TIDMSCLP

RNS Number : 7844R

Scancell Holdings Plc

31 October 2023

31 October 2023

Scancell Holdings plc

("Scancell" or the "Company")

Results for the Year Ended 30 April 2023

Scancell Holdings plc (AIM: SCLP), the developer of novel

immunotherapies for the treatment of cancer and infectious disease,

today announces its final audited financial results for the year

ended 30 April 2023 as well as a business update on progress

achieved post-period.

Key highlights (including post-period) SCIB1 (SCOPE trial)

-- SCIB1 reported positive data from the first stage of its

Phase 2 SCOPE trial for advanced melanoma.

-- SCIB1 in combination with checkpoint inhibitors (CPIs) showed

an 82% objective response rate (ORR) to treatment in 11 patients,

exceeding 70% ORR expectations and accompanied by meaningful tumour

volume reduction

-- In the real word setting in patients just receiving the

doublet CPI therapy, the ORR is 50% with a progression free

survival of 11.5 months

-- Recruitment in the second stage is expected to be complete by

the end of 2023 with data available in H1 2024 and a clear

potential development pathway

-- iSCIB1+ cohort could be added to SCOPE trial if the protocol

amendment is approved by the MHRA with early data with iSCIB1+

available in H1 2024

Modi-1 (ModiFY trial)

-- Modi-1 has completed dose escalation and safety cohorts of

the Phase 1/2 ModiFY trial and is now into expansion cohorts

-- Early data from patients receiving Modi-1 as a monotherapy

showed good safety and tolerability, with no dose limiting

toxicities observed in dose escalation cohorts

-- Modi-1 demonstrated encouraging early efficacy in a head and

neck cancer patient and in other hard- to-treat cancers such as

high grade serous ovarian carcinoma (HGSOC) and triple negative

breast cancer (TNBC)

-- Early clinical data with Modi-1 expected to be available in 2024

Antibodies

-- GlyMab (R) and AvidiMab (R) platforms provide potential out

licensing opportunities with active discussions ongoing with

Pharmaceutical and Biotech companies.

-- Data presented at AACR-CIMT in September illustrated the

potential of Scancell antibodies as chimeric antigen receptor T

cell (CART) therapies

Corporate

-- Jean-Michel Cosséry appointed as our Non-Executive Chairman,

bringing over 25 years of healthcare experience and a sustained

global track record of success

-- Sath Nirmalananthan appointed as Chief Financial Officer

-- Dr Mandeep Sehmi appointed as Head of Business Development

building our commercial capabilities

Financial Highlights

-- Operating loss for the 12-month period to 30 April 2023 of

GBP11.9 million (30 April 2022: operating loss of GBP13.3

million)

-- Group cash balance at 30 April 2023 was GBP19.9 million (30

April 2022: GBP28.7 million) with a cash runway through to early

2025 achieving the near-term clinical milestones for SCIB1 and

Modi-1

.

Prof Lindy Durrant, Chief Executive Officer, Scancell,

commented: "Throughout the year, we have continued to deliver

strong progress across the business and have achieved a number of

significant milestones. As previously communicated, our strategic

focus is to continue to progress our two lead assets, SCIB1 and

Modi-1, through clinical development. Both trials have made good

progress throughout the year and early data is encouraging. We were

particularly impressed by the recent positive data from the first

stage of our SCOPE trial with SCIB1 showing an 82% objective

response rates (ORR) better than 70% ORR that the trial was

configured to show. We are looking forward to progressing both the

SCOPE trial and the ModiFY trial and are funded to continue the

development of these high-potential assets to the next near-term

value inflection points.

Following our commercial license agreement with Genmab, we are

continuing to have active discussions with Pharmaceutical and

Biotech companies to maximize the value of our antibody platforms

through additional licensing opportunities and I look forward to

updating the market on those discussions in due course.

We were also pleased to welcome Jean-Michel Cosséry as

Non-Executive Chairman, Sath Nirmalananthan as Chief Financial

Officer and Dr Mandeep Sehmi as Head of Business Development. Now,

with a bolstered leadership team, sufficient cash in place to fund

our current strategy and with further key data from both the SCOPE

and ModiFY trial anticipated during 2024, I believe we are well

placed to achieve the potential of our treatments for patients

whilst also creating and delivering significant long-term value for

our shareholders."

For further information, please contact:

Scancell Holdings plc +44 (0) 20 3709 5700

Professor Lindy Durrant, CEO

Dr Jean-Michel Cosséry, Non-Executive Chairman

Stifel Nicolaus Europe Limited (Nominated Adviser and Joint

Broker) +44 (0) 20 7710 7600 Nicholas Moore/Samira

Essebiyea/William Palmer-Brown (Healthcare

Investment Banking)

Nick Adams/Nick Harland (Corporate Broking)

Panmure Gordon (UK) Limited (Joint Broker) +44 (0) 20 7886 2500

Freddy Crossley/Emma Earl (Corporate Finance)

Rupert Dearden (Corporate Broking)

Consilium Strategic Communications +44 (0) 20 3709 5700

Mary-Jane Elliott/Matthew Neal/Chris Welsh scancell@consilium-

comms.com

About Scancell

Scancell is a clinical stage biopharmaceutical company that is

leveraging its proprietary research, built up over many years of

studying the human adaptive immune system, to generate novel

medicines to treat significant unmet needs in cancer and infectious

disease. The Company is building a pipeline of innovative products

by utilising its four technology platforms: Moditope(R) and

ImmunoBody(R)for vaccines and GlyMab(R)and AvidiMab(R)for

antibodies.

Adaptive immune responses include antibodies and T cells (CD4

and CD8), both of which can recognise damaged or infected cells. In

order to destroy such cancerous or infected cells, Scancell uses

either vaccines to induce immune responses or monoclonal antibodies

(mAbs) to redirect immune cells or drugs. The Company's unique

approach is that its innovative products target modifications of

proteins and lipids. For the vaccines (Moditope

(R) and ImmunoBody (R) ) this includes citrullination and homocitrullination of proteins, whereas

its mAb portfolio targets glycans or sugars that are added onto

proteins and / or lipids (GlyMab(R)) or enhances the potency of

antibodies and their ability to directly kill tumour cells

(AvidiMab(R)).

For further information about Scancell, please visit: https://

www.scancell.co.uk/

CHAIRMAN'S STATEMENT

It is with great pleasure that I to write to you for the first

time as Chairman of Scancell. Since joining in February 2023, I

have been impressed by the groundbreaking science from which we

have developed a pipeline of patent-protected innovative

immune-oncology products and I strongly believe this is a pivotal

time in the Company's evolution.

Our lead cancer vaccines, SCIB1 and Modi-1, have shown positive

early efficacy results and recruitment continues on track to meet

further near-term clinical milestones during 2024. These clinical

assets are supplemented by our proprietary antibody platforms,

GlyMab(R)and AvidiMab(R), which provide potential for further

out-licensing deals following our commercial license agreement with

Genmab in October 2022.

Scancell is funded to reach these near-term milestones with

sufficient funds through to early 2025 and is backed by specialist

biotech investors, including Redmile Group and Vulpes Life

Sciences. We have an experienced board and leadership team with a

track record of delivery, combined with a highly skilled scientific

team and a lean organisation, all focused on delivering value from

our platforms in efficient timelines.

I'd like to take this opportunity to highlight our recent

impressive results from the first stage of the Phase 2 SCOPE trial.

The Phase 2 SCOPE trial is investigating SCIB1 delivered

needle-free and in combination with checkpoint inhibitors (CPIs) in

advanced melanoma. Remarkable initial data from 11 patients showed

an 82% objective response rate (ORR) to treatment with no increase

in toxicity, better than 70% ORR that the trial was configured to

show. We are excited because, to our knowledge, no other

combination has achieved this response rate with doublet checkpoint

inhibitors in unresectable metastatic melanoma. Confirmation of

this data in a larger cohort could make a significant impact on

melanoma patient survival, especially as melanoma is now the most

common cancer in young women and is increasing in incidence.

Our progress could not have been achieved without our talented

employees and I would like to thank them for their hard work and

dedication. In addition, the Board would like to thank all existing

shareholders, especially Redmile Group and Vulpes Life Sciences ,

for their continued support as we look forward to delivering on our

plans over the next 12 months and beyond.

Looking ahead we will remain focused on maintaining our momentum

for SCIB1 and Modi-1 whilst actively seeking out-licensing,

collaborations and partnerships to accelerate the development and

commercialisation of our products and platforms. We believe the

impressive data from the SCOPE trial, combined with further

near-term milestones and commercial opportunities will soon provide

exciting inflection drivers. We remain confident on achieving the

potential of these treatments for patients, whilst creating and

delivering significant long-term value for our shareholders.

Jean-Michel Cosséry

Chairman

CHIEF EXECUTIVE OFFICER'S REPORT

I am pleased to report that Scancell has delivered a strong

year, achieving significant clinical and commercial milestones. In

the period, the Company decided to concentrate its strategic focus

and resources on its lead cancer vaccines, SCIB1 and Modi-1 which

have shown positive early efficacy data. The decision to focus on

these assets reflects the need to manage our resources and cash in

a tough macroeconomic environment which is impacting ability to

access further capital. The Company has strong confidence in its

other assets and will continually assess partnering and

out-licensing options to drive these assets forward and add further

value.

Set out below is a summary of progress that has been made across

our innovative and proprietary vaccine and antibody platforms.

VACCINES

ImmunoBody(R) platform

Scancell's ImmunoBody(R)immunotherapy platform uses the body's

immune system to identify, attack and destroy tumours. This is

achieved by delivering a DNA plasmid to enhance the uptake and

presentation of cancer antigens to harness high avidity T cell

responses, offering the potential for enhanced efficacy and safety

compared with more conventional approaches. These vaccines have the

potential to be used as monotherapy or in combination with

checkpoint inhibitors and other agents. This platform has the

potential to enhance tumour destruction, prevent disease recurrence

and extend survival.

SCIB1

SCIB1 is the lead product from the Company's

ImmunoBody(R)immunotherapy platform. It is currently being

evaluated in a Phase 2 SCOPE trial in the UK in combination with

checkpoint inhibitors for the treatment of advanced melanoma. The

SCOPE study is an open-label, multi-cohort, multicentre Phase 2

study. In June 2022, the Medicines and Healthcare products

Regulatory Agency (MHRA) approved a protocol amendment allowing the

trial to include a cohort of advanced melanoma patients who will

receive SCIB1 plus doublet therapy consisting of ipilimumab

(Yervoy(R)) plus nivolumab (Opdivo(R)) in addition to the cohort

who will receive SCIB1 with pembrolizumab (Keytruda(R)). This

reflects the current treatment landscape for unresectable

metastatic melanoma patients. The Phase 2 study is designed to

assess whether the addition of SCIB1 treatment to CPI standard of

care results in an improvement in patient outcomes for patients

with metastatic disease. The primary objectives of the trial are

tumour response rate, progression-free survival and overall

survival in patients with advanced melanoma. The SCIB1 vaccine is

delivered via a PharmaJet(R)needle-free injection, which provides

enhanced patient acceptance versus electroporation.

In September 2023, Scancell reported positive data from the

first stage in its Phase 2 SCOPE trial, investigating SCIB1 in

combination with doublet therapy checkpoint inhibitors in advanced

melanoma. Initial data from 11 patients showed an 82% objective

response rate (ORR) to treatment, which is better than 70% ORR that

the trial was configured to show. The first milestone in the SCOPE

trial was to achieve responses in more than 8 out of 15 patients

which would suggest that SCIB1 in combination with doublet CPI

therapy might meaningfully improve current outcomes for these

patients. 16 stage IV metastatic patients received this

combination. 11 of these study patients have reached 13 weeks and

been evaluated at radiological imaging and nine have already shown

an objective response, equating to an ORR of 82% with no increase

in toxicity. At this time point the reduction in tumour volume was

31%-94%. Four patients reaching the 25 weeks imaging evaluation and

two reaching the 37 weeks evaluation have shown a 69%-94% and a

87%-94% reduction in total tumour burden, respectively. This

compares to an ORR of 50% reported in patients just receiving this

doublet CPI therapy in the real world setting with a progression

free survival time of 11.5 months.

The SCOPE trial has now successfully transitioned into the

second stage, which will recruit a further 27 patients (for a total

of 43). The aim is to achieve at least 18 further responses (i.e.,

27 responses in total) which would statistically demonstrate that

SCIB1, in combination with doublet therapy, exceeds currently

achievable ORRs. Based upon the first 11 patients there is a

greater than 90% probability that the second phase will also be

successful. The second stage of recruitment is expected to be

complete by the end of 2023 with data available in H1 2024.

If validated in the second stage of the SCOPE trial this will

provide confidence to initiate a randomised phase 2/3 adapted

registration programme in patients with unresectable melanoma. The

Phase 2 part of the adapted trial should take 18 months and we

anticipate it will generate significant partner interest.

iSCIB1+

iSCIB1+ is a modified version of SCIB1 developed using the

company's AvidiMab(R)platform. iSCIB1+ also includes more

melanoma-specific epitopes so it can be used by a broader patient

population rather than SCIB1 which is limited to the 40% of

patients who have the appropriate HLA. Furthermore, iSCIB1+ has

competitive advantages to SCIB1, including potentially increased

potency and extending the patent life by 15 years to 2031.

Given the significant improvements in potency, utility and

patent life with iSCIB1+, the Company plans to include an iSCIB1+

cohort in the SCOPE trial once a protocol amendment has been

approved by the MHRA. The amendment to the current trial protocol,

to include a new parallel cohort with the double CPIs with iSCIB1+,

has been submitted to the MHRA and we are awaiting a response.

The unresectable melanoma market represents a potential $1.5

billion per annum market.

Moditope(R) platform

Moditope(R)is a versatile proprietary cancer vaccine platform

that targets stress-induced post-translational modifications

(siPTMs) of proteins. This discovery has allowed the Company to

develop a completely new class of potent and selective therapeutic

vaccines. Examples of such modifications include citrullination, an

enzyme-based conversion of arginine to citrulline, and

homocitrullination, in which lysine residues are converted to

homocitrulline. Expression of peptides containing these

modifications have been demonstrated to induce potent CD4 cytotoxic

T cells that induce anti-tumour activity without any associated

toxicity.

Modi- 1

Modi-1, which targets citrullinated cancer antigens, is the

first therapeutic vaccine candidate to emerge from Company's

Moditope(R)platform. Modi-1 consists of three citrullinated

tumour-associated peptides exploiting the normal immune response to

stressed cells, which is largely mediated by cytotoxic CD4 T cells.

The peptides are linked to AMPLIVANT(R), a potent adjuvant which,

in preclinical models, enhanced the immune response of Modi-1

10-to-100 fold and resulted in highly efficient tumour clearance,

including protection against tumour recurrence. AMPLIVANT(R)is the

subject of a worldwide licensing and collaboration agreement with

ISA Pharmaceuticals for the manufacturing, development and

commercialisation of Modi-1.

The ModiFY study is an open-label, multicohort, multicentre,

adaptive Phase 1/2 trial with Modi-1 being administered alone or in

combination with CPIs in patients with head and neck, triple

negative breast and renal tumours and as a monotherapy in patients

with ovarian cancer, where there are no approved CPI therapies and

in patients with the other tumour types where CPIs are not

indicated. Modi-1 stimulates CD4 T cells which may directly impact

tumour growth however in some patients if the tumour environment is

highly immunosuppressive, these T cells may need to be protected by

CPIs. This open label Phase 1/2 study is assessing the safety and

immunogenicity of two citrullinated vimentin peptides and

citrullinated enolase peptide. This open label study will recruit

over 100 patients in up to 20 UK clinical trial sites. In addition,

the effect of Modi-1 in promoting T-cell infiltration into the

tumour will be assessed in a neoadjuvant cohort in which a further

30 patients with head and neck cancer will be treated with Modi-1

with or without CPI, prior to their first surgical resection.

The ModiFY trial has completed its dose escalation and safety

cohorts. Data from patients receiving the Modi- 1 cancer vaccine as

a monotherapy showed that it was safe and well tolerated and

demonstrated encouraging early efficacy in a head and neck cancer

patient and in other hard-to-treat cancers such as high grade

serous ovarian carcinoma (HGSOC) and triple negative breast cancer

(TNBC). The cohort of 16 ovarian cancer patients receiving Modi-1

has now been fully recruited. All patients had failed on previous

treatments and their disease was actively progressing when they

entered the study. Following treatment with Modi-1 44% of patients

achieved stable disease for at least 8 weeks, with some patients

experiencing a longer duration of disease stability for 4 months or

more. The number of patients who have experienced long periods of

stable disease following monotherapy with Modi-1 is encouraging in

this difficult to treat cancer and the Company believes that

combination therapy with checkpoint inhibitors, which are not

currently approved for the treatment of ovarian cancer, could

further improve outcomes for this patient group. Evaluation of

Modi-1 plus checkpoint inhibitors in other tumour types in the

ongoing Phase 1/2 study, will provide supporting data for this

proposed combination use.

In the other monotherapy cancer cohorts, a total of eight

patients have received full dose Modi-1. One TNBC patient remains

on trial with stable disease beyond 35 weeks. One head and neck

patient achieved a partial response. Recruitment is ongoing.

In July 2023, the ModiFY study moved into the expansion cohorts,

following approval by the safety review committee. The expansion

cohorts include Modi-1 in combination with checkpoint inhibitors

(CPI) and in the neoadjuvant setting. All three patients in Cohort

4 have now successfully received two doses of Modi-1 plus CPI and

the treatments were well tolerated with no safety concerns. 21

patients will be recruited into each cohort. Patients with triple

negative breast cancer will not be included in this part of the

study as these patients receive checkpoints in combination with

chemotherapy which may induce citrullination in normal cells and

induce toxicity.

This study will recruit 30 patients who will be randomised at

diagnosis to receive either two doses of Modi-1 three weeks apart

or two doses of Modi-1 plus one dose of CPI. Tumour biopsies will

be taken prior to immunisation and from the tumour resection 6

weeks following the initial vaccination. The two tumour samples

will allow the extent of T cell infiltration and activation pre-

and post-Modi-1 vaccination to be assessed with and without a

checkpoint inhibitor.

Early clinical data with Modi-1 expected to be available in

2024.

Modi- 2

Modi-2, which targets homocitrullinated cancer antigens, is the

second therapeutic vaccine candidate from the Company's

Moditope(R)platform and has the potential to address different

cancer indications to Modi-1, including tumours with a particularly

immunosuppressive environment.

In November 2022, the Company in-licensed the SNAPvax(TM)

technology from Vaccitech plc, a clinical-stage biopharmaceutical

company engaged in the discovery and development of novel

immunotherapies and vaccines. The agreement allows Scancell to

formulate and manufacture Modi-2. The SNAPvax(TM) technology

enables peptides to self-assemble with TLR-7/8a, a powerful

adjuvant, to promote strong T cell responses and is proven to

successfully overcome formulation issues associated with

immunogenic peptide antigens, which are often highly hydrophobic

and prone to manufacturing challenges with conventional

formulations. Modi-2 will use SNAPvax(TM) to co-deliver

homocitrullinated peptide antigens and TLR-7/8a adjuvants in self-

assembling nanoparticles designed to prime tumour killing T

cells.

The Company expects that the combination of Modi-2 with a highly

effective platform for inducing T cells (Vaccitech's SNAPvax(TM)

technology) will lead to a potentially superior therapeutic vaccine

candidate.

COVIDITY

As previously disclosed, the Company has decided not to take

this vaccine forward in house due to the large size of later stage

trials and the competitive Covid-19 landscape, however the previous

positive data in February 2023 for COVIDITY demonstrates the

validation of the vaccine platform, including AvidiMab(R). The

Company will now seek a partner to progress the COVIDITY vaccine

programme.

ANTIBODIES

GlyMab(R)

The GlyMab(R)platform provides a powerful and versatile approach

to generating novel antibody drug candidates for our own clinical

pipeline but also to create upfront, milestone and revenue

generating partnerships with other companies in areas such as drug

targeting to capitalise on other groups expertise. The

GlyMab(R)antibodies bind to sugar motifs, rather than peptide

epitopes, found on the surface of glycosylated proteins and lipids

expressed by cancer cells. The Company currently has a pipeline of

five anti-glycan mAbs: SC129, SC134, SC2811, SC88 and SC27 that

target solid tumours including pancreatic, small cell lung,

colorectal and gastric cancers. All of these drug candidates have

now been successfully humanised and are ready for the next stage of

development.

The GlyMab(R)antibodies can be developed into redirecting T cell

bispecific (TCB) antibodies with the potential of entering the

clinical trials providing a promising new therapeutic approach for

treating cancer. TCB antibodies have dual-binding specificity which

crosslinks tumour cells via their glycans with an activating

receptor CD3 on T cells. This results in activation of killer T

cells and tumour cell death. These antibodies are particularly

potent in tumours which have lost the T cell recognition molecule

major histocompatibility antigen (MHC) or where there is limited T

cell infiltration as they by-pass normal T cell activation pathways

and redirect the host immune system to the tumour. SC134 has now

been successfully developed in the lab as a TCB.

In October 2022, Scancell signed its first commercial license

agreement with Genmab. Genmab were granted a worldwide license to

an anti-glycan monoclonal antibody generated via Scancell's

proprietary GlyMab(R)platform, for the development and

commercialisation of novel therapeutic products. The Company

received

GBP5.3 million in up front payment as well as potential

milestone payments of up to $208 million for each product developed

and commercialised, up to a maximum of $624 million if Genmab

develops and commercialises products across all defined modalities.

The Company will also receive low single digit royalties from

Genmab on net sales of all commercialised products.

AvidiMab(R)

AvidiMab(R)is a versatile proprietary platform technology that

can enhance the avidity and thereby the potency of any antibody. To

date, the Company has used AvidiMab(R)in its internal programmes

to:

-- Engineer the anti-glycan mAbs to improve their ability to directly kill tumour cells.

-- Engineer other mAbs to enhance their potency and/or extend their patent lifetime.

-- Increase the breadth of response and potency of Scancell's ImmunoBody (R) cancer products.

-- Increase the potency of the T cell response in Scancell's

COVID-19 vaccine which in turn should lead to improvements in

long-term protection and immunological memory.

AvidiMab(R)platform successfully applied to internal programmes,

including iSCIB1+ and COVIDITY, and holds potential to enhance the

efficacy of third-party antibodies.

CORPORATE

The Company has been building its organisational capabilities

through key appointments to the Board and Leadership teams.

During the year Jean-Michel Cosséry was appointed as the

Non-Executive Chairman. Jean-Michel brings to Scancell over 25

years of experience in the pharmaceutical and biotechnology

industries and a sustained global track record of success in

commercial operations as well as in capital raising, US and

European public offerings, business development and M&A. We are

already capitalising on his experience as we continue on our

journey to deliver the next stage of growth.

The Company has also recently appointed Sath Nirmalananthan as

Chief Financial Officer and Dr Mandeep Sehmi as Head of Business

Development. Both appointments bring highly relevant experience

from the pharmaceutical sector to the company that will further

enhance its commercial capabilities and accelerate the Company

forward in achieving its strategic objectives.

FINANCIAL REVIEW

Profit or Loss and Other Comprehensive Income Statement

The Group made an operating loss for the year to 30 April 2023

of GBP11.9 million (2022: operating loss of GBP13.3 million).

Revenue from the licencing deal with Genmab of GBP5.3 million

reduced the operating loss significantly.

The increase in development expenditure to GBP11.6 million

(2022: GBP9.5 million) reflects an increase in average numbers of

research and clinical staff from 33 to 43 together with additional

costs incurred with increased recruitment in the SCOPE and ModiFY

clinical trials and completion of the COVID clinical trial.

Administrative expenditure has increased by 4% to GBP5.0 million

(2022: GBP4.8 million).

During the previous year the group received grant income of

GBP0.97 million from Innovate UK. This ceased at 31 March 2022.

Interest payable of GBP1.2 million (2022 restated: GBP1.8

million) largely relates to the effective interest on the

convertible loan notes (CLNs) which were issued in August and

November 2020. The interest paid on the Convertible Loan Notes in

the year amounted to GBP0.5 million (2022: GBP0.5 million)

The finance expense of GBP1.5 million (2022 restated: finance

income GBP16.0 million) relating to the derivative liability is the

fair value adjustment of the derivative liability at 30 April 2023.

The finance expense and prior year's credit are not cash items and

have no impact upon the Company's cashflow.

The restated loss on the substantial modification of the CLNs

for the year ended 30 April 2022 amounting to

GBP7.2 million arose from accounting adjustments from the

replacement of the CLNs in existence at 27 October 2021 with new

CLNs with a later maturity date.

The loss before taxation amounted to GBP14.2 million (2022

restated: GBP6.3 million) and the R&D tax credit increased to

GBP2.4 million (2022: GBP1.7 million). This increase reflects the

increased development expenditure incurred during the year.

Overall, the loss for the year was GBP11.9 million (2022

restated: loss GBP4.6 million).

Statement of Financial Position

At 30 April 2023, the Group had net liabilities of GBP6.2

million (2022 restated: GBP4.8 million net assets) including cash

at bank of GBP19.9 million (2022: GBP28.7 million). The net

liabilities have arisen at 30 April 2023 as a result of amending

the convertible loan notes' derivative liability valuation, as

described further below and incurring losses of GBP11.9 million for

the year.

The tax receivable due at the end of the year amounted to GBP4.2

million (2022: GBP3.0 million) and relates to the R&D tax

credit for the 2021/22 tax year plus the tax credit for the year to

30 April 2023. The 2021/22 tax credit of GBP1.7million has been

received post year-end.

The increase in Trade and other payables to GBP3.0 million

(2022: GBP2.1 million) is due to increased expenditure during the

year as development activities have increased.

The Derivative Liabilities represents the fair value of the

conversion feature of the CLNs with changes in value being shown in

the Consolidated Profit or Loss and Other Comprehensive Income

Statement as a finance income or expense.

Consolidated Cash Flow Statement

As at 30 April 2023 bank balances amounted to GBP19.9 million

(2022: GBP28.7 million). As can be seen in the Consolidated Cash

Flow Statement, there has been a decrease in cash and cash

equivalents of GBP8.8 million (2022: decrease GBP12.3 million). The

Company has been able to progress on all research and development

platforms with the cash used for this being GBP9.4 million (2022:

GBP11.5 million), purchase of fixed assets amounting to

GBP0.2million (2022: GBP1.3 million), and payment of interest on

the Convertible Loan Notes of GBP537k (2022: GBP537k).

Prior Period Restatement

The Company and its auditor reviewed the valuation and

accounting for convertible loan notes and identified certain

corrections required to the current and prior periods' Group and

company results, as fully described in note 24 to the consolidated

financial statements, included in the Report and Accounts for the

year ended 30 April 2023 which are now available on the Company's

website..

This prior period restatement also resulted in adjustments to

the cashflow statements, in respect of adjusting loss before tax,

non-cash revaluation gains/losses and non-cash interest payable.

There was no impact on cash itself and the prior period restatement

does not impact the convertible loans' notional amounts or maturity

dates disclosed.

OUTLOOK

Given the significant clinical and commercial milestones

achieved in the period, positive early efficacy data, and with

sufficient resources to fund our current strategy, the Company is

confident it will achieve its near-term clinical milestones. Key

milestones for the following 18 months include:

-- Second stage of SCOPE study in advanced melanoma with SCIB1

anticipated to complete recruitment by the end of 2023 with data

available in H1 2024

-- iSCIB1+ planned to be included in the SCOPE study. Protocol amendment pending MHRA approval

-- Phase 2/3 seamless adaptive registration trial with SCIB1 or iSCIB1+ to begin in 2024

-- ModiFY trial to continue recruitment in the expansion cohorts

with early clinical data expected in 2024

-- Continue to assess out-licensing options for the GlyMab (R)

and AvidiMab (R) platforms providing a source of non-dilutive cash

to drive our other assets forward in development

The Board is pleased with the progress that the Company has

achieved over the period and would like to thank our shareholders

once again for their continued support.

Professor Lindy Durrant

Chief Executive Officer

CONSOLIDATED PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

STATEMENT for the

year ended 30 April 2023

Notes 2023 2022

GBP'000 GBP'000

Restated(1)

Revenue 5,271 -

Cost of sales (525) -

------------------- ------------

Gross Profit 4,746 -

Development expenses (11,645) (9,477)

Administrative expenses (5,021) (4,787)

Grant income - 965

------------------- ------------

OPERATING LOSS 2 (11,920) (13,299)

Interest receivable and similar income 284 4

Interest payable (1,215) (1,777)

Loss on substantial modification of convertible

loan notes - (7,244)

Finance (expense) / income relating to derivative

liability revaluation (1,453) 16,044

------------------- ------------

LOSS BEFORE TAXATION (14,304) (6,272)

Taxation 3 2,368 1,703

------------------- ------------

LOSS FOR THE YEAR AND TOTAL COMPREHENSIVE LOSS (11,936) (4,569)

------------------- ------------

LOSS PER ORDINARY SHARE (pence) 4

Continuing

Basic (1.50)p (0.56)p

--------- ---------

Diluted (1.50)p (0.56)p

--------- ---------

1 Please refer to note 5 for further details on the prior period

restatement

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION As at 30 April 2023

2023 2022 2021

GBP'000 GBP'000 GBP'000

Restated(1) Restated(1)

ASSETS

Non-current assets

Tangible fixed assets 1,246 1,579 692

Right-of-use assets 1,003 1,165 283

Goodwill 3,415 3,415 3,415

---------- ----------- -----------

5,664 6,159 4,390

---------- ----------- -----------

Current assets

Trade and other receivables 538 647 968

Income tax assets 4,148 2,990 2,590

Cash and cash equivalents 19,920 28,725 41,110

---------- ----------- -----------

24,606 32,362 44,668

---------- ----------- -----------

TOTAL ASSETS 30,270 38,521 49,058

---------- ----------- -----------

LIABILITIES

Non-current liabilities

Convertible Loan note (18,481) (17,857) (15,119)

Derivative liability (14,000) (12,547) (22,893)

Lease liabilities (746) (856) (63)

---------- ----------- -----------

(33,227) (31,260) (38,075)

---------- ----------- -----------

Current liabilities

Trade and other payables (2,970) (2,137) (2,087)

Lease liabilities (306) (315) (208)

---------- ----------- -----------

(3,276) (2,452) (2,295)

---------- ----------- -----------

TOTAL LIABILITIES (36,503) (33,712) (40,370)

---------- ----------- -----------

NET (LIABILITIES)/ASSETS (6,233) 4,809 8,688

---------- ----------- -----------

SHAREHOLDERS' EQUITY

Called up share capital 819 815 815

Share premium account 65,181 65,019 65,019

Share option reserve 2,123 1,395 705

Retained losses (74,356) (62,420) (57,851)

-------- -------- --------

TOTAL SHAREHOLDERS' (DEFICIT) / EQUITY (6,233) 4,809 8,688

-------- -------- --------

1 Please refer to note 5 for further details on the prior period

restatement

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30 April 2023

Share Share Share Retained

Capital Premium Option losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ------------ ----------- ------------- ----------

Balance 1st May 2021 815 65,019 705 (47,054) 19,485

Prior Year Adjustment - - (10,797) (10,797)

---------- ------------ ----------- ------------- ----------

Balance 1st May 2021

(restated 1 ) 815 65,019 705 (57,851) 8,688

Share option credit - - 690 - 690

Loss for the year and

other comprehensive loss - - - (4,569) (4,569)

---------- ------------ ----------- ------------- ----------

Balance 30 April 2022

(restated 1 ) 815 65,019 1,395 (62,420) 4,809

Share issue 4 162 - - 166

Loss for the year and

other comprehensive loss - - - (11,936) (11,936)

Share option credit - - 728 - 728

---------- ------------ ----------- ------------- ----------

Balance 30 April 2023 819 65,181 2,123 (74,356) (6,233)

---------- ------------ ----------- ------------- ----------

1 Please refer to note 5 for further details on the prior period

restatement

2023 2022

GBP'000 GBP'000

Cash flows from operating activities Restated(1)

Loss before tax (14,304) (6,272)

Adjustments for:

Finance income (284) (4)

Lease interest paid 54 48

Convertible loan interest payable 1,161 1,729

Finance expense / (income) for derivative liability

revaluation 1,453 (16,044)

Loss on substantial modification of convertible

loan notes - 7,244

Depreciation 536 381

Amortisation of right-of-use asset 366 359

Share-based payment charge 728 690

---------------------- ------------

Cash used in operations before changes in

working capital (10,290) (11,869)

Decrease in other receivables 111 321

Increase in accounts and other payables 829 51

---------------------- ------------

Cash used in operations (9,350) (11,497)

Tax credits received 1,210 1,304

---------------------- ------------

Net cash used in operating activities (8,140) (10,193)

---------------------- ------------

Investing activities

Purchase of tangible fixed assets (203) (1,268)

Finance income 284 4

---------------------- ------------

Net cash generated from / (used in) investing

activities 81 (1,264)

---------------------- ------------

Financing activities

Proceeds from issue of share capital 166 -

Convertible loan interest paid (537) (537)

( 3 2 7 5

Lease payments ) ) (391)-

---------------------- ------------

Net cash (used in) financing activities (746) (928)

---------------------- ------------

Net (decrease)/increase in cash and cash equivalents (8,805) (12,385)

Cash and cash equivalents at beginning of

the year 28,725 41,110

---------------------- ------------

Cash and cash equivalents at end of the year 19,920 28,725

---------------------- ------------

1 Please refer to note 5 for further details on the prior period

restatement

1 BASIS OF PREPARATION

These financial results do not comprise statutory accounts for

the year ended 30 April 2023 within the meaning of Section 434 of

the Companies Act 2006. The financial information in this

announcement has been extracted from the audited financial

statements for the year ended 30 April 2023. The auditors reported

on those accounts and their report (i) was unqualified; (ii) did

not include references to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

(iii) did not contain statements under section 498 (2) or (3) of

the Companies Act 2006. The statutory accounts for the year ended

30 April 2023 have not yet been delivered to the Registrar of

Companies.

The financial statements have been prepared on the going concern

basis on the grounds that the directors have reviewed the funding

available and the group's cash flow forecast and are content that

sufficient resources are available to enable the group to continue

in operation for at least twelve months from the date of approval

of these financial statements.

These financial statements have been prepared in accordance with

UK adopted international accounting standards applicable to

companies reporting under IFRS. Assets and liabilities are

initially recognised at historical cost or transaction value unless

otherwise stated in the relevant accounting policies.

2 OPERATING LOSS

2022 2021

GBP'000 GBP'000

Operating Loss is stated after charging/(crediting):

Grant income - (965)

Depreciation on tangible fixed assets 536 381

Amortisation of right-of-use asset 366 360

Research and development 11,645 9,477

Foreign exchange losses / (gains) 358 (2)

Auditors' remuneration - fee payable for audit

of the company 42 32

Auditors' remuneration - fee payable for audit

of the subsidiary

company 41 32

Auditors remuneration - non -audit services - 8

Directors' remuneration 757 1,185

3 TAXATION

The tax credit on the loss on ordinary activities for the year

was as follows:

2023 2022

Current tax

GBP'000 GBP'000

UK corporation tax credits due on R&D expenditure 2,399

1,754 Adjustment to prior year

(31) (51)

2,368 1,703

3 TAXATION (continued) Factors affecting the tax credit

The tax assessed for the year is lower than the applicable rate

of corporation tax in the UK. The difference is explained

below:

2023 2022

GBP'000 GBP'000

Loss on ordinary activities before tax (14,304) (6,272)

Loss on ordinary activities multiplied by

the small company rate of

tax in the UK (19.49%) (2022: 19%) (2,788) (1,192)

Effects of:

Disallowed (income)/expenditure on convertible

loan 510 (1,345)

Other disallowed expenditure 172 131

Other timing differences 49 23

Enhanced tax relief on R&D expenditure (929) (771)

Prior year (under)/ over provision 31 51

Unrelieved losses carried forward 587 1,400

Current tax (credit) (2,368) (1,703)

The Group has tax losses to carry forward against future profits

of approximately GBP38.53 million (2022:

GBP35.22 million).

A deferred tax asset has not been recognised in respect of these

losses as the Group does not anticipate sufficient taxable profits

to arise in the foreseeable future to fully utilise them.

The estimated value of the deferred tax asset not recognised

measured at the prevailing rate of tax when the timing differences

are expected to reverse is GBP9.8 million (2022: GBP8.8million).

This is based on the substantively enacted rates at the balance

sheet date. The current UK corporation rate is 25%, effective from1

April 2023, as set out in the Finance Bill 2021 which was

substantively enacted on 24 May 2021.

In addition to the deferred tax asset on losses, the Group has a

potential future tax deduction on share options of GBP1,961,000

(2022: GBP1.397,000) and a deferred tax asset of GBP490,000 (2022:

GBP349,000) thereon. The additional tax deduction will crystallise

at the point the options are exercised. As the utilisation of this

additional deduction against taxable profits in the Group is

uncertain, no deferred tax asset has been recognised in respect of

the future tax deduction on share options.

Taxation receivable is GBP4,147,700 (2022: GBP2,990,000).

4 LOSS PER SHARE

Basic loss per share

The earnings and weighted average number of ordinary shares used

in the calculation of basic loss per share is as follows:

2023 2022

GBP'000 GBP'000

Restated

Loss used in calculation of basic loss

per share (11,936) (4,569)

Number Number

Weighted average number of ordinary shares

of 0.1p each

for the calculation of basic loss per

share 816,051,311 815,218,831

4 LOSS PER SHARE (continued)

Diluted loss per share

As the Group is reporting a loss from continuing operations for

both years then, consequentially, the share options are not

considered dilutive because the exercise of the share options would

have the effect of reducing the loss per share.

At the year end the issued share capital amounted to 818,903,461

ordinary shares.

5 PRIOR PERIOD RESTATEMENT

The Company and its auditor reviewed the valuation and

accounting for convertible loan notes and identified certain

corrections required to the current and prior periods' Group and

company results, as fully described in note 24 to the consolidated

financial statements, included in the Report and Accounts for the

year ended 30 April 2023.

This prior period restatement also resulted in adjustments to

the cashflow statements, in respect of adjusting loss before tax,

non-cash revaluation gains/losses and non-cash interest payable.

There was no impact on cash itself and the prior period restatement

does not impact the convertible loans' notional amounts or maturity

dates disclosed.

The consolidated financial statements are available on the

Company website (see note 7).

6 DELIVERY OF ACCOUNTS

The audited statutory accounts in respect of the prior year

ended 30 April 2022 have been delivered to the Registrar of

Companies. The auditors issued an unqualified audit opinion which

did not contain any statement under section 498(2) or 498(3) of the

Companies Act 2006.

7 AVAILABILITY OF ACCOUNTS

This announcement is not being posted to shareholders. Copies of

this announcement can be downloaded from the Company's website:

www.scancell.co.uk together with copies of the Report and Accounts

for the year ended 30 April 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FDSEESEDSEIS

(END) Dow Jones Newswires

October 31, 2023 03:00 ET (07:00 GMT)

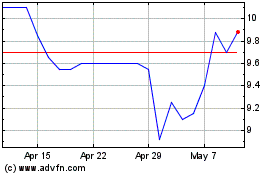

Scancell (LSE:SCLP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Scancell (LSE:SCLP)

Historical Stock Chart

From Feb 2024 to Feb 2025