Tate & Lyle PLC Capital Markets Day

12 September 2018 - 11:00PM

UK Regulatory

TIDMTATE

12 September 2018 - Tate & Lyle PLC

CAPITAL MARKETS DAY

Tate & Lyle, a global provider of ingredients and solutions

to food, beverage and industrial markets, will over the next two

days update investors on its strategic progress at its Capital

Markets Day in Hoffman Estates, Illinois and Lafayette, Indiana.

The Capital Markets Day will highlight:

-- Focused business delivering strong performance over the last three

years

-- Programmes underway to accelerate business performance: 'Sharpen,

Accelerate, Simplify'

-- Delivery of US$100m productivity benefits over 4 years

-- Growth expected to accelerate over time

It will confirm that the Group's outlook for the year ending 31

March 2019, as communicated on 24 May 2018, is unchanged, being

that growth in earnings per share1 in constant currency is expected

to be in a mid-single digit range, albeit towards the lower end due

to energy and transport cost inflation in North America and a

strong year of Commodities performance in fiscal 2018.

Nick Hampton, Chief Executive, said:

"Tate & Lyle has a strong value proposition anchored in our

ability to help our customers take sugar, calories and fat out of

food, and in the strength of our North American Primary Products

business. We work with our customers to help consumers across the

world make healthier and tastier choices when they eat and

drink.

By focusing on our three priorities of 'Sharpen, Accelerate,

Simplify' we believe we can realise the growth potential of our

business and, over time, grow earnings per share, improve organic

return on capital employed, and deliver strong cash generation to

support our progressive dividend policy.

We have a clear direction, a strong financial position and a new

leadership team which is driving greater pace and a dynamic culture

of partnership, agility and execution across the business."

Outline of the event

The Group will reaffirm its commitment: to growing its Food

& Beverage Solutions business driving revenue growth and margin

accretion; to manage its Sucralose business for cash; and in

Primary Products to optimise product mix to underpin stable

earnings and cash flow delivery. It will also provide more details

and insight into its three programmes to accelerate business

performance:

-- Sharpen our focus on our customers where our new category-led

approach increasingly enables us to work with our customers

more

closely and provide solutions in their key consumer

categories.

-- Accelerate portfolio development by delivering greater pace of

new product development, increasing our focus on external

partnerships

and alliances, and taking a more active approach to

acquisitions.

-- Deliver greater productivity by simplifying the business and

the way we work to generate US$100m in productivity benefits

over four

years. Examples of productivity initiatives will be illustrated

during

the tour of our corn wet mill in Lafayette, Indiana.

The new leadership team, with its diversity of experience and

knowledge, has the capabilities and commitment to deliver on these

priorities, and deliver earnings growth over time.

Presentation materials together with an audio recording will be

available on the Company's website at

www.tateandlyle.com/investors-hub shortly after the event.

For more information contact Tate & Lyle PLC:

Christopher Marsh, Group VP, Investor and Media Relations

Tel: +44 (0) 20 7257 2110 or Mobile: +44 (0) 7796 192 688

1 Adjusted diluted earnings per share from continuing

operations

View source version on businesswire.com:

https://www.businesswire.com/news/home/20180912005134/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

September 12, 2018 09:00 ET (13:00 GMT)

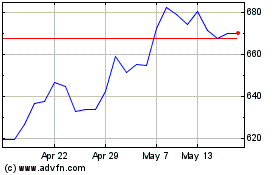

Tate & Lyle (LSE:TATE)

Historical Stock Chart

From Apr 2024 to May 2024

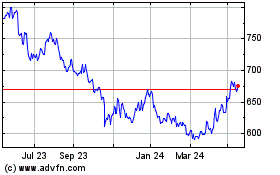

Tate & Lyle (LSE:TATE)

Historical Stock Chart

From May 2023 to May 2024