TIDMTRIN

RNS Number : 3220Z

Trinity Exploration & Production

11 January 2024

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. On publication of this announcement via a

Regulatory Information Service, this information is considered to

be in the public domain.

11 January 2024

Trinity Exploration & Production plc

("Trinity" or "the Group" or "the Company")

Q4 2023 Operational Update

Trinity Exploration & Production plc (AIM: TRIN), the

independent E&P company focused on Trinidad and Tobago ,

provides an update on operations for the three-month period ended

31 December 2023 ("Q4 2023" or "the Period"). The information

contained herein has not been audited and may be subject to further

review and amendment.

Jacobin-1 Operations

Trinity safely perforated two Lower Cruse 1 (LC-1) zones on 28

November 2023. As previously announced on 18 December 2023, initial

flowrates were encouraging given the very small choke size, however

the flowrates and Wellhead Flowing Pressures have progressively

declined over the intervening period whereby in early January the

rates were materially below expectations at approximately 20bfpd

split 50/50 oil and water. There continues to be a high volume of

gas produced from the well and some traces of sand. A pressure

survey has been conducted to assess, inter alia, the reservoir

pressures and this data showed that a significant reduction in

reservoir pressure had occurred over the period. The inference from

this is that the volumes of hydrocarbons connected to the wellbore

are lower than originally anticipated.

The forward plan is to convert the well to pumped production and

monitor the performance of the LC-1 zones. We will assess the

potential in the uphole zones and see if a recompletion of either

the Upper Cruse, Lower Forest or Upper Forest zones is justified.

Daily production is being collected and sold to Heritage. The data

gathered to date on Jacobin will also be of immense value in

finessing Trinity's subsurface models for the other Palo Seco

"Hummingbird" prospects and elsewhere in the basin, including

Buenos Ayres.

As announced on 18 December 2023, Trinity estimates that the

undisputed costs incurred to date thus far to be USD 8.3 million,

of which USD 6.2 million (unaudited) has already been paid up to

the end of the period. As previously reported, Trinity expects to

settle the total cost of this well without recourse to any external

finance.

Fiscal Reforms

As announced on 4 January 2024, the Trinidad and Tobago Finance

Act 2023 ("The Act") was assented to on 20 December 2023. The Act

includes reforms to the to the Supplemental Petroleum Tax ("SPT")

regime which are of material benefit to Trinity's ongoing and

prospective growth opportunities. The reforms will positively

affect the Company's cashflow throughout 2024 and be beneficial to

Trinity's ongoing projects, in particular the Trintes and wider

Galeota developments.

SPT liability for Trinity's offshore production is estimated at

USD 4-5m for 2023 and we expect a similar amount, adjusted for

production, to be additional operating cash flow in 2024 and the

future, at current long term oil price forecasts, which suggest

that the realised price will be below USD 75/bbl.

Q4 2023 Operational Highlights

-- Q4 2023 sales volumes averaged 2,736 bopd (Q3 2023: 2,705 bopd).

-- Full year 2023 sales volumes averaged 2,790 bopd (2022: 2,975

bopd), marginally below the lower end of previous guidance.

Averaged Annual and Quarterly Sales by Region

12m 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2023

--------------- -------------- -------------- -------------- --------------

Onshore 1,495 1,548 1,477 1,493 1,462

East Coast 943 1,038 985 843 908

West Coast 353 314 362 370 365

Total 2,790 2,899 2,824 2,705 2,736

----------- --------------- -------------- -------------- -------------- --------------

-- During Q4 2023:

- 33 workovers (Q3 2023: 37; Q4 2022: 27) were completed.

- There were 3 recompletions ("RCPs") in the Period (Q3 2023: 0; Q4 2022: 1).

- A total of 6 RCPs and 117 workovers were completed during 2023

(2022: 17 RCPs and 120 workovers).

- Swabbing operations continued across onshore and West Coast assets.

Q4 2023 Financial Highlights

The Group reports its consolidated financial information half

yearly, in its Annual Report & Accounts and Interim Results, in

accordance with UK adopted International Accounting Standards and

the London Stock Exchange's AIM Rules for Companies. Quarterly, the

Company provides unaudited information for guidance.

-- Average realisation of USD 71.6 /bbl for Q4 2023 (Q3 2023:

USD 72.5/bbl, Q4 2022: USD 75.4/bbl).

-- EBITDA, pre-hedging(1) , in Q4 2023 of USD 4.1 million

(unaudited) (Q3 2023: USD 4.6 million (unaudited); Q4 2022 USD 7.0

million).

-- Operating break-even(2) , pre-hedging(1) , Q4 2023 of USD

39.79/bbl (Q3 2023: 42.27bbl and USD 38.61 /bbl (unaudited) for the

full year 2023 (2022: USD 32.1/bbl).

(1) The Company had no hedging in place in 2023.

(2) Operating break-even is the realised price/bbl where the

adjusted EBITDA/bbl for the Group is equal to zero.

-- Cash balance of USD 9.8 million (unaudited) at 31 December

2023 versus USD 11.3 million (unaudited) at 30 June 2023 and USD

8.4 million (unaudited) at 30 September 2023.

-- The Group had drawn borrowings (overdraft) of USD 4.0 million

at 31 December 2023 (USD 2.0 million at 30 September 2023), which

reflect the value of outstanding VAT refunds due.

-- Completion of first dividend payment on 26 October 2023,

consistent with our Capital Allocation Policy.

Jeremy Bridglalsingh, Chief Executive Officer of Trinity,

commented:

"During the period, we continued to progress our work at the

Jacobin well. Our ongoing data collection work is important for us

to develop our understanding of the area and its potential for the

Buenos Ayres licence. We also continue to invest in our wider asset

base to offset natural decline and underpin its strong cash

generation potential.

"We welcomed the Government's fiscal reforms to the SPT regime

in Trinidad and Tobago which should have a significant impact on

our 2024 cashflow and facilitate strengthening of the balance

sheet.

"I look forward to updating shareholders on our progress

throughout the upcoming quarter."

Enquiries:

Trinity Exploration & Production plc Via Vigo Consulting

Jeremy Bridglalsingh, Chief Executive Officer

Julian Kennedy, Chief Financial Officer

Nick Clayton, Non- Executive Chairman

SPARK Advisory Partners Limited

(Nominated Adviser and Financial Adviser)

Mark Brady +44 (0)20 3368

James Keeshan 3550

Cavendish Capital Markets Limited (Broker) +44 (0)20 7397

Leif Powis 8900

Derrick Lee +44 (0)131 220

Neil McDonald 6939

Vigo Consulting Limited trinity@vigoconsulting.com

Finlay Thomson +44 (0)20 7390

Patrick d'Ancona 0230

About Trinity ( www.trinityexploration.com )

Trinity is an independent oil production company focused solely

on Trinidad and Tobago. Trinity operates producing and development

assets both onshore and offshore, in the shallow water West and

East Coasts of Trinidad. Trinity's portfolio includes current

production, significant near-term production growth opportunities

from low-risk developments and multiple exploration prospects with

the potential to deliver meaningful reserves/resources growth. The

Company operates all of its ten licences and, across all of the

Group's assets, management's estimate of the Group's 2P reserves as

at the end of 2022 was 17.96 mmbbls. Group 2C contingent resources

are estimated to be 48.88 mmbbls. The Group's overall 2P plus 2C

volumes are therefore 66.84 mmbbls.

Trinity is quoted on AIM, a market operated and regulated by the

London Stock Exchange Plc, under the ticker TRIN.

Qualified Person's Statement

The technical information contained in the announcement has been

reviewed and approved by Mark Kingsley, Trinity's Chief Operating

Officer. Mark Kingsley (BSc (Hons) Chemical Engineering, Birmingham

University) has over 35 years of experience in international oil

and gas exploration, development and production and is a Chartered

Engineer.

Disclaimer

This document contains certain forward-looking statements that

are subject to the usual risk factors and uncertainties associated

with the oil exploration and production business. Whilst the Group

believes the expectation reflected herein to be reasonable in light

of the information available to it at this time, the actual outcome

may be materially different owing to macroeconomic factors either

beyond the Group's control or otherwise within the Group's

control.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDLBLLFZFLZBBX

(END) Dow Jones Newswires

January 11, 2024 02:00 ET (07:00 GMT)

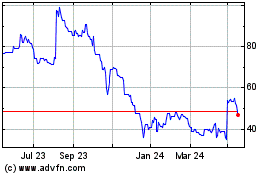

Trinity Exploration & Pr... (LSE:TRIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

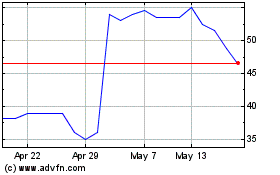

Trinity Exploration & Pr... (LSE:TRIN)

Historical Stock Chart

From Jan 2024 to Jan 2025