TIDMSURE

RNS Number : 9938S

Sure Ventures PLC

19 July 2022

Sure Ventures plc

Annual Report and Audited Financial Statements

For the year ended 31 March 2022

Company Number: 10829500

Table of Contents

1 Investment Objective, Policy and Performance Summary 1

2 Chairman's

Statement..........................................................................

3

3 Investment Manager's Report.............................................................. 7

4 Strategic

Report.................................................................................

11

Business Review 12

Principal Risks and Uncertainties 14

Key Performance Indicators 6

Promoting the Success of the Company

5 Directors' Report 8

Board of Directors 9

Statutory Information 20

Corporate Governance Statement 5

Report of the Audit Committee 32

Statement of Directors' Responsibilities 5

Directors' Remuneration Report 6

6 Independent Auditor's Report............................................................ 39

7 Financial Statements 6

Income Statement 7

Statement of Financial Position 8

Statement of Changes in Equity 9

Statement of Cash Flows 50

Notes to the Financial Statements 1

8 Alternative Performance Measures (APMs)

9 Glossary

10 Shareholders' Information 8

Directors, Portfolio Manager and Advisers 69

11 Investment Policy 70

1 Investment Objective, Policy and Performance Summary

Investment Objective

The investment objective of the Company is to achieve capital

growth for investors.

Investment Policy

The Company's Investment Policy can be found at page 70 of this

Annual Report.

Performance Summary

31 March 2022 31 March 2021

Number of ordinary shares in

issue 6,013,225 5,350,725

Market capitalisation

- Ordinary shares (in sterling) 6,133,500 5,618,000

Net asset value ("NAV") attributable

to ordinary shareholders

- Ordinary shares GBP 7,751,596 GBP 4,925,764

NAV per share attributable

to ordinary shareholders

- Ordinary shares (in sterling) 128.91p 92.06p

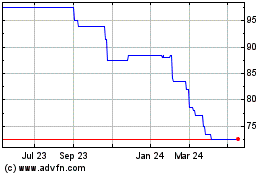

Ordinary share price (bid price)

in sterling 102.00p 105.00p

Ordinary share price (deficit)/premium

to NAV

in sterling (20.87%) 14.06%

Investments held at fair value

through profit and loss GBP 7,516,667 GBP 3,724,611

Cash and cash equivalents GBP282,178 GBP 1,255,199

Dividend History

There were no dividends paid during the period (2021 -

None).

Listing Information

The Company's shares are admitted to trading on the Specialist

Fund Segment (SFS) of the London Stock Exchange.

The ISIN number for the GBP shares is GB00BYWYZ460, Ticker:

SURE.

Website

The Company's website address is http://www.sureventuresplc.com

.

2 Chairman's Statement

Chairman's Statement

Dear Shareholders.

On behalf of my fellow directors, I am delighted to present the

annual results of Sure Ventures plc (the 'Company') for the year

ended 31 March 2022.

FINANCIAL PERFORMANCE

The Company's performance for the year to 31 March 2022 exceeded

expectations, returning an impressive net asset value ('NAV') total

return per share of +40.03% (2021: -0.58%). This is extremely

encouraging for our Investors with positive implications for the

future. We outline below the investment activity that has

contributed to this success.

The most notable aspect of the Company's performance since

inception to date is that none of the direct investments, or

underlying investment in Fund I, have yet failed. Those investments

which have not yet completed a follow-on funding round at an

uplifted valuation, still have a reasonable prospect of doing so.

This is unusual for an early-stage investment company such as

ourselves and is a real credit to the Company's investment team who

have demonstrated proven ability to pick winners with their

investment strategy. We can look forward to the future with

confidence.

2021 witnessed further gains in global markets and the UK and

Europe technology sector became a significant beneficiary from

pandemic-related stimulus measures which fuelled record-breaking

investments in private technology transactions. The pent-up demand

in private market deals that was forecast in early 2021 was evident

in both the value of new investments in the sector and deal count.

The prior accounting period to 31 March 2021 was a consolidation

year from which follow-on funding rounds were able to contribute to

steady growth in the Company's NAV as unrealised gains. This

consolidation set the scene for substantial uplifts in the current

year. Several of the investee companies including; VividQ, Admix,

CameraMatics and Getvisibility enjoyed strong gains. In a further

exciting development during the year, the Company announced its

commitment to a new investment vehicle. This commitment will be

alongside the British Business Bank in a second Sure Valley

Ventures fund, as further described below. The early months of 2022

have seen some value erosion in global large cap technology stocks

and so whilst the Company's performance has been particularly

solid, it is conscious of the investment environment and the need

to maintain its rigorous investment process as global markets

tackle the threat of inflation and rising interest rates.

In the year to 31 March 2022, the Company's NAV attributable to

shareholders grew by GBP2.83m to GBP7.75m through a combination of

NAV performance and new subscriptions.

In common with the current market trend of listed trusts, the

Company's share price now trades at a discount to its last

published NAV, currently around 20%. However, in June 2022 the

Company was able to validate its share price by raising new

subscriptions through a private placing at the mid-market share

price.

PORTFOLIO UPDATE - FUND I

The Company holds 25.9% in Sure Valley Ventures Fund I ('SVV'),

the first Sub-Fund of Suir Valley Funds ICAV ('Fund I'). The total

commitment in this first Fund was EUR7m (increasing its initial

commitment from EUR4.5m in September 2019), of which EUR5.6m (80%)

has been drawn down as at 31 March 2022.

The Company also holds direct investments outside of Fund I in

Immotion Group plc ('Immotion'), a listed immersive virtual reality

('VR") entertainment group and VividQ Limited, a privately owned

deep technology company pioneering the application of holography in

augmented reality ('AR') and VR. The Fund I portfolio also includes

one listed entity, ENGAGE XR Holdings plc (formerly VR Education

Holdings plc) 'ENGAGE' a developer of VR software and immersive

experiences with a specific focus on education. As at the year end,

the Company through its holding in Fund I, has a further fourteen

privately held companies in the AR, VR, internet of things ('IoT')

and artificial intelligence ('AI') space. The Company has, with its

investment in Artomatix, concluded its first successful portfolio

company exit in 2019 for x5 return of the original investment.

During the year, Fund I announced the following additional

investment:

-- SmartTech247 (June 2021), a global AI based cyber security

cloud business that protects enterprises as they migrate to

cloud-based IT operations, with over 100 technology partners and

more than 50 clients based in Europe and US.

The year also featured an GBP11m seed extension round for VividQ

led by UTokyo, the venture investment arm of the University of

Tokyo. The funding round closed in June 2021 and the uplift was a

significant contributor to the Q2 21 NAV given the Company's

investment in VividQ held through the Fund I portfolio and also its

direct holding of VividQ, representing an unrealised gain of 59% on

the Company's initial investment.

In October 2021 Admix announced a US$25m Series B round

representing a substantial uplift from the Company's initial

investment in Admix in 2018, that has now successfully raised

US$37million to date.

In December 2021 CameraMatics completed a EUR3.9m Series B

funding round in which SVV contributed alongside the existing

investors Enterprise Ireland and Puma, achieving a 90% increase in

valuation from January 2021.

Finally, in March 2022 Getvisibility announced a EUR10m funding

round in which SVV followed-on alongside new investors Alpha

Intelligence Capital and Fortino Capital, creating a 4x uplift and

unrealised gain from the Company's initial investment.

The Company's listed investment holdings, Immotion and ENGAGE,

had a mixed year with both share prices trading relatively flat

across the year. However, the investment holdings in both listed

companies have been reduced gradually to levels that are less

impactful of the Company's NAV, creating lower volatility through

dilution of these holdings.

PORTFOLIO UPDATE - FUND II

In March 2022 the Company announced its commitment of GBP5m to

the Sure Valley Ventures Enterprise Capital Fund. This is a GBP85m

first close of a total GBP95m UK software technology fund,

investing in AR, VR and the Metaverse, including AI, IoT and

Cybersecurity in investee companies throughout the UK ('Fund II').

The British Business Bank is the GBP50m cornerstone investor

through its Enterprise Capital Funds programme and it is envisaged

that investment in up to 25 software companies will be made during

the investment period.

As at the year end, the first portfolio Fund II investment of

GBP1m has been made in Retinize, a Belfast-based creative tech

company developing an Animotive software, harnessing VR technology

to transform the 3D animation production process.

Further information on the investment portfolio is provided in

the report of the Investment Manager which follows this

statement.

COMMITMENTS AND FUNDING

As previously mentioned, in 2019 the Company announced an

increase in subscription to Fund I of EUR2.5m taking its total

commitment to EUR7m, thereby increasing its share in the Fund from

21.6% to 25.9%. This commitment was made shortly before the Fund

closed to new subscribers validating the Company's belief that the

Fund I portfolio is at a mature stage and, with a number of

investee companies preparing for further funding rounds, there is

demonstrable potential for further uplifts to occur from initial

valuations. Several new funding rounds occurred in this financial

year and with others still at the negotiation stage the Company

expects further positive Fund I uplifts to occur in the coming

year.

The Company's commitment to Fund II is GBP5m over the duration

of the fund's investment period and the forecast capital calls

throughout the investment period was a key consideration prior to

agreeing to the Company's

commitment to Fund II.

The Company believes that it will have sufficient access to

funding to meet its remaining commitments to Fund I and to its

anticipated commitments to Fund II over the terms of each Funds'

investment cycle, through a combination of available cash,

anticipated subscriptions and access to undrawn facilities.

INVESTMENT ENVIRONMENT

The Company continues to be pleased by how the Investment

Manager has grown the investment portfolio of Fund I with other

complimentary businesses in diverse sectors. The anticipated new

funding rounds and subsequent portfolio uplifts throughout the year

have contributed to a particularly impressive portfolio performance

and the potential of the Fund I portfolio is now starting to be

rewarded as new funding rounds are completed. It is also noteworthy

that, to date, not one of these early-stage investee companies has

required any valuation reduction or impairment which is testament

to the rigorous investment process adopted by the Investment

Manager. The Company is very excited to be an investor in Fund II,

alongside the British Business Bank, as cornerstone investor who,

after a lengthy competitive process, selected Sure Valley Ventures

to participate in their very attractive Enterprise Capital

programme. In a post-pandemic world of rising inflation and higher

interest rates, as well as other geopolitical implications of the

conflict in Ukraine, the Company is conscious that the due

diligence carried out on its investment opportunity pipeline

requires greater scrutiny than ever before to produce a portfolio

as robust as the Fund I portfolio.

DIVID

During the year to 31 March 2022, the Company has not declared a

dividend (31 March 2021: GBPNil). Pursuant to the Company's

dividend policy the directors intend to manage the Company's

affairs to achieve shareholder returns through capital growth

rather than income. The Company does not expect to receive a

material amount of dividends or other income from its direct or

indirect investments. It should not be expected that the Company

will pay a significant annual dividend, if any.

GEARING

The Company may deploy gearing of up to 20% of NAV (calculated

at the time of borrowing) to seek to enhance returns and for the

purposes of capital flexibility and efficient portfolio management.

The Company's gearing is expected to primarily comprise bank

borrowings but may include the use of derivative instruments and

such other methods as the Board may determine. During the period to

31 March 2022 the Company did not employ any borrowing

(31 March 2021: GBPNil).

The Board will continue to review the Company's borrowing, in

conjunction with the Investment Manager on a regular basis pursuant

with the Company's overall cash management and investment

strategy.

CAPITAL RAISING

On 8 June 2021, the Company announced a placing of 662,500

ordinary shares that were admitted to trading on the Specialist

Fund Segment of the London Stock Exchange on 14 June 2021, under

the existing ISIN: GB00BYWYZ460, taking the total shares in

admission as at 31 March 2022 to 6,013,225.

Post year end, on 1 June 2022, the Company announced a further

placing of 441,860 ordinary shares that were admitted to trading on

the Specialist Fund Segment of the London Stock Exchange on 10 June

2022, under the existing ISIN: GB00BYWYZ460, taking the total

shares in admission as at 10 June 2022 to 6,455,085.

The Investment Manager's Report following this Statement gives

further detail on the affairs of the Company. The Board is

confident of the long-term prospects for the Company in pursuit of

its investment objectives.

OUTLOOK

The portfolio construction of Fund I is almost complete, save

for the likely addition of a final investment as Fund I becomes

fully seasoned. Follow-on rounds in the past year have been

extremely positive and the investment management team expects

future follow-on rounds will continue at equally positive

valuations. The Investment Manager will explore routes to market

and potential exits of Fund I investee companies, as well as

continuing to identify suitable key additions for Fund II. We fully

expect the year ahead to be another year of transformation

reflected through NAV appreciation, and the Company is confident

that there will be more positive developments to announce for both

Fund I and for Fund II.

Perry Wilson

Chairman

18 July 2022

3 Investment Manager's Report

Investment Manager's Report

The company

Sure Ventures plc (the "Company") was established to enable

investors to gain access to early stage technology companies in the

four exciting and expansive market verticals of augmented reality

and virtual reality (AR/VR), artificial intelligence (AI),

Cybersecurity and the Internet of Things (IoT).

The Company gains access to deal flow ordinarily reserved for

venture capital funds and ultra-high net worth angel investors,

establishing a diversified software-centric portfolio with a clear

strategy. Listing the fund on the London Stock Exchange offers

investors:

-- Relative liquidity

-- A quoted share price

-- A high level of corporate governance.

It is often too expensive, too risky and too labour intensive

for investors to build a portfolio of this nature themselves. We

are leveraging the diverse skillsets of an experienced management

team who have the industry network to gain access to quality deal

flow, the expertise to complete extensive due diligence in target

markets and the entrepreneurial skills to help these companies to

mature successfully. Those investing in the Company will get

exposure to Sure Valley Ventures which in turn makes direct

investments in the above sectors in the UK & Ireland.

Augmented Reality & Virtual Reality

The Immersive Technologies market has had a significant growth

boost during COVID-19 (Netflix or video games for example) and

AR/VR is no exception. The AR/VR market was valued at $14.84

billion in 2020 by Allied Market Research and is projected to reach

$454.73 billion by 2030, registering a Compound Annual Growth Rate

("CAGR") of 40.7%. Growth of the mobile gaming industry and

increase in internet connectivity act as the key drivers of the

global AR and VR market. In addition, increased use of consumer

electronic devices is expected to fuel the global AR/VR market

growth. Meta a key player in VR, has had great success with its

Quest 2 VR headset and plans to launch a new high-end metaverse

headset in Q2 this year, along with Apple which is expected to

launch an AR and VR headset before the end of the year, both of

which will help accelerate growth in the market even further.

Internet of Things

MarketsandMarkets also forecasts that the post-COVID-19 global

IoT market size is expected to grow from US$ 300.3 billion in 2021

to US$ 650.5 billion by 2026, at a CAGR of 16.7% from 2021 to 2026.

The major factors fueling the IoT market include access to

low-cost, low-power sensor technology, availability of high-speed

connectivity, increase in cloud adoption, and Increasing use of

data processing and analytics. Moreover, increase in smart city

initiatives worldwide, increase in connected devices to drive the

growth of IoT, and emerging 5G technology to help IoT adoption,

globally would provide lucrative opportunities for IoT vendors.

Cybersecurity

Grand View Research reports that the global cybersecurity market

size was valued at US$ 184.93 billion in 2021 and is expected to

expand at a CAGR of 12.0% from 2022 to 2030. The increasing number

of cyber-attacks with the emergence of e-commerce platforms,

deployment of cloud solutions, and proliferation of smart devices

are some of the factors driving the market growth. Cyber threats

are anticipated to evolve with the increase in usage of devices

with intelligent and IoT technologies. As such, organisations are

expected to adopt and deploy advanced cyber security solutions to

detect, mitigate, and minimize the risk of cyber-attacks, thereby

driving the market growth.

Artificial Intelligence

MarketsandMarkets forecasts the global artificial intelligence

(AI) market size to grow US$ 58.3 billion in 2021 to US$ 309.6

billion by 2026, at a CAGR of 39.7% during the forecast period.

Various factors such as growth of data-based AI and advancement in

deep learning and need to achieve robotic autonomy to stay

competitive in a global market are expected to drive the adoption

of the AI solutions and services.

The benefit of investing in companies in these four key sectors

at a Seed stage are that:

-- Sure Valley Ventures can invest in these companies at

attractive valuations of between GBP2m to GBP8m and get up to 20%

of the company for initial investment amounts of between GBP0.75m

to GBP1.25m.

-- The investment sectors (AR/VR, IoT, AI, and Cybersecurity)

have massive growth potential ahead of them which creates a

tailwind behind the companies that are creating these new

markets.

-- These sectors are also ones that have the potential of

creating the next big European Companies and build on Europe's

existing technology strengths.

-- These companies have the potential to get to exponential

growth and of achieving an IPO or being acquired by one of the

Silicon Valley giants who are all investing in these sectors.

-- The Sure Valley Ventures Platform and Network can help

fast-track the development of these companies across the chasm to

the Series A investment round, which in turn increases the

potential for an outsized return and also reduces the risk of the

failure of a portfolio company.

In summary, Sure Ventures plc can gain exposure to all of these

benefits through its participation in the Sure Valley Ventures

Funds, as further outlined below.

PORTFOLIO BREAKDOWN

On 6 February 2018 the Company entered into a EUR4.5m commitment

to Sure Valley Ventures ("Fund I"), the sole sub-fund of Suir

Valley Funds ICAV and its investment was equalised into Fund I at

that date. On 31 August 2019 a further EUR2.5m was committed to

Fund I, taking the total investment in Sure Valley Ventures to

EUR7m. The first drawdown was made on 5 March 2018 and as at 31

March 2022, a total of EUR5,583,987 had been drawn down against

this commitment.

On 26 April 2019 the Company made a direct investment of

GBP500,000 into VividQ Limited, a deep tech start-up with world

leading expertise in 3D holography. This investment represents the

second direct investment of the Company, alongside Immotion Group

PLC, which was announced on 24th April 2018.

On 25 February 2022, Sure Ventures plc committed to invest GBP5m

into the second fund of Sure Valley Ventures

("Fund II"). Fund II completed an GBP85m first close of a GBP95m

UK software technology fund, which aims to increase the supply of

equity capital to high-potential, early-stage UK companies. As

detailed in the Statement of Position included in the following

financial statements, these two Sure Valley Ventures Fund

investments alongside the two direct investments, represent the

entire portfolio of Sure Ventures plc as at 31 March 2022.

On 8 June 2021, the Company announced a placing of 662,500

ordinary shares. The ordinary shares were admitted to trading on

the Specialist Fund Segment of the London Stock Exchange on 14 June

2021, under the existing ISIN: GB00BYWYZ460, taking the total

shares in admission as at 31 March 2022 to 6,013,225.

suir valley Funds ICAV

Suir Valley Funds ICAV (the "ICAV") is a close-ended Irish

collective asset-management vehicle with segregated liability

between sub-funds incorporated in Ireland pursuant to the Irish

Collective Asset-management Vehicles Acts 2015 and 2020 and

constituted as an umbrella fund insofar as the share capital of the

ICAV is divided into different series with each series representing

a portfolio of assets comprising a separate sub-fund.

The ICAV was registered on 18 October 2016 and authorised by the

Central Bank of Ireland as a qualifying investor alternative

investment fund ("QIAIF") on 10 January 2017. The initial sub-fund

of the ICAV is Sure Valley Ventures, or Fund I, which had an

initial closing date of 1 March 2017. Fund I invests in a broad

range of software companies with a focus on companies in the AR/VR,

AI and IoT sectors.

As at 31 March 2022 Fund I had commitments totaling EUR27m and

had made sixteen direct investments into companies spanning the

AR/VR, AI and IoT sectors. One of these investments was sold in

2019, giving Fund I its first realised gain on exit of around 5X

return on investment. On 12 March 2018, Immersive VR Education

Limited, Fund I's first investment, completed a flotation on the

London Stock Exchange (AIM) and the Dublin Stock Exchange (ESM).

The public company is now called ENGAGE XR Holdings PLC - ticker

EXR (Formally VR Education Holdings PLC - VRE). EXR was the first

software company to list on the ESM since that market's inception.

In July 2020, following an improvement in share price, Fund I

decided to sell sufficient shares to recover its initial

investment. This resulted in a realised gain of EUR73k being

payable to Sure Ventures plc, along with its share of the initial

investment, and some Escrow funds from the aforementioned exit. The

final Escrow payment from the sale was settled in July 2021, seeing

another EUR151k flowing to the plc. Total distributions from the

Fund I to the plc as at 31 March 2022 were EUR1,759,630.

suir valley VENTURES ENTERPRISE CAPITAL FUND

Sure Valley Ventures Enterprise Capital Fund is a close-ended UK

based GP/LP Fund which completed its first close on 1 March 2022.

The total commitments for this first close were GBP85m, with

potential for a further GBP10m to be raised in a secondary close.

The British Business Bank are the cornerstone investor of this

Fund, committing GBP50m of the initial GBP85m, with Sure Ventures

plc committing a total of GBP5m.

Fund II will have a similar investment strategy to the first

Fund, being a seed capital investor in high growth software

companies that are focused on bringing a disruptive innovation to

market. It plans to invest into 25 software companies from across

the UK through its new fund. Currently based in London, Dublin, and

Cambridge, the Sure Valley team will also be opening an office in

Manchester to help access deals in the significant and exciting

innovation clusters that have developed around creative

technologies in the North of England and in the Metaverse and AI

opportunities in cities such as Manchester, Leeds, Sheffield and

Newcastle.

As at 31 March 2022 the Fund had drawn down a total of GBP1.62m

and has made its first investment into a Belfast based company

called Retinize, for an amount of GBP1m. The total invested capital

to date for Sure Ventures plc was GBP95,000.

Performance

In the year to 31 March 2022 the Company's performance continued

to improve, as it returned a net asset value of GBP1.29/unit,

representing a 40% uplift from the audited March-21 NAV of 92p. The

NAV improvement is largely a result of the ICAV NAV seeing similar

gains, as more portfolio companies complete follow-on funding

rounds at increased valuations, and hence large unrealised gains

being booked. The two direct investments have have mixed results,

with Immotion Group PLC, closing the year at 4.7p, down slightly

from 5.05p at the previous year end, whilst VividQ closed a new

funding round to give Sure Ventures plc an unrealised gain of 59%

on its initial holding. Given the lack of revenue to support the

ongoing operational costs of the plc, these unrealised gains are

key to maintaining a steady NAV, until the point that we see more

exits and realised gains.

FutuRe Investment OUTLOOK

Fund I has achieved one very positive realised gain, recovered

its full investment in its listed portfolio company, as well as

seeing a number of unrealised gains across the portfolio. The

portfolio of current investments is continuing to mature, with more

companies completing series A funding rounds, which has started to

provide the NAV growth that was set out to achieve from inception.

As the investment period of this Fund draws to a close, there is

one more potential investment to be made, with all remaining

capital being allocated to follow-on funding of existing

investments as these companies continue to grow.

We remain confident in the future outlook of the Company in the

forthcoming financial year and in line with the prospectus,

particularly with the launch of the new Enterprise Capital Fund,

whilst also reserving the right to make further direct investments

provided there is sufficient working capital to do so.

Shard Capital AIFM LLP

Investment Manager

18 July 2022

4 Strategic Report

Business Review

The strategic report on pages 11 to 17 has been prepared to help

shareholders assess how the Company operates and how it has

performed. The strategic report has been prepared in accordance

with the requirements of Section 414 A-D of the Companies Act 2006

(the "Act") and best practice. The business review section of the

strategic report discloses the Company's risks and uncertainties as

identified by the board, the key performance indicators used by the

board to measure the Company's performance, the strategies used to

implement the Company's objectives, the Company's environmental,

social and ethical policy and the Company's future

developments.

PrincipaL activity

The Company carries on business as an investment trust and its

principal activity is to invest in companies in accordance with the

Company's investment policy with a view to achieving its investment

objective.

Strategic and investment policy

Investment Policy

The Company's Investment Policy can be found at page 70 of this

Annual Report.

Future developments

While the future performance of the Company is dependent, to a

large degree, on the performance of the Fund which, in turn, is

subject to many external factors, the board's intention is that the

Company will continue to pursue its stated investment objective as

outlined on page 2. The Company's future developments and outlook

are discussed in more detail in the Chairman's Statement on page 4

and the Investment Manager's Report on page 7 - 10.

Premium/Discount management

The board closely monitors the premium or discount at which the

Company's ordinary shares trade in relation to the Company's

underlying net asset value and takes action accordingly. Throughout

the period under review the Company's ordinary shares traded at

both a premium and discount to its underlying net asset value. The

board is of the view that an increase of the Company's ordinary

shares in issue provides benefits to shareholders, including a

reduction in the Company's administrative expenses on a per share

basis and increased liquidity in the Company's shares.

Whilst the board believes that it is in the shareholders' best

interests to prevent the Company's shares trading at a discount to

net asset value as shareholders will be unable to realise the full

value of their investments, the current trend is for listed

investment trusts to trade at a discount to net asset value.

Notwithstanding this current discount to net asset value, the

Company may from time to time acquire its own shares, should there

be sufficient liquidity to do so.

Corporate and operational structure

Operational and portfolio management

The Company has outsourced its operations and portfolio

management to various service providers as detailed below:

-- Shard Capital AIFM LLP is appointed as the Company's manager

(the "Manager" or "Investment Manager") and Alternative Investment

Fund Manager ("AIFM") for the purposes of the Alternative

Investment Fund Managers Directive ("AIFMD");

-- Apex Fund Services (Ireland) Limited is appointed to act as the Company's administrator;

-- Apex Secretaries LLP (formerly Throgmorton Secretaries LLP)

is appointed as the Company's secretary.

-- INDOS Financial Limited is appointed as the Company's depositary;

-- Computershare Investor Services plc is appointed as the Company's share registrar;

-- Shard Capital Partners LLP is appointed to act as the Company's placing agent; and

-- PKF Littlejohn LLP is appointed to act as the Company's auditors.

Alternative Investment Fund Managers Directive

In accordance with the AIFMD, the Company has appointed Shard

Capital AIFM LLP to act as the Company's AIFM for the purposes of

the AIFMD. The AIFM ensures that the Company's assets are valued

appropriately in accordance with the relevant regulations and

guidance. In addition, the Company has appointed INDOS Financial

Limited as depositary, to provide depositary services to the

Company as required by the AIFMD.

Donations

The Company made no political or charitable donations during the

period under review to organisations either within or outside the

EU (2021 - none).

Environment, human rights, employee, social and community

issues

The Company is required by law to provide details of

environmental matters (including impact of the Company's business

on the environment), employee, human rights, social and community

issues (including information about any policies it has in relation

to these matters and the effectiveness of those policies). The

Company does not have any employees and the board comprises

non-executive directors. As an investment trust, its activities do

not have a direct impact on the environment. The Company aims to

minimise any detrimental effect that its actions may have by

adhering to applicable social legislation, and as a result does not

maintain specific policies in relation to these matters.

The Company has no operations and therefore no greenhouse gas

emissions to report nor does it have responsibility for any other

emissions producing sources under the Companies Act 2006 (Strategic

Report and Directors Reports) Regulations 2013, including those

within its underlying investment portfolio. However, the Company

believes that high standards of corporate social responsibility

such as the recycling of paper waste will support its strategy and

make good business sense.

In carrying out its investment activities and in relationships

with suppliers, the Company aims to conduct itself responsibly,

ethically and fairly.

Modern slavery

Due to the nature of the Company's business, the board does not

consider the Company to be directly within the scope of modern

slavery regulations. The board considers the Company's supply

chains, being with professional service providers within the UK or

the EU to be low risk in relation to this matter.

Anti-bribery and corruption

It is the Company's policy to conduct its business in an ethical

manner. The Company takes a zero tolerance approach to bribery and

corruption and is committed to acting professionally, fairly and

with integrity in its business dealings.

Principal Risks and Uncertainties

The board has carried out a robust assessment of its risks and

controls as detailed below. The day-to-day risk management

functions of the Company have been delegated to Shard Capital AIFM

LLP (the 'Manager'), which reports to the board.

OperationaL Risks

Third Party Service Providers

The Company has no employees and the directors have all been

appointed on a non-executive basis. Whilst the Company has taken

all reasonable steps to establish and maintain adequate procedures,

systems and controls to enable it to comply with its obligations,

the Company is reliant upon the performance of third-party service

providers for its executive function. In particular, the Manager,

Depositary, Administrator and Registrar amongst others, will be

performing services which are integral to the day-to-day operation,

including IT, of the Company.

The termination of service provision by any service provider, or

failure by any service provider to carry out its obligations to the

Company, or to carry out its obligations to the Company in

accordance with the terms of its appointment, could have a material

adverse effect on the Company's operations and its ability to meet

its investment objective.

Mitigation

Day-to-day oversight of third-party service providers is

exercised by the Manager and reported to the board on a quarterly

basis. As appropriate to the function being undertaken, each of the

service providers is subject to regular performance and compliance

monitoring. The performance of Shard Capital AIFM LLP in its duties

to the Company is subject to ongoing review by the board on a

quarterly basis as well as formal annual review by the Company's

management engagement committee.

The appointment of each service provider is governed by

agreements which contain the ability to terminate each of these

counterparties with limited notice should they continually or

materially breach any of their obligations to the Company.

Reliance on key individuals

The Company will rely on key individuals at the Manager to

identify and select investment opportunities and to manage the

day-to-day affairs of the Company. There can be no assurance as to

the continued service of these key individuals at the Manager. The

departure of key individuals from the Manager without adequate

replacement may have a material adverse effect on the Company's

business prospects and results of operations. Accordingly, the

ability of the Company to achieve its investment objective depends

heavily on the experience of the Manager's team, and more generally

on the ability of the Manager to attract and retain suitable

staff.

Mitigation

The interests of the Manager are closely aligned with the

performance of the Company through the management and performance

fee structures in place and direct investment by certain key

individuals of the Manager. Furthermore, investment decisions are

made by a team of professionals, mitigating the impact loss of any

single key professional within the Manager's organisation. The

performance of the Manager in its duties to the Company is subject

to ongoing review by the board as well as formal annual review by

the management engagement committee.

Fluctuations in the market price of Issue Shares

The market price of the issued shares may fluctuate widely in

response to different factors and there can be no assurance that

the issued shares will be repurchased by the Company even if they

trade materially below their net asset value. Similarly, the shares

may trade at a premium to net asset value whereby the shares can

trade on the open market at a price that is higher than the value

of the underlying assets. There can be no assurance, express or

implied, that shareholders will receive back the amount of their

investment in the issued shares.

Mitigation

The Manager and the board closely monitor the level of discount

or premium at which the shares trade on the open market. Subject to

shareholders' approval, and compliance with the relevant companies

legislation, the Company may purchase the shares in the market with

the intention of enhancing the net asset value per ordinary share,

however there can be no assurance that any purchases will take

place or that any purchases will have the effect of narrowing any

discount to net asset value at which the ordinary shares may trade.

When the shares trade at a premium the Company may issue shares to

reduce the premium at which shares trade. As at 31 March 2022 the

shares were trading at a discount to net asset value.

Investments

Achievement of the Investment Objective

There can be no assurance that the Manager will continue to be

successful in implementing the Company's investment objective.

Mitigation

The Company's investment decisions are delegated to the Manager.

Performance of the Company against its investment objectives is

closely monitored on an ongoing basis by the Manager and the board

and is reviewed in detail at each board meeting. Any action

required to mitigate underperformance is taken as deemed

appropriate by the Manager.

Borrowing

The Company may use borrowings in connection with its investment

activities including, where the Manager believes that it is in the

interests of shareholders to do so, for the purposes of seeking to

enhance investment returns. Such borrowings may subject the Company

to interest rate risk and additional losses if the value of its

investments falls. Whilst the use of borrowings should enhance the

net asset value of the issued shares when the value of the

Company's underlying assets is rising, it will have the opposite

effect where the underlying asset value is falling. In addition, in

the event that the Company's income falls for whatever reason, the

use of borrowings will increase the impact of such a fall on the

Company's return and accordingly will have an adverse effect on the

Company's ability to pay dividends to shareholders.

Mitigation

The Manager and the board closely monitor the level of gearing

of the Company. The Company has a maximum limitation on borrowings

of 20% of net asset value (calculated at the time of borrowing)

which the Manager may affect at its discretion. As at the date of

this report, the Company had no borrowings outstanding.

Liquidity of Investments

The Company expects to have a material level of exposure to

unquoted companies that are aligned with the Company's strategy and

that present opportunities to enhance the Company's return on its

investments. Such investments, by their nature, involve a higher

degree of valuation and performance uncertainties and liquidity

risks than investments in listed and quoted securities and they may

be more difficult to realise. The illiquidity of such investments

may make it difficult for the Company to sell them if the need

arises and may result in the Company realising significantly less

than the value at which it had previously recorded such

investments. Investments in unlisted equity securities, by their

nature, involve a higher degree of valuation and performance

uncertainties and liquidity risks than investments in listed

securities and therefore may be more difficult to realise.

Mitigation

The Company has established investment restrictions on the

extent to which it can invest up to 15% of net asset value in a

single investment. However, this restriction does not apply to

investments in the Fund or any Further Funds or collective

investment vehicles managed by third parties. Compliance with these

restrictions is monitored by the Manager and by the board on an

ongoing basis.

Regulations

Tax

Any changes in the Company's tax status or in taxation

legislation could affect the value of investments held by the

Company, affect the Company's ability to provide returns to

shareholders and affect the tax treatment for shareholders of their

investments in the Company.

Mitigation

The Company intends at all times to conduct its affairs so as to

enable it to qualify as an investment trust for the purposes of

Chapter 4 of Part 24 of the Corporation Tax Act 2010. Both the

board and the Manager are aware of the requirements which are to be

fulfilled in any accounting period for the Company to maintain its

investment trust status. Adherence to the conditions required to

satisfy the investment trust criteria are monitored by the

compliance function of the Manager and reviewed by the board on a

regular basis.

Breach of applicable legislative obligations

The Company and its third-party service providers are subject to

various legislation and regulations, including, but not limited to

The Data Protection Act 2018 and the General Data Protection

Regulation. Any breach of applicable legislative obligations could

have a negative impact on the Company and impact returns to

shareholders.

Mitigation

The Company engages only with third party service providers

which hold the appropriate regulatory approvals for the function

they are to perform, and can demonstrate that they can adhere to

the regulatory standards required of them. Each appointment is

governed by agreements which contain the ability to terminate each

of these counterparties with limited notice should they continually

or materially breach any of their legislative obligations, or their

obligations to the Company more broadly. Additionally, each of the

counterparties is subject to regular performance and compliance

monitoring by the Manager, as appropriate to their function, to

ensure that they are acting in accordance with applicable

regulations and are aware of any upcoming regulatory changes which

may affect the Company. Performance of third party service

providers is reported to the board on a quarterly basis, whilst the

performance of the Manager in its duties to the Company is subject

to ongoing review by the board on a quarterly basis as well as

formal annual review by the management engagement committee.

Key Performance Indicators

The board monitors success in implementing the Company's

strategy against a range of key performance indicators ("KPIs"),

which are viewed as significant measures of success over the longer

term. Although performance relative to the KPIs is also monitored

over shorter periods, it is success over the long term that is

viewed as more important, given the inherent volatility of

short-term investment returns. The principal KPIs are set out

below:

KPI Performance

Year ended 31 Year ended 31

March 2022 March 2021

--------------------- --------------------

Movement in net asset value Increased by Decreased by

per ordinary share 40.03% 0.58%

--------------------- --------------------

Premium/discount (after deducting Traded at a discount Traded at a premium

borrowings at fair value) of 20.87% at of 14.05% at

the year end the year end

--------------------- --------------------

Movement in the share price Decreased by Decreased by

2.9% 0.12%

--------------------- --------------------

The Company does not currently follow any benchmark. Similarly,

Sure Valley Ventures (the "Fund") does not follow any benchmark.

Accordingly, the portfolio of investments held by the Company and

Sure Valley Ventures will not mirror the stocks and weightings that

constitute any particular index or indices, which may lead to the

Company's shares failing to follow either the direction or extent

of any moves in the financial markets generally (which may or may

not be to the advantage of shareholders).

Promoting the success of the Company

Under Section 172 of the Companies Act 2006, the board has a

duty to promote the long-term success of the Company for the

benefit of its shareholders as a whole and, in doing so, have

regard to the likely consequences of its decisions in the long-term

upon the Company's other stakeholders and the environment.

The Company's objective is to achieve capital growth for

investors through exposure to early stage technology companies,

with a focus on software-centric businesses in its chosen target

markets.

The board believes that the values of integrity, accountability

and transparency form the basis of the Company's corporate culture

and promote good standards of governance.

The board has identified the Company's main stakeholders to be

its shareholders, Investment Manager and other key service

providers. The board seeks to understand the priorities of its

stakeholders and engages with them through the communication and

governance processes that it has put in place.

Shareholders

The board believes that transparent communication with

shareholders is important. In addition to the Annual Report and the

Half-yearly Report, the Company publishes quarterly portfolio

updates which are available on the Company's website together with

other information that the board believes shareholders will find

useful. The board welcomes feedback from shareholders and the

Investment Manager provides such feedback to the board on a regular

basis.

During the year, the Company issued 662,500 new ordinary shares

in response to investor demand. The board believes that share

issues are in the interests of shareholders as a whole as they

provide additional finance for investment opportunities, enable the

Company's fixed costs to be spread over a wider base and provide a

source of liquidity in the Company's shares.

Investment Manager

The Investment Manager has a fundamental role in promoting the

long-term success of the company. The board regularly reviews the

performance of the investment portfolio at quarterly board meetings

and performs a formal annual evaluation of the performance of the

Investment Manager. This contact enables constructive regular

dialogue between the Investment Manager and the board.

Other key service providers

The board believes that strong relationships with its other key

service providers (Company Secretary, Administrator, Depositary and

Registrar) are also important for the long-term success of the

Company. There is regular contact between the board and the

Company's other key service providers. The board performs an annual

review of the services provided by the Company Secretary,

Administrator, Depositary and Registrar to ensure that these are in

line with the Company's requirements.

Environmental, Social and Governance ("ESG")

The board and the Investment Manager recognise the importance of

the impact of the Company's decisions and ESG factors are

integrated in the investment process.

Approval

The Strategic Report was approved by the board of directors on

18 July 2022 and signed on its behalf by:

Perry Wilson

Chairman

5 Directors' Report

Bo a rd of Directors

Perry Wilson

Chairman of the board and the management engagement committee

and a member of the audit committee.

Perry Wilson (Chairman) (independent)

Perry Wilson is a financial services professional with over 25

years' experience in investment banking and fund management,

responsible for running portfolio risk positions in global markets.

He started his career in accountancy before joining the asset

trading group at Lazard in 1987, focusing on illiquid credit and

structured products and going on to become a director of the

bank.

In 2003 Mr Wilson joined Argo Capital as executive director, an

AIM listed alternative investment fund management firm and was part

of a small team of portfolio managers that oversaw the group's

fiftyfold AUM growth to US$1.3bn at it's height. After leaving Argo

in 2010 Mr Wilson joined Integra Capital to implement a liquid

credit strategy before setting up a fixed income sales and trading

operation for a Central Asian investment bank, Visor Capital in

2013.

Since 2015 Mr Wilson has been on the board of a number of UK and

offshore financial services firms and investment funds, as

independent non-executive director, and also acted as chair of

trustees for a UK pension plan, providing corporate governance and

oversight utilising his extensive financial markets background and

experience.

St. John Agnew

St. John Agnew

St. John trained as a solicitor and was an in-house Commercial

and Banking Counsel for TSB Bank. His responsibilities included

drafting and negotiating legal documentation in relation to all

Bank lending and commercial arrangements. This included many types

of commercial contracts and involved a close working relationship

with the technology team who required advice on a steady flow of

technology contracts.

He became an Investment Manager in 2000 and set up a fund in the

Cayman Islands in 2004 based on Technical Analysis which he

successfully operated and closed in late 2007. He continues to

advise on investment and is currently an Investment Manager

registered with Credo Capital with his own private clients.

St.John has also served as Trustee on a Pension fund for a

Charity and, using his legal and investment knowledge, he helped to

restructure the board to allow it to recognise and meet its

extensive ongoing Pension obligations. He is also currently a

non-executive director of a food company, The Big Prawn Company,

where he uses his knowledge and experience to help guide this

company.

gareth burchell

Gareth Burchell

Gareth Burchell began his career in the insurance industry and

spent three years at RBS Insurance prior to beginning his career in

investment advice and management. Mr. Burchell is currently Head of

Shard Capital Stockbrokers and chairs an investment committee that

specialises in providing funding for both listed and unlisted small

companies. Mr Burchell has had a focus on the small cap arena for

15 years and he and his team have provided GBP90 million of funding

across 221 companies. He has an in-depth knowledge of the UK

listing process of various small cap exchanges.

Statutory information

Board members, and directors' and officers' insurance

The names and biographical details of the board members who

served on the board as at the year end can be found on page 19.

During the year under review the Company's directors' and

officers' liability insurance for its directors and officers as

permitted by section 233 of the Companies Act 2006 was covered and

maintained by Shard Capital AIFM LLP.

Status of the Company

The Company is an investment company within the meaning of

section 833 of the Companies Act 2006.

The Company operates as an investment trust in accordance with

Chapter 4 of Part 24 of the Corporation Tax Act 2010 and the

Investment Trust (Approved Company) (Tax) Regulations 2011. The

Company has obtained its initial approval as an investment trust

from HM Revenue & Customs. In the opinion of the directors, the

Company has conducted its affairs since its initial approval as an

investment trust in order that it is able to maintain its status as

an investment trust.

The Company is an externally managed closed-ended investment

company with an unlimited life and has no employees.

Internal controls and risk management

Details of the Company's principal risks and uncertainties can

be found in the Strategic Report on pages 11 to 17 inclusive of

details of the Company's internal controls. Details of the

Company's application of hedging arrangements, if any, are set out

on page 72, the Investment Policy section of these financial

statements.

Share capital - voting and dividend

As at 31 March 2022, the Company had 6,013,225 (2021: 5,350,725)

ordinary shares in issue. There are no other classes of shares in

issue and no shares are held in treasury.

The maximum number of shares which can be admitted to trading on

the LSE without the publication of a prospectus is 20% of the

ordinary shares in issue on a rolling 12 month basis at the time of

admission of the shares.

During the year under review a total of 662,500 (2021: 480,769)

ordinary shares were issued as detailed below:

Shares issued Price paid per Premium to net

share (pence) asset value (%)

(1)

============== ===============

14 June 2021 662,500 100.00 8.63%

============== ============== =============== =================

(1) Last published NAV at time of issue

As at 31 March 2022 there were 6,013,225 ordinary shares of 1p

in issue. Since the year end a further 441,860 ordinary shares have

been issued.

The ordinary shares carry the right to receive dividends and

have one voting right per ordinary share. There are no shares which

carry specific rights with regard to the control of the Company.

The shares are freely transferable. There are no restrictions or

agreements between shareholders on the voting rights of any of the

ordinary shares or the transfer of shares.

The Company has been incorporated with an unlimited life.

On a winding up or a return of capital by the Company, the

ordinary shareholders are entitled to the capital of the

Company.

No final dividend is being recommended. The Company's policy is

to pay dividends, if any, on an annual basis, as set out in the

Company's prospectus dated 17 November 2017 and the supplementary

prospectus dated 2 January 2018 (the "Prospectus"). There were no

dividends paid in respect of the year ended 31 March 2022 (2021 -

None).

The Company will pay out such dividends as are required for it

to maintain its investment trust status.

Substantial share interests

The Company has received the following notification in

accordance with the Disclosure and Transparency Rule 5.1.2R of an

interest in the voting rights attaching to the Company's issued

share capital.

The Company received a notification on 8 March 2021 that Pires

Investments plc had acquired an interest in 1,500,000 ordinary

shares in the Company, representing 25.0% of the Company's ordinary

shares in issue at 31 March 2022.

Independent auditor

The Company's independent auditor, PKF Littlejohn LLP ("PKF"),

was appointed by the members on 16 April 2018 and has expressed its

willingness to continue to act as the Company's auditor for the

forthcoming financial year. The audit committee has carefully

considered the auditor's appointment, as required in accordance

with its terms of reference, and, having regard to its

effectiveness and the services it has provided the Company during

the period under review, has recommended to the board that the

independent auditor be appointed at the forthcoming Annual General

Meeting ("AGM"). At the AGM resolutions will be proposed for the

appointment of the independent auditor and to authorise the

directors to agree its remuneration for the forthcoming financial

year. In reaching its decision, the audit committee considered the

points detailed on pages 32 to 34 of the Audit Committee's

report.

Audit information

As r equi r e d b y section 4 1 8 o f t h e C om p ani e s A c t

2 0 06, t h e directors wh o he l d offi ce a t t h e d a te o f t

hi s repor t each confir m that , s o far as the y are awar e ,

there is no rele vant aud i t information o f w hich the C om p an

y 's au d itor is un aware a n d e ac h director ha s t a k e n al

l t h e s t ep s r e qui r e d o f a director to ma k e t h e m s

elve s a w a r e o f a n y r e l ev a n t a u d i t i n f o r m a t

io n a n d t o e s t ablish tha t t h e C om p an y ' s audi t o r

is awa re of that info r ma t ion.

Articles of Association

An y amendmen t s to t h e C om p an y ' s ar t icle s of a s so

cia t io n mus t b e mad e b y spe cia l r e s ol u t ion.

brexit

The broader impacts of Brexit may have an effect on the

financial statements and operations in the future, though it is not

possible to quantify likely impacts at this stage, any effects will

be reflected in the Company's underlying investments future price

movements. The board and all relevant parties continue to monitor

the implications for the Company and implement certain internal

controls to mitigate any risks that may arise in the future.

COVID-19 Pandemic

During the year and subsequent to the year end, the COVID-19

pandemic is ongoing and causing significant financial market and

social dislocation. The ultimate extent of the effect of this on

the Company is uncertain. The directors are continuing to monitor

developments relating to COVID-19 and the Company continues to

coordinate its operational response based on existing business

continuity plans and ongoing guidance from global health

organisations, relevant governments, and general pandemic response

best practices.

Going concern

The directors have reviewed the financial projections of the

Company from the date of this report, which shows that the Company

will be able to generate sufficient cash flows in order to meet its

liabilities as they fall due. Accordingly, the directors are

satisfied that the going concern basis remains appropriate for the

preparation of the financial statements. The Company also has

detailed policies and processes for managing the risks, set out in

the Investment Policy on pages 71 to 72.

Viability statement

In accordance with the revised Association of Investment

Companies Code of Corporate Governance published in February 2019

and revised UK Corporate Governance Code, published by the

Financial Reporting Council in July 2018, the directors have

assessed the prospects of the Company over a three-year period

ending March 2025. The board believes this period to be appropriate

taking into account the current trading position and the potential

impact of the principal risks that could affect the viability of

the Company. At 31 March 2022, the Company had cash balances of

GBP233,329 (2021: GBP1,201,153) in excess of all liabilities. There

are therefore limited risks to the viability of the Company.

Analysis to assess viability has focused on the risks in

delivery of the growth of the business and a series of projections

have been considered changing funding levels and the performance of

the assets acquired.

The analysis demonstrates that, the Company would be able to

withstand the impact of the risks identified. Based on the robust

assessment of the principal risks, prospects and viability of the

Company, the board confirms that they have reasonable expectation

that the Company will be able to continue in operation and meet its

liabilities as they fall due over the three-year period ending

March 2025.

Management and administration

Company Secretary

Apex Secretaries LLP (formerly Throgmorton Secretaries LLP) (the

"Company Secretary") is the company secretary of the Company.

Administrator

Apex Fund Services (Ireland) Ltd (the 'Administrator'), is the

administrator of the Company. The Administrator provides the

day-to-day administration of the Company. The Administrator is also

responsible for the Company's general administrative functions,

such as the calculation of the net asset value and maintenance of

the Company's accounting records.

Under the terms of the administration agreement, the

Administrator is entitled to an annual administration fee equal to

the greater of: (i) EUR28,000 per annum; and (ii) an amount equal

to 0.08% of the portion of NAV up to and including EUR100 million,

0.06% of the portion of NAV between EUR100 million and EUR200

million and 0.05% of the portion of NAV above EUR200 million

(exclusive of VAT and out of pocket expenses). The Administrator is

also entitled to reimbursement of all reasonable out of pocket

expenses incurred by it in connection with the performance of its

duties. The administration agreement can be terminated by either

party by providing 90 days' written notice.

Manager

Shard Capital AIFM LLP (the 'Manager'), a UK-based company

authorised and regulated by the Financial Conduct Authority, is the

Company's manager and alternative investment fund manager ("AIFM")

for the purposes of the Alternative Investment Fund Managers

Directive ("AIFMD"). The Manager is responsible for the

discretionary management of the Company's assets and ensures that

these are valued appropriately in accordance with the relevant

regulations and guidance.

Under the terms of the management agreement, the Manager is

entitled to a management fee and a performance fee together with

reimbursement of reasonable expenses incurred by it in the

performance of its duties. From the period from first admission,

the management fee payable was based on 1.25% of the NAV. The

Manager is also entitled to receive a performance fee equal to 15%

of any excess returns over a high watermark, subject to achieving a

hurdle rate of 8% in respect of each performance period. Further

details on the management fee and the performance fee can be found

in Note 4 to the financial statements. The management agreement can

be terminated by either party providing twelve months' written

notice.

Depositary

The Company's depositary is INDOS Financial Limited (the

"Depositary"), a company authorised and regulated by the Financial

Conduct Authority. Under the terms of the depositary services

agreement the Depositary is entitled to a monthly depositary fee

equal to the greater of: (i) GBP2,000 and GBP2,917 per month

(depending on the activity of the Company); and (ii) an amount

equal to 1/12 of 0.03% of NAV (exclusive of VAT and out of pocket

expenses). The depositary services agreement can be terminated by

either party by providing 90 days' written notice.

Change of control

There are no agreements which the Company is party to that might

be affected by a change of control of the Company.

Subsequent events

Following the year end, Sure Ventures plc raised gross proceeds

of GBP475,000 by way of a private placing. The ordinary shares were

issued at 107.5p per share, representing the closing mid-price on

31 May 2022.

Future developments

Indications of likely future developments in the business of the

Company are set out in the Strategic Report on pages 11-17.

regulatory disclosures

The disclosures below are made in compliance with the

requirements of Listing Rule 9.8.4.

Listing Rule

9.8.4 (1) - capitalised The Company has not capitalised any interest

interest in the year under review.

======================== ====================================================

9.8.4(2) - unaudited The Company has not published any unaudited

financial information financial information in either a class 1 circular

or a prospectus or in respect of any profit

forecast or profit estimate in accordance with

listing rule 9.2.18.

======================== ====================================================

9.8.4 (3) - deleted This provision has been deleted.

======================== ====================================================

9.8.4 (4) - incentive The Company has no long-term incentive schemes

schemes in operation.

======================== ====================================================

9.8.4 (5) and (6) Gareth Burchell has agreed to waive his director's

- waiver fee.

======================== ====================================================

9.8.4 (7), (8) During the year under review, the Company issued

and (9) a total of 662,500 (2021: 480,769) ordinary

shares with a nominal value of GBP0.01 and

an average price of 100 pence per share for

a total consideration of GBP662,500 (2021:

GBP475,000) excluding commission and issue

costs. Further details can be found on page

47.

======================== ====================================================

9.8.4 (8) and 9.8.4 The Company is not part of a group of companies.

(9) - relate to These particular Listing Rules therefore, do

companies that are not apply.

part of a group

of companies

======================== ====================================================

9.8.4 (10) - contract During the year under review, there were no

of significance contracts of significance subsisting to which

the Company is a party and in which a director

of the Company is or was materially interested

or between the Company and a controlling shareholder.

9.8.4 (11) The Company is not party to any contracts for

the provision of services to the Company by

a controlling shareholder.

====================== =======================================================

9.8.4 (12) and During the year under review, there were no

(13) - arrangements under which a shareholder has

waiving dividends waived or agreed to waive any dividends or

future dividends.

====================== =======================================================

9.8.4 (14) As set out in the prospectus dated 17 November

2017, the Company has not voluntarily adopted

Listing Rule 9.8.4(14).

====================== =======================================================

By order of the board

Apex Secretaries LLP

Company Secretary

Date: 18 July 2022

Corporate Governance Statement

The corporate governance statement explains how the board has

sought to protect shareholders' interests by protecting and

enhancing shareholder value. The directors are ultimately

responsible for the stewardship of the Company and this section

explains how they have fulfilled their corporate governance

responsibilities. This corporate governance statement forms part of

the directors' report.

As set out in the Prospectus, the Company has adopted certain

key provisions of the UK Listing Rules in accordance with the

London Stock Exchange (LSE) listings. Pursuant to the Listing Rules

as voluntarily adopted by the Company, companies must "comply or

explain" against each of the provisions of the UK Corporate

Governance Code (the "UK Code") published by the Financial

Reporting Council ("FRC"). The board is committed to high standards

of corporate governance. The Listing Rules and the Disclosure

Guidance and Transparency Rules ("DTR") require companies to

disclose how they have applied the principles and provisions of the

UK Code. A copy of the UK Code is available from the website of the

Financial Reporting Council at

https://www.frc.org.uk/directors/corporate-governance-and-stewardship/uk-corporate-governance-code

.

The Association of Investment Companies ("AIC") has published

its own Code on Corporate Governance (the "AIC Code"). The FRC has

confirmed that AIC member companies who report against the AIC Code

will be meeting their obligations in relation to the UK Code and

the associated disclosure requirements of the DTR. The AIC Code is

available from the AIC's website at www.theaic.co.uk.

The board has considered the principles and provisions of the

AIC Code. The AIC Code addresses the principles and provisions set

out in the UK Code, as well as setting out additional principles

and provisions on issues that are of specific relevance to the

Company.

The board considers that voluntarily reporting against the

principles and provisions of the AIC Code, which has been endorsed

by the Financial Reporting Council, provides more relevant

information to shareholders.

Statement of compliance

The Company has complied with the recommendations of the AIC

Code and the relevant provisions of the UK Code, except as set out

below.

The UK Code includes provisions relating to:

-- The role of the chief executive;

-- Executive directors' remuneration;

-- The appointment of a senior independent director; and

-- The need for an internal audit function.

The board considers these provisions are not relevant to the

Company, being an externally managed investment company with no

executive directors. In particular, all of the Company's day-to-day

management and administrative functions are outsourced to third

parties. As a result, the Company has no executive directors,

employees or internal operations. The Company has therefore not

reported further in respect of these provisions.

In addition, the board does not, at present, consider that

separate nomination and remuneration committees would be

appropriate given the board's size, being three members in total.

Currently, decisions concerning the board's remuneration,

nomination and board appraisals are undertaken by the board as a

whole. However, the need for separate nomination and remuneration

committees and an internal audit function will be kept under

review.

The Board of Directors

The board consists of three directors, all of whom are

non-executive directors. Biographies of the directors are shown on

page 19 and demonstrate the wide range of skills and experience

that they bring to the board. The directors possess business and

financial expertise relevant to the direction of the Company and

consider themselves to be committing sufficient time to the

Company's affairs.

None of the directors has a service contract with the Company,

nor are any such contracts proposed. Each director has been

appointed pursuant to a letter of appointment entered into with the

Company. The directors' appointment can be terminated in accordance

with the articles of association and without compensation. There

are no agreements between the Company and any director which

provide for compensation for loss of office in the event that there

is a change of control of the Company.

Copies of the letters of appointment will be available at the

AGM.

The Chairman, Perry Wilson, is independent and considers himself

to have sufficient time to commit to the Company's affairs. The

Chairman's other commitments are detailed in his biography on page

19.

The directors have determined that the size of the Company's

board does not warrant the appointment of a senior independent

director at this time. All of the directors are available to

address shareholder queries or engage in consultation as

required.

The operation of the Board

The board of directors meets at least four times a year and more

often if required.

The table below sets out the directors' attendance at board and

audit committee meetings held in the financial year ended 31 March

2022, against the number of meetings each board or audit committee

member was eligible to attend.

Director Board Audit Committee

======

Perry Wilson 7/7 2/2

================= ====== ================

Gareth Burchell 7/7 2/2

================= ====== ================

St. John Agnew 7/7 2/2

================= ====== ================

No individuals other than the committee or board members are

entitled to attend the relevant meetings unless they have been

invited to attend by the board or relevant committee.

Directors are provided with a comprehensive set of papers for

each board or committee meeting, which equips them with sufficient

information to prepare for the meetings.

The board has a formal schedule of matters specifically reserved

to it for decision to ensure effective control of strategic,

financial, operational and compliance issues, which includes:

-- The Company's structure including share issues and setting a

discount/premium management programme;

-- Risk management

-- Appointing the Manager and other service providers and setting their fees;

-- Approving board changes including the audit committee and management engagement committee;

-- Considering and authorising board conflicts of interest;

-- Approving the Company's annual accounts and half yearly

accounts including accounting policies;