TIDMRCHA

RNS Number : 3399N

Rothschild & Co Contin Fin CI Ltd

23 September 2019

Rothschild & Co Continuation Finance CI Limited

Half-yearly Report for the six-month period ended 30 June

2019

Interim Management Report

Summary of Important Events

Rothschild & Co Continuation Finance CI Limited (the

"Company") is a wholly-owned subsidiary of Rothschild & Co

Continuation Limited. The principal activity of the Company is the

raising of finance for the purpose of lending it to companies who

are members of the Rothschild Concordia SAS group. In the period

ended 30 June 2019, GBP125,000,000 perpetual subordinated

guaranteed notes were in issue by the Company.

Comparative numbers in the six months to 30 June 2018 have been

amended to reflect the impact of IFRS 9 on accounting for financial

instruments.

Risks and Uncertainties

The principal risks of the Company are credit risk, liquidity

risk, market risk and operational risk. The Company follows the

risk management policies of a fellow Group company, N M Rothschild

& Sons Limited.

The Company's market risk exposure is limited to interest rate

risk. Exposure to interest rate movements on the perpetual

subordinated note issues has been passed to a fellow subsidiary N M

Rothschild & Sons Limited ("NMR") and parent undertaking

Rothschild & Co Continuation Limited ("R&CoCL"), as the

issue proceeds have been on-lent to NMR and R&CoCL at a fixed

margin of 1/64 per cent above the rate being paid. Currency risk is

not considered significant as all material foreign currency

balances and cash flows are matched.

Liquidity risk has similarly been transferred to NMR and

R&CoCL as the funds on-lent have the same maturity dates as the

notes issued.

The Company's principal credit risk is with NMR and R&CoCL.

Since notes issued by the Company have been guaranteed by

R&CoCL, and funds have been on-lent to NMR and R&CoCL, the

Company's ability to meet its obligations in respect of notes

issued by it is affected by NMR's and R&CoCL ability to make

payments to the Company.

Operational risk arising from inadequate or failed internal

processes, people and systems or from external events is managed by

maintaining a strong framework of internal controls.

This half-yearly financial report has not been audited or

reviewed by the Company's auditors pursuant to the Auditing

Practices Board guidance on Review of Interim Financial

Information.

Responsibility Statement

The Directors confirm that to the best of their knowledge:

- The condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting;

and

- The interim management report includes a fair review

of (i) the important events that have occurred during

the first six months of the financial year, and their

impact on the condensed set of financial statements,

and (ii) the principal risks and uncertainties for the

remaining six months of the financial year.

By Order of the Board

Peter Barbour

Director

Condensed Interim Statement of Comprehensive Income

For the six months ended 30 June 2019

6 months 6 months

to to

30 June 30 June

2019 2018

Note GBP GBP

----------------------------------- ----- ------------ ------------

Interest income 5,557,577 5,557,577

----------------------------------- ----- ------------ ------------

Interest expense (5,547,945) (5,547,945)

----------------------------------- ----- ------------ ------------

Operating profit 9,632 9,632

----------------------------------- ----- ------------ ------------

Revaluation of loans 4 (525,000) (3,750,000)

----------------------------------- ----- ------------ ------------

Revaluations of debt securities 9 525,000 3,750,000

----------------------------------- ----- ------------ ------------

Administrative expenses (650) (651)

----------------------------------- ----- ------------ ------------

Profit before tax 8,982 8,981

----------------------------------- ----- ------------ ------------

Income tax expense 3 (1,707) (1,706)

----------------------------------- ----- ------------ ------------

Profit for the financial period 7,275 7,275

----------------------------------- ----- ------------ ------------

Other comprehensive income - -

----------------------------------- ----- ------------ ------------

Total comprehensive income for

the financial period 7,275 7,275

----------------------------------- ----- ------------ ------------

Condensed Interim Statement of Changes in Equity

For the six months ended 30 June 2019

Share Capital Retained Total

Earnings

GBP GBP GBP

-------------------------------- --------------- ---------- --------

At 1 January 2019 100,000 145,269 245,269

-------------------------------- --------------- ---------- --------

Total comprehensive income for

the period - 7,275 7,275

-------------------------------- --------------- ---------- --------

At 30 June 2019 100,000 152,544 252,544

-------------------------------- --------------- ---------- --------

At 31 December 2017 100,000 26,268 126,268

-------------------------------- --------------- ---------- --------

Transition to IFRS 9 - 103,750 103,750

-------------------------------- --------------- ---------- --------

At 1 January 2018 100,000 130,018 230,018

-------------------------------- --------------- ---------- --------

Total comprehensive income for

the period - 7,275 7,275

-------------------------------- --------------- ---------- --------

At 30 June 2018 100,000 137,293 237,293

-------------------------------- --------------- ---------- --------

Condensed Interim Balance Sheet

At 30 June 2019

At 30 June At 31 December

2019 2019 2018 2018

Note GBP GBP GBP GBP

----------------------------- ----- ------------ -------------- ------------- --------------

Non-current assets

Loans to group undertakings 4 153,662,500 154,187,500

----------------------------- ----- ------------ -------------- ------------- --------------

Current assets

Other financial assets 5 4,137,254 6,496,137

----------------------------- ----- ------------ -------------- ------------- --------------

Cash and cash equivalents 6 146,961 3,481,151

----------------------------- ----- ------------ -------------- ------------- --------------

4,284,215 9,977,288

----------------------------- ----- ------------ -------------- ------------- --------------

Current liabilities

Current tax payable (5,284) (3,577)

----------------------------- ----- ------------ -------------- ------------- --------------

Deferred tax 7 (21,250) (21,250)

----------------------------- ----- ------------ -------------- ------------- --------------

Other financial liabilities 8 (4,130,137) (9,832,192)

----------------------------- ----- ------------ -------------- ------------- --------------

Net current assets 127,544 120,269

----------------------------- ----- ------------ -------------- ------------- --------------

Total assets less

current liabilities 153,790,044 154,307,769

----------------------------- ----- ------------ -------------- ------------- --------------

Non-current liabilities

Subordinated guaranteed

notes 9 (153,537,500) (154,062,500)

----------------------------- ----- ------------ -------------- ------------- --------------

Net assets 252,544 245,269

----------------------------- ----- ------------ -------------- ------------- --------------

Shareholders' equity

Share capital 11 100,000 100,000

----------------------------- ----- ------------ -------------- ------------- --------------

Retained earnings 152,544 145,269

----------------------------- ----- ------------ -------------- ------------- --------------

Total shareholders'

equity 252,544 245,269

----------------------------- ----- ------------ -------------- ------------- --------------

Condensed Interim Cash Flow Statement

For the six months ended 30 June 2019

6 months to 6 months to

30 June 2019 30 June 2018

Note GBP GBP

------------------------------------- ----- ------------- -------------

Cash flow from operating activities

Profit for the financial period 7,275 7,275

------------------------------------- ----- ------------- -------------

Income tax expenses 1,707 1,706

------------------------------------- ----- ------------- -------------

Operating profit before changes

in working capital and provisions 8,982 8,981

------------------------------------- ----- ------------- -------------

Fair value movements of loans 525,000 3,750,000

------------------------------------- ----- ------------- -------------

Fair value movements of debt

securities (525,000) (3,750,000)

------------------------------------- ----- ------------- -------------

Net decrease in other financial

assets 2,358,883 2,358,885

------------------------------------- ----- ------------- -------------

Net decrease in other financial

liabilities (5,702,055) (5,702,055)

------------------------------------- ----- ------------- -------------

Cash (utilised)/generated

from operations (3,334,190) (3,334,189)

------------------------------------- ----- ------------- -------------

Net cash (used in)/from operating

activities (3,334,190) (3,334,189)

------------------------------------- ----- ------------- -------------

Net (decrease)/increase in

cash and cash equivalents (3,334,190) (3,334,189)

------------------------------------- ----- ------------- -------------

Cash and cash equivalents

at beginning of period 3,481,151 3,465,064

------------------------------------- ----- ------------- -------------

Cash and cash equivalents

at end of period 6 146,961 130,875

------------------------------------- ----- ------------- -------------

Interest paid and received during the period were as

follows:

6 months to 6 months to

30 June 2019 30 June 2018

GBP GBP

------------------- ------------- -------------

Interest paid 11,250,000 11,250,000

------------------- ------------- -------------

Interest received 7,916,460 7,916,462

------------------- ------------- -------------

The notes to the condensed interim financial statements form an

integral part of the condensed interim financial statements.

Notes to the Condensed Interim Financial Statements

(forming part of the Condensed Interim Financial Statements)

For the six months ended 30 June 2019

1. Basis of preparation

The condensed interim financial statements are prepared and

approved by the Directors in accordance with IAS 34 Interim

Financial Reporting. The condensed interim financial statements are

prepared under the historical cost accounting rules and should be

read in conjunction with the annual financial statements for the

year ended 31 December 2018, which have been prepared in accordance

with International Financial Reporting Standards.

The accounting policies and methods of valuation are identical

to those applied in the financial statements for the year ended 31

December 2018.

2. Directors' Emoluments

None of the Directors received any remuneration in respect of

their services to the Company during the period (2018: GBPnil).

3. Taxation

6 months to 6 months to

30 June 2019 30 June 2018

GBP GBP

-------------------------------- ------------- -------------

Profit before tax 8,982 8,981

-------------------------------- ------------- -------------

United Kingdom corporation tax

at 19% 1,707 1,706

-------------------------------- ------------- -------------

Tax charged for the period 1,707 1,706

-------------------------------- ------------- -------------

4. Loans to Group Undertakings

At 30 June At 31 December

2019 2018

GBP GBP

---------------------------------- ------------ ---------------

At beginning of period 154,187,500 125,000,000

---------------------------------- ------------ ---------------

Revaluation due to transition to

IFRS 9 - 35,125,000

---------------------------------- ------------ ---------------

154,187,500 160,125,000

---------------------------------- ------------ ---------------

Fair value movements (525,000) (5,937,500)

---------------------------------- ------------ ---------------

At end of period 153,662,500 154,187,500

---------------------------------- ------------ ---------------

Due

In 5 years or more 153,662,500 154,187,500

---------------------------------- ------------ ---------------

IFRS 9 requires the GBP125,000,000 loans to be carried at fair

value which as at 30 June 2019 was GBP153,662,500 (at 31 December

2018: GBP154,187,500). On an amortised cost basis, the value of the

loan at 30 June 2019 would be GBP125,000,000 (at 31 December 2018:

GBP125,000,000). The fair values are based on the market value of

the external debt securities (level 2).

The interest rate charged on the subordinated perpetual loans to

group undertakings is 9 1/64 per cent.

5. Other Financial Assets

At 30 June At 31 December

2019 2018

GBP GBP

------------------------------------ ----------- ---------------

Amounts owed by parent undertaking 2,482,352 2,556,432

------------------------------------ ----------- ---------------

Amounts owed by fellow subsidiary

undertaking 1,654,902 3,939,705

------------------------------------ ----------- ---------------

4,137,254 6,496,137

------------------------------------ ----------- ---------------

6. Cash and Cash Equivalents

At 30 June 2019 the Company held cash of GBP146,961 (31 December

2018: GBP3,481,151) to a fellow subsidiary undertaking.

7. Deferred Income Taxes

At 30 June At 31 December

2019 2018

GBP GBP

------------------------ ----------- ---------------

At beginning of period (21,250) -

------------------------ ----------- ---------------

Transition to IFRS 9 - (21,250)

------------------------ ----------- ---------------

At end of period (21,250) (21,250)

------------------------ ----------- ---------------

Deferred tax assets less liabilities are attributable to the

following items:

At 30 June At 31 December

2019 2018

GBP GBP

--------------------------------------------- ------------ ---------------

Fair value of intra group loans (4,872,625) (4,961,875)

--------------------------------------------- ------------ ---------------

Fair value of debt securities in issue 4,851,375 4,940,625

--------------------------------------------- ------------ ---------------

(21,250) (21,250)

--------------------------------------------- ------------ ---------------

Both the intra-group loans and debt securities in issue are

taxed on an amortised cost basis of accounting and accordingly

taxable/deductible temporary differences arise following the

adoption of IFRS 9.

8. Other Financial Liabilities

At 30 June At 31 December

2019 2018

GBP GBP

------------------ ----------- ---------------

Interest payable 4,130,137 9,832,192

------------------ ----------- ---------------

Interest is payable on the subordinated guaranteed notes at 9

per cent.

9. Subordinated Guaranteed Notes

At 30 June At 30 December

2019 2018

GBP GBP

---------------------------------- ------------ ---------------

At beginning of period 154,062,500 125,000,000

---------------------------------- ------------ ---------------

Revaluation due to transition to

IFRS 9 - 35,000,000

---------------------------------- ------------ ---------------

154,062,500 160,000,000

---------------------------------- ------------ ---------------

Fair value movements (525,000) (5,937,500)

---------------------------------- ------------ ---------------

At end of period 153,537,500 154,062,500

---------------------------------- ------------ ---------------

Due

In 5 years or more 153,537,500 154,062,500

---------------------------------- ------------ ---------------

Given the IFRS 9 requirement to fair value the related loans,

the Company has elected to fair value the subordinated guaranteed

notes, which as at 30 June 2019 was GBP153,537,500 (at 31 December

2018: GBP154,062,500). On an amortised cost basis, the value of the

subordinated guaranteed notes at 30 June 2019 would be

GBP125,000,000 (at 31 December 2018: GBP125,000,000). The fair

value was derived from the quoted market price at the balance sheet

date (level 1).

10. Maturity of Financial Liabilities

The following table shows contractual cash flows payable by the

Company on the subordinated guaranteed notes, analysed by remaining

contractual maturity at the balance sheet date. Interest cash flows

on the loan notes are shown up to five years only, with the

principal balance being shown in the > 5yr column.

Demand Demand 3m - 1yr 1yr - 5yr >5 yr Total

- 3m

GBP GBP GBP GBP GBP GBP

---------------- ------ -------- ----------- ----------- ------------ ------------

Loan notes

in issue - - 11,250,000 45,000,000 125,000,000 181,250,000

---------------- ------ -------- ----------- ----------- ------------ ------------

11. Share Capital

At 30 June At 31 December

2019 2018

GBP GBP

------------------------------- ----------- ---------------

Authorised

Ordinary shares of GBP1 each 100,000 100,000

------------------------------- ----------- ---------------

Allotted, called up and fully

paid

Ordinary shares of GBP1 each 100,000 100,000

------------------------------- ----------- ---------------

12. Related Party Transactions

Parties are considered to be related if one party controls, is

controlled by or has the ability to exercise significant influence

over the other party. This includes key management personnel, the

parent company and fellow subsidiaries.

Amounts recognised in respect of related parties at the period

end were as follows:

At 30 June At 31 December

2019 2018

GBP GBP

-------------------------------------------------- ----------- ---------------

Subordinated perpetual loan to parent undertaking

- fair value 61,465,000 61,675,000

-------------------------------------------------- ----------- ---------------

Subordinated perpetual loan to fellow subsidiary

undertaking - fair value 92,197,500 92,512,500

-------------------------------------------------- ----------- ---------------

Amounts owed by parent undertaking 2,482,352 2,556,432

-------------------------------------------------- ----------- ---------------

Amounts owed by fellow subsidiary undertaking 1,654,902 3,939,705

-------------------------------------------------- ----------- ---------------

Cash at fellow subsidiary undertaking 146,961 3,481,151

-------------------------------------------------- ----------- ---------------

Amounts recognised in the statement of comprehensive income in

respect of related party transactions were as follows:

6 months to 6 months

30 June to

2019 30 June

2018

GBP GBP

-------------------------------------------- ----------- ----------

Interest receivable from parent undertaking 3,334,546 3,334,546

-------------------------------------------- ----------- ----------

Interest receivable from fellow subsidiary

undertaking 2,223,031 2,223,031

-------------------------------------------- ----------- ----------

There were no loans made to Directors during the period (6

months to 30 June 2018: none) and no balances outstanding at the

period end (at 31 December 2018: GBPnil). There were no employees

of the Company during the period (6 months to 30 June 2018:

none).

13. Parent Undertaking and Ultimate Holding Company and

Registered Office

The largest group in which the results of the Company are

consolidated is that headed by Rothschild & Co Concordia SAS,

incorporated in France. The smallest group in which they are

consolidated is that headed by Rothschild & Co SCA, a French

public limited partnership, whose registered office is also at

23bis, Avenue de Messine, 75008 Paris. The accounts are available

on the Rothschild & Co website at www.rothschildandco.com.

The Company's immediate parent company is Rothschild & Co

Continuation Limited, incorporated in England and Wales and whose

registered office is at New Court, St Swithins Lane, London EC4N

8AL.

The Company's registered office is located at St Julian's Court,

St Peter Port, Guernsey, GY1 3BP.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR ZXLFLKKFBBBX

(END) Dow Jones Newswires

September 23, 2019 10:08 ET (14:08 GMT)

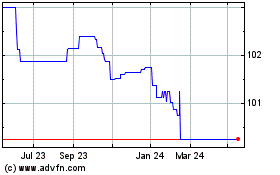

Rothschilds 9% (LSE:RCHA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rothschilds 9% (LSE:RCHA)

Historical Stock Chart

From Dec 2023 to Dec 2024