Residential Secure Income PLC Notice of AGM (8412V)

08 November 2017 - 4:09AM

UK Regulatory

TIDMRESI

RNS Number : 8412V

Residential Secure Income PLC

07 November 2017

7 November 2017

RESIDENTIAL SECURE INCOME PLC

(the "Company")

Notice of Annual General Meeting

The Company announces that its Annual General Meeting will be

held at 4pm on Wednesday 13 December 2017 at 21 Great Winchester

Street, London, EC2N 2JA. The following documents (as applicable)

are being mailed to shareholders or otherwise made available

today:

-- Notice of Annual General Meeting 2017

-- Form of Proxy

The documents are also available to view and download on the

Company's website at www.resi-reit.com

In accordance with Listing Rule 9.6.1 copies of the documents

have been submitted to the UK Listing Authority and will shortly be

available for inspection from the National Storage Mechanism at

www.morningstar.co.uk/uk/nsm

FOR FURTHER INFORMATION, PLEASE CONTACT:

Company Secretary +44 20 3597 7900

Langham Hall UK Services Email: resi-cosec@langhamhall.com

LLP

NOTES:

Residential Secure Income plc (LSE: RESI) is listed on the

premium segment of the Official List of the UK Listing Authority

and was admitted to trading on the Main Market of the London Stock

Exchange in July 2017.

ReSI has been established to invest in portfolios of Homes

across residential asset classes that comprise the stock of Housing

Associations and Local Authorities, comprising Shared Ownership

Homes and Rental Homes (being Market Rental Homes, Functional Homes

and Sub-Market Rental Homes) throughout the UK.

ReSI is managed by ReSI Capital Management Limited, a wholly

owned subsidiary of TradeRisks Limited which has a 16 year track

record of executing transactions within the UK social housing

sector and, to date, has arranged funding of over GBP10 billion in

the social housing, care and other specialist residential property

sectors.

ReSI seeks to deliver secure, long-dated, inflation-linked

income returns through investment in UK social housing. It aims to

meet demand from Housing Associations and Local Authorities for

alternative equity-like financing sources that allows them to

recycle capital back into socially and economically beneficial new

housing, making a meaningful contribution to the UK housing

shortage.

Homes acquired by ReSI will predominantly be on a freehold or

long leasehold basis (typically 99 years or more to maturity) and

benefit from long term (typically 20 years plus) inflation-adjusted

cash flows. Acquisitions by ReSI will be limited to Homes with

sufficient cashflows, counterparty credit quality and property

security that allow the Fund Manager to arrange long-term

investment grade equivalent debt.

ReSI is targeting, on a fully invested and geared basis, a

dividend yield of 5% per annum based on the issue price of 100

pence per Ordinary Share, which ReSI expects to increase broadly in

line with inflation, and a total return in excess of 8% per

annum(1) .

1. This is a target only and not a profit forecast and there can

be no assurance that it will be met.

Further information on ReSI is available at

www.resi-reit.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

NOAUBRBRBBAARAA

(END) Dow Jones Newswires

November 07, 2017 12:09 ET (17:09 GMT)

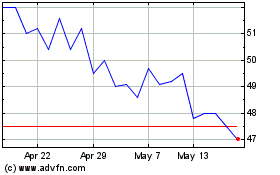

Residential Secure Income (LSE:RESI)

Historical Stock Chart

From Apr 2024 to May 2024

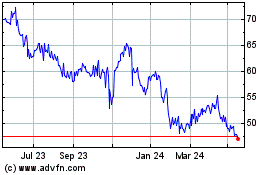

Residential Secure Income (LSE:RESI)

Historical Stock Chart

From May 2023 to May 2024