TIDMTIFS

RNS Number : 1279F

TI Fluid Systems PLC

03 November 2022

Released: 3 November 2022

TI Fluid Systems plc

Q3 2022 Trading Update

Continuing strong EV bookings

Updated 2022 outlook in line with market consensus

TI Fluid Systems plc, a leading global manufacturer of highly

engineered automotive fluid storage, carrying, delivery and thermal

management systems for light vehicles issues a trading update for

the third quarter and nine months ended 30 September 2022.

Summary

The Group continues to make excellent progress on its organic

electrification growth strategy with EUR0.9 billion of lifetime

revenue for Battery Electric Vehicle ("BEV") awards year to date,

of which EUR300 million was booked in Q3 2022. Further success on

Hybrid Electric Vehicles ("HEV") delivered EUR 1.0 billion lifetime

revenue bookings year to date.

The Group's revenue for the nine months to September 2022 grew

by 10.4% at actual rates compared to a global light vehicle

production ("GLVP") growth(1) of 7.5%. At constant currency,

revenue grew 4.5% and underperformed GLVP growth by 300 basis

points ("bps"). Over the first three quarters, the Group

outperformed the growth in GLVP in every region except China, where

revenue growth was impacted by mix on BEV growth. Q3 2022 revenue

was EUR846.4 million, an increase of 28.8% at actual rates compared

to last year and to a market growth of 27.5%. At constant currency,

revenue increased 19.9% in Q3 2022 and underperformed GLVP growth

by 760 bps.

Significant cost recoveries have been agreed with customers,

similar to other suppliers in the industry. However, inflationary

cost increases are expected to remain, and the Group continues to

actively pursue ongoing cost recoveries and price adjustments.

[1] All production volume outperformance metrics herein are

based on S&P Global Mobility, October 2022, and Company

estimates

Q3 Trading Results

The Group had EUR300 million of lifetime revenue BEV bookings in

Q3 2022, bringing BEV bookings for the first nine months of 2022 to

EUR0.9 billion which evidences the progress being made by the Group

on securing future revenue growth as the industry continues the

transition to BEV platforms.

GLVP volumes in Q3 2022 continued their rebound and were 27.5%

higher than in Q3 2021, driven by the recovery from the severe

microchip shortages and supply chain disruptions experienced in Q3

2021, partially tempered by the ongoing impact of the

Ukraine/Russia conflict on European volumes during 2022.

Q3 2022 Group revenue was 28.8% higher year over year at

reported rates at EUR846.4 million, or 19.9% year over year at

constant currency which represented an underperformance of 760 bps

compared to the change in GLVP growth for the quarter.

Revenue continues to grow at a favourable pace despite being

constrained by the Group's lower participation on the mainly

domestic BEV platforms in the Chinese market where significant BEV

growth is being supported by local incentives.

By segment, on a constant currency basis, FCS Q3 year over year

revenue grew by 22.7%, outperforming the market in all regions

except Asia Pacific, while FTDS Q3 revenue grew by 16.2%.

By region, on a constant currency basis, Q3 2022 revenue was

higher by 17.9% in Europe and Africa, 22.1% in North America, and

20.2% in Asia Pacific.

Nine months ended 30 September 2022

The Group delivered revenue of EUR2,405.9 million in the nine

months ended 30 September 2022, a 10.4% increase from the same

period in 2021.

9 months 9 months

ended ended

% Change

at constant

EURm Sep 22 Sep 21 % Change currency

Group Revenue 2,405.9 2,179.6 10.4% 4.5%

By Segment

Fluid Carrying Systems ("FCS") 1,373.9 1,186.8 15.8% 8.9%

Fuel Tank and Delivery Systems

("FTDS") 1,032.0 992.8 3.9% (0.9)%

By Region

Europe and Africa 880.9 862.4 2.1% 1.9%

Asia Pacific 821.8 756.8 8.6% 1.7%

North America 665.2 525.1 26.7% 12.7%

Latin America 38.0 35.3 7.6% (4.7)%

Compared to the same period last year, the US Dollar appreciated

by 11.0% against the Euro, and the Chinese Renminbi by 9.3%. With

just under half of the Group's revenue denominated in these

currencies, these foreign exchange rate movements against the Euro

had a significant positive impact on the Group's revenue

performance. The foreign exchange movements accounted for just over

half of the year-on-year reported revenue increase. On a constant

currency basis, revenue increased by 4.5%.

Revenue by Segment

FCS revenue increased by 8.9% at constant currency and

outperformed the growth in GLVP by 140 bps. The segment's revenue

growth is primarily driven by execution of the EV strategy in

Europe and North America and related programme launches.

FTDS revenue declined slightly by 0.9% at constant currency,

mainly impacted by the increase of BEV particularly in China,

launch activities in 2021 not repeated in 2022 as well as the exit

of part of the business in Latin America.

Revenue by Region

In Europe and Africa, revenue increased by 1.9% year over year

at constant currency, compared to a 0.9% decline in light vehicle

production volume in that region, representing an outperformance of

280 bps, as the business continues to benefit from thermal HEV/BEV

business launches in both divisions. This benefit offset the

cessation of operations in Russia.

Asia Pacific revenue increased by 1.7% year over year at

constant currency impacted by the increase in domestic Chinese OEM

smaller BEV production where the Group has minimal content, and

impact of continued COVID related lockdowns in the region.

In North America revenue significantly increased by 12.7% year

over year at constant currency and outperformed light vehicle

production volume growth in that region by 210 bps, primarily due

to continued thermal launches and programme ramp ups.

Outlook

Based on our current view of Q4 2022, we expect to report full

year results in line with current consensus market expectations,

with full year revenue growth consistent with, or slightly below,

GLVP growth (on a constant currency basis), a full year adjusted

EBIT margin of approximately 6.0%, and historical levels of cash

flow conversion.

Trading update call

TI Fluid Systems plc is holding a call for analysts and

investors at 11:00 am UK time today.

Conference Call Dial-In Details:

United Kingdom 0800 640 6441

United Kingdom (Local) 0203 936 2999

United States 1 855 9796 654

United States (Local) 1 646 664 1960

All other locations +44 203 936 2999

Access code: 560951

You can pre-register for the call using the link below to

receive a unique PIN to dial directly into the call:

Pre-Event Registration

An audio recording will be available on

http://www.tifluidsystems.com later today.

Enquiries

TI Fluid Systems plc

Tim Furber

Investor Relations

Tel: +44 1865 871887

FTI Consulting

Richard Mountain / Nick Hasell

Tel: +44 20 3727 1340

Cautionary Statement

This announcement contains certain forward-looking statements

with respect to the financial condition, results of operations and

business of TI Fluid Systems plc (the "Company"). The words

"believe", "expect", "anticipate", "intend", "estimate",

"forecast", "project", "will", "may", "should" and similar

expressions identify forward-looking statements. Others can be

identified from the context in which they are made. By their

nature, forward-looking statements involve risks and uncertainties,

and such forward-looking statements are made only as of the date of

this announcement. Accordingly, no assurance can be given that the

forward-looking statements will prove to be accurate, and you are

cautioned not to place undue reliance on forward-looking statements

due to the inherent uncertainty therein. Past performance of the

Company cannot be relied on as a guide to future performance.

Nothing in this announcement should be construed as a profit

forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKBBKOBDDBDK

(END) Dow Jones Newswires

November 03, 2022 03:00 ET (07:00 GMT)

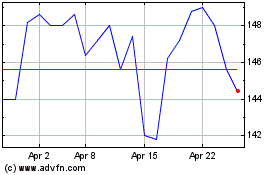

Ti Fluid Systems (LSE:TIFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ti Fluid Systems (LSE:TIFS)

Historical Stock Chart

From Apr 2023 to Apr 2024