Debt Resolve Inc - Current report filing (8-K)

18 December 2007 - 8:12AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of

Report (Date of earliest event reported): December 4, 2007

DEBT

RESOLVE, INC.

(Exact

Name of Registrant as Specified in Charter)

|

|

Delaware

|

0-29525

|

33-0889197

|

|

|

|

(State

or other jurisdiction

|

(Commission

File Number)

|

(IRS

Employer

|

|

|

|

of

incorporation)

|

|

Identification

No.)

|

|

|

|

707

Westchester Avenue, Suite L7

|

10604

|

|

|

|

White

Plains, New York

|

(Zip

Code)

|

|

|

|

(Address

of principal executive offices)

|

|

|

Registrant's

telephone number, including area code: (914) 949-5500

Check

the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement communications pursuant

to Rule 13e-4 (c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Item

7.01.

|

Regulation

FD Disclosure

|

Cautionary

Statement Pursuant to Safe Harbor Provisions of the Private Securities

Litigation Reform Act of 1995:

“Safe

Harbor” statement under the Private Securities Litigation Reform Act of 1995:

This report contains forward-looking statements identified by the use of words

such as should, believes, plans, goals, expects, may, will, or the negatives

thereof, and other variations thereon or comparable terminology. Such statements

are based on currently available information which management has assessed

but

which is dynamic and subject to rapid change due to risks and uncertainties

that

affect our business, including, but not limited to, the ability to finance

activities and maintain financial liquidity, unexpected resistance to the

adoption of our product offerings, obtaining or maintaining patent and other

proprietary intellectual property protection, the ability to develop a strong

brand identity, competitive and alternative technologies and product offerings

and other risks detailed from time to time in our filings with the U.S.

Securities and Exchange Commission. Any statements that express or involve

discussions with respect to predictions, expectations, beliefs, plans,

projections, objectives, goals, assumptions or future events or performance

are

not statements of historical fact and may be forward-looking statements.

Forward-looking statements involve a number of risks and uncertainties which

could cause actual results or events to differ materially from those presently

anticipated.

Note:

Information in this current report furnished pursuant to Item 7.01 shall not

be

deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended, or otherwise subject to the liabilities of that section.

The information in this current report shall not be incorporated by reference

into any registration statement pursuant to the Securities Act of 1933, as

amended. The furnishing of the information in this current report is not

intended to, and does not, constitute a representation that such furnishing

is

required by Regulation FD or that the information this current report contains

is material investor information that is not otherwise publicly

available.

Management

of Debt Resolve, Inc. hosted a third quarter conference call and business update

on December 4, 2007. The transcript of the conference call is attached hereto

and will also be posted on our website at

www.debtresolve.com

.

|

Item

9.01.

|

Financial

Statements and Exhibits

|

|

Exhibit

No.

|

Description

|

|

|

|

|

99.1

|

Transcript

of Third Quarter Conference Call and Business Update on December

4, 2007,

of Management of Debt

Resolve, Inc.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant

has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

|

|

|

DEBT

RESOLVE,

INC.

|

|

|

|

|

Date:

December 5, 2007

|

By:

|

/s/

James D. Burchetta

|

|

|

James

D. Burchetta

|

|

|

Co-Chairman

and

Chief Executive Officer

|

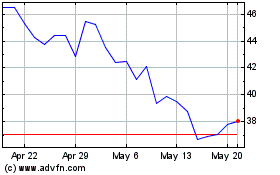

Direxion Daily Real Esta... (AMEX:DRV)

Historical Stock Chart

From Mar 2025 to Apr 2025

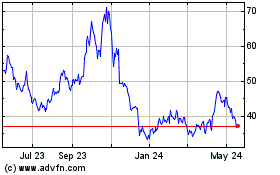

Direxion Daily Real Esta... (AMEX:DRV)

Historical Stock Chart

From Apr 2024 to Apr 2025

Real-Time news about Direxion Daily Real Estate Bear 3X Shares (American Stock Exchange): 0 recent articles

More Debt Resolve Inc News Articles