TIDMRCOI

RNS Number : 7498N

Riverstone Credit Opps. Inc PLC

25 January 2023

25 January 2023

Riverstone Credit Opportunities Income

Quarterly Update

Full Deployment Reached Despite Continued Successful

Realisations

Riverstone Credit Opportunities Income ("RCOI" or the

"Company"), the LSE-listed energy infrastructure and

energy-transition credit investor, is pleased to announce its

quarterly portfolio summary as of 31 December 2022, inclusive of

updated quarterly unaudited fair market valuations.

Unaudited Net Asset Value

As of 31 December 2022, the unaudited net asset value per

Ordinary Share, including net revenue for the quarter ended 31

December, was $1.08 ($1.10: 30 September 2022). This reduction was

principally due to a movement in the valuation of an equity

position.

Period Highlights

-- Established track record of attractive realisations continues:

o Circulus Solutions realised on 6 October 2022 at 16.6 percent

gross IRR and a 10.8 percent

net IRR and 1.14x gross MOIC and a 1.09x net MOIC

o Hoover Circular Solutions initial investment realised on 30

November 2022 at 15.0 percent

gross IRR and a 7.8 percent net IRR and a 1.10x gross MOIC and a

1.05x net MOIC; in

addition, loan amended and extended to 30 November 2026

-- Continues to invest capital in active pipeline of

infrastructure, infrastructure services and energy transition

opportunities to keep the fund substantially committed.

o On 30 November 2022, closed a new sustainability-linked first

lien term loan to Hoover

Circular Solutions, which refinanced the prior position.

o On 22 December 2022, closed a sustainability-linked first lien

term loan to Clean Energy

Fuels Corp. ("Clean Energy Fuels" or "CLNE"). At close on 22

December 2022, RCOI

committed $13.9 million.

o On 30 December 2022, closed a $28.6 million

sustainability-linked, first lien term loan to

a subsidiary of Max Midstream. At close on 30 December 2022,

RCOI committed $5.0

million.

o Throughout Q4 2022, committed an additional $2.1 million of

capital as part of an upsize

for Harland & Wolff Group Holdings PLC

-- Successfully closed a $15.0 million senior secured revolving

credit facility on 7 December 2022 aiming to further enhance

returns.

Portfolio Summary / Lifetime Key Performance Indicators

-- Portfolio of 100% floating rate, short duration, senior

secured loans supporting RCOI's ambition to deliver annual returns

to shareholders of 8-10%

-- 33.7% NAV total return(5) since IPO in May 2019 (14.5% annual return for 2022)

-- 22.6 cents in dividends paid since inception(6)

Market Update

-- With the strong backdrop of energy market performance, the

important global priority of de-carbonisation and the Company's

unique focus on short duration lending - the re-balancing of the

portfolio to energy-transition focused investments is now

complete.

-- There was a slight reduction in our NAV per share in Q4 2022

versus Q3 2022 ($1.10 to $1.08), due mainly to a reduction in the

mark on the common equity investment in Seawolf Water Resources.

While the business remains fundamentally healthy as it continues to

expand into new markets, the near-term outlook for its core

business of brackish water supply was modestly reduced, resulting

in a decrease in valuation.

-- Based on the current portfolio commitments, as well as the

addition of the revolving credit facility, we believe the ability

to maintain near full deployment is achievable.

Reuben Jeffery III, Chairman of RCOI, commented:

"Q4 2022 was very encouraging for RCOI given further profitable

realisations as well as new commitments in our target sectors. I

believe the Company is well-positioned to continue to provide

attractive returns from its portfolio as well as through new senior

secured investments from the considerable pipeline of opportunities

progressing through due diligence. Underlying rates are as high as

they've been in our history, and now with the Company's capital

fully deployed, we expect our shareholders to benefit from the

increased earnings power of the portfolio.

Since launch in May 2019, a period that has included challenging

conditions for equity investors, we are pleased that the Company

has delivered a total NAV return(5) of 33.7% (14.5% annual return

for 2022) including 22.6 cents per share in dividend

distributions(6) ."

Christopher Abbate and Jamie Brodsky, Co-Founders of Riverstone

Credit, the investment adviser, added:

" We achieved two key milestones in the fourth quarter. First,

as of year-end, RCOI's portfolio is now comprised almost

exclusively of Green and Sustainability-Linked loans, representing

approximately 95% of NAV. Second, with the closing of our revolving

credit facility in December, the Company is now able to better

manage its liquidity needs, allowing for higher deployment of

capital. With the Max Midstream deal completed on the last business

day of the year, RCOI is now 102% committed and approaching 100%

invested.

"In an active fourth quarter, RCOI had $23.9 million of

realisations and committed $34.6 million of new capital in four

investments, a refinancing of Hoover Circular Solutions, an upsize

to Harland & Wolff Group Holdings PLC, Clean Energy Fuels

Corp., and Max Midstream. We are pleased to have completed over 10

deal realisations since the start of COVID, all with a blended

gross IRR of 17% (net IRR of 13%), demonstrating the resilience of

our investment strategy. We look forward to a productive 2023."

Cumulative Portfolio Summary

Unrealised Portfolio [1]

Investment Subsector Commitment Cumulative Cumulative Gross Gross Gross % of % of 31 31

Name Date Committed Invested Realised Unrealised Realised Par Par Dec Dec

Capital Capital Capital Value Capital as of as of 2022 2022

($mm) ($mm) ($mm)(1) ($mm) & 31 Dec 30 Sept Gross Net

Unrealised 2022(2) 2022(2) MOIC MOIC

Value

($mm)

Caliber

Midstream(3) Infrastructure Aug-19 4.0 4.0 0.5 0.5 1.0 40.72% 40.71% 0.25x 0.20x

Imperium3NY Energy 2.70 2.49

LLC Transition Apr-21 6.8 5.4 6.7 2.7 9.4 (4) (4) 1.75x 1.70x

Blackbuck

Resources

LLC Infrastructure Jun-21 11.5 11.0 2.3 10.8 13.1 100.83% 100.44% 1.18x 1.13x

Streamline

Innovations Infrastructure

Inc. Services Nov-21 13.8 6.8 1.0 7.1 8.0 99.57% 99.12% 1.17x 1.12x

Harland

& Wolff

Group Holdings Infrastructure

PLC Services Mar-22 14.6 14.6 1.2 15.7 16.8 102.49% 96.98% 1.15x 1.10x

Seawolf 13.02 14.29

Water Resources Services Sept-22 9.0 9.0 0.1 13.0 13.1 (4) (4) 1.46x 1.41x

EPIC Propane

Pipeline,

LP Infrastructure Sept-22 13.9 13.9 0.5 13.9 14.4 99.08% 99.00% 1.04x 0.99x

Hoover

Circular Infrastructure

Solutions Services Nov-22 13.7 13.7 0.1 13.9 14.0 98.05% NA 1.02x 0.97x

Clean

Energy Energy

Fuels Corp Transition Dec-22 13.9 13.9 0.1 13.9 14.0 99.00% NA 1.01x 0.96x

Max Midstream Infrastructure Dec-22 5.0 5.0 0.1 5.0 5.1 100.00% NA 1.01x 0.96x

----------- ----------- --------- ----------- ----------- -------- -------- ------ ------

$106.2 $97.3 $12.6 $96.4 $109.0 1.12x 1.07x

Direct Lending Consolidated Portfolio Key Stats at Entry As of 31 December

2022

Weighted Avg. Entry Basis 97.5%

---------------------------------------------------------------

Weighted Avg. All-in Coupon at Entry 9.64 p.a.

---------------------------------------------------------------

Weighted Avg. Undrawn Spread at Entry 4.0 p.a.

---------------------------------------------------------------

Weighted Avg. Tenor at Entry 3.1 years

---------------------------------------------------------------

Weighted Avg. Call Premium at Entry 102.8

---------------------------------------------------------------

Security 100% Secured

---------------------------------------------------------------

Realised Portfolio

Investment Subsector Commitment Realisation Cumulative Cumulative Gross 31 Dec 31

Name Date Date Committed Invested Realised 2022 Dec

Capital Capital Capital Gross 2022

($mm) ($mm) ($mm)(1) MOIC Net

MOIC

Rocky Creek Exploration 1.15 1.10

Resources & Production Jun-19 Dec-19 6.0 4.3 4.9 x x

Infrastructure 1.02 0.97

CIG Logistics Services Jan-20 Jan-20 8.7 8.7 8.9 x x

Mallard Exploration 1.13 1.08

Exploration & Production Nov-19 Apr-20 13.8 6.8 7.7 x x

Market 1.01 0.96

Based Multiple Aug-20 Nov-20 13.4 13.4 13.6 x x

Project 1.23 1.18

Yellowstone Infrastructure Jun-19 Mar-21 5.8 5.8 7.2 x x

Ascent Exploration 1.21 1.16

Energy & Production Jun-19 Jun-21 13.3 13.3 16.1 x x

Pursuit Exploration 1.22 1.16

Oil & Gas & Production Jul-19 Jun-21 12.3 12.3 15 x x

Infrastructure 1.13 1.07

U.S. Shipping Services Feb-21 Aug-21 6.5 6.5 7.3 x x

Aspen Power 1.27 1.22

Partners Infrastructure Dec-20 Oct-21 6.9 3.4 4.3 x x

Project Infrastructure 1.28

Mariners Services Jul-19 Apr-22 13.2 13.2 17.6 1.33x x

Roaring 1.11

Fork Midstream Infrastructure Mar-21 Jun-22 5.9 5.9 6.9 1.16x x

FS Crude, 1.18

LLC Infrastructure Mar-20 Sept-22 13.7 13.7 16.9 1.23x x

EPIC Propane

Pipeline, 1.27

LP Infrastructure Dec-19 Sept-22 14.8 14.8 19.6 1.32x x

Circulus

Holdings, 1.09

PBLLC Infrastructure Aug-21 Oct-22 12.3 12.3 14.0 1.14x x

Hoover

Circular Infrastructure 1.05

Solutions Services Oct-20 Nov-22 15.4 15.4 17.0 1.10x x

$162.1 $149.8 $176.8 1.18x 1.13x

The Gross Realised Capital column includes interest, fee income,

and principal received. The Gross Unrealised Value column includes

the amortization of OID, accrued interest, fees and any unrealised

change in the value of the investment.

For Riverstone Credit Opportunities Income Plc:

Adam Weiss

+1 212 271 2953

J.P. Morgan Cazenove (Corporate

Broker) +44 (0)20 7742 4000

William Simmonds

Jérémie Birnbaum

James Bouverat (Sales)

Media Contacts:

Buchanan

Helen Tarbet Henry Tel: +44 (0) 20 7466 5109 Tel:

Wilson Jon Krinks +44 (0) 20 7466 5111 Tel: +44

Verity Parker (0) 20 7466 5199 Tel: +44 (0)

20 7466 5197 Email: rcoi@buchanan.uk.com

About Riverstone Credit Opportunities Income Plc :

RCOI lends to companies that build and operate the

infrastructure used to generate, transport, store and distribute

both renewable and conventional sources of energy, and companies

that provide services to that infrastructure. RCOI also lends to

companies seeking to facilitate the energy transition by

decarbonizing the energy, industrial and agricultural sectors,

building sustainable infrastructure and reducing or sequestering

carbon emissions. The Company seeks to ensure that its investments

are having a positive impact on climate change by structuring each

deal as either a green loan or a sustainability-linked loan,

documented using industry best practices.

For further details, see https://www.riverstonecoi.com/.

Neither the contents of RCOI's website nor the contents of any

website accessible from hyperlinks on the websites (or any other

website) is incorporated into, or forms part of, this

announcement.

1 Gross realised capital is total gross income realised on

invested capital.

(2) Includes fair market value of equity and rights where

applicable as a percentage of par.

(3) Includes Caliber HoldCo Escrow, Caliber MFC LLC equity,

Caliber Midstream Revolver & Priming Facility.

(4) Reflects the total fair market value in millions.

(5) NAV total return equals cumulative paid dividend cents per

share and NAV per share as of 31 December 2022 divided by the

opening capital net of share issuance costs as of 28 May 2019.

(6) Reflects cumulative dividend cents per share declared as of

30 September 2022 and paid as of 31 December 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUBIMLTMTTTBMJ

(END) Dow Jones Newswires

January 25, 2023 02:00 ET (07:00 GMT)

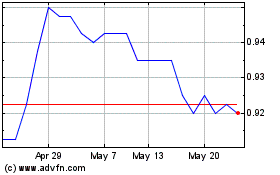

Riverstone Credit Opport... (LSE:RCOI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Riverstone Credit Opport... (LSE:RCOI)

Historical Stock Chart

From Jul 2023 to Jul 2024