Many investors are finally starting to believe that the U.S.

market is back on track. After all, the DJIA is at an all-time

high, while the housing and jobs markets are also performing well

to start 2013 (Impact of Positive Jobs Data on ETFs).

It appears that the Federal Reserve's measures along with decent

U.S. data is finally pushing stocks higher, rescuing investors from

a disappointing start to the year. And with a lack of big hurdles

on the horizon, some are predicting that this trend will continue

as we head into April as well.

As a testament to this bullish attitude, investors have seen the

benchmark S&P 500, as represented by the SPDR S&P

500 ETF (SPY), move

continually higher and within striking distance of all time highs.

In fact, the ETF’s one year performance is already impressive,

having added over 13.8%.

Still, while many investors may be focused in on the American

market, there are plenty of other developed nations that have

actually beaten out the U.S. in the past year. These markets may

often be overlooked, but they are clearly capable of big gains as

well.

So for investors seeking foreign plays that are doing well in

this market environment, a closer look at any of the following

three ETFs could be a good idea. This is not only from a

diversification perspective, but quite possibly if these trends

continue, a return look as well:

Australia

Australia is one such developed economy which is rich in natural

resources, has a better fiscal position than many other developed

economies, and is (relatively) close to booming Asian-Pacific

markets (Australia ETF Investing 101).

The economy posted a solid GDP growth rate of 3.2% in 2012 and

has not seen a recession for 21 years. Australia, a country blessed

with immense mineral wealth, has been enjoying the boom in the

mining sector due to increased demand for iron ore and coal from

emerging economies.

However, the slowdown in the Chinese economy impeded growth of

the mining sector as China accounts for two-thirds of Australia’s

iron ore exports and thereby plays an influential role in the

economy’s performance. But with China showing signs of rebounding,

it seems that the mining sector in Australia will regain strength

and commodity prices will again shoot up.

So investors looking to play this trend in the Australian

economy can look to invest in one of the most popular options in

the ETF industry. iShares MSCI Australia Index Fund

(EWA) portfolio of 71

stocks represent some of the largest Australian-listed securities,

and easily the most popular choice in teh Aussie ETF market

(Australia ETFs to Play the Coming Shale Boom)

EWA has managed to beat SPY in the one year period with a return

of 23.5% while its 2012 gains stand at 21.5%.

Australia ETF in Focus

This is one of the oldest ETFs to tap the Australian equity

market. The fund manages an asset base of $2.7 billion and trades

with volumes of more than one million shares a day. In spite of

providing exposure to a large basket, the fund has 60.9% of assets

invested in the top ten choices (Do Country ETFs Really Provide

Diversification?).

While many investors might expect the ETF to be heavy in

materials firms, the fund, like many other country-specific

ETFs, has a heavy exposure level to the financial sector of

the economy. Financials dominates 49.3% of the performance of the

ETF while another 19.8% goes to the materials sector.

Among individual holdings, however, the highest allocation goes

to the mining giant BHP Billiton (10.84%) and financial behemoth

Commonwealth Bank of Australia (10.63%). The fund charges a fee of

71 basis points annually.

Sweden

The Swedish economy emerged from the financial crisis as one of

the strongest in Europe. The strength of the economy lies in low

levels of public debt and a current account surplus (Nordic ETF

Investing 101).

Although the economy has somewhat slowed down in the fourth

quarter of 2012, it will be able to pick up on the back of more

expansionary policies and a stabilizing export market.

However, rising unemployment levels remain a matter of concern

for the economy. The government expects Sweden's jobless rate to

rise to 8.2% in 2012, compared with the previous forecast of

7.5%.

Still, given its overall strength, investors may still want to

tap the economy with the iShares MSCI Sweden Index Fund

(EWD). This is the lone

ETF for establishing exposure in Swedish securities directly,

holding about three dozen stocks in its portfolio.

The fund’s performance has been quite impressive in the

year-to-date period, while gains over the one year time frame have

been solid at 18.1%, easily beating out SPY’s returns in the same

time frame.

Sweden ETF in Focus

EWD manages an asset base of $413.3 million of which the ten

largest holdings make up 61.3%. Ericsson LM-B, Hennes &

Mauritz, and Nordea Bank form the top line of the fund. Among

sector holdings, industrials and financials play an influential

role in the performance of the ETF with a share of 30.6% and 28.5%,

respectively.

The fund also yields an impressive dividend of 2.63% per year,

greatly easing the 51 basis point expense ratio for investors (ETFs

for the Most Competitive Countries on Earth).

Denmark

Denmark appears to be slowly recovering from the financial

crisis and the economy is expected to regain some strength and show

improvement in 2013. The unemployment level in the economy is also

expected to come down going forward.

The country is expected to have healthy public finances, which

would keep the interest rates down, while inflation has also been

moderate. Further, Denmark enjoys significant account surplus,

foreign-exchange reserves and a favorable public debt

situation.

However, the Euro-zone accounts for a major portion of Denmark’s

exports and weakness in the region will affect the Danish

economy.

Investors looking to invest in the region can opt for the

iShares MSCI Denmark Capped Investable Market Index Fund

(EDEN). The fund climbed

20% in the past year, also beating SPY. The fund offers a

concentrated play in Denmark stocks with almost 63.3% of the asset

base in the top ten holdings (Access the Least Corrupt Countries

with These ETFs).

Denmark ETF in Focus

The fund invests its $3.5 million asset base in a portfolio of

37 stocks and charges investors a fee of 53 basis points. Among

sectors, Health Care, Industrials, Financials and Consumer Staples

influence the performance of the ETF with a double-digit

allocation.

For individual holdings, Novo Nordisk constitutes the top spot

in the basket with the largest share at 22%, while the next two

spots – Danske Bank and Carlsberg – make for a combined 13.3% share

combined.

The fund charges an annual fee of 53 bps from investors putting

it in line with other ETFs targeting the region.

Bottom Line

Many investors focus in on U.S. stocks, and in bull market times

like this, it is easy to see why. However, big gains can still be

had beyond our shores, and the aforementioned three foreign ETFs

are a testament to this, even when everyone seems to be zeroed in

on domestic holdings.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-MS DNMRK (EDEN): ETF Research Reports

ISHARS-AUSTRAL (EWA): ETF Research Reports

ISHARS-SWEDEN (EWD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

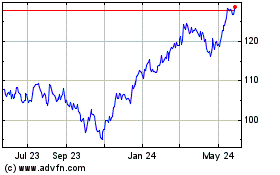

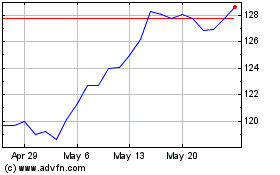

iShares MSCI Denmark ETF (AMEX:EDEN)

Historical Stock Chart

From Jan 2025 to Feb 2025

iShares MSCI Denmark ETF (AMEX:EDEN)

Historical Stock Chart

From Feb 2024 to Feb 2025