Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

26 February 2025 - 10:30PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on February 25, 2025.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR

13(E)(1) OF THE

SECURITIES EXCHANGE ACT OF 1934

ABRDN EMERGING MARKETS EX-CHINA FUND, INC.

(Name of Subject Company (issuer))

ABRDN EMERGING MARKETS EX-CHINA FUND, INC.

(Name of Filing Person (offeror))

COMMON STOCK,

$0.001 PAR VALUE PER SHARE

(Title of Class of Securities)

168834109

(CUSIP Number of Class of Securities)

Lucia Sitar, Esq.

abrdn Emerging Markets ex-China Fund, Inc.

c/o abrdn Inc.

1900 Market Street, Suite 200

Philadelphia, Pennsylvania 19103

Telephone: (215) 405-5773

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications on Behalf of the Person(s) Filing

Statement)

Copy to:

Thomas C. Bogle, Esq.

William J. Bielefeld, Esq.Dechert LLP

1900 K Street N.W.

Washington D.C. 20006

☐ Check box if

the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes to designate any transactions to which

this statement relates:

☐ third party tender offer subject

to Rule 14d-1

☒ issuer tender offer subject

to Rule 13e-4

☐ going-private transaction subject

to Rule 13e-3

☐ amendment

to Schedule 13D under Rule 13d-2

Check the following box if the filing is a final amendment reporting

the results of the tender offer: ☒

Introductory Statement

This Amendment No. 2 hereby amends and supplements

the Issuer Tender Offer Statement on Schedule TO initially filed by abrdn Emerging Markets ex-China Fund, Inc. (formerly known as

abrdn Emerging Markets Equity Income Fund, Inc.), a Maryland corporation (the “Fund”), with the Securities and Exchange

Commission (the “Commission”) on January 21, 2025 (as amended on February 21, 2025 and as further amended hereby,

the “Schedule TO”) in order to update Item 12 to add exhibit (a)(7), a copy of the press release issued by the Fund dated

February 25, 2025 announcing the final results of the offer and the information contained therein is incorporated by reference.

Except as amended herein, the information set forth

in the Offer to Purchase and the related Letter of Transmittal is incorporated herein by reference in answer to Items 1 through 11 of

Schedule TO.

1

Incorporated by reference to the Fund’s Schedule TO-I, as filed with the Commission on January 21, 2025.

2

Incorporated by reference to the Fund’s Schedule TO-I/A, as filed with the Commission on February 21, 2025.

3

Filed herewith.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

ABRDN EMERGING MARKETS EX-CHINA FUND, INC. |

| |

|

|

| |

By: |

/s/ Lucia Sitar |

| |

|

|

| |

|

Name: Lucia Sitar, Esq. |

| |

|

Title: Vice President of the Fund |

| |

|

Dated: February 25, 2025 |

Exhibit 99.(a)(7)

Press Release

FOR IMMEDIATE RELEASE

For More Information Contact:

abrdn U.S. Closed-End Funds

Investor Relations

1-800-522-5465

Investor.Relations@abrdn.com

ABRDN EMERGING MARKETS EX-CHINA FUND, INC.

(AEF) ANNOUNCES

FINAL RESULTS OF CASH TENDER OFFER

(Philadelphia,

February 25, 2025) – abrdn Emerging Markets Equity ex-China Fund, Inc. (formerly, abrdn Emerging Markets Equity

Income Fund, Inc.) (NYSE American: AEF), announced today the final results of its cash tender for up to 10,150,355 shares, representing

approximately 20% of the Fund’s outstanding shares. The offer expired at 5:00 p.m. New York City time on February 20,

2025.

Based on information provided by Computershare Trust Company N.A.,

the depositary of the tender offer, approximately 36,746,773 shares of common stock or 72.4% of the Fund’s outstanding stock were

properly tendered, and the Fund has accepted, subject to adjustment for fractional shares, 10,150,355 shares for cash payment at a price

equal to $6.07, which represents 98% of the Fund’s net asset value per share (“NAV”) as of the close of regular trading

on the NYSE American on February 21, 2025. Since the total number of shares tendered exceeded the number of shares the Fund offered

to purchase, all tenders of shares were subject to proration (at a ratio of approximately 0.27624999) in accordance with the terms of

the tender offer. Following the purchase of the properly tendered shares, the Fund will have 40,601,423 outstanding shares.

Effective February 24, 2025, under normal circumstances, the

Fund now invests at least 80% of its net assets (plus any borrowings for investment purposes) in emerging markets (excluding China) equity

securities and the Fund’s name was changed. As part of the Board’s commitment to shareholders relating to the investment

strategy changes, the Board has adopted a policy (the “Policy”) pursuant to which it will cause the Fund to conduct a one-time

tender offer for twenty percent (20%) of its then issued and outstanding shares of common stock on or before June 30, 2028, if the

Fund’s total return investment performance measured on a NAV basis does not equal or exceed the total return investment performance

of the MSCI Emerging Markets ex-China Index (Net Daily Total Return) during the period commencing on March 1, 2025 and ending on

February 28, 2028. The price at which shares are to be tendered and other terms and conditions of such tender offer would be determined

by the Board in its discretion based on its review and consideration of the then-current size of the Fund, market conditions and other

factors it deems relevant.

For more

insights into the updated investment strategy, listen to the recent podcast interview with Portfolio Manager Nick Robinson

available on the Fund’s website.

Important Information

The Fund’s daily NYSE American closing price and NAV, as well

as other information, including updated portfolio statistics and performance are available at www.abrdnaef.com or by calling the Fund’s

Investor Relations at 1-800-522-5465.

In the United States, abrdn is the marketing name for the following

affiliated, registered investment advisers: abrdn Inc., abrdn Investments Limited, and abrdn Asia Limited.

Closed-end funds are traded on the secondary market through one of

the stock exchanges. A Fund’s investment return and principal value will fluctuate so that an investor’s shares may be worth

more or less than the original cost. Shares of closed-end funds may trade above (a premium) or below (a discount) the NAV of the fund’s

portfolio. There is no assurance that a Fund will achieve its investment objective. Past performance does not guarantee future results.

abrdnaef.com

# # #

Exhibit 107

Calculation of Filing Fee Tables

FORM TO-I

(Form Type)

abrdn Emerging Markets ex-China Fund, Inc.

(Name of Issuer)

abrdn Emerging Markets ex-China Fund, Inc.

(Name of Person(s) Filing Statement)

| |

Transaction valuation |

Fee rate |

Amount of filing fee |

| Fees to be paid |

$61,612,654.85(1) |

0.015310% |

$9,432.90(2) |

| Fees Previously Paid |

$57,523,964.54 |

0.015310% |

$8,806.92(3) |

| Total Transaction Valuation |

$61,612,654.85 |

|

– |

| Total Fees Due for Filing |

|

|

$9,432.90 |

| Total Fees Previously Paid |

|

|

$8,806.92 |

| Total Fees Offsets |

|

|

– |

| Net Fee Due |

|

|

$625.98 |

| (1) | Calculated as the aggregate maximum purchase price to be paid 10,150,355 shares in the offer, based upon a price per share of $6.07,

which represents 98% of the net asset value per share of the close of the regular trading session of the NYSE American on February 21,

2025. |

| (2) | The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended,

as modified by Section 6(b) Filing Fee Rate Advisory for Fiscal Year 2025, $153.10 per million dollars of the value of the transaction. |

| (3) | The fee of $8,806.92 was paid by the Fund in connection with the filing of the Schedule TO-I by abrdn Emerging Markets ex-China Fund, Inc.

(formerly known as abrdn Emerging Markets Equity Income Fund, Inc.) (File No. 005-40493) on January 21, 2025 (the “Schedule

TO”). This is the final amendment to the Schedule TO and is being filed to report the results of the offer. |

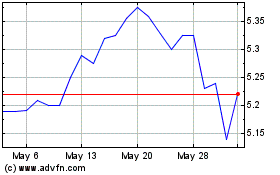

abrdn Emerging Markets e... (AMEX:AEF)

Historical Stock Chart

From Feb 2025 to Mar 2025

abrdn Emerging Markets e... (AMEX:AEF)

Historical Stock Chart

From Mar 2024 to Mar 2025