UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of January 2022

Commission

File Number: 001-39164

INDONESIA

ENERGY CORPORATION LIMITED

(Translation

of registrant’s name into English)

GIESMART

PLAZA 7th Floor

Jl.

Raya Pasar Minggu No. 17A

Pancoran

– Jakarta 12780 Indonesia

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): -.

Overview

On

January 21, 2022 (the “Initial Closing Date”), Indonesia Energy Corporation Limited, a Cayman Islands exempted company

(the “Company”), closed an initial $5.0 million tranche (the “First Tranche”) of a total anticipated

$7.0 million private placement with L1 Capital Global Opportunities Master Fund, Ltd. (the “Investor”) pursuant to

the terms of Securities Purchase Agreement, dated January 21, 2022, between the Company and the Investor (the “Purchase Agreement”).

In

connection with the closing of the First Tranche, the Company issued to the Investor (i) a 6% Original Issuance Discount Senior Convertible

Note in a principal amount of up to $7,000,000.00 (as described further below, the “Note”) and (ii) a five year Ordinary

Share Purchase Warrant (the “Initial Warrant”) to purchase up to 383,620 ordinary shares of the Company (the “Ordinary

Shares”) at an exercise price of $6.00 per share, subject to adjustment as described below.

Within

two (2) trading days of the declaration of effectiveness of the Registration Statement (as defined below), and subject to the satisfaction

of certain conditions precedent, a second tranche of funding under the Note (the “Second Tranche”) shall be provided

by the Investor in the principal amount of $2,000,000 (subject to potential reduction as described below). Such principal amount, if

funded, will be added to the principal amount of the Note, and the Investor will be entitled to receive an additional Ordinary Share

Purchase Warrant (carrying the same terms as the Initial Warrant) (the “Second Warrant” and collectively with the

Initial Warrant, the “Warrants”) to purchase up to 153,450 Ordinary Shares, if the full amount of the Second Tranche

is funded, at an exercise price of $6.00 per share, subject to adjustment as described below.

The

amount of the Second Tranche, and the corresponding number of Ordinary Shares underlying the Second Warrant, is subject to reduction

if the principal amount of the Note (after funding the Second Tranche) would be less than 25% of the then current market capitalization

of the Company at that time.

EF

Hutton, division of Benchmark Investment, LLC, acted as exclusive placement agent for the offering and received customary fees.

Terms

of the Purchase Agreement

The

terms of the Purchase Agreement contains customary representations and warranties, indemnification, and other covenants of the Company

and the Investor, as well as the following material terms:

Registration

Rights. No later than 30 business days from the Initial Closing Date, the Company shall prepare and file a Registration Statement

(the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) covering

the resale of all of the Ordinary Shares underlying the Note and the Warrants. The Company shall use its commercially reasonable efforts

to have the Registration Statement declared effective as soon as practicable after filing thereof but in no event later than the date

that is (i) 60 days following the Initial Closing Date if the Registration Statement is not subject to review by the SEC or (ii) 90 days

following the Initial Closing Date if the Registration Statement is subject to review by the SEC. The Company has also granted the Investor

certain “piggyback” registration rights with respect to the Ordinary Shares underlying the Note and the Warrants. The Company

will pay all fees and expenses incident to such registrations, excluding discounts, commissions, fees of underwriters, selling brokers,

dealer managers or similar securities industry professionals with respect to the shares being sold.

Future

Financing Participation Right. Subject to certain exceptions, for a period of one (1) year from the Initial Closing Date, the Investor

shall have the right to participate in up to thirty percent (30%) of future financings of the Company undertaken during that period.

Repayment

on Future Financings. If the Company issues any debt, including any subordinated debt or convertible debt (other than the Note),

then the Investor will have the option to cause the Company to immediately utilize 30% of the aggregate proceeds of such issuance to

repay the Note. In addition, if the Company issues any equity interests for cash as part of a financing transaction (other than in connection

with an “at the market” funding program), then the Investor will have the option to cause the Company to direct 30% of such

proceeds from such issuance to repay the Note.

Leak

Out. Subject to certain exceptions, and provided no Event of Default (as defined below) has occurred, the Investor shall uses its

best efforts in any month not to offer, sell, agree to offer or sell, solicit offers to purchase, grant any call option or purchase any

put option with respect to, or pledge, encumber, assign, borrow or otherwise dispose of Ordinary Shares underlying the Note and the Warrants

at less than $6.00 per share in an aggregate amount not to exceed the greater of (i) $750,000, or (ii) 40% of the average trading volume

of the Ordinary Shares in the preceding month.

Prohibited

Transactions. The Company shall not (without the prior written consent of the Investor): (i) enter into any financing transactions

that qualify as “variable rate transactions” until thirty (30) days after such time as the Note has been repaid in full and/or

has been fully converted into Ordinary Shares or (ii) utilize any “at the market” offering program in respect of its Ordinary

Shares in the thirty (30) day period following any date that the Company has made payments under the Note in the form of Ordinary Shares.

No

Repricing. The Company shall not, without the prior written consent of the Investor (i) authorize the amendment of any outstanding

note, option, warrant, or other derivative security convertible, exercisable or exchangeable for Ordinary Shares to reduce the conversion,

exercise or exchange price of any such security or (ii) grant a replacement note, option, warrant or other derivative security convertible,

exercisable or exchangeable for Ordinary Shares for the purpose of reducing the conversion, exercise or exchange price of any such security

being replaced.

Available

Information. As long as the Investor owns the Notes, the Warrants or the Ordinary Shares underlying the Note and the Warrants, the

Company (i) will timely file all reports required to be filed by the Company pursuant to the Securities Exchange Act of 1934, as amended

(the “Exchange Act”) and (ii) if the Company is not required to file reports pursuant to the Exchange Act, it will

prepare and furnish to such Investor and make publicly available in accordance with Rule 144(c) promulgated under the Securities Act

of 1933, as amended (the “Securities Act”) such information as is required for such Investor to sell its Company securities

under Rule 144.

Share

Reserve. The Company shall at all times keep authorized and reserved and available for issuance, free of preemptive rights, a number

of Ordinary Shares equal to two times the Ordinary Shares underlying the Note (based on an assumed conversion at the Floor Price, as

defined below) and the Warrants (the “Required Share Reserve”).

Termination.

The Purchase Agreement shall be subject to termination: (i) if trading in securities generally in the United States has been suspended

or limited for a consecutive period of greater than three (3) business days, or (ii) a banking moratorium has been declared by the United

States or the New York State authorities and is continuing for a consecutive period of greater than three (3) business days or (iii)

a change of control of the Company (as defined in the Purchase Agreement).

Terms

of the Note

Seniority;

Subsidiary Guarantee. The obligations of the Company under the Note shall rank senior to all other existing indebtedness and equity

of the Company. The Note is unsecured, but the Company’s payment obligations under the Note have been guaranteed by WJ Energy Group

Limited, the Company’s wholly-owned subsidiary, pursuant to a subsidiary guarantee in favor of the Investor (the “Subsidiary

Guarantee”).

Original

Issuance Discount; Second Tranche Closing. The Note carries a 6.0% original issue discount, resulting in proceeds before expenses

to the Company for the First Tranche of approximately $4,700,000. If the full amount of the Second Tranche is funded, after taking into

consideration the 6.0% original issue discount, the proceeds before expenses to the Company from the Second Tranche would be approximately

$1,880,000. Among other conditions precedent to the Second Tranche, the Investor shall not be obligated to fund the Second Tranche if

the Registration Statement is not declared effective by the SEC within 120 days from the Initial Closing Date. As described above, the

amount of the Second Tranche is subject to reduction (and could be no amount) based on the then market capitalization of the Company.

Maturity;

Voluntary Conversion. The Note has an 18-month maturity and a fixed conversion price of $6.00 per Ordinary Share for voluntary conversions

of the Note, subject to “full ratchet” price based anti-dilution adjustments for future issuances of Ordinary Shares by the

Company (subject to certain exceptions) and customary share-based adjustments for stock splits and the like.

Monthly

Installment Payments. Beginning 120 days after the Initial Closing Date, the Company is required to commence monthly installment

payments of the Note through maturity (or 14 payments) (“Monthly Payments”), which Monthly Payments may be made, at

the Company’s election, in cash or Ordinary Shares (or a combination of cash and Ordinary Shares), with such Ordinary Shares being

issued at a valuation equal to the lesser of: (i) $6.00 per share or (ii) 90% of the average of the two lowest closing bid prices of

the Ordinary Shares for the ten (10) consecutive trading days ending on the trading day immediately prior to the payment date (the “Market

Price”), with a floor price of $1.20 per share (which floor price may be waived by the Company, but not the Investor, under

certain circumstances) (the “Floor Price”). The Company shall not be permitted to make Monthly Payments under the

Note in Ordinary Shares if certain equity conditions are not met, including (i) an Event of Default (as defined below) has not occurred;

(ii) the Ordinary Shares shall be registered pursuant to an effective Registration Statement; (iii) no change of control of the Company

has been announced; (iv) the Ordinary Shares are then listed on a national stock exchange and (iv) the average daily trading volume for

the Ordinary Shares on the principal trading market for the Ordinary Shares for the 10 consecutive trading days prior to the applicable

payment date exceeds 50% of the amount of Ordinary Shares that is proposed to be paid by the Company in respect of such Monthly Payment.

If the market price of the Ordinary Shares decreases in the 10 days following a Monthly Payment made in Ordinary Shares, the Investor

will be entitled to receive an amount in additional Ordinary Shares or in cash based on a formula to account for the decrease in the

share price. The Investor has the right, at its sole option, to defer or accelerate up to four (4) Monthly Payments or any portion of

a Monthly Payment.

Prepayment;

Change of Control Payment. Subject to certain conditions precedent, the Note may be prepaid by the Company at any time with a prepayment

premium equal to ten percent (10%) of the principal amount of the Note. In addition, if the Company enters into a definitive agreement

with respect to a change of control of the Company, the Investor shall have the right to require the Company to prepay the Note with

a five percent (5%) payment premium.

Events

of Default. The Note is subject to customary events of default (each, an “Event of Default”), including, without

limitation: (i) payment defaults; (ii) default in the performance by the Company of its obligations, or breach by the Company of its

representations and warranties, under the Purchase Agreement, the Note or the Warrant; (iii) failure by the Company to maintain the Required

Share Reserve; (iv) default by the Company under other indebtedness in excess of $500,000; (v) bankruptucy, liquidation and similar matters

of or concerning the Company or its subsidiaries; (vi) delisting of the Ordinary Shares from a national exchange; (vii) consummation

by the Company of a “going private” transaction; (viii) the conviction of certain key Company executives of a felony or the

ability of such key executives to devote the full time to the Company for 120 days; and (ix) the occurrence of a material adverse effect

in respect of the Company which would reasonably be considered to substantially impair the ability of the Company to satisfy its obligations

in the Purchase Agreement, the Note or the Warrants.

Upon

an Event of Default, in additional to other customary remedies, the Investor shall have the right to convert the Note into Ordinary Shares

at 80% of the then Market Price.

Covenants.

The Note contains certain affirmative and negative covenants, including that the Company shall maintain a cash balance of at least $1.0

million.

Terms

of the Warrants

Pursuant

to the Purchase Agreement, on the Initial Closing Date, the Investor was issued the Initial Warrant to purchase up to 383,620 Ordinary

Shares, exercisable at $6.00 per share for 5 years from the Initial Closing Date. If the full amount of the Second Tranche is funded,

the Investor would be issued the Second Warrant to purchase up to 153,450 Ordinary Shares on the same terms as the Initial Warrant. The

exercise price of the Warrants is subject to “full ratchet” price-based anti-dilution adjustments for future issuances of

Ordinary Shares by the Company (subject to certain exceptions) and customary share-based adjustments for stock splits and the like. The

Warrants are exercisable via “cashless” exercise if there is not an effective registration statement covering resale of the

Ordinary Share under the Warrants.

The

foregoing description of the Purchase Agreement, Note, the Warrants and Subsidiary Guaranty are a summary only and does not purport to

be complete and, is qualified in its entirety by reference to the full text of such documents, the forms of which is attached hereto

as Exhibit 10.1, 10.2, 10.3 and 10.4, respectively, and incorporated herein by reference.

The

Note and Warrants described above were offered and sold in reliance upon an exemption from registration pursuant to Section 4(a)(2) and/or

Regulation D of the Securities Act of 1933, as amended.

Amendments

to Employment Agreements

On

January 21, 2022, the Company entered into a Second Amendment to Employment Agreement (the “Ingriselli Second Amendment”)

with Frank Ingriselli, the Company’s President. The effective date of the Ingriselli Second Amendment is January 1, 2022. The Ingriselli

Second Amendment amends that certain Employment Agreement between the Company and Mr. Ingriselli, effective February 1, 2019, as amended

by that certain First Amendment to Employment Agreement, effective as of February 1, 2020 (the “Ingriselli Agreement”).

Pursuant

to the Ingriselli Second Amendment: (i) the term of the Ingriselli Agreement was extended to December 31, 2023, unless terminated earlier

pursuant to the terms of the Ingriselli Agreement; and (ii) Mr. Ingriselli was granted an award of 60,000 Ordinary Shares, with 30,000

shares vesting on July 1, 2022 and 30,000 vesting on January 1, 2023, with a lock-up period of 180 days from each vesting date.

On

January 21, 2022, the Company entered into a Second Amendment to Employment Agreement (the “Overholtzer Second Amendment”)

with Gregory Overholtzer, the Company’s Chief Financial Officer. The effective date of the Overholtzer Second Amendment is January

1, 2022. The Overholtzer Second Amendment amends that certain Employment Agreement between the Company and Mr. Overholtzer, effective

February 1, 2019, as amended by that certain First Amendment to Employment Agreement, effective as of February 1, 2020 (the “Overholtzer

Agreement”).

Pursuant

to the Overholtzer Second Amendment, the term of the Overholtzer Agreement was extended to December 31, 2023, unless terminated earlier

pursuant to the terms of the Overholtzer Agreement.

No

further changes were made to either the Ingriselli Agreement or the Overholtzer Agreement.

The

foregoing description of the Ingriselli Second Amendment and the Overholtzer Second Amendment is a summary only and does not purport

to be complete and, is qualified in its entirety by reference to the full text of such documents, the forms of which is attached hereto

as Exhibit 10.5 and 10.6, respectively, and incorporated herein by reference.

Press

Release

On

January 24, 2021, the Company issued a press release announcing the entry into the Purchase Agreement and related matters. Such press

release is being furnished as Exhibit 99.1 hereto, and shall not be deemed “filed” for the purposes of Section 18 of the

Exchange Act, nor shall it be deemed incorporated by reference in any filing of the Company under the Securities Act, or the Exchange

Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference to this Form 6-K in such

filing.

Corporate

Governance and Shareholder Approval of Transaction

Although

the Company is a “foreign private issuer”, the Company’s corporate governance practices generally do not differ from

those followed by domestic companies listed on the NYSE American, other than as disclosed below or in the Company’s previously

filed or future Forms 20-F.

Section

713(a) of the NYSE American Company Guide (the “Company Guide”) generally provides that a domestic issuer listed on

the NYSE American is required to obtain shareholder approval in accordance with Section 705 of the Company Guide as a prerequisite to

approval of applications to list additional shares when the additional shares will be issued in connection with a transaction (such as

the transactions contemplated by the Purchase Agreement, the Note and the Warrant) involving the sale, issuance, or potential issuance

by the issuer of common shares (or securities convertible into common shares) equal to 20% or more of presently outstanding common shares

for less than the greater of book or market value of the shares (the “20% Rule”).

Notwithstanding

this general requirement, Section 110 of the Company Guide permits foreign private issuers to follow their home country practice rather

than the shareholder approval requirements of the 20% Rule. The laws of the Cayman Islands (the Company’s domicile of incorporation)

do not require shareholder approval prior to any of the foregoing types of issuances. The Company, therefore, is not required to obtain

such shareholder approval prior to entering into a transaction with the potential to issue securities in contravention of the 20% Rule.

Following the requirements of the Company Guide, the Company has elected to follow the Company’s home country rules with respect

to such issuances and will not be required to seek shareholder approval of the transactions contemplated by the Purchase Agreement, the

Note and the Warrants or similar financings in the future.

Exhibits

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Securities Purchase Agreement, dated January 21, 2022, between the Company and the Investor.

|

|

10.2

|

|

Senior Convertible Note issued to the Investor, dated January 21, 2022.

|

|

10.3

|

|

Form of Ordinary Share Purchase Warrant issued to the Investor.

|

|

10.4

|

|

Guaranty, dated January 21, 2022, by WJ Energy Group Limited favor of the Investor.

|

|

10.5

|

|

Second Amendment to Employment Agreement, dated January 21, 2022, between the Company and Frank Ingriselli.

|

|

10.6

|

|

Second Amendment to Employment Agreement, dated January 21, 2022, between the Company and Gregory Overholtzer.

|

|

99.1

|

|

Press Release of the Company, dated January 24, 2022.

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

Indonesia

Energy Corporation Limited

|

|

|

|

|

|

Dated:

January 25, 2022

|

By:

|

/s/

Dr. Wirawan Jusuf

|

|

|

Name:

|

Dr.

Wirawan Jusuf

|

|

|

Title:

|

Chairman

& Chief Executive Officer

|

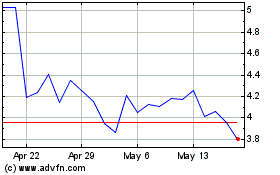

Indonesia Energy (AMEX:INDO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Indonesia Energy (AMEX:INDO)

Historical Stock Chart

From Dec 2023 to Dec 2024