TIDMSYME

RNS Number : 5814B

Supply @ME Capital PLC

03 October 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR PART,

DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM ANY JURISDICTION WHERE

SUCH DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU, WHICH IS PART OF UNITED

KINGDOM DOMESTIC LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU

EXIT) REGULATIONS (SI 2019/310) ("UK MAR"). UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION (AS DEFINED IN UK MAR)

IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

This announcement is an advertisement for the purposes of the

Prospectus Regulation Rules of the FCA and is not a prospectus nor

an offer of securities for sale in any jurisdiction.

Neither this announcement, nor anything contained herein shall

form the basis of, or be relied upon in connection with, any offer

or commitment whatsoever in any jurisdiction. Investors should not

subscribe for or purchase any securities referred to in this

announcement except solely on the basis of the information

contained in the prospectus referred to in this announcement

(together with any supplementary prospectus, if relevant, the

"Prospectus"), including the risk factors set out therein,

published by Supply@ME Capital plc (the "Company" or "SYME").

Words and expressions defined in the Prospectus shall, unless

the context provides otherwise, have the same meanings in this

announcement.

An electronic copy of the Prospectus dated 3 October 2022 will

shortly be available for inspection on the Company's website at

https://www.supplymecapital.com/investor/ and will be submitted to

the National Storage Mechanism maintained by the FCA and will be

available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

3 October 2022

Supply@ME Capital plc

Publication of Prospectus

Admission of Admission Shares

Secondary Admission of Secondary Admission Shares

Further Admission of Further Admission Shares

Entry into Side Letter with Venus to raise Venus Amount

Entry into Addendum Deed with Mercator containing Mercator

Repayment Option

Total Voting Rights

SYME, the fintech business which provides an innovative fintech

platform ("Platform") for use by manufacturing and trading

companies to access Inventory Monetisation(c) solutions enabling

their businesses to generate cashflow, is pleased to announce

publication of the Prospectus prepared in relation to, inter

alia:

-- Admission of Admission Shares, comprising 3,048,986,302

Ordinary Shares issued to Venus on conversion of GBP1,500,000

Tranche B Venus CLNs plus accrued interest;

-- Secondary Admission of Secondary Admission Shares, comprising

all remaining 1,230,000,000 Venus Mandatory Subscription Shares,

all remaining 7,500,000,000 Venus Optional Subscription Shares and

848,498,083 Ordinary Shares issued to Venus on conversion of

GBP417,500 Tranche A Venus CLNs plus accrued interest;

-- the entry by the Company and Venus into the Side Letter,

pursuant to which the Company has contractually agreed to raise the

Venus Amount (GBP4,365,000 in aggregate), and be in receipt of

immediately available funds to exercise and settle the Mercator

Exercise Option on or before 17 October 2022;

-- the entry by the Company, Supply@ME Italy and Mercator into

the Addendum Deed, pursuant to which the Company has secured the

Mercator Repayment Option to pay, at its discretion at any time

prior to or on 17 October 2022, GBP3,536,553 in cash in immediately

available funds to Mercator in full and final settlement of all

outstanding amounts payable under the Mercator Loan Notes and the

Mercator CLNs (including incurred fees), and, if such amount is

paid by the Company, the Company will not be required to issue any

additional Mercator Conversion Shares; and

-- assuming the exercise by the Company of the Mercator

Repayment Option utilising the Venus Amount and following any

relevant conversion or exercise event(s) from time to time, Further

Admission of up to a maximum of 9,442,956,647 Further Admission

Shares, comprising up to 961,832,433 Mercator Warrant Shares, up to

8,175,000,000 Venus Warrant Shares and up to 306,124,214 Open Offer

Warrant Shares.

Alessandro Zamboni, CEO of SYME, said:

"The publication of the Prospectus is an important step in the

Capital Enhancement Plan, announced on 27 April 2022, which seeks

to settle the Company's existing debts and procure further

financing on terms more favourable to SYME and our

Shareholders.

"Under the Capital Enhancement Plan, the Company entered into

the Mercator Amendment and the Venus Subscription Agreement and

undertook the Open Offer in order to raise up to GBP7,500,000 in

new equity capital to enable the Company, at its election, to

settle the outstanding Mercator Loan Notes and Mercator CLNs in

cash rather than by the conversion of Mercator CLNs into Mercator

Conversion Shares.

"Pursuant to the Side Letter and the Addendum Deed, both

executed today, the Company has agreed with Venus and Mercator

(respectively) to, inter alia, accelerate Venus's subscription of

all remaining Venus Mandatory Subscription Shares and Venus

Optional Subscription Shares at Secondary Admission to raise gross

proceeds of GBP4,365,000 (i.e., the Venus Amount).

"It is the intention of the Company to exercise the Mercator

Repayment Option and to pay GBP3,536,553to Mercator in full and

final settlement of all outstanding amounts payable by the Company

to Mercator under the Mercator Loan Notes and Mercator CLNs

(including incurred fees) utilising the Venus Amount.

"Given the inherent protective optionality baked into the

Mercator Repayment Option, for good order, the Company has set out

in the Part IV of the Prospectus the estimated maximum numbers of

New Ordinary Shares which it would need to issue in the context of

Further Admission in the scenario where it does and does not

trigger the Mercator Repayment Option. Clearly, the Company's

stated intention is to exercise the Mercator Repayment Option after

Secondary Admission takes place and once it is in receipt of the

Venus Amount - investors are strongly encouraged to bear that in

mind.

"The Board firmly believes that following Admission, Secondary

Admission and the exercise of the Mercator Repayment Option

utilising the Venus Amount, the "cap table" of the Company will be

rationalised and, when taken with the first Inventory

Monetisation(c) transaction, the investment proposition of SYME is

significantly de-risked and its equity story is advanced. Moreover,

the Company does not expect to raise additional finance through the

issue of further new Ordinary Shares in the foreseeable future,

save, of course, to the extent any outstanding warrants are

exercised by existing holders."

The Company has made applications to the FCA and the London

Stock Exchange in connection with Admission, which is expected to

occur at 8.00 a.m. on 6 October 2022.

The Company hereby notifies the market, in accordance with the

FCA's Disclosure Guidance and Transparency Rule 5.6.1, that on

Admission, the Company's issued share capital will consist of

47,008,292,650 Ordinary Shares, each with one vote. The Company

does not hold any Ordinary Shares in treasury. On Admission, the

total number of voting rights in the Company will be 47,008,292,650

and this figure may be used by Shareholders as the denominator for

the calculations by which they will determine if they are required

to notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

The Company will make applications to the FCA and the London

Stock Exchange in connection with Secondary Admission, which is

expected to occur on 11 October 2022.

Further Admission of any Further Admission Shares will become

effective, and unconditional dealings in such Further Admission

Shares will commence, on a date (or dates) to be determined

following the relevant conversion or exercise event(s) from time to

time.

The Company will notify the market of the total voting rights

denominator to be used by Shareholders following Secondary

Admission and Further Admission(s) in due course.

For the purposes of UK MAR, the person responsible for arranging

release of this announcement on behalf of SYME is Alessandro

Zamboni, CEO.

Enquiries

Investors & analysts:

Alessandro Zamboni, CEO, Supply@ME Capital plc,

investors@supplymecapital.com

Paul Vann, Walbrook PR Limited, +44 (0)20 7933 8780;

paul.vann@walbrookpr.com

Media:

Nicole Louis, MHP, Nicole.Louis@mhpc.com

Orrick, Herrington & Sutcliffe (UK) LLP is acting as legal

adviser to SYME.

Notes

SYME and its operating subsidiaries provide a Platform for use

by manufacturing and trading companies to access inventory trade

solutions enabling their businesses to generate cashflow, via a

non-credit approach and without incurring debt. This is achieved by

their existing eligible inventory being added to the Platform and

then monetised via purchase by third party Inventory Funders. The

inventory to be monetised can include warehouse goods waiting to be

sold to end-customers or goods/commodities that are part of a

typical import/export transaction. SYME announced in August 2021

the launch of a global Inventory Monetisation programme which will

be focused on both inventory in transit monetisation and warehouse

goods monetisation. This program will be focused on creditworthy

companies and not those in distress or otherwise seeking to

monetise illiquid inventories.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PDIFXLFBLBLLFBB

(END) Dow Jones Newswires

October 03, 2022 07:22 ET (11:22 GMT)

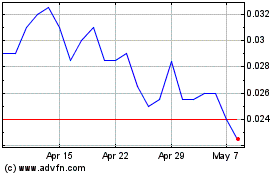

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supply@me Capital (LSE:SYME)

Historical Stock Chart

From Apr 2023 to Apr 2024