Tetragon Financial Group Ltd Tender Offer

12 April 2023 - 3:29AM

UK Regulatory

TIDMTFG

Tetragon Financial Group Limited Announcement of Final Results of Tender Offer

to Purchase Tetragon Non-Voting Shares

LONDON, April 11, 2023

Tetragon announces the final results of the "modified Dutch auction" tender

offer to purchase a portion of the outstanding non-voting shares of Tetragon

for a maximum aggregate payment of $25,000,000 in cash. The tender offer

expired at 11:59 p.m. (ET) on 6 April 2023.

J.P. Morgan Securities plc (which conducts its UK investment banking business

as J.P. Morgan Cazenove) acted as dealer manager for the tender offer and

Computershare Investor Services PLC acted as tender agent for the tender offer.

As dealer manager, J.P. Morgan determined the final purchase price at which

Tetragon will purchase shares in the tender offer. As tender agent,

Computershare determined the final proration factor.

In accordance with the terms of the tender offer, Tetragon has accepted for

purchase 2,325,574 non-voting shares at a purchase price of $10.75 per share.

The aggregate cost of this purchase is $24,999,920.50, excluding fees and

expenses relating to the tender offer. A total of 2,433,116 Tetragon non-voting

shares were properly tendered and not properly withdrawn at or below the

purchase price of $10.75 per share. Because more than $25,000,000 in value of

Tetragon non-voting shares was properly tendered and not properly withdrawn,

the tender offer was subject to proration pursuant to the terms of the tender

offer, with appropriate adjustments to avoid purchases of fractional shares.

The final proration factor, which is applicable only to shares properly

tendered and not properly withdrawn at the purchase price of $10.75 per share,

is 87.02%, rounded to the second decimal place.1

Tetragon will promptly make payment for the shares validly tendered and

accepted for purchase, which is expected to occur on or about 14 April 2023.

All shares tendered and not purchased in the tender offer will be promptly

returned to the tendering shareholders.

About Tetragon:

Tetragon is a Guernsey closed-ended investment company. Its non-voting shares

are listed on Euronext in Amsterdam, a regulated market of Euronext Amsterdam

N.V., and also traded on the Specialist Fund Segment of the Main Market of the

London Stock Exchange. Our investment manager is Tetragon Financial Management

LP. Find out more at www.tetragoninv.com.

Tetragon: Press Inquiries:

Yuko Thomas Prosek Partners

Investor Relations Pro-tetragon@prosek.com

ir@tetragoninv.com +44 20 3890 9193

+1 212 279 3115

This release contains inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation (2014/596/EU), or EU MAR, and of the UK version

of EU MAR as it forms part of UK law by virtue of the European Union

(Withdrawal) Act (as amended).

This release does not contain or constitute an offer to sell or a solicitation

of an offer to purchase securities in the United States or any other

jurisdiction. The securities of Tetragon have not been and will not be

registered under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States or to U.S. persons unless they are

registered under applicable law or exempt from registration. Tetragon does not

intend to register any portion of its securities in the United States or to

conduct a public offer of securities in the United States. In addition,

Tetragon has not been and will not be registered under the U.S. Investment

Company Act of 1940, as amended, and investors will not be entitled to the

benefits of such Act. Tetragon is registered in the public register of the

Netherlands Authority for the Financial Markets (Autoriteit Financiële Markten)

under Section 1:107 of the Dutch Financial Markets Supervision Act as an

alternative investment fund from a designated state.

J.P. Morgan Securities plc, which is authorised by the UK Prudential Regulation

Authority and regulated by the UK Financial Conduct Authority and the

Prudential Regulation Authority in the United Kingdom, is acting exclusively

for Tetragon and for no one else in connection with the tender offer and will

not be responsible to anyone (whether or not recipient of the tender offer)

other than Tetragon for providing the protections afforded to the clients of

J.P. Morgan Securities plc or for providing advice in relation to the tender

offer.

1 The full final proration factor applied is 87.02095765019410%.

END

(END) Dow Jones Newswires

April 11, 2023 13:29 ET (17:29 GMT)

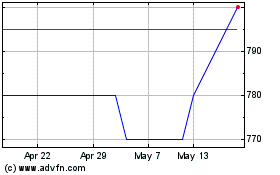

Tetragon Financial (LSE:TFGS)

Historical Stock Chart

From Jan 2025 to Feb 2025

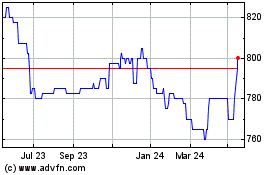

Tetragon Financial (LSE:TFGS)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Tetragon Financial Group Limited (London Stock Exchange): 0 recent articles

More Tetragon Financial Group Limited News Articles