Brambles Plans $1.95 Billion Return to Holders from IFCO Sale

25 February 2019 - 9:21AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Australian reusable crates and pallets

supplier Brambles Ltd. (BXB.AU) flagged the return of up to US$1.95

billion to its shareholders after signing a deal to sell a

plastic-containers business.

Brambles in a statement Monday said it was selling its IFCO unit

to a wholly owned subsidiary of Abu Dhabi Investment Authority for

an enterprise value of US$2.51 billion.

The sale is expected to wrap up in the second quarter, subject

to regulatory approval, and the company said it intended to return

about US$300 million in cash from the proceeds to shareholders and

buy back up to US$1.65 billion of its own shares. The remainder

would be used to repay debt, it added.

The company has been looking to spin off or sell the IFCO

business since late last year. The unit supplies crates for moving

fresh produce to retailers in Europe, Asia and the Americas.

The planned exit follows earlier deals to sell Brambles' North

American recycled whitewood pallets business and a stake in an

oil-and-gas joint venture with Hoover Container Solutions.

"The sale will allow Brambles to focus on our strategic

priorities and to pursue continued revenue growth within our core

markets, while also reviewing additional opportunities in emerging

markets," Chief Executive Graham Chipchase said.

The IFCO business generated revenue of almost US$1.1 billion and

earnings before interest, tax, depreciation and amortization of

US$248 million in the last financial year.

Last week, Brambles reported a 27% fall in its half-year profit

to US$319.8 million as it grappled with rising transport and fuel

costs, and after a one-off tax benefit a year ago wasn't repeated.

The company has been seeking a turnaround after its share price was

badly hit in the wake of a rare profit warning and hefty writedowns

in the 2017 financial year.

On Monday, the company reiterated it was evaluating its dividend

policy and would update investors with its full-year results,

though it remained committed to maintaining a strong

investment-grade credit rating and maintaining a progressive

dividend policy for fiscal 2019.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 24, 2019 17:06 ET (22:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

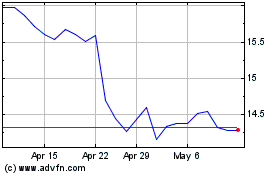

Brambles (ASX:BXB)

Historical Stock Chart

From Apr 2024 to May 2024

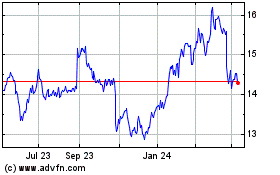

Brambles (ASX:BXB)

Historical Stock Chart

From May 2023 to May 2024