Castellum, Inc. (NYSE-American: CTM) (“Castellum” or “the

Company”), a cybersecurity, electronic warfare, and software

services company focused on the federal government, announces

certain unaudited highlights of its operating results for its year

ended December 31, 2024.

Revenue for 2024 was $44.8 million, down slightly

from $45.2 million in 2023. Operating loss was ($7.2 million)

versus ($16.7 million) in 2023, which included $6.9 million of

non-cash charges for goodwill impairment.

Management uses a Non-GAAP measure,

Adjusted EBITDA, as an important measure of

the Company's operating performance. Adjusted EBITDA

was $0.8 million for 2024 and excludes non-cash

charges, such as stock-based compensation expense of $5.4

million, and depreciation and amortization of $2.2

million, compared to $0.2 million for 2023. See

the reconciliation to

GAAP in the chart below.

Cash flow provided by operating activities for

2024 was $1.1 million versus ($2.3 million) in 2023.

Total cash as of December 31, 2024, was $12.3

million versus $1.8 million as of December 31, 2023. Debt as of

December 31, 2024, was $10.7 million versus $12.4 million as of

December 31, 2023.

Castellum's fully audited financial results for

the year ended December 31, 2024, are expected to be filed on or

before March 15, 2025, on Form 10-K, available at www.sec.gov.

"I’m encouraged by the progress we made in 2024,

particularly since I assumed the role of CEO this past July," said

Glen Ives, President and Chief Executive Officer of the Company.

“While we produced solid revenue and gross profit in 2024, 2025

will be our year of growth as new contract wins and continued

execution on our existing contracts should lead to strong

year-over-year growth in revenue and adjusted EBITDA. Our decreased

debt and dramatic increase in cash from our offerings, combined

with our recent IDIQ wins have really positioned us well for

2025.”

About Castellum,

Inc.:

Castellum, Inc. (NYSE-American: CTM) is a

cybersecurity, electronic warfare, and software engineering

services company focused on the federal government -

http://castellumus.com.

Cautionary Statement Concerning

Forward-Looking Statements:

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements represent the Company’s

expectations or beliefs concerning future events and can generally

be identified by the use of statements that include words such as

“estimate,” “project,” “believe,” “anticipate,” “shooting to,”

“intend,” “plan,” “foresee,” “likely,” “will,” “would,” “appears,”

“goal,” “target” or similar words or phrases. Forward-looking

statements include, but are not limited to, statements regarding

the Company’s expectations for revenue growth and new customer

opportunities, improvements to cost structure, and profitability.

Forward-looking statements include, but are not limited to,

statements regarding the Company’s expectations for revenue growth

and new customer opportunities, including opportunities arising

from its contracts with NAVAIR and other customers, improvements to

cost structure, and profitability. These forward-looking statements

are subject to risks, uncertainties, and other factors, many of

which are outside of the Company’s control, that could cause actual

results to differ materially from the results expressed or implied

in the forward-looking statements, including, among others: the

Company’s ability to compete against new and existing competitors;

its ability to effectively integrate and grow its acquired

companies; its ability to identify additional acquisition targets

and close additional acquisitions; the impact on the Company’s

revenue due to a delay in the U.S. Congress approving a federal

budget, operating under a prolonged continuing resolution,

government shutdown, or breach of the debt ceiling, as well as the

imposition by the U.S. government of sequestration in the absence

of an approved budget; the ability of the U.S. federal government

to unilaterally cancel a contract with or without cause, and more

specifically, the potential impact of the U.S. DOGE Service

Temporary Organization on government spending and terminating

contracts for convenience.. For a more detailed description of

these and other risk factors, please refer to the Company’s Annual

Report on Form 10-K and its Quarterly Reports on Form 10-Q and

other filings with the Securities and Exchange Commission (“SEC”)

which can be viewed at www.sec.gov. All forward-looking statements

are inherently uncertain, based on current expectations and

assumptions concerning future events or future performance of the

Company. Readers are cautioned not to place undue reliance on these

forward-looking statements, which are only predictions and speak

only as of the date hereof. The Company expressly disclaims any

intent or obligation to update any of the forward-looking

statements made in this release or in any of its SEC filings except

as may be otherwise stated by the Company.

Non-GAAP Financial Measures and Key

Performance Metrics

This press release contains Non-GAAP Adjusted

EBITDA, which is a Non-GAAP financial measure that is used by

management to measure the Company's operating performance. A

reconciliation of this measure to the most directly comparable GAAP

financial measure is contained herein. To the extent required,

statements disclosing this measure's definition, utility, and

purpose are also set forth herein.

Definition:

Adjusted EBITDA is a Non-GAAP measure, calculated

as the Company’s earnings before (not including expenses related

to) interest, taxes, depreciation, and amortization, also adjusted

for other non-cash items such as stock-based compensation, and

other non-recurring, cash items, such as expenses for a one-time

policy change.

Utility and Purpose:

The Company discloses Non-GAAP Adjusted EBITDA

because this Non-GAAP measure is used by management to evaluate our

business, measure its operating performance, and make strategic

decisions. We believe Non-GAAP Adjusted EBITDA is useful for

investors and others in understanding and evaluating our operating

results in the same manner as its management. However, Non-GAAP

Adjusted EBITDA is not a financial measure calculated in accordance

with GAAP and should not be considered as a substitute for GAAP

operating loss or any other operating performance measure

calculated in accordance with GAAP. Using this Non-GAAP measure to

analyze our business would have material limitations because the

calculations are based on the subjective determination of

management regarding the nature and classification of events and

circumstances that investors may find significant. In addition,

although other companies in our industry may report a measure

titled Non-GAAP Adjusted EBITDA, this measure may be calculated

differently from how we calculate this Non-GAAP financial measure,

which reduces its overall usefulness as a comparative measure.

Because of these inherent limitations, you should consider Non-GAAP

Adjusted EBITDA alongside other financial performance measures,

including net loss and our other financial results presented in

accordance with GAAP.

| Castellum,

Inc.Reconciliation of unaudited Non-GAAP Adjusted EBITDA to

Operating Income/ (Loss)The Year Ended December 31, 2024,

and 2023 |

|

|

|

2024 |

|

|

2023 |

|

|

Revenues |

$ |

44,764,852 |

|

$ |

45,243,812 |

|

|

Gross Profit |

|

18,266,415 |

|

|

18,675,327 |

|

| Loss

from operations before other income (expense) |

|

(7,244,627 |

) |

|

(16,668,825 |

) |

| |

|

|

| Add

back: |

|

|

|

Depreciation and amortization |

|

2,220,185 |

|

|

2,528,815 |

|

| |

|

|

|

Adjust for non-cash and one-time charges: |

|

|

|

Stock based compensation |

|

5,426,985 |

|

|

7,495,759 |

|

|

Goodwill Impairment |

|

- |

|

|

6,919,094 |

|

|

Change in FV of earnout |

|

- |

|

|

(92,000 |

) |

|

Non-recurring charges |

|

445,007 |

|

|

- |

|

|

Total non-cash charges |

|

5,871,992 |

|

|

14,322,853 |

|

| |

|

|

|

Non-GAAP Adjusted EBITDA |

$ |

847,550 |

|

$ |

182,843 |

|

| |

|

|

|

|

|

|

Contact: Glen

Ives President and Chief Executive

Officer Phone: (703) 752-6157

info@castellumus.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d022e960-9912-4701-8fdb-fcb3ed07050a

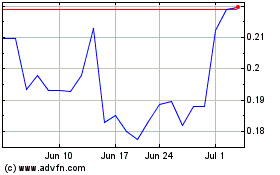

Castellum (AMEX:CTM)

Historical Stock Chart

From Feb 2025 to Mar 2025

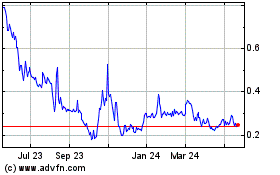

Castellum (AMEX:CTM)

Historical Stock Chart

From Mar 2024 to Mar 2025