TIDMZEN

RNS Number : 9366Q

Zenith Energy Ltd

24 October 2019

October 24, 2019

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon

publication of this announcement via a regulatory information

service ("RIS"), the inside information contained in this document

is now considered to be in the public domain.

ZENITH ENERGY LTD.

("Zenith" or the "Company")

Further Reduction of Debt

Zenith Energy Ltd., ("Zenith" or the "Company"), (LSE: ZEN;

TSX.V: ZEE; OSE: ZENA-ME), the international oil & gas

production company operating the largest onshore oilfield in

Azerbaijan, is pleased to announce that it has successfully further

reduced its debt position with a specific focus on the elimination

of all short-term debt positions.

Loan Facility for US$1,485,000 and accrued interest

The Company can today confirm that it has repaid the first

tranche of the settlement of this liability.

As announced on September 17, 2019, the Company entered

negotiations with the lender to settle the liability at a

significant discount.

On October 1, 2019, the Company announced that, following

negotiations with the lender, it had successfully agreed to settle

the aforementioned liability for a total amount of US$1,000,000,

representing a profit of US$1,080,523.

Unsecured notes for GBP90,000 and accrued interest

On March 25, 2019, Zenith issued unsecured notes for a total

amount of GBP90,000.

The Company can today confirm that it successfully repaid the

unsecured notes for GBP90,000, with related accrued interest.

Conversions under Convertible Loan Facility

The Company has received three Conversion Notices ("Conversion")

from the consortium of lenders (the "Lenders") for the US$1,500,000

Convertible Loan Facility ("Convertible Loan") announced on

September 5, 2018.

The Conversion has been made in three different tranches during

the months of September 2019 and October 2019:

1. 2,666,935 common shares ("Conversion Shares") at a price of GBP0.0305 per Conversion Share;

2. 3,702,263 Conversion Shares at a price of GBP0.0221 per Conversion Share; and

3. 5,055,204 Conversion Shares at a price of GBP0.0221 per Conversion Share,

for a total of 11,421,402 Conversion Shares, equivalent to a

total amount of US$340,000.

The total outstanding liability in relation to the Convertible

Loan will now stand at US$420,000 following the completion of the

Convertible Loan Facility and the Conversion.

On March 11, 2019, the Company announced that it had favourably

renegotiated the Convertible Loan to include a fixed conversion

price of GBP0.0505 ("Fixed Conversion Price") for the Convertible

Loan Facility which expired on September 1, 2019.

The Company also announced that it had agreed with the Lenders

to amend the terms of the Convertible Loan to include the

possibility of optional redemptions (the "Optional Redemption") to

be made by the Company in lieu of conversion of the Convertible

Loan by the Lenders for set redemption amounts (the "Redemption

Amounts") amortised across the duration of the Facility.

Zenith has paid a total of US$600,000 in Optional Redemptions to

reduce the total outstanding liability in relation to the

Convertible since the aforementioned revised terms were agreed.

Admission of Conversion Shares

An application will be made for the Conversion Shares to be

admitted to the standard segment of the Financial Conduct Authority

Official List and to trading on the Main Market for listed

securities of the London Stock Exchange ("Admission").

The Conversion Shares will rank pari passu in all respects with

the Company's existing common shares, and it is expected that

Admission will become effective on October 30, 2019.

Total Voting Rights

The Company wishes to announce, in accordance with the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules, the

information set out below following the completion of a Private

Placement in Norway last announced on October 22, 2019 and the

aforementioned Conversions.

Class of share Total number of Number Total number of

shares of voting voting rights

rights per class of share

per share

Common Shares in

issue and admitted

to trading on the

Main Market of

the London Stock

Exchange 277,403,856 1 277,403,856

------------------ ------------ ---------------------

Common Shares in

issue and admitted

to trading on the

TSXV 407,566,366 1 407,566,366

------------------ ------------ ---------------------

Common Shares in

issue and admitted

to trading on the

Merkur Market of

the Oslo Børs 407,566,366 1 407,566,366

------------------ ------------ ---------------------

No Common Shares are held in treasury. The above figure for

total number of Common Shares may be used by shareholders in the

Company as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Andrea Cattaneo, Chief Executive Officer of Zenith,

commented:

"In line with our key strategy of further strengthening our

financial position we have taken targeted steps to significantly

improve our balance sheet in recent months

It is important to underline that the Company made an

exceptional profit of US$1,080,523 from the successful settlement

at a sizeable discount of a Loan Facility.

We look forward to building upon this progress in due course in

order to support Zenith's successful development."

Further Information:

Zenith Energy Ltd

Andrea Cattaneo, Chief Executive Tel: +1 (587) 315 9031

Officer

-----------------------------

E-mail: info@zenithenergy.ca

-----------------------------

Peterhouse Capital - Joint Broker Tel: + 44 (0) 207 469

0930

-----------------------------

Lucy Williams

-----------------------------

Charles Goodfellow

-----------------------------

Novum Securities Limited - Joint Tel: + 44 (0) 207 399

Broker 9400

-----------------------------

Charlie Brook-Partridge

-----------------------------

Hugh McAlister

-----------------------------

IFC Advisory Limited - Financial Tel: + 44 (0) 203 934

PR & IR 6630

-----------------------------

Graham Herring

-----------------------------

Zach Cohen

-----------------------------

Notes to Editors:

Zenith Energy Ltd. is an international oil and gas production

company, listed on the TSX Venture Exchange (TSX.V:ZEE) and London

Stock Exchange (LSE:ZEN). In addition, the Company's common share

capital was admitted to trading on the Merkur Market of the Oslo

Børs (ZENA:ME) on November 8, 2018. The Merkur Market is a

multilateral trading facility owned and operated by the Oslo

Børs.

The Company was assigned a medium to long-term issuer credit

rating of "B+ with Positive Outlook" on October 9, 2019 by Arc

Ratings, S.A.

The Company operates the largest onshore oilfield in Azerbaijan

following the signing of a 25-year REDPSA, (Rehabilitation,

Exploration, Development and Production Sharing Agreement), with

SOCAR, State Oil Company of the Republic of Azerbaijan, in

2016.

The Company's primary focus is the development of its Azerbaijan

operations by leveraging its technical expertise and financial

resources to maximise low-cost oil production via a systematic

field rehabilitation programme intended to achieve significantly

increased revenue. Zenith also operates, or has working interests

in, a number of natural gas production concessions in Italy. The

Company's Italian operations produce natural gas, condensate and

electricity.

Zenith's development strategy is to identify and rapidly seize

value-accretive hydrocarbon production opportunities in the onshore

oil & gas sector. The Company's Board of Directors and senior

management team have the experience and technical expertise to

develop the Company successfully.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKNDPOBDDCKB

(END) Dow Jones Newswires

October 24, 2019 02:00 ET (06:00 GMT)

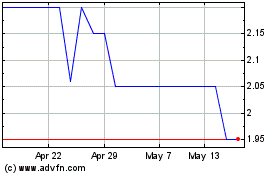

Zenith Energy (LSE:ZEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

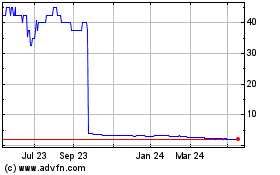

Zenith Energy (LSE:ZEN)

Historical Stock Chart

From Jul 2023 to Jul 2024