Primorus Investments PLC New Investments (7936O)

23 August 2017 - 8:47PM

UK Regulatory

TIDMPRIM

RNS Number : 7936O

Primorus Investments PLC

23 August 2017

Primorus Investments plc

("Primorus" or the "Company")

New Investments

Primorus Investments plc (AIM: PRIM, NEX: PRIM) announces that

it has made three new investments, as detailed below:

TruSpine Technologies Limited

Primorus has invested, by way of subscription, GBP500,000 in

TruSpine Technologies Limited ("TruSpine") on a pre-new money

valuation of GBP15m. Founded in December 2014, TruSpine secured

intellectual property and subsequently developed the Faci--LOK and

Cervi--FAS minimally invasive spine stabilisation devices, and the

VOSC Catheter atherosclerosis treatment product 'VOSC Catheter'.

This development is on--going and TruSpine is targeting FDA

clearance and commercialisation of its first product, the

Faci--LOK. FDA submission is expected by the end of Q4 2017.

An AIM IPO is planned to take place following FDA approval,

which is expected to be received in H1 2018. In the year ended 31

March 2016, TruSpine incurred a loss of GBP45,325.

Sport:80 plc

Primorus has invested, by way of subscription, GBP100,000 in

Sport:80 plc ("Sport:80") on a pre-new money valuation of GBP10m as

part of a fundraising of up to GBP1m. Sport:80 is a technology and

management company with a proprietary cloud-based platform focused

on transforming the business operations and management of sports

organisations. The Sport:80 platform is used by 20 prominent sports

organisations.

Sport:80 is revenue-generating with four-fold revenue growth per

annum since 2014. In the 12 months to 31 December 2016 it had total

turnover of approximately GBP458,000 and made a loss before tax of

approximately GBP269,000. An AIM IPO is planned for 2018.

Farina Investments (UK) Limited

Primorus has invested, by way of subscription, GBP100,000 in

Farina Investments (UK) Limited ("Farina") on a pre-new money

valuation of GBP4m. Farina is a boutique corporate finance and

asset management company which specialises in leveraging profit

opportunity in the post-crisis financial landscape. Farina has been

carefully structured and strategically placed to fully capitalise

on these opportunities, thereby optimising capital growth,

profitability and returns for both the company and investors.

Farina is currently exploring various UK listing opportunities

either via IPO or reverse takeover. In the year ended 31 July 2016,

turnover was GBP1.9 million, net profit was GBP116,000 and assets

under management were GBP1.8 million. Farina is not authorised and

regulated by the Financial Conduct Authority.

Following the investments noted above, the Company will have

available cash resources of approximately GBP1.35 million.

Alastair Clayton, Executive Director commented:

"We are very pleased to be able to participate in these

respective pre-IPO opportunities. Over the past months we have

invested significant time in getting to know management, understand

the core businesses, valuations and pathways to market.

"Pre-IPO is at the heart of our investment strategy and we look

forward to being able to demonstrate real value accretion for our

shareholders as we begin to exit existing investments via trade

sales and IPOs or other mechanisms to crystallise tangible

value.

"The Board fundamentally believes the pre-IPO sector is both

underserved and has the potential to offer significant returns over

time to disciplined, risk-weighted investors.

"We look forward to updating shareholders on the progress of

TruSpine, Sport:80 and Farina as well as in the near term providing

an update on our existing portfolio such as stakes in Fresho, GMOW

and our significant, high profile holding in HHDL once we are made

aware of the precise dates of the upcoming proposed flow test

programme by the Board of HHDL."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3137 1902

Optiva Securities Limited

Christian Dennis / Jeremy King

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBXLFLDVFZBBE

(END) Dow Jones Newswires

August 23, 2017 06:47 ET (10:47 GMT)

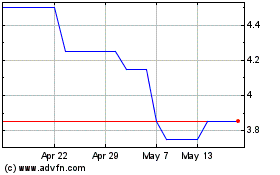

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From Apr 2024 to May 2024

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From May 2023 to May 2024