UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: November, 2024

Commission File No. 0001-40381

NEW PACIFIC METALS CORP.

(Translation of registrant's name into English)

Suite 1750 - 1066 W. Hastings Street

Vancouver BC, Canada V6E 3X1

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [ ] Form 40-F [X]

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: November 18, 2024 |

NEW PACIFIC METALS CORP. |

| |

|

| |

/s/ Jalen Yuan |

| |

Jalen Yuan |

| |

Chief Financial Officer |

EXHIBIT INDEX

Exhibit 99.1

| TABLE

OF CONTENTS |

|

| |

|

| 1 |

SUMMARY |

1 |

| |

|

|

| 1.1 |

EXECUTIVE

SUMMARY |

1 |

| 1.2 |

TECHNICAL

SUMMARY |

6 |

| |

|

|

| 2 |

INTRODUCTION |

19 |

| |

|

|

| 2.1 |

Terms

of Reference |

19 |

| 2.2 |

Effective

Date |

19 |

| 2.3 |

Qualified

Persons |

19 |

| 2.4 |

Sources

of Information |

20 |

| 2.5 |

Key

Units of Measure |

21 |

| 2.6 |

List

of Abbreviations |

21 |

| |

|

|

| 3 |

RELIANCE

ON OTHER EXPERTS |

24 |

| |

|

|

| 4 |

PROPERTY

DESCRIPTION AND LOCATION |

25 |

| |

|

|

| 4.1 |

Land

Tenure |

27 |

| 4.2 |

Terms

of the Joint Venture |

29 |

| |

|

|

| 5 |

ACCESSIBILITY,

CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

30 |

| |

|

|

| 5.1 |

Accessibility |

30 |

| 5.2 |

Physiography

and Climate |

30 |

| 5.3 |

Local

Resources and Infrastructure |

30 |

| |

|

|

| 6 |

HISTORY |

32 |

| |

|

|

| 6.1 |

Historical

Resource Estimates |

32 |

| 6.2 |

Past

Production |

32 |

| |

|

|

| 7 |

GEOLOGICAL

SETTING AND MINERALISATION |

33 |

| |

|

|

| 7.1 |

Regional

Geology |

33 |

| 7.2 |

Local

Geology of Carangas Property |

35 |

| 7.3 |

Mineralization |

40 |

| |

|

|

| 8 |

DEPOSIT

TYPES |

44 |

| |

|

|

| 9 |

EXPLORATION |

45 |

| |

|

|

| 9.1 |

Sampling

and Mapping |

45 |

| 9.2 |

Geophysics |

46 |

| 9.3 |

Exploration

Potential |

47 |

| |

|

|

| 10 |

DRILLING |

48 |

| |

|

|

| 10.1 |

Drilling

Type |

50 |

| 10.2 |

Drilling

Locational Data |

50 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page i of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

| 10.3 |

Drilling

Sample Recovery |

50 |

| 10.4 |

Process

Verification |

50 |

| |

|

|

| 11 |

SAMPLE

PREPARATION, ANALYSES AND SECURITY |

51 |

| |

|

|

| 11.1 |

Sample

Collection |

51 |

| 11.2 |

Assay

Laboratory Sample Preparation and Analysis |

53 |

| 11.3 |

Bulk

Density |

53 |

| 11.4 |

Quality

Control Data |

54 |

| 11.5 |

Security

and Storage |

61 |

| 11.6 |

RPM

Opinion on Adequacy of Sample Preparation, Analyses, Security and QA/QC |

62 |

| |

|

|

| 12 |

DATA

VERIFICATION |

63 |

| |

|

|

| 12.1 |

Data

Verification Measures |

63 |

| 12.2 |

Database

Validation |

63 |

| 12.3 |

Validation

of Mineralisation |

63 |

| 12.4 |

Drill

Hole Location Validation |

64 |

| 12.5 |

Core

Logging, Sampling, and Storage Facilities |

65 |

| 12.6 |

RPM

Opinion on the Validity of the Data |

65 |

| |

|

|

| 13 |

MINERAL

PROCESSING AND METALLURGICAL TESTING |

66 |

| |

|

|

| 13.1 |

Introduction |

66 |

| 13.2 |

Historical

metallurgical testwork (2022-2023) |

66 |

| 13.3 |

Recent

metallurgical testwork (2024) |

68 |

| 13.4 |

Sample

selections and head assays |

68 |

| 13.5 |

Mineralogy

of the oxidized silver/lead/zinc mineralized samples |

71 |

| 13.6 |

Bulk

flotation of the USZ Oxidized sample |

73 |

| 13.7 |

Selective

flotation of the USZ Transitional sample |

73 |

| 13.8 |

Flotation

testing of the USZ Sulfide sample |

75 |

| 13.9 |

Flotation

testing for the USZ LOM composite sample |

78 |

| 13.10 |

Metallurgical

testing for the sample from the Lower Gold Zone |

92 |

| 13.11 |

Bulk

flotation to produce the gold concentrate |

93 |

| |

|

|

| 14 |

MINERAL

RESOURCE ESTIMATE |

97 |

| |

|

|

| 14.1 |

Resource

Database |

97 |

| 14.2 |

Depletion

Areas |

98 |

| 14.3 |

Geological

Interpretation |

98 |

| 14.4 |

Resource

Assays |

101 |

| 14.5 |

Treatment

of High-Grade Assays |

102 |

| 14.6 |

Compositing |

103 |

| 14.7 |

Search

Strategy and Grade Interpolation Parameters |

103 |

| 14.8 |

Bulk

Density |

106 |

| 14.9 |

Block

Models |

106 |

| 14.10 |

Cut

off Grade and Optimization Parameters |

108 |

| 14.11 |

Classification |

109 |

| 14.12 |

Block

Model Validation |

112 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page ii of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

| 14.13 |

Mineral

Resource Reporting |

117 |

| |

|

|

| 15 |

MINERAL

RESERVE ESTIMATE |

118 |

| |

|

|

| 16 |

MINING

METHODS |

119 |

| |

|

|

| 16.1 |

Introduction |

119 |

| 16.2 |

Key

Design Criteria |

121 |

| 16.3 |

Pit

Optimization |

125 |

| 16.4 |

Pit

Designs |

126 |

| 16.5 |

Low

Grade and Oxide Stockpile Design |

133 |

| 16.6 |

Waste

Rock Storage Facility Design |

133 |

| 16.7 |

Ex-Pit

Haul Roads |

134 |

| 16.8 |

Mine

Production Schedule |

134 |

| 16.9 |

Mine

Operations |

145 |

| 16.10 |

Risks |

145 |

| |

|

|

| 17 |

RECOVERY

METHODS |

147 |

| |

|

|

| 17.1 |

Design

Criteria |

148 |

| 17.2 |

Process

Flow Sheet |

153 |

| 17.3 |

Process

Description |

156 |

| 17.4 |

Power |

157 |

| 17.5 |

Water |

158 |

| 17.6 |

Reagents

and Consumables |

158 |

| 17.7 |

Other

Facilities and Servies |

159 |

| 17.8 |

Concentrate

production |

160 |

| 17.9 |

QP

Comments |

161 |

| |

|

|

| 18 |

PROJECT

INFRASTRUCTURE |

163 |

| |

|

|

| 18.1 |

Access

roads |

163 |

| 18.2 |

Power

Supply |

163 |

| 18.3 |

Water

Supply, Potable Water Supply, and Wastewater Treatment Plant. |

165 |

| 18.4 |

Fuel

Supply |

165 |

| 18.5 |

Administrative

Complex Building |

166 |

| 18.6 |

Camp

Accommodation and Lunchroom |

166 |

| 18.7 |

Emergency

Responses |

166 |

| 18.8 |

Communications |

166 |

| 18.9 |

Warehouse |

166 |

| 18.10 |

Truck

Shop and Truck Wash |

167 |

| 18.11 |

Maintenance

Shop Building |

167 |

| 18.12 |

Change

Room |

167 |

| 18.13 |

Assay

Laboratory |

167 |

| 18.14 |

Main

Gate |

167 |

| 18.15 |

Truck

Scale |

167 |

| 18.16 |

Explosives |

167 |

| 18.17 |

Tailings |

167 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page iii of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

| 19 |

MARKET

STUDIES AND CONTRACTS |

177 |

| |

|

|

| 19.1 |

Markets |

177 |

| 19.2 |

Royalties |

178 |

| 19.3 |

Contracts |

178 |

| |

|

|

| 20 |

ENVIRONMENTAL

STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT |

179 |

| |

|

|

| 20.1 |

Introduction |

179 |

| 20.2 |

Environmental

Legislation and Applicable Project Permitting |

179 |

| 20.3 |

Environmental

Baseline Work to Date |

181 |

| 20.4 |

Social

or Community Requirements |

186 |

| 20.5 |

Mine

Closure Requirements |

187 |

| |

|

|

| 21 |

CAPITAL

AND OPERATING COSTS |

188 |

| |

|

|

| 21.1 |

Capital

Costs |

188 |

| 21.2 |

Operating

Costs |

192 |

| |

|

|

| 22 |

ECONOMIC

ANALYSIS |

195 |

| |

|

|

| 22.1 |

Methodology |

195 |

| 22.2 |

Economic

Analysis |

198 |

| 22.3 |

Sensitivity

Analysis |

201 |

| |

|

|

| 23 |

ADJACENT

PROPERTIES |

202 |

| |

|

|

| 24 |

OTHER

RELEVANT DATA AND INFORMATION |

203 |

| |

|

|

| 24.1 |

Alternate

Project Development Plan |

203 |

| |

|

|

| 25 |

INTERPRETATION

AND CONCLUSIONS |

210 |

| |

|

|

| 25.1 |

Geology

and Mineralization |

210 |

| 25.2 |

Data

Verification and Mineral Resources |

210 |

| 25.3 |

Exploration

Potential |

210 |

| 25.4 |

Mining |

210 |

| 25.5 |

Mineral

Processing and Metallurgical Testing |

211 |

| 25.6 |

Recovery

Methods |

211 |

| 25.7 |

Infrastructure |

212 |

| 25.8 |

Tailings

Storage Facility |

212 |

| 25.9 |

Environmental

Studies |

213 |

| 25.10 |

Market

Studies and Contracts |

213 |

| 25.11 |

Capital

Costs |

213 |

| 25.12 |

Operating

Costs |

213 |

| 25.13 |

Indicative

Economic Results |

213 |

| 25.14 |

Project

Risks and Opportunities |

214 |

| |

|

|

| 26 |

RECOMMENDATIONS |

217 |

| |

|

|

| 26.1 |

Geology |

217 |

| 26.2 |

Mining |

217 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page iv of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

| 26.3 |

Mineral

and Metallurgical Testing |

218 |

| 26.4 |

Infrastructure |

219 |

| 26.5 |

Environment

and Social |

219 |

| 26.6 |

Estimated

Budget for Recommendations |

219 |

| |

|

|

| 27 |

REFERENCES |

221 |

| |

|

|

| 28 |

DATE

AND SIGNATURE PAGE |

224 |

| |

|

|

| 29 |

CERTIFICATE

OF QUALIFIED PERSON |

226 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page v of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

| LIST

OF TABLES |

|

| |

|

|

| Table

1-1 |

Economic

Analysis Results |

5 |

| Table

1-2 |

NPV

and IRR Sensitivity Analysis by Input Cost |

6 |

| Table

1-3 |

Sensitivity

analysis of silver prices |

6 |

| Table

1-4 |

Sensitivity

to Discount Rate |

6 |

| Table

1-5 |

Carangas

Deposit - Conceptual Pit* Constrained Mineral Resource as of 25 August 2023 |

10 |

| Table

1-6 |

PEA

Mine Plan Production Summary |

11 |

| Table

1-7 |

Assigned

Commodity Pricing |

14 |

| Table

1-8 |

Concentrate

Payables, Refining and Transportation Assumptions |

15 |

| Table

1-9 |

Capital

Cost Breakdown |

16 |

| Table

1-10 |

Operating

Cost Breakdown |

16 |

| Table

2-1 |

Qualified

Persons |

20 |

| Table

4-1 |

Mining

Rights of Carangas Property |

27 |

| Table

5-1 |

Weather

of Carangas Region |

30 |

| Table

7-1 |

Summary

of Carangas Mineralized Zones |

42 |

| Table

9-1 |

Summary

of Exploration Programs at Carangas |

45 |

| Table

10-1 |

Carangas

Drilling History |

48 |

| Table

11-1 |

QA/QC

Sample Status |

54 |

| Table

11-2 |

CRMs

of Carangas Project |

55 |

| Table

11-3 |

Statistical

Summary for Duplicate Samples July 2021 – April 2023 |

58 |

| Table

11-4 |

Statistical

Summary for Umpire Duplicates Samples |

61 |

| Table

12-1 |

Drill

Core Intervals Viewed |

64 |

| Table

13-1 |

Drill

Holes and Core Intervals Selected for the Comminution Testing |

67 |

| Table

13-2 |

Specific

Gravity, Rod Mill Work Index, Ball Mill Work and Abrasion Index |

67 |

| Table

13-3 |

Samples

Selected from the Upper Silver Zone and Lower Gold Zone |

69 |

| Table

13-4 |

Head

Assays of the Five Composite Samples |

71 |

| Table

13-5 |

Mineral

Compositions of the USZ Oxidized and USZ Transitional Composite Samples |

71 |

| Table

13-6 |

Conditions

of Rougher Tests for the USZ Oxidized Sample |

73 |

| Table

13-7 |

Results

of Rougher Flotation Tests for the USZ Oxidized Sample |

73 |

| Table

13-8 |

Conditions

of Rougher Flotation Tests for the USZ Transitional Sample |

74 |

| Table

13-9 |

Results

of Rougher Flotation Tests for the USZ Transitional Sample |

74 |

| Table

13-10 |

Conditions

of Rougher Flotation Tests for the USZ Sulfide Sample |

76 |

| Table

13-11 |

Results

of Rougher Flotation Tests for the USZ Sulfide Sample |

76 |

| Table

13-12 |

Ag/Pb

Rougher Flotation Tests for the USZ LOM Composite Sample |

79 |

| Table

13-13 |

Results

of Rougher Flotation Tests for the USZ LOM Composite Sample |

80 |

| Table

13-14 |

Conditions

of Cleaner Flotation Tests for the USZ LOM Composite Sample |

86 |

| Table

13-15 |

Results

of Cleaner Flotation Tests for the USZ LOM Composite Sample |

87 |

| Table

13-16 |

Conditions

of the Locked Cycle Test for the USZ LOM Composite Sample |

91 |

| Table

13-17 |

Results

of the Locked Cycle Tests 55 and 57 for the USZ LOM Composite Sample |

92 |

| Table

13-18 |

Results

of Gravity Concentration for the Sample from the Lower Gold Zone |

92 |

| Table

13-19 |

Expected

Gravity Recoverable Gold Recovery for a Commercial Operation |

93 |

| Table

13-20 |

Conditions

of Rougher Flotation Tests for the Gold Sample |

94 |

| Table

13-21 |

Results

of Rougher Flotation Tests for the Gold Sample |

94 |

| Table

13-22 |

Conditions

of Flotation Tests to Produce a Copper-Enriched Concentrate |

95 |

| Table

13-23 |

Results

of Selective Flotation Tests to Produce a Copper-Enriched Concentrate |

95 |

| Table

13-24 |

Conditions

and Results of Cyanide Leaching for the Sample from the Lower Gold Zone |

96 |

| Table

13-25 |

Conditions

and Results for the Cyanide Leach of Flotation Concentrate |

96 |

| Table

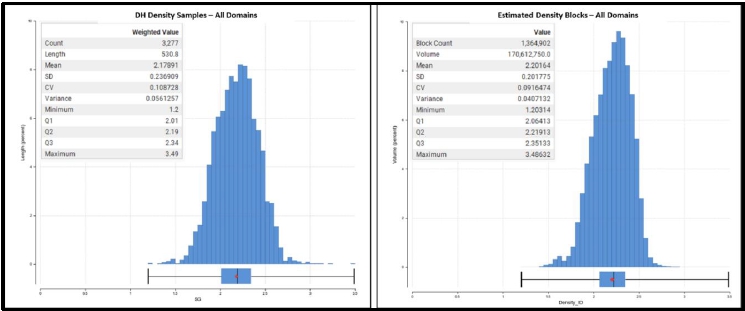

14-1 |

Density

Statistics Table |

98 |

| Table

14-2 |

Univariate

Statistics of Grade Composites, by Domain |

102 |

| Table

14-3 |

Top

Cut Values into all Domains |

102 |

| Table

14-4 |

Carangas

Grade Estimation Search Parameters |

105 |

| Table

14-5 |

Density

Estimation Parameters |

106 |

| Table

14-6 |

Carangas

Block Model Definition Parameters |

107 |

| Table

14-7 |

Commodity

Prices Used in the Resource Calculation |

108 |

| Table

14-8 |

Composite

vs. Block Model Grade Statistical Validation |

112 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page vi of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

| Table

14-9 |

3D

Volumetric Model comparison |

112 |

| Table

14-10 |

Statement

of Mineral Resources* at the Carangas Project as of 25th August 2023 |

117 |

| Table

16-1 |

PEA

Mine Plan Production Summary |

119 |

| Table

16-2 |

Net

Smelter Price and Recoveries for Mine Planning |

122 |

| Table

16-3 |

Cutoff

Grade |

123 |

| Table

16-4 |

Operating

Cost Inputs for Pseudoflow Pit Shells |

125 |

| Table

16-5 |

Designed

Open Pit Contents |

127 |

| Table

16-6 |

Mine

Production Schedule |

137 |

| Table

17-1 |

Project

Design Criteria |

149 |

| Table

17-2 |

Major

Equipment List |

158 |

| Table

17-3 |

Reagents

Consumption |

159 |

| Table

17-4 |

Grinding

Consumables |

159 |

| Table

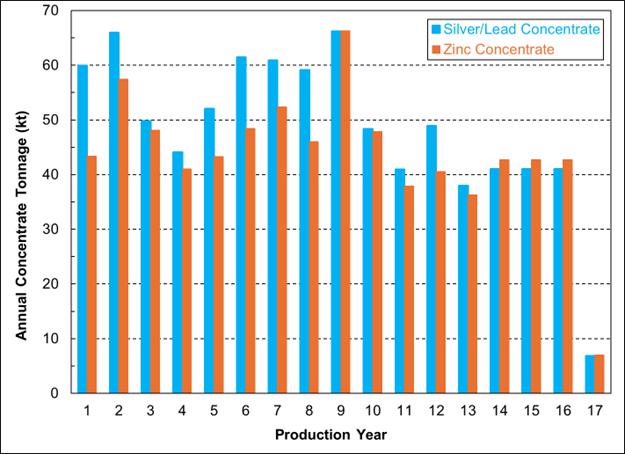

17-5 |

Annual

concentrate production |

161 |

| Table

18-1 |

Geographical

Location of Substations |

163 |

| Table

18-2 |

Pagador

– Carangas Line Summary Table |

165 |

| Table

18-3 |

Conventional

TSF Option 1 – Staging Plan |

171 |

| Table

18-4 |

Conventional

TSF Option 1 Staging Estimated Capital Cost |

173 |

| Table

18-5` |

Conventional

TSF Option 1 Staging Estimated Operating Cost |

173 |

| Table

18-6 |

Dry

Stack Option Estimated Capital Cost |

175 |

| Table

18-7 |

Dry

Stack Option Estimated Operating Cost |

175 |

| Table

18-8 |

Tailings

Options Cost Summary |

175 |

| Table

19-1 |

Assigned

Commodity Pricing |

177 |

| Table

19-2 |

Concentrate

Payables, Treatment, Refining and Transportation Assumptions |

178 |

| Table

20-1 |

Physico-chemical

parameters |

184 |

| Table

20-2 |

Particulate

Matter Results |

185 |

| Table

20-3 |

Gases

Results |

185 |

| Table

21-1 |

Capital

Cost Breakdown |

188 |

| Table

21-2 |

Mine

Area Capital Cost Summary |

190 |

| Table

21-3 |

Initial

Capital Cost - Processing Plant |

190 |

| Table

21-4 |

Infrastructure

Initial Capital Cost |

191 |

| Table

21-5 |

Tailings

Management Capital Cost Breakdown |

191 |

| Table

21-6 |

Operating

Cost Breakdown |

192 |

| Table

21-7 |

Processing

Operating Cost Breakdown |

193 |

| Table

21-8 |

Key

Reagents and Consumables Price |

193 |

| Table

21-9 |

Tailings

Management Operating Cost |

194 |

| Table

21-10 |

G&A

Operating Cost Estimate |

194 |

| Table

22-1 |

LOM

Average Metallurgical Assumptions |

197 |

| Table

22-2 |

Concentrate

Pricing Terms |

198 |

| Table

22-3 |

Metal

Prices |

198 |

| Table

22-4 |

Financial

Model Economic Analysis Summary |

199 |

| Table

22-5 |

Economic

Analysis Results |

201 |

| Table

22-6 |

NPV

and IRR Sensitivity Analysis by Input Cost |

201 |

| Table

22-7 |

Sensitivity

analysis of silver prices |

201 |

| Table

22-8 |

Sensitivity

to Discount Rate |

201 |

| Table

24-1 |

Alternate

Pit Design Contents |

204 |

| Table

26-1 |

Estimated

Budget for Recommendations |

220 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page vii of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

| LIST

OF FIGURES |

|

| |

|

|

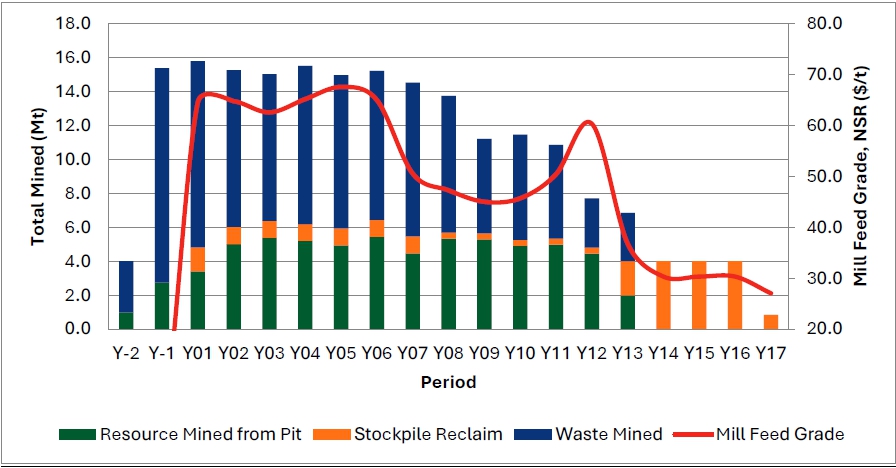

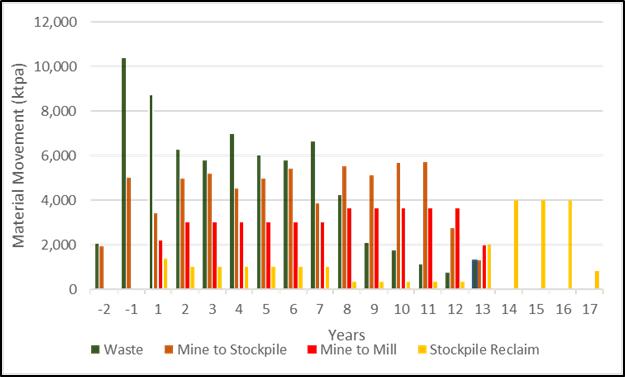

| Figure

1-1 |

Mine

Production Schedule Summary |

12 |

| Figure

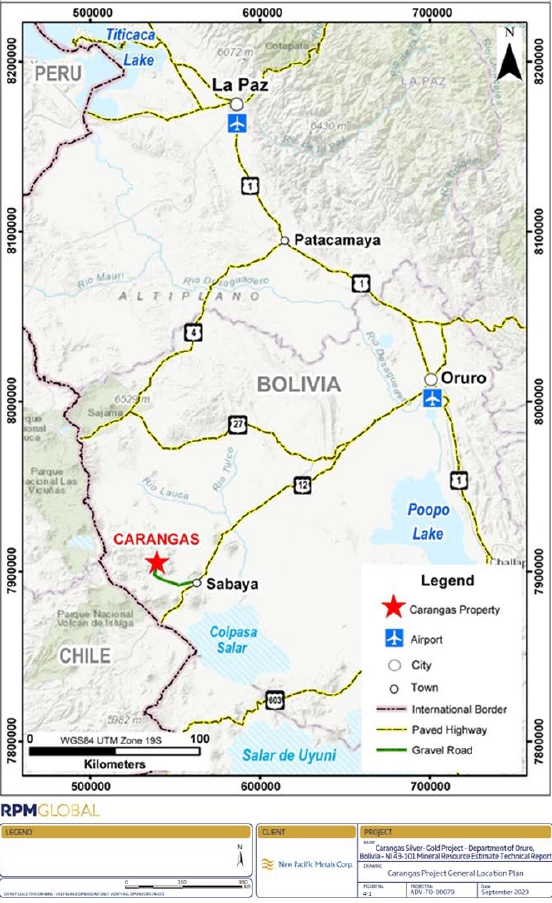

4-1 |

Carangas

Project General Location Plan |

26 |

| Figure

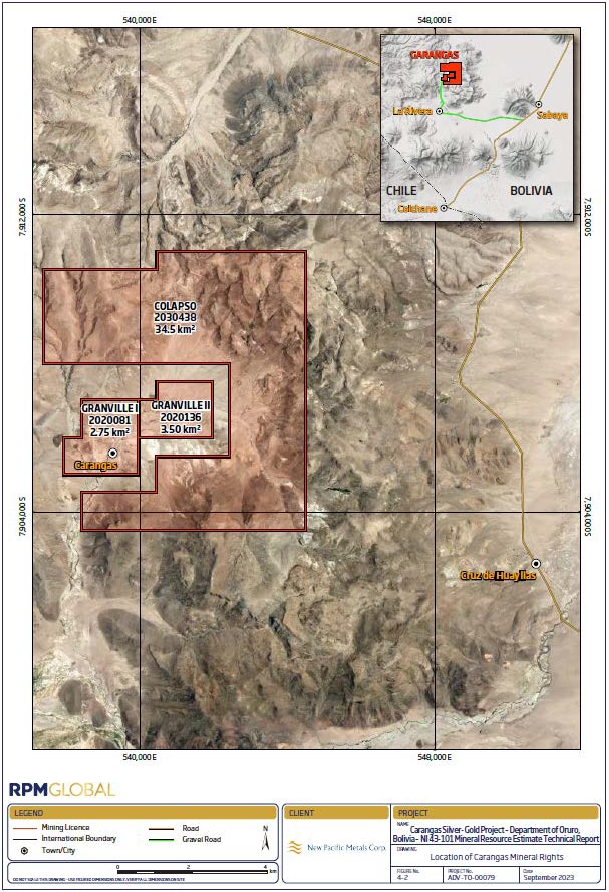

4-2 |

Location

of Carangas Mineral Rights |

28 |

| Figure

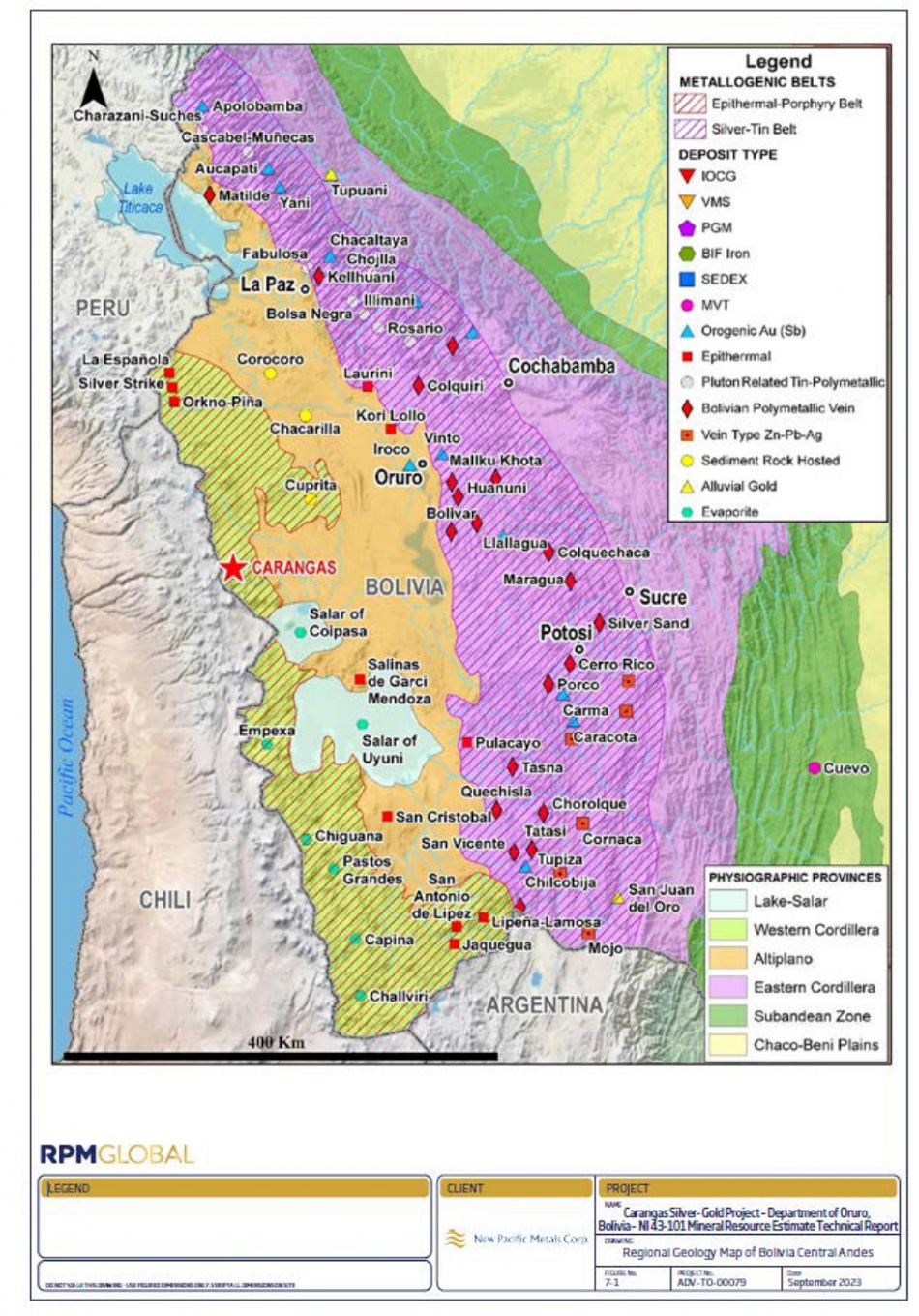

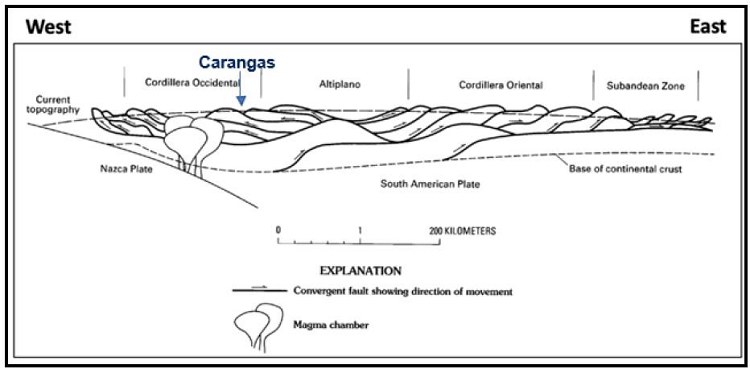

7-1 |

Regional

Geology Map of Bolivia's Central Andes |

34 |

| Figure

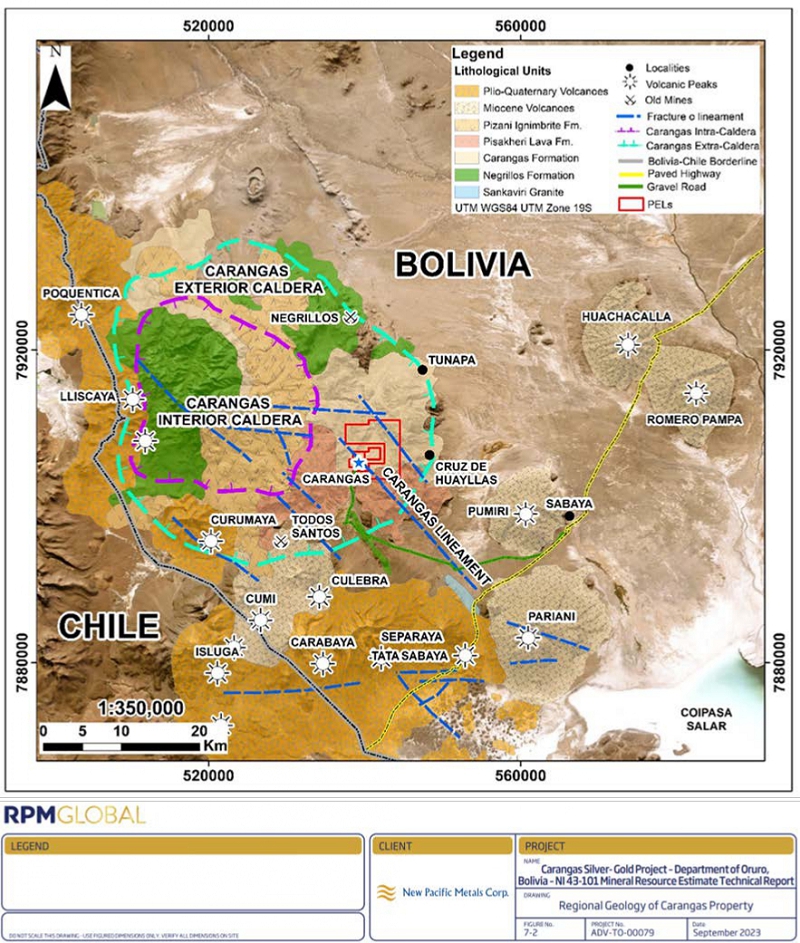

7-2 |

Regional

Geology of Carangas Property |

36 |

| Figure

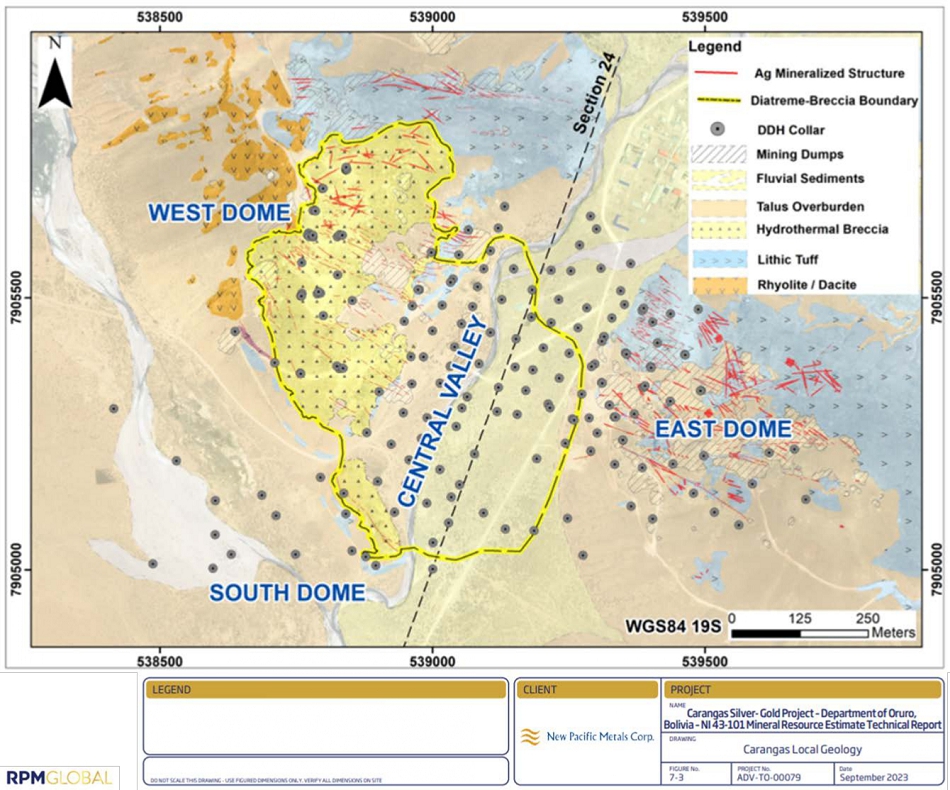

7-3 |

Carangas

Local Geology |

38 |

| Figure

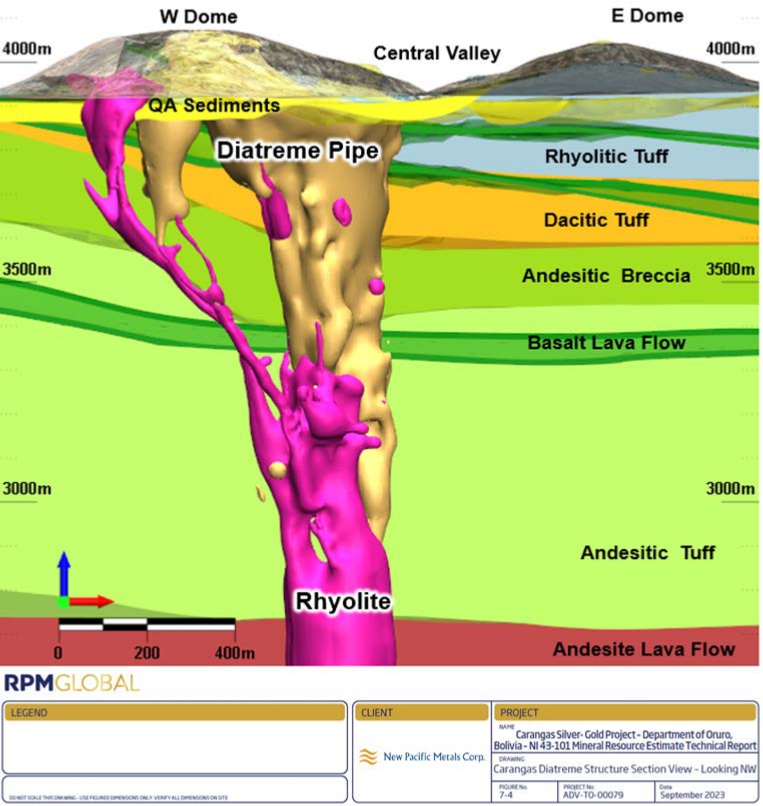

7-4 |

Carangas

Diatreme Structure Section View – Looking NW |

39 |

| Figure

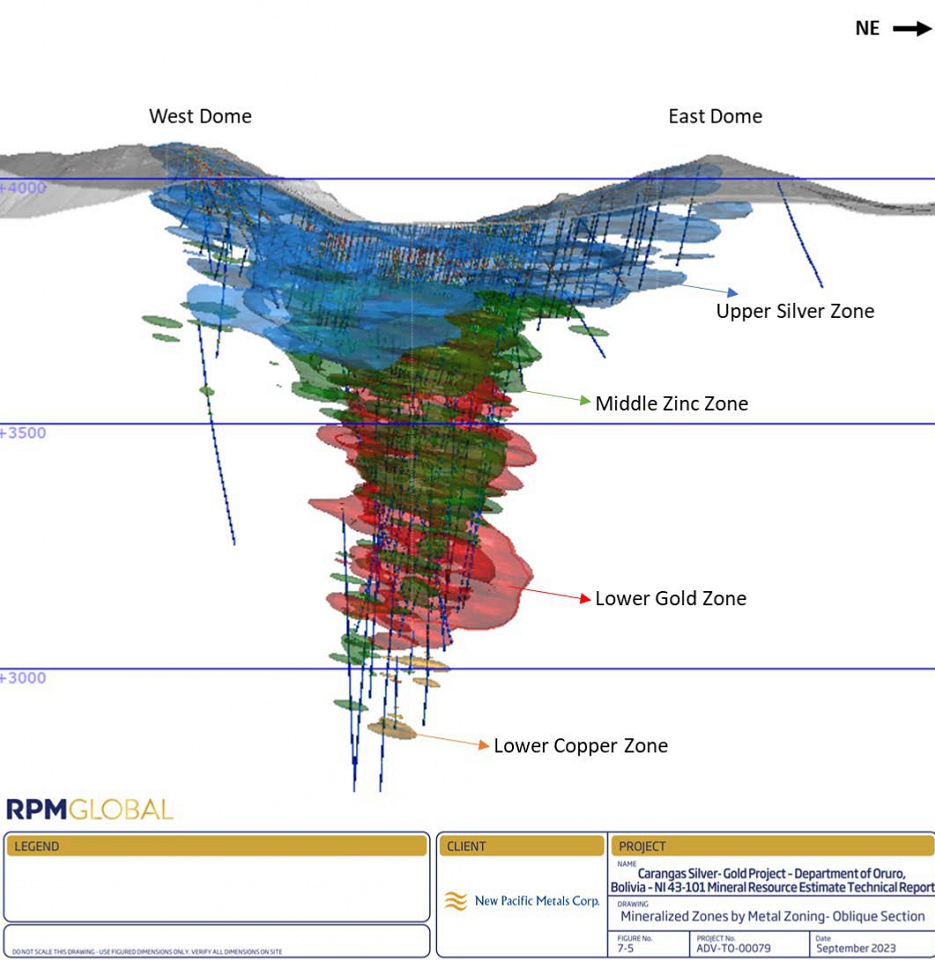

7-5 |

Mineralized

Zones by Metal Zoning- Oblique Section |

41 |

| Figure

8-1 |

Schematic

Cross-Section of Bolivia Region |

44 |

| Figure

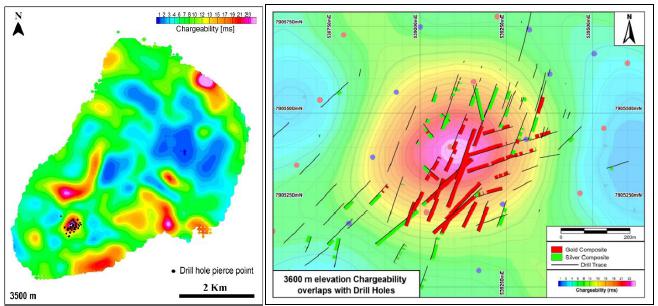

9-1 |

IP

Chargeability Anomalies of Carangas Area |

47 |

| Figure

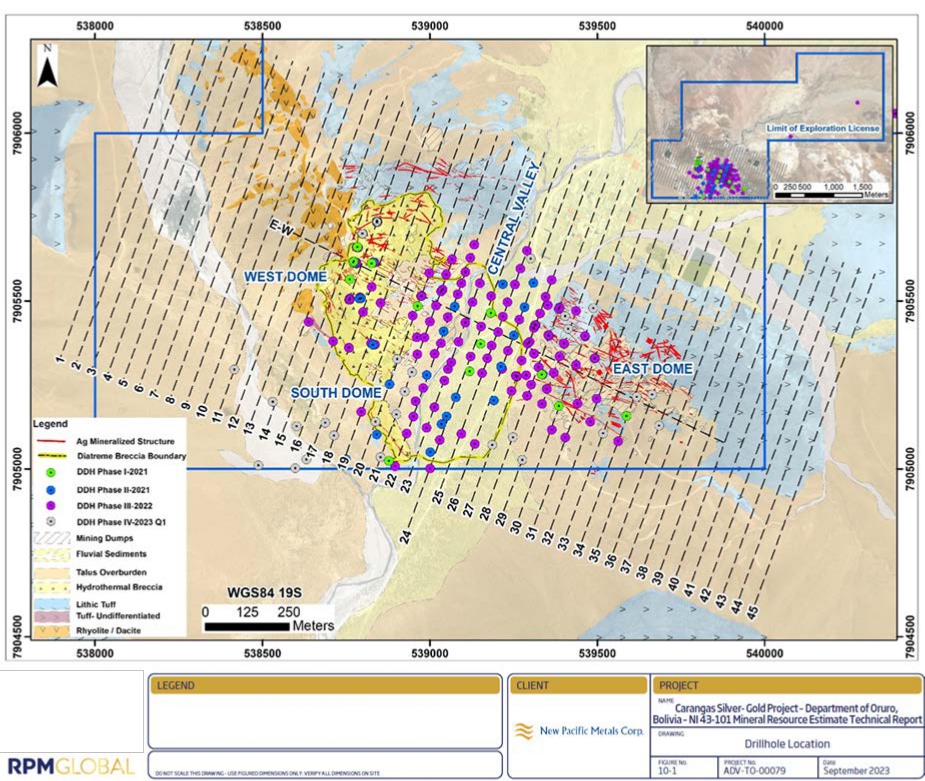

10-1 |

Drillhole

Location |

49 |

| Figure

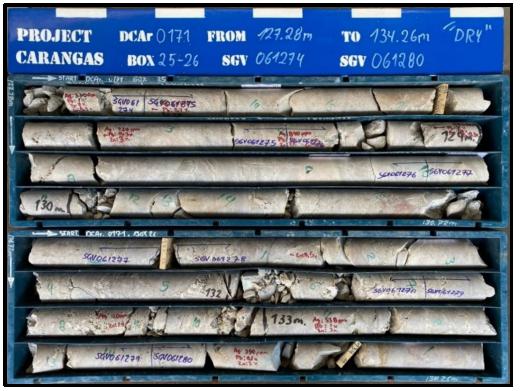

11-1 |

Drill

Core Box Example – Drill Hole DCAr0171 |

52 |

| Figure

11-2 |

Core

Cutting and Sample Bag |

52 |

| Figure

11-3 |

Specific

Gravity Measurement |

54 |

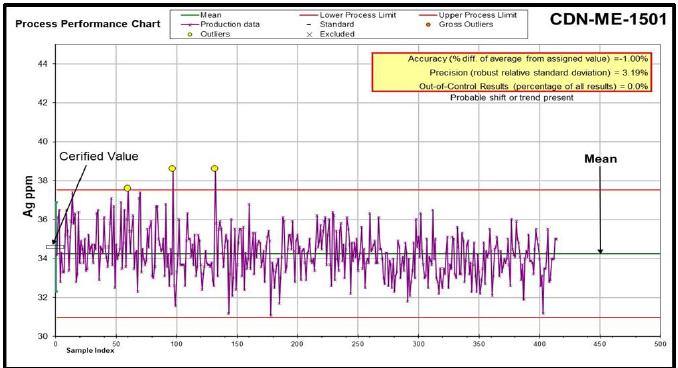

| Figure

11-4 |

Control

Chart for CDN-ME-1501 (Ag) (July 2021 – November 2022) |

56 |

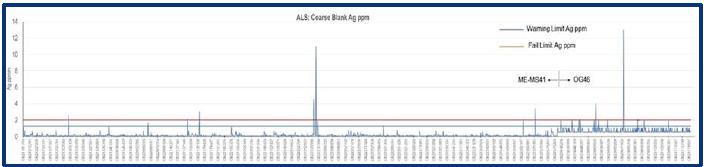

| Figure

11-5 |

Control

Chart for Coarse Blank Samples |

57 |

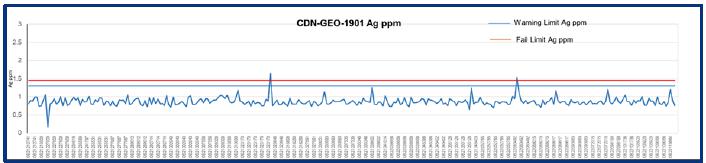

| Figure

11-6 |

Control

Chart for Pulp Blank CDN-GEO-1901 |

57 |

| Figure

11-7 |

Precision

Plot of Field (1/4 core) Duplicates for Silver Assays |

58 |

| Figure

11-8 |

Quantile-Quantile

Plot of Field (1/4 core) Duplicates for Silver Assays |

59 |

| Figure

11-9 |

Coarse

Duplicate Precision Scatterplot – Silver Assays |

59 |

| Figure

11-10 |

Precision

Plot of Pulp Duplicates for Silver Assays |

60 |

| Figure

11-11 |

Umpire

Pulp Duplicates Precision Scatterplot for Silver Assays |

61 |

| Figure

11-12 |

Secure

Core Yard Storage |

62 |

| Figure

12-1 |

Drill

Core Mineralization Intercept Examples |

64 |

| Figure

12-2 |

Drillholes

Collar Field Registration |

65 |

| Figure

13-1 |

Locations

of the Intervals Selected for the Metallurgical Samples |

70 |

| Figure

13-2 |

Deportment

of Lead for the USZ Oxidized and USZ Transitional Composite Samples |

72 |

| Figure

13-3 |

Deportment

of Zinc for the USZ Oxidized and USZ Transitional Composite Samples |

72 |

| Figure

13-4 |

Silver

and Lead Recoveries of Rougher Flotation for the USZ Transitional Sample |

75 |

| Figure

13-5 |

Silver

and Lead Recoveries of Rougher Flotation for the USZ Sulfide Sample |

77 |

| Figure

13-6 |

Enrichment

Ratios of Silver/Lead Rougher Flotation for the USZ Sulfide Sample |

78 |

| Figure

13-7 |

Silver

Recovery of Silver/Lead Rougher Flotation for the USZ LOM Composite Sample |

81 |

| Figure

13-8 |

Lead

Recovery of Silver/Lead Rougher Flotation for the USZ LOM Composite Sample |

82 |

| Figure

13-9 |

Silver/Zinc

Enrichment Ratio for the USZ LOM Composite Sample |

83 |

| Figure

13-10 |

Silver/Sulfur

Enrichment Ratio for the USZ LOM Composite Sample |

84 |

| Figure

13-11 |

Silver

Recovery of Silver/Lead Cleaner Tests for the USZ LOM Composite Sample |

88 |

| Figure

13-12 |

Lead

Recovery of Silver/Lead Cleaner Testsfor the USZ LOM Composite Sample |

89 |

| Figure

13-13 |

Silver

and Lead in the Concentrate for the USZ LOM Composite Sample |

89 |

| Figure

13-14 |

Zinc

Content in the Concentrate for the USZ LOM Composite Sample |

90 |

| Figure

13-15 |

Size-by-Size

Gravity Recoverable Gold for the Sample from the Lower Gold Zone |

93 |

| Figure

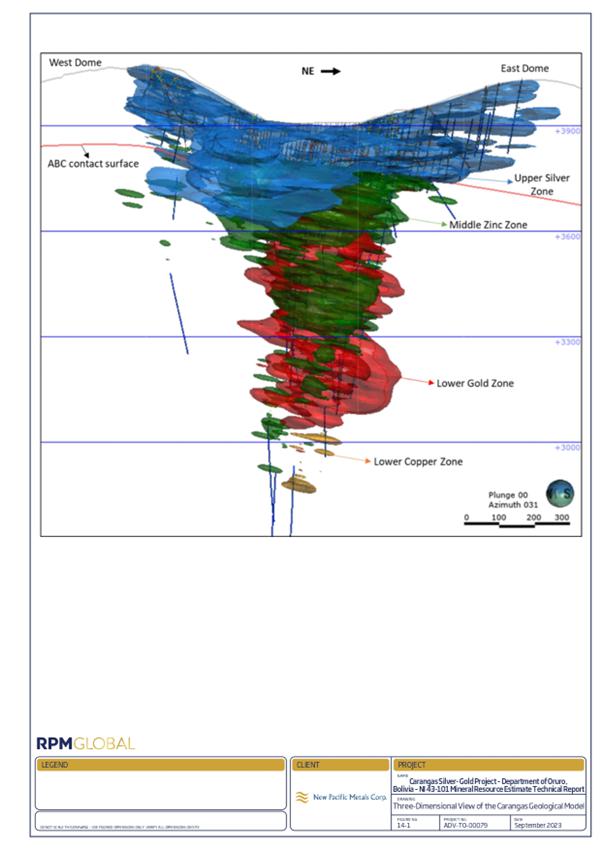

14-1 |

Three-Dimensional

View of the Carangas Geological Model |

100 |

| Figure

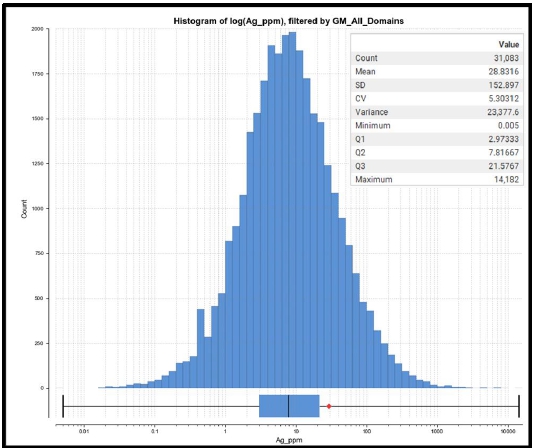

14-2 |

Ag

Log Histogram for 1.5 m Composites |

101 |

| Figure

14-3 |

Length

Histogram for Raw Assay Intervals |

103 |

| Figure

14-4 |

Estimation

Density Histogram Validation |

106 |

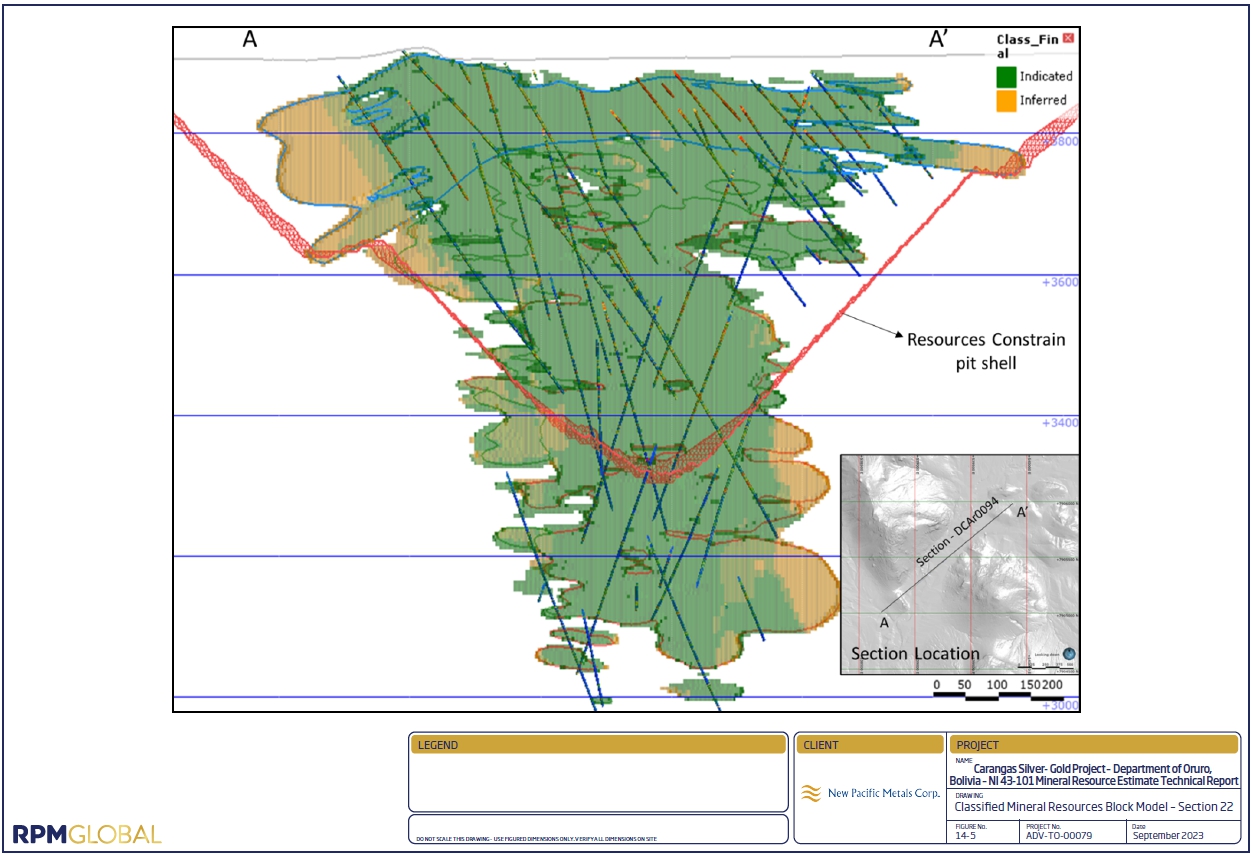

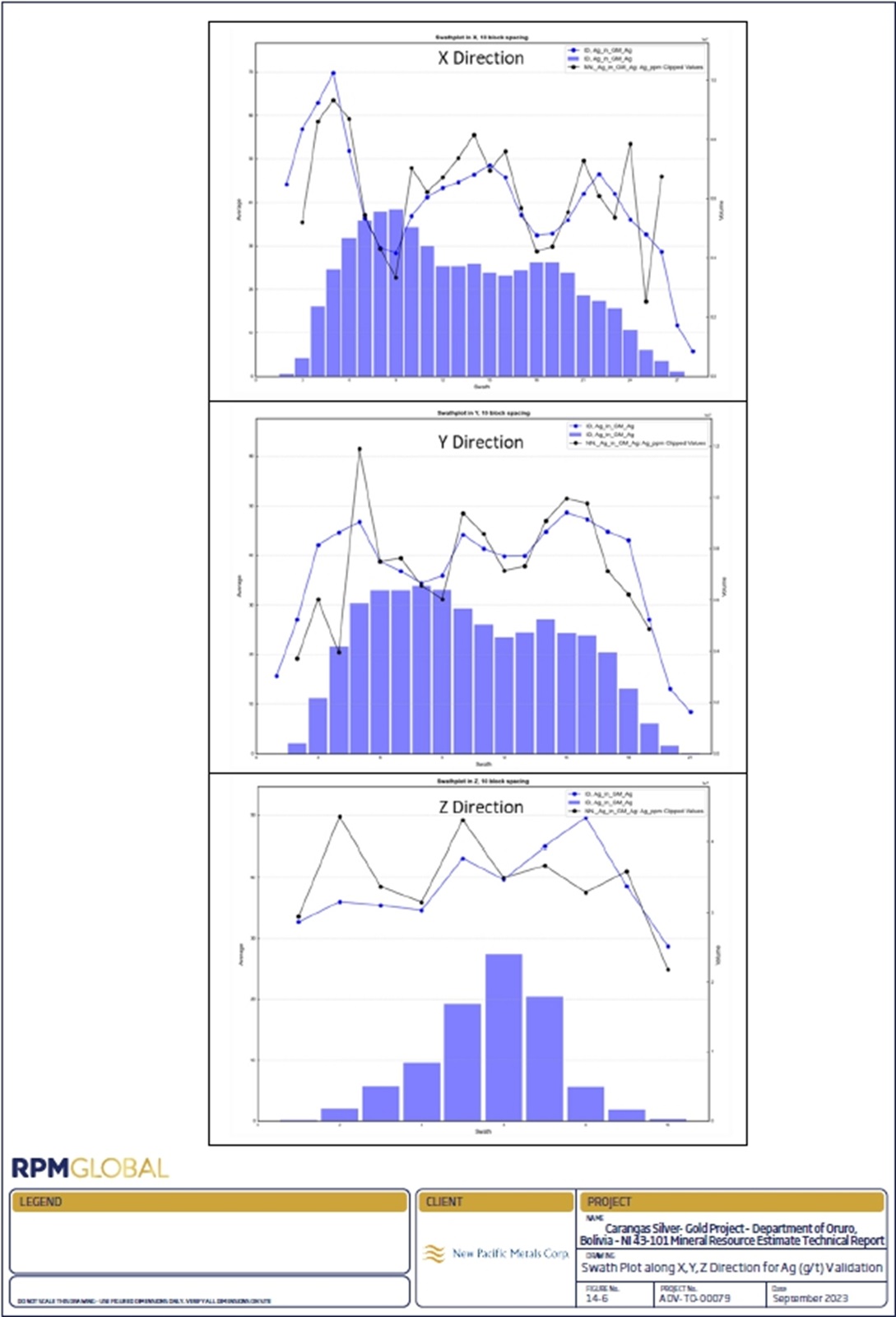

| Figure

14-5 |

Classified

Mineral Resources Block Model – Section 22 |

111 |

| Figure

14-6 |

Swath

Plot along X,Y,Z Direction for Ag (g/t) Validation |

114 |

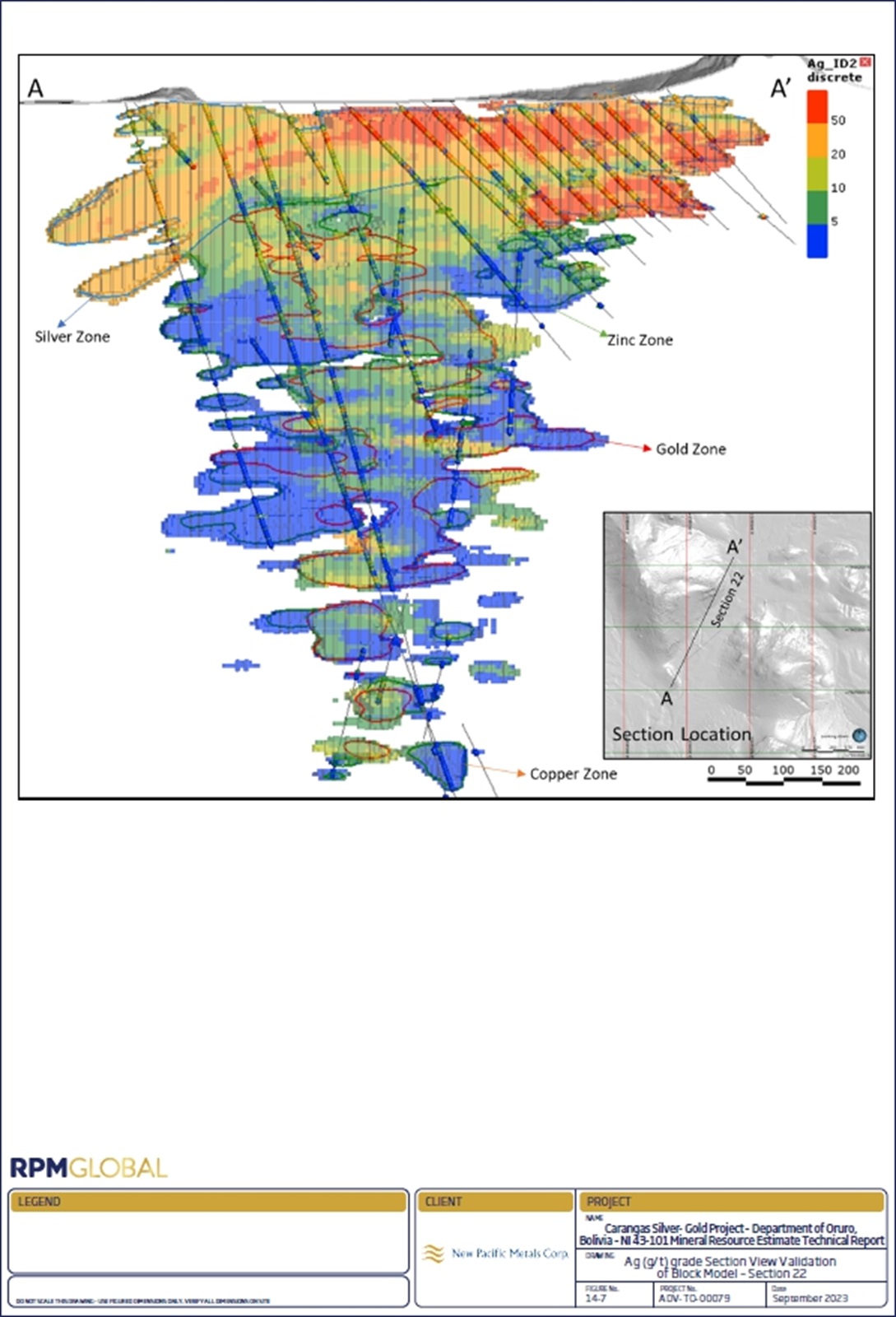

| Figure

14-7 |

Ag

(g/t) grade Section View Validation of Block Model – Section 22 |

115 |

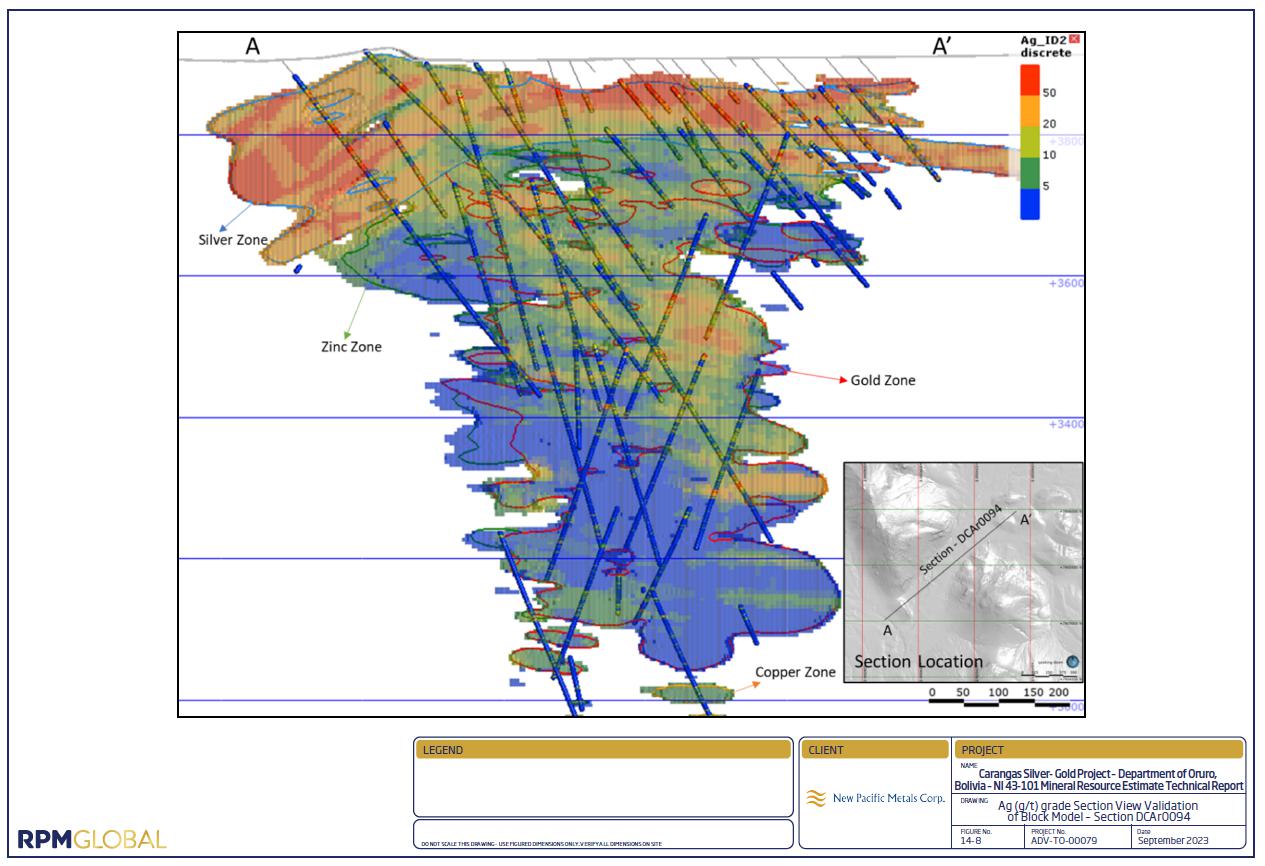

| Figure

14-8 |

Ag

(g/t) grade Section View Validation of Block Model – Section DCAr0094 |

116 |

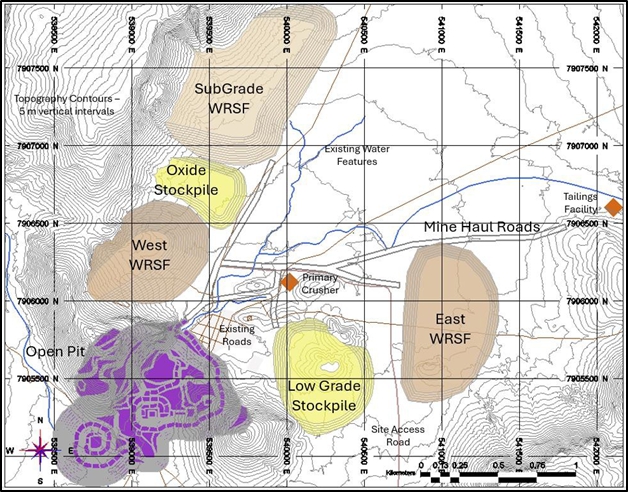

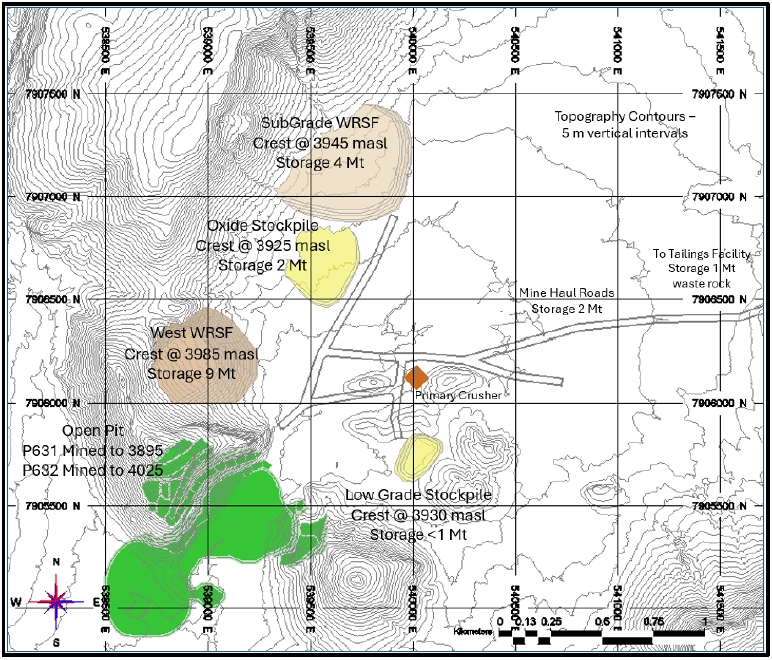

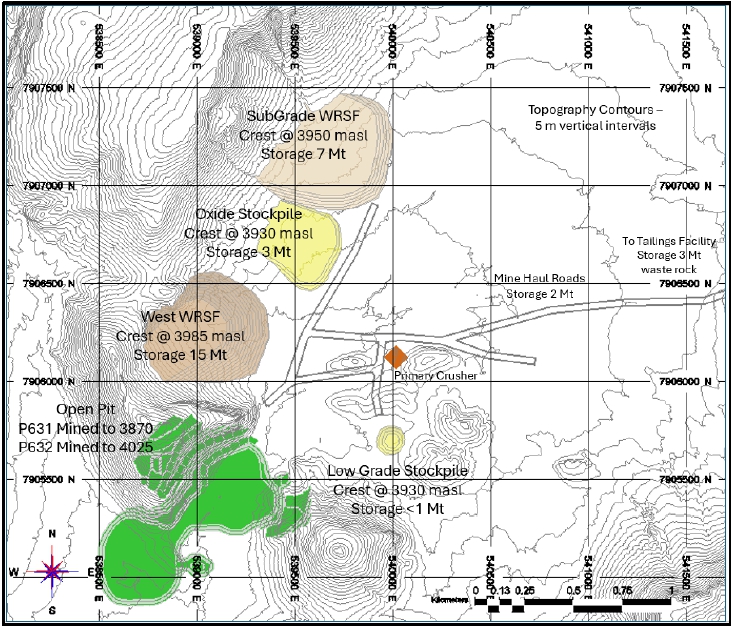

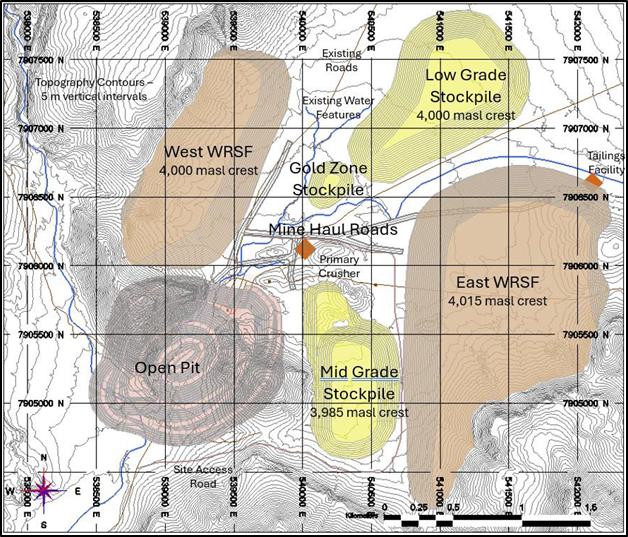

| Figure

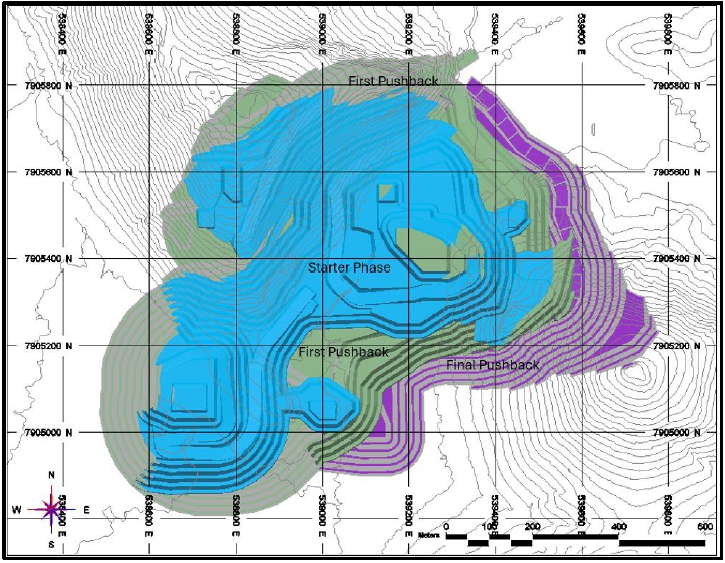

16-1 |

Mine

Operations General Arrangements |

120 |

| Figure

16-2 |

Mining

Loss and Dilution Application on 3800 masl bench |

124 |

| Figure

16-3 |

Pseudoflow

Pit Shell Resource Contents by Case |

126 |

| Figure

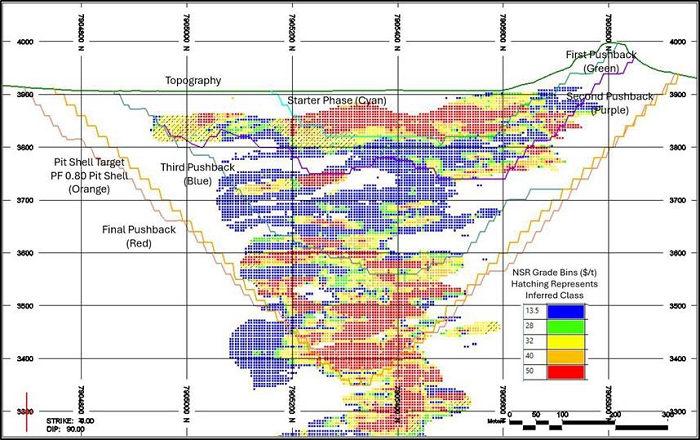

16-4 |

Designed

Open Pit Contents |

128 |

| Figure

16-5 |

Ultimate

Pit Design, P633 |

129 |

| Figure

16-6 |

Phased

Pit Designs |

130 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page viii of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

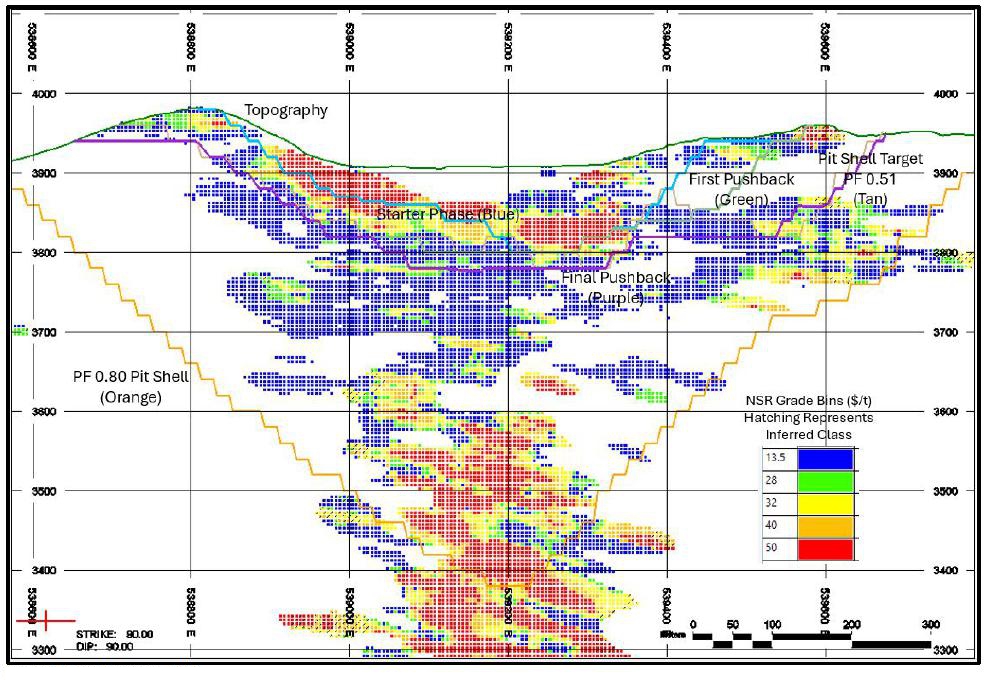

| Figure

16-7 |

Pit

Designs, EW Section View, 7905400N |

131 |

| Figure

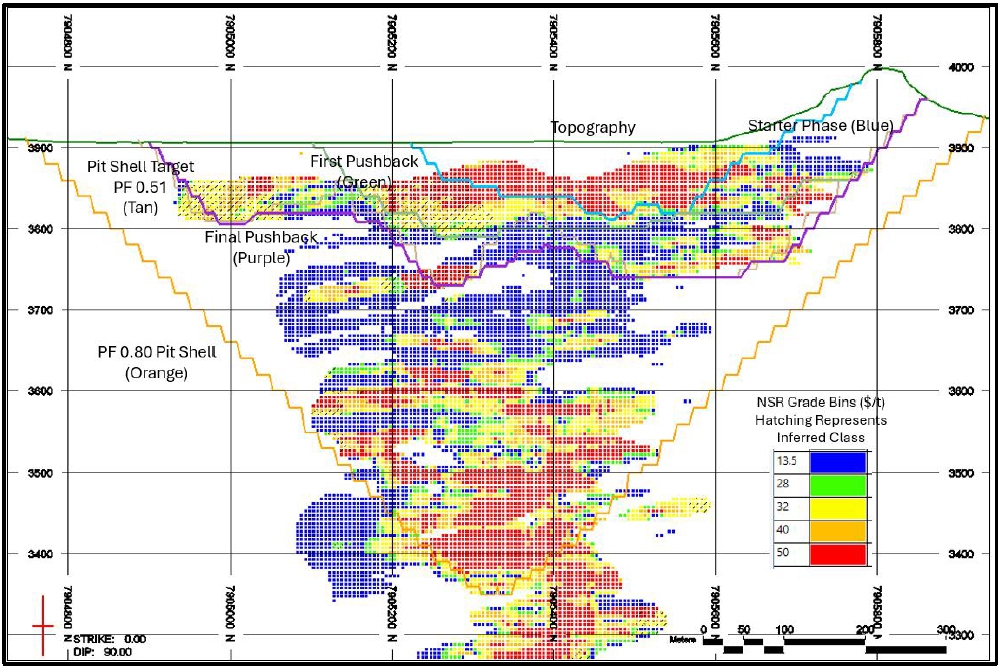

16-8 |

Pit

Designs, NS Section View, 593150E |

132 |

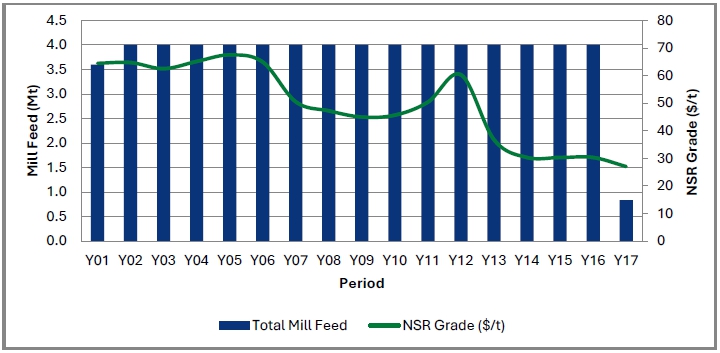

| Figure

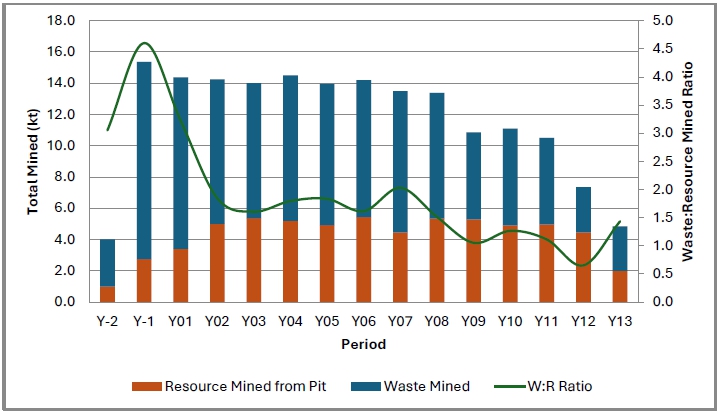

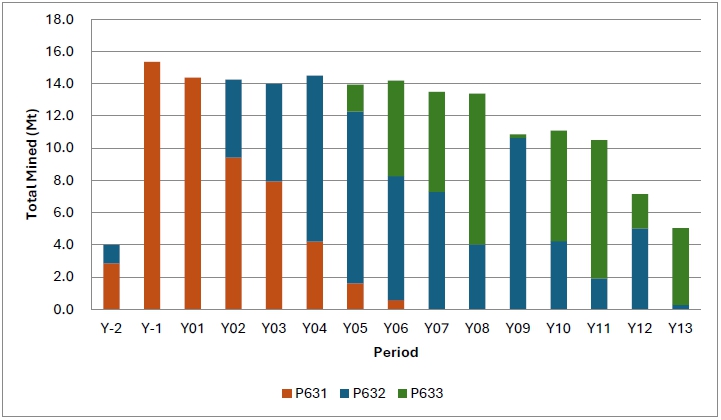

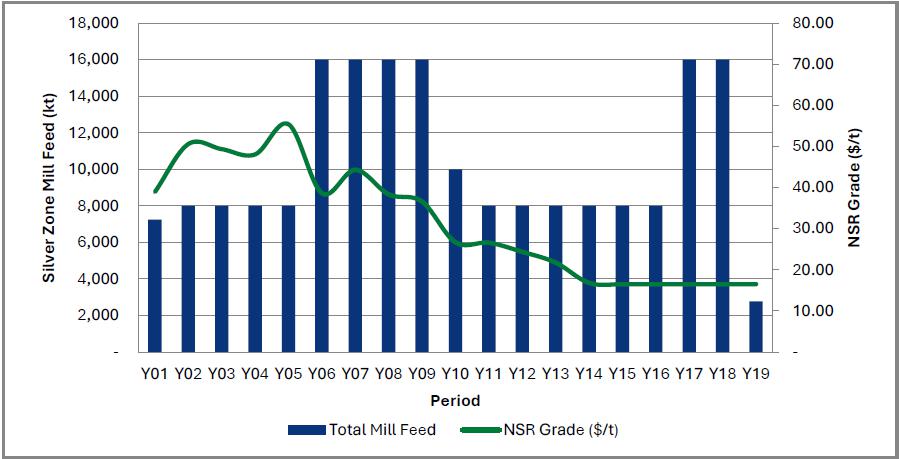

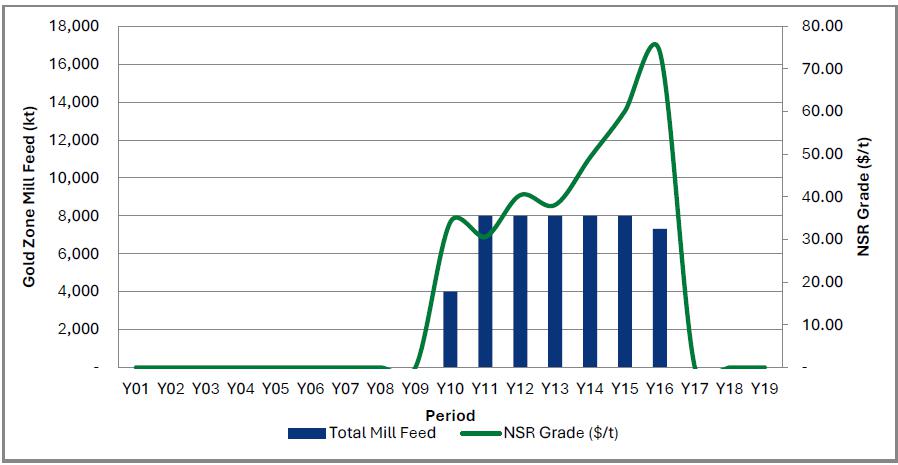

16-9 |

Annual

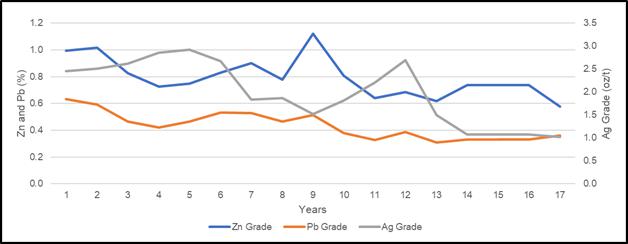

Mill Feed Tonnes and Grade |

135 |

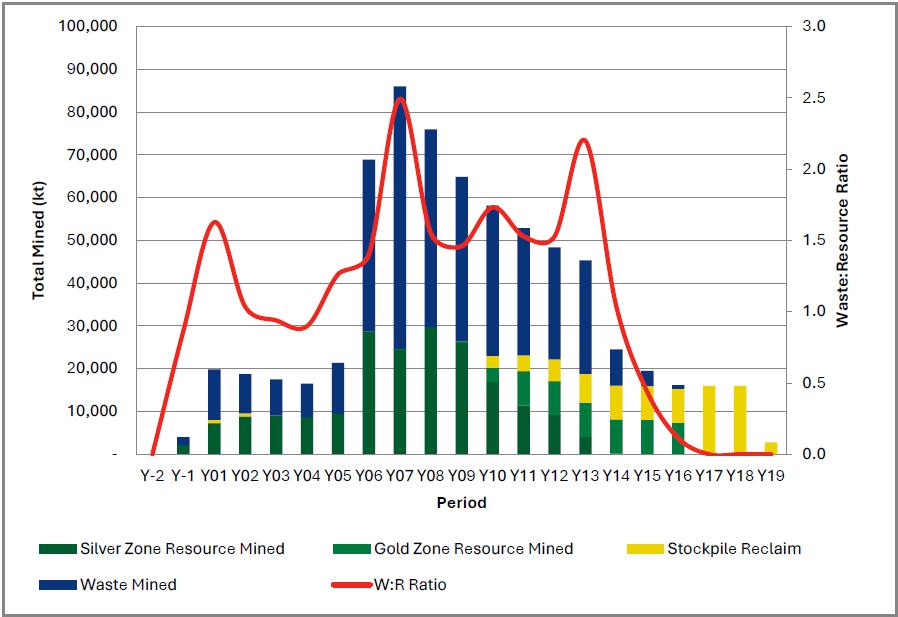

| Figure

16-10 |

Annual

Material Mined and Waste Mining Ratio |

136 |

| Figure

16-11 |

Pit

Phases Mined |

136 |

| Figure

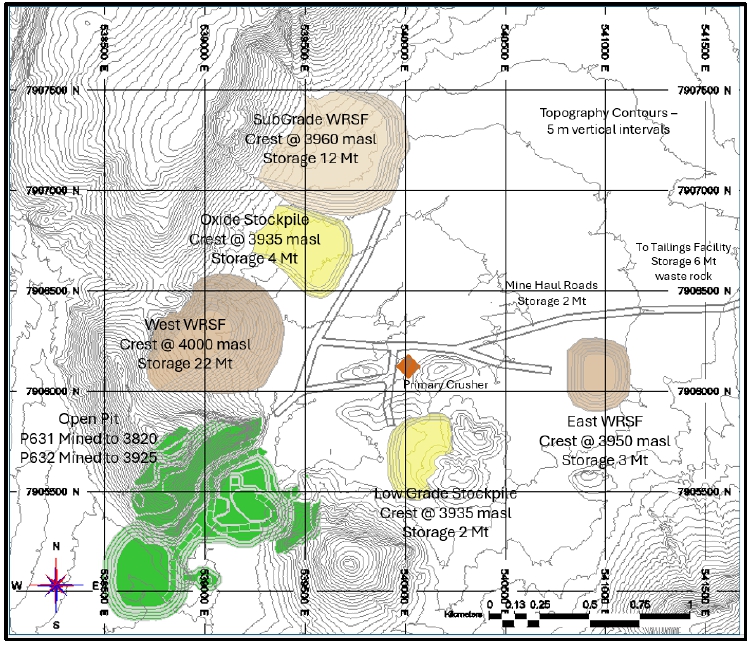

16-12 |

End

of Period Mine Production Schedule, Year -1 |

139 |

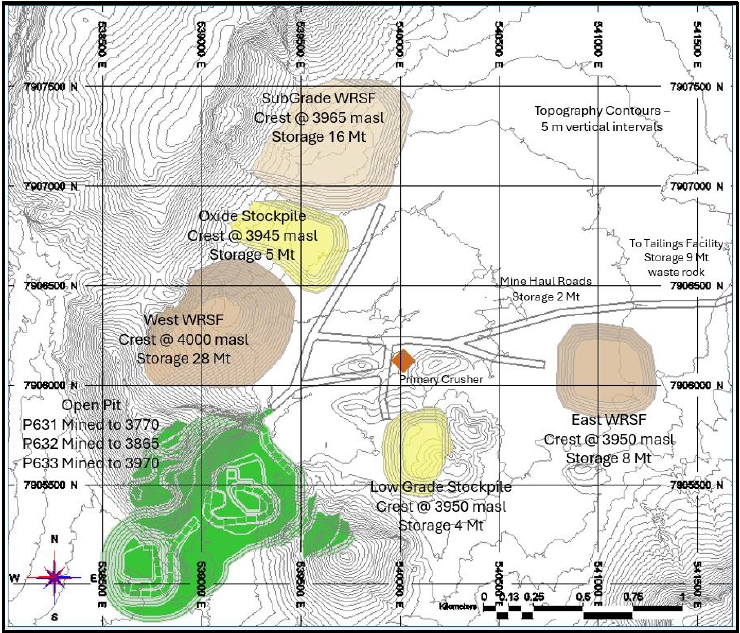

| Figure

16-13 |

End

of Period Mine Production Schedule, Year 1 |

140 |

| Figure

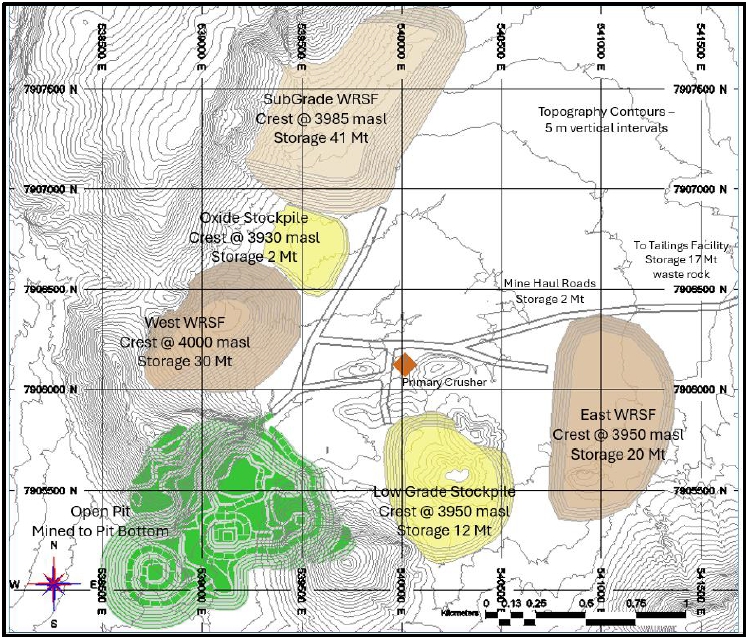

16-14 |

End of Period Production Schedule, Year 3 |

141 |

| Figure

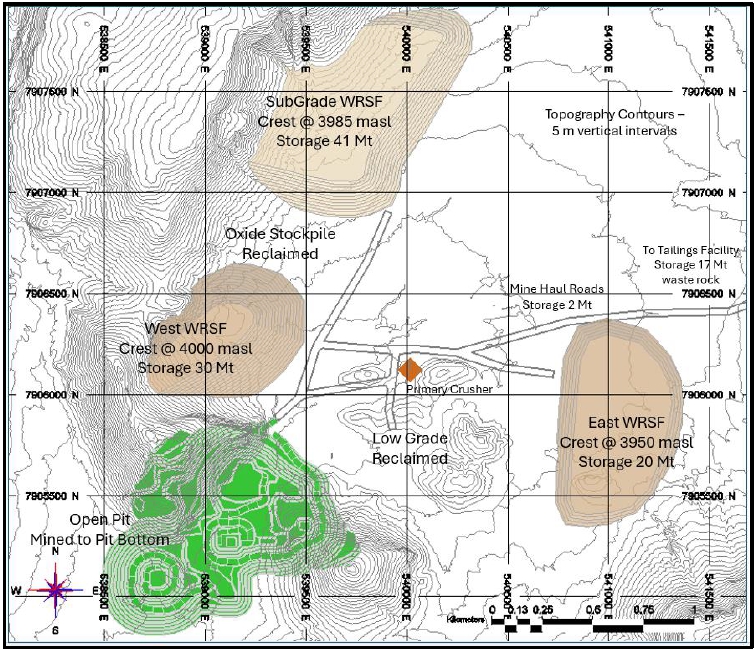

16-15 |

End

of Period Production Schedule, Year 5 |

142 |

| Figure

16-16 |

End

of Period Production Schedule, Year 13 |

143 |

| Figure

16-17 |

End

of Period Production Schedule, Year 17 |

144 |

| Figure

17-1 |

Silver/Lead

Flotation Flowsheet |

154 |

| Figure

17-2 |

Zinc

Flotation Flowsheet |

155 |

| Figure

18-1 |

Paved

Road and Secondary Road to Carangas Project |

163 |

| Figure

18-2 |

Site

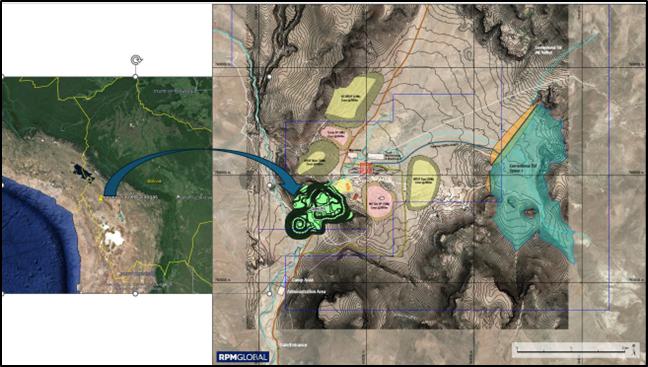

geographical location |

164 |

| Figure

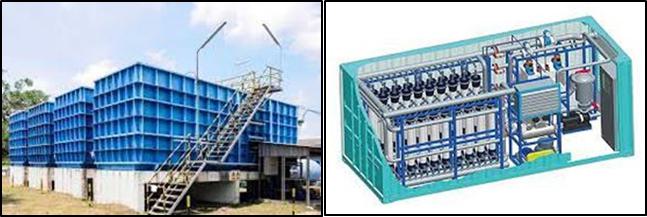

18-3 |

Containerized

wastewater treatment plant and containerized potable water treatment |

165 |

| Figure

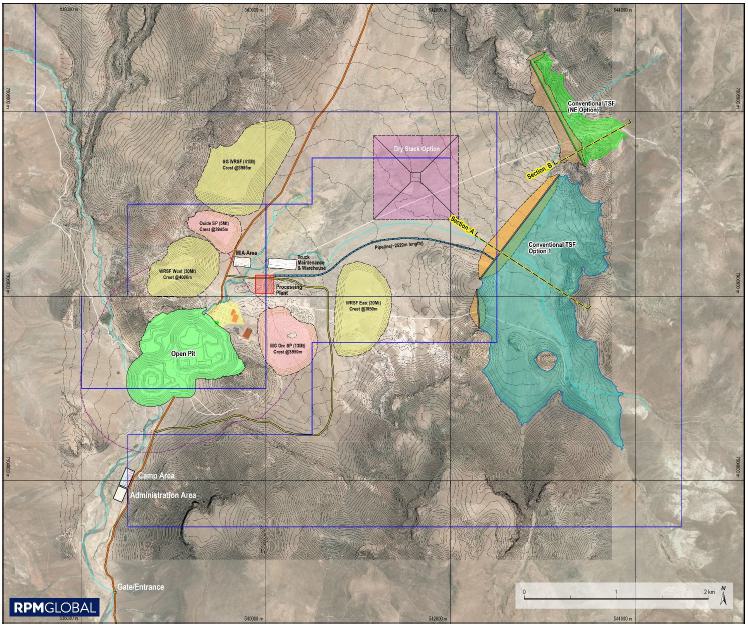

18-4 |

Proposed

Locations of Conventional TSFs and Dry Stack Options |

169 |

| Figure

18-5 |

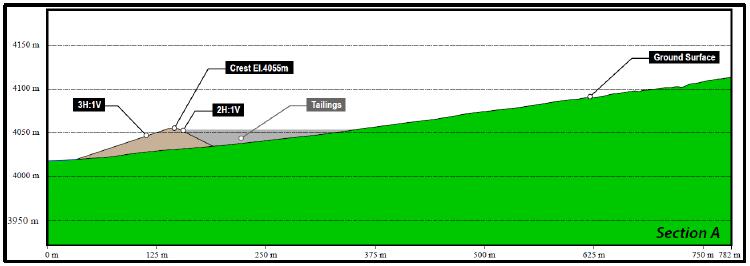

Conventional

TSF NE – Cross-Section |

170 |

| Figure

18-6 |

Conventional

TSF Option 1 – Maximum Cross-Section |

171 |

| Figure

18-7 |

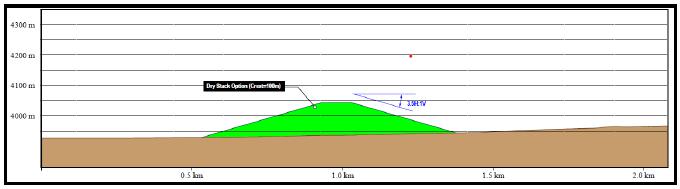

Dry

Stack - Typical Section |

174 |

| Figure

20-1 |

Environmental

Impact Evaluation Process |

180 |

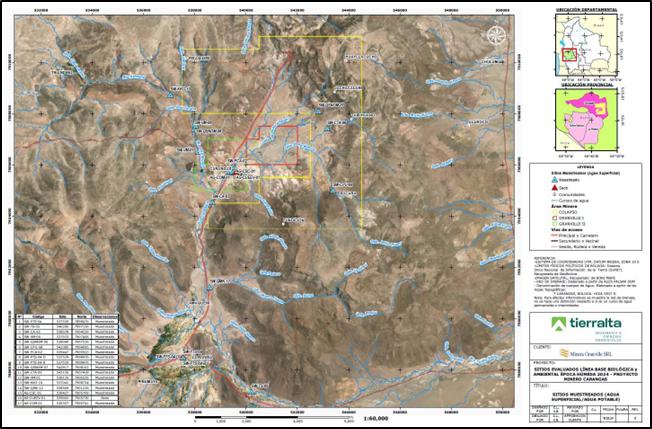

| Figure

20-2 |

Surface

Water Sampling Points |

182 |

| Figure

20-3 |

Photograph

of a sampling point Carangas micro basin |

183 |

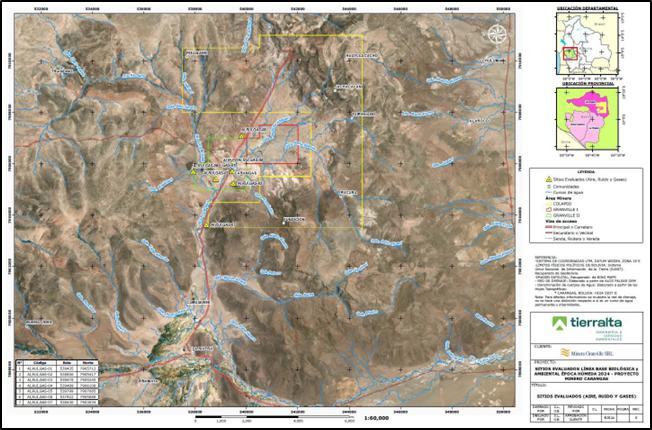

| Figure

20-4 |

Sampling

Points for Ambient Air, Gases and Noise |

186 |

| Figure

21-1 |

CAPEX

Distribution |

189 |

| Figure

22-1 |

Material

Movement |

196 |

| Figure

22-2 |

Head

Grades |

196 |

| Figure

22-3 |

Concentrate

Production |

197 |

| Figure

24-1 |

Alternate

Open Pit Design, P625 |

205 |

| Figure

24-2 |

Alternate

Pit Designs, NS Section View, 593150E |

206 |

| Figure

24-3 |

Mine

General Arrangement for Alternate Project Case |

207 |

| Figure

24-4 |

Alternate

Production Scenario: Silver Zone Mill Feed |

208 |

| Figure

24-5 |

Alternate

Production Scenario Gold Zone Mill Feed |

208 |

| Figure

24-6 |

Alternate

Production Scenario Mine Production Summary |

209 |

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page ix of ix | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

RPMGlobal Canada Limited (“RPM”)

was engaged by New Pacific Metals Corp. (“New Pacific”, “NPM”, the “Company” or the “Client”)

to complete an Independent Preliminary Economic Analysis (“PEA” or the “Report”) of the Carangas Silver-Gold-Lead-Zinc

Project (the “Project”, “Property” or “Relevant Asset”), located in Oruro Department, Bolivia. This

Technical Report conforms to National Instrument 43-101 “Standards of Disclosure for Mineral Projects” of the Canadian Securities

Administrators (“NI 43-101”).

In September 2023 New Pacific commissioned

RPM to complete a Preliminary Economic Assessment (“PEA”) based on a Mineral Resource Estimate (“2023 MRE”) for the

Carangas Silver-Gold-Lead-Zinc Project (the “Project” or the “Carangas”) in accordance with the guidelines of NI 43-101

and Form 43-101 F1.

The Project is located near the town

of Carangas in the Oruro Department, Bolivia. RPM visited the property twice:

| § | Anderson

Gonçalves, Principal Geologist FAusIMM, visited the project between March 27 and 30,

2023. |

| | |

| § | Marcelo

del Giudice, Principal Metallurgist FAusIMM, and Blaine Bovee, Principal Mining Engineer,

visited the project between October 31 and November 2, 2023. |

New Pacific Metals Corp is a Canadian

exploration and development company that has three precious metal projects in Bolivia.

New Pacific Metals Corp. trades on the

Toronto Stock Exchange (TSX) under the trading symbol NUAG and on the NYSE American under the symbol NEWP. The headquarters is in Vancouver,

British Columbia.

Exploration at Carangas commenced in

the late 1980s with mapping and channel chip sampling carried out in the old mining adits of San Jose and Orko Tonku at West Dome and

the adits at East Dome. More than 350 samples were collected with an average grade of 64 g/t silver. Since 2021, exploration activities

have focused on surface drilling. Drilling operations lasted until the end of April 2023.

The preliminary economic analysis

contained within this study is partly based on Inferred Mineral Resources that are considered too speculative geologically to have the

economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA

based on these Mineral Resources will be realized.

The PEA is based on Indicated and Inferred

Mineral Resources mined via a conventional open-pit mining approach. The assessment assumes a processing capacity of 4.0 million tonnes

per annum (Mtpa), utilizing a series of operations, including crushing, grinding, flotation, concentrate thickening, and filtration to

produce silver/lead and zinc/silver concentrates.

The Project’s life-of-mine

(LOM) plan includes a total of 64.4 million tonnes of mill feed at average grades of 0.80% zinc, 0.44% lead, and 63 g/t silver, mined

over a 16.2-year period through conventional open-pit mining. The cumulative production in concentrates is projected to yield 106.2 million

ounces of payable silver, 281.2 thousand tonnes of payable zinc, and 173.4 thousand tonnes of payable lead.

On a stand-alone basis, the Project generates

an undiscounted pre-tax cash flow totalling $1,447 million over the mine life, with a post-tax payback period of 3.2 years from the start

of production. The after-tax net present value (NPV) at a 5% discount rate is estimated at $501 million, and the after-tax internal rate

of return (IRR) is 26%.

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 1 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

The PEA demonstrates positive economic

potential for the Carangas Project, supporting further advancement and development of the Project.

Specific conclusions by area are as follows:

GEOLOGY AND MINERAL RESOURCES

Geology and Mineralization: The

Carangas deposit is a sizable polymetallic silver-gold-lead-zinc deposit situated in a Tertiary-age volcanic complex within the South

American Epithermal-Porphyry Belt. Mineralization is structured into distinct zones: an Upper Silver Zone (silver with lead and zinc),

a Middle Zinc Zone (zinc with minor silver and lead), and a Lower Gold Zone (gold with traces of silver, copper, and zinc). Gold mineralization

is open to north and northeast directions at depth. Beyond the drilled area, there are multiple IP chargeability anomalies with geophysical

signatures similar to those of the known mineralization. These anomalies constitute targets for future drilling to assess if additional

material is suitable for consideration in Mineral Resources.

Data Verification and Resource Confidence:

New Pacific's procedures in core logging, sampling, and data QAQC have met industry standards, with the QP affirming the data’s

reliability and its suitability for resource estimation. The resource estimate complies with NI 43-101 standards and shows preliminary

indicators for eventual economic extraction.

Exploration Potential: Previous

exploration indicates additional potential for resource expansion, particularly for gold at depth and in the areas (outside current Mineral

Resource pit shell) identified with IP chargeability anomalies. These anomalies have not yet been classified as Mineral Resources and

should be tested with additional exploration drilling program.

MINING

The Carangas Project PEA outlines a viable

open-pit mining plan that includes detailed production schedules, capital, and operating cost estimates. The project is designed to exploit

a 64.4 million tonne (Mt) resource with grades of 63 g/t silver, 0.44% lead, and 0.80% zinc at a waste-to-mill feed ratio of 1.7:1. The

pit and stockpile layouts, as well as operational plans, align with practices typical of other regional open-pit metal mines, with contractor

mining operations shown to be effective in similar settings.

The estimated capital and operating costs,

assessed at a scoping level of engineering, are deemed reasonable and support the financial projections and cash flow model developed

in the PEA. This analysis suggests that the project has the potential for positive economic outcomes under the proposed mine plan.

METALLURGICAL TESTWORK AND PROCESSING AND RECOVERY METHODS

Metallurgical Testing: The

Carangas Project’s metallurgical testwork program was conducted by ALS Metallurgy in Kamloops, British Columbia, Canada, under the

supervision of Dr. Jinxing Ji. This program builds upon earlier testing by Bureau Veritas Mineral/Metallurgy and ALS Metallurgy, focusing

on flotation to produce silver/lead and zinc/silver concentrates from the Upper Silver Zone (USZ)and cyanide leach for gold doré

production from the Lower Gold Zone (LGZ). The testwork included comminution testing, mineralogical analysis, gravity concentration, and

both bulk and selective flotation, covering composite samples from various zones within the deposit.

Composite samples for testing were prepared

using intervals from multiple drill holes across the deposit. In the Upper Silver Zone, the composite samples included the oxidized, transitional,

and sulfide samples, with an additional composite sample representing the life-of-mine averages. A separate composite sample was prepared

for testing from the Lower Gold Zone.

Sequential selective flotation successfully

produced marketable silver/lead and zinc/silver concentrates from the Upper Silver Zone, achieving a total silver recovery of 87.3% in

the two concentrates. Metallurgical testing

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 2 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

of the Lower Gold Zone indicated

effective gold recoveries with gravity concentration, cyanide leach, and flotation.

Proposed Process Flowsheet and Recovery

Methods: The proposed processing flowsheet for the Carangas Project involves sequential selective flotation to produce separate silver/lead

and zinc/silver concentrates. The plant design includes a single-stage crushing circuit, a SABC (Semi-Autogenous Mill, Ball Mill, Crusher)

grinding circuit, and dedicated silver/lead and zinc flotation circuits, each with rougher, regrinding, and three-stage cleaner circuits.

Concentrate thickening, filtering, intermediate and final tailing thickeners are also included, with the intermediate thickening to reduce

cross-contamination of process waters between two flotation circuits. The thickened final tailings are disposed of at the Tailings Storage

Facility (TSF), with decant water recycled to the process plant.

The processing plant is designed with

a nominal capacity of 4.0 Mtpa, achieving life-of-mine production of 826,000 tonnes of silver/lead concentrate and 744,000 tonnes of zinc/silver

concentrate. The average concentrate grades are 3,975 g/t silver and 24.0% lead for the silver/lead concentrate, 356 g/t silver and 45.8%

zinc for the zinc/silver concentrate.

INFRASTRUCTURE

Infrastructure and Support Systems:

The Carangas Project requires essential infrastructure development before operations commence, focusing on securing stable water and

power supplies. Power will be sourced through an agreement with a government-owned power supplier, with a dedicated transmission line

to the site. Securing a long-term power price agreement is critical to mitigate the risk of fluctuating electricity costs, and the line

can be upgraded if needed for future expansion.

Water for initial construction will be

drawn from an on-site stream. At the same time, operational needs will be met through a pipeline system, drawing from a combination of

groundwater via water wells and surface water from the nearby rivers. Site access improvements are required, notably upgrading the last

few kilometres of road, with annual maintenance planned. Fuel will be supplied by trucks, and contractual agreements are recommended to

ensure reliable delivery and mitigate risks from potential political or economic disruptions.

All necessary non-process infrastructure

buildings will be constructed to standard specifications, and the infrastructure design is expected to support the mine’s operations

over its life. The conventional slurry tailings storage facility (TSF) was chosen over dry-stacking due to lower operational costs and

its suitability for the project area.

Tailings Storage Facility: The

conventional slurry TSF design has been completed at a PEA level, based on general geological assumptions, without detailed meteorological

or hydrological studies. It also assumes that waste rock will meet geochemical standards for embankment construction. Further studies

are recommended to confirm these assumptions in the next project phase.

ENVIRONMENTAL STUDIES

The baseline studies that were initiated

are reasonable for what is expected to be able to produce the required Environmental Impact Assessment (EIA). These studies should continue

to have an in-depth understanding of the physical and biological aspects of the project's area of influence.

GEOLOGY AND DRILLING

Additional drilling is recommended to

improve confidence in the Carangas Project’s Mineral Resources. This includes:

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 3 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

| § | Infill

Drilling: Aimed at confirming mineral continuity within a 50 m by 50 m drilling grid in core

areas, supporting resource classification and future economic studies. |

| | |

| § | Step-out

Drilling: Targeting extensions of gold mineralization beyond the conceptual pit in the north

and northeast directions. |

| | |

| § | Exploration

Drilling: Focusing on IP chargeability anomalies beyond drilled areas may indicate similar

mineralization and potential resource expansion. |

MINING ENGINEERING

To advance to Pre-Feasibility, the following are recommended with

a $3 million budget:

| § | Geotechnical

Drilling: Focused on open-pit stability with rock strength testing and hydraulic characterization. |

| | |

| § | Hydrogeological

and Hydrological Studies: To refine pit water management strategies. |

| | |

| § | Geochemical

Waste Rock Characterization: Updating potentially acid-generating (PAG) models. |

| | |

| § | Condemnation

Drilling: Ensuring planned infrastructure locations are free of valuable mineralization. |

| | |

| § | Trade-Off

Studies: Evaluating contractor vs. owner-operated mining fleet options, cost-effectiveness

of equipment, and potential for electrified equipment. |

MINERAL PROCESSING AND METALLURGICAL TESTING

Additional metallurgical testing is recommended to enhance

flotation performance, minimize chemical reagent use, and finalize design parameters. Future testing should:

| § | Expand

Flotation Testing: Using non-oxidized core intervals to reduce issues with oxidized samples

and to improve selectivity. |

| | |

| § | Optimize

Zinc Flotation pH: Addressing high slurry viscosity in the zinc circuit by testing lower

pH levels and different reagents. |

| | |

| § | Conduct

Comminution Testing: Conduct comminution testing on various samples across the deposit to

refine mill design. |

| | |

| § | Examine

Process Water Impact: To optimize flotation efficiency by assessing cross-contamination effects

between circuits. |

| | |

| § | Thickening

and Filtration Studies: These are for flotation tailings and concentrates to enhance handling

and disposal. |

INFRASTRUCTURE

Infrastructure studies should prioritize:

| § | Water

Source Development: Drilling local wells to secure fresh water and conducting hydrology studies

for seasonal water availability from nearby rivers. |

| | |

| § | Geotechnical

and Hydrological Studies for TSF: To verify that the tailings storage facility (TSF) design

meets regulatory standards and ensure containment stability. |

| | |

| § | Environmental

and Geochemical Testing of Tailings: Including acid-base accounting (ABA) and net acid generation

(NAG) to assess potential acid drainage and metal leaching from waste rock. |

ENVIRONMENTAL AND SOCIAL BASELINE STUDIES

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 4 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

Baseline environmental studies are

necessary to complete an Environmental Impact Assessment that meets regulatory standards. A social baseline assessment should be initiated

to engage with nearby communities, with a focus on developing a community engagement and social investment plan.

A preliminary

economic analysis for the Carangas project was completed in connection with the PEA study. The economic analysis and its underlying assumptions

are preliminary in nature and include forward-looking statements. These statements involve a number of significant assumptions, including,

but not limited to, Mineral Resource estimates, the proposed mine plan, cost estimates, metallurgical recoveries, concentrate grades,

environmental and social considerations, infrastructure requirements, product marketing, and associated costs. There is no certainty

that the economic projections within this report will be realized.

The preliminary economics analysis includes

Inferred Mineral Resources that are considered too speculative geologically. There is no certainty that the 2024 PEA based on the Mineral

Resources will be realized. Mineral Resources that are not mineral reserves have not demonstrated economic viability.

The discounted cash flow (DCF) methodology

was employed to calculate the project’s net present value, internal rate of return, and payback period. The cash flow estimates

are unlevered and calculated at the Carangas asset level. This economic analysis does not incorporate any corporate-level considerations

from New Pacific Metals or any of its subsidiaries.

The NPV was calculated using a 5% discount

rate, which is a standard real discount rate for evaluating precious metals projects. The cash flows were discounted from the second half

of year –2.

No inflation adjustments were applied to the

cash flow model.

Considering the Project on a stand-alone

basis, the undiscounted pre-tax cash flow totals $1,447 million over the mine life, and post-tax payback occurs 3.2 years from the start

of production.

The economic analysis results are shown in

Table 1-1.

Table 1-1 Economic

Analysis Results

| |

Economic Analysis Results |

| Post Tax NPV @ 5% ($M) |

501 |

| IRR (%) |

26 |

| Payback (years) |

3.2 |

A sensitivity analysis was conducted

to evaluate the influence of variations in LOM capital and operating costs. This analysis assessed the impact on post-tax NPV, applying

a 5% annual discount rate, and on IRR by adjusting mining cost, process cost, and LOM capex, respectively, by +/-10% to +/-20%. The results

of the cost sensitivity analysis are summarized in Table 1-2.

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 5 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

Table

1-2 NPV and IRR Sensitivity Analysis by Input Cost

| |

Cost Sensitivity |

| Sensitivity Items |

-20% |

-10% |

100%

(base case) |

+10% |

+20% |

| Mining Cost (Post-tax NPV $M / IRR) |

534/27% |

518/26% |

501/26% |

485/25% |

468/25% |

| Processing Cost (Post-tax NPV $M / IRR) |

563/28% |

532/27% |

501/26% |

470/25% |

439/24% |

| Life-of-Mine Capex (Post-tax NPV $M / IRR) |

558/32% |

530/29% |

501/26% |

473/23% |

444/21% |

Another sensitivity analysis was

conducted for the silver metal price. The change in NPV and IRR is presented in Table 1-3.

Table

1-3 Sensitivity analysis of silver prices

| |

Silver Price Sensitivity |

| Silver Price (US$/oz) |

$18.00 |

$21.00 |

$24.00

(base case) |

$27.00 |

$30.00 |

| Result (Post-tax NPV $M / IRR) |

254/17% |

378/22% |

501/26% |

625/30% |

748/34% |

An additional sensitivity analysis considering

different discount rates is shown in Table 1-4.

Table

1-4 Sensitivity to Discount Rate

| Discount Rates (%) |

5% |

8% |

10% |

12% |

| Post Tax NPV @ ($M) |

501 |

359 |

285 |

224 |

The sensitivity analysis results indicate

that the post-tax NPV remains positive across the evaluated sensitivity range. The NPV is highly sensitive to variations in silver price

and discount rate while showing moderate sensitivity to changes in capital and operating costs.

| 1.2.1 | Property Description and Location |

The Carangas Property is located

in the Carangas district, situated in Bolivia's western part of the Oruro Department, approximately 190 kilometres southwest of Oruro

City. The property is currently held by Minera Granville S.R.L.(Granville), a private Bolivian company, and comprises three Prospecting

and Exploration Licenses (PELs), namely Granville I, Granville II, and Colapso, covering a total area of 40.75 km²

New Pacific Metals entered into a Mining

Association Contract (MAC) with Granville to jointly explore and develop the property under applicable Bolivian laws and pursuant to the

terms and conditions of the MAC. New Pacific Metals will cover all costs related to the exploration, development, and mining of the project,

with the majority of the profits from mining production going to New Pacific Metals and a smaller portion allocated to Granville. As the

holder of the mineral title to the property, Granville will be responsible for permitting matters to ensure the property remains in good

standing under applicable Bolivian laws. The agreement has a term of 30 years and is renewable for an additional 15 years.

The Property consists of three mining

rights (PELs) granted to Minera Granville S.R.L. by the Bolivian authority AJAM (Mining Administrative Jurisdictional Authority). Each

PEL has a five-year validity term, with provisions for one extension of three years. Minera Granville manages the annual costs of maintaining

the PELs. New Pacific Metals (NPM) has a joint venture agreement or MAC with Minera Granville to conduct the geological and mining works

related to these PELs.

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 6 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

RPM is not aware of any environmental

liabilities on the property. New Pacific Metals has all required permits to conduct the proposed work on the property. RPM is not aware

of any other significant factors and risks that may affect access, title, or the right or ability to perform the proposed work program

on the property.

| 1.2.3 | Existing Infrastructure |

There is currently a camp accommodation

for geologists to support exploration activities. The access road is by the existing 5 m wide compacted dirt roads to the camp.

Mining activities in the Carangas

district began in the late 16th century in the Spanish colonial era. During that time, mining activities were mainly focused

on oxide materials and native silver. Currently, widespread ruins of historical mine workings are visible in the East and West Dome, historically

known as San Antonio and Espiritu Santo hills.

Following the decline of the Spanish colonial

era, mining activities in the Carangas area diminished. In the 20th century, ownership of the Property was transferred between

various international and Bolivian local mining companies. Notably, in the early 20th century, mining operations were revived by Moritz

Hochschild and Federico Alhfeld, a German geologist regarded as the father of Bolivian geology, who was working on the Property in 1923.

There has been a very limited amount

of historical mineral exploration at Carangas. COMSUR conducted the earliest recorded exploration. This local Bolivian mining company

conducted channel sampling in the underground workings of the San Jose, Orcko Tunku, and San Antonio adits in 1985. It collected over

350 samples with an average silver grade of 64 g/t Ag. Llicancabur Mining Ltda., a local Bolivia mining company, completed a total of

1,001 meters in 9 reverse circulation holes in 1995, and COMSUR drilled 914.2 meters in 6 diamond drill holes in 2000 (Lopez-Montaño,

2019).

| 1.2.5 | Geology and Mineralization |

The Property sits in the South American

Epithermal-Porphyry Belt, featuring a geological sequence that includes Jurassic granites and the volcanic rocks of the Negrillos Formation

and the Carangas Formation of Tertiary age. The Negrillos Formation consists of eroded lavas, tuffs, and volcanic breccias from ancient

volcanic cones. Above the Negrillos Formation, the Carangas Formation includes rhyolitic to rhyo-dacitic intrusive dykes, lithic tuffs,

phreatomagmatic breccias intercalated with fluvial sediments in the upper portion and andesitic volcanoclastic rocks in the lower portion.

The Carangas area is interpreted as a

grand volcanic caldera system of the Tertiary age. The Property is located at the southwest corner of the Carangas basin. It geomorphologically

comprises two prominent hills, the West Dome and the East Dome, and a fluvial valley in between called the Central Valley. In addition,

there is a small hill known as South Dome near the south end of the Central Valley. At the Property's surface, silver-lead-zinc mineralized

vein structures predominantly strike in a West-Northwest direction with steep dips, either sub- vertically or slightly dipping to the

south or the north. In addition, there are some vein sets trending in northerly and northeast directions. To depth below the shallow silver-lead-zinc

horizon, mineralization is dominated by gold plus a minor amount of silver and copper in the lower portion of the mineralized system.

Based on data obtained from drilling,

the area of West Dome and Central Valley is interpreted as a diatreme structure with the shape of an inverted cone filled with breccias

of phreatomagmatic origin and rhyo-dacitic intrusive dykes. On the top of West Dome, unlithified sandy sediments with horizontal beddings

intercalated with phreatomagmatic breccias of altered rhyolitic and older volcanoclastic clasts are well exposed on surface, evidencing

a volcanic maar environment. The intrusion of magma, once reaching the meteoric water level near surface, led to a series of intense explosive

eruptions and fracturing, which in turn generated abundant open spaces, including cracks and pores in breccias, favourable for the circulation

of hydrothermal fluids and the deposition of sulfide minerals of metals.

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 7 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

Three zones of mineralization can

be recognized as zoning of different metals. The Upper Silver Zone is near surface and dominated by silver plus moderate amounts of lead

and zinc. Below the upper zone, the Middle Zinc Zone is dominated by zinc plus minor silver and lead. The Lower Gold Zone is dominated

by gold plus a small amount of silver, copper, and zinc.

The Carangas project underwent a

systematic exploration process, beginning with the Company's reconnaissance mapping and sampling in 2019. This initial phase was followed

by detailed surface- underground mapping and sampling throughout 2020-2021. Exploration activities continued intermittently in 2022 and

concluded with the sampling and mapping of previously inaccessible historical underground workings.

In 2020, New Pacific collected 383 rock

chip samples from 55 outcrops. The samples were taken at two-meter intervals approximately perpendicular to the strike direction of mineralization,

covering a total length of 769 meters. Out of these samples, 117 returned grades ranging from 30 to 2,350 g/t Ag, with an average grade

of 160 g/t Ag. These samples were used as a guideline for further exploration programs.

The Property features historical underground

mining workings. The company conducted surveys of all safe and accessible tunnels, totalling 2.4 kilometres, which are all developed within

the Carangas Formation. To date, a total of 425 samples have been collected. Among these samples, 112 (26.35%) returned assay results

ranging from 30 to 1,060 g/t Ag, with an average grade of 122 g/t Ag.

Furthermore, the company implemented

systematic geophysical surveying programs, including a ground magnetometry survey and an Offset (3D) Bipole-Dipole Induced Polarization

(IP)-Magneto-Telluric (MT) survey, from 2021 to 2023. The known mineralization system responds well to magnetic lows and IP chargeability

highs, and multiple additional anomalies were identified.

The Company started exploration

drilling in June 2021 and completed resource definition drilling at the end of April 2023. During that period, as many as five rigs were

running at Carangas, and a total of 81,145 meters were drilled in 189 holes. Maldonado Exploraciones, a contracted drilling company from

La Paz, Bolivia, conducted all drilling roughly broken down into four stages.

| § | Phase

I drilling: started on June 21, 2021, and concluded on September 24, 2021. Thirteen holes

were completed, totalling 3,790.4 meters, to verify historical drill results and to test

the lateral and depth extent of the known mineralization exposed on the surface at West Dome

and East Dome. |

| | |

| § | Phase

II: drilling commenced on October 6, 2021, and completed on December 17, 2021. In this phase,

22 holes were drilled for a total of 9,420 meters with the objective of testing mineralization

covered by young sediments in the Central Valley area. |

| | |

| § | Phase

III: a resource definition drill program, started on February 3, 2022, and completed on December

14, 2022. Five drill rigs were employed for the drill program to rapidly define the mineral

resource potential at Carangas. During this period, a total of 50,311 meters were drilled

in 115 holes on a drill grid of approximately 50-meter spacing, and most holes intersected

broad mineralization. |

| | |

| § | Phase

IV: drilling is a continuation of the 2022 resource definition drill program with the aim

to infill areas drilled in 2021-2022 and step out beyond these previously drilled areas.

As of the end of April 2023, a total of 39 holes were completed for a total of 17,623.5 meters

in this phase of drilling. |

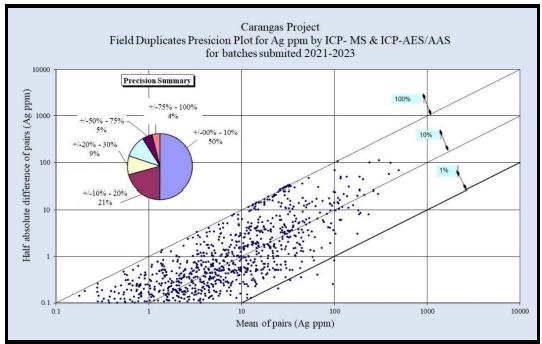

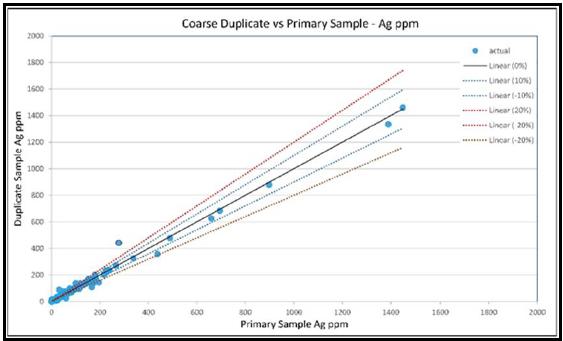

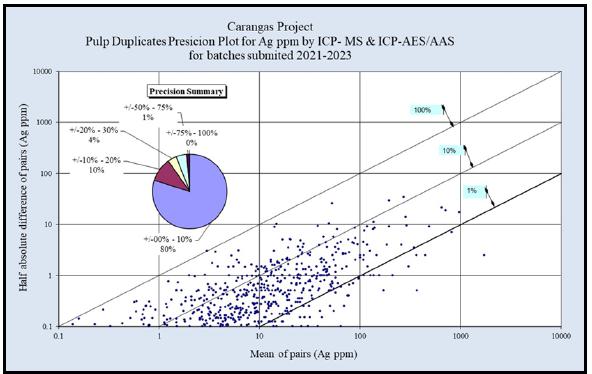

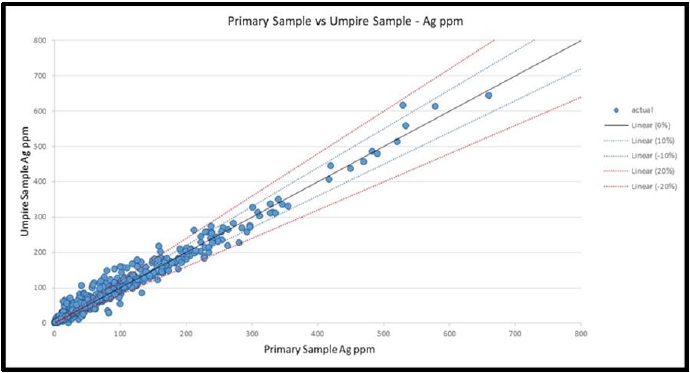

| 1.2.8 | Sample Preparation, Assay, and QA/QC |

New Pacific has established a series

of working procedures and protocols regarding core logging, sampling, core quality assurance/quality control (QAQC) and data validation,

which include the regular submission of check samples to umpire Alfred H Knight laboratory in Lima, Peru.

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 8 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

All drill holes were geologically

logged and sampled by New Pacific field personnel at the company’s facilities in Carangas. Geological logging included detailed

recording of lithology, alteration, mineralization, structure and RQD measurements. Drill cores are stored in a secure core storage area

at the Company’s Carangas camp for future checks and audits.

New Pacific personnel oversees the delivery

of drill core and rock chip samples from the Carangas camp to the ALS laboratories in Oruro, Bolivia, for sample preparation. Then, the

pulp samples were shipped to ALS in Lima, Peru, for geochemical analysis. ALS Oruro and ALS Lima are part of ALS Global, a commercial

laboratory specializing in analytical geochemistry services, all of which are accredited in accordance with ISO/IES 17025:2017 and are

independent of New Pacific.

All drill core, rock chip, and grab samples

are prepared using the following procedures: (1) crush to 70% less than 2 mm; (2) riffle split of 250 g; and (3) pulverize the split to

more than 85% passing a 75-micron sieve.

New Pacific has established comprehensive

QA/QC procedures covering every step of sampling, preparation, and geochemical analysis, including inserting certified reference materials

(CRMs), blanks and duplicates into regular sample sequences. The use of a reasonable number of different control samples is robust. It

returns a good variety of verifications throughout the complete process, and the umpire lab check analysis gives a good level of reproducibility

of the database.

The insertion ratio of control samples

is 24%, which is higher than the industry benchmark (15-20%).

In the QP's opinion, the data acquisition,

analysis and validation comply with the best industry practices and are trustworthy for Mineral Resource estimates and technical reporting.

| 1.2.9 | Mineral Processing and Metallurgical Testing |

Following the completion of the

first metallurgical testwork program in May 2023 with five mineralized samples, another five composite samples were collected in December

2023 from the Upper Silver Zone and Lower Gold Zone for the second metallurgical testwork program to support the current preliminary economic

assessment.

Four mineralized samples were prepared

using intervals from multiple drill holes in the Upper Silver Zone. The first sample was a nearly fully oxidized silver/lead/zinc mineralization

which contained 61 g/t silver, 0.44% lead, 0.08% zinc and 0.20% sulfur. The second sample was a partially oxidized silver/lead/zinc mineralization

which contained 61 g/t silver, 0.48% lead, 0.65% zinc and 0.89% sulfur. The third sample was a fresh silver/lead/zinc mineralization which

contained 59 g/t silver, 0.42% lead, 0.89% zinc and 1.75% sulfur. The fourth sample consisted of 12.5% fully oxidized sample, 2.5% partially

oxidized sample and 85.0% fresh sample, which was close to the life-of-mine average mineralization. Bulk flotation was applied to the

fully oxidized sample to produce a silver/lead concentrate. Sequential selective flotation was applied for the other three samples to

produce a silver/lead concentrate and a silver/zinc concentrate. For the fourth life-of-mine average sample, the locked cycle flotation

test produced a high-silver containing lead concentrate, which contained 3,658 g/t silver and 24.0% lead with corresponding recoveries

of 81.6% for silver and 73.4% for lead, and a silver/zinc concentrate which contained 325 g/t silver and 45.8% zinc with corresponding

recoveries of 6.0% for silver and 66.9% for zinc. The total silver recovery in these two concentrates was 87.6%.

In the Lower Gold Zone, one composite

sample was prepared, which contained 1.01 g/t gold, 11 g/t silver, 0.060% copper and 3.07% sulfur. This sample was amenable to gravity

concentration, whole-ore cyanide leach and bulk flotation. A large amount of free gold particles was present between 53 µm and 300

µm. Based on the gravity concentration testwork results, a commercial gravity concentration circuit installed to process a portion

of cyclone underflow is expected to recover about 45% gold at a primary grind size of 80% passing 75 µm. This gold sample was amenable

to cyanide leach with 94.0% gold recovery at a grind size of 80% passing 90 µm, 48-hour retention time and cyanide consumption of

0.55 kg/t NaCN. Bulk flotation of this gold sample achieved 98.0% gold recovery and 94.7% silver recovery on average at 10.9% concentrate

mass pull.

Three samples from the Upper Silver Zone,

Lower Silver Zone and Lower Gold Zone were subjected to comminution testing. The measured rod mill work index, ball mill work index and

abrasion index values were

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 9 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

10.1 ~ 12.3 kW.h/t, 10.7 ~ 12.8 kW.h/t and 0.038 ~ 0.075 g,

respectively. These values indicate that these three samples were moderately hard and mildly abrasive.

RPM has independently estimated

the Mineral Resources of the Carangas Project based on the data provided by New Pacific Metals as of June 1, 2023. The Mineral Resource

estimate and underlying data comply with the guidelines of the CIM Definition Standards under NI 43-101. RPM considers it suitable for

public reporting. The QP, Mr. Anderson Goncalves Candido, completed the Mineral Resources Estimate.

Mineral Resources were reported using

a cut-off value of 40 g/t AgEq and a conceptual open-pit mining constraint, assuming that extraction will be conducted using an open-pit

mining method. The cut-off value was determined using a number of technical factors and a consensus five-year forecast of metal prices.

Three

zones of mineralization can be recognized as zoning of different metals. The Upper Silver Zone, the Middle Zinc Zone and the Lower

Gold Zone. The Mineral Resources are stated in these three zones. The results of the Mineral Resource estimate for the Carangas

deposit are presented in Table 1-5.

Table 1-5 Carangas Deposit

- Conceptual Pit* Constrained Mineral Resource as of 25 August 2023

| Domain |

Category |

Tonnage |

AgEq |

Ag |

Au |

Pb |

Zn |

| Mt |

g/t |

Mozs |

g/t |

Mozs |

g/t |

Kozs |

% |

Mlbs |

% |

Mlbs |

| Upper

Silver Zone |

Indicated |

119.18 |

85 |

326.8 |

45 |

171.2 |

0.06 |

216.4 |

0.35 |

916.6 |

0.66 |

1,729.6 |

| Inferred |

31.30 |

80 |

80.8 |

43 |

43.3 |

0.10 |

104.6 |

0.29 |

202.4 |

0.51 |

350.0 |

| Middle

Zinc Zone |

Indicated |

43.42 |

56 |

78.1 |

11 |

15.0 |

0.06 |

77.4 |

0.36 |

343.6 |

0.77 |

739.4 |

| Inferred |

9.32 |

54 |

16.2 |

9 |

2.6 |

0.05 |

15.6 |

0.36 |

74.1 |

0.79 |

162.3 |

| Lower

Gold Zone |

Indicated |

52.28 |

92 |

154.9 |

11 |

19.1 |

0.77 |

1,294.4 |

0.16 |

184.7 |

0.16 |

184.7 |

| Inferred |

4.37 |

91 |

12.8 |

13 |

1.8 |

0.69 |

97.5 |

0.22 |

21.4 |

0.22 |

21.4 |

Source:

compiled by RPM GLOBAL, 2023

*

Notes:

1.

CIM Definition Standards (2014) were used for reporting the Mineral Resources.

2.

The Qualified Person (as defined in NI 43-101) for the purposes of the MRE is Anderson Candido, FAusIMM, Principal Geologist

with RPM (the "QP").

3.

Mineral Resources are constrained by an optimized pit shell at a metal price of $23.00/oz Ag, $1,900.00/oz Au, $0.95/lb Pb, $1.25/lb

Zn, recovery of 90% Ag, 98% Au, 83% Pb, 58% Zn and Cut-off grade of 40 g/t AgEq and reported as per Section 14.

4. Drilling results up to June 1, 2023.

5.

The numbers may not compute exactly due to rounding.

6.

Mineral Resources are reported on a dry in-situ basis.

7.

Mineral Resources are not mineral reserves and have not demonstrated economic viability.

Below the conceptual pit constraint,

gold-dominated mineralized material of similar size and grade to the reported Mineral Resources of the Gold Domain within the conceptual

pit exists. Gold mineralization remains open to the north and northeast at depth.

RPM considers that the reported Mineral

Resources have reasonable prospects for eventual economic extraction using open-pit mining methods.

This section is not relevant to this

Technical Report.

| | ADV-TO-00090 | NI 43-101 Technical Report Carangas Deposit Preliminary Economic Assessment | September 2024 | | | Page 10 of 227 | |

| | |

| oThis report has been prepared for Pacific New Metals Corp and must be read in its entirety and subject to the limitations, assumptions and disclaimers contained in the body of the report. © RPMGlobal Canada Limited 2024 |

The deposit is amenable to open-pit

mining practices. Open pit mine designs, mine production schedules and mine capital and operating costs have been developed for the Carangas

deposit at a scoping level of engineering. The Mineral Resources described in Section 14 form the basis of the mine planning, including

Indicated and Inferred class resources.

Mine planning

is based on conventional drill/blast/load/haul open pit mining methods suited for the project location and local site requirements. The

open pit activities are designed for approximately two years of construction followed by thirteen years of mine operations and four years

of post-pit mining stockpile processing. The subset of Mineral Resources contained within the designed open pits are summarized in Table

1-6, with a $28/t NSR (Net Smelter Return) cut-off and form the basis of the mine plan and production schedule.

Table 1-6 PEA Mine Plan Production

Summary

| Factor |

Value |

| PEA Mill Feed |

64.4 Mt |

| Mill Feed NSR |

$50.6/t |

| Mill Feed Ag Grade |

63 g/t |

| Mill Feed Pb Grade |

0.44 % |

| Mill Feed Zn Grade |

0.80 % |

| Waste Rock |

111.7 Mt |

| Waste: Mill Feed Ratio |

1.7 |

Notes:

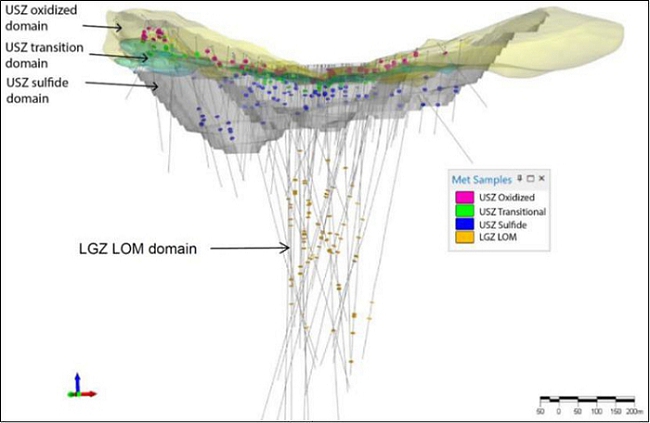

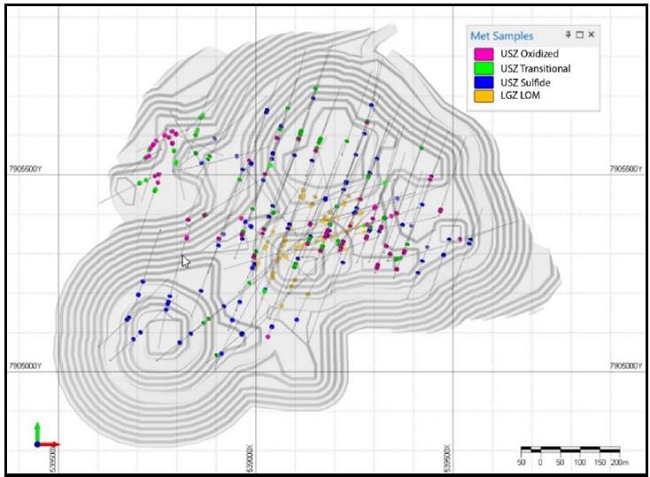

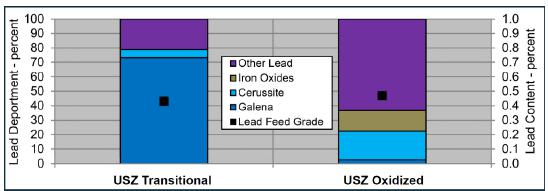

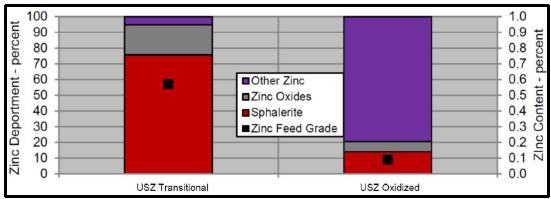

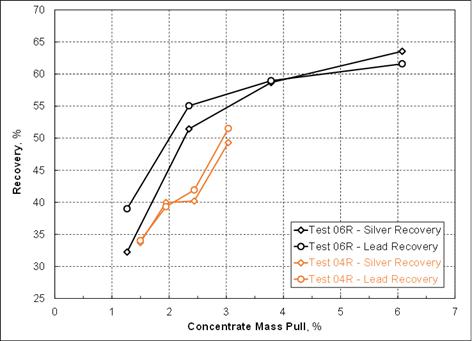

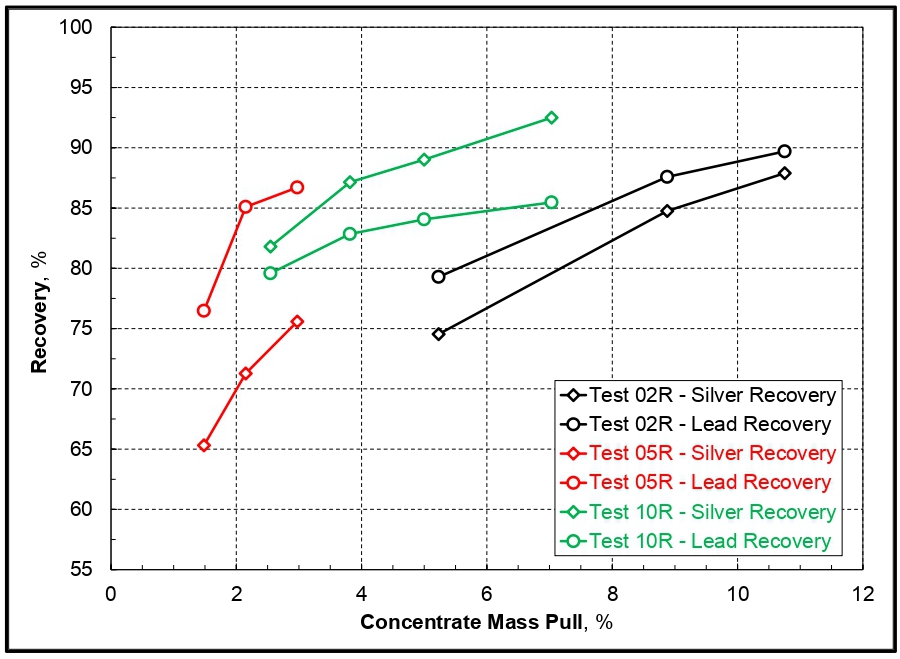

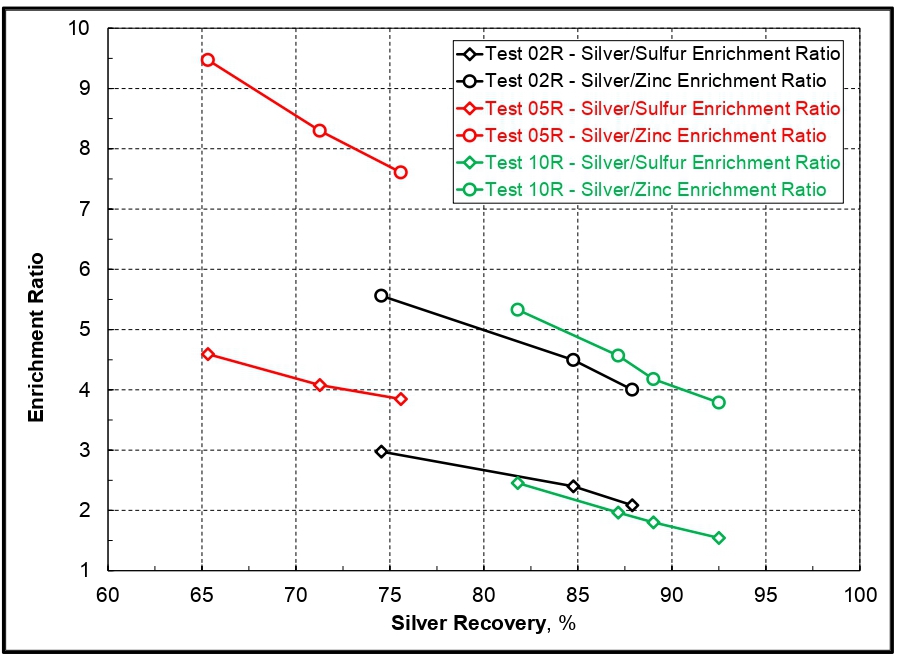

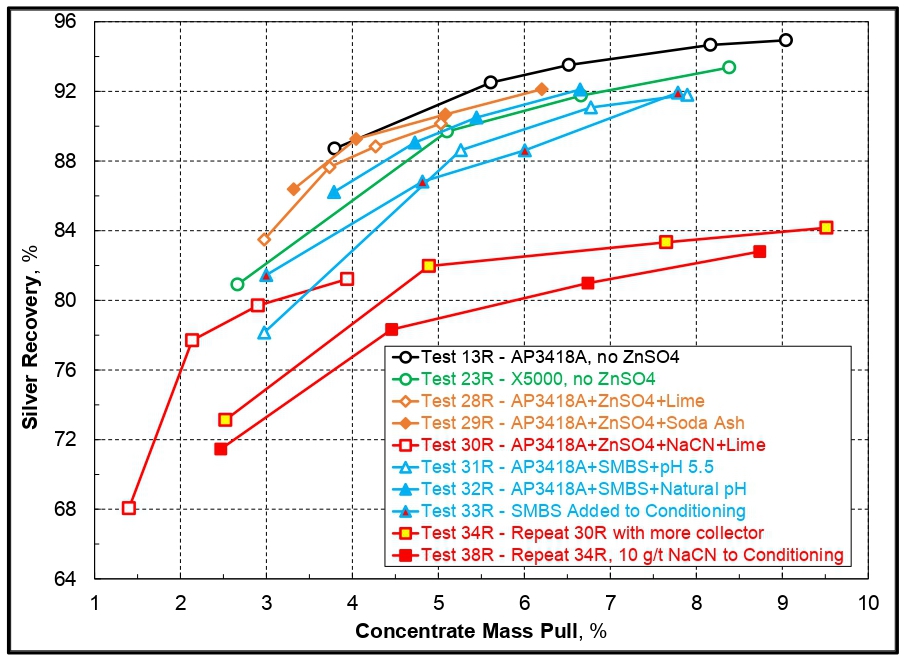

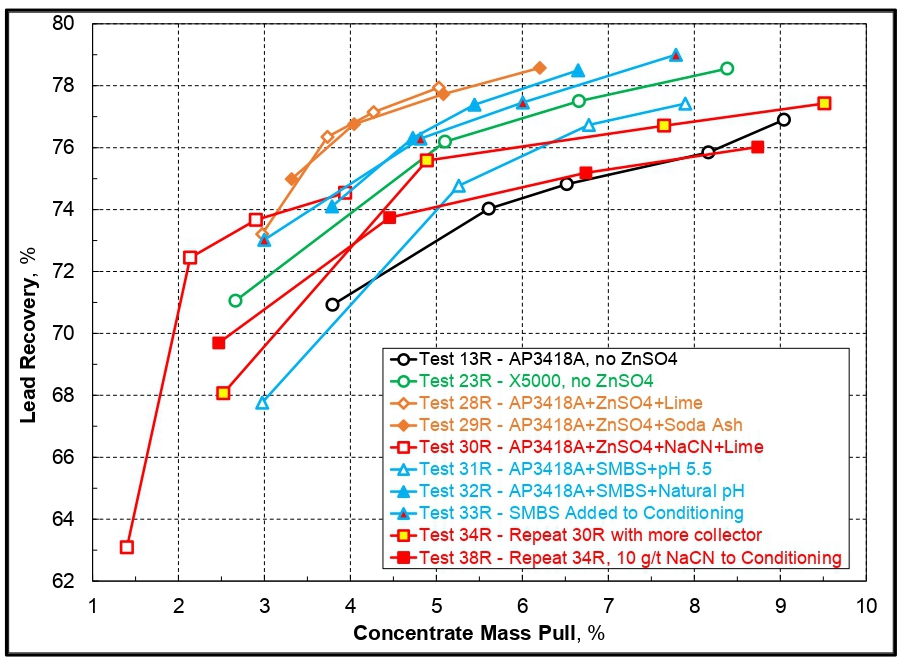

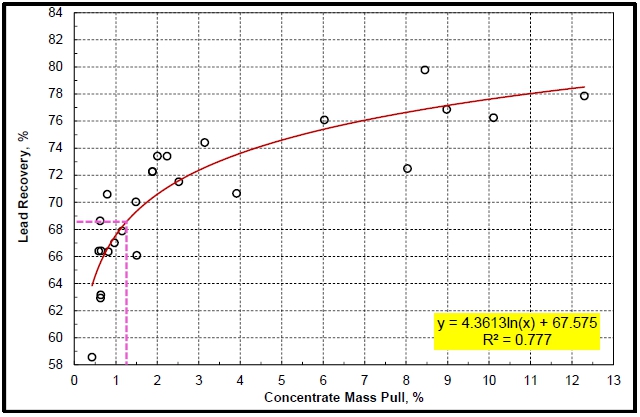

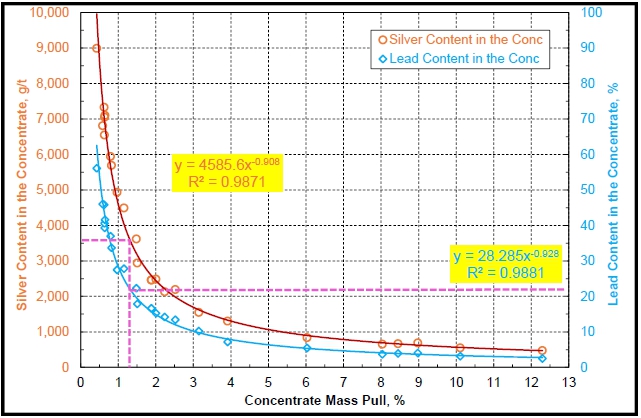

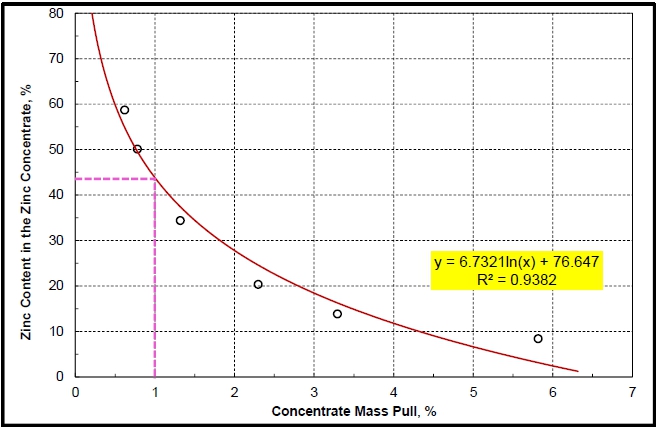

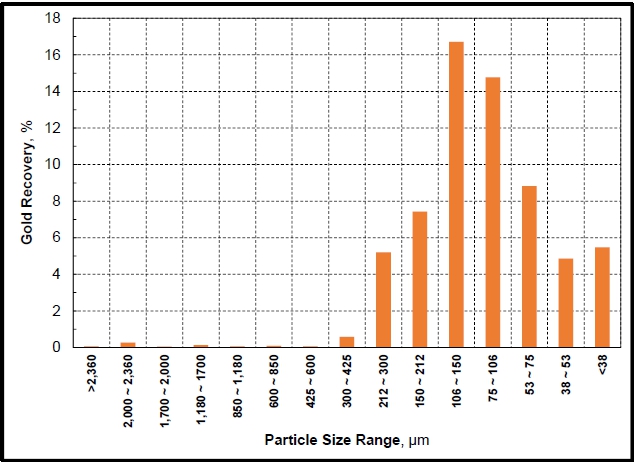

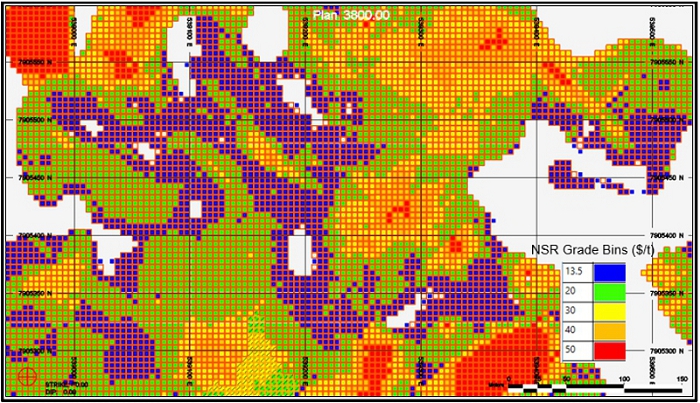

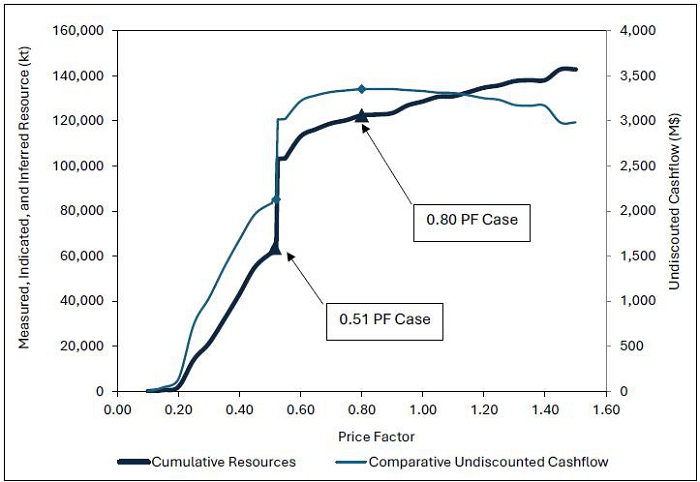

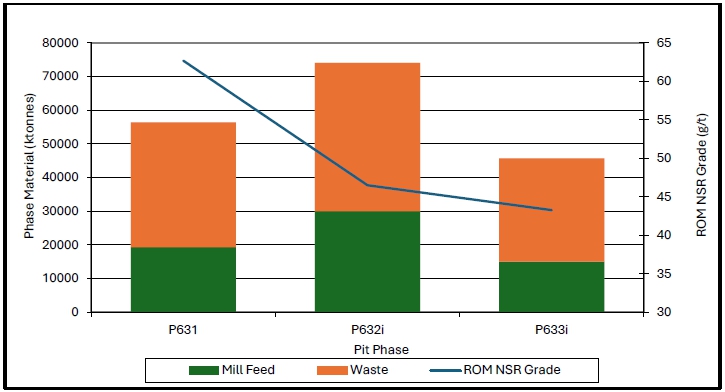

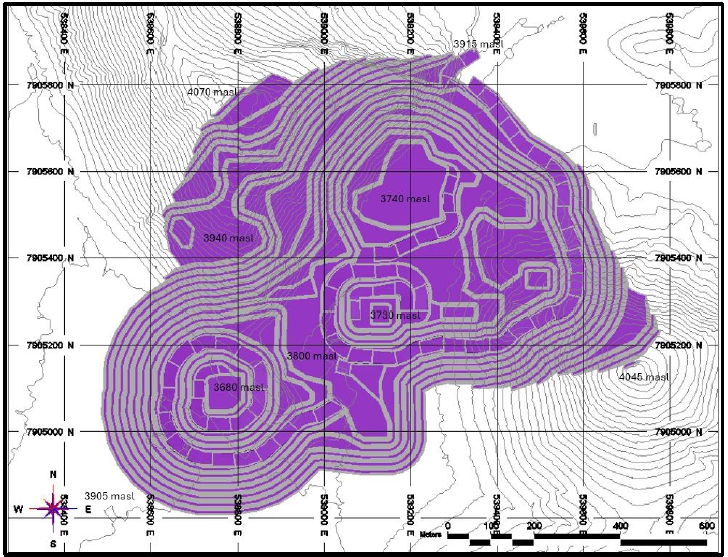

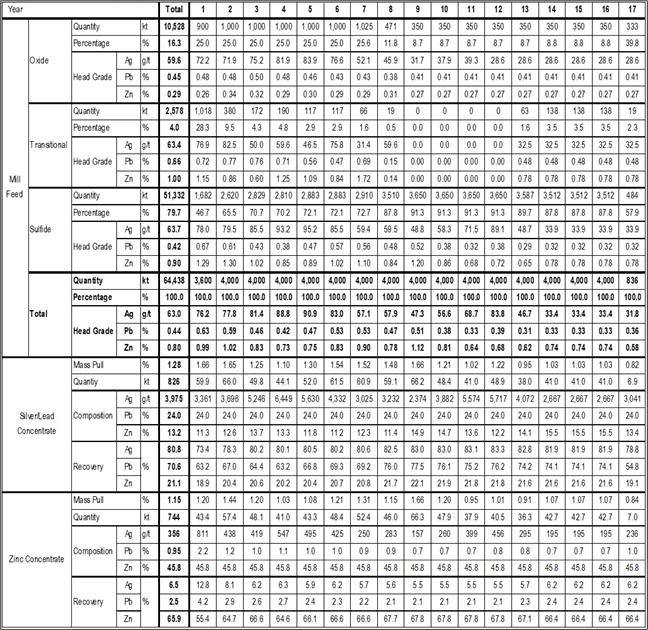

| 1. | The PEA Mine Plan and Mill