TIDMXTR

RNS Number : 5059S

Xtract Resources plc

06 November 2023

For immediate release

6 November 2023

Xtract Resources Plc

("Xtract" or the "Company")

Bushranger Pit Optimisation & Financial Study

The Board of Xtract Resources Plc ("Xtract" or the "Company") is

pleased to announce the successful completion of an updated Pit

Optimisation & Financial Modelling Study ( " Bushranger Study "

) to examine the economics of open pit extraction of the

copper-gold Mineral Resources currently defined on the Bushranger

Porphyry Copper-Gold Project ("Project") in central New South

Wales, Australia.

Highlights

-- Xtract engaged independent consultants, Optimal Mining

Solutions (Pty) Ltd of Australia ("Optimal Mining") , to

investigate the economics of a 5Mtpa, 20Mtpa or 25Mtpa open pit

mining operation, focussed on the extraction of shallow

higher-grade mineralisation from the Bushranger Project.

-- The Racecourse Prospect Mineral Resource is 512Mt @ 0.22%

CuEq*, at a cut-off of 0.1% CuEq, containing 1.1Mt of copper

equivalent metal and classified as Inferred and Indicated in

accordance with JORC (2012) (see RNS 23 November 2022).

-- The current Racecourse Prospect Mineral Resource has the

potential to be economically mined at mining rates of 20Mpta, or

greater, and at copper prices of US$10,000/t and above.

-- The Bushranger Study concluded that the highest post tax NPV8

of AU$363m (NPV10 - AU$265m) processes ore above 0.10% CuEq at

20mtpa with a sale price of US$11,000/t.

-- The Bushranger Study recognised that optimisation of the

processing plant capacity, capital costs, operating costs and

metallurgical recoveries could greatly improve the economic

outcomes of mining the Racecourse deposit. Addition of an ore

sorter does not add value at this stage.

-- The Company is focusing efforts on further improvements in

metallurgical recovery and potential associated cost benefits

linked to capital and operating costs.

-- The Bushranger Study concluded that due to the large size and

relatively low grade of the Racecourse deposit, conditions are

expected to be excellent for efficient and productive mining. The

current Ascot Mineral Resource is not of sufficient size, or close

enough to surface, to warrant mining.

-- The Company believes that the discovery of the Ascot prospect

porphyry copper deposit (see RNS 9 December 2021) confirms that the

Bushranger Project hosts multiple copper-gold porphyry systems and

further new discoveries could significantly enhance the economics

of the overall Bushranger Project.

*CuEq % = (Cu%) + (Au g/t * 0.6577)% + (Ag g/t * 0.008769) %

Cu Price = US$8800/t, Au Price = US$1800/oz, Ag Price =

US$24/oz

Colin Bird, Executive Chairman said: "The final results from the

Bushranger Study show that the currently defined Mineral Resources

on the Bushranger Project have the potential to be the basis of a

large scale, economic mining operation, producing significant free

cash flows. The outcomes generated from the mining study are a

solid start to understanding the economics of mining the Project's

mineral resources and show there is considerable upside possible

through optimisation of plant capacity, capital costs, operating

costs and metallurgical recoveries, along with potential

incorporation of alternative ore pre-concentration methods. More

work is warranted in all these areas but particularly metallurgical

studies where improved recoveries could have a knock-on effect on

both capital and operating cost. Larger deposits require

significantly more capital expenditure and as such warrant

considerable study and due diligence at an early stage of project

development when optimisation can radically change a Project's

fortunes. We are at this stage and with this in mind, the Company

will continue with its studies working towards the ultimate mine

and operating plan that provides the best scenario for development

of the Bushranger resource."

Final Results from Bushranger Study

Following definition of the updated Mineral Resource for the

Racecourse Prospect and definition of the maiden Mineral Resource

for the Ascot Prospect, Xtract contracted Optimal Mining to

complete the Bushranger Study. The Bushranger Study was aimed at

examining the economics of 5Mtpa (the high-grade option), 20Mtpa or

25Mtpa open pit mining operation.

Where appropriate, input from other independent consultants was

utilised, including Measured Resources (mineral resource estimate),

Lycopodium (mineral processing experts) and TOMRA (ore sorting

technology). The Bushranger Study was commissioned to assess the

open pit potential based on the currently defined Inferred and

Indicated Resources. The objective of the Bushranger Study was to

assess the potential of the deposit to be initially developed as an

open cut mine and to identity material variables which could affect

the overall economics of a mining operation at Bushranger. The

Bushranger Study included inferred and indicated Mineral Resources

some of which are considered too speculative geologically to have

economic considerations applied to them that would enable them to

be categorised as mineral reserves. The Bushranger Study was based

on technical and economic assessments that are insufficient to

support estimation of Ore Reserves or to provide assurance of an

economic development case at this stage, or to provide certainty

that the conclusions of the Bushranger Study will be realised.

The economic limits of the deposit were initially calculated as

part of a pit optimisation assessment using Deswik's pseudoflow

module. The economic limits of the deposit were calculated applying

all foreseeable operating costs and revenues, with capital costs

not included. The pit optimisation assessment was undertaken

utilising the following assumptions:

-- Capital Cost Estimate - AU$713M (10Mtpa), AU$1,159M (20Mtpa)

-- Annual Feed Rate (ROM t) - 5Mpta, 20Mtpa and 25Mtpa

-- Concentrate Output Cu Grade - 25%

-- Copper Metal Recovery - 88%

-- Gold Metal Recovery - 82.3%

-- Silver Metal Recovery - 75%

-- Overall Pit Wall Angle - 46 (0)

-- Block Model Regularisation - 10m x 10m x 10m Cells

-- Ore Dilution Grade Cu - 0%

-- Ore Dilution Grade Au - 0 g/t

-- Ore Dilution Grade Ag - 0 g/t

-- Cut off Grades - 0.10% CuEq*, 0.15% CuEq

-- Copper Sales Price - US$8,000/t, $9,000/t, $10,000/t, $11,000/t

-- Gold Sales Price - US$1,900/oz

-- Silver Sales Price - US$22/oz

-- Exchange Rate AUD - US$0.70

-- Treatment Cost - US$85/conc t

-- Refining Charge Cu - US$/0.085/lb payable copper

-- Refining Charge Au - US$/5.00/oz payable gold

-- Refining Charge Ag - US$/0.50/oz payable silver

-- Mining Cost - AU$1.70/t (20Mtpa), AU$1.67/t (25Mtpa)

-- Depth Penalty for Ore - AU$0.0016/t per vertical metre

-- Depth Penalty for Waste - AU$0.0023/t per vertical metre

-- Environmental Costs - AU$0.052/t (20Mtpa), AU$0.051/t (25Mtpa)

-- Royalty (% of ex-mine value) - 4.0%

-- Processing Cost - AU$11.63/t milled (20Mtpa), AU$8.41

(20Mpta - low-cost option), AU$10.64/t milled (25Mpta)

-- G& A Costs - AU$1.50/t milled (20Mtpa), AU$1.35/t milled

(25Mpta)

-- Freight - AU$127.30/concentrate t

-- Copper Payable % - 95%

-- Gold Payable % - between 90% and 98%, with average of 93%

realised

-- Silver Payable % - 90%

Using the four different scenarios for the copper price (

US$8,000/t, $9,000/t, $10,000/t, $11,000/t), the two different

copper cut-off grades (0.10% CuEq and 0.15% CuEq) and the two

scenarios for the mining rate (20Mtpa and 25Mtpa), a total of 16

cases were assessed in the pit optimisation assessment for the

Racecourse and Ascot Mineral Resources. A separate ore extraction

case was considering for reducing the processing cost from

AU$11.63/t milled to AU$8.41/t milled. Therefore, in total 17 ore

extraction cases were assessed in the pit optimisation assessment

and the physical outcomes are given in Table 1.

Case 12, of 25Mtpa mining rate, $11k/t copper sale price and

0.10% CuEq cut-off grade, provides the highest cashflow of AU$1.9b.

However, as shown by case 17, which is the same as case 12 but with

the lower operating costs of AU$8.41/t milled, improvements to the

operating costs can significantly impact the economic outcomes,

with case 17 generating an additional AU$425M in free cash

flow.

The physical outcomes as set out in the link below show that the

current Ascot Mineral Resource only generated small quantities,

<5Mt of ore, and consequently, is too small to warrant

development in its current form:

Table 1 - Bushranger Project Open Pit Mining Analysis - Ore

Extraction Cases

http://www.rns-pdf.londonstockexchange.com/rns/5059S_1-2023-11-6.pdf

Due to the grade of the copper-gold mineralisation at the

Racecourse deposit, processing costs are nearly 50% of the total

operating costs. Pre-concentration of ore has the potential to

lower operating costs due to reducing processing mass and

accordingly, Xtract had completed tests using the TOMRA ore sorting

system as announced on 20 July 2023.

The results from TOMRA tests were inconsistent and following

further assessment of the TOMRA results, Optimal Mining have

determined that using TOMRA only improves the margin of ore blocks

with extremely low copper grades (<0.1%). Accordingly, the

conclusion from this assessment is that due to the low potential

for providing economic benefits, a sorter for ore pre-concentration

was not included in the final financial modelling.

In the next stage of the Bushranger Study, the economic limits

of selected pit optimisation assessment scenarios were further

developed by Optimal Mining into detailed practical open pit shells

with accompanying large out-of-pit dump designs. The practical pit

shell designs contained batters and berms and haulage ramps to the

process plant and overburden dumps. The pit shells were divided

into mining benches, strips and blocks and interrogated by the

geological model to provide the quantities and qualities for the

seven selected mining scenario schedules.

A detailed dig and dump schedule, including haulage modelling,

was completed for all seven detailed

cases with the results imported into a financial model for

economic assessment.

The seven detailed cases which were fully designed, scheduled

and haulage modelled are as follows:

-- Option 1 - 5mtpa @ $8k/t copper with 0.25% CuEq cut-off grade

-- Option 2 - 20mtpa @ $8k/t copper with 0.15% CuEq cut-off grade

-- Option 3 - 20mtpa @ $9k/t copper with 0.15% CuEq cut-off grade

-- Option 4 - 20mtpa @ $10k/t copper with 0.10% CuEeq cut-off

grade

-- Option 5 - 20mtpa @ $11k/t copper with 0.10% CuEq cut-off grade

-- Option 6 - same as Option 5 with lower processing cost (case

17)

-- Option 7 - same as Option 5 with 5mtpa production rate

Details of the ore extraction cases are set out Table 2 in the

link below and summarised as follows:

Option Option Option Option Option Option Option

Item Units 1 2 3 4 5 6 7

Quantities Unit Total Total Total Total Total Total Total

----- ------ ------ ------ ------ ------ ------ ------

EBITDA AU$ '000 $301,075 $832,934 $1,156,980 $1,546,265 $2,090,895 $2,109,517 $1,730,271

Free cash flow AU$ '000 $185,526 $1,288,250 $1,341,073 $1,541,532 $1,825,980 $1,830,203 $1,549,151

--------------- --------- --------- ---------- ---------- ---------- ---------- ---------- ----------

AU$

NPV8 '000 -$547,800 -$74,120 -$19,431 $185,950 $362,842 $296,797 -$95,473

--------------- --------- --------- ---------- ---------- ---------- ---------- ---------- ----------

Breakeven

Copper Price US$/t $11,973 $8,313 $9,085 $9,349 $9,900 $10,170 $11,570

--------------- --------- --------- ---------- ---------- ---------- ---------- ---------- ----------

AU$

NPV10 '000 -$569,354 -$153,145 -$99,466 $104,862 $264,610 $193,973 -$197,086

--------------- --------- --------- ---------- ---------- ---------- ---------- ---------- ----------

Table 2 - Bushranger Project Open Pit Mining Analysis - Detailed

Schedule Scenarios

http://www.rns-pdf.londonstockexchange.com/rns/5059S_2-2023-11-6.pdf

The following equipment assumptions were applied in the seven

detailed schedule scenarios:

1. The following dig units were used in the schedules:

-- PC4000 - 1,300 bcm/hr on waste and ore

-- PC7000 - 2,000 bcm/hr on ore and 2,100 bcm/hr on waste

-- PC8000 - 2,200 bcm/hr on waste and ore

2. All dig units operate for up to 6,000 hours per annum.

3. The following trucks were used in the schedules:

-- Komatsu 830E - 83 bcm (220t) capacity, loaded by PC4000's and PC7000's.

-- Komatsu 930E - 109 bcm (290t) capacity, loaded by PC8000's.

4. Stockpiling will be pivotal to achieving the required annual ore tonnes.

5. 4 ore stockpiles have been created adjacent to the mill -

high grade (>0.25%), medium grade (0.20%-0.25%), low grade

(0.15%-0.20%), very low grade (<0.15%)

6. Stockpile loaders rehandle from the ore stockpiles to the crusher in grade priority.

7. Drill and blast is not scheduled but is not expected to be a constraint.

The following mining assumptions were applied in the seven

detailed schedule scenarios:

1. Several dependencies were established to ensure the logical

sequence of the dig and dump faces, including:

-- The entire bench above, in the same phase, must be completed before starting the next bench.

-- Blocks must be dug in the correct sequence away from the ramp mouth.

2. Annual ore tonnes are constrained to 5mt, 20mt 25mt, however

monthly ore tonnes are slightly higher so any shortfalls can be

picked up later in the year.

3. In general, the waste dump logic is as follows:

-- Small pit shells (options 1 to 5) only dump to the western dumps.

-- The large 20mtpa pit shell (option 6) dumps to the western and eastern dumps.

4. All options dump in the area adjacent to the processing plant first.

5. Ex-pit high grade and medium grade ore is dumped directly to

the ROM stockpile if capacity exists, otherwise dumped to ore

stockpiles. Low grade ore is always dumped to stockpiles.

Other key mining operation assumptions used in developing the

financial models for the seven detailed schedule options were as

follows:

1. Vegetation Clearing $5,000/ha

2. Topsoil Removal $6.00/bcm

3. Diesel $1.00/litre (includes fuel rebate)

4. Bulk Explosives $1,375/explosive tonne

5. Explosive Ancillaries $300/explosive tonne

6. Multi-skilled Operator $186,000/year

7. Skilled Operator $138,000/year

8. Mechanical Maintainer $192,000/year

9. Electrical Maintainer $204,000/year

10. All labour rates are fully costed including wages,

superannuation, bonuses, on-costs, etc.

11. A labour factor of 1.2 (for coverage, training, leave, etc.)

was applied

12. Each employee works 1,500 hours annually

Conclusions of Bushranger Study

The key conclusions from the Bushranger Study of the Racecourse

and Ascot Mineral Resources on the Bushranger Copper-Gold Porphyry

Project are as follows:

1. The Racecourse deposit contains significant low-grade tonnes

of copper, gold and silver which may be economically recoverable at

copper sale prices above US$10,000/t.

2. An annual production rate of 20mtpa is required to generate a positive post tax NPV8.

3. The highest post tax NPV8 of AU$363m (NPV10 - AU$265m)

(Detailed schedule option 5) processes ore above 0.10% CuEq at

20mtpa with a sale price of US$11,000/t.

4. The highest post tax NPV8 option provides a return on

investment of 7.1% with a payback period of 6 years.

5. Due to its large size and grade, conditions are expected to

be excellent for the efficient and productive mining of the

deposit.

6. The economic recovery of all metals (copper, gold, silver)

from low grade ores (<0.2% Cu) is pivotal for the economic

viability of the project.

7. Optimisation of the processing plant capacity, capital cost,

metallurgical recoveries and operating cost has the potential to

greatly improve the economic viability of the project and further

work is warranted in all of these areas.

8. A higher grade, lower volume, 5mpta mining practical mining

option does not appear to be economic.

9. Addition of an ore sorter does not add value at this stage.

10. The current Ascot Mineral Resource is not of sufficient

size, or close enough to the surface, to warrant mining.

The Company believes that additional tonnes of shallow

higher-grade copper-gold mineralisation has the potential to

significantly positively impact the economics of the overall

Bushranger Copper-Gold Porphyry Project and porphyry targets remain

untested in close proximity to the Racecourse Mineral Resource.

Further information is available from the Company's website

which details the company's project portfolio as well as a copy of

this announcement: www.xtractresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

The person who arranged for the release of this announcement on

behalf of the Company was Colin Bird, Executive Chairman and

Director.

Enquiries :

Xtract Resources Plc Colin Bird, +44 (0)20 3416 6471

Executive Chairman www.xtractresources.com

Beaumont Cornish Limited Roland Cornish +44 (0)207628 3369

Nominated Adviser Michael Cornish www.beaumontcornish.co.uk

and Joint Broker Felicity Geidt

Novum Securities Limited Jon Belliss +44 (0)207 399 9427

Joint Broker Colin Rowbury www.novumsecurities.com

Qualified Person

Information in this announcement relating to the exploration

works has been reviewed by Edward (Ed) Slowey, BSc, PGeo, a

consultant to Xtract. Mr Slowey is a graduate geologist with more

than 40 years' relevant experience in mineral exploration and

mining, a founder member of the Institute of Geologists of Ireland

and is a Qualified Person under the AIM rules. Mr Slowey has

reviewed and approved the geological content of this

announcement.

Qualified Person

In accordance with AIM Note for Mining and Oil & Gas

Companies, June 2009 ("Guidance Note"), Colin Bird, CC.ENG, FIMMM,

South African and UK Certified Mine Manager and Director of Xtract

Resources plc, with more than 40 years' experience mainly in hard

rock mining, is the qualified person as defined in the Guidance

Note of the London Stock Exchange, who has reviewed the technical

information contained in this press release.

Optimal Mining Solutions (Pty) Ltd of Australia

Optimal Mining Solutions (Pty) Ltd of Australia has reviewed the

information in this announcement which has been derived from the

Pit Optimisation & Financial Modelling Study and has confirmed

that the information so presented is balanced and complete and not

inconsistent with the Pit Optimisation & Financial Modelling

Study .

Mineral Reserves and Resources

The Company estimates and discloses mineral reserves and

resources using the definitions adopted by JORC. Further details

are available at www.jorc.org. See the "Glossary of Geological and

Mining Terms" for complete definitions of mineral reserves and

mineral resources.

About Mineral Resources

Mineral resources are not mineral reserves and do not have

demonstrated economic viability but do have reasonable prospect for

economic extraction. They fall into three categories: measured,

indicated, and inferred. The reported mineral resources are stated

inclusive of mineral reserves. Measured and indicated mineral

resources are sufficiently well-defined to allow geological and

grade continuity to be reasonably assumed and permit the

application of technical and economic parameters in assessing the

economic viability of the mineral resource. Inferred mineral

resources are estimated on limited information not sufficient to

verify geological and grade continuity or to allow technical and

economic parameters to be applied. Inferred mineral resources are

too speculative geologically to have economic considerations

applied to them. There is no certainty that mineral resources of

any category will be upgraded to mineral reserves.

Important Information about Mineral Reserve and Resource

Estimates

Whilst the Company takes all reasonable care in the preparation

and verification of the mineral reserve and resource figures. the

figures are estimates based in part on forward-looking information.

Estimates are based on management's knowledge, mining experience,

analysis of drilling results, the quality of available data and

management's best judgment. They are, however, imprecise by nature,

may change over time, and include many variables and assumptions

including geological interpretation, commodity prices and currency

exchange rates, recovery rates, and operating and capital costs.

There is no assurance that the indicated levels of metal will be

produced, and the Company may have to re-estimate the mineral

reserves based on actual production experience. Changes in the

metal price, production costs or recovery rates could make it

unprofitable to operate or develop a particular deposit for a

period of time.

Forward Looking Statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"will" or the negative of those, variations or comparable

expressions, including references to assumptions. These

forward-looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions

regarding the Company's future growth, results of operations,

performance, future capital and other expenditures (including the

amount, nature and sources of funding thereof), competitive

advantages, business prospects and opportunities. Such forward

looking statements re ect the Directors' current beliefs and

assumptions and are based on information currently available to the

Directors. A number of factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements including risks associated with vulnerability to general

economic and business conditions, competition, environmental and

other regulatory changes, actions by governmental authorities, the

availability of capital markets, reliance on key personnel,

uninsured and underinsured losses and other factors, many of which

are beyond the control of the Company. Although any forward-looking

statements contained in this announcement are based upon what the

Directors believe to be reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with such

forward looking statements.

TECHNICAL GLOSSARY

The following is a summary of technical terms:

"Ag" Silver

"Au" Gold

"Cu" Copper

"CuEq" Copper equivalent grade, calculated using

assumed metal prices for copper, gold and

other metals

"Indicated Mineral That part of a Mineral Resource for which

Resource" quantity, grade (or quality), densities, shape

and physical characteristics are estimated

with sufficient confidence to allow the application

of Modifying Factors in sufficient detail

to support mine planning and evaluation of

the economic viability of the deposit. Geological

evidence is derived from adequately detailed

and reliable exploration, sampling and testing

gathered through appropriate techniques from

locations such as outcrops, trenches, pits,

workings and drill holes, and is sufficient

to assume geological and grade (or quality)

continuity between points of observation where

data and samples are gathered. (JORC 2012)

"Inferred Mineral That part of a Mineral Resource for which

Resource" quantity and grade (or quality) are estimated

on the basis of limited geological evidence

and sampling. Geological evidence is sufficient

to imply but not verify geological and grade

(or quality) continuity. It is based on exploration,

sampling and testing information gathered

through appropriate techniques from locations

such as outcrops, trenches, pits, workings

and drill holes. (JORC 2012)

"mineralisation" Process of formation and concentration of

elements and their chemical compounds within

a mass or body of rock

"NPV" Post-tax net present value

"porphyry" A deposit of disseminated copper minerals

in or around a large body of intrusive rock

"Pseudoflow" The Pseudoflow algorithm is used to outline

the ultimate pit limit by finding the maximum

net value of the blocks extracted.

"Mtpa" Million tonnes per annum

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFQLFBXFLLFBF

(END) Dow Jones Newswires

November 06, 2023 06:30 ET (11:30 GMT)

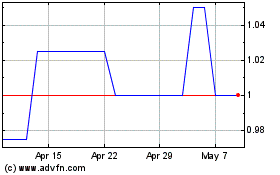

Xtract Resources (LSE:XTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Xtract Resources (LSE:XTR)

Historical Stock Chart

From Apr 2023 to Apr 2024