TIDMSURE

RNS Number : 6953K

Sure Ventures PLC

23 December 2022

Sure Ventures plc ('Sure Ventures' or 'the Company')

Portfolio Update Q3 2022, NAV Calculation and Director

commentary

Sure Ventures is a London listed venture capital fund which

invests in early stage software companies in the rapidly growing

technology areas of Augmented Reality ('AR'), Virtual Reality

('VR'), Internet of Things ('IoT') and Artificial Intelligence

(AI). We are pleased to provide an update on the Company's

investment portfolio.

SURE VALLEY VENTURES FUND

Sure Ventures made a EUR7million commitment to Sure Valley

Ventures Fund ('Sure Valley') representing an interest in Sure

Valley of approximately 25.9%. This commitment was made at a price

of EUR1.00 per share. The current NAV of the Sure Valley Ventures

ICAV is EUR1.40 which is a 4.76% decrease from its NAV as at Q1

2022.

Sure Valley has several investments across the AI, AR, VR and

IoT sectors and the major contributing factors and commentary on

underlying companies that has driven this NAV calculation are as

follows:

GetVisibility

This software delivers visibility over unstructured data, e.g.

Word documents or pdfs, for enterprises, by automatically,

accurately and precisely scanning and classifying the data to a

corporate taxonomy using artificial intelligence (AI) at scale (NLP

and Neural Networks). The software enables customers to find,

protect and remediate issues with sensitive/confidential and

regulated data. Getvisibility also integrates into data protection

solutions like Azure Information Protection (AIP) from Microsoft to

allow customers to apply protection automatically (removing the

need for manual intervention by staff).

GetVisibility have made some key customer wins, has opened a new

US West Coast Office in San Francisco, California and has be

awarded the Horizon Europe Seal of Excellence. The product role out

is positive and we are very pleased with their progress and look

forward to sharing more news in the Q4 update.

Smarttech247

Smarttech247 is a multi-award-winning MDR (Managed Detection

& Response) company and a

market leader in Security Operations. Trusted by global

organizations, Smarttech247 combine

threat intelligence with managed detection and response to

provide actionable insights, 24/7

threat detection, investigation, and response. Smarttech247's

service is geared towards proactive

prevention and this is done by utilizing the latest in cloud,

big data analytics and machine learning,

along with Smarttech247's industry leading incident response

team.

Smarttech 247 has now listed on AIM on the 15(th) of December

2022 at a valuation of GBP36.8m raising GBP3.67m from investors and

will us the cash injection to fund its continued international

growth. The Company is profitable and cash generative and has

achieved significant revenue growth in FY21 (20% over projected

revenue and 50% growth compared to FY20) and expects continued

growth in FY22.

Smarttech247 has a diverse portfolio of blue-chip customers that

includes pharmaceutical, technology, industrial and services

companies. The Company has demonstrated a return on investment for

clients that have implemented its platform. Forrester Consulting

determined that the VisionX product provides in excess of a 300%

ROI and EUR2 million net of present value (NPV), providing

customers with a "payback" on investment within 6 months.

Smarttech247 is highly focused on innovation and operational

excellence and has exciting plans to continue to expand its

Research and Development department in order to further enhance its

security technologies. Two new proprietary technologies ThreatHub

and VisionX were launched in 2022, in addition to NoPhish in

2021.

EveryAngle-New Investment

We are pleased to announce a new investment completed by the

first Sure Valley Ventures fund ("SVV1") in EVERYangle Ltd, trading

as EVERYANGLE, a Dublin-based, computer-vision company that helps

physical retailers, hospitality venues, and convenience service

stations to optimise operations.

EVERYANGLE has raised EUR2.7 million in a seed fundraise which

will be used to accelerate sales, invest in ongoing product

development and drive further expansion in the US and UK. The

funding round was led by Sure Valley Ventures, Act Venture Capital

and Furthr VC (formerly DBIC Ventures), with participation from

Enterprise Ireland.

EVERYANGLE's platform uses computer vision and machine learning

to analyse CCTV footage rapidly and cost effectively at-scale to

help retailers, hospitality and fuel station operators gain rich

in-store customer insights, reduce loss and optimise their

operations. The company plans to increase its headcount over the

next 24 months with recruitment underway for key hires in machine

learning, data science, software engineering, product management

and sales. EVERYANGLE has developed strategic go-to-market

partnerships with major vendors including Cisco and SAP, global

distributors such as TD Synnex, as well as international reseller

partners including CDW and WWT. These extensive partnerships enable

EVERYANGLE to serve sectors such as retail, hospitality,

manufacturing and healthcare, with customers including Mulberry,

Peloton and Oxford Industries.

Listed holdings

Equity markets have been volatile, and both Engage XR (EXR.L)

and Immotion PLC (IMMO.L) traded lower on a quarter-on-quarter

basis. The AIFM are happy with both positions and are long term

investors.

Immotion PLC

With revenue of GBP4.4m for the first half of 2022, almost

double the same period last year (and exceeding that of our

seasonally stronger H2 last year) the strength of our core LBE

business is being demonstrated clearly and I am excited by its

growth prospects.

The decision to focus all our efforts on LBE is delivering

results and with the disposal of Uvisan and the spin out of HBE now

agreed in principle we can, as we move through the remainder of H2,

focus our planning and resources on accelerating growth of our core

LBE partner estate.

We believe that considerable growth opportunities lie ahead of

us in both the aquarium sector, where we are now a well-established

player, and in the zoo market where we have taken our initial steps

in what should be an even larger market.

ENGAGE XR

Interim results in September 2022 showed that the business was

trading well with total revenue for the Group up c.41% to EUR1.76m

(H1 2021: EUR1.25m ), ENGAGE revenue up 62% to EUR1.46m (H1 2021:

EUR0.90m) with the Unaudited gross margin 81% in H1 2022 (H1 2021:

80%) and net cash of EUR4.9m as at 30 June 2022.

While interest remains strong in ENGAGE, the Board expects that

the Group will be behind current market consensus expectations for

2022 in terms of revenue and EBITDA loss. The Board currently

expects to report Group revenues for the year to 31 December 2022

of between EUR3.5m and EUR4.0m with an EBITDA loss of between

EUR5.6m and EUR5.9m reflecting the increased headcount in the

Group. ENGAGE revenues are expected to have increased by at least

70% year on year and now represent approximately 86% of the Group's

revenues.

SURE VALLEY VENTURES ENTERPRISE CAPITAL FUND

Sure Valley Ventures ("SVV") has led a GBP3m seed round in

Opsmatix Systems Limited trading as Jaid ("Jaid"), an innovative

technology firm providing AI-powered human communication solutions,

marking the fund's second investment. The proceeds of the funding

will be used to expand its industry-leading machine learning team,

build out business development efforts across America and Europe

and expand into Asia.

Jaid is a rapidly growing company that provides AI as a Service

(AIaaS) solutions to businesses to automate a variety of use cases,

including client service automation, sales automation, payment

exception processing, and claims administration processing. Jaid's

technology helps businesses reduce costs, improve efficiency, and

make data-driven decisions.

This will now appear in our NAV calculation of the Q4 update

which we will release in February 2023.

Sure Ventures PLC NAV

The Sure ventures PLC NAV at the end of September 2022 sits at

124.09p. This represents a 1.32% decrease across the period, down

from 125.75p per share at the end of Q2. This decrease represents

costs and changes to the value of its listed holdings in Engage XR

and Immotion PLC.

Forward looking statement & Director comment

When calculating the NAV for both Sure Valley Ventures and Sure

Ventures PLC we do not re-rate an unlisted investee company

valuation unless there is a funding round priced by another

investor. The nature and stage of the software companies that we

invest requires patience and we are now starting to see these

businesses mature at a strong pace. The pipeline of deals for Sure

Valley V entures Enterprise Capital fund remains robust despite the

market conditions

Gareth Burchell comment

"The market back-drop and specifically the technology sector has

had a hard year in 2022. The Sure Ventures NAV has remained strong

given this backdrop and several of the investments in the fund are

starting to attract interest from larger, more acquisitive players

in their relevant verticals.

We welcome two new investments in Everyangle (SVV1) and Jaid

(Enterprise Capital fund) both of which have been funded from

current cash. The listing of Smarttech247 will of course be

represented in our Q4 NAV, but we are pleased with the injection of

capital and look forward to being updated with its progress."

For further information, please visit www.sureventuresplc.com or

contact:

Gareth Burchell

Sure Ventures plc

+44 (0) 20 7186 9918

Notes to Editors

Sure Ventures plc listed on the London Stock Exchange in January

2018 giving retail investors access to an asset class that is

usually dominated by private venture capital funds. Sure Ventures

is focusing on companies in the UK, Republic of Ireland and other

European countries, making seed and series A investments in

companies with first rate management teams, products which benefit

from market validation with target revenue run rates of at least

GBP400,000 over the next 12 months. Website:

https://www.sureventuresplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUUUOORUNUUUUA

(END) Dow Jones Newswires

December 23, 2022 02:00 ET (07:00 GMT)

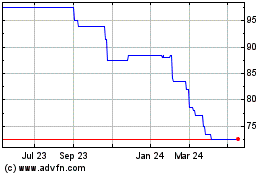

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Dec 2023 to Dec 2024