Castellum, Inc. Announces Closing of $4 Million Revolver with Live Oak Bank

23 February 2024 - 10:45PM

Castellum, Inc. (NYSE-American: CTM), a cybersecurity and software

services company focused on the federal government, announces that

it has closed its previously announced $4 million financing with

Live Oak Bank.

Castellum, Inc. ("Castellum") now has a $4 million

revolving credit facility secured by cash, receivables, and the

Company's other assets. As part of the transaction, Castellum

rolled over approximately $625,000 drawn down on its existing

revolver with Live Oak Bank, paid down $400,000 owed to Robert

Eisiminger, and paid down approximately $809,000 owed to the

Buckhout Charitable Remainder Trust (the "BCR Trust"). The

remaining $6.0 million balance owed to Mr. Eisiminger is now due in

Q3 2026. The balance of $2.4 million owed to the BCR Trust will be

fully amortized over 24 months starting September 2024, with the

final payment due in August 2026. $400,000 owed to another creditor

in 2024 is now due in July 2025, at which point it will amortize

over 8 months. Importantly, the amount owed to the BCR Trust is no

longer convertible into Castellum's common stock, eliminating over

12 million shares of potential dilution from the Company's cap

table. Outside the amortization of the remaining six payments on

the term loan owed to Live Oak Bank, and the initial four (4)

amortization payments to the BCR Trust in September – December of

this year, the Company now has no debt maturities remaining in

2024.

"This debt restructuring and refinancing is a

milestone event for Castellum and our shareholders. We have

eliminated the debt wall, which was facing us in 2024,

significantly reduced our diluted share count by restructuring the

BCR Trust note into a non-convertible structure, and provided

additional borrowing capacity with our new revolver," said Mark

Fuller, President and Chief Executive Officer of Castellum. "As we

continue to amortize our existing term loan with Live Oak Bank, our

debt/cash operating profit ratio keeps improving, and we position

ourselves for a much brighter future. Together with our recent

equity take down from our universal shelf registration and cash

from operations, this financing puts Castellum on a much stronger

financial footing."

The Company expects to file a Form 8-K later today

with the Securities and Exchange Commission which provides more

information about the Live Oak Bank financing and restructuring of

the notes payable to Robert Eisiminger, the BCR Trust, and the

additional creditor referred to above.

About Castellum,

Inc.

Castellum, Inc. (NYSE-American: CTM) is a

defense-oriented technology company executing strategic

acquisitions in the cybersecurity, MBSE, and information warfare

areas - http://castellumus.com/.

Cautionary Statement Concerning

Forward-Looking Statements:

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements represent the Company's

expectations or beliefs concerning future events and can generally

be identified by the use of statements that include words such as

"estimate," "project," "believe," "anticipate," "shooting to,"

"intend," "plan," "foresee," "likely," "will," "would," "appears,"

"goal," "target" or similar words or phrases. Forward-looking

statements include, but are not limited to, statements regarding

the Company's expectations for revenue growth and new customer

opportunities, improvements to cost structure, and profitability.

These forward-looking statements are subject to risks,

uncertainties, and other factors, many of which are outside of the

Company's control, that could cause actual results to differ

materially from the results expressed or implied in the

forward-looking statements, including, among others: the Company's

ability to compete against new and existing competitors; its

ability to effectively integrate and grow its acquired companies;

its ability to identify additional acquisition targets and close

additional acquisitions; the impact on the Company's revenue due to

a delay in the U.S. Congress approving a federal budget; and the

Company's ability to maintain the listing of its common stock on

the NYSE American LLC. For a more detailed description of these and

other risk factors, please refer to the Company's Annual Report on

Form 10-K and its Quarterly Reports on Form 10-Q and other filings

with the Securities and Exchange Commission ("SEC") which can be

viewed at www.sec.gov. All forward-looking statements are

inherently uncertain, based on current expectations and assumptions

concerning future events or future performance of the Company.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which are only predictions and speak

only as of the date hereof. The Company expressly disclaims any

intent or obligation to update any of the forward-looking

statements made in this release or in any of its SEC filings except

as may be otherwise stated by the Company.

Contact:

Mark Fuller, President and CEO Contact:

Info@castellumus.com Phone: (301) 961-4895

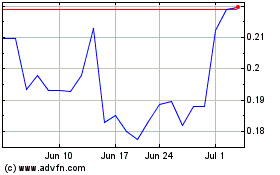

Castellum (AMEX:CTM)

Historical Stock Chart

From Feb 2025 to Mar 2025

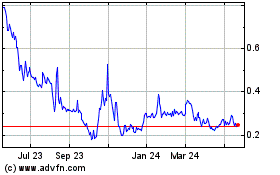

Castellum (AMEX:CTM)

Historical Stock Chart

From Mar 2024 to Mar 2025