made for those

debts considered to be doubtful of collection.

(j) Revenue Recognition

Profit from development properties sold is recognised based on the

percentage of completion method where the outcome of the development can

be reliably estimated, in the proportion which total costs incurred to

date bear to the total estimated costs of the development.

Sales of goods are recognised when goods are delivered or services

performed.

Dividend revenue from quoted investment and rental revenue are recognised

on the receipt basis.

Interest revenue is recognised on receivable basis.

(k) Hire Purchase

Cost of property, plant and equipment acquired under the hire purchase

instalment plans are capitalised as property, plant and equipment and

depreciated in accordance with the Company's policy on depreciation of

property, plant and equipment. The hire purchase obligations are included

in creditors and the related financing charges are allocated to the

income statement on the sum-of-digit method.

-21-

(I) Transactions In Foreign Currencies

Transactions in foreign currencies are translated into Ringgit Malaysia

at the rates of exchange ruling at the dates of the transactions and

where settlement had not taken place by 31st October, 2001, at the

approximate rates ruling as at that date. All gains and losses on

exchange are included in the income statement.

The principal exchange rate (denominated in unit of Ringgit Malaysia per

foreign currency) used in translating at the financial year end is as

follows:-

2001 2000

RM RM

U.S. Dollar 3.80 3.80

(m) Deferred Taxation

Provision is made by using the liability method for deferred taxation in

respect of all material timing differences except where it is thought

reasonable that the tax effects of such deferrals will continue in the

foreseeable future. Deferred tax benefits are only recognised to the

extent of any deferred tax liability and where there is a reasonable

expectation of realisation in the near future.

(n) Cash and Cash Equivalents

Cash and cash equivalents consists of cash and bank balances, demand

deposits, bank overdrafts and highly liquid investments that are readily

convertible to known amount of cash and are subject to an insignificant

risk of changes in value.

(o) Capitalisation of Borrowing Costs

Interest incurred on borrowings related to development properties is

capitalised during the period when activities to develop and construct

these assets are in progress. Capitalisation of borrowing costs will

cease when these assets are ready for their intended sale.

-22-

2. PROPERTY, PLANT AND EQUIPMENT

SHORT

TERM DEVELOPMENT

FREEHOLD LEASEHOLD COSTS & PLANT & MOTOR

LAND LAND DREDGE BUILDINGS EQUIPMENT VEHICLES TOTAL

RM RM RM RM RM RM RM

GROUP

COST

At 1.11.00 95,118 3,431,398 26,481,516 6,889,909 19,937,252 432,778 57,267,971

Additions - - - - 210,859 120,000 330,859

Disposals - - - - (240,592) (175,426) (416,018)

At 31.10.01 95,118 3,431,398 26,481,516 6,889,909 19,907,519 377,352 57,182,812

ACCUMULATED DEPRECIATION

At 1.11.00 - 3,431,396 26,481,516 1,921,206 8,508,712 294,865 40,637,695

Charge for

the year - - - 105,715 1,696,118 76,339 1,878,172

Disposals - - - - (240,592) (151,983) (392,575)

At 31.10.01 - 3,431,396 26,481,516 2,026,921 9,964,238 219,221 42,123,292

NET BOOK

VALUE AT

31.10.01 95,118 2 - 4,862,988 9,943,281 158,131 15,059,520

IMPAIRMENT LOSS - - - (600,000) (200,000) - (800,000)

NET CARRYING

VALUE AT

31.10.01 95,118 2 - 4,262,988 9,743,281 158,131 14,259,520

NET BOOK VALUE AT

31.10.00 95,118 2 - 4,968,703 11,428,540 137,913 16,630,276

Depreciation

charge for

the year

ended

31.10.00 - - - 105,741 1,614,819 118,396 1,838,956

-23-

SHORT

TERM DEVELOPMENT

FREEHOLD LEASEHOLD COSTS & PLANT & MOTOR

LAND LAND DREDGE BUILDINGS EQUIPMENT VEHICLES TOTAL

RM RM RM RM RM RM RM

GROUP

COST

At 1.11.00 95,118 3,431,398 26,481,516 1,604,061 4,065,790 176,626 35,854,509

Additions - - - - 210,859 120,000 330,859

Disposals - - - - (240,592) (175,426) (416,018)

At 31.10.01 95,118 3,431,398 26,481,516 1,604,061 4.036,057 121,200 35,769,350

ACCUMULATED

DEPRECIATION

At 1.11.00 - 3,431,396 26,481,516 1,604,058 3,961,728 129,316 35,608,014

Charge for

the year - - - - 114,460 29,067 143,527

Disposals - - - - (240,592) (151,983) (392,575)

At 31.10.01 - 3,431,396 26,481,516 1,604,058 3,835,596 6,400 35,358,966

NET BOOK VALUE

At 31.10.01 95,118 2 - 3 200,461 114,800 410,384

At 31.10.00 95,118 2 - 3 104,062 47,310 246,495

Depreciation

charge for

the year

ended

31.10.00 - - - 27 29,553 35,055 64,635

The lease period of the short term leasehold land of the Group and of the

Company expired in year 2004.

The impairment loss of a subsidiary company is determined based on the

difference between the carrying amount of its property, plant and equipment and

recoverable amount estimated by independent valuation based on open market value

basis carried out on 25th and 28th January, 2002.

-24-

Included in the above property, plant and equipment are motor vehicles acquired

under the hire purchase instalment plans as follows:-

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Cost 356,352 411,778 120,000 175,426

Net book value 157,331 136,713 114,000 46,110

3. INVESTMENT IN SUBSIDIARY COMPANIES

COMPANY

2001 2000

RM RM

Unquoted shares, at cost 188,013,209 188,013,207

Less: Reduction in stamp duty on acquisition of

subsidiary companies (458,205) -

187,555,004 188,013,207

The above reduction in stamp duty was given by Stamp Duty Office upon approval

of appeal.

The particulars of the subsidiary companies are as follows:-

Effective

Country of Equity

Name of Company Incorporation Interest Principal Activities

2001 2000

PTB Clay Products Sdn. Bhd. Malaysia 100% 100% Ceased operations

Ukaylake Country Club Sdn. Malaysia 100% 100% Dormant

Bhd.

Golden Domain Holdings Malaysia 100% 100% Investment holding

Sdn. Bhd.

Petaling Ventures Sdn. Malaysia 100% - Dormant*

Bhd. (formerly known as

Intensive Strategies Sdn.

Bhd.)

-25-

Effective

Country of Equity

Name of Company Incorporation Interest Principal Activities

2001 2000

Interest Held Through

Golden Domain

Holdings Sdn. Bhd.

Lembah Langat

Development Sdn. Bhd. Malaysia 100% 100% Property investment and development

PTB Development

Sdn. Bhd. Malaysia 100% 100% Property investment

PTB Horticulture Farm

Sdn. Bhd. Malaysia 100% 100% Property investment and property development

Golden Domain Development Malaysia 100% 100% Investment holding, property investment and property

Sdn. Bhd. development

Interest Held Through

Golden Domain Development

Sdn. Bhd.

Majurama Developments

Sdn. Bhd. Malaysia 100% 100% Property development

Magilds Industrial Park

Sdn. Bhd. Malaysia 100% 100% Property development

* The financial statements of this subsidiary company is based on

unaudited management financial statements.

4. INTEREST IN ASSOCIATED COMPANY

GROUP/COMPANY

2001 2000

RM RM

Unquoted shares, at cost 114 (114)

Provision for diminution in value (114) (114)

- -

The Group's share of" losses in the associated company totalling RM2,929,713/-

(2000: RM2,594,700/-) are not recognised as the share of losses of associated

company are limited to the carrying value of the investment.

- 26 -

GROUP/COMPANY

2001 2000

RM RM

Amount owing by an associated company 8,004,752 8,004,752

Provision for doubtful debts (8,004,752) (8,004,752)

- -

The particulars of the associated company is as follows:-

Name of Company Country of Effective Equity Principal Activities

Incorporation Interest

2001 2000

Fandison Resources Management Ltd. Hong Kong 40% 40% Investment holding

5. INVESTMENT PROPERTIES

GROUP

2001 2000

RM RM

Long term leased land, at Group cost 87,638,700 87,638,700

The long term leased land stated at Group cost are based on independent valuation

on open market value basis carried out in 1999.

6. LAND AND DEVELOPMENT EXPENDITURE

GROUP

2001 2000

RM RM

Freehold land 77,648,756 89,900,000

Long term leased land 95,361,300 95,361,300

173,010,056 185,261,300

Leasehold land 94,175,370 88,435,880

Add: Adjustment to Group cost (458,205) 7,986,434

93,717,165 96,422,314

Total land stated at Group cost carried down 266,727,221 281,683,614

-27-

GROUP

2001 2000

RM RM

Total land stated at Group cost brought down 266,727,221 281,683,614

Development expenditure, at cost 47,499,820 36,518,455

Total land and development expenditure 314,227,041 318,202,069

Less: Long term portion (disclosed in deferred land

and expenditure)

- land 160,525,501 160,858,907

- development expenditure 1,039,188 626,290

(161,564,689) (161,485,197)

152,662,352 156,716,872

Add: Portion of profit attributable to development

work performed to date 10,406,409 14,715,592

163,068,761 171,432,464

Less: Progress billings (35,370,893) (51,606,595)

127,697,868 119,825,869

(a) Included in development expenditure are interest on borrowing incurred

during the year amounting to RM171,814/- (2000: RM270,791/-).

(b) Land and development properties amounting to RM46,225,088/- (2000 :

RM45,007,288/-) are pledged as security for the term loan facility of a

subsidiary company.

(c) The adjustment to Group cost during the year was due to reduction in stamp

duty from Stamp Duty Office upon approval of appeal by the Company. The

adjustment to Group cost in year 2000 was in respect of underprovision of

deferred tax on fair value of development properties which were acquired in 1999.

7. INVENTORIES

GROUP

2001 2000

RM RM

Completed unsold properties

At cost 10,122,258 18,225,092

At net realisable value 5,535,994 -

15,658,252 18,225,092

- 28 -

8. SHORT TERM INVESTMENTS

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Quoted shares, at cost

At beginning of the year 1,152,400 1,158,055 1,150,419 1,156,074

Less: Disposal - (5,655) - (5,655)

At end of the year 1,152,400 1,152,400 1,150,419 1,150,419

Less: Provision for diminution in value

At beginning of the year 779,418 650,254 779,418 650,254

Addition during the year - 129,164 - 129,164

At end of the year (779,418) (779,418) (779,418) (779,418)

372,982 372,982 371,001 371,001

Market value of quoted shares 389,801 380,216 382,241 371,606

9. TRADE DEBTORS

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Total outstanding 38,762,909 30,105,979 9,500 9,500

Less: Provision for doubtful debts (93,952) (9,500) (9,500) (9,500)

38,668,957 30,096,479 - -

- 29 -

10. OTHER DEBTORS, DEPOSITS AND PREPAYMENTS

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Other debtors, deposits and prepayments 1,158,080 3,371,448 210,564 1,280,563

Less: Provision for doubtful debts (56,873) - (56,873) -

1,101,207 3,371,448 153,691 1,280,563

Income tax recoverable 9,350 14,388 9,350 14,388

1,110,557 3,385,836 163,041 1,294,951

11. AMOUNT OWING BY SUBSIDIARY COMPANIES

Included in the amount owing by subsidiary companies is an amount of

RM152,735,000/- (2000 : RM119,500,000/-) representing the purchase consideration

paid by the Company for the acquisitions made by Golden Domain Holdings Sdn.

Bhd., a wholly owned subsidiary company, comprising the Ulu Kelang Project,

Ulu Yam Project, Bukit Ceylon Project and all of the preference shares in Golden

Domain Development Sdn. Bhd., Magilds Industrial Park Sdn. Bhd. and Majurama

Developments Sdn. Bhd.. The purchase consideration was satisfied by the Company

via the issuance of ICULS and rights issue of RM99,500,000/- and RM53,235,000/-

respectively.

These balances are non-trade in nature, unsecured, interest free and have no

fixed term of repayment.

12. DEPOSITS WITH LICENSED BANKS

The following deposits are included in the deposits with licensed banks of the

Group and Company:-

(a) fixed deposit of RM484,500/- (2000 : RM50,000/-) is pledged as security for

a bank guarantee facility granted to the Group; and

(b) Cash deposit of Nil (2000 : RM33,235,000/-) representing the balance of

purchase consideration payable by the Company to the vendor of Ulu Kelang Project.

- 30 -

13. CASH AND BANK BALANCES

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Cash and bank balances 1,343,364 4,857,535 319,238 1,011,386

Cash held under housing development account 991,801 - - -

2,335,165 4,857,535 319,238 1,011,386

14. TRADE CREDITORS

Included in trade creditors are:-

GROUP

2001 2000

RM RM

Amount owing to companies in which a director of the Company,

Tan Sri Dr. Chen Lip Keong, has substantial indirect

financial interest

Subsidiary companies of FACB Resorts Berhad

Arosa Builders Sdn. Bhd. 974,973 1,227,071

FACB Construction Sdn. Bhd. 147,071 -

1,122,044 1,227,071

These amounts are unsecured, interest free and are repayable based on the

commercial terms of the Company.

- 31 -

15. OTHER CREDITORS AND ACCRUALS

Included in the other creditors and accruals are:-

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Amount owing to companies in which a director,

Tan Sri Dr. Chen Lip Keong, has substantial direct and indirect

financial interest:-

FACB Resorts Berhad 29,148 43,317 28,131 42,300

Subsidiary companies of FACB

Resorts Berhad

Bukit Unggul Country Club Berhad 4,330 2,692 4,330 2,692

FACB Industries Sdn. Bhd. 68,654 68,870 68,654 68,870

First Travel And Tours (M) Sdn. Bhd. 1,702 8,670 1,702 8,670

Bukit Unggul Golf and Country Resort Sdn. Bhd. 93 93 - -

103,927 123,642 102,817 122,532

The above balances are unsecured, interest free and are repayable at terms

mutually agreed upon between the parties involved.

16. HIRE PURCHASE CREDITORS

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Gross instalments 156,108 164,457 103,530 50,388

Less: Interest in suspense (23,433) (39,121) (20,866) (11,832)

132,675 125,336 82,664 38,556

Amount repayable within 1 year (63,630) (70,728) (13,619) (26,718)

Amount repayable after 1 year but not later than 5 years 69,045 54,608 69,045 11,838

- 32 -

17. TERM LOAN - SECURED

GROUP

2001 2000

RM RM

Term loan - repayable within 1 year 1,032,206 3,662,206

The above term loan bears interest at rates ranging from 7% to 8.05% (2000 : 7%

to 8%) per annum and is repayable as follows:-

(a) payments totalling RM600,000/- is to be made through redemption of 12 units

of the lots at RM50,000/- per unit;

(b) first 12 monthly instalments of RM25,000/- commencing on 31st May, 2000;

(c) second 5 monthly instalments of RM360,000/-; and

(d) a final instalment of RM362,206/-.

The term loan is secured on the following:-

(a) a debenture over the assets of a subsidiary company including a first legal

charge over the development land;

(b) assignment of sales proceeds from a phase of the development project; and

(c) a corporate guarantee from the Company.

18. SHARE CAPITAL

GROUP/COMPANY

2001 2000

RM RM

Ordinary shares of RM1/- each

Authorised:

500,000,000 ordinary shares 500,000,000 500,000,000

Issued and fully paid:

At beginning of the year 100,844,060 20,168,412

Allotted during the year - 80,673,648

Warrants exercised during the year - 2,000

Conversion of Irredeemable Convertible

Unsecured Loan Stocks 2000/2010 ("ICULS") 146,379,310 -

At end of the year 247,223,370 100,844,060

- 33 -

During the financial year, RM169,800,000/- nominal value of ICULS has been

converted into 146,379,310 fully paid ordinary shares of RM1/- each of the

Company at a conversion price of RM1.16 per share.

The new shares issued rank pari passu in all respect with the existing ordinary

shares of the Company.

As at year end, the number of unexercised detachable warrants 2000/2010 of the

Company was 40,335,824 (2000 : 40,335,824). The exercise price of these warrants

is at RM1.16 per new ordinary share of the Company.

19. RESERVES

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

NON-DISTRIBUTABLE

Reserve on consolidation 212,472 212,472 - -

Share premium 28,133,307 4,712,617 28,133,307 4,712,617

28,345,779 4,925,089 28,133,307 4,712,617

DISTRIBUTABLE

Accumulated losses * (20,849,727)(21,438,388) (24,698,364) (20,678,256)

Profit on sales of properties 2,371,237 2,371,237 3,363,987 3,363,987

(18,478,490)(19,067,151) (21,334,377) (17,314,269)

9,867,289 (14,142,062) 6,798,930 (12,601,652)

*Accumulated By:-

The Company (24,698,364)(20,678,256)

Subsidiary companies 3,848,637 (760,132)

(20,849,727)(21,438,388)

20. IRREDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS 2000/2010

("ICULS")

GROUP/COMPANY

2001 2000

RM RM

At beginning of the year 284,500,000 -

Issued during the year - 284,500,000

Converted during the year (169,800,000) -

At end of the year 114,700,000 284,500,000

- 34 -

The ICULS at nominal value of RM1/- each were issued on 2nd February, 2000 and

are constituted by a Trust Deed dated 28th January, 2000 made between the

Company and the trustee for the holders of the ICULS. The main feature of the

ICULS are as follows:-

(a) the ICULS may be convertible at a conversion price of RM1.16 nominal value

of ICULS for each new ordinary share of RM1/- each in the Company on the

following staggered conversion period:-

Year Of ICULS In Issue Percentage Convertible

First Up to maximum of 30% of their holding

Second Up to maximum of 30% of their holding

Third Up to maximum of 40% of their holding

(b) the remaining ICULS shall be converted into fully paid ordinary shares of

RM1/-each in the Company on the maturity date of ten years from the date of

issue of the ICULS at the rate of RM1.16 nominal value of the ICULS; and

(c) upon conversion of the ICULS into new ordinary shares, such shares should

rank pari passu in all respect with the existing ordinary shares of the Company

in issue at the time of conversion except that they would not be entitled to

any rights allotment, dividends or other distributions declared in respect of a

financial year on or before the financial year in which the ICULS are converted

or any interim dividend declared on or before the date of conversion of the

ICULS.

During the financial year, RM169,800,000/- nominal value of ICULS has been

converted into 146,379,310 fully paid ordinary shares of RM1/- each of the

Company at a conversion price of RM1.16 nominal value of the ICULS.

21. DEFERRED TAXATION

GROUP

2001 2000

RM RM

At beginning of the year 40,883,899 35,346,674

Transfer to income statements (note 24) (628,263) (2,449,209)

Adjustment to Group cost - 7,986,434

At end of the year 40,255,636 40,883,899

- 35 -

The above deferred tax is in respect of:-

GROUP

2001 2000

RM RM

Deferred tax liability on timing differences arising from

revaluation surplus as a result of revaluation of

development properties in the subsidiary companies 41,207,536 41,835,799

Others (951,900) (951,900)

40,255,636 40,883,899

The adjustment to Group cost is in respect of underprovision of deferred tax on

fair value of development properties which were acquired in 1999.

The estimated deferred tax liabilities/(benefits) arising from timing

differences not provided in the financial statements are as follows:-

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Capital allowances claimed

in excess of depreciation

charge 600,000 1,026,300 (29,000) (74,700)

Unrelieved tax losses (5,633,000) (5,069,000) (4,648,000) (4,228,000)

Unabsorbed capital allowance (2,708,000) (2,154,000) (154,000) (101,000)

Others (653,000) (530,000) - -

(8,394,000) (6,726,700) (4,831,000) (4,403,700)

The estimated unrelieved tax losses and unabsorbed capital allowances are subject

to agreement by the Inland Revenue Board and are not available for set-off

within the Group.

- 36 -

22. OPERATING REVENUE

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Revenue comprises the following:-

Revenue from completed and

uncompleted development properties

sold including commercial and residential lots 23,826,851 40,437,672 - -

Sales of bricks - 3,150 - -

Management fee received and receivable - - 1,349,536 933,829

23,826,851 40,440,822 1,349,536 933,829

23. PROFIT/(LOSS) BEFORE TAXATION

(a) Profit/(Loss) before taxation is arrived at after charging/(crediting):-

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Auditors' remuneration

- current year 47,000 49,500 20,000 20,000

- underprovision in prior year 3,000 - - -

Bad debt written off - 287,229 - 287,229

Bank overdraft interest - 34,874 - -

Professional fees incurred on corporate exercise 2,298,451 - 2,298,451 -

Depreciation of property, plant and equipment 1,878,172 1,838,956 143,527 64,635

Directors' remuneration

- fees 118,472 - 118,472 -

- other emoluments 529,312 399,674 529,312 399,674

Hire purchase interest 43,181 36,915 13,446 8,334

Impairment loss on property, plant and equipment 800,000 - - -

Loss on disposal of quoted investment - 3,905 - 3,905

Office rental 261,360 234,600 261,360 234,600

Write down inventories to net realisable value 93,973 - - -

- 37 -

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Provision for diminution in value of quoted shares - 129,164 - 129,164

Provision of doubtful debts 141,325 - 56,873 -

Preliminary expenses written off - 5,833 - -

Pre-operating expenses written off - 26,959 - -

Term loan interest - 270,791 - -

Dividend revenue (19,786) (10,561) (19,520) (10,281)

Gain on disposal of property, plant and equipment (66,807) (80,608) (66,807) -

Interest revenue (664,955) (544,533) (457,958) (531,932)

Rental revenue (125,632) (51,895) (125,632) (51,895)

Provision of doubtful debt no longer required - (37,327) - (37,327)

(b) Employees Information

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Staff costs 2,381,527 1,544,617 2,332,868 1,466,858

The number of employees of the Group and of the Company as at financial year end

were 49 (2000 : 45) and 48 (2000 : 45) respectively.

24. TAXATION

GROUP

2001 2000

RM RM

Based on results for the year 3,381,270 5,430,235

Overprovision in prior year (835,793) (1,953)

Transfer to deferred taxation (note 21) (628,263)(2,449,209)

1,917,214 2,979,073

The effective tax rate of the Group is higher than the standard tax rate as

there is no Group relief for losses suffered by certain subsidiary companies and

certain expenses were disallowed for tax purposes.

- 38 -

The Company has estimated tax credit of RM6,440,000/- (2000 : RM6,440,000/-)

under Section 108 of the Income Tax Act, 1967, to frank future payment of

dividends of approximately RM16,560,000/- (2000 : RM16,560,000/-) without

incurring additional tax liability, subject to agreement by Inland Revenue Board.

The Group and the Company have the following estimated unrelieved tax losses and

unabsorbed capital allowances available for set off against future taxable

profits, subject to agreement by the Inland Revenue Board:-

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Unrelieved tax losses 20,119,000 18,104,000 16,600,000 15,100,000

Unabsorbed capital allowances 9,673,000 7,693,000 550,000 360,000

29,792,000 25,797,000 17,150,000 15,460,000

The Group has approximately RMl3,882,000/- (2000 : RM13,882,000/-) tax exempt

income available for distribution by way of tax exempt dividend, subject to

agreement by the Inland Revenue Board. The tax exempt income account is in

respect of chargeable income for the year ended 31st October, 1999 of which

income tax has been waived.

25. EARNINGS PER SHARE

The basic earnings per share of the Group is calculated by dividing the Group's

profit for the year of RM588,661/- (2000 : RM4,331,451/-) by the weighted

average number of ordinary shares in issue during the year of 162,029,405

(2000 : 81,681,224) ordinary shares of RM1/- each.

The fully diluted earnings per ordinary share for the year has been calculated

based on the net profit for the year of RM588,661/- (2000 : RM5,215,924/-

adjusted net profit for the year) and on the adjusted weighted average number of

ordinary shares issued and issuable of 346,102,681 (2000 : 272,165,971) shares.

The adjusted net profit for the year 2000 has been arrived at after adding back

notional saving (net of tax) on the cost of borrowing and notional interest

income from fixed deposits (net of tax). The adjusted weighted average number

of ordinary shares issued and issuable has been arrived at based on the

assumption that all the warrant and ICULS issued are convened into

ordinary shares at the respective conversion date.

26. ACQUISITION OF SUBSIDIARY COMPANIES

During the year, the Company had acquired 2 ordinary shares of RM1/- each

comprising the entire equity interest in Petaling Ventures Sdn. Bhd. (formerly

known as Intensive Strategies Sdn. Bhd.) for a purchase consideration of RM2/.

(In year 2000, the Company acquired Ukaylake Country Club Sdn. Bhd.).

- 39 -

(a) The effect of the acquisition on the consolidated financial position of the

Group at the year end is as follows:-

2001 2000

RM RM

Inter-company balance (1,798) -

Decrease in Group's net assets (1,798) -

(b) The effect of the acquisition on the consolidated financial results of the

Group for the current period from date of acquisition was as follows:-

2001 2000

RM RM

Administrative costs (1,798) -

Loss before taxation (1,798) -

(c) Cash flow on acquisition.

GROUP

2001 2000

RM RM

Intangible assets - 7,190

Cash deposits and bank balances 2 2,000

Creditors - (9,188)

Total Purchase Consideration 2 2

Less: Cash and cash equivalents acquired (2) (2,000)

Cash Flow On Acquisition, Net of Cash and

Cash Equivalents Acquired - (1,998)

27. PURCHASE OF PROPERTY, PLANT AND EQUIPMENT

During the year, the Group and the Company acquired property, plant and

equipment with aggregate costs of RM330,859/- (2000 : RM63,881/-) of which

RM84,000/- (2000: Nil) was acquired by means of hire purchase. Cash payments of

RM246,859/- (2000: RM63,881/-) were made to purchase property, plant and

equipment.

28. CASH AND CASH EQUIVALENTS

GROUP COMPANY

2001 2000 2001 2000

RM RM RM RM

Deposits with licensed banks - 33,674,000 - 33,235,000

Cash and bank balances 2,335,165 4,857,535 319,238 1,011,386

2,335,165 38,531,535 319,238 34,246,386

- 40 -

Included in cash and bank balances of the Group are amounts totalling

RM99l,801/-(2000 : Nil) held under housing development account maintained

pursuant to the requirements of the Housing Developers (Housing Development

Account) Regulations, 1991, which are not freely available for use.

29. CONTINGENT LIABILITIES - UNSECURED

COMPANY

2001 2000

RM RM

In respect of corporate guarantee for term loan

facility granted to a subsidiary company as stated

in note 17 to the financial statements 1,032,206 3,662,206

30. SIGNIFICANT RELATED PARTIES TRANSACTIONS

Significant related parties transactions for the year are as follows:-

COMPANY

2001 2000

RM RM

(i) Companies in which a director of the

Company, Tan Sri Dr. Chen Lip Keong, has substantial direct

and indirect financial interest:-

Office rental paid and payable to FACB Resorts Berhad. 261,360 217,800

Contract costs paid and payable to Arosa Builders Sdn.

Bhd., a subsidiary company of FACB Resorts Berhad, for a

contract awarded on 21st August, 1997 1,382,843 3,435,201

Travelling expenses paid to First Travel and

Tours Sdn. Bhd., a subsidiary company of

FACB Resorts Berhad. 58,900 90,014

Contract costs paid and payable to FACB

Construction Sdn. Bhd., a subsidiary company

of FACB Resorts Berhad., for a contract

awarded on 18th November, 2000 617,321 -

(ii) Legal services charged by a firm in which a director

of the Company, Wong Swee Min, has substantial interest - 395,093

(iii) Management fee charged to subsidiary

companies (1,349,536) (933,829)

The Directors are of the opinion that the above transactions have been entered

in the normal course of business and have been established under terms mutually

agreed upon between the parties concerned.

- 41 -

31. SEGMENT ANALYSIS

SEGMENTAL INFORMATION - BY ACTIVITY

(LOSS)/PROFIT TOTAL

OPERATING BEFORE ASSETS

REVENUE TAXATION EMPLOYED

RM RM RM

2001

Investment holding - (5,429,931) 1,313,666

Manufacturing - (2,691,065) 13,888,301

Property development 23,826,851 10,626,871 434,589,223

23,826,851 2,505,875 449,791,190

2000

Investment holding - (2,562,269) 36,208,833

Manufacturing 3,150 (2,162,324) 16,755,241

Property development 40,437,672 12,035,117 423,277,892

40,440,822 7,310,524 476,241,966

As the Group operates within one geographical segment, geographical segment

analysis is not applicable.

32. REGISTERED OFFICE AND PRINCIPAL PLACE OF BUSINESS

(a) Registered Office

Level 19, Menara PanGlobal, No. 8, Lorong P. Ramlee, 50250 Kuala Lumpur.

(b) Principal Place of Business

Level 18, Menara PanGlobal, No. 8. Lorong P.Ramlee, 50250 Kuala Lumpur.

- 42 -

DETAILED INCOME STATEMENT

FOR THE YEAR ENDED 31ST OCTOBER, 2001

2001 2000

RM RM

OPERATING REVENUE

Management fee 1,349,536 933,829

OTHER OPERATING REVENUE

Dividend revenue 19,520 10,281

Gain on disposal of property, plant and equipment 66,807 -

Gain on foreign exchange 3,896 -

Overprovision of retrenchment benefit - 63,497

Provision for doubtful debts no longer required - 37,327

Interest revenue 457,958 531,932

Rental revenue 125,632 51,895

Sundry revenue 35,959 154,335

2,059,308 1,783,096

LESS:

DISTRIBUTION COSTS - SCHEDULE A 21,883 33,934

ADMINISTRATIVE COSTS - SCHEDULE B 3,506,261 2,431,716

OTHER OPERATING COSTS - SCHEDULE C 2,534,916 869,000

FINANCE COSTS - SCHEDULE D 16,356 10,179

(6,079,416) (3,344,829)

LOSS FOR THE YEAR (4,020,108) (1,561,733)

(This statement is prepared for management purposes only and

does not form part of the audited financial statements of the Company)

- 43 -

SCHEDULE OF DISTRIBUTION COSTS

FOR THE YEAR ENDED 31ST OCTOBER, 2001

2001 2000

RM RM

SCHEDULE A

Advertising expenses 14,316 12,621

Travelling expenses 7,567 21,313

21,883 33,934

(This statement is prepared for management purposes only and

does not form part of the audited financial statements of the Company)

- 44 -

SCHEDULE OF ADMINISTRATIVE COSTS

FOR THE YEAR ENDED 31ST OCTOBER, 2001

2001 2000

RM RM

SCHEDULE B

Audit - fee 20,000 20,000

- service tax 1,000 1,000

Bonus 11,368 38,666

Broker fees - 28

Business promotion 77,091 63,966

Depreciation of property, plant and equipment 143,527 64,635

Directors' remuneration - fees 118,472 -

- other emoluments 529,312 399,674

Electricity 8,403 10,883

Employees' Provident Fund and Socso 168,500 102,946

Entertainment 7,622 13,296

ICULS and warrants maintenance 50,750 -

Insurance and licence fee 22,050 9,614

Medical expenses 13,687 5,386

Office rental 261,360 234,600

Postage 778 797

Printing and stationery 27,717 36,264

Professional fees - current year 19,609 58,105

- overprovision in prior year - (4,841)

Quit rent and assessment 95,600 154,896

Salaries, allowances and overtime 1,581,774 967,983

Secretarial fees 58,647 74,912

Share registration fee 113,931 90,993

Staff welfare and refreshment 18,835 21,039

Stamp duty 77,163 -

Subscription fees 4,792 2,781

Sundry expenses 96 450

Telephone charges 43,462 47,019

Upkeep of motor vehicles 15,947 6,745

Upkeep of office 3,666 5,264

Upkeep of office equipment 11,102 4,615

3,506,261 2,431,716

(This statement is prepared for management purposes only and

does not form part of the audited financial statements of the Company)

- 45 -

SCHEDULE OF OTHER OPERATING COST

FOR THE YEAR ENDED 31ST OCTOBER, 2001

2001 2000

RM RM

SCHEDULE C

Bad debts written off - 287,229

Professional fees 2,298,451 -

Donation 5,180 1,300

Electricity on dredge 39,947 30,584

Labour costs 9,392 369,504

Loss on disposal of quoted shares - 3,905

Mines maintenance costs 85,106 41,560

Penalty 6,875 3,584

Provision for diminution in value of quoted shares - 129,164

Provision for doubtful debts 56,873 -

Transportation 19,467 -

Upkeep of office - 2,170

Valuation fees 13,625 -

2,534,916 869,000

(This statement is prepared for management purposes only and

does not form part of the audited financial statements of the Company)

- 46 -

SCHEDULE OF FINANCE COSTS

FOR THE YEAR ENDED 31ST OCTOBER, 2001

2001 2000

RM RM

SCHEDULE D

Bank charges 2,910 1,845

Hire purchase interest 13,446 8,334

16,356 10,179

(This statement is prepared for management purposes only and

does not form part of the audited financial statements of the Company)

- 47 -

This information is provided by RNS

The company news service from the London Stock Exchange

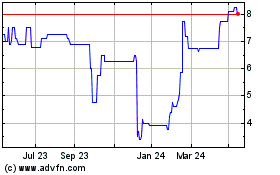

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

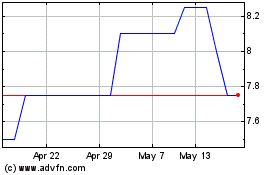

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024