false

0001460602

0001460602

2024-08-09

2024-08-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 9, 2024

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38416 |

|

98-0583166 |

(State

or other jurisdiction

of

incorporation |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

August 9, 2024, Orgenesis Inc. (“Orgenesis”) and Harley Street Healthcare Group (London) Plc Ltd. (“HSHG”) entered

into a Strategic Partnership Agreement (the “Agreement”) pursuant to which Orgenesis and HSHG agreed to form a joint venture

to collaborate in the clinical development and commercialization of wellness and longevity-related services, including personalized preventative

care and regenerative therapies, which are to be offered on a subscription basis by HSHG in line with a planned offering of “Health

& Wellness as a Service” initially within the territory of the United Kingdom, the UAE, MENA, Canada, ASEAN, the Balkans, Africa,

Latam and the Indian Subcontinent (the “Territory”). Pursuant to the Agreement, any new joint venture entity to be formed

(the “JV”) will initially be owned 49% by Orgenesis and 51% by HSHG. Thereafter, ownership of the JV entity will be based

on each party’s respective contributions, and control of the board of the JV entity will be based upon such percentage contributions.

Until the parties mutually agree to form the new JV entity, HSHG and Orgenesis shall each carry out the respective tasks assigned to

them for the implementation of the project in accordance with the Agreement and the applicable work plan thereunder.

Pursuant

to the Agreement, HSHG agreed to invest (by the end of December 2024 for phase I) $5 million in Orgenesis shares of common stock at a

purchase price equal to the greater of (i) $1.03 per share (subject to adjustment for stock splits, consolidations and similar transactions)

or (ii) a 5% premium to the Nasdaq official closing price of the common stock of Orgenesis at the time of HSHG’s investment. Upon

receipt by Orgenesis of the $5 million investment set forth above, HSHG will receive 4,854,369 three-year warrants to purchase 4,854,369

shares of Orgenesis common stock at an exercise price equal to the greater of (i) $1.03 per share (subject to adjustment for stock splits,

consolidations and similar transactions) or (ii) a 10% premium to the Nasdaq official closing price of the Orgenesis common stock. In

addition, HSHG will have the option to provide up to $5 million of additional funding for phase II, to be invested by December 31, 2025

in Orgenesis shares of common stock under the same terms (the “Option”). The Option shall expire on the one year anniversary

of the date which Orgenesis receives the original investment from HSHG (the “Effective Date”). In addition, following the

Effective Date, HSHG will have the option to nominate a representative board member to join the Orgenesis board of directors, subject

to Orgenesis obtaining the proper corporate approvals and the applicable rules and regulations of the Nasdaq Stock Market.

Orgenesis

shall contribute to the JV its intellectual property rights in the form of a license agreement to be entered into by the parties, which

will require that HSHG shall be solely responsible for payment of all costs of the manufacturing, distributing, marketing and/or selling

of Orgenesis products within the Territory. In addition, Orgenesis shall provide the know-how and tech transfer of Orgenesis products,

and will support the JV and HSHG in the implementation of one or more products in the Territory, including implementing the relevant

Orgenesis’ quality management system, all as specified and detailed in the applicable work plan and the relevant master services

agreement. Orgenesis will have the option to nominate a representative board member to join the JV and HSHG’s board of directors,

subject to HSHG obtaining the proper approval for adding a board member.

In

addition, each of the parties may provide additional funding in an amount to be mutually agreed by the parties, to cover the operations

costs of the project in accordance with the applicable work plan. Such additional investment may be in the form of an equity investment

for shares in the JV entity, a convertible loan, and/or procured services (the “Additional Investment”), if required (as

determined by the Parties) upon mutual agreement in order to continue the activities of the applicable project(s). The valuation of the

JV/any jointly controlled entities for the purposes of such Additional Investment will be mutually agreed by the parties or determined

by an independent third-party expert to be mutually selected by the parties. Any Additional Investment by either party may result in

a dilution of the other party’s participating interest.

Orgenesis

and HSHG shall have the right to purchase all of HSHG’s or Orgenesis’ interest in the JV subject to all rules and regulations

to which it is then subject, including without limitation, the rules of any U.S. national securities exchange (“ORGS Buy-Out”).

In the event that the ORGS Buy-Out is implemented, then, for the purposes of the ORGS Buy-Out, the JV’s valuation shall be determined

by an independent third-party expert to be mutually selected by the parties.

The

foregoing summary of the Agreement does not purport to be complete, and is subject to and qualified in its entirety by the Agreement

attached as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

disclosure set forth in Item 1.01 above related to HSHG’s investment in Orgenesis common stock and warrants are incorporated by

reference into this Item 3.02. The shares of Orgenesis common stock, warrants and the shares of common stock issuable upon exercise of

the warrants have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) and are instead

being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act.

Item

9.01. Financial Statements and Exhibits.

The

exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

*

Annexes, schedules and/or exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally

a copy of any omitted attachment to the SEC upon request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ORGENESIS

INC. |

| |

|

| Date:

August 12, 2024 |

By:

|

/s/

Victor Miller |

| |

|

Victor

Miller |

| |

|

Chief

Financial Officer, Treasurer and |

| |

|

Secretary

|

Exhibit

10.1

STRATEGIC

PARTNERSHIP AGREEMENT

This

STRATEGIC PARTNERSHIP AGREEMENT (“Agreement”) is entered into on this 9th day of August 2024 (“Effective Date”)

by and between Orgenesis, Inc. a Nevada corporation, USA, having an address at 20271 Goldenrod Lane, Germantown ,MD 20876, USA (“Orgenesis”)

and Harley Street Healthcare Group (London) Plc Ltd., a company duly incorporated under the laws of the state of the England having its

commercial office at 28 Portland Pl, London W1B 1LY, United Kingdom (“HSHG” or “Company”); (HSHG together with

Orgenesis may also be referred to herein as the “Parties” and each as a “Party”).

WHEREAS,

Orgenesis is engaged, inter alia, in the development and commercialization of cell and gene therapeutic products, including, without

limitation, the products described in Exhibit A attached hereto (the products described in Exhibit A, hereinafter the “Orgenesis

Products”) and is the owner of or holds the rights to related know-how and other intellectual property (“Orgenesis Background

IP”); and

WHEREAS

HSHG and Orgenesis agree to formalize a joint venture to collaborate in the clinical development and commercialization of three (3) Orgenesis

products, which is to be launched by the end of Q4 2024. These products will be offered to the community on a subscription basis in line

with planned offering of “Health & Wellness As A Service” (HWAAS). Initially within the territory of the United Kingdom,

the UAE, MENA, Canada, ASEAN, the Balkans, Africa, Latam and the Indian Subcontinent (the “Territory”), all following the

terms and conditions of this Agreement; and

WHEREAS

HSHG and Orgenesis jointly aim to offer the products with at least a 20% profit margin on all the product revenues during the first 5

years with expectations to grow the revenues by 10%-15% per year, to help deliver the return on investment as part of the turnaround

strategy.

NOW

THEREFORE THE PARTIES DO HEREBY AGREE AS FOLLOWS:

Terms

defined in this Section and elsewhere, parenthetically, in this Agreement, shall have the same meaning throughout this Agreement. Defined

terms may be used in the singular or in the plural.

| 1.1. | “Affiliate”

shall mean, as to either Party, any corporation which controls, is controlled by, or is under

common control with, such Party; A corporation shall be deemed to control another corporation

if it owns, directly or indirectly, more than 50% (fifty percent) of the voting shares, or

has the power to elect more than half of the directors, of such other corporation; |

| 1.2. | “Development”

means pre-clinical and clinical and regulatory activities, including without limitation pre-clinical

and clinical trials (“Clinical Trials”), as required for obtaining all required

regulatory approval(s) and/or reimbursement approval for commercialization of the Orgenesis

Products within the Territory; |

| 1.3. | “Work

Plan” the work plan for carrying out a Project (as defined below) which may be entered

into by the Parties from time to time. |

| 2. | PURPOSE

AND OBJECT OF THE STRATEGIC PARTNERSHIP |

Summary

and scope:

Orgenesis

and HSHG will launch a new JV entity-initially owned 49% (Orgenesis):51% (HSHG). This JV will focus on delivering wellness & longevity-related

services to the market. Orgenesis will invest through its IPs, whereas HSHG will invest Cash according to the following agreed action

plan:

| i. | Upon

the formation of the strategic partnership agreement Orgenesis and HSHG will issue a joint

press release as per the legal requirements. |

| ii. | The

JV will launch wellness and longevity-related products and services to the global market

in Phases with the aim to generate revenue by Q4 of 2024. |

| iii. | “Phase

1 Products” shall include a) Bio Cell Banking of Immune Cells - part of personalised

preventative care; b) Aging & Longevity therapies & products packaged with functional

medicine; c) Preventative illness screening; d) regeneration therapies with stem cells among

others. |

The

JV will map out the 5-year revenue projections. Future relevant financial results will be reflected on the Orgenesis balance sheet according

to the rules of US GAAP. Recurring revenues will include Health -Wellness as a Service (HWAAS). The JV will aim to grow this revenue

at 15% year-on-year over a 5-year timeline as part of the agreed Work Plan.

The

Parties agree on the following milestones to be achieved in the said Work Plan:

| i. | HSHG

will commit to invest $ 5 million in shares of common stock of Orgenesis at the greater of

(i) $1.03 per share (subject to adjustment for stock splits, consolidations and similar transactions)

or (ii) a 5% premium to the Nasdaq official closing price of the common stock of Orgenesis

at the time of HSHG’s investment (See 3.1.1 below). |

| ii. | Upon

receipt of the $5 million investment in (i) above, HSHG will receive 4,854,369 three-year

warrants to purchase 4,854,369 shares of common stock of Orgenesis at the greater of (i)

$1.03 (subject to adjustment for stock splits, consolidations and similar transactions) or

(ii) a 10% premium to the Nasdaq official closing price of the common stock of Orgenesis. |

| iii. | The

Parties will have the right to consolidate the JV entirely into its consolidated financial

results if required under US GAAP or applicable accounting standards. |

Detailed

Scope of the Partnership:

| 2.1. | The

Parties agree to collaborate and work together by forming a joint venture, subject to the

terms and conditions of this agreement, for the purpose of setting up one or more centers

for development and commercializing of cell and gene therapies and/or treatment of patients

with Orgenesis Products and for providing Bio-banking services, preventive illness screening

and longevity therapies, all within the Territory (the “Centers” and “Project”

respectively). Each of the project for the establishment of each of the Centers shall be

governed by a separate Work Plan to be entered into by the Parties The first mutually agreed

Work Plan is attached hereto as Exhibit B. |

| 2.2. | The

Parties shall carry out the joint activities in accordance with the applicable Work Plan

as may be amended, from time to time, by the Parties in writing. |

| 2.3. | Nothing

in this Agreement shall be considered as a limitation of the powers or rights of any of the

Parties to carry on its independent business for its sole benefit in addition to the Project,

except that the Parties undertake to use commercially reasonable efforts to safeguard and

further their common interests in relation to the Project(s). |

| 2.4. | Upon

mutual written agreement of the Parties, the Parties may establish a separate entity to carry

out the Project(s) (“Entity”), in which case the Parties will prepare and execute

appropriate mutually agreed upon formation documents and shareholder rights agreements to

form the new legal Entity. The Entity will initially be 51% owned by Company and 49% by Orgenesis.

Thereafter, ownership of the entity will be based on each’s respective contributions,

and control of the Board will be based upon such percentage contributions. Once organized

and at the first meeting held by the board of directors of the new Entity (“Board”),

the new Entity shall ratify the actions taken by the Parties to that date, as promoters of

the new Entity, to the extent both Parties consented to such actions. Until the Parties mutually

agree to form the new Entity (if at all), HSHG and Orgenesis shall each carry out the respective

tasks assigned to them for the implementation of the Project in accordance with this Agreement

and the applicable Work Plan. Each Party shall maintain complete and accurate books and records

relating to its activities under this Agreement (“Records”) and shall grant the

other Party’s representatives with reasonable access to such Records and provide such

other Party with all other information relating to such activities, as reasonably requested

by such other Party from time to time, subject to Section 8 below; |

| 3. | Contribution

by Parties |

| 3.1. | Each

Party shall contribute to the JV and its Projects in the following agreed manner: |

3.1.1.

HSHG shall market the Orgenesis and HSHG cobranded Products in the Territory under the applicable regulatory requirements and commits

to investing in the products through the joint venture an aggregate investment amount of US 5 Million Dollars ($5,000,000) in phase 1

(by end of Dec 2024) in shares of common stock of Orgenesis. The effective date of this agreement will be the date on which Orgenesis

receives the investment amount, or another amount, to be agreed upon between the parties.

| 3.1.2 | In

addition, HSHG will have the option to provide up to 5 million Dollars ($5,000,000) of additional

funding for phase II, to be invested by December 31, 2025 in shares of common stock of Orgenesis,

under the same terms (the “Option”). The Option shall expire on the one- year

anniversary of the Effective Date. |

As

a commitment to the above plan HSHG will organize the funding through the sale of its assets and debentures.

For

clarification purposes, the Orgenesis common stock share price for HSHG investments under this agreement will be the higher of (i) $US

1.03 per share, or (ii) 5% premium to the closing market price of Orgenesis Inc. common stock, at the prior business day to the time

of investment.

| 3.1.2. | Permit

Orgenesis and/or its Affiliates (as applicable) to carry out activities required to be carried

out by Orgenesis and/or its Affiliates (as applicable) with respect to the Project under

the Work Plan from HSHG’s /JV’s premises and/or provide the necessary real estate

property to enable Orgenesis and/or its Affiliates (as applicable) to carry out such activities

in accordance with the Work Plan and/or MSA. |

| 3.1.3. | HSHG

will have the option to nominate a representative board member to join Orgenesis’ Board

of Directors, subject to Orgenesis obtaining the proper corporate approvals and following

the procedure for adding a Board member. |

| 3.2. | Orgenesis

Contribution to the Project. |

Orgenesis

will:

| 3.2.1. | Grant

intellectual property rights to the joint venture company. The JV supported by HSHG shall

be solely responsible for payment of all costs of the manufacturing, distributing, marketing

and/or selling Orgenesis Products within the Territory pursuant to a License Agreement to

be agreed upon between the Parties. |

| 3.2.2. | The

Orgenesis License Agreement and IP transfer to the Joint Venture related the products will

contain diligence requirements, quality and reporting standards and other standard rights

and obligations representations and warranties which are common in licensing agreements for

international biotech licensing agreements and granting of IPs |

| 3.2.3. | Orgenesis

shall provide the know-how and tech transfer of Orgenesis Products, and will support the

JV/HSHG in the implementation of one or more products in the Territory, including implementing

the relevant Orgenesis’ quality management system, all as specified and detailed in

the applicable Work Plan and the relevant master services agreement. |

| 3.2.4. | Orgenesis

will have the option to nominate a representative board member to join the JV and HSHG’s

Board of Directors, subject to HSHG obtaining the proper approval for adding a Board member. |

| 3.3. | Additional

Contribution: In addition, each of the Parties may provide additional funding in an amount

to be mutually agreed by the Parties, to cover the operations costs of the Project in accordance

with the Work Plan (“Funding Amount”). |

| 4. | DEVELOPMENT

OF THE PRODUCTS: |

| 4.1. | Each

Party shall exert its best commercial efforts to carry out its respective tasks under the

relevant Work Plan in a timely and professional manner in accordance with such Work Plan. |

| 4.2. | Notwithstanding

anything to the contrary in this Agreement, neither Party shall have the authority or right,

nor shall any Party hold itself out as having the authority or right to assume, create or

undertake any obligation of any kind whatsoever, expressed or implied, on behalf or in the

name of the other Party unless otherwise agreed by the Parties in writing, and/or as set

forth in this Agreement. |

| 4.3. | The

Development shall be conducted in accordance with and subject to the relevant Work Plan. |

| 4.4. | The

Clinical Activity and any approvals required for conducting such Clinical Activity shall

be performed and/or obtained (as applicable) in accordance with and subject to the then applicable

protocol and the relevant Work Plan and all applicable laws, regulations and standards. |

| 5. | ADDITIONAL

INVESTMENTS: BUY-OUT |

| 5.1. | Each

Party shall have the right, to invest additional sums (in addition to the amounts to be contributed

by HSHG as set forth In Section 3.1 above), in the Project (which such investment may be

in the form of an equity investment for shares in the JV Entity, a convertible loan, and/or

procured services (the “Additional Investment”), if required (as determined by

the Parties) upon mutual agreement in order to continue the activities of the Project(s).

The valuation of the JV/any jointly controlled entities for the purposes of such Additional

Investment will be mutually agreed by the Parties or determined by an independent third-party

expert to be mutually selected by the Parties. Any Additional Investment by either Party

may result in a dilution of the other Party’s participating interest. |

| 5.2. | Orgenesis

and HSHG shall have the right to purchase all of HSHG’s or Orgenesis’ interest

in the joint venture subject to all rules and regulations to which it is then subject, including

without limitation, the rules of any U.S. national securities exchange (“ORGS Buy-Out”).

In the event that the ORGS Buy-Out is implemented, then, for the purposes of the ORGS Buy-Out,

the Entity’s valuation shall be determined by an independent third-party expert to

be mutually selected by the Parties. |

| 6.1 | The

Parties will form a steering committee composed of one (1) representative from Orgenesis,

and two (2) representatives from HSHG, to facilitate and oversee Development under the Work

Plan (the “Steering Committee”). |

| 7.1. | As

between the Parties, Orgenesis is and shall remain the exclusive owner of all Orgenesis Background

IP, and of any improvements thereon, modification thereto and/or derivatives thereof. |

| 7.2. | Foreground

IP: Subject to Section 7.1 above, the Parties shall jointly own all rights, title and interests

in and to any and all new inventions, discoveries, data rights, information, know how, materials,

processes, manufacturing protocols, clinical results, methods, techniques, products, treatments,

materials, and any other Intellectual Property which is generated, conceived, developed and/or

reduced to practice by and/or on behalf of the Company under the activities of the Project,

and/or resulting from the performance of the Work Plan (collectively, the “Project

IP”) For clarity, Project IP specifically excludes, Orgenesis Background IP. |

| 7.3. | Filing,

Prosecution and Maintenance of Project IP: Orgenesis shall have control over the filing,

prosecution and maintenance all patent applications and patents covering the Project IP after

consultation with the Company. |

| 8.1. | As

used in this Agreement, “Confidential Information” means nonpublic information,

data and/or materials that may be disclosed by or on behalf of one Party (the “Disclosing

Party”) to the other Party (the “Receiving Party”) in connection with this

Agreement or which was disclosed prior to the Effective Date in connection with the subject

matter hereof, in whatever form, provided that such information is clearly marked as confidential.

Information disclosed other than in written or other tangible form will be deemed Confidential

Information only if the Disclosing Party provides the Receiving Party with a written statement

within thirty (30) days of the initial disclosure that identifies which portion of such information

is to be deemed Confidential Information. Notwithstanding the forgoing, the failure to mark

or identify information as confidential shall not prevent its being treated as Confidential

Information if it is reasonably clear that such information is commercially sensitive information.

The Receiving Party agrees (i) to use such Confidential Information of the Disclosing Party

solely for performing its obligations and/or exercising it rights under this Agreement; and

(ii) except as otherwise expressly permitted herein, to not disclose such Confidential Information

of the Disclosing Party to any Third Party without prior written permission. |

| 8.2. | The

foregoing confidentiality obligations do not pertain to any Confidential Information that

a Receiving Party establishes: (i) was known to the Receiving Party without restriction prior

to receipt from the Disclosing Party; (ii) is now or becomes public knowledge, other than

through acts or omissions of the Receiving Party and/or anyone on its behalf in breach of

this Agreement; (iii) is disclosed at any time without restriction to the Receiving Party

by a third party with a lawful right to disclose such information; (iv) was independently

developed by or on behalf of the Receiving Party, outside the scope of this Agreement, without

use of and/or reference to the Confidential Information of the Disclosing Party; or (v) is

disclosed by the Receiving Party to comply with any applicable law, court order or governmental

regulation, only to the minimum extent required to comply with such law, order, or regulation,

provided that the Receiving Party shall, to the extent permissible, provide prior notice

of such required to the Disclosing Party. |

| 8.3. | Without

limiting the Parties’ obligations, the Parties shall hold in confidence and not disclose

the terms and conditions of this Agreement. Notwithstanding the foregoing, a Party may disclose

the existence and terms and condition of this Agreement and material developments hereunder

(i) to the extent required to comply with applicable law (including but not limited to securities

laws and regulations) or the listing requirements of a securities exchange, provided that

such Party use reasonable efforts to seek and obtain confidential treatment as permitted

under such applicable laws and listing requirements and/or (ii) to bona fide potential investors,

acquirers, merger partners, collaborators or licensees, or to professional advisors (e.g.

attorneys, accountants and prospective investment bankers) involved in such activities, for

the limited purpose of evaluating such investment, transaction, or license and under appropriate

conditions of confidentiality, only to the extent necessary and with the agreement by those

permitted individuals to maintain such information in strict confidence. |

| 8.4. | Each

Party shall be entitled to disclose Confidential Information of the other Party to its Affiliates

and to their respective officers, employees, consultants provided that they have a need to

know such Confidential Information and are bound by confidentiality and non-sue obligations

no less protective of the Disclosing Party`s rights as those under this Agreement. |

| 8.5. | Upon

the termination of this Agreement or, if earlier, upon the written request by Disclosing

Party at any time, Receiving Party shall promptly [within 14 (fourteen) days] return or destroy

(at the direction of Disclosing Party) all Confidential Information to Disclosing Party and

all documents or media containing any such Confidential Information, retaining only one copy

for archival purposes only. Notwithstanding the foregoing, it is agreed that Receiving Party

shall not be required to destroy any computer files created during automatic system back

up which are subsequently stored securely by Receiving Party. |

| 8.6. | Notwithstanding

the provisions of this Section 8 above, Orgenesis shall not be prevented from mentioning

the name of the JV/HSHG, and/or any employee of JV/HSHG or from disclosing any information

if, and to the extent that, such mention or disclosure is to competent authorities for the

purposes of obtaining approval or permission for the exercise of the License, or in the fulfillment

of any legal duty owed to any competent authority (including a duty to make regulatory filings). |

| 9. | REPRESENTATIONS

AND WARRANTIES |

| 9.1. | Each

of the Parties hereby represents and warrants to the other Party, acknowledging that the

other Party has entered into this Agreement in reliance of such representations and warranties.

hereunder |

| 9.2. | Authorization:

Each Party has full power and authority to enter into this Agreement and perform its duties

and undertakings as set forth herein and any and all confirmations and approvals for the

same, to the extent required, have been obtained prior to the date hereof. |

| 9.3. | No

Breach; Compliance: There is no impediment at law or contract to either Party’s entering

into this Agreement, to the performance of its obligations particularized in this Agreement

and to its implementation thereof, and its entering into this Agreement, insofar as it relates

to such Party, will not result in a breach of statute or demand of any authority operating

within the scope of its authorities at law. The performance by each Party of its respective

obligations is and will be it all time in strict compliance with the provisions of applicable

law. |

| 9.4. | No

Impediment: Entering into this Agreement, insofar as such relates to a Party, will not result

in the imposition of any charge, pledge, attachment, lien or other burden in respect of the

JV/Parties’ assets and rights and will not give any third parties a cause, right or

claim in respect of the JV/Parties’ assets and rights. |

| 9.5. | Consents:

No consent, authorization, license, permit, registration or approval of any governmental

or public body or authority is required in connection with the execution and delivery of

this Agreement by the Parties or with the performance by the Parties of their respective

obligations hereunder. |

Neither

Party shall assign any of its rights nor obligations under this Agreement without the prior written consent of the other party, such

consent not to be unreasonably withheld; provided, however, that Orgenesis may assign or otherwise transfer this Agreement and/or any

of its rights and/or obligations under this Agreement to an Affiliate thereof without the prior consent of HSHG. Any purported assignment

or transfer not affected in accordance with this Section shall be deemed void and of no force and/or effect.

| 11. | INDEMNIFICATION;

LIMITATION OF LIABILITY |

| 11.1. | Indemnification

by Orgenesis: Orgenesis shall indemnify and defend HSHG and its employees, officers, directors

and agents (each a “Company Indemnitee”) from and against any and all judgments,

settlements, liabilities, damages, losses, costs and expenses (including reasonable attorneys’

fees and expenses) arising out of any third party claim, demand or other proceeding (each,

a “Claim”) to the extent resulting from; (a) a material breach by Orgenesis of

any of its representations, warranties, covenants or obligations set forth in this Agreement;

or (b) a Orgenesis Indemnitee’s or any of Orgenesis’ Affiliates’ gross

negligence, recklessness or willful misconduct in the performance of this Agreement; provided

however, that Orgenesis’ obligations pursuant to this Section 11.1 shall not

apply to the extent such Claims arise out of or result from Company’ breach of this

Agreement or the negligence, recklessness or willful misconduct of any Company Indemnitee

and/or otherwise due to a cause which gives rise to indemnification by Company under Section

11.2 below. |

| 11.2. | Indemnification

by HSHG: HSHG shall indemnify and defend Orgenesis and its Affiliates and each of their respective

agents, employees, officers and directors successors and permitted assigns (each a “Orgenesis

Indemnitee”) from and against any and all Claims to the extent arising out of or resulting

from: (a) a material breach by the JV/HSHG of any of its representations, warranties, covenants

or obligations set forth in this Agreement; and/or (c) any Company Indemnitee’s and/or

Company Affiliate’s gross negligence, recklessness or willful misconduct. |

| 11.3. | Procedure:

The obligations under Section 11.1 and 11.2 abbe are subject to the following conditions: |

| 11.3.1. | the

Party or other person intending to claim indemnification under this Section 11 above

(an “Indemnified Party”) shall promptly notify the other Party (the “Indemnifying

Party”) of any Claim in respect of which the Indemnified Party intends to claim such

indemnification (provided, that no delay or deficiency on the part of the Indemnified Party

in so notifying the Indemnifying Party shall relieve the Indemnifying Party of any liability

or obligation under this Agreement except to the extent the Indemnifying Party has suffered

actual prejudice directly caused by the delay or other deficiency), and the Indemnifying

Party shall have the right to assume full control over the defense and settlement thereof

provided, however, that an Indemnified Party shall have the right to retain its own counsel

and to participate in the defense thereof, with the fees and expenses to be paid by the Indemnified

Party unless the Indemnifying Party does not assume the defense. |

| 11.3.2. | if

the Indemnifying Party shall fail to timely assume the defense of and reasonably defend such

Claim, the Indemnified Party shall have the right to retain or assume control of such defense

and the Indemnifying Party shall pay (as incurred and on demand) the fees and expenses of

counsel retained by the Indemnified Party. |

| 11.3.3. | the

Indemnifying Party shall not be liable for the indemnification of any Claim settled (or resolved

by consent to the entry of judgment) without the written consent of the Indemnifying Party.

The Indemnifying Party shall obtain the prior written consent (which shall not be unreasonably

withheld or delayed) of the Indemnified Party before entering into any settlement of (or

resolving by consent to the entry of judgment upon) such Claim unless (i) there is no finding

or admission of any violation of law or any violation of the rights of any person by an Indemnified

Party, no requirement that the Indemnified Party admit negligence, fault or culpability,

and no adverse effect on any other claims that may be made by or against the Indemnified

Party and (ii) the sole relief provided is monetary damages that are paid in full by the

Indemnifying Party and such settlement does not require the Indemnified Party to take (or

refrain from taking) any action. |

| 11.3.4. | the

Indemnified Party, and its employees and agents, shall cooperate fully with the Indemnifying

Party and its legal representatives in the investigations of any Claim. Regardless of who

controls the defense, each Party hereto shall reasonably cooperate in the defense as may

be requested. |

| 11.4. | LIMITATION

OF LIABILITY. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW AND EXCEPT FOR LABILITY DUE

TO A PARTY’S BREACH OF SECTION 8 ABOVE AND/OR A PARTY’S LIABILITY UNDER SECTION

11.1 OR 11.2 ABOVE, IN NO EVENT SHALL EITHER PARTY OR ITS AFFILIATES BE LIABLE TO THE OTHER

PARTY FOR ANY PUNITIVE, EXEMPLARY, INDIRECT AND/OR CONSEQUENTIAL DAMAGES AND/OR LOST PROFITS

ARISING OUT OF AND/OR IN CONNECTION WITH THIS AGREEMENT. |

| 12.1. | The

term of this Agreement shall commence on the Effective Date and, unless terminated as provided

in this Section 12, shall continue in full force and effect thereafter. |

| 12.2. | Without

derogating from the Parties’ rights hereunder or by law to any other or additional

remedy or relief, it is agreed that either Party may terminate this Agreement hereunder by

serving a written notice to that effect on the other upon or after: |

| 12.2.1. | a

material breach of this Agreement by the other Party, which material breach cannot be cured

or, if curable, which has not been cured by the Party in breach within thirty (30) days after

receipt of a written notice from the other Party in respect of such breach, or |

| 12.2.2. | the

granting of a winding-up order in respect of the other Party, or upon an order being granted

against the other Party for the appointment of a receiver, or if such other Party passes

a resolution for its voluntary winding-up, or if a temporary or permanent liquidator or receiver

is appointed in respect of such other party, or if a temporary or permanent attachment order

is granted on such other party’s assets, or a substantial portion thereof, or if such

other Party shall seek protection under any laws or regulations, the effect of which is to

suspend or impair the rights of any or all of its creditors, or to impose a moratorium on

such creditors; provided that in the case that any such order or act is initiated by any

third party, the right of termination shall apply only if such order or act as aforesaid

is not cancelled within 60 (sixty) days of the grant of such order or the performance of

such act. |

| 12.3. | Neither

expiration of this Agreement, nor termination of this Agreement for any reason, shall relieve

the Parties of any obligation occurring prior thereto and shall be without prejudice to the

rights and remedies of either Party with respect to any antecedent breach of the provisions

of this Agreement. |

| 12.4. | Upon

termination or expiration of this Agreement, for any reason, the following Sections of this

Agreement will survive: 1 (Definitions) 7 (intellectual Property) 8 (Confidentiality),

11 (Indemnification; Limitation of Liability), 12.3 and 12.4 (Termination), 13 (Notices),

14 14 (Governing Law and Jurisdiction) and 15 (Miscellaneous). |

Any

notice or other communication required to be given by one Party to the other under this Agreement shall be in writing and shall be deemed

to have been served: (i) if personally delivered, when actually delivered; or (ii) if sent by electronic mail, upon transmission thereof,

if during normal business hours, and if not then at the start of business on the first business day thereafter (provided that any notice

terminating this Agreement which is sent by electronic mail shall be followed by a notice sent in any other manner provided herein),

or (iii) 10 (ten) days after being mailed by certified or registered mail, postage prepaid (for the purposes of proving such service

- it being sufficient to prove that such notice was properly addressed and posted) to the respective addresses of the Parties set out

below, or to such other address or addresses as any of the Parties may from time to time in writing designate to the other Party pursuant

to this Section 13:

To

ORGENESIS:

To

the attention of Vered Caplan

Orgenesis,

Inc.

20271

Goldenrod Lane, Germantown,

Maryland,

20876,

USA

Email:

vered.c@orgenesis.com

With

Copy to (which such copy shall not constitute notice):

Mark

Cohen, Esq.

Pearl

Cohen Zedek Latzer Baratz LLP

Times

Square Tower

7

Times Square

New

York, New York 10036,

USA

Email:

MCohen@PearlCohen.com

To

HSHG:

To

the attention of Sanjeev Kumar

Harley

Street Healthcare Group (HSHG).

28

Portland Place, London,

United

Kingdom

Email:

sanjeev@harleyoflondon.co.uk

| 14. | GOVERNING

LAW AND JURISDICTION |

This

Agreement shall be governed in all respects by the laws of the State of New York, USA (without application of is conflict of law provisions

directing that the laws of another jurisdiction shall apply). The federal and state courts located in New York County, New York, USA,

shall have exclusive jurisdiction over any dispute and/or claim arising form and/or related to this Agreement and the Parties hereby

submit to the personal jurisdiction of such courts with respect to any such dispute and/or claim.

| 15.1. | The

preamble and Exhibits hereto form an integral part of this Agreement. In this Agreement “including”

or “includes” means including without limiting the generality of any description

preceding such terms. The headings in this Agreement are intended solely for convenience

or reference and shall be given no effect in the interpretation of this Agreement. |

| 15.2. | This

Agreement constitutes the full and complete agreement between the Parties and supersedes

any and all agreements or understandings, whether written or oral, concerning the subject

matter of this Agreement. |

| 15.3. | This

Agreement may be amended only by a written document signed by both Parties. |

| 15.4. | The

Parties hereby undertake to act in good faith towards each other, to use their best efforts,

to contribute their energy and experience in their areas of expertise to furthering the activities

of the Project and in order to render the provisions of this Agreement valid and effective. |

| 15.5. | This

Agreement may be executed in any number of counterparts (including counterparts transmitted

by email or fax), each of which shall be deemed to be an original, but all of which taken

together shall be deemed to constitute one and the same instrument. |

| 15.6. | No

waiver by any Party, whether express or implied, of its rights under any provision of this

Agreement shall constitute a waiver of such Party’s rights under such provisions at

any other time or a waiver of such party’s rights under any other provision of this

Agreement. No failure by any Party to take any action against any breach of this Agreement

or default by the other Party hereto shall constitute a waiver of the former Party’s

rights to enforce any provision of this Agreement or to take action against such breach or

default or any subsequent breach or default by such other Party. |

| 15.7. | If

any provision of this Agreement is held to be unenforceable under applicable law, then such

provision shall be modified as set out below and the balance of this Agreement shall be interpreted

as if such provision were so modified and shall be enforceable in accordance with its terms.

The Parties shall negotiate in good faith in order to agree on the terms of an alternative

provision which complies with applicable law and achieves, to the greatest extent possible,

the same effect as would have been achieved by the invalid or unenforceable provision. |

| 15.8. | Nothing

contained in this Agreement shall be construed to place the parties in a relationship of

partners or parties to a joint venture or to constitute either Party an agent, employee or

a legal representative of the other Party and neither Party shall have power or authority

to act on behalf of the other Party or to bind the other Party in any manner whatsoever. |

| 15.9. | Each

Party represents that it has been represented by legal counsel in connection with this Agreement

and acknowledges that it has participated in the drafting this Agreement. ln interpreting

and applying the terms and provisions of this Agreement, the Parties agree that no presumption

shall exist or be implied against the Party which drafted such terms and provisions. |

| 15.10. | The

ruling language of this Agreement is English. To the extent practicable with third Parties,

English shall be the language used for all purposes in connection with the Project and this

Agreement. |

WHEREOF

THE PARTIES HAVE CAUSED THIS AGREEMENT TO BE EXECUTED BY THEIR DULY AUTHORIZED REPRESENTATIVES AS OF THIS 9th DAY OF AUGUST, 2024.

| ORGENESIS,

INC. |

|

HARLEY

STREET HEALTHCARE GROUP. |

| |

|

|

|

|

| By: |

/s/

Vered Caplan |

|

By: |

/s/

Sanjeev Kumar |

| |

|

|

|

|

| Name: |

Vered

Caplan |

|

Name: |

Sanjeev

Kumar |

| |

|

|

|

|

| Title: |

Chief

Executive Officer |

|

Title: |

Founder

& Chief Visionary Officer |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

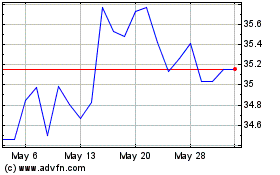

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Innovator Ibd Breakout O... (AMEX:BOUT)

Historical Stock Chart

From Feb 2024 to Feb 2025