TIDMVANL

RNS Number : 5155A

Van Elle Holdings PLC

22 January 2020

Van Elle Holdings plc

22 January 2020

Interim results for the six months ended 31 October 2019

Van Elle Holdings plc ("Van Elle", the "Company" or the

"Group"), the leading geotechnical engineering company offering a

wide range of ground engineering techniques and services to

customers in a variety of UK construction end markets, announces

its interim results for the six months ended 31 October 2019.

Highlights

6 months ended 6 months ended Change

31 Oct 2019 31 Oct 2018 %

--------------------------------- --------------- --------------- -------

Revenue (GBPm) 48.5 42.9 13.1

Underlying* EBITDA (GBPm) 3.7 5.2 (28.8)

Reported EBITDA (GBPm) 3.5 4.8 (27.1)

Underlying* operating profit

(GBPm) 1.5 3.0 (50.0)

Reported operating profit

(GBPm) 1.2 2.6 (53.8)

Underlying* profit before

taxation (GBPm) 1.1 2.8 (60.7)

Reported profit before taxation

(GBPm) 0.9 2.4 (62.5)

Underlying* earnings per

share (p) 1.2 2.8 (57.1)

Reported earnings per share

(p) 0.9 2.4 (62.5)

Dividend per share (p) 0.2 1.0 (80.0)

Operating cash conversion

**(%) 41.8% 100.3%

Return on capital employed***

(%) 2.8% 6.4%

--------------------------------- --------------- --------------- -------

* before share-based payments and exceptional costs

** defined as cash generated from operations divided by EBITDA

less profit on sale of fixed assets

*** Return on capital employed calculated as underlying

operating profit divided by net assets less cash and excluding

loans and borrowings

The October 2019 results are not directly comparable to the

previous periods as a result of the adoption of IFRS 16. The impact

on the results is not considered to be material and is explained in

note 1

Summary highlights

-- Despite a challenging market backdrop, the benefit of

self-help initiatives and revenue growth resulted in an improving

performance as the half progressed

-- Revenue grew by 13.1% to GBP48.5m (H1 2019: GBP42.9m),

reflecting growth in the housing and highways markets, contrasted

with subdued conditions in commercial and rail markets

-- Underlying PBT reduced to GBP1.1m (H1 2019: GBP2.8m),

reflecting a weak first quarter and adverse sales mix across the

period

-- Progress against the previously announced transformation

programme remains on track, with phase 1 now substantially

complete:

o Simplified divisional structure implemented with each under

new, strengthened leadership;

o All operations now based at a single site in Kirkby in

Ashfield;

o Positive developments with strategic customer engagement and

development of bid pipelines;

o Operational performance stabilised, with a continued focus on

margin improvement;

o Ongoing investment in the development of new products and

services to diversify capabilities

-- Cash performance was affected by some long running final

accounts, but net debt is manageable at GBP10.4m (H1 2019: GBP5.6m)

after adjustment for adoption of IFRS16

-- Due to subdued profitability in the first half the Board is

recommending a reduced interim dividend of 0.2 pence per share

(FY2019: 1.0 pence)

-- The Group's new Chief Financial Officer, Graeme Campbell,

joins Van Elle from Severfield plc on 17 February 2020

Mark Cutler, Chief Executive, commented:

"The business continues to improve and, despite challenging

market conditions through the first half, we have made progress. We

have a clear strategy focused on three core markets - housing,

infrastructure and regional construction - where we offer a broad

range of end-to-end technical capabilities through our extensive

and well-invested rig fleet. Good progress continues to be made in

building long term and strategic relationships with our key

customers in all sectors.

"Operational performance is stable with previous challenges now

substantially addressed. The simplified divisional structure with

motivated, co-located teams under strengthened leadership means

that we are more efficient and joined-up. This allows us to focus

even more intently on customer service, operational excellence,

margin improvement and cash generation.

"Whilst mindful of ongoing volatility across construction

markets and recognising a slower Q3 than previous years due to

subdued rail activity, the Board expects some market improvement

and further progress in the balance of the second half. This is

also supported by the benefits of ongoing improvements under the

Group's transformation programme. Consequently, the Board expects

to deliver results for the full year within the range of market

expectations."

For further information please contact:

Instinctif Partners (Financial PR) Tel: 020 7457 2020

Mark Garraway

James Gray

Rosie Driscoll

Peel Hunt LLP (Broker) Tel: 020 7418 8900

Charles Batten

Mike Bell

Edward Allsopp

Van Elle Holdings plc - Interim Report to 31 October 2019

Strategic overview

Van Elle continues to be in transition, following a plan focused

on improving the performance of the business through a range of

organisational, commercial and operational actions whilst also

putting in place the building blocks of future sustainable growth

in line with our updated strategy.

Good progress is being made in delivery of the three-phase

transformation programme and early benefits are starting to be

evidenced despite the challenging market conditions that have

prevailed though FY2019 and the first half of FY2020.

Phase one of the three-phase transformation programme is now

substantially complete, with highlights including:

- The restructuring of the business divisions is substantially

complete with several key managerial changes made during the period

aimed at improving the leadership capability and acting on areas of

identified efficiency opportunity.

- The rationalisation of multiple offices into a single open

plan site in Kirkby was completed in the first quarter. This has

improved internal communications and facilitated greater efficiency

of information flow and back office support.

- The bidding process and governance has been strengthened

alongside a programme of more intensive customer engagement. This

continues to deliver a strong order book despite increased levels

of competition in a market which remains volatile.

- Further commercial appointments have been made to strengthen the divisional capabilities.

- Operational performance is satisfactory and, in particular,

the issues faced last year in the General Piling business have been

addressed. Across the Group, consistency of delivery has been

enhanced through the roll-out of the Perfect Delivery programme

which applies lessons learned from past performance to focus on

operational excellence and customer satisfaction.

- Efficiency savings are continuously targeted through process

improvement and a streamlining of overhead structures as

appropriate, without inhibiting our capacity to grow. A cost

reduction programme is focused on waste reduction and synergies

across the business.

- Investment in new products and services, both enhancements to

existing core capabilities and the development of new specialist

techniques and services continues through an active innovation

programme.

- Best practice forums, corporate learning, training programmes

and employee engagement programmes all continue to improve

operational efficiency.

In the second half of the financial year, the focus will remain

on further embedding these internal improvements and continuing to

develop the foundations for expected growth. The Board expects some

modest improvement in market conditions in the second half which

should support continued positive momentum, building on the

progress seen in the first half.

Trading review

For the six months ended 31 October 2019, revenue increased by

13.1% GBP48.5m (H1 2019: GBP42.9m). Sales were segmented to our end

markets as follows: Residential 51.3% (H1 2019: 50.8%),

Infrastructure 25.9% (H1 2019: 28.2%) and Regional Construction

22.5% (H1 2019: 19.7%).

As previously reported, trading activity in the first quarter

was relatively subdued and below prior year levels as a result of

weak contractor confidence and continued project delays. The second

quarter saw a promising upturn in overall activity as key projects

were mobilised in certain segments of the UK construction

market.

In terms of divisional performance, whilst General and

Specialist Piling revenues were slightly down compared to the

comparative period in the prior year, there has been significant

growth within Ground Engineering Services, up approximately GBP7m

to GBP17m; driven primarily by housing sector growth as a result of

improved customer focus and closer relationships with national

housebuilders which are seeking faster build times and integrated

piling and foundation solutions.

In contrast the Group has seen increased competition in the

regional construction market and subdued activity levels in the

rail sector (as a result of delays to Network Rail's CP6

programme), impacting on several of the Group's higher margin

activities.

Underlying Profit Before Tax was weaker at GBP1.1m (H1 2019:

GBP2.8m), resulting from the impact on overhead recovery of lower

revenues in the first quarter and the generally adverse sales mix

across the first half, described above. The Group also completed

two challenging contracts in the first quarter which suffered delay

and additional costs and are subject to ongoing commercial

resolution.

Despite increased levels of competition in a market which

remains volatile, the Group's focus on bidding process and

governance, alongside a programme of more intensive customer

engagement continues to deliver a strong orderbook, which, adopting

the more prudent basis previously advised, sits at GBP32.0m at the

period end (FY 2019: GBP34.0m).

Working capital performance has been more challenging than in

previous periods, primarily due to several projects awaiting final

account resolution and some evidence of poor payment practice

amongst a minority of our customers. Action has been taken to

further strengthen customer risk assessment processes and

strengthen the divisional commercial teams to address this. Whilst

the Group doesn't envisage any material issues with receivable

recovery, it has deemed it appropriate to take a further GBP150K

provision against aged debtors.

The Group has continued to invest positively in the development

of new and innovative products and services while maintaining a

cautious rig investment programme. These include the development of

a new operational capability for vibro stone columns ('vibro')

targeted at the housing and industrial building sectors; the

continued development of the Group's unique rail track bed

stabilisation system; the wider application of the Smartfoot

modular foundations system in housing, and several other specialist

piling techniques that will support long term growth opportunities.

In the period the cost of new property, plant and equipment (PPE)

investment has been GBP2.3m and related development expenditure was

GBP420K, the latter capitalised as intangible assets in accordance

with IAS 38.

Whilst rig acquisition remains selective, management continues

to appraise opportunities to increase its fleet on a strategic

basis. In line with this approach, the Group acquired an additional

new driven rig targeted at its housing sector operations, certain

specialist assets at auction following the liquidation of rail

competitor Aspin and two second hand vibro rigs in the period

Net debt at 31 October 2019 of GBP10.4m (H1 2019: GBP5.6m)

includes GBP3.9m of lease liabilities arising from the adoption of

IFRS16. The comparison of net debt is set out in note 7.

The Group's banking facilities are unchanged with a GBP2.5m

unused overdraft facility in place with Lloyds. The Group also has

a GBP900K business loan secured against freehold property which is

due to be repaid by the end of 2020. This loan has been

reclassified as repayable on demand due to a breach in the original

covenants caused by low first half profitability. While the Board

is satisfied that the Group continues to operate with sufficient

cash reserves (and the cash position has improved further since the

period end) in view of the more challenging working capital

position and increased debtors, while focused on the objective to

reduce net debt by year end, the Board have implemented more

rigorous cash management disciplines and regularly reviews cashflow

forecasts.

Operating performance in the period

General Piling

Revenue was marginally lower at GBP17.7m (H1 2019: GBP18.5m),

primarily as a result of a subdued first quarter, reflecting delays

to projects experienced at the end of FY 2019 and a single

challenging contract on which the Group's entitlement is the

subject of ongoing claims recovery. As the Group's largest

division, the impact of the lower revenue in the early part of the

year had a significant impact on overhead recovery and together

with a weaker work mix, with reduced levels of rotary piling,

contributed to a reduction in underlying operating profit of 51% to

GBP227K (H1 2019: GBP465K).

Under new leadership since the beginning of the financial year,

the division has continued the operational and work winning

improvements outlined previously and progress was evident from Q1

into Q2 as a result. However, whilst volume levels were more

encouraging, the division continues to experience a sub-optimal

work mix with fewer higher margin rotary schemes and greater

competition from major rivals than in prior years. Several of the

smaller rigs have also been redeployed to the Housing division in

order to take best advantage of the opportunities available to the

Group.

Specialist Piling

The division, comprising the Specialist Piling and Rail business

units saw revenue marginally reduced to GBP14.0m (H1 2019:

GBP14.5m) although underlying operating profit was down 80% at 394K

(H1 2019: GBP1.93m).

After continued delays in Q1 and a challenging contract now

commercially resolved and which is subject to re-pricing for future

phases, the Specialist Piling unit performed in line with

expectations during the second quarter. The improvements as a

result of successfully mobilised and commenced operations on

several Smart Motorways projects, some of which will run for up to

two years. The previously announced, more selective approach to

ground stabilisation activity (and the closure of the former

dedicated division) has been successfully implemented and continues

to compliment the wider integrated range of services.

The Rail business unit has been heavily impacted throughout the

period by delays to Network Rail's CP6 programme and the completion

of some longer running CP5 projects, resulting in redeployment of

personnel and restructuring including some redundancies. In

parallel, the business has focussed intensively on customer key

account development and preparations for growth in CP6 and has

diversified slightly in order to increase resilience, including a

more comprehensive sheet piling offer and development of its first

track bed stabilisation opportunities in Ireland.

The rail sector is typically the Group's highest margin segment

and so the impact of the very challenging market conditions in this

sector during the first half have had a material adverse impact on

divisional and Group profitability. However, Van Elle remains a

clear market leader in these activities and the potential

opportunities presented by the mobilisation of major investment

programmes, including CP6 and HS2, are significant.

Ground Engineering Services

Revenue increased significantly to GBP16.9m (H1 2019: GBP9.9m)

and underlying operating profit increased 24% to GBP804K (H1 2019:

GBP647K)

Ground Engineering Services comprises the Housing division,

including the Smartfoot modular foundation system and Strata, the

Geotechnical division. Revenues have grown strongly driven by

closer relationships with national housebuilders which are seeking

faster build times and integrated piling and foundation solutions.

This is a segment in which the Group continues to invest for the

long term and in the period has diversified its services though the

development of specialist vibro piling techniques and further

developments to its precast concrete Smartfoot foundation system.

Strata has also seen strong revenue growth driven primarily by

ground investigation on major highways projects in which we are

developing a strong reputation alongside our piling activity.

Market overview

Across the Infrastructure sector the Group experienced mixed

fortunes in the period. In highways, the Group successfully

mobilised several Smart Motorway projects where it enjoys a market

leading position. In rail volumes were significantly down on the

prior year as preparations for Network Rail's CP6 programme

impacted workload across the market. Although some restructuring

and redeployment has been necessary, the business is well

positioned with a strong reputation and differentiated capabilities

to be able to mobilise quickly once spending starts to accelerate

as expected in the second half.

The regional construction market has been and remains highly

competitive, but due to closer working relationships with our

customers, including earlier engagement on projects, the Group has

secured several good quality projects and has improved its

execution compared to last year. The Group is not expecting a

material improvement in regional markets in the second half,

although some confidence is expected to return following the UK

General Election result.

The residential market continues to offer growth opportunities

to the Group, both in private housing and also larger scale

residential and retirement sectors. The business has successfully

diversified its offering in the period in order to take greater

advantage of these opportunities and has redeployed resources

internally to enable greater operational control as our customer

base widens.

Board news

The Board is pleased to confirm that Graeme Campbell will take

up the role of Chief Financial Officer on 17 February 2020,

following the announcement of his appointment in September 2019.

Graeme was previously Chief Financial Officer of ASX-listed

engineering services company Engenco and joins Van Elle from

Severfield plc.

Dividend

In view of the weak trading performance in the first half and

the dependence on improved second half trading, the Board is

declaring a reduced dividend of 0.2 pence per share (H1 2019: 1.0

pence) and will decide on the level of dividend for the year once

the second half performance is known. The interim dividend will be

paid on 27 March 2020 to shareholders on the register on 14

February 2020. The shares will be marked ex-dividend on 13 February

2020.

The board has become aware of a technical compliance

irregularity concerning the final dividend for the year ended 30

April 2019 approved at the Company's annual general meeting on 12

September 2019. This is explained in note 1.

Current trading and outlook

Current activity levels and prospects in Housing and Highways

remain positive, with further opportunities presented by the

development investment made in the first half.

As expected, and in light of the subdued market activity levels

during the delayed transition to the CP6 funding period, the Group

undertook significantly less rail work over the Christmas period

than in the prior year. Nevertheless, the Board does expect modest

improvement to both the rail and commercial building markets as the

second half progresses, which may be further bolstered in the event

that CP6 rail spending accelerates and/or the HS2 project is given

the go-ahead, although the timing of any such recovery remains

uncertain.

The actions being taken by the management team under the Group's

transformation programme to improve operational performance are

yielding early benefits and these actions will continue in tandem

with expected increased activity levels and improved work mix

described above, in the second half and beyond.

Whilst mindful of the ongoing volatility across construction

markets, the Board expects the Group to make further progress in

the second half, supported by the benefits of ongoing improvements

under the Group's transformation programme. Consequently, the Board

expects to deliver results for the full year within the range of

market expectations.

Consolidated statement of comprehensive income

6 months

6 months to to 12 months to

31 Oct 2019 31 Oct 2018 30 Apr 2019

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------ ---- ------------------------------ --------------------- --------------

Revenue 2 48,524 42,921 88,468

Cost of sales (35,282) (28,841) (60,281)

------------------------------------ ---- ------------------------------ --------------------- --------------

Gross profit (13,242) 14,080 28,187

Administrative expenses (12,013) (11,453) (23,625)

------------------------------------ ---- ------------------------------ --------------------- --------------

Operating Profit 1,229 2,627 4,562

------------------------------------ ---- ------------------------------ --------------------- --------------

Operating profit before share-based

payments and exceptional costs 1,455 3,038 5,244

Share based payments 5 (80) (80) (123)

Exceptional cost 4 (146) (331) (559)

------------------------------------ ---- ------------------------------ --------------------- --------------

Operating profit 1,229 2,627 4,562

------------------------------------ ---- ------------------------------ --------------------- --------------

Finance expense (322) (297) (579)

Finance income 12 25 52

------------------------------------ ---- ------------------------------ --------------------- --------------

Profit before tax 919 2,355 4,035

Income tax expense (175) (471) (823)

------------------------------------ ---- ------------------------------ --------------------- --------------

Total comprehensive income

for the year 744 1,884 3,212

------------------------------------ ---- ------------------------------ --------------------- --------------

Earnings per share (pence)

Basic 5 0.9 2.4 4.0

Diluted 5 0.9 2.4 4.0

------------------------------------ ---- ------------------------------ --------------------- --------------

All amounts relate to continuing operations. There was no other

comprehensive income in either the current or preceding

period/year.

Consolidated statement of financial position

As at 31 October 2019

31 Oct 2019 31 Oct 2018 30 Apr 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------- ---- ------------- ------------- ------------

Non-current assets

Property, plant and equipment 19,150 39,038 38,486

Right-of-use assets 22,987 - -

Intangible assets 2,685 2,303 2,289

------------------------------------- ------------- ------------- ------------

44,822 41,341 40,775

------------------------------------ ------------- ------------- ------------

Current assets

Inventories 2,960 2,372 2,882

Trade and other receivables 21,931 19,946 20,558

Corporation tax receivable - - 118

Cash and cash equivalents 3,949 9,384 7,997

------------------------------------- ------------- ------------- ------------

28,840 31,702 31,555

------------------------------------ ------------- ------------- ------------

Total assets 73,662 73,043 72,330

------------------------------------- ------------- ------------- ------------

Current liabilities

Trade and other payables 15,922 14,830 16,506

Loans and borrowings 5,231 5,071 4,695

Provisions 236 253 236

Corporation tax payable 6 438 -

------------------------------------- ------------- ------------- ------------

21,395 20,592 21,437

------------------------------------ ------------- ------------- ------------

Non-current liabilities

Loans and borrowings 9,121 9,945 7,534

Deferred tax 1,061 1,016 1,298

------------------------------------- ------------- ------------- ------------

10,182 10,961 8,832

------------------------------------ ------------- ------------- ------------

Total liabilities 31,577 31,553 30,269

------------------------------------- ------------- ------------- ------------

Net assets 42,085 41,490 42,061

------------------------------------- ------------- ------------- ------------

Equity

Share capital 1,600 1,600 1,600

Share premium 8,633 8,633 8,633

Retained earnings 31,834 31,239 31,810

Non-controlling interest 18 18 18

------------------------------------- ------------- ------------- ------------

Total equity 42,085 41,490 42,061

------------------------------------- ------------- ------------- ------------

The unaudited interim consolidated statement was approved by the

Board of Directors on 21 January 2020.

Consolidated statement of cash flows

For the 6 months ended 31 October 2019

Note 6 months 6 months 12 months

to 31 Oct to 31 Oct to 30 Apr

2019 (unaudited) 2018 (unaudited) 2019 (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ----- ------------------ ------------------ ----------------

Cash flows from operating activities

Cash generated from operations 6 1,403 4,786 9,463

Interest received 12 25 52

Interest paid (322) (297) (579)

Income tax paid (287) (740) (1,366)

-------------------------------------- ----- ------------------ ------------------ ----------------

Net cash generated from operating

activities 806 3,774 7,570

-------------------------------------- ----- ------------------ ------------------ ----------------

Cash flows from investing activities

Purchases of property, plant

and equipment (1,376) (735) (2,390)

Disposal of property, plant

and equipment 354 323 393

Purchases of intangibles (422) - (10)

----------------

Net cash absorbed in investing

activities (1,444) (412) (2,007)

-------------------------------------- ----- ------------------ ------------------ ----------------

Cash flows from financing activities

Repayment of bank borrowings (75) (75) (150)

Repayments of Invest to Grow

loan (15) (47) (95)

Payments to lease creditors (2,520) (2,896) (5,561)

Dividends paid (800) (1,840) (2,640)

-------------------------------------- ----- ------------------ ------------------ ----------------

Net cash absorbed in financing

activities (3,410) (4,858) (8,446)

-------------------------------------- ----- ------------------ ------------------ ----------------

Net decrease in cash and cash

equivalents (4,048) (1,496) (2,883)

Cash and cash equivalents at

beginning of period 7,997 10,880 10,880

-------------------------------------- ----- ------------------ ------------------ ----------------

Cash and cash equivalents at

end of period 7 3,949 9,384 7,997

-------------------------------------- ----- ------------------ ------------------ ----------------

Consolidated statement of changes in equity

For the 6 months ended 31 October 2019

Non-controlling

Share Share interest Retained Total

capital premium earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

Balance at 1

May 2018

(audited) 1,600 8,633 18 31,115 41,366

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

Total

comprehensive

income - - - 1,884 1,884

Share-based payment

expense - - - 80 80

Dividend

payment - - - (1,840) (1,840)

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

- - - 124 124

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

Balance at 31

October 2018

(unaudited) 1,600 8,633 18 31,239 41,490

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

Total

comprehensive

income - - - 1,328 1,328

Share-based

payment

expense - - - 43 43

Dividend

payment - - - (800) (800)

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

- - - 571 571

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

Balance at 30

April 2019

(audited) 1,600 8,633 18 31,810 42,061

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

Total

comprehensive

income - - - 744 744

Share-based

payment

expense - - - 80 80

Dividend

payment (note

1) - - - (800) (800)

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

- - -

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

Balance at 31

October 2019

(unaudited) 1,600 8,633 18 31,834 42,085

------------------------- ------------------- ------------------- -------------------------- -------------------- ------------------

Notes to the interim results

For the 6 months ended 31 October 2019

1. Basis of preparation

The unaudited interim consolidated statement of Van Elle

Holdings plc is for the six months ended 31 October 2019 and do not

comprise statutory accounts within the meaning of section 435 of

the Companies Act 2006. These consolidated financial statements

have been prepared in compliance with the recognition and

measurement requirement of International Financial Reporting

Standards, International Accounting Standards and Interpretations

(collectively IFRSs) as adopted by the EU. They do not include all

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the

group's annual report. The unaudited interim consolidated statement

has been prepared in accordance with the accounting policies that

are expected to be applied in the report and accounts for the year

ending 30 April 2020.

The comparative figures for the year ended 30 April 2019 do not

constitute statutory accounts within the meaning of section 435 of

the Companies Act 2006, but they have been derived from the audited

financial statements for that year, which have been filed with the

Registrar of Companies. The report of the auditors was unqualified

and did not contain statements under section 498 (2) or (3) of the

Companies Act 2006 not a reference to any matters which the auditor

drew attention by way of emphasis of matter without qualifying

their report.

Dividends

The Board has become aware of an irregularity concerning

technical compliance with the Companies Act 2006 in respect of the

final dividend approved by shareholders at the Company's annual

general meeting on 12 September 2019 (the "Dividend").

Note 12 (Dividends) to the Consolidated Financial Statements of

the Group for the year ended 30 April 2019 (the "2018/19

Accounts"), in referring to the Dividend, stated that:

"The Board of the subsidiary company will pay a dividend to the

Company in advance of the final proposed dividend being paid to

ensure that the Company has sufficient distributable reserves in

order to pay the dividend."

Regrettably, as a result of an administrative oversight, the

subsidiary company dividend referred to in Note 12 to the 2018/19

Accounts was not made and as a consequence the requisite level of

distributable reserves were not available within the Company prior

to the payment of the Dividend. In addition, interim accounts

should have been filed by the Company in respect of the payment of

the Dividend. Consequently, the Dividend is technically

unlawful.

The Group's historic reported trading results and financial

condition and ability to pay future dividends are entirely

unaffected, however to address the unlawful nature of the Dividend

the Board intends to call a general meeting of the Company in due

course at which various resolutions to address these issues will be

proposed.

The directors have no reason to believe that the resolutions to

be proposed at the general meeting will not be passed and therefore

have accounted for the Dividend as a distribution in these

financial statements.

Accounting policies

Except as described below, the accounting policies adopted in

the preparation of the unaudited Group interim consolidated

statement to 31 October 2019 are consistent with the policies

applied by the Group in its consolidated financial statements as

at, and for the year ended 30 April 2019.

This is the first set of the Group's financial statements where

IFRS 16 Leases has been applied. The impact on this interim

consolidated statement and the change to the Group's significant

accounting policies are described in further detail below.

IFRS 16 Leases Overview

The Group has initially adopted IFRS 16 Leases from 1 May 2019.

IFRS 16 Leases replaces IAS 17 Leases and provides a single lease

accounting model, requiring the lessees to recognise right of use

assets and lease liabilities in the balance sheet for all

applicable leases. The Group has applied the modified retrospective

adoption method in IFRS 16, and, therefore only recognised leases

on balance sheet as at 1 May 2019. It has decided to measure

right-of-use assets by reference to the measurement of the lease

liability on that date. This meant there was no immediate impact to

net assets on that date. In applying the modified retrospective

approach, the Group has taken advantage of the following practical

expedients:

-- A single discount rate has been applied to portfolios of

leases with reasonably similar characteristics.

-- Initial direct costs have not been included in the

measurement of the right-of-use asset as at the date of initial

application.

-- For the purposes of measuring the right-of-use asset

hindsight has been used. Therefore, it has been measured based on

prevailing estimates at the date of initial application and not

retrospectively by making estimates and judgements (such as the

term of leases) based on circumstances on or after the lease

commencement date

At 30 April 2019 operating lease commitments amounted to

GBP9,313,000. The effect of discounting those commitments has

resulted in lease liabilities of approximately GBP3,961,000 being

recognised on 1 May 2019 with a corresponding right-of-use assets

of GBP3,659,000, the figures being different due to the offset of

GBP302,000 lease incentive accrual against the asset.

Instead of recognising an operating expense for its operating

lease payments, the Group has instead recognised interest on its

lease liabilities and amortisation on its right-of-use assets.

In the 6 months to 31 October 2019 this has decreased operating

lease payments by GBP76,000, increased depreciation by GBP66,000

and finance charges by GBP72,000.

Changes in Accounting policy

The details of the new significant accounting policy and the

nature of the change to previous accounting policy in relation to

the Group's adoption of IFRS 16 Leases are set out below.

Amended accounting policy Previous accounting Nature of change in accounting

policy policy

The Group assesses whether The Group previously

a contract is or contains determined whether a

a lease at inception contract was or contained

of the contract. policy a lease under IFRIC 4.

in relation to the Group's In practice, all contracts

adoption of IFRS 16 Leases that are classified as

are set out below. a lease under IFRS 16

were also previously

A contract is or contains classified as a lease

a lease if the contract under IFRIC 4 and vice

includes the right to versa.

control the use of an

identified asset for

a period of time in exchange

for consideration. Factors

that are considered when

making this assessment

include: the Group's

right to obtain substantially

all the economic benefits

from use of the asset;

the Group's right to

direct the use of the

asset; and the supplier's

right to substitute the

asset

----------------------------- ----------------------------------

The Group allocates the Where substantially Under IAS 17, the Group

consideration in the all the risks and previously classified

contract to each lease rewards incidental leases as operating or

component on the basis to ownership of a finance leases based

of relative stand-alone leased asset have on its assessment of

selling prices. For each been transferred to whether the lease transferred

lease component, the the Group (a "finance significantly all the

Group recognises a right lease"), the asset risks and rewards of

of use asset and a lease is treated as if it ownership to the Group.

liability at the lease had been purchased Under IFRS 16, the majority

commencement date. outright. The amount of the Group's leases

initially recognised are recognised on the

as an asset is the balance sheet as right

lower of the fair of use assets and lease

value of the leased liabilities, including

asset and the present those arrangements previously

value of the minimum classified as either

lease payments payable finance leases or operating

over the term of the leases under IAS 17.

lease. The corresponding

lease commitment is

shown as a liability.

Lease payments are

analysed between capital

and interest. The

interest element is

charged to the consolidated

statement of comprehensive

income over the period

of the lease and is

calculated so that

it represents a constant

proportion of the

lease liability. The

capital element reduces

the balance owed to

the lessor.

----------------------------- ----------------------------------

Lease liabilities are Where substantially Lease liabilities were

presented as "obligations all the risks and only recognised under

under leases" in the rewards incidental IAS 17 in respect of

balance sheet. to ownership are not arrangements classified

The lease liability is transferred to the as finance leases. This

initially measured at Group (an "operating distinction no longer

the present value of lease"), the total exists under IFRS 16.

future lease payments, rentals payable under

discounted at the interest the lease are charged Where an arrangement

rate implicit in the to the consolidated was treated as a finance

lease. Where the implicit statement of comprehensive lease under IAS 17, a

interest rate cannot income on a straight-line liability was initially

be determined, the Group basis over the lease recognised equal to the

discounts the future term. The aggregate value of the asset capitalised

lease payments using benefit of lease incentives within property, plant

its incremental borrowing is recognised as a and equipment (see below).

rate. reduction of the rental The liability was subsequently

The lease liability is expense over the lease measured at amortised

subsequently measured term on a straight-line cost using the effective

at amortised cost using basis. interest method. There

the effective interest is no material difference

method. between the amounts recognised

as liabilities or as

interest expense for

such arrangements following

the adoption of IFRS

16.

Lease payments associated

with operating leases

were recognised as an

expense on a straight-line

basis over the lease

term, with no amounts

being recognised on the

balance sheet. Under

IFRS 16 lease liabilities

are also recognised for

leases previously classified

as operating leases.

The lease liability is

recognised at the present

value of the future lease

payments.

----------------------------- ----------------------------------

Right of use assets are Assets were only recognised

presented in "property, under IAS 17 in respect

plant and equipment" of arrangements classified

on the balance sheet. as finance leases.

The right of use asset Where an arrangement

is initially measured was previously treated

at cost, representing as a finance lease under

the initial amount of IAS 17, an asset was

the lease liability adjusted recognised within property,

for any up-front lease plant and equipment at

payments, direct costs the fair value of the

incurred or lease incentives asset or, if lower, the

received. present value of the

minimum lease payments.

The right of use asset The asset was subsequently

is subsequently depreciated depreciated on the same

on a straight-line basis basis as other similar

to the earlier of the assets purchased by the

end of the useful life Group without recourse

of the right of use asset to financing arrangements.

or the end of the lease Such assets are now presented

term. The estimated useful as right of use assets

lives of right of use within property, plant

assets are determined and equipment. There

on the same basis as is no material difference

those of property, plant between the amounts recognised

and equipment. as assets or as depreciation

expense for such arrangements

following the adoption

of IFRS 16.

In addition, under IFRS

16 a right of use asset

is now recognised within

property, plant and equipment

for assets under leases

that were previously

classified as operating

leases under IAS 17,

for which were lease

payments were recognised

as an expense on a straight-line

basis over the lease

term, with no amounts

being recognised on the

balance sheet.

----------------------------- ----------------------------------

No right of use asset The treatment of short-term

or lease liability is leases and leases for

recognised in respect low-value assets is unchanged

of leases with terms on adoption of IFRS 16

of 12 months or less as all such leases were

or in relation to low previously classified

value assets. Lease payments as operating leases under

associated with such IAS 17.

leases are recognised

as an expense on a straight-line

basis over the lease

term.

----------------------------- ----------------------------------

Functional currency

The unaudited interim consolidated statements are presented in

Sterling, which is also the Group's functional currency. Amounts

are rounded to the nearest thousand, unless otherwise stated.

2. Segment information

The Group evaluates segmental performance based on profit or

loss from operations calculated in accordance with IFRS but

excluding non-recurring losses, such as goodwill impairment and the

effects of share-based payments. Specialist Piling includes the

specialist and rail business units and Ground Engineering Services

comprises housing and geotechnical (Strata) business units. Note

that General Piling tends to undertake the larger residential

projects. Loans and borrowings, insurances and head office central

services' costs are allocated to the segments based on levels of

turnover. All turnover and operations are based in the UK.

Operating segments - 6 months to 31 October 2019

Ground

General Specialist Engineering Head Total

Piling Piling Services Office

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Revenue 17,661 13,950 16,855 58 48,524

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Operating

profit

Underlying

operating

profit 227 394 804 30 1,455

Share-based

payments (80) (80)

Exceptional

item (8) (93) (45) (146)

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Operating

profit 219 301 804 (95) 1,229

Finance

expense (322) (322)

Finance

income 12 12

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Profit before

tax 219 301 804 (405) 919

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Assets

Property,

plant

& equipment 2,710 4,157 4,785 7,498 19,150

Right-of-use

assets 7,036 7,720 3,080 5,151 22,987

Inventories 1,058 720 1,165 17 2,960

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Reportable

segment

assets 10,804 12,597 9,030 12,666 45,097

Intangible

assets 2,685 2,685

Trade and

other

receivables 21,931 21,931

Cash and cash

equivalents 3,949 3,949

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Total assets 10,804 12,597 9,030 41,231 73,662

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Liabilities

Loans and

borrowings 14,352 14,352

Trade and

other

payables 15,928 15,928

Provisions 236 236

Deferred tax 1,061 1,061

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Total

liabilities 31,577 31,577

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

Other

information

Capital

expenditure 25 404 1,885 3,795 6,109

Depreciation

/

amortisation 575 779 385 511 2,250

------------------------ ------------------- ---------------------- ---------------------- ------------------ ---------------------

There are no individual customers accounting for more than 10%

of Group revenue in either the current or preceding period/

year.

Operating segments - 6 months to 31 October 2018

Ground

General Specialist Engineering Head Total

Piling Piling Services Office

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Revenue 18,537 14,461 9,923 42,921

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Operating

profit

Underlying

operating

profit 465 1,926 647 - 3,038

Share-based

payments - - - (80) (80)

Exceptional

item - - - (331) (331)

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Operating

profit 465 1,926 647 (411) 2,627

Finance

expense - - - (297) (297)

Finance

income - - - 25 25

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Profit before

tax 465 1,926 647 (683) 2,355

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Assets

Property,

plant

& equipment 13,077 12,458 4,287 9,216 39,038

Inventories 1,220 415 712 25 2,372

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Reportable

segment

assets 14,297 12,873 4,999 9,241 41,410

Intangible

assets - - - 2,303 2,303

Trade and

other

receivables - - - 19,946 19,946

Cash and cash

equivalents - - - 9,384 9,384

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Total assets 14,297 12,873 4,999 40,874 73,043

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Liabilities

Loans and

borrowings - - - 15,016 15,016

Trade and

other

payables - - - 15,268 15,268

Provisions - - - 253 253

Deferred tax - - - 1,016 1,016

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Total

liabilities - - - 31,553 31,553

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

Other

information

Capital

expenditure 1,113 367 147 359 1,986

Depreciation

/

amortisation 699 794 233 429 2,155

------------------------ ------------------- ---------------------- ---------------------- ------------------ ------------------

There are no individual customers accounting for more than 10%

of Group revenue in either the current or preceding period/

year.

Operating segments - 12 months to 30 April 2019

Ground

General Specialist Engineering Head

Piling Piling Services office Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ------- ---------- ----------- ------- -------

Revenue 37,201 28,630 22,637 - 88,468

---------------------------- ------- ---------- ----------- ------- -------

Underlying operating

profit 1,238 2,697 1,309 - 5,244

Share-based payments - - - (123) (123)

Exceptional item - - - (559) (559)

---------------------------- ------- ---------- ----------- ------- -------

Operating profit 1,238 2,697 1,309 (682) 4,562

Finance expense - - - (579) (579)

Finance income - - - 52 52

---------------------------- ------- ---------- ----------- ------- -------

Profit before tax 1,238 2,697 1,309 (1,209) 4,035

---------------------------- ------- ---------- ----------- ------- -------

Assets

Property, plant and

equipment 11,033 12,434 5,465 9,554 38,486

Inventories 1,142 890 828 22 2,882

---------------------------- ------- ---------- ----------- ------- -------

Reportable segment

assets 12,175 13,324 6,293 9,576 41,368

Intangible assets - - - 2,289 2,289

Trade and other receivables - - - 20,676 20,676

Cash and cash equivalents - - - 7,997 7,997

---------------------------- ------- ---------- ----------- ------- -------

Total assets 12,175 13,324 6,293 40,538 72,330

---------------------------- ------- ---------- ----------- ------- -------

Liabilities

Loans and borrowings - - - 12,229 12,229

Trade and other payables - - - 16,506 16,506

Provisions - - - 236 236

Deferred tax - - - 1,298 1,298

---------------------------- ------- ---------- ----------- ------- -------

Total liabilities - - - 30,269 30,269

---------------------------- ------- ---------- ----------- ------- -------

Other information

Capital expenditure 1,310 656 793 879 3,638

Depreciation/amortisation 1,249 1,588 581 918 4,336

---------------------------- ------- ---------- ----------- ------- -------

There are no individual customers accounting for more than 10%

of Group revenue in either the current or preceding period/

year.

2. Revenue from contracts with customers

Disaggregation of revenue - 6 months to 31 October 2019

Ground

General Specialist Engineering

Piling Piling Services Total

End market GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------- ---------- ----------- -------

Residential 8,569 1,447 14,903 24,919

Infrastructure 953 10,361 1,249 12,563

Regional Construction 8,139 2,107 691 10,937

Other - 35 70 105

---------------------- ------- ---------- ----------- -------

Total 17,661 13,950 16,913 48,524

---------------------- ------- ---------- ----------- -------

Disaggregation of revenue - 6 months to 31 October 2018

Ground

General Specialist Engineering

Piling Piling Services Total

End market GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------- ---------- ----------- -------

Residential 10,952 1,989 8,844 21,785

Infrastructure 1,969 9,485 651 12,105

Regional Construction 5,373 2,753 320 8,446

Public 161 234 108 503

Other 82 82

---------------------- ------- ---------- ----------- -------

Total 18,537 14,461 9,923 42,921

---------------------- ------- ---------- ----------- -------

Disaggregation of revenue - 12 months to 30 April 2019

Ground

General Specialist Engineering

Piling Piling Services Total

End market GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ------- ---------- ----------- -------

Residential 16,076 2,687 20,044 38,807

Infrastructure 5,549 20,576 1,545 27,670

Regional Construction 14,494 5,143 895 20,532

Public 1,001 224 153 1,378

Other 81 - - 81

---------------------- ------- ---------- ----------- -------

Total 37,201 28,630 22,637 88,468

---------------------- ------- ---------- ----------- -------

4. Exceptional costs

6 months 6 months 12 months

to 31 Oct to 31 Oct to 30 Apr

2019 (unaudited) 2018 (unaudited) 2019 (audited)

GBP'000 GBP'000 GBP'000

------------------- ------------------ ------------------ ----------------

Exceptional costs 146 331 559

------------------- ------------------ ------------------ ----------------

Exceptional costs for the six months to 31 October 2019 relate

to restructuring and redundancy costs related to restructuring of

the Group.

Prior year exceptional costs related to restructuring and

redundancy costs.

5. Earnings per share

The calculation of basic and diluted earnings per share is based

on the following data:

6 months 6 months 12 months

to 31 Oct to 31 Oct to 30 Apr

2019 (unaudited) 2018 (unaudited) 2019 (audited)

'000 '000 '000

------------------------------------ ------------------ ------------------ ------------------

Basic weighted average number

of shares 80,000 80,000 80,000

Dilutive potential ordinary shares - - -

from share options

------------------------------------ ------------------ ------------------ ----------------

Diluted weighted average number

of shares 80,000 80,000 80,000

------------------------------------ ------------------ ------------------ ----------------

GBP'000 GBP'000 GBP'000

------------------------------------ ------------------ ------------------ ----------------

Profit for the period/year 744 1,884 3,212

------------------------------------ ------------------ ------------------ ----------------

Add back / (deduct):

Share-based payments 80 80 123

Exceptional costs 146 331 559

Tax effect of the above (28) (63) (106)

------------------------------------ ------------------ ------------------ ----------------

Underlying profit for the year 942 2,232 3,788

------------------------------------ ------------------ ------------------ ----------------

Pence Pence Pence

------------------------------------ ------------------ ------------------ ----------------

Earnings per share

Basic 0.9 2.4 4.0

Diluted 0.9 2.4 4.0

Basic - excluding exceptional

costs and share-based payments 1.2 2.8 4.7

Diluted - excluding exceptional

costs and share-based payments 1.2 2.8 4.7

------------------------------------ ------------------ ------------------ ----------------

The calculation of the basic earnings per share is based on the

earnings attributable to ordinary shareholders and on 80,000,000

ordinary shares (6 months ended 31 Oct 2018: 80,000,000 and 12

months ended 30 Apr 2019: 80,000,000) being the weighted average

number of ordinary shares.

The underlying earnings per share is based on profit adjusted

for exceptional operating costs and share-based payment charges,

net of tax, and on the same weighted average number of shares used

in the basic earnings per share calculation above. The Directors

consider that this measure provides an additional indicator of the

underlying performance of the Group.

There is no dilutive effect of the share options as performance

conditions remain unsatisfied and the share price was below the

exercise price.

6. Cash generated from operations

6 months 6 months 12 months

to 31 Oct to 31 Oct to 30 Apr

2019 (unaudited) 2018 (unaudited) 2019 (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------------ ------------------ ----------------

Operating profit 1,229 2,627 4,562

Adjustments for:

Depreciation of property, plant

and equipment 2,224 2,131 4,291

Amortisation of intangible assets 26 24 45

Profit on disposal of property,

plant and equipment (120) (8) (26)

Share-based payment expense 80 80 123

-------------------------------------- ------------------ ------------------ ----------------

Operating cash flows before movement

in working capital 3,439 4,854 8,995

Decrease/(Increase) in inventories (78) 193 (317)

Decrease/(Increase) in trade and

other receivables (1,372) 2,279 1,666

(Decrease)/Increase in trade and

other payables (586) (2,523) (847)

Decrease in provisions - (17) (34)

-------------------------------------- ------------------ ------------------

Cash generated from operations 1,403 4,786 9,463

-------------------------------------- ------------------ ------------------ ----------------

7. Analysis of cash and cash equivalents and reconciliation to net debt

31 Oct 2019 31 Oct 2018 30 Apr 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------------------- ------------- ------------- ------------

Cash at bank 3,901 9,340 7,953

Cash in hand 48 44 44

---------------------------- ------------- ------------- ------------

Cash and cash equivalents 3,949 9,384 7,997

Bank loans secured (900) (1,050) (975)

Other loans secured - (62) (15)

---------------------------- ------------- ------------- ------------

Plant and equipment leases (9,491) (13,902) (11,239)

Property leases (3,961)

---------------------------- ------------- ------------- ------------

Total lease liability (13,452) (13,902) (11,239)

---------------------------- ------------- ------------- ------------

Net debt (10,403) (5,630) (4,232)

---------------------------- ------------- ------------- ------------

Property leases at 31 October 2019 are right-of-use assets

capitalised under IFRS16.

INDEPENDENT REVIEW REPORT TO VAN ELLE HOLDINGS PLC

Introduction

We have been engaged by the company to review the unaudited

interim consolidated statement in the half-yearly financial report

for the six months ended 31 October 2019 which comprises the

consolidated statement of comprehensive income, the consolidated

statement of financial position, the consolidated statement of cash

flows, the consolidated statement of changes in equity and the

related notes.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the unaudited interim consolidated statement.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

Our responsibility

Our responsibility is to express to the company a conclusion on

the unaudited interim consolidated statement in the half-yearly

financial report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the unaudited interim consolidated

statement in the half-yearly financial report for the six months

ended 31 October 2019 is not prepared, in all material respects, in

accordance with the rules of the London Stock Exchange for

companies trading securities on AIM.

BDO LLP

Chartered Accountants

Nottingham

21 January 2020

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DDGDBGUDDGGB

(END) Dow Jones Newswires

January 22, 2020 02:00 ET (07:00 GMT)

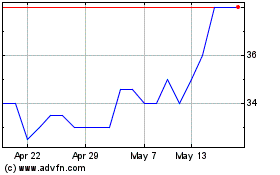

Van Elle (LSE:VANL)

Historical Stock Chart

From Jul 2024 to Jul 2024

Van Elle (LSE:VANL)

Historical Stock Chart

From Jul 2023 to Jul 2024