Debt Resolve Inc - Current report filing (8-K)

24 October 2007 - 7:29AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

____________________________________________________________

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

___________________________________________________________________

Date

of

report (Date of earliest event reported): October 17, 2007

DEBT

RESOLVE, INC.

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

0-29525

|

33-0889197

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

707

Westchester Avenue, Suite L7 White Plains, New York

|

10604

|

|

(Address

of principal executive offices)

|

(Zip

C

ode)

|

Registrant's

telephone number, including area code: (914) 949-5500

Check

the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 DFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4

(c) under the Exchange Act (17 CFR

240.13e-4(c))

CURRENT

REPORT ON FORM 8-K

DEBT

RESOLVE, INC.

October

17, 2007

On

October 17, 2007, we entered into a line of credit with Mr. William B. Mooney,

a

director of ours (the “Lender”), pursuant to which we may borrow from time to

time up to $275,000 to be used to fund our working capital needs, including

the

operation of our debt-collection subsidiary, First Performance Corporation.

Borrowings under the line of credit will bear interest at 12% per annum, with

interest payable monthly in cash. The principal balance outstanding will be

due

at any time upon 30 days’ written notice from Lender, subject to mandatory

prepayment (without penalty) of principal and interest, in whole or in part,

from the net cash proceeds of any public or private, equity or debt financing

we

may procure. Lender’s obligation to lend such funds is subject to a number of

conditions, including review by Lender of our proposed use of such funds. As

part of this transaction, we have issued to Lender a five-year warrant to

purchase an aggregate of up to 137,500 shares of our common stock at an exercise

price of $2.00 per share. Our Co-Chairmen, Mr. James D. Burchetta and Mr.

Charles S. Brofman (the “Guarantors”), have, in separate agreements, agreed to

each personally guarantee 33% of our payment obligation with respect to the

outstanding balance under the line of credit.

Lender

is

a member of our Board of Directors. The independent and disinterested members

of

our Board determined that the line of credit was on terms no less favorable

to

Debt Resolve than could have been obtained form unaffiliated third parties.

|

Item

9.01.

|

Financial

Statements and Exhibits.

|

|

|

10.1

|

Line

of Credit Agreement, dated October 17, 2007, between Debt Resolve,

Inc.

and William B. Mooney, together with form of Non-Negotiable Promissory

Note and Form of Warrant.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant

has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

|

|

|

DEBT

RESOLVE,

INC.

|

|

|

|

|

Date:

October 23, 2007

|

By:

|

/s/ James

D.

Burchetta

|

|

|

James

D. Burchetta

Co-Chairman

and Chief Executive Officer

|

|

|

|

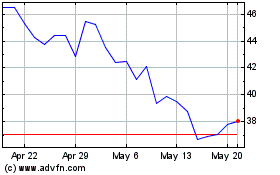

Direxion Daily Real Esta... (AMEX:DRV)

Historical Stock Chart

From Mar 2025 to Apr 2025

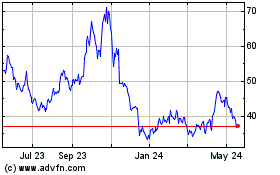

Direxion Daily Real Esta... (AMEX:DRV)

Historical Stock Chart

From Apr 2024 to Apr 2025

Real-Time news about Direxion Daily Real Estate Bear 3X Shares (American Stock Exchange): 0 recent articles

More Debt Resolve Inc News Articles