false

0001643988

0001643988

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 13, 2023

Loop Media, Inc.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

001-41508 |

|

47-3975872 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

2600 West Olive Avenue, Suite 54470

Burbank, CA |

|

91505 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(213) 436-2100

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common stock, $0.0001 par value per share |

|

LPTV |

|

The NYSE American, LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement

Line of Credit Loan Agreement, Note and Warrant Amendments

As previously disclosed, effective as of May 13, 2022, Loop Media, Inc.

(the “Company”) entered into a Non-Revolving Line of Credit Loan Agreement (the “Loan Agreement”)

with several institutions and individuals (each individually a “Lender” and collectively, the “Lenders”)

and RAT Investment Holdings, LP, as administrator of the loan (the “Loan Administrator”) for aggregate loans of up

to $2.2 million (the “Line of Credit”), evidenced by a Non-Revolving Line of Credit Promissory Note (the “Note”),

also effective as of May 13, 2022. The Line of Credit had an initial maturity date of November 13, 2023, or eighteen (18) months

from the date of the Loan Agreement (the “Line of Credit Maturity Date”), and accrues interest, payable semi-annually

in arrears, at a fixed rate of interest equal to twelve (12) percent per year.

In connection with the Line of Credit, on May 13, 2022, the Company

issued a warrant (each a “Line of Credit Warrant” and collectively, the “Line of Credit Warrants”)

to each Lender for an aggregate of up to 209,522 shares of the Company’s common stock. Each Line of Credit Warrant initially had

an exercise price of $5.25 per share, expires on May 13, 2025 (the “Line of Credit Warrant Expiration Date”),

and is exercisable at any time prior to the Line of Credit Warrant Expiration Date.

As previously disclosed, in connection with each Lender’s delivery

of a subordination agreement to GemCap Solutions, LLC (the “Senior Lender”) as required under the Company’s Loan

and Security Agreement with the Senior Lender, on July 29, 2022, the Company issued a warrant (each a “Subordination Agreement

Warrant” and collectively, the “Subordination Agreement Warrants”) to each Lender for an aggregate of up

to 104,759 shares of the Company’s common stock. Each Subordination Agreement Warrant initially had an exercise price of $5.25 per

share, expires on July 29, 2025 (the “Subordination Agreement Warrant Expiration Date”), and is exercisable at

any time prior to the Subordination Agreement Expiration Date.

Effective as of November 13, 2023, the Company entered into a

Non-Revolving Line of Credit Loan Agreement Amendment (the “Loan Agreement Amendment”) with the Lenders to: (i) extend

the Line of Credit Maturity Date from eighteen (18) months to twenty-seven (27) months from the date of the Loan Agreement, or August 13,

2024; and (ii) amend the payment terms of the Line of Credit such that no payment of interest or principal under the Loan Agreement

or the Note will be due and payable from November 13, 2023, to the Line of Credit Maturity Date, as extended, except for (a) one

payment of $374,000 on November 13, 2023 (comprised of accrued interest of $132,000 due through November 13, 2023, an initial payment

of principal of $220,000 and $22,000 as consideration to extend the maturity date of the Line of Credit); and (b) nine (9) monthly

payments of principal of $220,000 plus accrued interest, commencing December 13, 2023. In consideration for the extension of the

Line of Credit Maturity Date, the Company agreed to amend the Line of Credit Warrants and the Subordination Agreement Warrants (together,

the “Warrants”) to reduce the respective exercise prices thereof to $1.00. The Company also agreed to apply one-third

(1/3) of the net proceeds of any capital raise that takes place subsequent to the date of the Loan Agreement Amendment, other than proceeds

from an equity offering under the Company’s at-the-market program or from an affiliate or insider, toward paying down the then outstanding

principal amount due under the Line of Credit. Pursuant to the Loan Agreement Amendment, each Lender agreed to enter into a lock-up agreement

restricting the disposal of any shares of the Company’s common stock that are issued in connection with the exercise of the Warrants

for a period of twelve (12) months from the date of the Loan Agreement Amendment.

The Company issued an Amended and Restated Non-Revolving Line of Credit

Promissory Note Amendment (the “Amended and Restated Note”) to the Lenders reflecting the extension of the Line of

Credit Maturity Date.

The descriptions of the Loan Agreement Amendment and the Amended and

Restated Note are qualified in their entirety by reference to the full texts of the Loan Agreement Amendment and the Amended and Restated

Note, which are incorporated by reference herein. Copies of the Loan Agreement Amendment and the Amended and Restated Note are included

herein as Exhibits 10.1 and 10.2, respectively.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information in Item 1.01 with respect to the Loan Agreement, the

Note, the Loan Agreement Amendment and the Amended and Restated Note is incorporated by reference into this Item 2.03.

Item

3.02 Unregistered Sales of Equity Securities

The

information in Item 1.01 with respect to the Warrants is incorporated by reference into this Item 3.02. The issuance of the Warrants was

not registered under the Securities Act of 1933, as amended (the “Securities Act”). The Warrants were issued

in a private placement exempt from the registration requirements of the Securities Act, in reliance on the exemptions set forth in Section 4(a)(2) of

the Securities Act.

Item

3.03 Material Modifications to Rights of Security Holders.

The information in Item 1.01 with respect to the Warrants is incorporated

by reference into this Item 3.03.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: November 17, 2023 |

LOOP MEDIA, INC. |

| |

|

| |

By: |

/s/

Jon Niermann |

| |

|

Jon Niermann, CEO |

Exhibit 10.1

NON-REVOLVING LINE OF CREDIT

LOAN AGREEMENT AMENDMENT

This Non-Revolving Line of Credit Line of Credit

Loan Agreement Amendment (the “Amendment”) is dated as of November 13, 2023 (the “Amendment Effective

Date”), amends that certain Non-Revolving Line of Credit Agreement (the “Agreement”), with an effective date

of May 13, 2022, between Loop Media, Inc., a Nevada corporation (the “Borrower”), RAT Investment Holdings,

LP, as administrator of the loan (the “Administrator”) and the lenders set out in Exhibit A hereto

(each a “Lender” and collectively, the “Lenders”). Each of the Borrower, the Administrator and each

Lender is a “Party” to this Amendment and together are “Parties.” Terms used herein but not otherwise defined

herein have the meaning given to such terms in the Agreement.

WHEREAS, the Parties have agreed that the Agreement

should be amended as set forth in this Amendment. including having the Line of Credit Maturity Date shall be extended by nine (9) months,

from eighteen (18) months from the Effective Date of the Agreement to twenty-seven (27) months from the Effective Date of the Agreement.

NOW, THEREFORE, in consideration of the mutual

covenants contained in this Amendment, and for other good and valuable consideration the receipt and adequacy of which are hereby acknowledged,

the Borrower and the Lender agree as follows:

| 1. | Extension of Line of Credit Maturity Date. |

Section I – Definitions and

Interpretation – 1.1 Terms Defined – “Line of Credit Maturity Date” in the Agreement is hereby removed and replaced

in its entirety by the following:

“Line of Credit Maturity Date

– Twenty-seven (27) months from the Effective Date.”

| 2. | Amendment of Payment Terms. |

Section II – The Loan –

2.3 “Interest” in the Agreement is hereby amended and supplemented to add paragraph c. to the end of such Section, as follows:

c. Notwithstanding paragraph a. and

b. of this Section, no payments of interest or principal under the Agreement or the Note will be due and payable from November 13,

2023, to the Line of Credit Maturity Date, except as follows:

| i. | November 13, 2023: one payment of $374,000 (accrued interest of $132,000 due through November 13,

2023; initial payment of principal of $220,000; one point of $22,000 as consideration to extend the maturity date of the Loan); and |

| ii. | Nine (9) monthly payments of principal of $220,000 plus accrued interest, commencing December 13,

2023. |

| (a) | In consideration for the extension of the Line of Credit Maturity Date, Lender hereby agrees to amend

each warrant identified in Exhibit A hereto (each a “Warrant” and collectively, the “Warrants”)

to reduce the Warrant Exercise Price (as defined in each Warrant) to $1.00. The amended Aggregate Exercise Price (as defined in each Warrant)

for each Warrant is set out in Exhibit A. |

| (b) | Each Lender hereby agrees to enter into a Lock-Up Letter Agreement in substantially the form attached

as Exhibit B hereto restricting the disposal of any shares of common stock of the Lender that are issued in connection

with the exercise of the Warrant for a period of twelve (12) months from the Amendment Effective Date. |

| 4. | Use of Proceeds of Future Non-Affiliate Capital Raises. |

| (a) | In consideration for the extension of the Line of Credit Maturity Date, Lender hereby agrees to apply

one-third (1/3) of the net proceeds of any capital raise, other than proceeds from an equity offering under the Company’s at-the-market

(ATM) program or from an affiliate or insider, that takes place after the Amendment Effective Date, toward paying down the then outstanding

principal amount due under the Loans. |

| (a) | Governing Law. This Amendment will be governed by and construed in accordance with the internal

laws of the State of Florida without giving effect to any choice or conflict of law provision or rule. |

| (b) | Counterparts. This Amendment may be executed in counterparts, each of which will be deemed an original,

but all of which together will be deemed to be one and the same agreement. Counterparts may be delivered via facsimile, electronic mail

(including PDF or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com), or other transmission

method, and any counterpart so delivered will be deemed to have been duly and validly delivered and be valid and effective for all purposes. |

| (c) | Entire Agreement. This Amendment, together with the Agreement, constitutes the full and entire

understanding and agreement between the parties with regard to the subject therein and herein. Except as amended by this Amendment, the

Agreement shall remain unchanged and in full force and effect, and this Amendment shall be governed by and subject to the terms of each

of the Agreement, as amended hereby. In the event of any inconsistency between this Amendment and the Agreement, the provisions of this

Amendment will control. |

[SIGNATURE PAGES FOLLOW]

IN

WITNESS WHEREOF, the undersigned have caused this Amendment to be duly executed by their respective authorized signatories

as of the Amendment Effective Date.

| BORROWER: |

|

| |

|

| LOOP MEDIA, INC. |

|

| |

|

| By: |

/s/ |

|

| Name: |

Neil Watanabe |

|

| Title: |

CFO |

|

| |

|

| LOAN ADMINISTRATOR: |

|

| |

|

| RAT INVESTMENT HOLDINGS, LP |

|

| |

|

| By: |

/s/ |

|

| Name: |

Roger A. Tichenor |

|

| Title: |

General Partner |

|

| |

|

| LENDER: |

|

| |

|

| RAT INVESTMENT HOLDINGS, LP |

|

| |

|

| By: |

/s/ |

|

| Name: |

Roger A. Tichenor |

|

| Title: |

General Partner |

|

| |

|

| LENDER: |

|

| |

|

| BOSTON FIDELITY FINANCIAL, LLC |

|

| |

|

| By: |

/s/ |

|

| Name: |

Shannon Ciaravella |

|

| Title: |

Managing Member |

|

(Signature page to Non-Revolving Line of

Credit Loan Agreement Amendment)

| LENDER: |

|

| |

|

| RANDALL OSER LP |

|

| |

|

| By: |

/s/ |

|

| Name: |

Randall Oser |

|

| |

|

| LENDER: |

|

| |

|

| NEIL OSER |

|

| |

|

| By: |

/s/ |

|

| Name: |

Neil Oser |

|

| |

|

| LENDER: |

|

| |

|

| SIESTA PRIVATE MORTGAGES, LLC |

|

| |

|

| By: |

/s/ |

|

| Name: |

Scott D. Williams |

|

| Title: |

Manager |

|

| |

|

| LENDER: |

|

| |

|

| AFW VENTURES, LLC |

|

| |

|

| By: |

/s/ |

|

| Name: |

Ralph Wheaton |

|

| Title: |

Manager |

|

(Signature page to Non-Revolving Line of

Credit Loan Agreement Amendment)

| LENDER: |

|

| |

|

| ERE SEP, LLC |

|

| |

|

| By: |

/s/ |

|

| Name: |

Eric Elliott |

|

| Title: |

Managing Member |

|

| |

|

| LENDER: |

|

| |

|

| ON PURPOSE HOLDINGS, LP |

|

| |

|

| By: |

/s/ |

|

| Name: |

Harris B. Williams, Jr. |

|

| Title: |

General Partner |

|

| |

|

| LENDER: |

|

| |

|

| ADK HOLDINGS, LLC |

|

| |

|

| By: |

/s/ |

|

| Name: |

Jared Kaban |

|

| Title: |

Managing Member |

|

(Signature page to Non-Revolving Line of

Credit Loan Agreement Amendment)

EXHIBIT A

Lenders and Warrant Schedule

| LENDER/HOLDER | |

LOAN

AMOUNT | | |

WARRANT

NUMBER | |

WARRANT

SHARES | | |

AMENDED

WARRANT

EXERCISE

PRICE | | |

AMENDED

AGGREGATE

EXERCISE

PRICE | |

| Boston Fidelity Financial, LLC | |

$ | 1,000,000 | | |

CSW-22-008 | |

| 95,238 | | |

$ | 1.00 | | |

$ | 95,238 | |

| Attn: Shannon Ciaravella, Managing Member | |

| | | |

CSW-22-008a | |

| 47,619 | | |

$ | 1.00 | | |

$ | 47,619 | |

| | |

| | | |

| |

| | | |

| | | |

| | |

| Randall Oser | |

$ | 200,000 | | |

CSW-22-009 | |

| 19,047 | | |

$ | 1.00 | | |

$ | 19,047 | |

| | |

| | | |

CSW-22-009a | |

| 9,523 | | |

$ | 1.00 | | |

$ | 9,523 | |

| | |

| | | |

| |

| | | |

| | | |

| | |

| Neil Oser | |

$ | 200,000 | | |

CSW-22-010 | |

| 19,047 | | |

$ | 1.00 | | |

$ | 19,047 | |

| | |

| | | |

CSW-22-010a | |

| 9,523 | | |

$ | 1.00 | | |

$ | 9,523 | |

| | |

| | | |

| |

| | | |

| | | |

| | |

| Siesta Private Mortgages, LLC | |

$ | 100,000 | | |

CSW-22-011 | |

| 9,524 | | |

$ | 1.00 | | |

$ | 9,524 | |

| Scott D. Williams, Manager | |

| | | |

CSW-22-011a | |

| 4,762 | | |

$ | 1.00 | | |

$ | 4,762 | |

| | |

| | | |

| |

| | | |

| | | |

| | |

| RAT Investment Holdings, LP | |

$ | 100,000 | | |

CSW-22-012 | |

| 9,524 | | |

$ | 1.00 | | |

$ | 9,524 | |

| Roger Tichenor, General Partner | |

| | | |

CSW-22-012a | |

| 4,762 | | |

$ | 1.00 | | |

$ | 4,762 | |

| | |

| | | |

| |

| | | |

| | | |

| | |

| AFW Ventures, LLC | |

$ | 100,000 | | |

CSW-22-013 | |

| 9,524 | | |

$ | 1.00 | | |

$ | 9,524 | |

| Ralph Wheaton, Manager | |

| | | |

CSW-22-013a | |

| 4,762 | | |

$ | 1.00 | | |

$ | 4,762 | |

| | |

| | | |

| |

| | | |

| | | |

| | |

| ERE SEP, LLC | |

$ | 100,000 | | |

CSW-22-014 | |

| 9,524 | | |

$ | 1.00 | | |

$ | 9,524 | |

| Eric Elliott, Managing Member | |

| | | |

CSW-22-014a | |

| 4,762 | | |

$ | 1.00 | | |

$ | 4,762 | |

| | |

| | | |

| |

| | | |

| | | |

| | |

| On Purpose Holdings, LP | |

$ | 200,000 | | |

CSW-22-015 | |

| 19,047 | | |

$ | 1.00 | | |

$ | 19,047 | |

| Harris B. Williams, Jr., General Partner | |

| | | |

CSW-22-015a | |

| 9,523 | | |

$ | 1.00 | | |

$ | 9,523 | |

| | |

| | | |

| |

| | | |

| | | |

| | |

| ADK Holdings, LP | |

$ | 200,000 | | |

CSW-22-016 | |

| 19,047 | | |

$ | 1.00 | | |

$ | 19,047 | |

| Jared Kaban, Managing Member | |

| | | |

CSW-22-016a | |

| 9,523 | | |

$ | 1.00 | | |

$ | 9,523 | |

EXHIBIT B

Form of Lock-Up Letter Agreement

Loop Media, Inc.

Re:

That certain Non-Revolving Line of Credit Loan Agreement, dated May 13, 2022, as amended on November 13, 2023, pursuant to which

Loop Media, Inc., a Nevada corporation (the “Company”) issued a warrant (the “LOC

Warrant”) to [LENDER] (the “Lender”), which allows Lender to purchase an aggregate of up

to [X] shares of common stock of the Company, par value $0.0001 per share (the “Shares”); and that certain

Letter Agreement, dated July 22, 2022, pursuant to which the Company issued a warrant (together with the LOC Warrant, the “Warrants”)

to Lender, which allows Lender to purchase an aggregate of up to [X] Shares.

Ladies and Gentlemen:

Defined

terms not otherwise defined in this letter agreement (this “Letter Agreement”) shall have the meanings set forth

in the Warrants. In satisfaction of a condition of the Company’s obligations under the Loan Agreement, the undersigned irrevocably

agrees with the Company that, for a period of one year from the date hereof (such period, the “Restriction Period”),

the undersigned will not offer, sell, contract to sell, hypothecate, pledge or otherwise dispose of (or enter into any transaction which

is designed to, or might reasonably be expected to, result in the disposition (whether by actual disposition or effective economic disposition

due to cash settlement or otherwise) by the undersigned or any Affiliate of the undersigned or any person in privity with the undersigned

or any Affiliate of the undersigned), directly or indirectly, including the filing (or participation in the filing) of a registration

statement with the Commission in respect of, or establish or increase a put equivalent position or liquidate or decrease a call equivalent

position within the meaning of Section 16 of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”)

any Shares obtained as a result of the exercise of the Warrants, and any Common Stock Equivalents received as a result of owning, holding

or acquiring such Shares, or Common Stock Equivalents, including the Warrants, other than transfers: (A) as a bona

fide gift or gifts; (B) to any trust for the direct or indirect benefit of the undersigned or the immediate family of the undersigned;

(C) pursuant to a qualified domestic order or in connection with a divorce settlement; (D) by will or intestate succession to

the legal representative, heir, beneficiary or immediate family of the undersigned upon the death of the undersigned; or (E) in sales

to “accredited investors” within the meaning of the U.S. Securities Act of 1933 in a private placement that is not a sale

on the OTC MKT or on any national securities exchange, provided that, (1) in the case of any transfer, distribution or sale pursuant

to clauses (A) through (E), it shall be a condition precedent to any such transferor distribution that prior to any such transfer,

each donee, trustee, distributee, transferee, or purchaser, as the case may be, delivers to the Company a signed lock-up agreement, substantially

in the form of this Letter Agreement, for the balance of the Restriction Period; (2) in the case of transfers pursuant to clauses

(A) through (D), any such transfer shall not involve a disposition for value; (3) in the case of any transfer pursuant to clauses

(A) through (C) or Clause (E), such transfers are not required to be reported with the Commission under the Exchange Act; and

(4) in the case of any transfer pursuant to clauses (A) through (E), the undersigned does not otherwise voluntarily effect any

public filing or report regarding such transfers.

As used herein:

| (i) | “immediate family” shall mean the spouse, domestic partner, lineal descendant, father, mother, brother, sister, or any

other person with whom the undersigned has a relationship by blood, marriage or adoption not more remote than first cousin; |

| (ii) | “Affiliate” means any Person that, directly or indirectly through one of more intermediaries, controls or is controlled

by or is under common control with a Person as such terms are used in and construed under Rule 405 under the Securities Act of 1933,

as amended; |

| (iii) | “Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture,

limited liability company, joint stock company, government (or agency or subdivision thereof) or other entity of any kind; and |

| (iv) | “Common Stock Equivalent” shall be defined as a security, including stock options, warrants, convertible bonds, preferred

bonds, preferred stock, two-class common stock and contingent shares, that can be converted into common stock. |

Beneficial ownership shall

be calculated in accordance with Section 13(d) of the Exchange Act. In order to enforce this covenant, the Company shall impose

irrevocable stop-transfer instructions preventing the Transfer Agent from effecting any actions in violation of this Letter Agreement.

The “Transfer Agent” means ClearTrust, LLC, the current transfer agent of the Company, with a mailing address of 16540 Pointe

Village Drive, Suite 2305, Lutz, Florida 33558 and a facsimile number of +1 (813) 338-4549, and any successor transfer agent of the

Company.

The undersigned acknowledges

that the execution, delivery and performance of this Letter Agreement is a material inducement to the Company to complete the transactions

contemplated by the Loan Agreement and that the Company shall be entitled to specific performance of the undersigned’s obligations

hereunder. The undersigned hereby represents that the undersigned has the power and authority to execute, deliver and perform this Letter

Agreement, that the undersigned has received adequate consideration therefor and that the undersigned will indirectly benefit from the

closing of the transactions contemplated by the Loan Agreement.

This Letter Agreement may

not be amended or otherwise modified in any respect without the written consent of the Company and the undersigned. This Letter Agreement

shall be construed and enforced in accordance with the laws of the State of New York without regard to the principles of conflict of laws.

The undersigned hereby irrevocably submits to the exclusive jurisdiction of the United States District Court sitting in the Southern District

of New York and the courts of the State of New York located in Manhattan, for the purposes of any suit, action or proceeding arising out

of or relating to this Letter Agreement, and hereby waives, and agrees not to assert in any such suit, action or proceeding, any claim

that (i) it is not personally subject to the jurisdiction of such court, (ii) the suit, action or proceeding is brought in an

inconvenient forum, or (iii) the venue of the suit, action or proceeding is improper. The undersigned hereby irrevocably waives personal

service of process and consents to process being served in any such suit, action or proceeding by receiving a copy thereof sent to the

Company at the address in effect for notices to it under the Loan Agreement and agrees that such service shall constitute good and sufficient

service of process and notice thereof. The undersigned hereby waives any right to a trial by jury. Nothing contained herein shall be deemed

to limit in any way any right to serve process in any manner permitted by law.

This Letter Agreement shall

be binding on successors and assigns of the undersigned with respect to the Shares and any such successor or assign shall enter into a

similar agreement for the benefit of the Company.

This Letter Agreement shall

automatically terminate, and the undersigned shall be released from its obligations hereunder, upon the termination of the Loan Agreement

prior to payment for and delivery of the securities of the Company delivered thereunder.

[Signature Page Follows]

| Very Truly Yours, |

|

| |

|

| [LENDER] |

|

| |

|

| By: |

|

|

| |

|

| Signature: NAME, TITLE |

|

| |

|

| |

|

| Name of Securityholder/Director/Officer (Print exact name) |

|

| |

|

| Date: |

|

|

Exhibit 10.2

AMENDED AND RESTATED

NON-REVOLVING LINE OF CREDIT PROMISSORY NOTE

| $2,200,000.00 |

November 13, 2023 |

THIS

AMENDED AND RESTATED NON-REVOLVING LINE OF CREDIT PROMISSORY NOTE (this “Note”) is effective as of November 13,

2023, and is issued by Loop Media, Inc., a Nevada corporation (the “Borrower”) to the Lenders set out in Exhibit A

hereto (collectively, the “Lender”).

WHEREAS,

on May 13, 2022, Borrower and Lender entered into that certain Non-Revolving Line of Credit Loan Agreement (the “Agreement”)

in which Lender agreed to make loans to Borrower, as a non-revolving line of credit not to exceed the sum of $2,200,000 in the aggregate

(the “Loan”), which Loan is evidenced by that certain Non-Revolving Line of Credit Promissory Note dated May 13,

2022 (the “Original Note”), in the aggregate principal amount of up to two million two hundred thousand dollars ($2,200,000.00);

WHEREAS,

as of the date hereof, Borrower and Lender have entered into that certain Non-Revolving Line of Credit Agreement Amendment (the “Amendment”)

to extend the Maturity Date of the Original Note by nine (9) months, from eighteen (18) months from the Effective Date of the Agreement

to twenty-seven (27) months from the Effective Date of the Agreement (the “Extended Maturity Date”);

WHEREAS, Borrower

and Lender desire to amend and restate the Original Note in order to reflect the Extended Maturity Date, and, accordingly, Borrower has

agreed to execute and deliver this Note;

WHEREAS,

Borrower and Lender desire to amend the payment instructions in the Original Note; and

NOW,

THEREFORE, in consideration of the premises, the agreements hereinafter set forth and other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby covenant and agree as follows, effective

as of the date first above written:

A. The

Maturity Date of this Note shall be twenty-seven (27) months from the Effective Date of the Original Note.

B. Payments

to Lender shall be made to: ______________________________________, according to wire instructions

provided to Borrower.

C. This

Note does not extinguish the outstanding indebtedness evidenced by the Original Note and is not intended to be a substitution or novation

of the original indebtedness or instruments evidencing the same, all of which shall continue in full force and effect except as specifically

amended and restated hereby.

D. This

Note completely amends and replaces the Original Note and the Original Note shall have no further force or effect whatsoever.

E. The

Original Note is hereby amended, restated and replaced in its entirety by this Note to read as follows:

FOR

VALUE RECEIVED, Loop Media, Inc., a Nevada corporation (“Borrower”), promises to pay to the order of

the Lenders set out on Exhibit B to the Loan Agreement (defined below) (collectively, the “Lender”), the aggregate

of such amounts Lender has disbursed to Borrower during the period from the date first set forth above to the Maturity Date (defined below),

up to TWO MILLION TWO HUNDRED THOUSAND AND 00/100 DOLLARS ($2,200,000.00), in lawful money of the United States of America (the “Loan”

or the “Advances”), together with all accrued interest on the principal amount of all Advances made hereunder from

the date such Advance was made at a rate specified in that certain Non-Revolving Line of Credit Loan Agreement between RAT Investment

Holdings, LP, the Lenders and Borrower, as amended as of the same date as this Note (“Loan Agreement”). Capitalized

terms used in this Amended and Restated Non-Revolving Line of Credit Promissory Note (this “Note”) that are not otherwise

defined herein shall have the respective meanings set forth in the Loan Agreement.

This Note evidences the Loans

incurred under the Loan Agreement to which reference is made for a statement of the terms and provisions thereof, including those under

which such indebtedness may be declared to be immediately due and payable. This Note is entitled to the benefits of, inter alia,

the Loan Agreement and the other Loan Documents.

On the Maturity Date, the

then outstanding principal balance of the Loan, all accrued and unpaid interest, and any other amounts owed by Borrower to Lender pursuant

to the Loan Agreement and other Loan Documents shall be due and payable in full. All payments made under this Note to Lender (collectively,

a “Payment”) shall be made payable to Lender by wire transfer or corporate check at the address provided next to its

signature below. Payments to Lender shall be made payable to “RAT Investment Holdings, LP” at the following address: ______________________________________, according to wire instructions provided to Lender.

For purposes of this Note,

the maturity date shall be twenty-seven (27) months from the date of this Note (the “Maturity Date”).

After the Maturity Date or

due date on this Note (whether at the stated maturity, by acceleration, or otherwise), interest shall be charged on the respective principal

amount remaining unpaid at a rate specified in the Loan Agreement, until paid.

Notwithstanding the foregoing,

however, in no event shall the interest charged exceed the maximum rate of interest allowed by applicable law, as amended from time to

time. Lender does not intend to charge any amount of interest, monthly renewal fee or other fees or charges in the nature of interest

that exceeds the maximum rate allowed by applicable law. If any payment of interest or in the nature of interest hereunder would cause

the foregoing interest rate limitation to be exceeded, then such excess payment shall be credited as a payment of principal.

If any Payment is more than

five (5) Business Days late, Borrower agrees to pay Lender a late charge equal to five percent (5.0%) of such Payment (“Late

Fee”). The provisions of this Note establishing a Late Fee shall not be deemed to extend the time for any Payment due or to

constitute a “grace period” giving Borrower a right to cure such default.

If any Payment becomes due

and payable on a day other than a Business Day, the due date thereof shall be extended to the next succeeding Business Day.

Unless otherwise specified

herein, a Payment shall be applied by Lender first to interest and lawful charges then accrued, and then to principal, unless otherwise

determined by Lender in its discretion.

Borrower will have the right

to prepay the Loans, in whole or in part, at any time upon three (3) Business Days’ prior notice to Lender; provided, however,

if applicable, Borrower must pay such prepayment premium pursuant to Section 2.5 of the Loan Agreement, if applicable.

Borrower shall be in default

under this Note upon the occurrence of an Event of Default under the Loan Agreement.

Lender shall have, in addition

to the rights and remedies contained in this Note and any other related documents, all of the rights and remedies of a creditor, now or

hereafter available at law or in equity and under the Loan Agreement. Lender may, at its option, exercise any one or more of such rights

and remedies individually, partially, or in any combination from time to time, including, to the extent applicable, before the occurrence

of an event of default. No right, power, or remedy conferred upon Lender by the related documents shall be exclusive of any other right,

power, or remedy referred to therein or now or hereafter available at law or in equity.

Without limiting the generality

of the foregoing, if a default shall occur then Lender may declare the indebtedness owed to Lender by Borrower hereunder and any or all

of any other indebtedness owed by Borrower to Lender, whether direct or indirect, contingent or certain, to be accelerated and due and

payable at once, whereupon such indebtedness, together with interest thereon, shall forthwith become due and payable, all without presentment,

demand, protest, or other notice of any kind from Lender, all of which are hereby expressly waived; and Lender may proceed to do other

all things provided by law, equity, or contract to enforce its rights under such indebtedness and to collect all amounts owing to Lender.

All parties liable for any

Payment agree to pay or reimburse Lender for all of its costs and expenses incurred in connection with the administration, supervision,

collection, or enforcement of, or the preservation of any rights under, this Note or the obligation evidenced hereby, including without

limitation, the fees and disbursements of counsel for Lender including attorneys' fees out of court, in trial, on appeal, in bankruptcy

proceedings, or otherwise. All parties liable for any Payment agree to promptly pay, indemnify, and reimburse Lender for, and hold Lender

harmless against any liability for, any and all documentary stamp taxes, nonrecurring intangible taxes, or other taxes, together with

any interest, penalties, or other liabilities in connection therewith, that Lender now or hereafter determines are payable with respect

to this Note or the obligations evidenced by this Note. The foregoing obligations shall survive Payment of this Note.

All notices, requests, and

demands to or upon the parties hereto, shall be deemed to have been given or made when delivered by hand, or when deposited in the mail,

postage prepaid by registered or certified mail, return receipt requested, addressed to the address provided next to the signatures below

or such other address as may be hereafter designated in writing by one party to the other.

This Note shall be governed

by, and construed and interpreted in accordance with, the laws of the State of Florida, excluding those laws relating to the resolution

of conflicts between laws of different jurisdictions.

In any litigation in connection

with or to enforce this Note, any endorsement or guaranty of this Note, or any of the other related documents, Borrower irrevocably consents

to and confers personal jurisdiction the state and federal courts located within Sarasota County, Florida, expressly waives any objections

as to venue in any of such courts, and agrees that service of process may be made on Borrower by mailing a copy of the summons and complaint

by registered or certified mail, return receipt requested, to its address set forth herein (or otherwise expressly provided in writing).

Nothing contained herein shall, however, prevent Lender from bringing any action or exercising any rights within any other state or jurisdiction

or from obtaining personal jurisdiction by any other means available by applicable law.

In the event that any one

or more of the provisions of this Note is determined to be invalid, illegal, or unenforceable in any respect as to one or more of the

parties, all remaining provisions nevertheless shall remain effective and binding on the parties thereto and the validity, legality, and

enforceability thereof shall not be affected or impaired thereby. If any such provision is held to be illegal, invalid, or unenforceable,

there will be deemed added in lieu thereof a provision as similar in terms to such provision as is possible, that is legal, valid, and

enforceable. To the extent permitted by applicable law, Borrower hereby waives any law that renders any such provision invalid, illegal,

or unenforceable in any respect.

The singular shall include

the plural and any gender shall be applicable to all genders when the context permits or implies

No delay or omission on the

part of Lender in exercising any right or remedy hereunder shall operate as a waiver of such right or remedy or of any other right or

remedy and no single or partial exercise of any right or remedy shall preclude any other or further exercise of that or any other right

or remedy. Presentment, demand, notice of nonpayment, notice of protest, protest, notice of dishonor and all other notices are hereby

waived by Borrower.

This Note may not be modified

or amended nor shall any provision of it be waived except by a written instrument signed by the party against whom such action is to be

enforced.

This Agreement shall inure

to the benefit of and be binding upon the successors and assigns of each of the parties. Borrower may not transfer, assign or delegate

any of its duties or obligations hereunder and Lender shall not assign or otherwise transfer any of its rights or obligations hereunder

without the consent of Borrower. In the event Lender transfers or assigns its obligations hereunder, Lender shall be relieved of all liability

therefor.

Time is of the essence in

the performance of this Note.

This Note is entitled to the

benefit of all of the provisions of the Loan Agreement.

Borrower and Lender (by

its acceptance hereof) hereby knowingly, irrevocably, voluntarily, and intentionally waive any right to a trial by jury in respect of

any litigation based on this Note or any other document executed in connection with this Note or arising out of, under, or in connection

therewith, or any course of conduct, course of dealing, statements (whether oral or written), or actions of any party. This provision

is a material inducement for Lender to enter into the transaction evidenced hereby.

[SIGNATURE APPEARS ON THE FOLLOWING PAGE]

IN

WITNESS WHEREOF, Borrower has executed this Note as of the date first written above.

| BORROWER: |

|

| |

|

| Loop Media Inc., a Nevada corporation |

|

| |

|

| By: |

/s/ |

|

| Name: Neil T. Watanabe |

|

| Title: Chief Financial Officer |

|

Address:

2600 West Olive Avenue, Suite 5470

Burbank, CA 91505

Email

Address: neil@loop.tv

EXHIBIT A

Lenders

| LENDER | |

PRINCIPAL

LOAN

AMOUNT | |

| Boston Fidelity Financial, LLC | |

$ | 1,000,000 | |

| Attn: Shannon Ciaravella, Managing Member | |

| | |

| | |

| | |

| Randall Oser | |

$ | 200,000 | |

| | |

| | |

| Neil Oser | |

$ | 200,000 | |

| | |

| | |

| Siesta Private Mortgages, LLC | |

$ | 100,000 | |

| Scott D. Williams, Manager | |

| | |

| | |

| | |

| RAT Investment Holdings, LP | |

$ | 100,000 | |

| Roger Tichenor, General Partner | |

| | |

| | |

| | |

| AFW Ventures, LLC | |

$ | 100,000 | |

| Ralph Wheaton, Manager | |

| | |

| | |

| | |

| ERE SEP, LLC | |

$ | 100,000 | |

| Eric Elliott, Managing Member | |

| | |

| | |

| | |

| On Purpose Holdings, LP | |

$ | 200,000 | |

| Harris B. Williams, Jr., General Partner | |

| | |

| | |

| | |

| ADK Holdings, LP | |

$ | 200,000 | |

| Jared Kaban, Managing Member | |

| | |

| | |

| | |

| TOTAL: | |

$ | 2,200,000 | |

v3.23.3

Cover

|

Nov. 13, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity File Number |

001-41508

|

| Entity Registrant Name |

Loop Media, Inc.

|

| Entity Central Index Key |

0001643988

|

| Entity Tax Identification Number |

47-3975872

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2600 West Olive Avenue

|

| Entity Address, Address Line Two |

Suite 54470

|

| Entity Address, City or Town |

Burbank

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91505

|

| City Area Code |

213

|

| Local Phone Number |

436-2100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

LPTV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

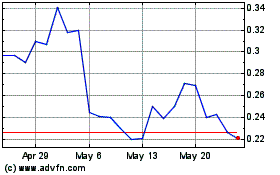

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Loop Media (AMEX:LPTV)

Historical Stock Chart

From Jan 2024 to Jan 2025