TIDMPRU

RNS Number : 7140V

Prudential PLC

25 July 2018

RNS Number: 7140V

Prudential plc

25 July, 2018

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Nothing in this ANNOUNCEMENT constitutes an offer to buy or the

solicitation of an offer to sell securities in any

jurisdiction.

Invitations by Prudential plc in respect of certain senior

bonds

Prudential plc (the "Company") has today extended invitations to

the holders of the senior bonds referred to in the table below (the

"Holders") to consider and, if thought fit, vote in respect of

certain modifications to the terms and conditions of such senior

bonds (the "Proposal").

This announcement does not contain the full terms and conditions

of the Proposal, which are contained in the consent solicitation

memorandum dated 25 July, 2018 (the "Memorandum") prepared by the

Company. Holders may obtain a copy of the Memorandum from the

Tabulation Agent, the contact details for which are set out below.

In order to receive a copy of the Memorandum, a Holder will be

required to provide certain confirmations as to his or her status

as a Holder. Holders are advised to read carefully the

Memorandum.

Capitalised terms used in this announcement but not defined have

the meanings given to them in the Memorandum.

Description of the Bonds

Description ISIN Outstanding Voting Early Total

of the nominal Fee* Voting early

Bonds amount Amount* consideration*

**

---------------- -------------- ---------------- ------- --------- ----------------

GBP300,000,000

6 7/8 per

cent. Bonds

due 2023

(the "2023

Bonds") XS0083544212 GBP300,000,000 0.50 1.50 2.00

---------------- -------------- ---------------- ------- --------- ----------------

GBP250,000,000

5 7/8 per

cent. Bonds

due 2029

(the "2029

Bonds"

and, together

with the

2023 bonds,

the "Bonds"

and each

a "Series") XS0096874671 GBP250,000,000 3.50 7.50 11.00

* Expressed as a percentage of the nominal amount of the Bonds of the relevant Series

** Holders who submit an Instruction (whether in favour of or

against the relevant Extraordinary

Resolution) in relation to any of their Bonds which is received

by the Tabulation Agent prior to 5.00 p.m. (London Time) on 8

August, 2018 (being the Early Voting Deadline) will be eligible to

receive a total early consideration which comprises: (i) the Voting

Fee, and (ii) the Early Voting Amount, subject as further described

herein.

The Proposal has been considered by a Special Committee (the

"Special Committee") of The Investment Association ("IA") at the

request of the Company. The members of the Special Committee, who

hold in aggregate approximately 42.90 per cent. of the aggregate

nominal amount of the Bonds currently outstanding, have examined

the Proposal. They have informed the Company: (i) that they find

the Proposal acceptable; and (ii) that, subject to client and other

approvals, they intend to vote in favour of the Proposal in respect

of their holdings of Bonds. The Special Committee has advised the

Company that this recommendation relates only to the proposals set

out in the Memorandum with respect to the Bonds and not to any

future offers or proposals which the Company may make.

Rationale for the Proposal

In March 2018, the Company announced its intention to demerge

its UK and Europe business ("M&G Prudential"), resulting in two

separately-listed companies (the "Demerger"). On completion of the

Demerger, shareholders will hold interests in both the Company and

M&G Prudential.

On completion of the Demerger, The Prudential Assurance Company

Limited will cease to be a subsidiary of the Company. Pursuant to

the terms and conditions currently applicable to the Bonds, this

would constitute an Event of Default if certain other conditions

were also met. The Proposal is therefore intended to enable an

amendment to the terms and conditions currently applicable to the

Bonds in order to avoid an Event of Default should the Demerger

proceed.

Key terms and conditions of the Proposal

The Company has invited Holders of each Series to instruct the

Principal Paying Agent to appoint one or more representatives of

the Tabulation Agent as their proxy to attend a meeting convened in

respect of the relevant Series (each a "Meeting") and to vote in

the manner specified in such instruction in respect of an

extraordinary resolution proposed by the Company (the details of

which are set out in full in the Memorandum and are summarised

below). Among other things, the extraordinary resolution for each

Series provides for the Trustee to be authorised and requested to

execute a supplemental trust deed in order to supplement the 2023

Trust Deed or the 2029 Trust Deed and remove Condition 8(viii) from

the 2023 Bond Conditions or the 2029 Bond Conditions, each as

applicable.

The Extraordinary Resolutions

If the extraordinary resolution proposed by the Company in

relation to each Series (each an "Extraordinary Resolution") is

passed and the amendment referred to therein is subsequently

implemented, the terms and conditions of each Series (the "Bond

Conditions") will be modified by:

(i) the deletion of paragraph (viii) of Condition 8; and

(ii) the replacement of the reference to paragraph (viii) in the

opening sentence of Condition 8 with a reference to paragraph

(vii),

with no other amendments being made to the Bond Conditions.

Each Extraordinary Resolution is conditional on the passing of

the Extraordinary Resolution in respect of the other Series.

Fees

Holders who submit a valid instruction in accordance with the

terms and conditions set out in the Memorandum (whether in favour

of or against the relevant extraordinary resolution) in relation to

any of their Bonds which is received by the Tabulation Agent prior

to the Final Voting Deadline (as set out below) will be eligible to

receive the Voting Fee (as set out in the table above), subject to:

(i) the relevant instruction not being revoked (in the limited

circumstances in which such revocations are permitted); (ii) the

extraordinary resolution being passed in respect of each Series;

and (iii) the amendment referred to in each extraordinary

resolution subsequently being implemented.

Holders who submit a valid instruction in accordance with the

terms and conditions set out in the Memorandum (whether in favour

of or against the relevant Extraordinary Resolution) in relation to

any of their Bonds which is received by the Tabulation Agent prior

to the Early Voting Deadline (as set out below) will be eligible to

receive the Early Voting Amount (as set out in the table above),

subject to: (i) the relevant instruction not being revoked (in the

limited circumstances in which such revocations are permitted);

(ii) the extraordinary resolution being passed in respect of each

Series; and (iii) the amendment referred to in each extraordinary

resolution subsequently being implemented. This amount shall be

paid in addition to the Voting Fee.

Payment of any such amounts will be made on the Payment Date (as

set out below).

This announcement does not contain the full terms and conditions

of the Proposal, which are contained in the Memorandum. Holders are

advised to read carefully the Memorandum.

Indicative timetable

The following indicative timetable sets out expected dates and

times of the key events in relation to the Proposal. This is

subject to change and will depend, among other things, on timely

receipt (and non-revocation) of valid instructions, the right of

the Company to extend, re-open, amend and/or withdraw the Proposal

(other than the terms of the 2023 Extraordinary Resolution or 2029

Extraordinary Resolution) as described in the Memorandum and the

passing of each extraordinary resolution at the first Meeting for

the relevant Series. Accordingly, the actual timetable may differ

significantly from the timetable below.

Date and time Event

------------------------------ ------------------------

25 July, 2018 Commencement of the

Proposal

5.00 p.m. (London Time) Early Voting Deadline

on 8 August, 2018

10.00 a.m. (London Time) Final Voting Deadline

on 14 August, 2018

10.00 a.m. (London Time) Meeting in respect of

on 16 August, 2018 the 2023 Bonds

10.15 a.m. (London Time) Meeting in respect of

on 16 August, 2018 the 2029 Bonds

As soon as reasonably Announcement of results

practicable after conclusion of Meetings

of both Meetings

No later than the fifth Payment Date

Business Day following

implementation of the

Amendment

The deadlines set by any intermediary or the Clearing Systems

will be earlier than certain of these deadlines. Holders should

contact the intermediary through which they hold their Bonds as

soon as possible to ensure proper and timely delivery of

Instructions.

2023 Bondholders' Meeting

The initial 2023 Bondholders' Meeting will be held at the

offices of Slaughter and May at One Bunhill Row, London EC1Y 8YY on

16 August, 2018 at 10.00 a.m. (London time).At the 2023

Bondholders' Meeting, Holders of 2023 Bonds will be asked to

consider and, if thought fit, pass the 2023 Extraordinary

Resolution.

The 2023 Bondholders' Meeting will require a quorum of two or

more persons holding or representing a clear majority in principal

amount of the 2023 Bonds for the time being outstanding, provided

that if the initial 2023 Bondholders' Meeting is adjourned through

lack of quorum, the quorum at such adjourned Meeting will be two or

more persons being or representing Holders of 2023 Bonds whatever

the principal amount of the Bonds for the time being outstanding so

held or represented. Any such adjournment will be for a period of

not less than 14 days nor more than 42 days.

To be passed, the 2023 Extraordinary Resolution will require a

majority consisting of not less than three-quarters of the votes

cast at the 2023 Bondholders' Meeting.

If passed, the 2023 Extraordinary Resolution shall be binding on

Holders of 2023 Bonds, whether or not they are present at the

relevant Meeting.

2029 Bondholders' Meeting

The initial 2029 Bondholders' Meeting will be held at the

offices of Slaughter and May at One Bunhill Row, London EC1Y 8YY on

16 August, 2018 at 10.15 a.m. (London time).

At the 2029 Bondholders' Meeting, Holders of 2029 Bonds will be

asked to consider and, if thought fit, pass the 2029 Extraordinary

Resolution.

The 2029 Bondholders' Meeting will require a quorum of two or

more persons holding or representing a clear majority in principal

amount of the 2029 Bonds for the time being outstanding, provided

that if the initial 2029 Bondholders' Meeting is adjourned through

lack of quorum, the quorum at such adjourned Meeting will be two or

more persons being or representing Holders of 2029 Bonds whatever

the principal amount of the Bonds for the time being outstanding so

held or represented. Any such adjournment will be for a period of

not less than 14 days nor more than 42 days.

To be passed, the 2029 Extraordinary Resolution will require a

majority consisting of not less than three-quarters of the votes

cast at the 2029 Bondholders' Meeting.

If passed, the 2029 Extraordinary Resolution shall be binding on

Holders of 2029 Bonds, whether or not they are present at the

relevant Meeting.

Announcements

The Company will announce:

(A) the results of each Meeting;

(B) the outcome of the Proposal; and

(C) the final Payment Date (as applicable),

as soon as reasonably practicable after the conclusion of both

Meetings.

Unless stated otherwise, all announcements in connection with

the Proposal will be made by: (i) publication through RNS; and (ii)

the delivery of notices to the Clearing Systems for communication

to Direct Participants. Such announcements may also be made (a) on

the relevant Reuters Insider screen page and (b) by the issue of a

press release to a financial news service selected by the Company

(such as Reuters or Bloomberg).

Questions and requests for assistance in connection with the

Proposal may be directed to the Solicitation Agents.

SOLICITATION AGENTS

Barclays Bank Goldman Sachs NatWest Markets

PLC International Plc

5 The North Colonnade Peterborough 250 Bishopsgate

Canary Wharf Court London EC2M 4AA

London E14 4BB 133 Fleet Street

Telephone: London EC4A 2BB Telephone:

+44 20 3134 8515 Telephone: +44 20 7678 5282

Attention: +44 20 7774 9862 Attention:

Liability Management Attention: Liability Management

Group Liability Management Email:

Email: Group liabilitymanagement

eu.lm@barclays.com Email: @natwestmarkets.com

liabilitymanagement.eu@gs.com

TABULATION AGENT PRINCIPAL PAYING AGENT

Lucid Issuer Services

Limited Citibank, N.A., London

Branch

Tankerton Works

12 Argyle Walk

London WC1H 8HA Citigroup Centre

Telephone: Canada Square

+44 20 7704 0880 Canary Wharf

Attention: London E14 5LB

David Shilson / Alexander

Yangaev

Email:

prudential@lucid-is.com

Person responsible

The person responsible for arranging the release of this

announcement on behalf of Prudential plc is Alan Porter, Group

General Counsel and Company Secretary.

Prudential plc is not affiliated in any manner with Prudential

Financial, Inc. a company whose principal place of business is in

the United States of America.

Enquiries to:

Treasury Media:

Elisabeth +44 (0)20 +44 (0)20

Wenusch 7548 3538 Tom Willetts 7548 2776

Investors/

Analysts:

+44 (0)20

Richard Gradidge 7548 3860

DISCLAIMER

Please note that Holders must read this announcement in

conjunction with the Memorandum. The Memorandum contains important

information which should be read carefully before any decision is

made with respect to the Proposal.

Holders who are in any doubt as to the action they should take

or the impact of the Proposal or any related instruction are

strongly advised to consult their own professional advisers,

including as to any tax consequences.

None of the Company, the Solicitation Agents, the Principal

Paying Agent, the Trustee, the Tabulation Agent or any director,

officer, employee, agent or affiliate of any such person is acting

for any Holder, or will be responsible to any Holder for providing

any protections which would be afforded to its clients or for

providing advice in relation to the Proposal or the matters

referred to therein, and accordingly none of the Company, the

Solicitation Agents, the Principal Paying Agent, the Trustee, the

Tabulation Agent nor any of their respective directors, officers,

employees, agents or affiliates makes any recommendation whatsoever

regarding the Proposal and none of the Company, the Solicitation

Agents, the Principal Paying Agent, the Tabulation Agent nor any of

their respective directors, officers, employees, agents or

affiliates makes any recommendation as to whether any Holder should

submit any instruction in connection therewith.

Any materials relating to the Proposal do not constitute, and

may not be used in connection with, any form of invitation, offer

or solicitation in any place where such invitations, offers or

solicitations are not permitted by law. If a jurisdiction requires

that the Proposal be made by a licenced broker or dealer and any of

the Solicitation Agents or any of their affiliates is a licensed

broker or dealer in such jurisdiction, the Proposal shall be deemed

to be made by the Solicitation Agents or such affiliate, as the

case may be, on behalf of the Company in such jurisdiction.

The distribution of the Memorandum and the making of the

Proposal by the Company in certain jurisdictions may be restricted

by law. Persons into whose possession this announcement or the

Memorandum come are required by the Company, the Solicitation

Agents and the Tabulation Agent to inform themselves about and to

observe any such restrictions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCRAMPTMBJTMFP

(END) Dow Jones Newswires

July 25, 2018 05:00 ET (09:00 GMT)

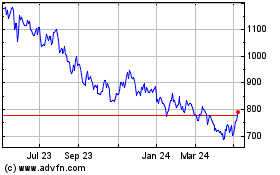

Prudential (LSE:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

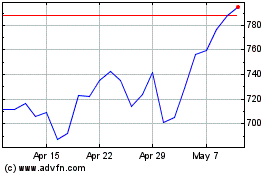

Prudential (LSE:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025