TIDMRCHA

RNS Number : 6425X

Rothschild & Co Contin Fin CI Ltd

30 April 2019

Rothschild & Co Continuation Finance CI Limited (formerly

Rothschilds Continuation Finance (C.I) Limited)

Report of the Directors and Financial Statements

for the year ended 31 December 2018

Report of the Directors

The Directors present their Directors' report and financial

statements for the year ended 31 December 2018.

Principal Activities and Business Review

The principal activity of Rothschild & Co Continuation

Finance CI Limited ("the Company") is the raising of finance for

the purpose of lending it to other members of the Rothschild &

Co Concordia SAS group.

In 2017, the Company changed its financial year end from 31

March to 31 December. This set of financial statements is the first

full year since this change and consequently, the comparative

figures for the Company's income statement, statement of

comprehensive income, statement of changes in equity, cash flow

statement and related notes are for the 9 months from 1 April 2017

to 31 December 2017.

As mentioned above, the Company operates as a finance vehicle

which issues debt and lends it onto other Rothschild & Co Group

companies on substantially the same terms. The only debt currently

in issue is perpetual subordinated notes. Given the nature of this

debt and the related loans to group companies, the Directors

consider that accrual accounting, as per prior years, best reflects

the purpose of the Company as a pass through financing vehicle and

to match the GBP125m loan asset and debt securities in issue. On

this basis, the loan asset and debt securities would be matched on

the balance sheet at GBP125m which reflects the real asset and

liability position of the Company.

However, the loans to the group undertakings do not pass the

"solely payments of principal and interest" test under IFRS 9

(which came into force from 1 January 2018) due to technical terms

in the loan documentation which, in accordance with IFRS 9,

override the Directors' view of the business. The Company has

therefore been required to report the loan asset at fair value on

the balance sheet, which resulted in an opening reserves gain of

GBP35.1m and a loss for the year of GBP5.9m (both before tax).

Given this mandatory treatment, the Directors have elected to fair

value the liabilities which result in offsetting losses of GBP35.0m

on transition to IFRS 9 and a gain of GBP5.9m in the income

statement for the year. The fair values of both loan asset and debt

securities have been based on a review of available quotes and any

third party transactions for the debt securities. The value of the

loan asset is marginally higher given the 1/64 per cent higher

margin than the debt securities.

Provision for deferred tax has been made on the fair value

movements, albeit that under various tax regulations both the loans

and debt securities will continue to be taxed on an amortised cost

basis. This resulted in a net deferred tax liability of

GBP21,250.

Overall, the impact of the IFRS 9 mandatory and elected changes,

along with the normal interest margin, is that reserves have

increased by GBP119,001 with a profit after tax for the year of

GBP15,251.

Principal Risks and Uncertainties

The principal risks of the Company are credit risk, liquidity

risk, market risk and operational risk. The Company follows the

risk management policies of fellow subsidiary undertaking, NM

Rothschild & Sons Limited ("NMR").

The Company's principal risk is credit exposure to other group

companies, as the notes issued by the Company have been on lent to

Rothschild & Co Continuation Limited ("RCL") and NMR. RCL has

also guaranteed the notes issued. The Company's ability to meet its

obligations in respect of notes issued by it is therefore reliant

on NMR and RCL to make payments to the Company. Currently an

uncertainty the Company is exposed to is the impact of Brexit on

NMR. NMR does not expect any structural or regulatory issues. The

changes in the UK and European economic environment could impact

revenues and profitability, but does not affect the going concern

assessment.

The changes to fair value accounting do not alter these risks

and the Company remains reliant on NMR's guarantee for the GBP125m

nominal amount and for interest payments from both RCL and NMR.

The Company's market risk exposure is limited to interest rate

movements. Exposure to interest rate movements on the perpetual

subordinated note issues has been passed to NMR and RCL, as the

issue proceeds have been lent onwards at a fixed margin of 1/64 per

cent above the rate being paid.

Liquidity risk has similarly been transferred to NMR and RCL as

the funds on-lent have the same maturity dates as the notes issued.

Operational risk arising from inadequate or failed internal

processes, people and systems or from external events is managed by

maintaining a strong framework of internal controls.

Directors

The Directors who held office during the year were as

follows:

Peter Barbour

Anthony Coghlan

Mark Crump

David Oxburgh

Directors' Indemnity

The Company has provided qualifying third-party indemnities for

the benefit of its Directors. These were provided during the year

and remain in force at the date of this report.

Dividends

During the year, the Company did not pay any dividends (9 months

to 31 December 2017: GBP150,000).

Auditor

Pursuant to the Companies (Guernsey) Law 2008, the auditor will

be deemed to be reappointed and KPMG LLP will therefore continue in

office.

Audit Information

The Directors who held office at the date of approval of this

Report of the Directors confirm that, so far as they are each

aware, there is no relevant audit information of which the

Company's auditor is unaware, and each Director has taken all the

steps that he or she ought to have taken as a Director to make

himself or herself aware of any relevant audit information and to

establish that the Company's auditors are aware of that

information.

Directors' Responsibilities Statement

The Directors are responsible for preparing the Directors'

Report and the financial statements in accordance with applicable

law and regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law they have

elected to prepare the financial statements in accordance with

International Financial Reporting Standards as adopted by the

European Union (IFRSs as adopted by the EU) and applicable law.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and of the profit or

loss of the Company for that period.

In preparing these financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable and prudent;

-- state whether they have been prepared in accordance with IFRS as adopted by the EU;

-- assess the Company's ability to continue as a going concern,

disclosing, as applicable, matters related to going concern;

and

-- use the going concern basis of accounting unless they either

intend to liquidate the Company or to cease operations, or have no

realistic alternative but to do so.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies (Guernsey) Law

2008. They have general responsibility for taking such steps as are

reasonably open to them to safeguard the assets of the Company and

to prevent and detect fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

By Order of the Board

Anthony Coghlan Peter Barbour

Director Director

30 April 2019

Independent Auditor's Report to the Members of Rothschild &

Co Continuation Finance CI Limited

1. Our opinion is unmodified

We have audited the financial statements of Rothschild & Co

Continuation Finance CI Limited ("the Company") for the year ended

31 December 2018 which comprise the statement of comprehensive

income, balance sheet, statement of changes in equity, cash flow

statement and the related notes, including the accounting policies

in note 1.

In our opinion:

-- the financial statements give a true and fair view of the

state of the Company's affairs as at 31 December 2018 and of the

Company's profit for the year then ended;

-- the Company financial statements have been properly prepared

in accordance with International Financial Reporting Standards as

adopted by the European Union (IFRSs as adopted by the EU);

-- the financial statements have been prepared in accordance

with the requirements of the Companies (Guernsey) Law 2008

Basis for Opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) ("ISAs (UK)") and applicable law. Our

responsibilities are described below. We believe that the audit

evidence we have obtained is a sufficient and appropriate basis for

our opinion. Our audit opinion is consistent with our report to

those charged with governance.

We were appointed as auditor by the Directors on 31 March 1994.

The period of total uninterrupted engagement is the 24 years ended

31 December 2018. We have fulfilled our ethical responsibilities

under, and we remain independent of the Company in accordance with,

UK ethical requirements including the FRC Ethical Standard as

applied to listed public interest entities. No non-audit services

prohibited by that standard were provided.

Overview

=========================================================================================

Materiality: GBP1.64m (31 December 2017:GBP1.35m)

financial statements 1% (31 December 2017: 1%) of

as a whole Total Assets

======================== ===============================================================

Risks of material vs December 2017

misstatement

======================== ===============================================================

Recurring Loans to group Loans to group undertakings

risks undertaking and subordinated guaranteed

and Subordinated notes are classified

guaranteed at fair value upon adoption

notes of IFRS 9 on 1 January

2018. Therefore, a new

risk related to the fair

value of loans and subordinated

guaranteed notes has

been identified in the

current year. As a result,

the risk of recoverability

is not separately identified.

====================== ======================== =======================================

2. Key audit matters: our assessment of risks of material misstatement

Key audit matters are those matters that, in our professional

judgement, were of most significance in the audit of the financial

statements and include the most significant assessed risks of

material misstatement (whether or not due to fraud) identified by

us, including those which had the greatest effect on: the overall

audit strategy; the allocation of resources in the audit; and

directing the efforts of the engagement team. We summarise below

the key audit matters in arriving at our audit opinion above,

together with our key audit procedures to address those matters,

and, as required for public interest entities, our results from

those procedures. These matters were addressed, and our results are

based on procedures undertaken, in the context of, and solely for

the purpose of, our audit of the financial statements as a whole,

and in forming our opinion thereon, and consequently are incidental

to that opinion, and we do not provide a separate opinion on these

matters.

The risk Our response

========================== ============================ ============================================================

The impact of Unprecedented levels We have developed a standardised

uncertainties of uncertainty firm-wide approach to the

due to Britain All audits assess and consideration of the uncertainties

exiting the European challenge the arising from Brexit in planning

Union on our reasonableness and performing our audits.

audit of estimates, in Our procedures included:

Refer to page particular * Our Brexit knowledge - We considered the Directors'

2 (principal as described in loans assessment of Brexit-related sources of risk for the

risks and uncertainties) to group undertaking, Company's business and financial resources compared

effective interest rate with our own understanding of the risks. We

adjustment below, related considered the directors' plans to take action to

disclosures and the mitigate the risks.

appropriateness of the

going concern basis

of preparation of the * Sensitivity analysis - When addressing the fair value

annual accounts. All of loans to group undertakings and subordinated

of these depend on guaranteed notes, we compared the directors'

assessments sensitivity analysis to our assessment of the full

of the future economic range of reasonably possible scenarios resulting from

environment and the Brexit uncertainty.

Company's future

prospects

and performance. * Assessing transparency - As well as assessing

In addition, we are individual disclosures as part of our procedures on

required to consider loans to group undertakings, we considered all the

the other information Brexit related disclosures together, including those

presented in the Annual in the strategic report, comparing the overall

Report including the picture against our understanding of the risks.

principal risks

disclosure

and to consider the Our results

directors' statement As reported under valuation

that the annual report of loans to group undertakings

and financial statements and subordinated guaranteed

taken as a whole is notes, we found the resulting

fair, balanced and disclosures of sensitivity

understandable and disclosures in relation

and provides the to going concern to be acceptable.

information However, no audit should

necessary for be expected to predict the

shareholders unknowable factors or all

to assess the Company's possible future implications

position and performance, for a Company and this is

business model and particularly the case in

strategy. relation to Brexit.

Brexit is one of the

most significant economic

events for the UK and

at the date of this

report its effects are

subject to unprecedented

levels of uncertainty

of outcomes, with the

full range of possible

effects unknown.

========================== ============================ ============================================================

The risk Our response

========================= ============================= ============================================================

Valuation of Low Risk, high value: Our procedures included:

Loans to group The amount of the * Test of details: We involved our valuation

undertakings intercompany specialists to independently determine the fair value

and subordinated loan receivables represent of the loans to group undertakings and the

guaranteed notes 94% (December 2017: 93%) subordinated guaranteed notes at the IFRS 9

Loans to group of the Company's total transition date of 1 January 2018 and as at the year

undertakings assets. ended 31 December 2018.

(GBP154 million; The terms of the loans to

31 December 2017: group undertakings are

GBP125 million) similar * We assessed whether the Company's disclosures in

Subordinated to the subordinated relation to fair value were in compliance with the

guaranteed notes guaranteed relevant standards.

(GBP154 million; notes. The fair value of

31 December 2017:GBP125 subordinated guaranteed

million) notes Our results:

in issue is based on We found the valuation of

Refer to page available loans to group undertakings

16 (note 6) and quotes from brokers and and subordinated guaranteed

page 17 (note third notes, and the relevant

11) party transactions where disclosures to be acceptable.

available. As a result, (December 2017: N/A)

valuation

is not at a high risk of

material misstatement or

subject to significant

judgement.

However, due to its

materiality

in the context of the

financial

statements, valuation of

loan to parent undertaking

and subordinated

guaranteed

notes is considered to be

an area that has the

greatest

effect on our audit.

========================= ============================= ============================================================

3. Our application of materiality and an overview of the scope of our audit

Materiality for the Company as a whole was set at GBP1.64m (31

December 2017: GBP1.35m), determined with reference to a benchmark

of total assets (of which it represents 1% (31 December 2017: 1%).

%). The threshold for reporting misstatements to those charged with

governance was GBP0.08m (31 December 2017: GBP0.07m).

4. We have nothing to report on going concern

The Directors have prepared the financial statements on the

going concern basis as they do not intend to liquidate the Company

or to cease its operations, and as they have concluded that the

Company's financial position means that this is realistic. They

have also concluded that there are no material uncertainties that

could have cast significant doubt over its ability to continue as a

going concern for at least a year from the date of approval of the

financial statements ("the going concern period").

Our responsibility is to conclude on the appropriateness of the

Directors' conclusions and, had there been a material uncertainty

related to going concern, to make reference to that in this audit

report. However, as we cannot predict all future events or

conditions and as subsequent events may result in outcomes that are

inconsistent with judgements that were reasonable at the time they

were made, the absence of reference to a material uncertainty in

this auditor's report is not a guarantee that the Company will

continue in operation.

In our evaluation of the Directors' conclusions, we considered

the inherent risks to the Company's business model, including the

impact of Brexit and analysed how those risks might affect the

Company's financial resources or ability to continue operations

over the going concern period. We evaluated those risks and

concluded they were not significant enough to require us to perform

additional audit procedures.

Based on this work, we are required to report to you if we have

concluded that the use of the going concern basis of accounting is

inappropriate or there is an undisclosed material uncertainty that

may cast significant doubt over the use of that basis for a period

of at least a year from the date of approval of the financial

statements.

We have nothing to report in these respects, and we did not

identify going concern as a key audit matter.

5. We have nothing to report the other information in the financial statements

The Directors are responsible for the other information

presented in the financial statements. Our opinion on the financial

statements does not cover the other information and, accordingly,

we do not express an audit opinion or, except as explicitly stated

below, any form of assurance conclusion thereon.

Our responsibility is to read the other information and, in

doing so, consider whether, based on our financial statements audit

work, the information therein is materially misstated or

inconsistent with the financial statements or our audit knowledge.

Based solely on that work we have not identified material

misstatements in the other information.

Directors' report

Based solely on our work on the other information:

-- we have not identified material misstatements in the Directors'

report;

-- in our opinion the information given in the report for

the financial year is consistent with the financial statements;

and

-- in our opinion the report has been prepared in accordance

with the Companies (Guernsey) Law 2008.

6. We have nothing to report on the other matters on which we are required to report by exception

Under the Companies (Guernsey) Law 2008, we are required to

report to you if, in our opinion:

-- adequate accounting records have not been kept by the

Company, or returns adequate for our audit have not been

received from branches not visited by us; or

-- the Company financial statements are not in agreement

with the accounting records and returns; or

-- certain disclosures of Directors' remuneration specified

by law are not made; or

-- we have not received all the information and explanations

we require for our audit.

We have nothing to report in these respects.

7. Respective responsibilities

Directors' responsibilities

As explained more fully in their statement set out on page 3,

the Directors are responsible for: the preparation of the financial

statements including being satisfied that they give a true and fair

view; such internal control as they determine is necessary to

enable the preparation of financial statements that are free from

material misstatement, whether due to fraud or error; assessing the

Company's ability to continue as a going concern, disclosing, as

applicable, matters related to going concern; and using the going

concern basis of accounting unless they either intend to liquidate

the Company or to cease operations, or have no realistic

alternative but to do so.

Auditor's responsibilities

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or other irregularities (see

below), or error, and to issue our opinion in an auditor's report.

Reasonable assurance is a high level of assurance, but does not

guarantee that an audit conducted in accordance with ISAs (UK) will

always detect a material misstatement when it exists. Misstatements

can arise from fraud, other irregularities or error and are

considered material if, individually or in aggregate, they could

reasonably be expected to influence the economic decisions of users

taken on the basis of the financial statements.

A fuller description of our responsibilities is provided on the

FRC's website at: www.frc.org.uk/auditorsresponsibilities.

Irregularities - ability to detect

We identified areas of laws and regulations that could

reasonably be expected to have a material effect on the annual

accounts from our general commercial and sector experience, through

discussion with the directors (as required by auditing standards),

and from inspection of the Group's regulatory correspondence and

discussed with the directors the policies and procedures regarding

compliance with laws and regulations. We communicated identified

laws and regulations throughout our team and remained alert to any

indications of non-compliance throughout the audit. The potential

effect of these laws and regulations on the financial statements

varies considerably.

The Company is subject to laws and regulations that directly

affect the financial statements including financial reporting

legislation (including related companies legislation),

distributable profits legislation, and taxation legislation and we

assessed the extent of compliance with these laws and regulations

as part of our procedures on the related financial statement

items.

Whilst the Company is subject to many other laws and

regulations, we did not identify any others where the consequences

of non-compliance alone could have a material effect on amounts or

disclosures in the financial statements.

Owing to the inherent limitations of an audit, there is an

unavoidable risk that we may not have detected some material

misstatements in the financial statements, even though we have

properly planned and performed our audit in accordance with

auditing standards. For example, the further removed non-compliance

with laws and regulations (irregularities) is from the events and

transactions reflected in the financial statements, the less likely

the inherently limited procedures required by auditing standards

would identify it. In addition, as with any audit, there remained a

higher risk of non-detection of irregularities, as these may

involve collusion, forgery, intentional omissions,

misrepresentations, or the override of internal controls. We are

not responsible for preventing non-compliance and cannot be

expected to detect non-compliance with all laws and

regulations.

8. The purpose of our audit work and to whom we owe our responsibilities

This report is made solely to the Company's members, as a body,

in accordance with section 262 of the Companies (Guernsey) Law

2008. Our audit work has been undertaken so that we might state to

the Company's members those matters we are required to state to

them in an auditor's report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company and the Company's

members, as a body, for our audit work, for this report, or for the

opinions we have formed.

Pamela McIntyre (Senior Statutory Auditor)

for and on behalf of KPMG LLP, Statutory Auditor

Chartered Accountants

15 Canada Square

London E14 5GL

30 April 2019

Statement of Comprehensive Income

For the year ended 31 December 2018

Year to 9 months

31 December to

2018 31 December

2017

Notes GBP GBP

------------------------------- ------ ------------------------ --------------

Interest income 11,269,478 8,490,743

------------------------------- ------ ------------------------ --------------

Interest expense (11,250,000) (8,476,027)

------------------------------- ------ ------------------------ --------------

Operating profit 19,478 14,716

------------------------------- ------ ------------------------ --------------

Revaluation of loans 6 (5,937,500) -

------------------------------- ------ ------------------------ --------------

Revaluation of debt securities 11 5,937,500 -

------------------------------- ------ ------------------------ --------------

Administrative expenses (650) -

------------------------------- ------ ------------------------ --------------

Profit before tax 18,828 14,716

------------------------------- ------ ------------------------ --------------

Income tax expense 5 (3,577) (2,796)

------------------------------- ------ ------------------------ --------------

Profit for the financial year 15,251 11,920

------------------------------- ------ ------------------------ --------------

Other comprehensive income - -

------------------------------- ------ ------------------------ --------------

Total comprehensive income for

the financial year 15,251 11,920

------------------------------- ------ ------------------------ --------------

All amounts are in respect of continuing activities.

Balance Sheet

At 31 December 2018

31 December 31 December

2018 2018 2017 2017

Notes GBP GBP GBP GBP

---------------------------- ------ ------------- -------------- ----------------- -------------------

Non-current assets

Loans to group undertakings 6 154,187,500 125,000,000

---------------------------- ------ ------------- -------------- ----------------- -------------------

Current assets

Other financial assets 7 6,496,137 6,496,192

---------------------------- ------ ------------- -------------- ----------------- -------------------

Cash and cash equivalents 8 3,481,151 3,465,064

---------------------------- ------ ------------- -------------- ----------------- -------------------

9,977,288 9,961,256

---------------------------- ------ ------------- -------------- ----------------- -------------------

Current liabilities

Current tax liability 5 (3,577) (2,796)

---------------------------- ------ ------------- -------------- ----------------- -------------------

Deferred tax liability 9 (21,250) -

---------------------------- ------ ------------- -------------- ----------------- -------------------

Other financial liabilities 10 (9,832,192) (9,832,192)

---------------------------- ------ ------------- -------------- ----------------- -------------------

Net current assets 120,269 126,268

---------------------------- ------ ------------- -------------- ----------------- -------------------

Total assets less

current liabilities 154,307,769 125,126,268

---------------------------- ------ ------------- -------------- ----------------- -------------------

Non-current liabilities

Subordinated guaranteed

notes 11 (154,062,500) (125,000,000)

---------------------------- ------ ------------- -------------- ----------------- -------------------

Net assets 245,269 126,268

---------------------------- ------ ------------- -------------- ----------------- -------------------

Shareholders' equity

Share capital 12 100,000 100,000

---------------------------- ------ ------------- -------------- ----------------- -------------------

Retained earnings 145,269 26,268

---------------------------- ------ ------------- -------------- ----------------- -------------------

Total shareholders'

equity 245,269 126,268

---------------------------- ------ ------------- -------------- ----------------- -------------------

Approved by the Board of Directors and signed on its behalf on

30 April 2019 by:

Anthony Coghlan Peter Barbour

Director Director

Statement of Changes in Equity

For the Year ended 31 December 2018

Share Capital Retained Earnings Total Equity

GBP GBP GBP

--------------------------- ------------- ----------------- ------------

At 31 December 2017 100,000 26,268 126,268

--------------------------- ------------- ----------------- ------------

Transition to IFRS 9 - 103,750 103,750

--------------------------- ------------- ----------------- ------------

At 1 January 2018 100,000 130,018 230,018

--------------------------- ------------- ----------------- ------------

Total comprehensive income

for the financial year - 15,251 15,251

--------------------------- ------------- ----------------- ------------

At 31 December 2018 100,000 145,269 245,269

--------------------------- ------------- ----------------- ------------

At 1 April 2017 100,000 164,348 264,348

--------------------------- ------------- ----------------- ------------

Total comprehensive income

for the financial period - 11,920 11,920

--------------------------- ------------- ----------------- ------------

Shareholders' dividends - (150,000) (150,000)

--------------------------- ------------- ----------------- ------------

At 31 December 2017 100,000 26,268 126,268

--------------------------- ------------- ----------------- ------------

Cash Flow Statement

For the year ended 31 December 2018

Year to 9 months

31 December to 31 December

2018 2017

Notes GBP GBP

------------------------------------------- ----- ------------------------ ----------------

Cash flow from operating activities

(Loss)/profit for the financial year 15,251 11,920

------------------------------------------- ----- ------------------------ ----------------

Income tax expense 3,577 2,796

------------------------------------------- ----- ------------------------ ----------------

Operating profit before changes in

working capital and provisions 18,828 14,716

------------------------ ----------------

Fair value movements of loans 5,937,500 -

------------------------------------------- ----- ------------------------ ----------------

Fair value movements of debt securities (5,937,500) -

------------------------------------------- ----- ------------------------ ----------------

Net decrease/(increase) in debtors 55 (5,137,673)

------------------------------------------- ----- ------------------------ ----------------

Net (decrease)/increase in other financial

liabilities - 8,476,028

------------------------------------------- ----- ------------------------ ----------------

Cash generated from operations 18,883 3,353,071

------------------------------------------- ----- ------------------------ ----------------

Income taxes paid (2,796) (3,667)

------------------------------------------- ----- ------------------------ ----------------

Net cash flow from operating activities 16,087 3,349,404

------------------------------------------- ----- ------------------------ ----------------

Cash flow used in financing activities

Dividends paid - (150,000)

------------------------------------------- ----- ------------------------ ----------------

Net cash flow used in financing activities - (150,000)

------------------------------------------- ----- ------------------------ ----------------

Net increase in cash and cash equivalents 16,087 3,199,404

------------------------------------------- ----- ------------------------ ----------------

Cash and cash equivalents at beginning

of year 3,465,064 265,660

------------------------------------------- ----- ------------------------ ----------------

Cash and cash equivalents at end of

year 8 3,481,151 3,465,064

------------------------------------------- ----- ------------------------ ----------------

Interest paid and received during the period were as follows

:

Year to 9 months

31 December to 31 December

2018 2017

GBP GBP

------------------ ------------ ----------------

Interest paid 11,250,000 -

------------------ ------------ ----------------

Interest received 11,269,533 3,353,070

------------------ ------------ ----------------

Notes to the Financial Statements

(forming part of the Financial Statements)

For the year ended 31 December 2018

1. Accounting Policies

Rothschild & Co Continuation Finance CI Limited ("the

Company") is a private limited company incorporated in Guernsey.

The principal accounting policies which have been consistently

adopted in the presentation of the financial statements are as

follows:

a. Basis of preparation

The financial statements are prepared and approved by the

Directors in accordance with International Financial Reporting

Standards ("IFRS") and International Financial Reporting

Interpretations Committee ("IFRIC") interpretations, endorsed by

the European Union ("EU") and with those requirements of the

Companies (Guernsey) Law 2008 applicable to companies reporting

under IFRS. The financial statements are presented in sterling,

unless otherwise stated.

The maturities of the Company's liabilities are matched with the

maturities of its assets. There is, therefore a strong expectation

that the Company has adequate resources to continue in operational

existence for the foreseeable future and accordingly, the financial

statements have been prepared on a going concern basis.

The financial statements are presented in sterling, unless

otherwise stated.

Standards affecting the financial statements

IFRS 9 Financial Instruments and IFRS 15 Revenue from Contracts

with Customers were implemented with effect from 1 January 2018.

IFRS 15 has not had a significant effect on these financial

statements.

IFRS 9, which replaces IAS 39 Financial Instruments: Recognition

and Measurement, includes revised guidance in respect of the

classification and measurement of financial assets and liabilities

and introduces additional requirements for liabilities and hedge

accounting as well as a new expected credit loss model for

calculating impairment on financial assets.

Previously financial assets were classified as either fair value

through profit or loss, loans and advances, held-to-maturity

investments or available-for-sale. IFRS 9 eliminates the loans and

advances categories, and requires financial assets to be measured

at amortised cost, fair value through profit or loss ("FVTPL") or

fair value through other comprehensive income ("FVOCI").

IFRS 9 resulted in the requirement to fair value the loans to

the parent undertaking, and as a result the Company has elected to

fair value the debt securities in issue. The full impact of this

transition to IFRS 9 can be seen in note 15.

Future accounting policies

A number of new standards, amendments to standards and

interpretations are effective for accounting periods ending after

31 December 2018 and therefore have not been applied in preparing

these financial statements. The Company has reviewed these new

standards to determine their effects on the Company's financial

reporting, and none are expected to have a material impact on the

Company's financial statements.

b. Interest receivable and payable

Interest income and expense represents interest arising out of

lending and borrowing activities. Interest income and expense is

recognised in the income statement using the effective interest

rate method.

c. Taxation

Tax payable on profits is recognised in the statement of

comprehensive income.

Deferred tax is provided in full, using the balance sheet

liability method, on temporary differences arising between the tax

bases of assets and liabilities and their carrying amounts.

Deferred tax is determined using tax rates and laws that are

expected to apply when a deferred tax asset is realised, or when a

deferred tax liability is settled.

d. Cash and cash equivalents

For the purposes of the cash flow statement, cash and cash

equivalents comprise balances with other group companies that are

readily convertible to cash and are subject to an insignificant

risk of changes in value.

e. Capital management

The Company is not subject to any externally imposed capital

requirements. It is dependent on Rothschild & Co Continuation

Limited (the parent undertaking) to provide capital resources which

are therefore managed on a group basis.

f. Financial assets and liabilities

Financial assets and liabilities are recognised on trade date

and derecognised on either trade date, if applicable, or on

maturity or repayment.

i. Loans and advances

Loans and advances are non-derivative financial assets with

fixed or determinable payments that are not quoted in an active

market.

From 1 January 2018, loans and advances are initially recorded

at fair value and any subsequent movement in fair value is

recognised in the income statement.

Prior to 1 January 2018, loans and advances are initially

recorded at fair value, including any transaction costs and are

subsequently measured at amortised cost using the effective

interest rate method. Gains and losses arising on derecognition of

loans and advances are recognised in other operating income.

ii. Financial liabilities

From 1 January 2018, debt securities in issue are recorded at

fair value with any changes in fair value recognised in the income

statement. All other financial liabilities are recognised at

amortised cost.

Prior to 1 January 2018, all financial liabilities are carried

at amortised cost using the effective interest rate method.

g. Accounting judgements and estimates

The preparation of financial statements in accordance with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise judgement in applying the

accounting policies.

Valuation of financial assets and liabilities

Fair value is the price that would be received on selling an

asset or paid to transfer a liability in an orderly transaction

between market participants. For financial instruments carried at

fair value, market prices or rates are used to determine fair value

where an active market exists (such as a recognised exchange), as

this is the best evidence of the fair value of a financial

instrument. Where no active market price or rate is available, fair

values are estimated using inputs based on market conditions at the

balance sheet date.

Deferred tax

The recoverability of deferred tax assets is based on

management's assessment of the availability of future taxable

profits against which the deferred tax assets will be utilised.

2. Financial Risk Management

The Company follows the financial risk management policies of

the parent undertaking, Rothschild & Co Continuation Limited.

The key risks arising from the Company's activities involving

financial instruments, which are monitored at the group level, are

as follows:

- Credit risk - the risk of loss arising from client or

counterparty default is not considered a significant risk to the

Company as all asset balances are with other group companies as

detailed in note 13 Related Party Transactions.

- Market risk - exposure to changes in market variables such as

interest rates, currency exchange rates, equity and debt prices is

not considered significant as the terms of financial assets

substantially match those of financial liabilities.

- Liquidity risk - the risk that the Company is unable to meet

its obligations as they fall due or that it is unable to fund its

commitments is not considered significant as material cash inflows

and outflows from financial assets and liabilities are

substantially matched.

3. Directors' Emoluments

None of the Directors received any remuneration in respect of

their services to the Company during the year (9 months to 31

December 2017: GBPnil).

4. Audit Fee

The amount receivable by the auditors and their associates in

respect of the audit of these financial statements is GBP5,000 (9

months to 31 December 2017: GBP5,000). The audit fee is paid on a

group basis by N M Rothschild & Sons Limited.

5. Taxation

Year to 9 months

31 December to

2018 31 December

2017

GBP GBP

-------------- ------------- -------------

Current tax 3,577 2,796

-------------- ------------- -------------

Deferred tax - -

-------------- ------------- -------------

Total tax 3,577 2,796

-------------- ------------- -------------

The tax charge can be explained as follows:

Year to 9 months

31 December to

2018 31 December

2017

GBP GBP

------------------------------------------ ------------- -------------

Profit before tax 18,828 14,716

------------------------------------------ ------------- -------------

United Kingdom corporation tax charge at

19% 3,577 2,796

------------------------------------------ ------------- -------------

Total current tax 3,577 2,796

------------------------------------------ ------------- -------------

6. Non-Current Assets: Loans to Group Undertakings

Year to 9 months

31 December to

2018 31 December

2017

GBP GBP

----------------------------------------- -------------- --------------

At beginning of period 125,000,000 125,000,000

----------------------------------------- -------------- --------------

Revaluation due to transition to IFRS 9 35,125,000 -

----------------------------------------- -------------- --------------

160,125,000 125,000,000

----------------------------------------- -------------- --------------

Fair value movements (5,937,500) -

----------------------------------------- -------------- --------------

At end of period 154,187,500 125,000,000

----------------------------------------- -------------- --------------

Due

In 5 years or more 154,187,500 125,000,000

----------------------------------------- -------------- --------------

IFRS 9 requires the GBP125,000,000 loans to be carried at fair

value which as at 31 December 2018 was GBP154,187,500 (at 31

December 2017: GBP160,125,000). On an amortised cost basis, the

value of the loan at 31 December 2018 would be GBP125,000,000 (at

31 December 2017: GBP125,000,000). The fair values are based on the

market value of the external debt securities (level 2).

The interest rate charged on the subordinated perpetual loans to

group undertakings is 9 1/64 per cent.

7. Other Financial Assets

31 December 31 December

2018 2017

GBP GBP

----------------------------------- ------------------------------------------- -------------

Amounts owed by parent undertaking 2,556,432 2,556,486

----------------------------------- ------------------------------------------- -------------

Amounts owed by fellow subsidiary

undertaking 3,939,705 3,939,706

----------------------------------- ------------------------------------------- -------------

6,496,137 6,496,192

----------------------------------- ------------------------------------------- -------------

8. Cash and Cash Equivalents

At the year end the Company held cash of GBP3,481,151 (at 31

December 2017: GBP3,465,064) at a fellow subsidiary

undertaking.

9. Deferred Income Taxes

Year to 9 months

31 December to

2018 31 December

2017

GBP GBP

------------------------ ------------- -------------

At beginning of period - -

------------------------ ------------- -------------

Transition to IFRS 9 (21,250) -

------------------------ ------------- -------------

Recognised in income

Income statement credit - -

------------------------ ------------- -------------

At end of period (21,250) -

------------------------ ------------- -------------

Deferred tax assets less liabilities are attributable to the

following items:

Year to 9 months

31 December to

2018 31 December

2017

GBP GBP

--------------------------------------- ------------- -------------

Fair value of intra group loans (4,961,875) -

--------------------------------------- ------------- -------------

Fair value of debt securities in issue 4,940,625 -

--------------------------------------- ------------- -------------

(21,250) -

--------------------------------------- ------------- -------------

Both the intra-group loans and debt securities in issue are

taxed on an amortised cost basis of accounting and accordingly

taxable/deductible temporary differences arise following the

adoption of IFRS 9.

10. Other Financial Liabilities

31 December 31 December

2018 2017

GBP GBP

----------------- ------------------ -------------

Interest payable 9,832,192 9,832,192

----------------- ------------------ -------------

Interest payable on the subordinated guaranteed notes is fixed

at 9 per cent.

11. Subordinated Guaranteed Notes

Year to 9 months

31 December to

2018 31 December

2017

GBP GBP

----------------------------------------- -------------- --------------

At beginning of period 125,000,000 125,000,000

----------------------------------------- -------------- --------------

Revaluation due to transition to IFRS 9 35,000,000 -

----------------------------------------- -------------- --------------

160,000,000 125,000,000

----------------------------------------- -------------- --------------

Fair value movements (5,937,500) -

----------------------------------------- -------------- --------------

At end of period 154,062,500 125,000,000

----------------------------------------- -------------- --------------

Repayable

In 5 years or more 154,062,500 125,000,000

----------------------------------------- -------------- --------------

Given the IFRS 9 requirement to fair value the related loans,

the Company has elected to fair value the subordinated guaranteed

notes, which as at 31 December 2018 was GBP154,062,500 (at 31

December 2017: GBP160,000,000). On an amortised cost basis, the

value of the subordinated guaranteed notes at 31 December 2018

would be GBP125,000,000 (at 31 December 2017: GBP125,000,000). The

fair value was derived from the quoted market price at the balance

sheet date (level 1).

The following table shows contractual cash flows payable by the

Company on the subordinated guaranteed notes, analysed by remaining

contractual maturity at the balance sheet date. Interest cash flows

on the loan are shown up to five years only, with the prinicipal

balance being shown in the > 5yr column.

At 31 December Demand Demand-3m 3m - 1yr 1yr - 5yr > 5yr Total

2018

GBP GBP GBP GBP GBP GBP

--------------- ------ ---------- -------- ---------- ----------- -----------

Loan notes in

issue - 11,250,000 - 45,000,000 125,000,000 181,250,000

--------------- ------ ---------- -------- ---------- ----------- -----------

At 31 December Demand Demand-3m 3m - 1yr 1yr - 5yr > 5yr Total

2017

GBP GBP GBP GBP GBP GBP

--------------- ------ ---------- -------- ---------- ----------- -----------

Loan notes in

issue - 11,250,000 - 45,000,000 125,000,000 181,250,000

--------------- ------ ---------- -------- ---------- ----------- -----------

12. Share Capital

31 December 31 December

2018 2017

GBP GBP

----------------------------------- ------------ ------------

Authorised

Ordinary shares of GBP1 each 100,000 100,000

------------------------------------ ------------ ------------

Allotted, called up and fully paid

Ordinary shares of GBP1 each 100,000 100,000

------------------------------------ ------------ ------------

13. Related Party Transactions

Parties are considered related if one party controls, is

controlled by or has the ability to exercise significant influence

over the other party. This includes key management personnel, the

parent Company, subsidiaries and fellow subsidiaries.

Amounts receivable from related parties at the year-end were as

follows:

31 December 31 December

2018 2017

GBP GBP

---------------------------------------------- ------------ -------------

Subordinated perpetual loan to parent

undertaking

- at amortised cost - 50,000,000

---------------------------------------------- ------------ -------------

Subordinated perpetual loan to parent

undertaking 61,675,000 -

- at fair value

---------------------------------------------- ------------ -------------

Subordinated perpetual loan to fellow

subsidiary undertaking

- at amortised cost - 75,000,000

---------------------------------------------- ------------ -------------

Subordinated perpetual loan to fellow

subsidiary undertaking 92,512,500 -

- at fair value

---------------------------------------------- ------------ -------------

Amounts owed by parent undertaking 2,556,432 2,556,486

---------------------------------------------- ------------ -------------

Amounts owed by fellow subsidiary undertaking 3,939,705 3,939,706

---------------------------------------------- ------------ -------------

Cash at fellow subsidiary undertaking 3,481,151 3,465,064

---------------------------------------------- ------------ -------------

Amounts recognised in the statement of comprehensive income in

respect of related party transactions were as follows:

Year to 9 months

31 December to

2018 31 December

2017

GBP GBP

-------------------------------------------- --------------------------------------- -------------

Interest receivable from parent undertaking 6,761,665 5,094,446

-------------------------------------------- --------------------------------------- -------------

Interest receivable from fellow subsidiary

undertaking 4,507,813 3,396,297

-------------------------------------------- --------------------------------------- -------------

Amounts recognised directly in equity in respect of related

party transactions were as follows:

Year to 9 months to

31 December 31 December

2018 2017

GBP GBP

---------------------------------------- -------------- ------------

Dividend payable to parent undertaking - 150,000

---------------------------------------- -------------- ------------

There were no loans made to Directors during the year (9 months

to 31 December 2017: none) and no balances outstanding at the year

end (at 31 December 2017: GBPnil). There were no employees of the

Company during the year (9 months to 31 December 2017: none).

14. Parent Undertaking and Ultimate Holding Company

The largest group in which the results of the Company are

consolidated is that headed by Rothschild & Co Concordia SAS,

incorporated in France, and whose registered office is at 23bis,

Avenue de Messine, 75008 Paris. The smallest group in which they

are consolidated is that headed by Rothschild & Co SCA, a

French public limited partnership whose registered office is also

at 23bis, Avenue de Messine, 75008 Paris. The accounts are

available on Rothschild & Co website at

www.rothschildandco.com.

The Company's immediate parent company is Rothschild & Co

Continuation Limited, incorporated in England and Wales and whose

registered office is at New Court, St Swithins Lane, London EC4N

8AL.

The Company's registered office is located at St Julian's Court,

St Peter Port, Guernsey,GY1 3BP.

15. Transition to IFRS 9 on 1 January 2018

a) Classification of financial assets and liabilities.

The following table shows the original measurement categories

under IAS 39 and the new measurement categories under IFRS 9 for

each class of financial assets and liabilities as at 1 January

2018:

Original Original

classification New classification carrying New carrying

under IAS under IFRS value under value under

39 9 IAS 39 IFRS 9

Note

----------------------- ------ ----------------- -------------------- ------------- -------------

Financial assets

Loans to group Amortised

undertakings cost FVTPL 125,000,000 160,125,000

------------------------------- ----------------- ------------------- ------------- -------------

Total financial

assets 125,000,000 160,125,000

------------------------------------------------------------------------ ------------- -------------

Financial liabilities

Debt securities Amortised

in issue cost FVTPL 125,000,000 160,000,000

------------------------------- ----------------- ------------------- ------------- -------------

Total financial

liabilities 125,000,000 160,000,000

------------------------------------------------------------------------ ------------- -------------

b) Impact of transition to IFRS 9

The following table shows the effect on the Company's balance

sheet of the transition from IAS 39 to IFRS 9:

IAS 39 Balance IFRS 9 Balance

Sheet 31 Classification Sheet 1

December and measurement January

2017 changes 2018

------------------------------ --------------- ----------------- ---------------

Assets

Loans to group undertakings 125,000,000 35,125,000 160,125,000

------------------------------ --------------- ----------------- ---------------

Cash and cash equivalents 3,465,064 - 3,465,064

------------------------------ --------------- ----------------- ---------------

Other financial assets 6,496,192 - 6,496,192

------------------------------ --------------- ----------------- ---------------

Total assets 134,961,256 35,125,000 170,086,256

------------------------------ --------------- ----------------- ---------------

Liabilities

Current tax liability 2,796 - 2,796

------------------------------ --------------- ----------------- ---------------

Deferred tax liability - 21,250 21,250

------------------------------ --------------- ----------------- ---------------

Other financial liabilities 9,832,192 - 9,832,192

------------------------------ --------------- ----------------- ---------------

Debt securities 125,000,000 35,000,000 160,000,000

------------------------------ --------------- ----------------- ---------------

Total liabilities 134,834,988 35,021,250 169,856,238

------------------------------ --------------- ----------------- ---------------

Equity

Share capital 100,000 - 100,000

------------------------------ --------------- ----------------- ---------------

Retained earnings 26,268 103,750 130,018

------------------------------ --------------- ----------------- ---------------

Total equity 126,268 103,750 230,018

------------------------------ --------------- ----------------- ---------------

Total equity and liabilities 134,961,256 35,125,000 170,086,256

------------------------------ --------------- ----------------- ---------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR CKKDBABKDCQN

(END) Dow Jones Newswires

April 30, 2019 12:38 ET (16:38 GMT)

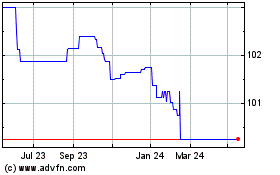

Rothschilds 9% (LSE:RCHA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rothschilds 9% (LSE:RCHA)

Historical Stock Chart

From Dec 2023 to Dec 2024