false

0001662684

0001662684

2024-08-20

2024-08-20

0001662684

dei:FormerAddressMember

2024-08-20

2024-08-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 20, 2024

KULR TECHNOLOGY GROUP, INC.

(Exact name of the registrant as specified in its charter)

| Delaware |

|

001-40454 |

|

81-1004273 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

555 Forge River Road, Suite 100, Webster, Texas

77598

(Address of principle executive offices) (Zip code)

Registrant’s telephone number, including area code: (408) 663-5247

4863 Shawline Street, San Diego, California 92111

(Former name or address if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14A-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14D-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered: |

| Common Stock |

|

KULR |

|

NYSE American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry into a Material Definitive Agreement. |

The description in Item 5.02

below, as it relates to the terms and conditions of the Severance Agreement And General Release, a copy of which is filed herewith

as Exhibit 10.1, is incorporated herein by reference.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On August 20, 2024, KULR

Technology Corporation, a wholly owned subsidiary of KULR Technology Group, Inc. (the “Company”), entered into a Separation and

General Release Agreement (the “Agreement”) with Keith Cochran, pursuant to which Mr. Cochran’s employment

with KULR Technology Corporation terminated. Accordingly, effective August 20, 2024, Mr. Cochran resigned as President and Chief Operating

Officer of the Company, and from all other appointments and positions held with the Company and any of its affiliated entities. Mr. Cochran’s

resignation from the Company is as a result of his decision to pursue alternative professional and personal endeavors and not as a result

of any disagreements with the Company or the Board of Directors of the Company on any matter relating to its operations, policies or practices.

The Agreement contains customary

protections, including a general release of claims by Mr. Cochran in favor of the Company and certain other related parties.

The Agreement will only go effective after the Revocation Period has expired. Pursuant to the terms of the Agreement, on the Effective

Date, Mr. Cochran will be entitled to termination benefits in the form of (i) a lump sum payment of Ninety-Nine Thousand Five Hundred

Fifty-One Dollars and Twelve Cents ($99,551.12) subject to legally required payroll withholdings/deductions, (ii) early settlement of

vested grants and accelerated vesting of a portion of the Mr. Cochran’s outstanding equity awards in the aggregate amount of 875,000

shares of the Company’s common stock underlying such grants, deliverable no earlier than November 25, 2024, and (iii) continuation

of COBRA health insurance premiums for four months, in exchange for release of claims in favor of the Company and its affiliates.

The forgoing summary of the

Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement attached as Exhibit 10.1 hereto

and incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure |

On August 21, 2024, the Company issued a press

release announcing the resignation of Mr. Keith Cochran and the move of the principal office. A copy of the press release is attached

herewith as Exhibit 99.1.

By filing this Current Report

on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in

this report that is required to be disclosed solely by reason of Regulation FD. The Company uses, and will continue to use, its website,

press releases, and various social media channels, including its Twitter account (twitter.com/kulrtech), its LinkedIn account (linkedin.com/company/kulr-technology-corporation),

its Facebook account (facebook.com/KULRTechnology), its TikTok account (tiktok.com/Kulr_tech), its Instagram account (instagram.com/Kulr_tech),

and its YouTube account (youtube.com/channel/UC3wZBPINQd51N6p35Mo5uQg), as additional means of disclosing public information to

investors, the media and others interested in the Company. It is possible that certain information that the Company posts on its website,

disseminated in press releases and on social media could be deemed to be material information, and the Company encourages investors, the

media and others interested in the Company to review the business and financial information that the Company posts on its website, disseminates

in press releass and on the social media channels identified above, as such information could be deemed to be material information.

The information in this Item

7.01 disclosure, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section.

In addition, the information in this Item 7.01 disclosure, including Exhibits 99.1, shall not be incorporated by reference into the filings

of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

On August 20, 2024, the Company’s

Board of Directors changed the Company’s principal executive office to Webster, Texas. The office space at 4863 Shawline

Street, San Diego, California 92111, which previously served as the Company’s principal executive office, will continue

to be utilized as a critical innovation hub. The new principal executive office, principal place of business and headquarters

is located at 555 Forge River Road, Suite 100, Webster, Texas 77598.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on behalf of the undersigned hereunto

duly authorized.

| |

KULR TECHNOLOGY GROUP, INC. |

| |

|

|

| |

|

|

| Date: August 21, 2024 |

By: |

/s/ Michael Mo |

| |

|

Michael Mo |

| |

|

Chief Executive Officer |

Exhibit 10.1

SEVERANCE AGREEMENT AND GENERAL RELEASE

This Severance Agreement and General Release (“Agreement”)

is made and entered into by and between Terry Keith Cochran (“Employee”) and KULR Technology Corporation (“Company”).

For good and valuable consideration as reflected below, Employee and the Company contract and agree as follows:

1. Resignation

from Employment. Employee shall resign from his employment with the Company effective close of business on August 20,

2024, due to plans to pursue alternative professional and personal endeavors.

2. No

Admissions. The Company and Employee both agree that they are not entering into this Agreement because of any wrongdoing or

liability of the other party or on the part of any other individual or company released in this Agreement. Therefore, this Agreement cannot

and will not be considered as an admission of wrongdoing or liability by any of them. Employee is voluntarily resigning and not as a result

of any disagreements with the Company, its parent corporation, their respective managements, or the Board of Directors of the Company’s

parent corporation on any matter relating to the operations, policies or practices of the Company or its parent corporation.

3. Severance

Benefits. Employee shall receive the following in consideration for the promises, covenants, and releases contained herein.

| a. | Severance Payment. The Company agrees to provide a one-time severance payment to Employee

in the gross amount of Ninety-Nine Thousand Five Hundred Fifty-One Dollars and Twelve Cents ($99,551.12) subject to legally required payroll

withholdings/deductions (“Severance Payment”). The Severance Payment shall be made no later than seven (7) days from

the Effective Date of this Agreement as set forth in Paragraph 6. |

| b. | COBRA Coverage - If Employee timely and properly elects continuation health benefits, the

Company agrees to pay the full cost of Employee’s COBRA health insurance premiums for up to four (4) months. The Company reserves

the right to require proof of payment prior to issuing reimbursement for COBRA premiums. |

| c. | Early Settlement and Accelerated Vesting of Equity Grants. In consideration for the

Employee’s satisfaction of all the terms and conditions of this Agreement and the Employee’s execution of this unrevoked agreement,

the Company agrees to cause its parent corporation to agree to the early settlement and accelerated vesting of a portion of the Employee’s

outstanding equity awards such that shall deliver to Employee 875,000 shares of KULR Technology Group Inc. Common Stock underlying such

grants (the “Separation Grant Shares”) on November 25, 2024. The Employee agrees to receive the Separation Grant

Shares and, for the avoidance of doubt, to the cancellation and/or surrender of any and all remaining equity grants issued or promised

to the Employee. |

4. Employee’s

Release of Claims. In exchange for the consideration provided to Employee in Paragraph 3 of the Agreement, Employee hereby

irrevocably and unconditionally releases, acquits and forever discharges the Company, and any of its subsidiaries, parents, affiliates,

including KULR Technology Group Inc., managing agents, employees, professional employer organizations (PEO), staffing agencies, servants,

consultants, agents, directors, officers, independent contractors, representatives, insurance carriers and attorneys (and the servants,

agents, employees, directors, officers, independent contractors, representatives, consultants, insurance carriers and attorneys of any

such subsidiaries, parents affiliates, PEO’s, or staffing agencies), and all persons acting by, through, under or in concert with

any of them, and each of their respective heirs, successors, and assigns (hereinafter collectively referred to as "Releasees"),

or any of them, from any and all charges, complaints, claims, liabilities, obligations, promises, agreements, controversies, damages,

actions, causes of action, suits, rights, demands, costs, losses, debts and expenses (including attorney's fees and costs actually incurred)

of any nature whatsoever, known or unknown, suspected or unsuspected, including, but not limited to, rights arising out of alleged violations

of any contracts, express or implied, any covenant of good faith and fair dealing, express or implied, or any tort including defamation,

or any legal restrictions on the Company’s right to hire, to refuse to hire or terminate its employees, or any federal, state or

other governmental statute, regulation or ordinance, including, without limitation: (1) the Civil Rights Act of 1964, as amended;

(2) 42 U.S.C. § 1981; (3) Section 503 of the Rehabilitation Act of 1973; (4) the Fair Labor Standards Act (including

the Equal Pay Act); (5) the Americans with Disabilities Act; (6) the Age Discrimination in Employment Act of 1967, as amended;

(7) the Federal Family and Medical Leave Act; (8) the Immigration Reform and Control Act; (9) the Federal Worker Adjustment

and Retraining Notification Act (WARN); (10) the Employee Retirement Income Security Act, as amended; (11) the National Labor Relations

Act; (12) the Genetic Information Nondiscrimination Act of 2008; (13) the United States Constitution; (14) the California Workers' Compensation

Act; (15) the California Constitution; (16) the California Labor Code, including the Private Attorney General Act of 2004 (“PAGA”);

(17) the California Business and Professions Code; (18) the California Government Code; (19) the California Family Rights Act; (20) the

California Pregnancy Discrimination Act; (21) the California Wage Orders; (22) the Families First Coronavirus Response Act; (23) the Constitution

of Florida, including Article X, Section 24; (24) the Florida Civil Rights Act, Chapter 448 of the Florida Statutes, including

the Florida Minimum Wage Act, Fla. Stat. 448.110, (25) the Florida Whistleblower Act, Fla. Stat. 448.102, and (26) Florida Workers’

Compensation Retaliation claims, Fla. Stat. 440.205, (27) any claims arising under any Executive

Order, each as amended; (28) the Texas Labor Code that may be legally waived and released including the Texas Payday

Act, the Texas Anti-Retaliation Act, Chapter 21 of the Texas Labor Code and Texas Whistleblower Act; (29)

the Texas Commission on Human Rights Act; (30) any Sabine Pilot claim; (31) any claim of retaliation

including, but not limited to, retaliation for filing a workers’ compensation claim; (32) any claim arising under the common law

of California, Florida, or Texas, and (33) claims of discharge in violation of a substantial public policy of the States of California,

Florida, and/or Texas; (34) state and federal racketeering acts, and/or (35) any other provision of federal, California, Florida, or Texas

state, or local statutory or common law or regulation (including whistleblower claims, claims for personal injury, invasion of privacy,

negligent hiring, retention or supervision, defamation, intentional or negligent infliction of emotional distress and/or mental anguish,

negligence, assault, battery, false imprisonment, retaliatory or wrongful discharge, and the like), which Employee now has, owns or holds,

or claims to have, own or hold, or which Employee at any time heretofore had, owned or held, or claimed to have, own or hold against any

of the Releasees up to and including, at the time of Employee’ execution of the Agreement.

5. Waiver

of Section 1542. Employee hereby states that it is his intention in executing this Agreement that the same shall be effective

as a bar to each and every claim, demand, cause of action, obligation, damage, liability, charge, and attorney’s fees and costs

herein above released. Employee hereby expressly waives and relinquishes all rights and benefits, if any, arising under the provisions

of Section 1542 of the Civil Code of the State of California which provides:

Section 1542. [Certain Claims

Not Affected By General Release.] A general release does not extend to claims that the creditor or releasing party does not know or suspect

to exist in his or her favor at the time of executing the release and that, if known by him or her, would have materially affected his

or her settlement with the debtor or released party.

6. Acknowledgment

of Rights and Waiver of Claims Under the Age Discrimination in Employment Act. Employee acknowledges that this Agreement constitutes

written notice from the Company that Employee should consult with an attorney before signing this Agreement, and Employee acknowledges

that he has fully discussed all aspects of this Agreement with his attorney to the extent he desires to do so. Employee agrees that he

has carefully read and fully understands all of the provisions of this Agreement and that he is voluntarily entering into this Agreement.

Employee agrees that, as part of this Agreement, he has been provided with consideration in addition to anything of value to which he

is already entitled. Employee is advised that, prior to waiving claims he may have under the Age Discrimination in Employment Act, he

may take up to twenty-one (21) calendar days to consider this Agreement before signing, and, if accepted, he may revoke this Agreement

within seven (7) calendar days (“Revocation Period”) after he signs this Agreement. This Agreement is not effective until

after both the Revocation Period has expired and the Employee and the Company have both signed this Agreement (“Effective Date”).

Employee agrees that if he wishes to revoke this Agreement, Employee will notify the Company in writing, addressed to Michael Mo at michael.mo@kulrtechnology.com,

delivered on or before the expiration of the Revocation Period. In the event this Agreement is signed prior to the expiration of 21 calendar

days, Employee acknowledges that he voluntarily and knowingly agrees to waive his entitlement to take 21 days to consider this Agreement

for the purpose of expediting the settlement.

7. Acknowledgement

of Receipt of All Wages Due. Employee agrees and acknowledges that any dispute related to the payment of wages or other compensation

to Employee is hereby resolved to Employee’s complete and full satisfaction and that Employee has, in fact, received all wages and

compensation to which he is due with the sole exception of the Severance Benefit referenced in Paragraph 3 of the Agreement. Employee

agrees that California Labor Code section 206.5 is not applicable because there is a good faith dispute as to whether the Company owes

Employee any wages. Section 206.5 provides, in pertinent part, as follows: “An employer shall not require the execution of

a release of a claim or right on account of wages due, or to become due, or made as an advance on wages to be earned, unless payment of

those wages has been made.”

8. Covenant

Not to Sue. Except as described below, Employee agrees and covenants not to file any suit, charge, representative action, including

PAGA, class action or complaint against Releasees in any court or administrative agency, with regard to any claim, demand, liability or

obligation arising out of Employee’s employment with the Company or separation therefrom. Employee further represents that no claims,

complaints, charges, or other proceedings are pending in any court, administrative agency, commission, or other forum relating directly

or indirectly to Employee’s employment by the Company. Nothing in this Agreement shall be construed to prohibit Employee from filing

a charge or assisting others in filing a charge with or participating in any investigation or proceeding conducted by the EEOC, the NLRB,

the SEC, other U.S. government agencies, or a comparable state or local agency. Notwithstanding the foregoing, Employee agrees to waive

Employee’s right to recover monetary damages in any charge, complaint, or lawsuit filed by Employee or by anyone else on Employee’s

behalf.

9. No

Workplace Injuries. As of the date of signing this Agreement, Employee represents and affirms that Employee has not sustained

any workplace injury nor does Employee have any occupational diseases of any kind that have not already been resolved. Employee does not

intend to file any claim or seek any benefits of any kind under workers’ compensation laws including those in California, Florida,

and Texas.

10. Confidentiality.

Employee and any other person or entity acting on Employee’s behalf, agrees to keep the terms and conditions of this

Agreement confidential and shall not disclose them to any other person or entity, with the limited exception that Employee may disclose

the terms to Employee’s spouse, attorney, and/or financial advisor, and Employee shall be responsible for requiring confidentiality

on their part. Employee understands and agrees that a violation of this Paragraph shall amount to a breach of this Agreement and shall

result in discipline up to and including immediate discharge and forfeiture of severance agreement eligibility. Nothing in this Agreement

prevents Employee from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination

or any other conduct that Employee has reason to believe is unlawful. Further, nothing in this Agreement prevents or restricts Employee

from enforcing Employee’s Section 7 rights under the National Labor Relations Act, participating in section 7 activity (including

the right to communicate with former coworkers and/or third parties about terms and conditions of employment or labor disputes, unrelated

to the amount of severance pay under this Agreement) or other otherwise cooperating with the National Labor Relation Board’s investigative

process through investigation, testimony, or otherwise with an administrative agency or court. The parties believe this confidentiality

provision is reasonable and intend to comply with it.

11. No

Disparaging Conduct. Employee and any other person or entity acting on Employee’s behalf agrees and promises that he

will not undertake any harassing or disparaging conduct, written, verbally, or otherwise, directed at the Company, or any subsidiary or

affiliate, including managers and directors. of the Company, and that he will refrain from making any negative, detracting, derogatory,

and unfavorable statements about the Company. Nothing in this Agreement prevents Employee from discussing or disclosing information about

unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Employee has reason to believe is unlawful.

This Section is not intended to prevent cooperation through investigation, testimony, or otherwise with an administrative agency

or court. This Section is also not intended to prevent Employee from exercising any other rights protected by law, including the

right to communicate with former coworkers and/or third parties about terms and conditions of employment or labor disputes, unrelated

to the amount of severance pay under this Agreement, when the communication is not so disloyal, reckless, or maliciously untrue as to

lose the protection of the law.

12. Confidential

Information / Trade Secrets. Employee acknowledges that, as part of Employee’s employment with the Company, Employee had access

to confidential information and otherwise information of a nature not generally disclosed to the public, and Employee agrees to keep confidential

and not disclose to anyone, the business, proprietary, and trade secret information in Employee’s possession, as well as any personal,

confidential, or otherwise proprietary information regarding Company’s employees, and/or Company’s personnel practices and

related matters. This obligation is understood to be in addition to, and not as any replacement for, any agreements Employee may have

signed with Company concerning confidentiality, trade secrets, non-disclosure, non-solicitation, and/or assignment of inventions or other

intellectual property developments, which agreements will remain in full force and effect (for example, the KULR Technology Corporation

Proprietary Information Agreement). Employee agrees that Employee will not take, copy, use or distribute in any form or manner the Company’s

proprietary documents or information, including, but not limited to, research and development materials, information regarding client

lists and client contact information, business partners, financial information, business and strategic plans, software programs and codes,

access codes, and other similar materials or information. Notwithstanding any provisions in this agreement or Company’s policy applicable

to the unauthorized use or disclosure of trade secrets, Employee is hereby notified that, pursuant to the Defend Trade Secrets Act as

contained in 18 U.S.C. § 1833, Employee cannot be held criminally or civilly liable under any federal or state trade secret law for

the disclosure of a trade secret that is made (i) in confidence to a federal, state, or local government official, either directly

or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law. Employee

also may not be held so liable for such disclosures made in a complaint or other document filed in a lawsuit or other proceeding, if such

filing is made under seal. In addition, individuals who file a lawsuit for retaliation by an employer for reporting a suspected violation

of law may disclose the trade secret to the attorney of the individual and use the trade secret information in the court proceeding, if

the individual files any document containing the trade secret under seal and does not disclose the trade secret, except pursuant to court

order provided the individual’s actions are consistent with 18 U.S.C. § 1833.

13. Company

Property. Employee hereby represents and warrants that on or before the date of Employee’s separation, Employee will

return to the Company all Company property and copies thereof in Employee’s custody, including, but not limited to, company-issued

keys, cell phone, the originals and copies of all business documents, computer software, print-outs, brochures, product information, personnel

records, confidential proprietary management information, and any other document related to the Company or its business.

14. Employment

References. Employee agrees to direct all reference requests to Michael Mo at michael.mo@kulrtechnology.com. In

response to any such inquiry directed to Michael Mo, unless required otherwise by law, Employer agrees to provide a positive reference

in good faith with respect to Employee’s performance as an employee of the Company also including: (i) dates of employment;

and (ii) last position held.

15. Medicare

Reporting. Employee declares that Employee is not Medicare eligible nor within thirty (30) months of becoming Medicare eligible; is

not sixty five (65) years of age or older; is not suffering from end stage renal failure; has not received Social Security benefits for

twenty four (24) months or longer; has not applied for Social Security disability benefits, and/or has not been denied Social Security

disability benefits and appealing the denial; and therefore, no Medicare Set Aside Allocation is being established. Employee attests that

the claims made and released herein are not related to any illness or injury for which Employee would apply or receive Medicare benefits.

Whether or not the Centers for Medicare & Medicaid Services (“CMS”), or any related agency representing CMS’

interests, determines that CMS has an interest in the payment to Employee under this settlement, Employee agrees to (i) indemnify,

defend and hold Releasees harmless from any action by CMS relating to medical expenses of Employee, including full satisfaction by Employee

of any lien(s) asserted by CMS; (ii) reasonably cooperate with Releasees upon request with respect to any information needed

to satisfy the reporting requirements under Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007, if applicable;

and (iii) waive any and all future actions against Releasees for any private cause of action for damages pursuant to 42 U.S.C. §

1395y(b)(3)(A).

16. Liens

or Assignments. Employee hereby agrees, represents and warrants that he shall have sole responsibility for the satisfaction

of any and all liens or assignments in law, equity, or otherwise, against any of the matters released herein, and that he will fully satisfy

all liens, if any, immediately upon receipt of the Severance Benefits referenced in Paragraph 3 of this Agreement. Employee further represents,

agrees and warrants that he shall defend Releasees, hold Releasees harmless from, and indemnify Releasees from, any liabilities or costs

which they may incur as a result of any liens of any nature and/or Employee’s failure to satisfy any liens.

17. Entire

Agreement. Aside from any previously signed confidentiality agreements, trade secret agreements, and arbitration agreements,

this Agreement contains the entire agreement of both the Company and Employee and takes the place of any and all other agreements, understandings,

negotiations, or discussions, whether oral or written, express or implied, between the Company and Employee. The Company and Employee

each acknowledge that no representations have been made to them which are not contained in the Agreement, that they have not signed this

Agreement in reliance on any representation not expressly set forth in this Agreement, and that any representations of any kind not contained

in this Agreement shall not be valid or binding, unless, following the signing of this Agreement, the parties put such a modification

in a writing signed by both an authorized representative of the Company and Employee.

18. Enforcement

Costs. The Company and Employee agree that in the event litigation is initiated by either party to this Agreement to interpret

or enforce this Agreement, the prevailing party will be entitled to recover legal costs and reasonable attorney’s fees incurred

in connection with the litigation, in addition to any other relief granted. This Agreement shall be interpreted pursuant to Florida law.

19. Future

Cooperation. Employee agrees to cooperate fully with the Company with respect to any investigations, legal proceedings, or

other matters which arose during or may arise after Employee’s employment with the Company. Employee agrees to remain available

to participate, and, if necessary, provide testimony in any such matters.

20. Provisions

Severable. The Company and Employee agree that if any provisions of this Agreement should be declared illegal or invalid, the

remaining provisions will continue to be binding and enforceable.

21. Headings

and Terms. The paragraph headings of this Agreement are for convenience only and are not intended to have any effect in construing

or interpreting this Agreement. The term “including” in this Agreement is used to list items by examples only, not as a complete

listing.

22. Separate

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be considered an original Agreement.

Facsimile reproductions of original signatures shall be binding for the purpose of executing and enforcing this Agreement.

23. Successors

and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and the Releasees and the

respective heirs, executors, administrators, personal representatives, successors, and assigns of the parties and Releasees.

24. Governing

Law. This Agreement shall be deemed to have been entered into and shall be construed and enforced in accordance with the laws

of the State of Florida.

25. Full

and Knowing Waiver and Attorney Review Period. Employee acknowledges that this Agreement constitutes written notice from the Company

that he has a right to consult an attorney regarding this Agreement, and that he has been provided with a reasonable time period of not

less than twenty-one (21) days to do so. Employee acknowledges that he has fully discussed all aspects of this Agreement with an attorney

to the extent he desires to do so. Employee acknowledges that he may sign this Agreement prior to the termination of the twenty-one (21)

day period for reviewing this Agreement, and warrants that any signature prior to the end of this twenty-one (21) day period is knowing,

voluntary, and has not been induced by the Company through fraud, misrepresentation, a threat by the Company to withdraw or alter the

Agreement prior to the expiration of the reasonable time period, or by the Company providing different terms to other employees who sign

a similar severance or separation agreement prior to the expiration of such twenty-one (21) day time period.

| AGREED BY THE PARTIES: | |

|

| | |

|

| EMPLOYEE | |

COMPANY |

| | |

|

| | |

|

| TERRY KEITH COCHRAN | |

MICHAEL MO |

| | |

Chief Executive Officer |

| | |

KULR Technology Corporation |

| | |

|

| | |

|

| Print Name | |

Print Name |

| | |

|

| Dated: |

| |

Dated: |

|

Exhibit 99.1

KULR Changes Designation of Principal Executive

Office to Texas, Announces Leadership Transition

SAN DIEGO

/ GLOBENEWSWIRE / August 21, 2024 / KULR Technology Group, Inc. (NYSE American: KULR) (the "Company"

or "KULR"), a global leader in sustainable energy management, announced today the mutually agreed upon resignation of Keith

Cochran as President and Chief Operating Officer, effective August 20, 2024. KULR has re-allocated the oversight of its day-to-day operations

among its executive level management, headed by Chief Executive Officer, Michael Mo.

“On behalf of the Board and rest of the Company, I want to thank

Keith for his years of service to the Company,” said Michael Mo. “We are appreciative of Keith's expertise and leadership

throughout his tenure as President and Chief Operating Officer and wish him well in his future endeavors.”

KULR’s Board believes the new leadership structure fully aligns

with the Company’s accelerated strategic shift to Webster, Texas, which the Company has designated as its principal executive office.

While Webster is already the Company's largest office, its San Diego location will continue to be a critical innovation hub.

About

KULR Technology Group Inc.

KULR Technology Group Inc. (NYSE

American: KULR) is a leading energy management platform company offering proven solutions that play a critical role in accelerating the

electrification of the circular economy. Leveraging a foundation in developing, manufacturing, and licensing next-generation carbon fiber

thermal management technologies for batteries and electronic systems, KULR has evolved its holistic suite of products and services to

enable its customers across disciplines to operate with efficiency and sustainability in mind. For more information, please visit www.kulrtechnology.com.

Safe Harbor Statement

This press release does not constitute an offer to sell or a solicitation of offers to buy any securities of any entity. This release

contains certain forward-looking statements based on our current expectations, forecasts and assumptions that involve risks and uncertainties.

Forward-looking statements in this release are based on information available to us as of the date hereof. Our actual results may differ

materially from those stated or implied in such forward-looking statements, due to risks and uncertainties associated with our business,

which include the risk factors disclosed in our Form 10-K filed with the Securities and Exchange Commission on April 12, 2024, as may

be amended or supplemented by other reports we file with the Securities and Exchange Commission from time to time. Forward-looking statements

include statements regarding our expectations, beliefs, intentions, or strategies regarding the future and can be identified by forward-looking

words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “should,” and “would” or similar words. All forecasts are provided by management in this release

are based on information available at this time and management expects that internal projections and expectations may change over time.

In addition, the forecasts are entirely on management’s best estimate of our future financial performance given our current contracts,

current backlog of opportunities and conversations with new and existing customers about our products and services. We assume no obligation

to update the information included in this press release, whether because of new information, future events or otherwise.

Investor Relations:

KULR Technology Group, Inc.

Phone: 858-866-8478 x 847

Email: ir@kulrtechnology.com

v3.24.2.u1

Cover

|

Aug. 20, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 20, 2024

|

| Entity File Number |

001-40454

|

| Entity Registrant Name |

KULR TECHNOLOGY GROUP, INC.

|

| Entity Central Index Key |

0001662684

|

| Entity Tax Identification Number |

81-1004273

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

555 Forge River Road

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Webster

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77598

|

| City Area Code |

408

|

| Local Phone Number |

663-5247

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

KULR

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

4863 Shawline Street

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92111

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

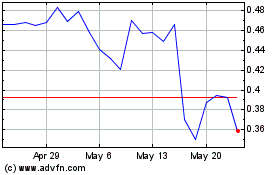

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Dec 2024 to Jan 2025

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Jan 2024 to Jan 2025