TIDMWPHO

RNS Number : 2944N

Windar Photonics PLC

29 September 2021

29 September 2021

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Windar Photonics plc

("Windar", the "Company" or the "Group")

Unaudited interim report for the six months ended 30 June

2020

Windar Photonics plc (AIM:WPHO), the technology group that has

developed a cost efficient and innovative LiDAR wind sensor for use

on electricity generating wind turbines, announces its unaudited

interim results for the six months ended 30 June 2021.

For further information, please contact:

Windar Photonics plc Tel: +45 24234930

Jørgen Korsgaard Jensen, CEO

Cenkos Securities plc (Nomad & Broker) Tel: 0131 220 6939

Neil McDonald / Pete Lynch

Notes to Editors:

Windar Photonics is a technology group that develops

cost-efficient and innovative Light Detection and Ranging ("LiDAR")

optimisation systems for use on electricity generating wind

turbines. LiDAR wind sensors in general are designed to remotely

measure wind speed and direction.

http://investor.windarphotonics.com

CHAIRMAN'S STATEMENT

The Company's performance in 2021 showed an improvement from the

corresponding prior year period with realised revenue for the first

half year of 2021 of EUR0.31 million, equivalent to an increase of

11% compared to the first six months of 2020 (H1 2020: EUR0.27

million). Despite this modest growth, the revenue earned continued

to be negatively impacted by the ongoing delays seen in end-user

projects caused by the Covid-19 pandemic, which include the on/off

travel restrictions in place, particularly in Asian markets.

Despite the ongoing impact of the Covid-19 pandemic, the Company

saw continued market interest for our products. This interest has

been realised with the receipt of orders for a further EUR0.9

million, primarily customers from the Asian markets. As at 30 June

2021, the Company order backlog stood at EUR2.2 million, an

increase from EUR1.6 million at the end of year 2020. In addition,

further orders have been received since the 30 June 2021, putting

the Company in a strong position for future delivery. The order

intake is evenly split between sales to the OEM and Retro-fit

market segments.

The various cost cutting initiatives implemented during 2020

continued in 2021 and an additional 5% reduction of the total

administrative expenses has resulted in achieving a reduced net

Loss before taxation of EUR0.95 million when compared to the same

period in the prior year (H1 2020: EUR1.03 million).

During the period, two very important customer test projects

were completed with encouraging results. Both tests utilised the

Plug and Play WindTimizer turbine integration module including the

recently developed on/off (hourly) toggling module, facilitating

the precise performance of before/after tests, eliminating any

impact of environmental changes during the before/after periods. It

is notable that the Windar products are the only Lidar products in

the market with such Plug and Play and testing functionality.

The largest of the two test projects was completed at the end of

the first half of the year in Asia, where the Company completed a

12 month test project with one of the world's leading IPPs, with an

installed capacity of 35GW. The project included five different

turbine platforms, with an average turbine size of 2.6MW. Before

considering the reduced down time of the wind turbines, the average

Annual Energy Production (AEP) was increased by more than 3%, with

the results being verified by the IPP technology institute. The

Company has received additional minor orders during the period from

this IPP but expects to see a larger roll-out as of next year.

The second test project on the Vestas V82 turbine platform in

North America, was completed at the end of 2020 and at the

beginning of the first half year, the average AEP increase of 3%

was verified also by the wind turbine manufacturer. Negotiations

have been ongoing and significant orders for two Turbine Parks are

expected in the near future. However, these negotiations in which

the Company is not directly involved have taken longer than

initially estimated and due to timing of eventual orders, these are

not likely to be delivered within the current financial year. As

Vestas Global Service has endorsed the Vestas/Windar solution as

the preferred optimisation solution for the V82 turbine platform,

we have initiated activities to address the roughly 4,000 V82

turbines installed globally. Following the successful pilot test

customer inquiries have already been received for similar pilot

test runs on additional wind turbine parks in North America.

Regarding the OEM market segments we have seen some delays in

executing the previous received orders; however, during the period

the Company has received larger orders from new OEM customers in

Asia. The Company expected to see a continued growth in this

segment, but timing of deliveries is unclear at the current

stage.

Regarding our Lidar as a Service (LaaS) offering, the Company

completed one pilot test with a North American customer on five

Vestas V90 turbines during the period. Based on our advanced yaw

alignment, wind speed and turbulence technologies we were able to

demonstrate a potential 3.9% AEP increase by optimizing controller

set points regarding the Wind Sector Management and the Nacelle

Transfer Function. The Company expects to conclude orders within

this market segment in the near future.

As previously announced, our One Unit system platform was

successfully launched during the period. During the first half of

2021, our rain intensity detection technology was successfully

completed and presented by the Company and The Danish Technology

University (DTU) on the Wind Energy Science Conference (WESC 2021)

in Hannover, Germany in May 2021. This technology is aimed at

reducing leading-edge erosion of the wind turbine rotor blades. The

functionality will be fully implemented in all our product

platforms from January 2022 as a standard feature.

Within our EUDP funded Licoreim development project, focused on

general wind turbine load reductions based on our WindVision(TM)

system, we have seen good progress. The main parties besides the

Company in the project are DTU, SiemensGamesa and Mita Teknik. For

the retro-fit implementation, we have seen fatigue load reduction

potentials of 7-9% in respect of blade and tower loads and expect

to implement on a test turbine in Germany within the coming

months.

Similarly, we have seen good progress within our Eurostar funded

Lawis development project, focused on merging all major optical

components into one single component. Besides targeting improved

optical performances, this is a key target for further cost

optimisations across our product platforms.

Financial Overview

Overall, the Group realised revenues of EUR0.31 million (H1

2020: EUR0.27 million) and a net loss of EUR0.86 million for the

period (H1 2020: loss of EUR1.01 million) after depreciation,

amortisation and warrant costs of EUR0.17 million (H1 2020: EUR0.18

million).

Cash flow from operations produced a net outflow of EUR0.54

million for the period compared to a net outflow of EUR0.65 million

in H1 2020.

Outlook

Due to the delays detailed above, part of the order backlog of

EUR2.2 million as per the end of the first half year is expected to

be carried forward into 2022. The Company currently estimates that

recognised revenue will grow by 45% to 50% in 2021, compared to the

previous year. Despite the recent delays, the Group's cash flow

position is constantly being monitored with respect to eventual

consequences of orders and project delays. However, management

believe that there are a number of actions available to them in

order to manage the cash position if needed.

In the event that the Company is successful in finalising the

aforementioned orders from North America in the near future the

order backlog to be carried forward into 2022 is expected to be

further strengthened from the position outlined above. In view of

the encouraging project pipeline within the LaaS and Asian market

segments, the Board believes that the Group is well placed to

deliver a significantly improved financial performance in 2022.

The above estimates assume no further restrictions in relation

to the current pandemic. Any further restrictions would not

significantly affect overall order intake but could alter the

timing of revenue recognition.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE SIX MONTHSED 30 JUNE 2021

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

(unaudited) (unaudited) (audited)

Note EUR EUR EUR

Revenue 305,991 274,752 1,333,956

Cost of goods sold (147,703) (151,445) (632,586)

Gross profit 158,288 123,307 701,370

Administrative expenses (1,120,163) (1,172,592) (2,183,141)

Other operating income 16,136 16,076 32,196

Loss from operations (945,739) (1,033,209) (1,449,575)

Finance expenses (16,601) (47,465) (143,110)

Loss before taxation (962,340) (1,080,674) (1,592,685)

Taxation 100,850 67,194 252,517

Loss for the period (861,490) (1,013,480) (1,340,168)

Other comprehensive income

Items that will or maybe reclassified

to profit or loss:

Exchange losses arising on

translation of foreign operations (11,759) 14,932 22,584

Total comprehensive loss for

the period (873,249) (998,548) (1,317,584)

============ ============ =============

Loss per share for loss attributable

to the ordinary equity holders

of Windar Photonics plc

Basic and diluted, cents per

share 2 (1,6) (2.1) (2.7)

------------ ------------ -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE

2021

As at As at As at

30 June 30 June 31 December

2021 2020 2020

(unaudited) (unaudited) (audited)

Notes EUR EUR EUR

Assets

Non-current assets

Intangible assets 1,073,665 1,223,825 1,205,243

Property, plant & equipment 12,120 41,236 27,698

Deposits 25,614 24,957 25,382

Total non-current assets 1,111,399 1,290,018 1,258,323

-------------------------------- ------ ------------- ------------- -------------

Current assets

Inventory 3 602,139 1,062,398 636,785

Trade receivables 4 396,752 160,284 429,241

Other receivables 4 157,914 101,863 220,047

Tax credit receivables 4 353,993 67,303 253,030

Prepayments 4,743 15,152 14,195

Restricted cash and cash -

equivalents - -

Cash and cash equivalents 78,077 268,174 626,361

Total current assets 1,593,618 1,675,174 2,179,659

-------------------------------- ------ ------------- ------------- -------------

Total assets 2,705,017 2,965,192 3,437,982

-------------------------------- ------ ------------- ------------- -------------

Equity

Share capital 5 675,664 622,375 675,664

Share premium 14,502,837 14,016,576 14,502,837

Merger reserve 2,910,866 2,910,866 2,910,866

Foreign currency reserve (7,805) (3,698) 3,955

Accumulated loss (18,488,434) (17,337,276) (17,651,945)

Total equity (406,872) 208,843 441,377

-------------------------------- ------ ------------- ------------- -------------

Non-current liabilities

Warranty provisions 38,509 61,310 38,493

Loans 6 1,533,259 1,164,431 1,719,825

-------------------------------- ------ ------------- ------------- -------------

Total non-current liabilities 1,571,768 1,225,741 1,758,318

-------------------------------- ------ ------------- ------------- -------------

Current liabilities

Trade payables 7 736,586 950,015 726,007

Other payables and accruals 7 503,776 188,906 274,202

Invoice discounting 7 - 42,372 -

Contract liabilities 7 110,915 220,274 215,905

Loans 7 188,844 129,041 22,173

-------------------------------- ------ ------------- ------------- -------------

Total current liabilities 1,540,121 1,530,608 1,238,287

-------------------------------- ------ ------------- ------------- -------------

Total liabilities 3,111,889 2,756,349 2,996,605

-------------------------------- ------ ------------- ------------- -------------

Total equity and liabilities 2,705,017 2,965,192 3,437,982

-------------------------------- ------ ------------- ------------- -------------

CONSOLIDATED CASH FLOW STATEMENT FOR THE SIX MONTHSED

30 JUNE 2021

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

(unaudited) (unaudited) (audited)

EUR EUR EUR

Loss for the period before

tax (962,340) (1,080,674) (1,592,685)

Adjustments for:

Finance expenses 16,601 47,465 143,110

Amortisation 127,173 143,254 286,903

Depreciation 15,239 20,640 38,752

Received tax credit - 212,570 212,864

Foreign exchange difference (11,759) 14,932 22,691

Warrants expense 25,000 15,000 27,020

--------------------------------------- ------------ ------------ -------------

(790,086) (626,813) (861,345)

Movements in working capital

Changes in inventory 34,647 (42,834) 382,779

Changes in receivables 94,622 (66,139) (453,281)

Changes in prepayments 9,451 29,706 30,663

Changes in deposits (233) 23 (401)

Changes in trade payables 10,580 (95,780) (319,788)

Changes in contract liabilities (104,990) 150,320 145,951

Changes in warranty provision 16 140 (22,677)

Changes in other payables

and provision 209,640 266 62,321

Cash flow (used in) operations (536,353) (651,111) (1,035,778)

--------------------------------------- ------------ ------------ -------------

Investing activities

Payments for intangible assets (114,296) (245,743) (469,362)

Grants received 107,200 74,055 (4,449)

Payments for tangible assets - - 174,713

Cash flow (used in) investing

activities (7,096) (171,688) (299,098)

--------------------------------------- ------------ ------------ -------------

Financing activities

Proceeds from issue of share

capital - 375,714 975,214

Costs associated with the

issue of share capital - (37,571) (97,521)

Proceeds from new long term

loans - - 402,447

(Reduction) / proceeds from

invoice discounting - 40,380 (1,992)

(Decrease)/ increase restricted

cash balances - - -

Repayment of loans - - (5,171)

Interest (paid)/received (16,601) (47,465) (74,357)

Cash flow from financing activities (16,601) 331,058 1,198,620

--------------------------------------- ------------ ------------ -------------

Net (decrease)/increase in

cash and cash equivalents (560,050) (491,741) (136,256)

Exchange differences 11,766 (3,109) (407)

Cash and cash equivalents at

the beginning of the period 626,361 763,024 763,024

Cash and cash equivalents at

the end of the period 78,077 268,174 626,361

--------------------------------------- ------------ ------------ -------------

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX

MONTHS

ED 30 JUNE 2021

Share Share Merger Foreign Accumulated Total

Capital Premium reserve currency Losses

reserve

EUR EUR EUR EUR EUR EUR

--------------------- --------- ----------- ---------- ---------- ------------- ------------

At 1 January 2020 608,689 13,692,119 2,910,866 (18,630) (16,338,796) 854,248

New shares issued 13,686 324,457 - - - 338,143

Share option and

warrant costs - - - - 15,000 15,000

--------- ----------- ---------- ---------- ------------- ------------

Transaction with

owners 13,686 324,457 - - 15,000 353,143

--------- ----------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (1,013,480) (1,013,480)

Other comprehensive

loss - - - 14,932 - 14,932

Total comprehensive

income - - - 14,932 (1,013,480) (998,548)

At 30 June 2020 622,375 14,016,576 2,910,866 (3,698) (17,337,276) 208,843

New shares issued 53,289 583,782 - - - 637,071

Costs associated

with capital raise - (97,521) - - - (97,521)

Share option and

warrant costs - - - - 12,020 12,020

--------- ----------- ---------- ---------- ------------- ------------

Transaction with

owners 53,289 486,261 - - 12,020 551,570

--------- ----------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (326,688) (326,688)

Other comprehensive

income - - - 7,652 - 7,652

Total comprehensive

income - - - 7,652 (326,688) (319,036)

At 31 December 2020 675,664 14,502,837 2,910,866 3,954 (17,651,944) 441,377

New shares issued - - - - - -

Share option and

warrant costs - - - - 25,000 25,000

--------- ----------- ---------- ---------- ------------- ------------

Transaction with

owners - - - - 25,000 25,000

--------- ----------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (861,490) (861,490)

Other comprehensive

Income - - - (11,759) - (11,759)

Total comprehensive

income - - - (11,759) (861,490) (873,249)

At 30 June 2021 675,664 14,502,837 2,910,866 (7,805) (18,488,434) (406,872)

--------------------- --------- ----------- ---------- ---------- ------------- ------------

1. BASIS OF PREPARATION

The financial information for the six months ended 30 June 2021

and 30 June 2020 does not constitute the Groups statutory financial

statements for those periods with the meaning of Section 434(3) of

the Companies Act 2006 and has neither been audited or reviewed

pursuant to guidance issued by the Auditing Practices Board. The

annual financial statements of Windar Photonics plc are prepared in

accordance with International Financial Reporting Standards. The

principal accounting policies used in preparing the Interim

financial statements are those that the Group expects to apply in

its financial statements for the year ended 31 December 2021 and

are unchanged from those disclosed in the Group's Annual Report for

the year ended 31 December 2020. The comparative financial

information for the year ended 31 December 2020 included within

this report does not constitute the full statutory accounts for

that period. The statutory Annual Report and Financial Statements

for 2020 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Annual Report and Financial

Statements for 2020 was unqualified, but included a reference to

the material uncertainty related to going concern in respect of the

timing of future revenues without qualifying their report and did

not contain a statement under section 498(2)-498(3) of the

Companies Act 2006. After making enquiries, the directors have a

reasonable expectation that the Group has adequate resources to

continue operating for the next 12 months. Accordingly, they

continue to adopt the going concern basis in preparing the half

yearly condensed consolidated financial statements. This interim

report was approved by the directors.

2. Loss per share

The loss and weighted average number of ordinary shares used in

the calculation of basic loss per share are as follows:

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

EUR EUR EUR

Loss for the period (861,490) (1,013,480) (1,340,168)

----------- ------------- -------------

Weighted average number of ordinary

shares for the purpose of basic

earnings per share 54,595,522 49,167,898 49,819,356

Basic loss and diluted, cents per

share (1,6) (2.1) (2.7)

----------- ------------- -------------

There is no dilutive effect of the warrants as the dilution

would reduce the loss per share.

3. Inventory

As at

As at As at 31 December

30 June 30 June 2020

2021 2020

EUR EUR EUR

Raw materials 125,256 358,827 16,145

Work in progress 284,199 337,247 181,598

Finished goods 192,684 366,324 439,042

------------------ ---------- ---------- -------------

Inventory 602,139 1,062,398 636,785

------------------ ---------- ---------- -------------

4. Trade and other receivables

As at

As at As at 31 December

30 June 30 June 2020

2021 2020

EUR EUR EUR

--------------------------------------- ---------- ---------- -------------

Trade receivables 908,507 672,039 1,301,858

Less; provision for impairment

of trade receivables (511,755) (511,755) (872,617)

--------------------------------------- ---------- ---------- -------------

Trade receivables - net 396,752 160,284 429,241

Total financial assets other than

cash and cash equivalents classified

at amortised costs 396,752 160,284 429,241

--------------------------------------- ---------- ---------- -------------

Tax receivables 353,993 67,303 253,030

Other receivables 157,914 101,863 220,047

Total other receivables 511,907 169,166 473,077

Total trade and other receivables 908,659 329,450 902,318

--------------------------------------- ---------- ---------- -------------

Classified as follows:

Current Portion 908,659 329,450 902,318

--------------------------------------- ---------- ---------- -------------

5. Share capital

Number

of shares EUR

Shares as 30 June 2020 49,751,078 622,375

Issue of shares for cash 4,844,446 53,289

Shares at 31 December 2020 54,595,524 675,664

Issue of shares for cash - -

Shares at 30 June 2021 54,595,524 675,664

------------------------------- ----------- --------

At 30 June 2021, the share capital comprises 54,595,524 shares

of 1 pence each.

6. Borrowings

The carrying value and fair value of Group's borrowings are as

follows:

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2020

2021 2020

EUR EUR EUR

Growth Fund (including accrued

interest) 1,719,825 1,285,457 1,736,802

Nordea Ejendomme 2,278 8,015 5,196

Total financial assets other than

cash and cash equivalents classified

as loans and receivables 1,722,103 1,293,472 1,741,998

--------------------------------------- ----------- ----------- -------------

The Growth Fund borrowing from the Danish public institution,

Vækstfonden, initially bore interest at a fixed annual rate of 12

per cent with a full bullet repayment in June 2021. Terms for the

borrowing were amended in June 2020, and November 2020, pursuant to

which the interest rate was reduced to 7 percent p.a. and the loan

is to be repaid in equal quarterly instalments over the period from

1 January 2022 until 1 January 2026. In November 2020 the Company

has received an offer on an additional Covid loan of EUR400,000 at

an annual interest rate of Cibor + 5% to be repaid over a 5 year

period starting from January 2022 The cash proceeds has been

received post reporting period.

The loan from Nordea Ejendomme is in respect of amounts included

in the fitting out of the offices in Denmark. The loan is repayable

over the 6 years and matures in November 2021 and carries a fixed

interest rate of 6 per cent.

All loans are denominated in Danish Kroner.

7. Trade and other payables

As at As at

As at 30 June 31 December

30 June 2021 2020 2020

EUR EUR EUR

Invoice discounting - 42,372 -

Trade payables 736,586 950,015 726,007

Other payables and accruals 503,776 188,906 274,202

Current portion of loans 188,844 129,041 22,173

Total financial liabilities,

excluding 'non-current'

loans and borrowings classified

as financial liabilities

measured at amortised cost 1,429,206 1,310,334 1,022,382

---------------------------------- --------------- ------------ -------------

Contract liabilities 110,915 220,274 215,905

---------------------------------- --------------- ------------ -------------

Total trade and other payables 1,540,121 1,530,608 1,238,287

---------------------------------- --------------- ------------ -------------

Classified as follows:

Current Portion 1,540,121 1,530,608 1,238,287

---------------------------------- --------------- ------------ -------------

There is no material difference between the net book value and

the fair values of current trade and other payables due to their

short-term nature.

8. Availability of Interim Report

Copies of the Interim Report will not be sent to shareholders

but will be available from the Group's website

www.investor.windarphotonics.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDCCGDDGBI

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

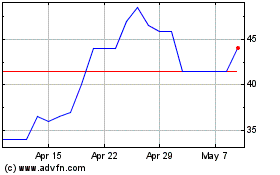

Windar Photonics (LSE:WPHO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Windar Photonics (LSE:WPHO)

Historical Stock Chart

From Feb 2024 to Feb 2025