Amended Current Report Filing (8-k/a)

06 June 2019 - 5:53AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 18, 2019

NUCOR CORPORATION

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

|

|

1-4119

|

|

13-1860817

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1915 Rexford Road, Charlotte, North Carolina

|

|

28211

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (704)

366-7000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, par value $0.40 per share

|

|

NUE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

EXPLANATORY NOTE

This Amendment No. 1 amends the Current Report on Form

8-K

(the “Original

8-K”)

Nucor Corporation (the “Corporation”) filed with the Securities and Exchange Commission on April 18, 2019, regarding, among other things, the retirement of R. Joseph Stratman as Chief

Digital Officer and Executive Vice President of the Corporation. The disclosure included in the Original

8-K

otherwise remains unchanged.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

(e) On June 5, 2019, the Corporation and Mr. Stratman

entered into a Retirement, Separation, Waiver and Release Agreement (the “Retirement Agreement”) in connection with Mr. Stratman’s retirement from employment with the Corporation, effective June 8, 2019. The Retirement

Agreement supersedes all previous agreements related to Mr. Stratman’s employment with the Corporation, including the Executive Employment Agreement between Mr. Stratman and the Corporation, effective as of September 30, 2007.

In consideration for Mr. Stratman’s comprehensive release of claims against the Corporation and its affiliates and his

post-employment covenants set forth in the Retirement Agreement, Mr. Stratman will be entitled to receive monthly payments from the Corporation of $218,747.85 for the 24 months immediately following his retirement. Pursuant to the Retirement

Agreement, Mr. Stratman has agreed not to (i) compete with the Corporation during the

24-month

period following his retirement, (ii) disclose proprietary and confidential information (including

trade secrets) of the Corporation, (iii) encourage the Corporation’s existing or prospective customers or suppliers to purchase steel or steel products from any competitor of the Corporation or otherwise attempt to influence any business

or business negotiations such customers or suppliers may transact or have with the Corporation during the

24-month

period following his retirement and (iv) encourage any employee of the Corporation to

terminate his or her employment with the Corporation during the

24-month

period following his retirement. The Retirement Agreement further provides that any inventions, designs or other ideas conceived by

Mr. Stratman during his employment with the Corporation will be assigned to the Corporation. Under the terms of the Retirement Agreement, Mr. Stratman may revoke the Retirement Agreement for a period of seven days after June 5, 2019,

the date Mr. Stratman executed the Retirement Agreement. The Retirement Agreement shall not become effective or enforceable until the

seven-day

revocation period has ended.

The foregoing description of the terms and conditions of the Retirement Agreement does not purport to be complete and is qualified in its

entirety by reference to the full text of the Retirement Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

(#)

|

Indicates a management contract or compensatory plan or arrangement.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NUCOR CORPORATION

|

|

|

|

|

|

|

Date: June 5, 2019

|

|

|

|

By:

|

|

/s/ James D. Frias

|

|

|

|

|

|

|

|

James D. Frias

|

|

|

|

|

|

|

|

Chief Financial Officer, Treasurer and Executive Vice President

|

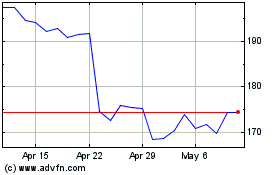

Nucor (NYSE:NUE)

Historical Stock Chart

From Mar 2024 to Apr 2024

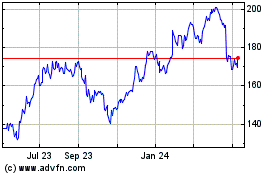

Nucor (NYSE:NUE)

Historical Stock Chart

From Apr 2023 to Apr 2024