Could a Possible Rate Cut Be Good News for the Chile ETF? - ETF News And Commentary

31 January 2014 - 12:00AM

Zacks

The Chilean equity markets were under pressure for most of 2013,

thanks to outflow of capital from emerging markets over taper

concern and declining copper prices.

Fluctuations in the price of copper impact this Latin American

economy since it is the largest producer of the metal in the world.

Also, a subdued Chinese growth rate, one of Chile’s largest trading

partners, kept the markets of Chile under pressure last year (Read:

China ETFs Tumble to Start 2014).

However, things might turn around for Chile, at least for the next

few months, as its central bank aims to change its current stance

on monetary policy.

The Current Picture

The central bank of Chile kept its benchmark interest rates

unchanged at 4.5% in its January policy. The bank has now kept the

interest rate steady for the second consecutive month.

An unexpected jump in inflation to 3% in December from 1.5% in

October prompted the bank to keep interest rates unchanged in its

December and January policy. The depreciation of the peso against

the greenback is considered as the prime reason for the spike in

inflation.

The bank had made two consecutive interest rate cuts in October and

November by 25 basis points each. However, President Rodrigo

Vergara signaled that lackluster figures for gross domestic product

(GDP) might prompt the bank to loosen its monetary policy in its

upcoming policy meeting (Read: Best ETF Strategies for 2014).

Factors Paving the Way for Rate Cuts

GDP

The economy’s GDP, as measured by its Imacec index, rose modestly

at 2.8% year over year in both November and December. The expansion

rate was the slowest since July 2011.

Manufacturing Output

Moreover, uninspiring manufacturing output data for the month of

November (down 1.1% year over year) is also a matter of concern.

It marked the fourth successive monthly decline in

manufacturing production, largely blamed on lower production of

iron and steel products.

Inflation

Also, Rodrigo Vergara, the President of Chile’s central bank,

believes that a less than full capacity growth in the economy will

keep inflation below its target level of 3%. A rise in inflation in

the preceding two months is believed to be temporary, and nothing

to base policy decisions on.

Thus, lower GDP and manufacturing data along with expectations of

falling inflation might lead its central bank to consider cutting

rates in its next policy meeting. This cut aimed to boost the

Chilean economy is expected to cheer the morale of equity

investors. A drop will enable corporates to borrow at a lower cost,

thereby boosting their profits.

As such, investors willing to participate in the rally can easily

do so via the ETF route and might consider adding

iShares

MSCI Chile Capped ETF (

ECH) which we have

highlighted in further detail below:.

ECH in Focus

The fund follows the MSCI Chile IMI 25/50 Index. ECH holds 41

securities in total and charges investors 61 basis points a year in

fees (See all Latin American ETFs here).

The ETF currently manages an asset base of $352.4 million.

With almost 60% allocation towards its top 10 holdings, the fund is

exposed to higher concentration risk. S.A.C.I. Falabella

(8.66%), Empresas Copec (8.55%) and Enersis Sa (8.43%) are the top

three holdings.

From a sector perspective, utilities (24.69%), financials (17.3%)

and consumer staples (12.42%) account for nearly 54% of the total

fund assets.

The ETF had slumped around 25% in 2013 due to various reasons

including weak copper prices, a stronger dollar and weaker demand

from emerging markets (See Latin America ETFs Beyond Brazil).

The fund has a dividend yield of 1.48%.

Bottom Line

It might be a good idea for investors to get into ECH, which is

trading almost 30% below its January 2013 level. A cut in interest

rates is expected to give some boost to ECH. Moreover, improving

economic conditions in the U.S., Europe and China might enhance the

global demand for commodities, providing relief to commodity

focused ETFs such as this Chilean fund.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-MSCI CHL (ECH): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

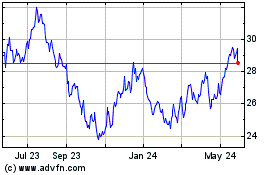

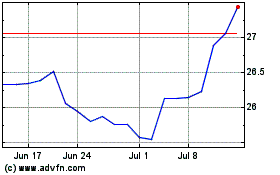

iShares MSCI Chile ETF (AMEX:ECH)

Historical Stock Chart

From Dec 2024 to Jan 2025

iShares MSCI Chile ETF (AMEX:ECH)

Historical Stock Chart

From Jan 2024 to Jan 2025