Golden Minerals Reports Third Quarter 2024 Financial Results

20 November 2024 - 9:25AM

Business Wire

Golden Minerals Company (“Golden Minerals,” “Golden” or the

“Company”) (NYSE-A: AUMN and TSX: AUMN) has today released

financial results for the quarter ending September 30, 2024. (All

figures are in approximate U.S. dollars.)

Third Quarter Financial Summary

- The Company recorded no revenue related to gold and silver in

doré, but recorded revenue of $0.1 million from the sale of metals

at the Velardeña Properties during the third quarter 2024. This

revenue relates to concentrate shipments that were completed

earlier in 2024 but were finalized during the third quarter 2024.

In the third quarter 2023, the Company recorded $2.5 million of

revenue which was related to the sale of metals at its Rodeo

mine.

- The Company recorded $1.6 million of net other operating income

during the third quarter 2024 which was related primarily to the

sale of Silex Argentina and Minera Labri. In the third quarter

2023, the Company recorded $0.1 million of net other operating

income.

- Cash and cash equivalents balance was $1.8 million as of

September 30, 2024, compared to $3.8 million as of December 31,

2023.

- Zero debt as of September 30, 2024, unchanged from December 31,

2023.

- Net gain was $0.2 million or $0.01 per share in the third

quarter 2024, compared to a net loss of $3.2 million or $0.38 per

share in the third quarter 2023.

Cash Inflows and Expenditures

Cash expenditures during the nine months ended September 30,

2024 totaled $10.1 million and included:

- $5.9 million from the net loss on discontinued operations and

assets held for sale, which includes $4.6 million of net operating

costs, $0.9 million of severance payments made to employees in

Mexico who were terminated during the nine months ended September

30, 2024, and $0.4 million in care and maintenance costs at the El

Quevar project net of zero reimbursements from Barrick;

- $3.0 million in general and administrative expenses; and

- $1.2 million in exploration expenditures.

The above expenditures were partially offset by cash inflows of

$8.1 million from the following:

- $4.5 million of proceeds received from the sale of the assets

held for sale and discontinued operations as follows;

- $2.5 million of proceeds from the sale of the Velardeña and

Chicago mines, sulfide plant, mine equipment and mine

concessions

- $1.0 million of proceeds from the sale of Velardeña Plant 2 and

water wells

- $1.0 million of proceeds from the first two payments on the

sale of Silex Argentina

- $2.6 million from the collection of value added tax (“VAT”)

receivables from the Mexican Government;

- $0.4 million of proceeds received from the sale of Minera

Labri; and

- $0.6 million of other working capital changes.

Liquidity and Capital Resources

The Company does not currently have sufficient resources to meet

its expected cash needs during the twelve months ending September

30, 2025. At September 30, 2024, the Company had current assets of

approximately $2.5 million, including cash and cash equivalents of

approximately $1.8 million. On the same date, it had accounts

payable and other current liabilities of approximately $4.5

million, which includes $1.0 million in deferred revenue for the

sale of the Velardeña oxide plant and water wells. As previously

disclosed, the Company ceased mining at the Velardeña mines in

Mexico in the first quarter 2024, and subsequently sold the mines

and certain related assets. As of November 15, 2024, the Company is

still owed $1.7 million, plus VAT, of the purchase price for the

remaining Velardeña assets. The Company’s only near-term

opportunity to generate cash flow to meet its expected cash

requirements is from the sale of assets, equity or other external

financing. With the receipt of the proceeds from the sale of Silex

Argentina, and the cash payments received to date for the Yoquivo

Transaction, as of November 15, 2024 the Company has cash and cash

equivalents of approximately $3.6 million and accounts payable of

approximately $1.2 million. In the absence of additional cash

inflows, the Company anticipates that its cash resources will be

exhausted in the second quarter of 2025.

Golden Minerals will need to secure additional sources of

capital. In order to satisfy the Company’s projected general,

administrative, exploration and other expenses through September

30, 2025, it will need approximately $1.5 to $3.5 million in

capital inflows. These capital inflows may take the form of asset

sales, equity or other external financing activities, collection of

the outstanding amount due on the Velardeña sale, or from other

sources.

The Company is taking actions to address its liquidity and

financial stability concerns. As a part of these efforts, the

Company is pursuing various objectives, including the receipt of

the unpaid proceeds from the Velardeña sale, completion of the sale

of the Yoquivo gold-silver project, or obtaining equity or other

external financing. The Company also continues to evaluate other

strategic transactions. The proceeds from these transactions would

be directed toward addressing the Company’s ongoing operating

expenses and satisfying its liabilities, while seeking to maximize

any remaining value for its shareholders. If the Company is unable

to obtain additional resources, it may be forced to cease

operations and liquidate.

As previously disclosed, the Company has received notices from

the NYSE American LLC (the “NYSE American”) that it is not

compliant with the NYSE American listing standards. The Company has

until December 6, 2024 (the “Compliance Deadline”) in order to

regain compliance. The Company is continuing its efforts to regain

compliance; however, if the Company is unable to regain compliance

by the deadline, the Company expects the NYSE American to initiate

delisting proceedings.

Quarterly Report on Form 10-Q

The Company’s consolidated financial statements and management’s

discussion and analysis, as well as other important disclosures,

may be found in the Company’s Quarterly Report on Form 10-Q for the

quarter ended September 30, 2024. This Form 10-Q is available on

the Company’s website at Golden Minerals Company - SEC Filings. It

has also been filed with the U.S. Securities and Exchange

Commission on EDGAR at www.sec.gov/edgar and with the Canadian

securities regulatory authorities on SEDAR at www.sedar.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and applicable Canadian securities legislation, such as

statements regarding (i) the Company’s anticipated near-term

capital needs, and potential sources of capital; (ii) the

anticipated timing of exhaustion of the Company’s cash resources in

the absence of additional cash inflows; (iii) the Company being

forced to cease operations and liquidate if it is unable to obtain

additional cash resources; (iv) the Company’s capital inflow needs

to satisfy the Company’s projected general, administrative,

exploration and other expenses through September 30, 2025; (v) the

Company’s plans for and the timing of the Company’s receipt of the

outstanding amount owed of the purchase price for remaining

Velardeña assets; and (vi) the NYSE American staff initiating

delisting proceedings against the Company if it is not in

compliance with the NYSE American’s continued listing standards by

the Compliance Deadline. These statements are subject to risks and

uncertainties, including the failure by the buyer of the remaining

Velardeña assets to make the required payments due; whether the

Company continues to be listed on the NYSE American; the inability

of the Company to obtain sufficient capital to meet its

obligations; increases in costs and declines in general economic

conditions; changes in political conditions, in tax, royalty,

environmental and other laws in the United States, Mexico or

Argentina and other market conditions; and fluctuations in silver

and gold prices. Golden Minerals assumes no obligation to update

this information. Additional risks relating to Golden Minerals may

be found in the periodic and current reports filed with the

Securities & Exchange Commission by Golden Minerals, including

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023.

Follow us at www.linkedin.com/company/golden-minerals-company/

and https://twitter.com/Golden_Minerals.

For additional information, please visit

http://www.goldenminerals.com/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119531882/en/

Golden Minerals Company (303) 839-5060

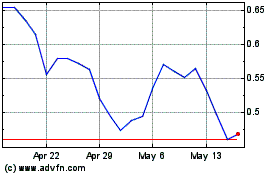

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Jan 2025 to Feb 2025

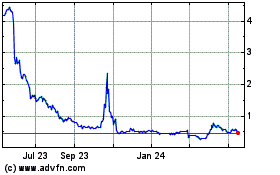

Golden Minerals (AMEX:AUMN)

Historical Stock Chart

From Feb 2024 to Feb 2025