UK Grocers Relieved by Late-Christmas Shopping But Discounters Gain Ground

11 January 2019 - 3:54AM

Dow Jones News

--Tesco beat analyst expectations for sales growth in its

third-quarter and Christmas trading update, sending U.K.

supermarket stocks higher.

--Tesco highlighted stronger growth in the late-Christmas

period, suggesting shoppers spent more in December following poor

November sales for British retailers.

--Recent industry figures suggest discount chains are continuing

to build market share, while the heads of supermarket chains

Sainsbury's and Morrisons have warned of Brexit's potential effect

on the industry.

By Adam Clark

A late surge in Christmas sales meant the U.K.'s largest

supermarkets avoided the worst of the crisis in the retail sector,

but concerns over customers turning toward lower-cost rivals are

intensifying as Brexit uncertainty weighs on economic

confidence.

Tesco PLC (TSCO.LN), the U.K.'s largest supermarket chain,

boosted investor confidence on Thursday by beating analyst

expectations for both its third-quarter and Christmas sales. A 2.6%

increase in like-for-like sales in the six weeks to Jan. 5

suggested customers returned to spending after reports of a weak

November for British retailers. Chief Executive David Lewis told

analysts that Tesco had achieved its highest rate of Christmas

growth since 2009, without relying heavily on promotional

activity.

The results sent Tesco's stock up about 2% toward the close of

the session, among the best performers in the FTSE 100. It also

boosted sentiment toward listed rivals J Sainsbury PLC (SBRY.LN)

and Wm. Morrison Supermarkets PLC (MRW.LN) which disappointed

investors in their own Christmas trading updates earlier in the

week.

Sainsbury's, the second-largest U.K. grocer, was particularly

hard hit on Wednesday when it reported a 1.1% drop in like-for-like

sales, excluding fuel, for the 15 weeks to Jan. 5. The company said

the figures were affected by the inclusion of November, when its

decision to opt out of Black Friday promotions hit its

general-merchandise business, including catalogue retailer

Argos.

Sainsbury's Chief Executive Mike Coupe also worried investors

when he said customers had gone for cheaper options during the

quarter. Figures from consultancy Kantar earlier in the week showed

German discount chains Lidl and Aldi took a record combined market

share of 12.8% over the Christmas period.

Mr. Coupe warned that a hard Brexit in which the U.K. fails to

secure a trade deal with the European Union before exiting the bloc

would be a "significant operational challenge" for the retail

industry.

Morrisons Chief Executive David Potts also highlighted hesitant

consumer spending over the festive period and Brexit concerns.

"I think from the country's point of view, entering relatively

unchartered territories with regard to the outcomes from Brexit,

then it would be entirely natural for consumers to feel a bit more

cautious," he said.

Despite such concerns, all three of the listed supermarkets have

outperformed the FTSE 100 over the medium-term with the large-cap

index having fallen 11% over the last year. Sainsbury's is up 8.4%

over the same period, having gained on its prospective merger with

Walmart Inc.'s (WMT) Asda, while Tesco is up 1.8%, and Morrisons is

down 4.5%.

Write to Adam Clark at adam.clark@dowjones.com

(END) Dow Jones Newswires

January 10, 2019 11:39 ET (16:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

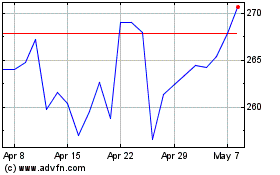

Sainsbury (j) (LSE:SBRY)

Historical Stock Chart

From Apr 2024 to May 2024

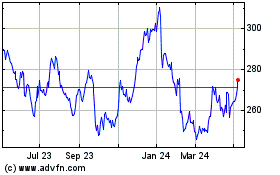

Sainsbury (j) (LSE:SBRY)

Historical Stock Chart

From May 2023 to May 2024