TIDMRBG

RNS Number : 2557R

AIM

26 June 2020

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

Revolution Bars Group plc

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES):

21 Old Street, Ashton-under-Lyne, Tameside, OL6 6LA

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

https://www.revolutionbarsgroup.com/investors/aim-rule-26/

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

Revolution Bars Group plc is a leading operator of 74 premium

bars, with a strong national presence across the UK and significant

growth opportunities. The Company's bars are located predominantly

in town or city centre high streets, with two high quality

brands: 'Revolution' and 'Revolución de Cuba'.

The Group's business model is to maintain strong cash generation

from its existing estate of bars, whilst prioritising investment

in the core estate to drive like-for-like sales for both the

Revolución de Cuba and Revolution brands. Both brands

focus on a premium drinks and food-led offering, typically

trading from late morning through into late evening.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

The issued fully paid up share capital of the Company: (i)

as at 25 June 2020 (being the latest practicable date prior

to the date of this Schedule One announcement); and (ii) as

it is expected to be immediately following Admission, is:

Number of Ordinary Nominal Amount

Shares

At the date of this Schedule 50,029,159 GBP50,029.16

One announcement

------------------- ---------------

On Admission 125,046,654 GBP125,046.65

------------------- ---------------

All Ordinary Shares in the capital of the Company are registered

and may be held in either certificated or uncertificated form.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

The Company proposes to raise approximately GBP15.0 million

upon admission to AIM by way of a Firm Placing of 45,000,000

new ordinary shares and a Placing and Open Offer of 30,017,495

new ordinary shares.

Therefore, the total issued share capital at Admission will

be 125,046,654 ordinary shares, which, at 20 pence per ordinary

share (being the issue price of the new ordinary shares being

issued pursuant to the Firm Placing and the Placing and Open

Offer), results in a market capitalisation on Admission of

approximately GBP25.0 million.

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

15.83%

**Calculated on the basis of each substantial shareholder's

shareholding as at 25 June 2020 and their respective participations

in the Firm Placing, and including each Director's shareholding,

as adjusted for each respective Director's participation in

the Firm Placing and the Open Offer, as appropriate.

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

N/A

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Name of Director Position

Keith Graeme Edelman Non-Executive Chairman

---------------------------------

Robert (Rob) Antony Pitcher Chief Executive Officer

---------------------------------

Michael (Mike) Raymond Foster Chief Financial Officer

---------------------------------

Jemima Chloe Bird Senior Independent Non-Executive

Director

---------------------------------

William Tuffy Independent Non-Executive

Director

---------------------------------

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

As far as the Company is aware, the below is the list of significant

shareholders as at 25 June 2020 and their respective interests

in the Company's share capital both prior to and on Admission:

Shareholder Holding % Interest *Holding *% Interest

pre-Admission pre-Admission on Admission on Admission

Artemis Investment

Management 10,511,232 21.01 18,911,235 15.12

-------------- -------------- ------------- -------------

Legal & General Investment

Management 4,588,000 9.17 8,717,206 6.97

-------------- -------------- ------------- -------------

IG Markets 3,519,242 7.03 4,599,242 3.68

-------------- -------------- ------------- -------------

Hargreaves Lansdown 3,107,650 6.21 Below 3% Below 3%

-------------- -------------- ------------- -------------

Adrian John Williams 2,876,919 5.75 5,126,919 4.10

-------------- -------------- ------------- -------------

AXA Framlington Investment

Managers 2,498,819 4.99 3,848,819 3.08

-------------- -------------- ------------- -------------

GLG Partners 2,230,825 4.46 Below 3% Below 3%

-------------- -------------- ------------- -------------

Barclays Smart Investor 1,853,650 3.71 Below 3% Below 3%

-------------- -------------- ------------- -------------

Goldman Sachs

International 1,705,637 3.41 Below 3% Below 3%

-------------- -------------- ------------- -------------

Interactive Investor 1,679,854 3.36 Below 3% Below 3%

-------------- -------------- ------------- -------------

HSBC James Capel 1,545,979 3.09 Below 3% Below 3%

-------------- -------------- ------------- -------------

Deltic Group 1,500,000 3.00 Below 3% Below 3%

-------------- -------------- ------------- -------------

Chelverton Asset

Management 1,500,000 3.00 Below 3% Below 3%

-------------- -------------- ------------- -------------

*Calculated on the basis of each shareholder's shareholding

as at 25 June 2020 and their respective participations in the

Firm Placing.

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

BDO LLP

Kennedys LLP

Kuit Steinhart Levy LLP

Grant Thornton LLP

Macfarlanes LLP

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 27 June

(ii) N/A

(iii) By 27 December 2020 (annual results for the 52 weeks

ending 27 June 2020);

By 26 March 2021 (interim results for the 26 weeks ending 26

December 2020); and

By 3 January 2021 (annual results for the 53 weeks ending 3

July 2021)

EXPECTED ADMISSION DATE:

27 July 2020

NAME AND ADDRESS OF NOMINATED ADVISER:

finnCap Ltd

1 Bartholomew Close

London

EC1A 7BL

NAME AND ADDRESS OF BROKER:

finnCap Ltd

1 Bartholomew Close

London

EC1A 7BL

and

Peel Hunt LLP

Moor House

120 London Wall

London EC2Y 5ET

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

N/A - Quoted applicant

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

UK Corporate Governance Code

DATE OF NOTIFICATION:

26 June 2020

NEW/ UPDATE:

New

QUOTED APPLICANTS MUST ALSO COMPLETE THE FOLLOWING:

THE NAME OF THE AIM DESIGNATED MARKET UPON WHICH THE APPLICANT'S

SECURITIES HAVE BEEN TRADED:

Listed on the premium segment of the FCA's Official List and

traded on the London Stock Exchange's main market for listed

securities

THE DATE FROM WHICH THE APPLICANT'S SECURITIES HAVE BEEN SO

TRADED:

18 March 2015

CONFIRMATION THAT, FOLLOWING DUE AND CAREFUL ENQUIRY, THE APPLICANT

HAS ADHERED TO ANY LEGAL AND REGULATORY REQUIREMENTS INVOLVED

IN HAVING ITS SECURITIES TRADED UPON SUCH A MARKET OR DETAILS

OF WHERE THERE HAS BEEN ANY BREACH:

The Company confirms, following due and careful enquiry, that

it has adhered to all legal and regulatory requirements applicable

to companies whose securities are admitted to listing on the

FCA's Official List and to trading on the London Stock Exchange's

main market for listed securities.

AN ADDRESS OR WEB-SITE ADDRESS WHERE ANY DOCUMENTS OR ANNOUNCEMENTS

WHICH THE APPLICANT HAS MADE PUBLIC OVER THE LAST TWO YEARS

(IN CONSEQUENCE OF HAVING ITS SECURITIES SO TRADED) ARE AVAILABLE:

https://www.revolutionbarsgroup.com/

DETAILS OF THE APPLICANT'S STRATEGY FOLLOWING ADMISSION INCLUDING,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

STRATEGY:

Prior to the onset of the COVID-19 pandemic, the Group was

demonstrating signs that the turnaround strategy put in place

by the Board was successful, with the Group achieving growth

in both like-for-like sales and Adjusted EBITDA and making

significant progress on debt reduction. Following the escalation

of the COVID-19 pandemic in the UK, on 18 March 2020, the Company

announced that recent trading had been impacted by the COVID-19

pandemic and its wider effects. Shortly thereafter, on 20 March

2020, the UK Government announced the closure of all bars,

pubs and restaurants due to the COVID-19 pandemic. From this

date, the Group was forced to suspend the trading of its entire

portfolio of 74 bars.

In the event that the restrictions on trading related to the

COVID-19 pandemic are lifted and the Group is able to reopen

its portfolio of bars earlier than anticipated by the Group's

downside case scenario, the Board expects to resume its program

of venue refurbishments, and to be in a good position to potentially

take advantage of growth opportunities post-COVID-19, which

could include the acquisition of new sites at a time when the

Board believes acquisition prices will be depressed. However,

should the restrictions on trading related to the COVID-19

pandemic be consistent with the Group's downside case scenario,

the Board will be initially limited in its capacity to resume

its programme of venue refurbishments or take advantage of

growth opportunities post-COVID-19 until such point as the

Group has generated sufficient operating cashflow.

The Group will make some changes to its operating model, assuming

current social distancing measures, and anticipates a gradual

recovery in customer numbers. The base case scenario assumes

that the Group will deliver sales in August 2020 at approximately

55 per cent. of the prior year comparable period with only

marginal improvement in September 2020 and October 2020. However,

it is expected that social distancing restrictions will have

been relaxed by November 2020 at which point sales will increase

to 80 per cent. of the prior year comparable period with a

further improvement to 90 per cent. of the prior year comparable

period by December 2020 with a further gradual improvement

to 100 per cent. of the comparable period by June 2021.

A DESCRIPTION OF ANY SIGNIFICANT CHANGE IN FINANCIAL OR TRADING

POSITION OF THE APPLICANT, WHICH HAS OCCURRED SINCE THE END

OF THE LAST FINANCIAL PERIOD FOR WHICH AUDITED STATEMENTS HAVE

BEEN PUBLISHED:

Prior to the onset of the COVID-19 pandemic, the Group was

demonstrating signs that the turnaround strategy put in place

by the Board was successful, with the Group achieving growth

in both like-for-like Sales and Adjusted EBITDA and making

significant progress on debt reduction.

The Group published its unaudited interim financial information

relating to the 26 week period ended 28 December 2019 o n 26

February 2020, detailing the financial performance of the Group

since the publishing of its audited annual results for the

52 weeks ended 29 June 2019 on 1 October 2019.

Following the escalation of the COVID-19 pandemic in the UK,

on 18 March 2020, the Company announced that recent trading

had been impacted by the COVID-19 pandemic and its wider effects.

Shortly thereafter, on 20 March 2020, the UK Government announced

the closure of all bars, pubs and restaurants due to the COVID-19

pandemic. From this date, the Group was forced to suspend the

trading of its entire portfolio of 74 bars. As a result of

these measures the Group has been unable to resume normal trading

across all of its bars and currently anticipates a staged reopening

of its estate after 4 July 2020 in accordance with UK Government

guidance and the current COVID-19 restrictions.

Other than as disclosed above and via the Company's previous

RNS announcements, including its unaudited interim results

for the six month period ended on 28 December 2019 on 26 February

2020, there have been no significant changes in the financial

or trading position of the Company since the end of the 52

weeks period ended 29 June 2019.

A STATEMENT THAT THE DIRECTORS OF THE APPLICANT HAVE NO REASON

TO BELIEVE THAT THE WORKING CAPITAL AVAILABLE TO IT OR ITS

GROUP WILL BE INSUFFICIENT FOR AT LEAST TWELVE MONTHS FROM

THE DATE OF ITS ADMISSION:

The Directors have no reason to believe that the working capital

available to the Company or the Group will be insufficient

for at least 12 months from the date of its Admission.

In making the above working capital statement, the Directors,

have applied the ESMA Recommendations, which require the Directors

to assess whether there is sufficient margin or headroom to

cover a reasonable worst case scenario.

COVID-19 has resulted in significantly increased levels of

uncertainty for many companies, and in particular for the Restaurant

and Bars sector that the business operates in, with a wide

range of possible financial impacts, resulting in challenges

to COVID-19-impacted businesses in producing sufficiently reliable

forecasts of their future financial performance to determine

the reasonable worst case scenario.

For purposes of this working capital statement, the Directors

have formed their view of a reasonable worst case scenario

using the following COVID-19-specific assumptions, which the

working capital statement is therefore dependent upon:

* The assumed opening date for all sites is November

2020

* The like-for-like sales compared to last year, are

assumed to be 75% in November 2020, 80% in December

2020 and then increasing incrementally each month up

to 100% in June 2021.

* Variable costs are assumed to flex in line with the

assumed revenue assumptions.

* Capital expenditure is assumed to be deferred in line

with the deferral of the opening of the sites.

* No rent reductions are assumed, beyond those already

secured.

The working capital statement in this Schedule One announcement

has been prepared following the application of the ESMA Recommendations

and the technical supplement to the FCA Statement of Policy

published on 8 April 2020 relating to the COVID-19 crisis.

DETAILS OF ANY LOCK-IN ARRANGEMENTS PURSUANT TO RULE 7 OF THE

AIM RULES:

N/A

A BRIEF DESCRIPTION OF THE ARRANGEMENTS FOR SETTLING THE APPLICANT'S

SECURITIES:

Settlement will continue to be through the CREST system for

dealings in ordinary shares held in uncertificated form. Ordinary

s hares can also be dealt in certificated form.

A WEBSITE ADDRESS DETAILING THE RIGHTS ATTACHING TO THE APPLICANT'S

SECURITIES:

https://www.revolutionbarsgroup.com/

INFORMATION EQUIVALENT TO THAT REQUIRED FOR AN ADMISSION DOCUMENT

WHICH IS NOT CURRENTLY PUBLIC:

Information is contained within the Appendix to this Schedule

One announcement, available on the Company's website at https://www.revolutionbarsgroup.com/

A WEBSITE ADDRESS OF A PAGE CONTAINING THE APPLICANT'S LATEST

ANNUAL REPORT AND ACCOUNTS WHICH MUST HAVE A FINANCIAL YEAR

END NOT MORE THEN NINE MONTHS PRIOR TO ADMISSION AND INTERIM

RESULTS WHERE APPLICABLE. THE ACCOUNTS MUST BE PREPARED IN

ACCORDANCE WITH ACCOUNTING STANDARDS PERMISSIBLE UNDER AIM

RULE 19:

https://www.revolutionbarsgroup.com/investors/results-centre/

THE NUMBER OF EACH CLASS OF SECURITIES HELD IN TREASURY:

As of the date of this Schedule One announcement, there are

no ordinary shares held in treasury

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PAASEMFFMESSEIM

(END) Dow Jones Newswires

June 26, 2020 08:15 ET (12:15 GMT)

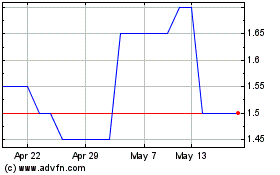

Revolution Bars (LSE:RBG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Revolution Bars (LSE:RBG)

Historical Stock Chart

From Jul 2023 to Jul 2024