Indonesia Energy Commences New 3D Seismic Operations at its Kruh Block and Expects to Drill New Production Wells By End of Year

24 June 2024 - 9:30PM

Indonesia

Energy Corporation (NYSE American: INDO)

("IEC"), an oil and gas exploration and production company based in

Indonesia, today provided an operational update and announced that

new 3D seismic exploratory operations at its 63,000 acre Kruh Block

have commenced. Importantly, IEC anticipates that the results of

this seismic work will allow IEC to drill new production wells at

Kruh Block the by the end of 2024.

Additionally, IEC announced that key

environmental permits have been granted at IEC’s 650,000 acre

Citarum Block where reserves could potentially exceed a billion

barrels of oil equivalent. IEC’s receipt of these permits

represents an important milestone for IEC as the permits will allow

for meaningful exploratory work by IEC at Citarum for the first

time.

As the operator of the Kruh block, IEC’s 3-D

seismic program will cover the Kruh, North Kruh and West Kruh

Fields. This 29 square km high-quality seismic program is

strategically focused on existing proved reservoirs of the

Talangakar and Lemat formations, as well as the very large and

promising shallow oil/gas zones in the K-28 well discovered by

IEC’s work in 2022.

The new, high quality three-dimensional seismic

data will enable the identification of additional locations of

proved undeveloped reserves and resources. This in turn will pave

the way to prioritize the sequence of upcoming drilling locations

as IEC recommences drilling operations at Kruh Block. Preparations

for the new drilling operation are underway, with plans to drill

the first well in the fourth quarter of 2024 after the evaluation

of the new three-dimensional seismic data is completed.

IEC announced in September 2023 that its joint

operation contract with Pertamina, the Indonesian state-owned oil

and gas company, covering the Kruh Block was extended by 5 years

from May 2030 to September 2035. Kruh Block covers approximately

63,000 acres and is located onshore on the Island of South Sumatra

in Indonesia.

The amended joint

operation contract has the following key terms:

- The amended

contract increases IEC’s after-tax profit split from

the current 15% to 35%, for an increase of more than

100%.

- In addition, given the 5-year

extended term of the contract, the amended contract is

expected to increase IEC’s proved reserves at Kruh Block by

over 40%.

- Furthermore, given the increased

profit split, IEC’s anticipated net cash flow

calculations based on its Kruh Block development plan are

expected to increase by over 200% versus IEC’s anticipations under

the prior contract.

At Citarum Block, IEC’s receipt of government

environmental permits to commence seismic operations which are

planned for late this year or early next year, with plans to also

commence drilling next year. As required by government regulations,

IEC relinquished approximately 35% of its original Citarum acreage

but has retained approximately 97% of the original prospective

resources and now has approximately 650,000 acres on which

drilling could take place. As previously reported, IEC’s estimates

are that the Citarum Block has prospective oil-equivalent resources

of over one (1) billion barrels of oil.

Mr. Frank Ingriselli, IEC's President, commented

"We are very excited about the commencement of new seismic

operations on our Kruh Block enhanced by the significant

improvements in our economics from the 2023 contract extension with

the Indonesian government. All of this bodes well for our company

as we look to recommence drilling at Kruh Block in late 2024. We

continue to believe that Kruh Block is a world class asset and, in

order to maximize future production capability, the seismic

operations planned across the entire Kruh Block should positively

leverage what we have learned from our previous discoveries,

including our 2022 gas discovery, and determine the best locations

to re-start our continuous drilling campaign.”

“Additionally, we have now also moved forward

with activities at our potential billion-barrel equivalent natural

gas 650,000-acre Citarum Block, where the previous operator drilled

several gas discoveries. In short, we’ve never been more excited

about IEC’s potential, and we look forward to continuing our

efforts as we seek to drive positive shareholder value," concluded

Mr. Ingriselli

About Indonesia Energy Corporation

Limited

Indonesia Energy Corporation Limited (NYSE

American: INDO) is a publicly traded energy company engaged in the

acquisition and development of strategic, high growth energy

projects in Indonesia. IEC’s principal assets are its Kruh Block

(63,000 acres) located onshore on the Island of Sumatra in

Indonesia and its Citarum Block (650,000 acres) located onshore on

the Island of Java in Indonesia. IEC is headquartered in Jakarta,

Indonesia and has a representative office in Danville, California.

For more information on IEC, please

visit www.indo-energy.com.

Cautionary Statement Regarding

Forward-Looking Statements

All statements in this press release and related

statements of of Indonesia Energy Corporation Limited (“IEC”) and

its representatives and partners that are not based on historical

fact are "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995 and the provisions

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended (the

“Acts”). In particular, when used in the preceding discussion, the

words “could,” "estimates," "believes," "hopes," "expects,"

"intends," “on-track”, "plans," "anticipates," or "may," and

similar conditional expressions are intended to identify

forward-looking statements within the meaning of the Acts and are

subject to the safe harbor created by the Acts. Any statements made

in this news release other than those of historical fact, about an

action, event or development, are forward-looking statements. While

management has based any forward-looking statements contained

herein on its current expectations, the information on which such

expectations were based may change. These forward-looking

statements rely on a number of assumptions concerning future events

and are subject to a number of risks, uncertainties, and other

factors, many of which are outside of the IEC's control, that could

cause actual results (including, without limitation, the

anticipated benefits of the amended Kruh Block contract as well as

the results of IEC’s exploration, drilling and production

activities and the impact of such contract and activities on IEC’s

results of operations) to materially and adversely differ from such

statements. Such risks, uncertainties, and other factors include,

but are not necessarily limited to, those set forth in the Risk

Factors section of the Company’s annual report on Form 20-F for the

fiscal year ended December 31, 2023, filed on April 26, 2024 and

other SEC filings, with the Securities and Exchange Commission

(SEC). Copies are of such documents are available on the SEC's

website, www.sec.gov. IEC undertakes no obligation to update

these statements for revisions or changes after the date of this

release, except as required by law.

Company

Contact:

Frank C. IngriselliPresident, Indonesia Energy

Corporation LimitedFrank.Ingriselli@Indo-Energy.com

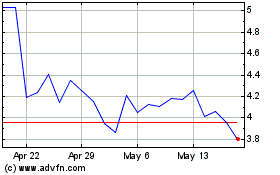

Indonesia Energy (AMEX:INDO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Indonesia Energy (AMEX:INDO)

Historical Stock Chart

From Feb 2024 to Feb 2025