Golden Minerals Announces Completion of Sale of its El Quevar Silver Project and Provides Corporate Update

25 October 2024 - 8:00AM

Business Wire

Golden Minerals Company (“Golden” or the “Company”) (NYSE-A:

AUMN and TSX: AUMN) today announced the completion of the

previously-announced sale of Silex Argentina S.A., its wholly-owned

subsidiary that owns the El Quevar Project located in Salta

Province, Argentina, to Butte Energy Inc.

The total purchase price for the acquisition of Silex was US$3.5

million, of which $1 million was previously paid, and the balance

of $2.5 million was paid on October 24, 2024.

Concurrent with the closing of the transaction, Butte Energy

changed its name to Argenta Silver Corp.

INFOR Financial Inc. acted as financial advisor to the Company

in relation to this transaction and Fasken Martineau DuMoulin LLP

acted as Canadian counsel to the Company.

Corporate Update

The Company continues to hold an interest in several remaining

exploration properties, including Sarita Este/Desierto, a

gold-silver-copper exploration project located in northwest Salta

Province Argentina and Sand Canyon, an exploration-stage,

gold-silver project in northwestern Nevada. The Company will not be

able to further explore or develop any of its properties without

the receipt of additional capital.

As previously disclosed, the Company ceased mining at the

Velardeña mines in Mexico in the first quarter 2024, and

subsequently sold the mines and certain related assets. The Company

is still owed US$1.8 million plus VAT of the purchase price for the

remaining Velardeña assets. The Company’s only near-term

opportunity to generate cash flow to meet its expected cash

requirements is from the sale of assets, equity or other external

financing. With the receipt of the proceeds from the sale of the El

Quevar project, as of October 24, 2024 the Company has cash and

cash equivalents of approximately $3.6 million and accounts payable

of approximately $1.6 million.

The Company is taking actions to address its liquidity and

financial stability concerns. As a part of these efforts, the

Company is evaluating and pursuing alternatives, including the

potential sale of the Company, finalizing the sale of its assets at

the Velardeña Properties, seeking buyers or partners for the

Company’s other assets or obtaining equity or other external

financing. The proceeds from these sales would be directed toward

addressing the Company’s ongoing operating expenses and satisfying

its liabilities, while seeking to maximize any remaining value for

its shareholders. If the Company is unable to obtain additional

resources, it may be forced to cease operations and liquidate.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and forward-looking information within the meaning of

applicable Canadian securities legislation (collectively,

“forward-looking statements”), including statements regarding the

Company’s ongoing evaluation and pursuit of alternatives to obtain

sufficient funding to continue as a going concern. These statements

are subject to risks and uncertainties including the ability of the

Company to receive the outstanding amounts owed in respect of the

sale of the Velardeña Properties and the ability of the Company to

identify and execute a strategic transaction or financing in order

to avoid the need to liquidate. Golden Minerals assumes no

obligation to update this information. Additional risks relating to

Golden Minerals may be found in the periodic and current reports

filed with the Securities & Exchange Commission by Golden

Minerals, including the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023.

For additional information, please visit

http://www.goldenminerals.com/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024144986/en/

Golden Minerals Company (303) 839-5060

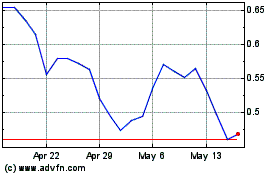

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Jan 2025 to Feb 2025

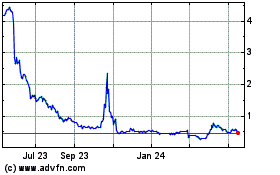

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Feb 2024 to Feb 2025