UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: August, 2024

Commission File No. 001-40381

NEW PACIFIC METALS CORP.

(Translation of registrant’s name into English)

Suite 1750 - 1066 W. Hastings Street

Vancouver BC, Canada V6E 3X1

(Address of principal executive office)

[Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ ] Form 40-F

[X]

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: August 14, 2024 |

NEW PACIFIC METALS CORP. |

|

| |

|

|

| |

/s/ Jonathan Hoyles |

|

| |

Jonathan Hoyles |

|

| |

General Counsel & Corporate Secretary |

|

EXHIBIT INDEX

Exhibit 99.1

| AMC Mining Consultants

(Canada) Ltd. |

|

| BC0767129 |

|

|

|

|

200 Granville Street,

Suite 202

Vancouver BC V6C 1S4

Canada |

|

| T |

+1 604 669 0044 |

|

| E |

vancouver@amcconsultants.com |

|

| W |

amcconsultants.com |

|

Technical Report

Silver Sand Project Pre-Feasibility Study

New Pacific Metals Corp.

Potosí, Bolivia

In accordance with the requirements of National Instrument

43-101 “Standards of Disclosure for Mineral Projects” (effective 09 June 2023) of the Canadian Securities Administrators

Qualified Persons:

E. Tucker, P.Eng.

D. Nussipakynova, P.Geo.

A. Holloway, P.Eng.

W. Rogers, P.Eng.

M. Molavi, P.Eng.

L. Botham, P.Eng.

AMC Project 0723071

Effective date 19 June 2024

EGBC Permit to Practice #: 1002350

Unearth

a smarter way

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

This 2024 Technical Report reports

a Mineral Reserve estimate and provides the results of a Preliminary Feasibility Study (PFS) for the Silver Sand Property (the Property

or Silver Sand), Potosí Department, Bolivia. The report has been prepared by AMC Mining Consultants (Canada) Ltd. (AMC Consultants)

of Vancouver, Canada on behalf of New Pacific Metals Corp. (New Pacific or the Company) and has an effective date of 19 June 2024. The

previous Technical Report on the Property titled “Silver Sand Deposit Preliminary Economic Assessment,” has an effective date

of 30 November 2022.

New Pacific, through its

wholly owned subsidiaries, acquired exploration and mining rights over an aggregate area of approximately 60 square kilometres (km2)

covering the Silver Sand deposit and its surrounding areas. The Silver Sand area has been intermittently mined for silver from narrow

high-grade mineralized veins in the Cretaceous sandstone since the early to mid-1500s.

The 2024 Technical Report has been

prepared in accordance with the requirements of National Instrument 43-101 (NI 43-101), “Standards of Disclosure for Mineral Projects”

(effective 09 June 2023) of the Canadian Securities Administrators (CSA) for lodgement on CSA’s “System for Electronic Document

Analysis and Retrieval” (SEDAR+).

| 1.2 | Property description and ownership |

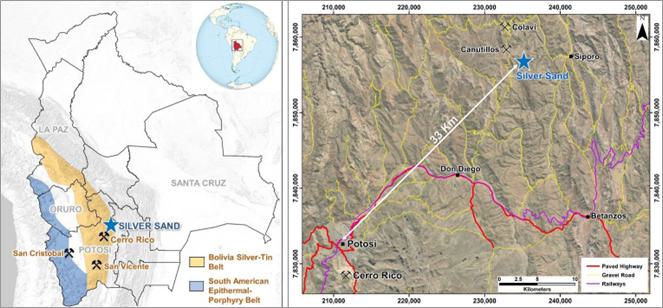

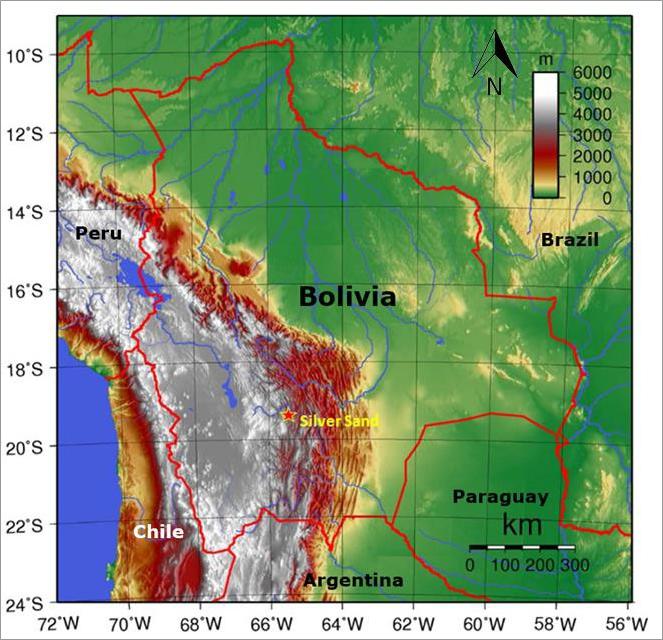

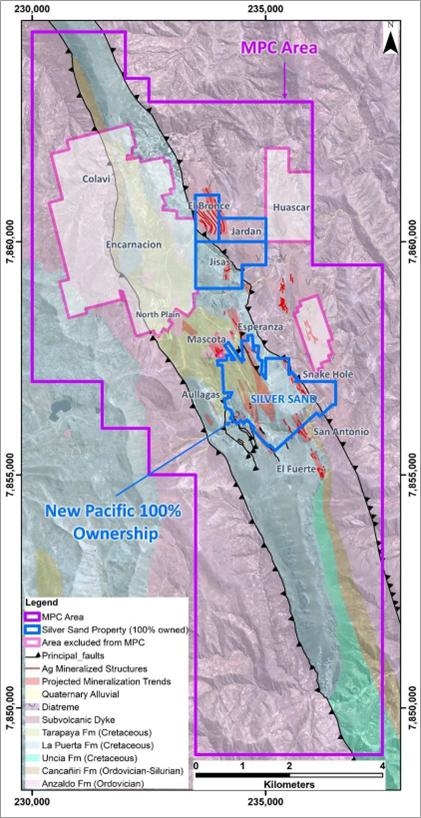

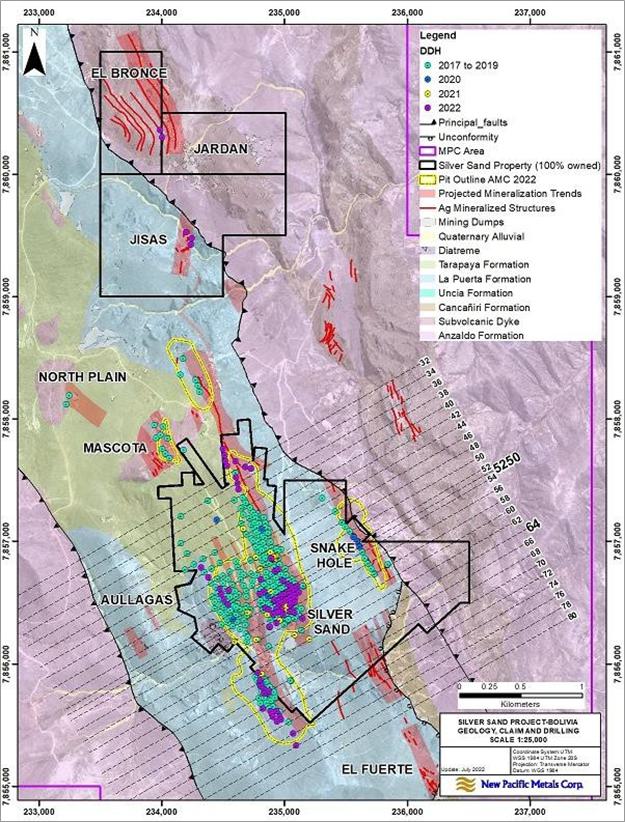

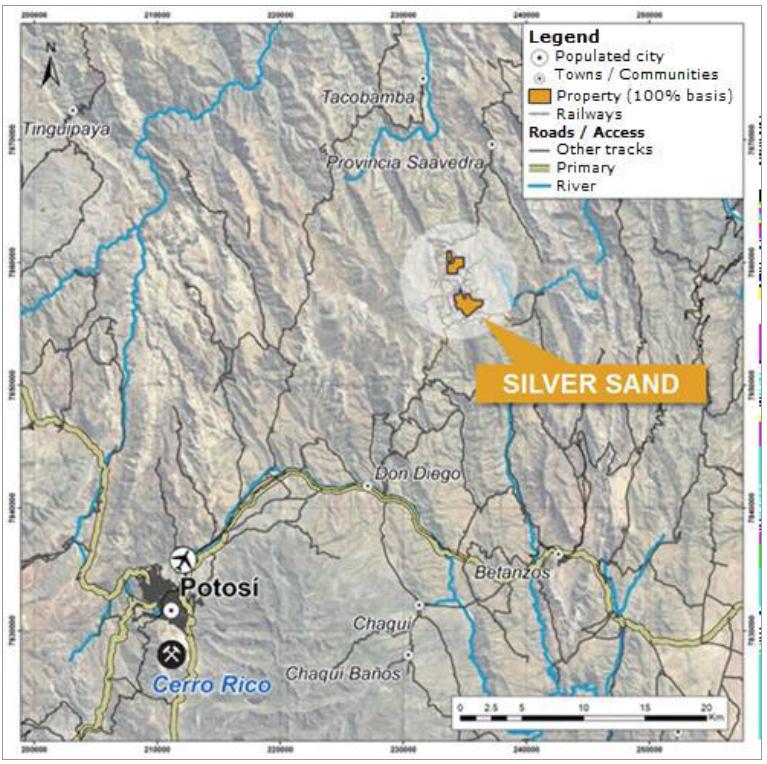

The Property is situated in the

Colavi District of Potosí Department in southwestern Bolivia, 33 kilometres (km) north-east of Potosí city, the department

capital. The approximate geographic centre of the Property is 19°22’ 4.97” S latitude and 65°31’ 22.93”

W longitude at an elevation of 4,072 metres above sea level (masl).

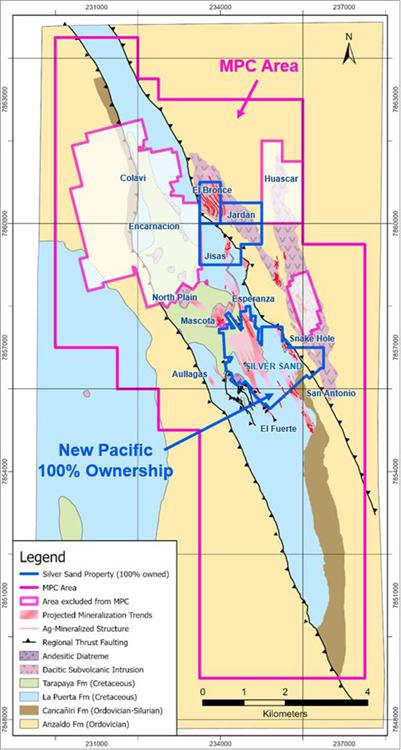

The Property consists of

multiple types of tenure under a consolidated Administrative Mining Contract (AMC) covering an area of 3.1656 km2

and is held through New Pacific’s 100% owned subsidiary Minera Alcira Sociedad Anónima Alcira S.A. (Alcira).

The AMC is valid for 30 years and can be extended for an additional 30 years. In addition, New Pacific has acquired a 100% interest in

three continuous mineral concessions called Jisas, Jardan and El Bronce originally owned by third party private entities. These three

concessions were converted to two AMCs covering an area of 2.25 km2. The total area

under full control of the Company is 5.42 km2.

In addition, through Alcira,

New Pacific entered into a Mining Production Contract (MPC) with Corporación Minera de Bolivia (COMIBOL) on 11 January 2019 and

an updated MPC was entered with COMIBOL on 19 January 2022 which covers 12 ATEs (Temporary Special Authorization) and 196 cuadriculas

for an area of approximately 55 km2 that surround and overlap the Silver Sand core area.

The Company continues to engage with COMIBOL, to obtain the ratification and approval of the signed MPC at the Silver Sand project by

the Plurinational Legislative Assembly of Bolivia. The Company and COMIBOL have refined the MPC workplan to concentrate exclusively on

claims immediately adjacent to the Silver Sand project boundary. This streamlined landholding, while maintaining the core value of the

MPC to the Silver Sand project, is anticipated to facilitate progress towards ratification and approval of the MPC. For COMIBOL to obtain

mining rights over such areas, AJAM (Jurisdictional Mining Administrative Authority) will have to grant them by way of AMCs or Exploration

Licenses in accordance with Bolivian mining laws. In addition, the MPC must be ratified by the Congress of Bolivia (Congress) to be valid

and enforceable.

Once the MPC has been ratified by

Congress, the MPC with COMIBOL will be valid for 15 years which may be automatically renewed for an additional 15-year term and potentially,

subject to submission of an acceptable work plan, for an additional 15-year term for a total of 45 years.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| 1.3 | Accessibility, climate, local resources, infrastructure and physiography |

The Property is located approximately

36 km north-east of the Cerro Rico de Potosí silver and base metal mine, 46 km south-west of the city of Sucre, and 33 km north-east

of the city of Potosí.

The Property is accessed from Sucre

and Potosí by travelling along a paved highway to the community of Don Diego, and then north from Don Diego along a 27 km, maintained

all-weather gravel road. Don Diego is accessed by driving 129 km to south-west from Sucre, or 29 km to the north-east from Potosí

along paved Highway 5.

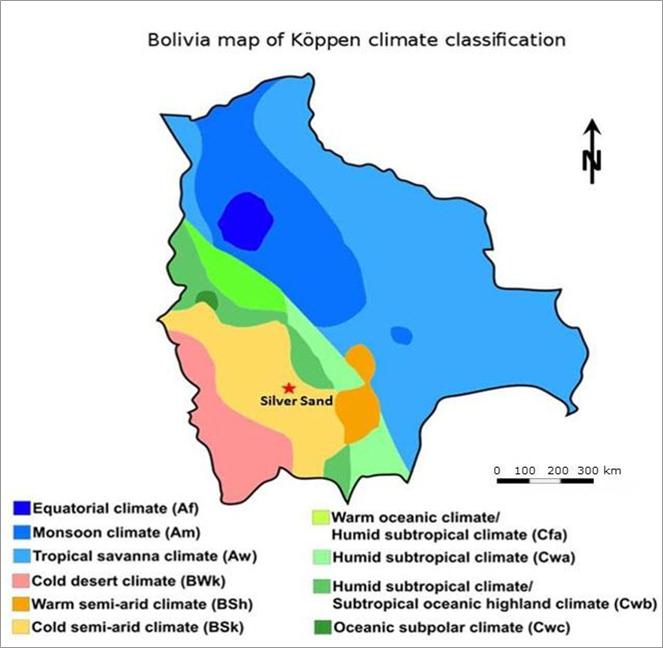

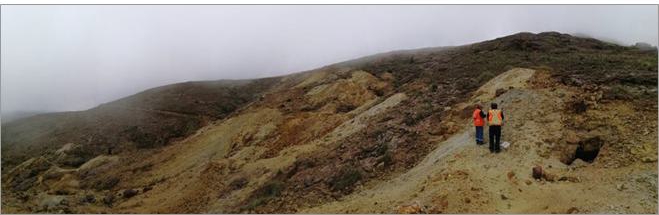

The Property is situated approximately

within the central section of the Cordillera Oriental of Bolivia and consists of rolling hills with elevations ranging from 3,900 to 4,100

masl (metres above sea level). Due to the high elevation, the Property area has a cold, semi-arid desert climate despite the region’s

location approximately 19 degrees south of the equator.

The region experiences a rainy season

in the warmer summer months from December to mid-April which contributes approximately 80% of the average annual precipitation of 393

millimetres (mm). The driest period is from May to August with very little precipitation. Overall, the climate is mild and is amendable

to year-round mining.

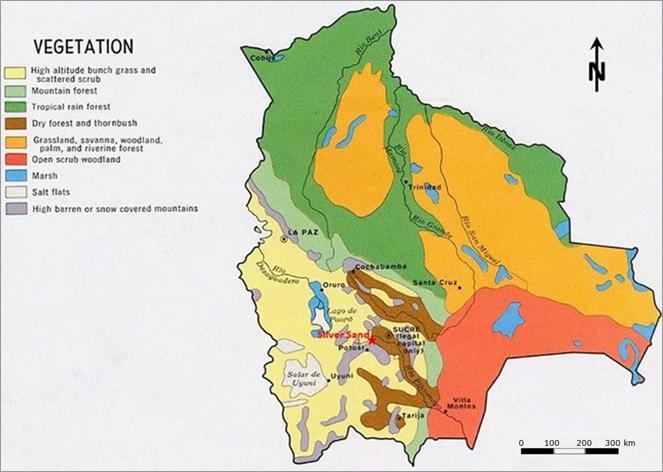

Vegetation on the Property is poorly

developed and mainly consists of sparsely scattered low grasses and shrubs. In valleys below 4,000 m elevation, some eucalyptus trees

are grown. Animals such as alpacas, llamas, vicunas, and guanacos are common in the Cordillera Oriental.

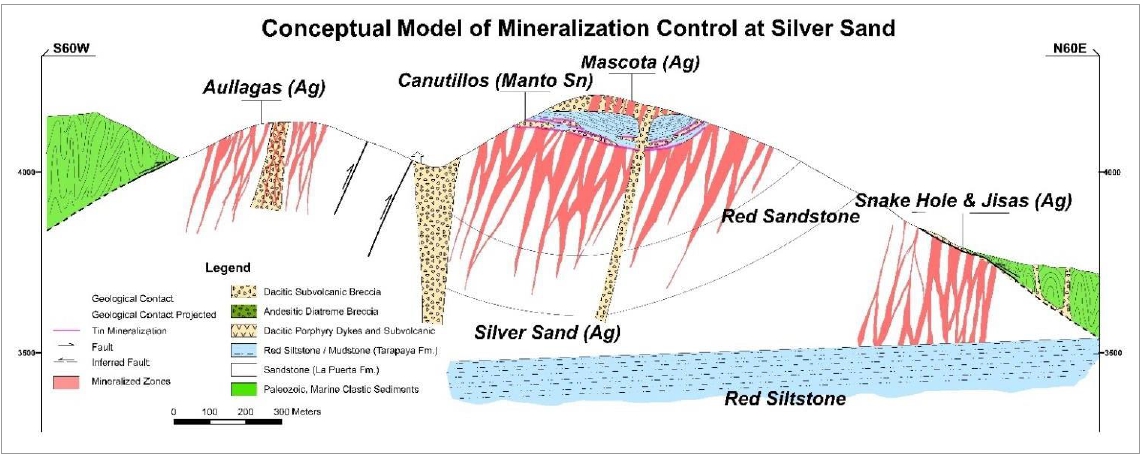

| 1.4 | Geological setting and mineralization |

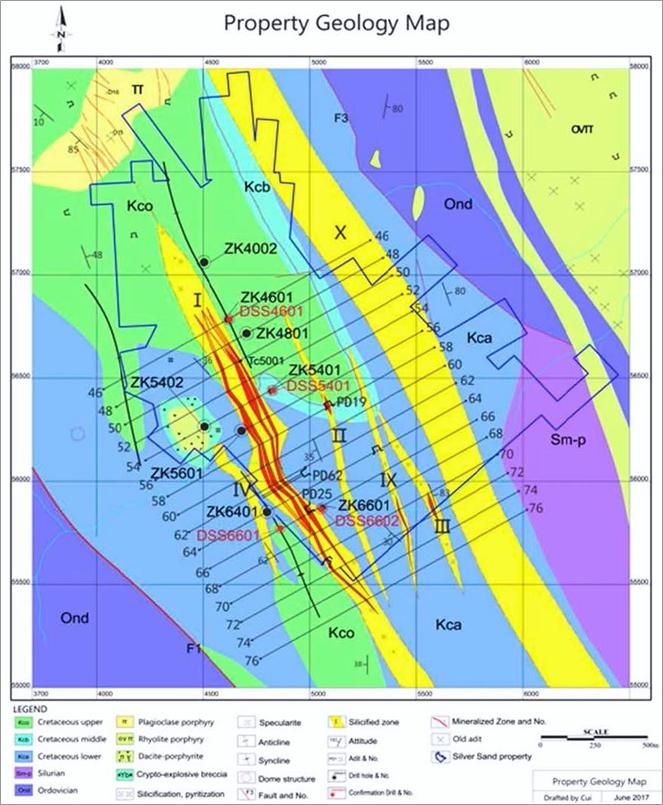

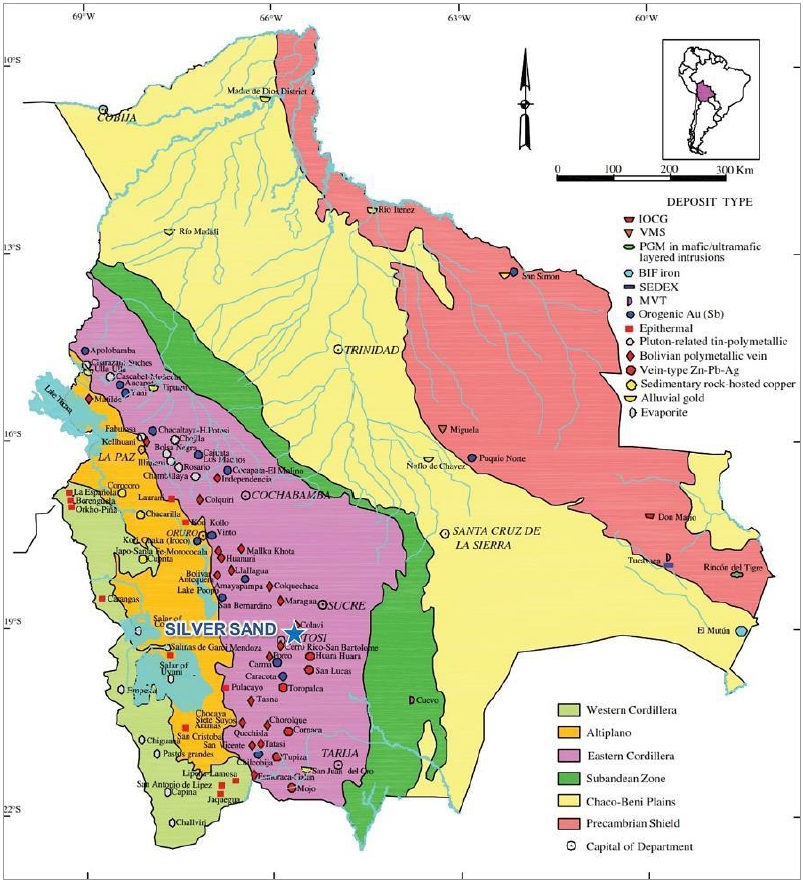

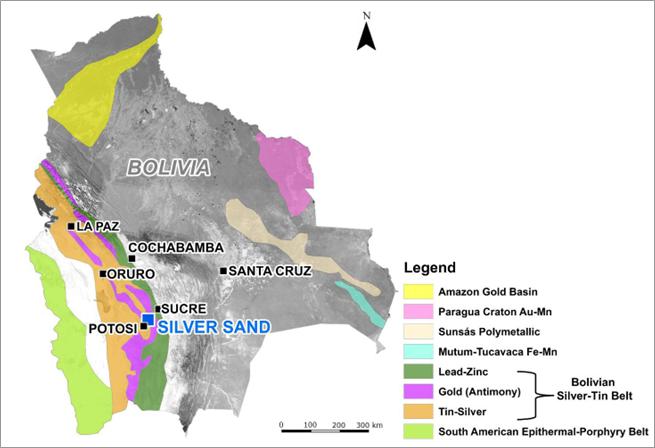

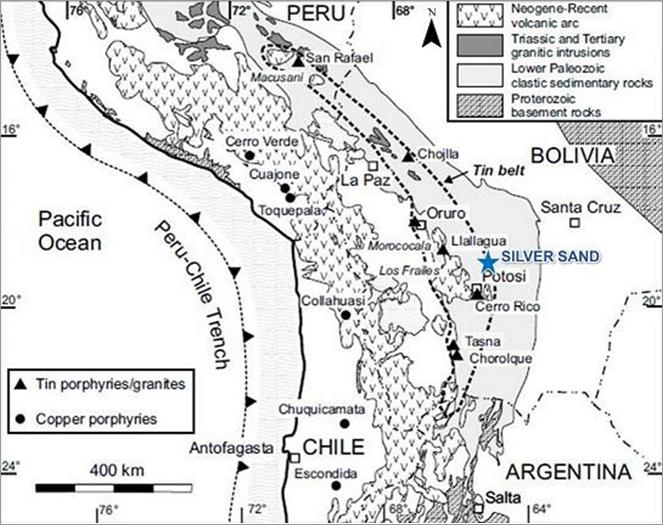

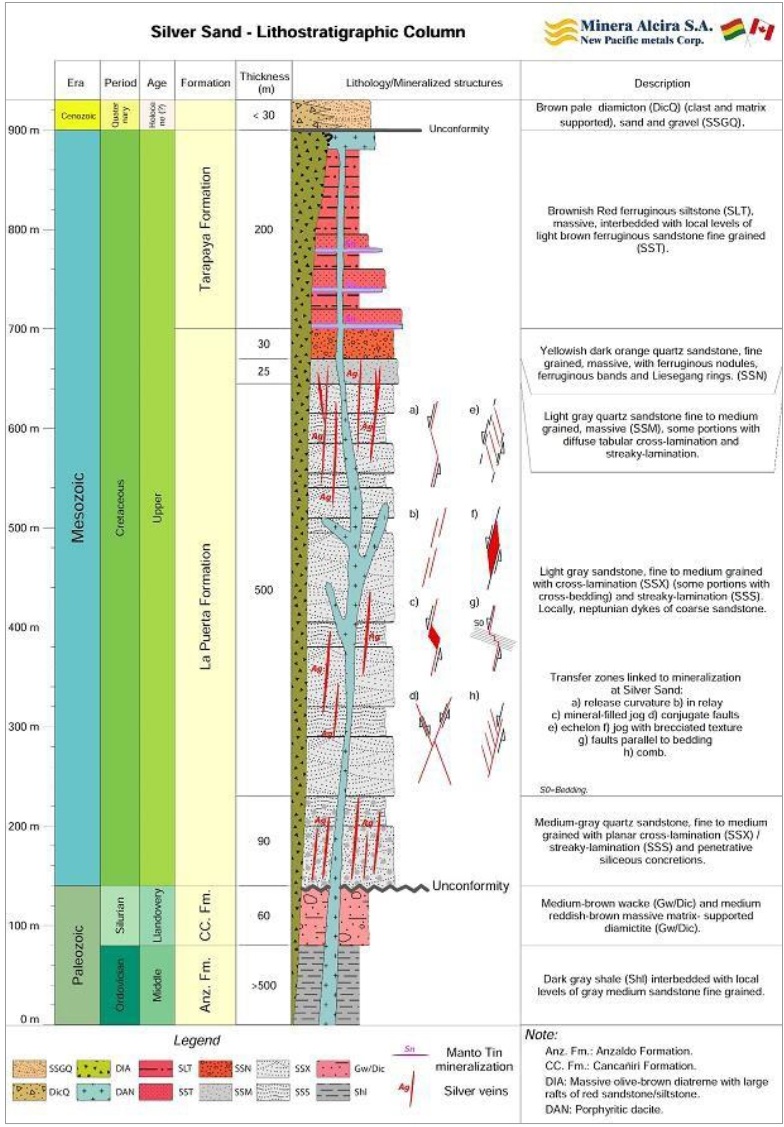

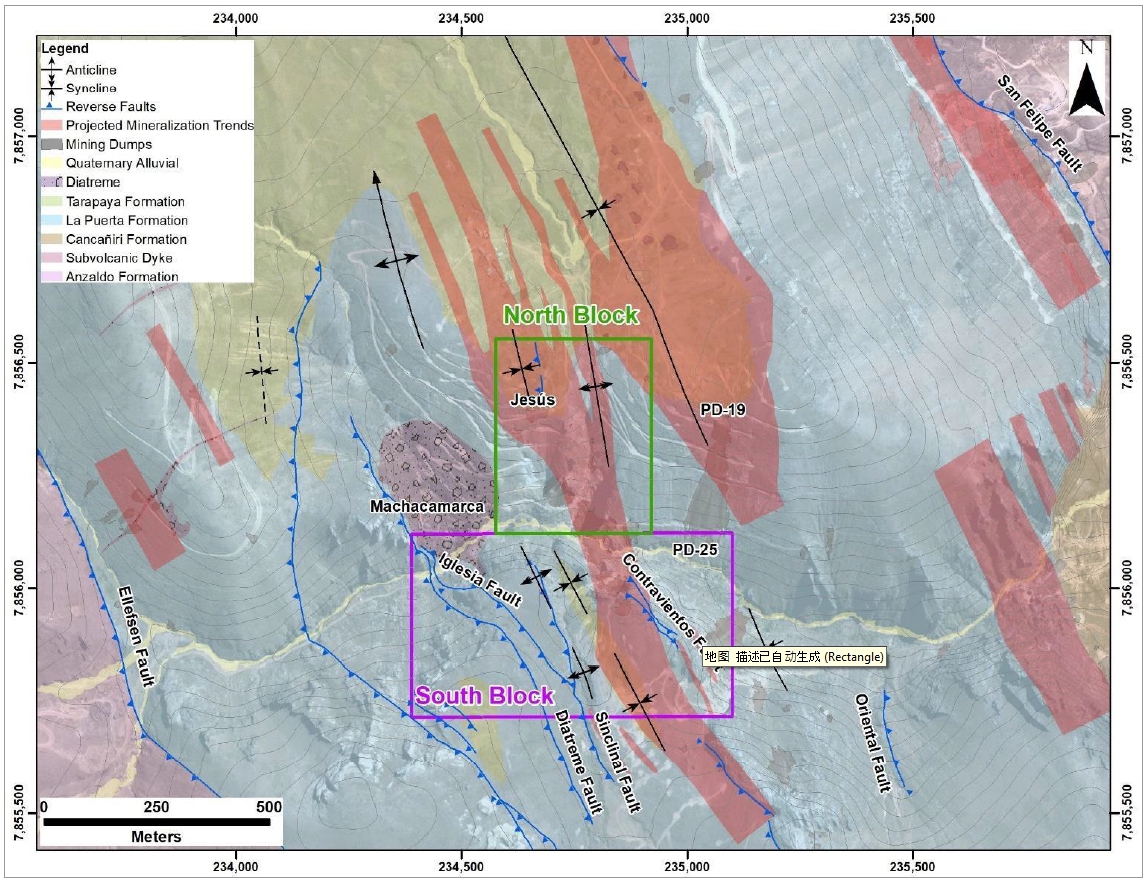

The Silver Sand Property is located

in the south section of the polymetallic silver-tin belt in the Eastern Cordillera of the Central Andes, Bolivia. The oldest rocks observed

within the Property comprise Ordovician to Silurian marine, clastic sediments which have been intensely folded and faulted.

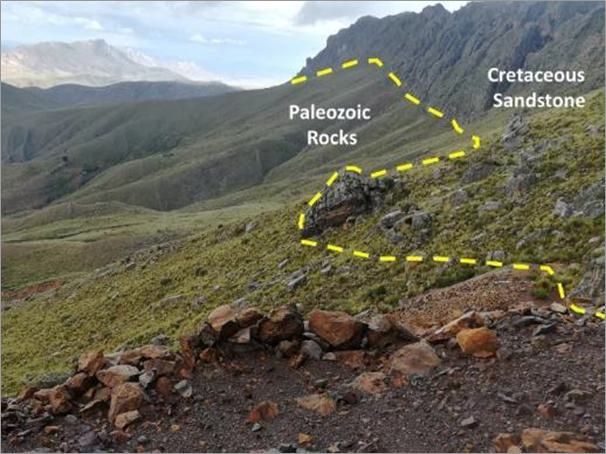

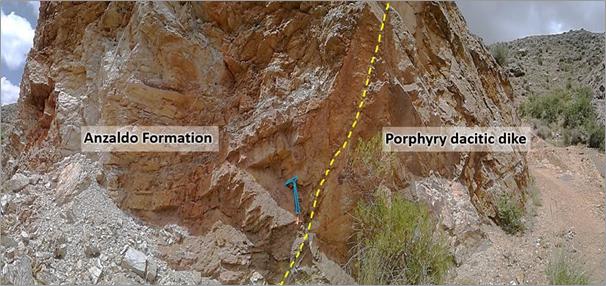

Bedrock in the Property area mainly

consists of weakly deformed Cretaceous continental sandstone, siltstone, and mudstone and the strongly deformed Paleozoic marine sedimentary

rocks. The Cretaceous sedimentary sequence forms an open syncline which plunges gently NNW and is bounded to the SW and NE by NW trending

faults.

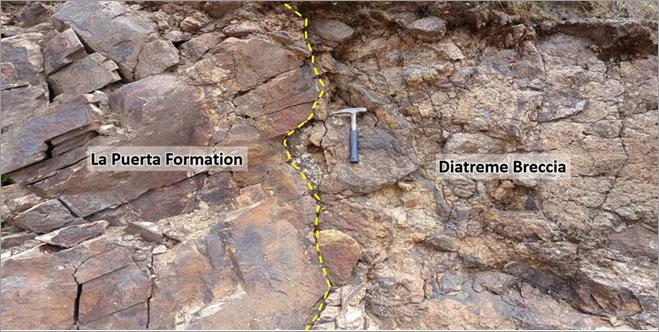

The Cretaceous sedimentary sequence

within the Property is divided into the lower La Puerta Formation and the upper Tarapaya Formation. The La Puerta Formation consists of

sandstones and unconformably overlies the highly folded Paleozoic marine sedimentary rocks. The Tarapaya Formation conformably overlies

the La Puerta sandstones in the central part of the Property and comprises siltstones and mudstones intercalated with minor sandstone.

Both the Cretaceous and Paleozoic

sedimentary sequences are intruded by numerous small Miocene subvolcanic dacitic porphyry intrusions.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

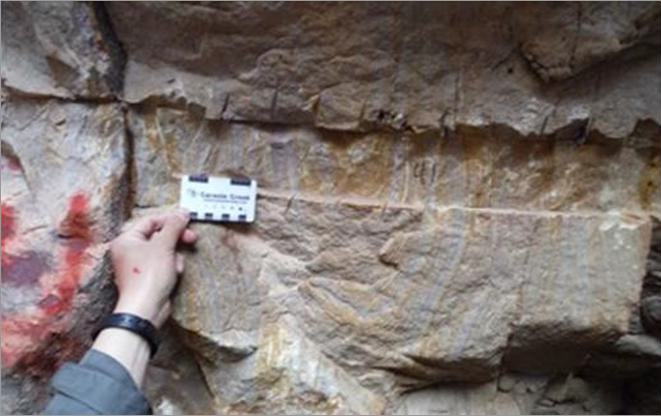

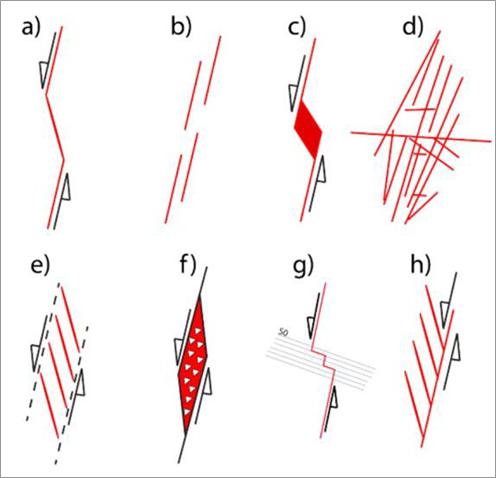

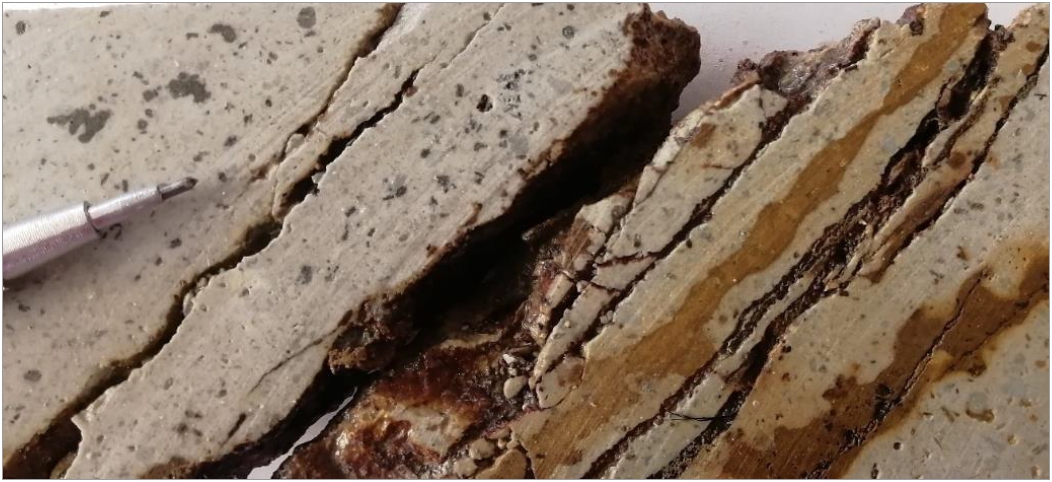

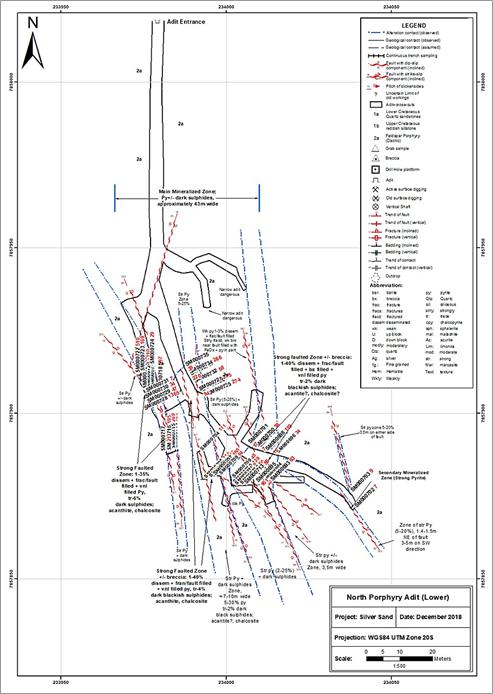

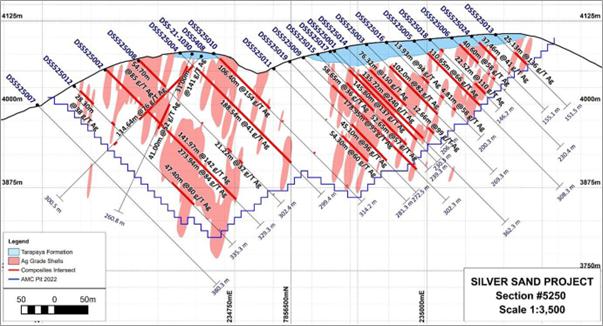

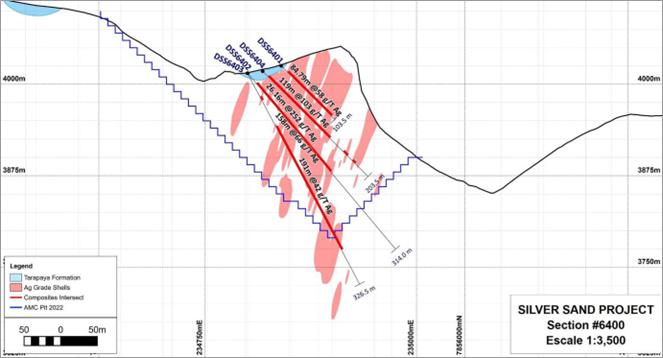

The Property exhibits a variety

of geometries and morphology of the mineralized bodies which are controlled and hosted by local structures of tectonic transfer nature.

Some are evident in outcrops, but the best examples are observed in drill cores and in underground workings. Mineralized structures usually

appear as steps-overs developed between two neighbouring fault / vein segments that exhibit an echelon arrangement and may or may not

be connected by lower-ranking faults / vein. These types of structures are of fractal type, which implies that they repeat their geometry,

regardless of the observation scale, in arrangements of sigmoid (jogs), echelon, subparallel stepped, relay, horsetails, and extensional

nets (swarms).

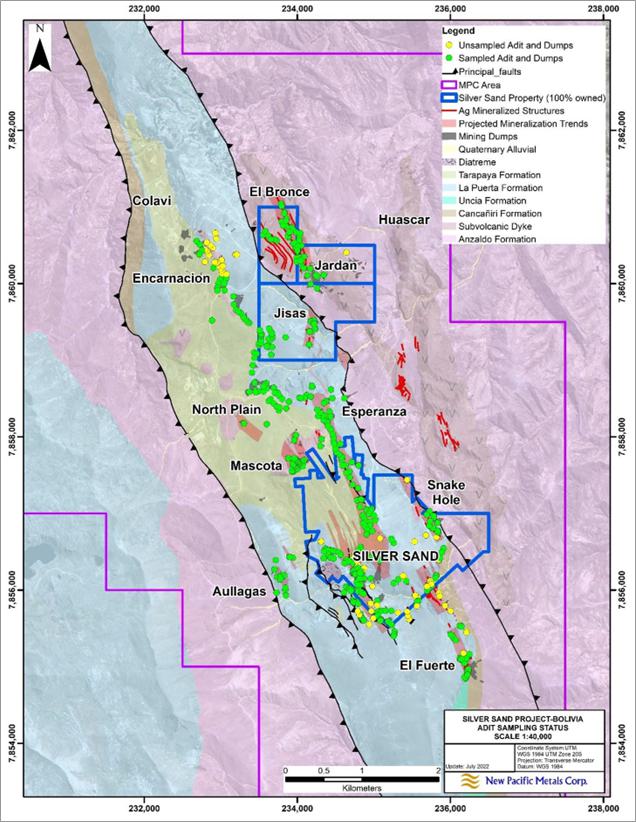

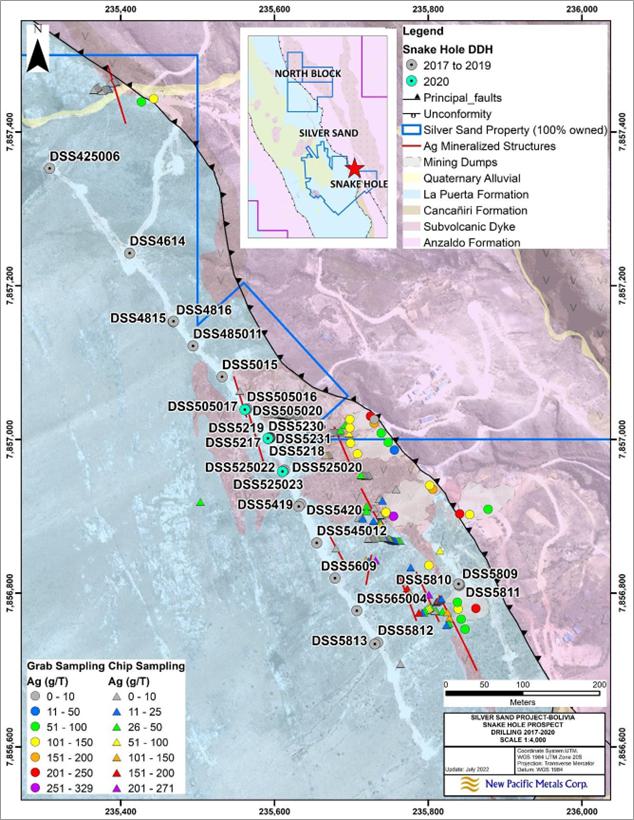

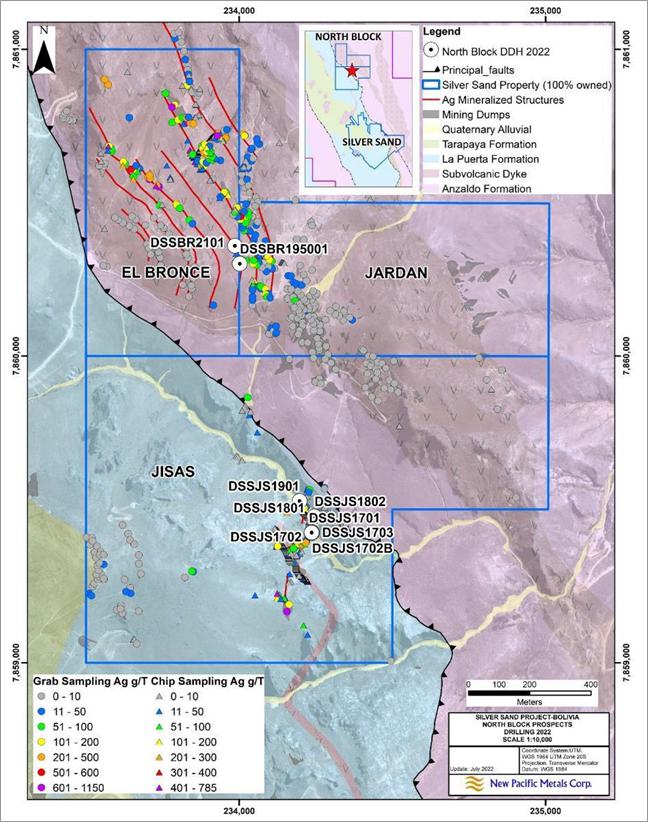

11 mineralized prospects have been

identified across the Property to date. These include the Silver Sand deposit and the El Fuerte, San Antonio, Aullagas, Snake Hole, Mascota,

Esperanza, North Plain, Jisas, Jardan, El Bronce, occurrences. Silver Sand, Snake Hole, Jisas, El Bronce, Aullagas, Mascota and Esperanza

have been tested by drilling. Another nine prospects were defined by rock chip and grab sampling of ancient and recent artisanal mine

workings and dumps and remain to be drill tested. Exploration results from surface outcrops and underground workings defined a silver

mineralized belt 7.5 km long and 2 km wide.

At the Silver Sand deposit mineralization

has been traced for more than 2,000 m along strike, to a maximum width of about 680 m and a dip extension of more than 250 m.

Four mineralization

styles have been recognized in the Property, and these in order of importance are: (1) sandstone-hosted silver mineralization, (2)

porphyritic dacitic-hosted silver mineralization, (3) diatream breccia-hosted silver mineralization, and (4) manto-type tin and base

metal mineralization.

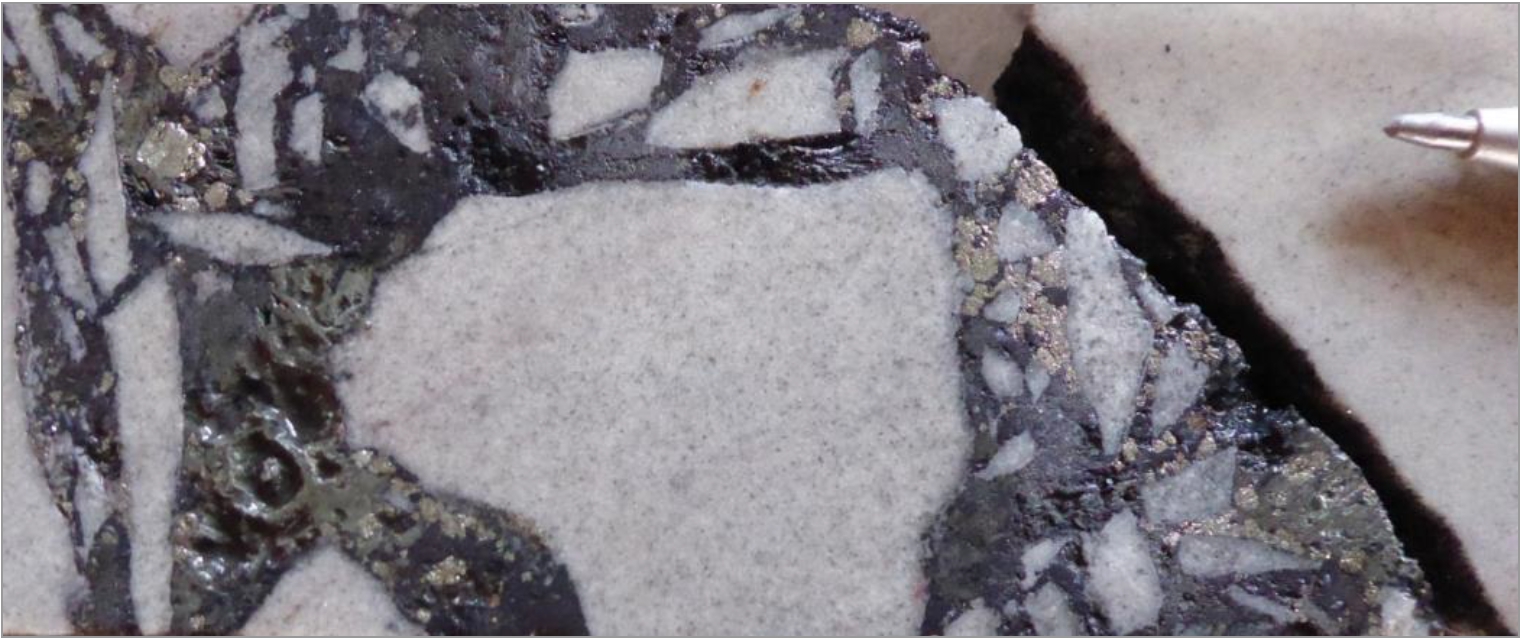

The mineralization in the Silver

Sand project comprises silver-containing sulphosalts and sulphides occurring within sheeted veins, stockworks, veinlets, breccia infill

and disseminated within host rocks. The most common silver-bearing minerals include freibergite [(Ag,Cu,Fe)12(Sb,As)4S13],

miargyrite [AgSbS2], polybasite [(Ag,Cu)6(Sb,As)2S7]

[Ag9CuS4], bournonite [PbCuSbS3]

(some lattices of copper may be replaced by silver), andorite [PbAgSb3S6], and boulangerite [Pb5Sb4S11]

(some lattices of lead may be replaced by silver). Most silver mineralization is hosted in La Puerta sandstone units with minor amounts

in porphyritic dacite and diatreme breccia.

Silver mineralization is hosted

by faults, fractures, fissures, and crackle breccia zones in the Cretaceous La Puerta (brittle) sandstone and porphyritic dacitic dikes,

laccolith, and stocks. In the mineralized sandstone, open spaces are filled with silver-containing sulphosalts and sulphides in forms

of sheeted veins, stockworks, and veinlets, as well as breccia fillings and minor disseminations. Most silver mineralization in the Property

is structurally controlled with secondary rheological controls. The intensity of mineralization is dependent on the frequency of various

mineralized vein structures developed in the brittle host rocks.

Silver and base metal mineralization

in the Silver Sand Property was formed during the regional uplifting and erosion process associated with the Tertiary orogenic events

in the Eastern Cordillera. The genetic model of silver and tin mineralization in the Property is a magmatic-hydrothermal system related

to a deep-seated magmatic centre.

Since October 2017, New Pacific

has carried out an extensive property-scale reconnaissance investigation program by surface and underground sampling of the mineralization

outcrops and the accessible ancient underground mine workings across the Property.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

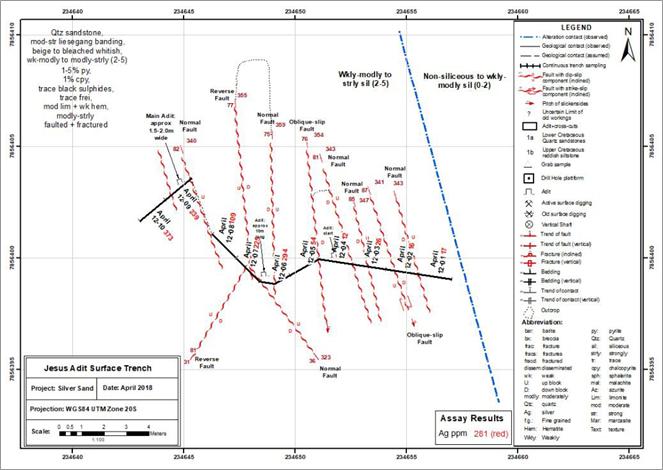

1,046 rock chip samples were collected

from 35 separate outcrops by New Pacific. Continuous chip samples were collected at 1.5 m intervals along lines roughly perpendicular

to the strike direction of the mineralization zones. Sample lines covered a total length of 2,863 m. Most of the sampled outcrops are

located above or near old mine workings.

New Pacific has also mapped and

sampled 65 historical mine workings comprising 5,780 m of underground tunnels. A total of 1,171 continuous chip samples has been collected

at 1 - 2 m intervals along walls of available tunnels that cut across the mineralized zones.

Mine dumps from historical mining

activities are scattered across a significant portion of the Property. New Pacific has collected a total of 1,408 grab samples from historical

mine dumps. The majority of samples collected were remnants of high-grade narrow veins extracted from underground mining activity. Of

the 1,408 samples collected from historical mine dumps to date, 439 samples (31%) returned assay results between 30 and 3,290 grams per

tonne (g/t) Ag with an average grade of 194 g/t Ag.

Assay results of underground chip

samples and surface mine dump grab samples show that silver mineralization widely occurs in the wall rocks of the previously mined-out

high-grade veins in the abandoned ancient underground mining works.

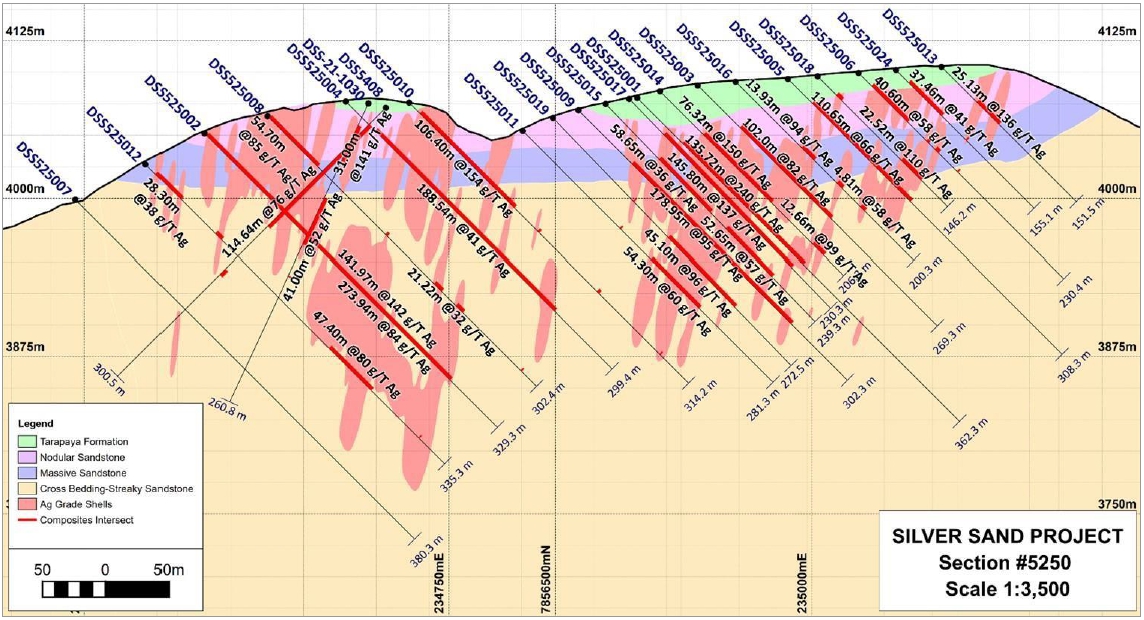

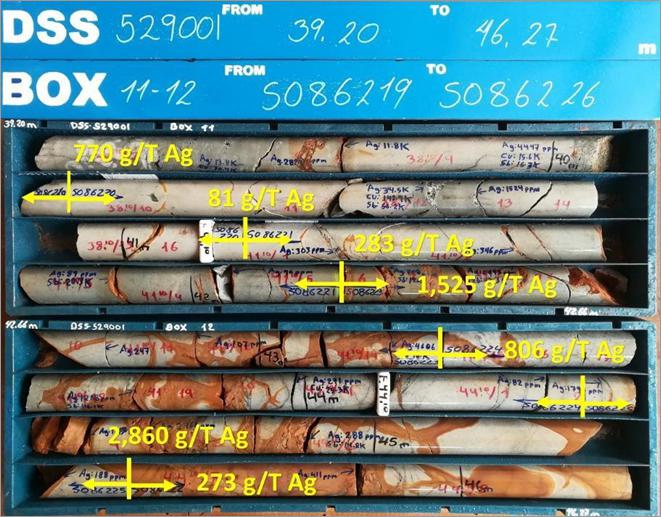

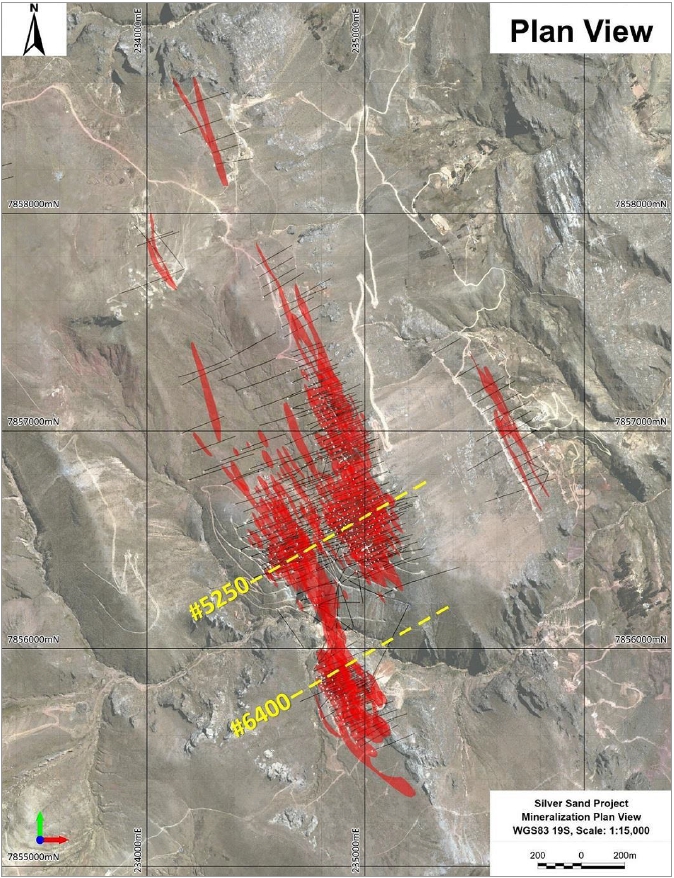

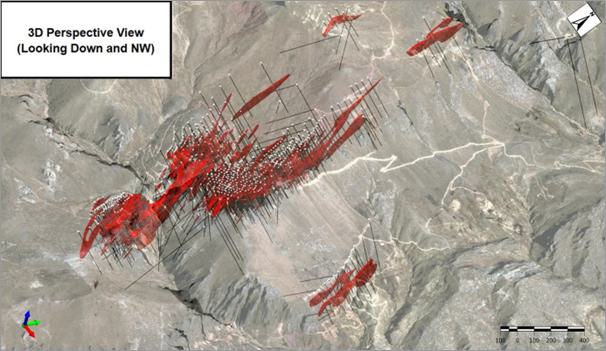

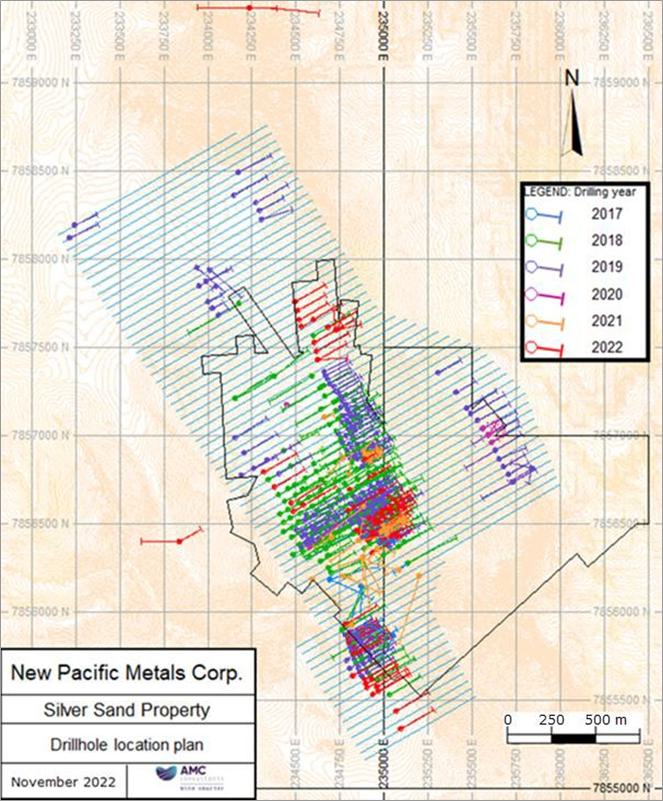

From October 2017 to July 2022,

New Pacific conducted intensive diamond drilling programs on the Property totalling 139,920 m in 564 drillholes. A total of 523 HQ diamond

holes for a total metreage of 128,074 m was drilled over the Silver Sand core area to define the mineralization. After drilling specific

exploration targets, holes were drilled on a 50 m x 50 m grid to delineate the spatial extensions of the major mineralized zones. This

was followed up by drilling on a nominal 25 x 25 m grid, infilling defined areas of mineralization. Drilling was halted during 2020 and

part 2021 due to COVID-19 protocols and recommenced later in 2021.

All holes were drilled from the surface.

Drillholes were drilled up to 545 m deep at inclinations between -45° and -80° towards azimuths of 060° (~NE) and 220°

(~SW) to intercept the principal trend of mineralized vein structures perpendicularly.

The drilling programs have covered

an area of approximately 1,600 m long in the north-south direction and 800 m wide in the east-west direction and have defined silver mineralization

at the Silver Sand deposit over an oblique strike length of 2 km, a collective width of 650 m and to a depth of 250 m below surface.

Drill coring was completed using

conventional HQ (64 millimetre (mm) diameter) equipment and 3 m drill rods. Drill collars are surveyed using a Real-Time Kinematic differential

global positioning system (GPS), and downhole deviation surveys are completed by the drilling contractor using a REFLEX EZ-SHOT and SPT

GyroMaster downhole survey tools. Drillholes are surveyed at a depth of approximately 20 m, and on approximately 30 m intervals as drilling

progresses. Upon completion of each drillhole a concrete monument is constructed with the hole details inscribed.

Core is collected by New Pacific

personnel and drill core containing visible mineralization is wrapped in paper to minimize disturbance during transport. Logging is both

carried out at the rig where a quick log is completed, and after transportation to the company’s Betanzos core processing facility,

which is located approximately 1.5 hours drive from the Property. Currently data is directly collected or loaded into MX Deposit a database

software from Sequent.

In addition to drilling in the Silver

Sand core area, drilling was carried out at Snake Hole (32 drillholes for 7,457 m) and at the northern prospects, (nine drillholes for

4,298 m). These holes

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

were more exploratory in nature

but the same procedures as the grid drilling in the core area were employed.

Core recovery from the drill programs

varies between 0% (voids and overburden) and 100%, averaging 97%. More than 92% of core intervals have a core recovery of greater than

95%.

| 1.7 | Sample preparation, assay, and QA/QC |

New Pacific has developed and implemented

good standard procedures for sample preparation, analytical, and security protocols.

New Pacific manages all aspects

of sampling from the collection of samples, to sample delivery to the laboratory. All samples are stored and processed at the Betanzos

facility. This facility is surrounded by a brick wall, has a locked gate, and is monitored by video surveillance and security guard 24

hours a day, seven days a week. Within the facility, there are separate and locked areas for core logging, sampling, and storage.

Samples are transported on a weekly

basis by New Pacific personnel from the Betanzos facility to the ALS laboratories (ALS) in Oruro, Bolivia for sample preparation, and

then shipped to ALS in Lima, Peru for geochemical analysis. ALS Oruro and ALS Lima are part of ALS Global – an independent commercial

laboratory specializing in analytical geochemistry services, all of which are accredited in accordance with ISO/IES 17025:2017, and are

independent of New Pacific.

All core, chip, and grab samples

are prepared using the following procedures: (1) crush to 70% less than 2 mm; (2) riffle split off 250 g; and (3) pulverize split to better

than 85% passing a 75-micron sieve.

Sample analysis in 2017 and 2018

comprised an aqua regia digest followed by Inductively Coupled Plasma (ICP) Atomic Emission Spectroscopy (AES) analysis of Ag, Pb, and

Zn (ALS code OG46). Assay results greater than 1,500 g/t Ag were sent for fire assay and gravimetric finish analysis. In 2019 New Pacific

changed its analysis protocol to include systematic multielement analysis for an initial 51 element ICP mass spectroscopy (MS) analysis.

Over-limit samples were handled differently for different elements and protocols were further amended for the 2021-2022 drilling.

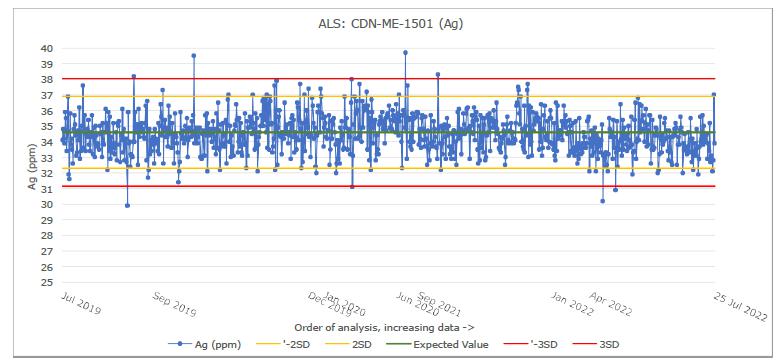

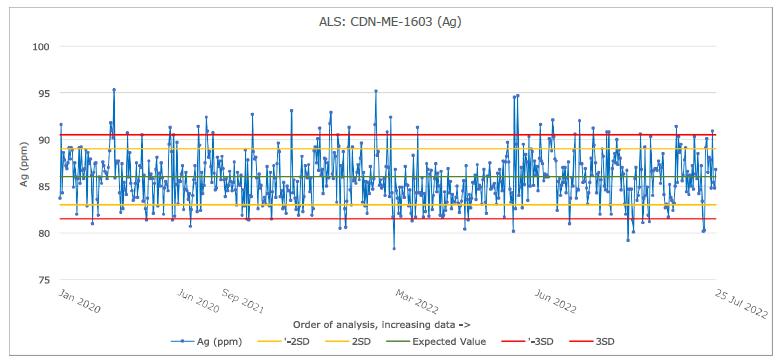

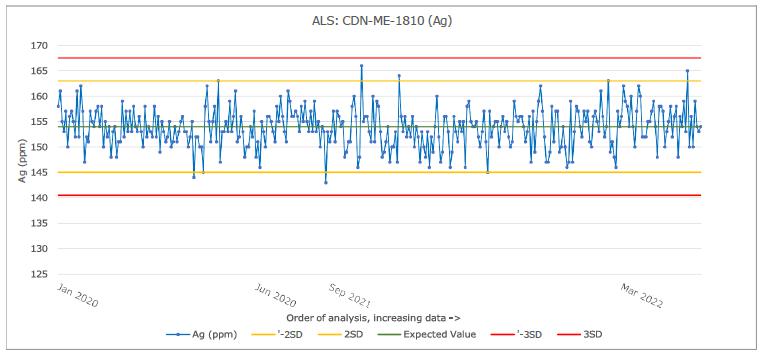

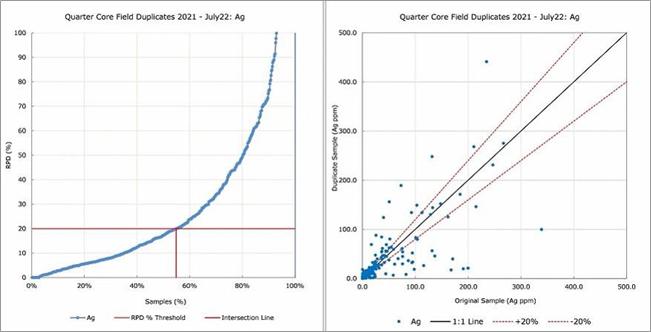

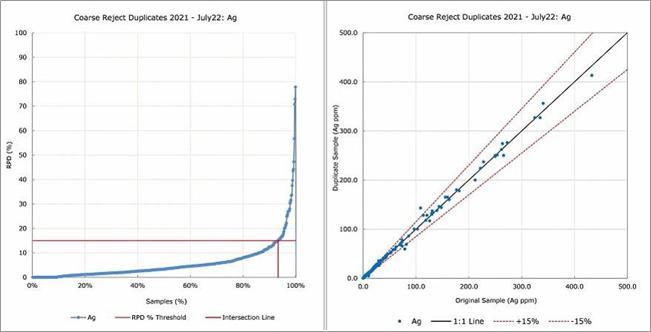

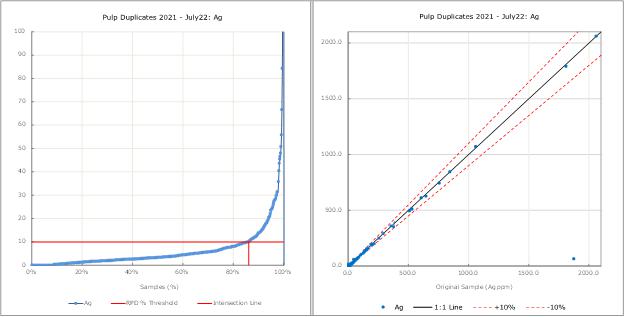

Drill programs have included Quality

Assurance / Quality Control (QA/QC) monitoring programs which have incorporated the insertion of certified reference materials (CRMs),

blanks, and duplicates into the sample streams, and umpire (check) assays at a separate laboratory at different times.

Four different CRMs have been used

throughout the project history. A total of 4,495 CRMs was submitted between October 2017 and July 2022 representing an average overall

insertion rate of 5%. Insertion rates for CRMs have been consistently above 5% on a yearly basis with the exception of 2019.

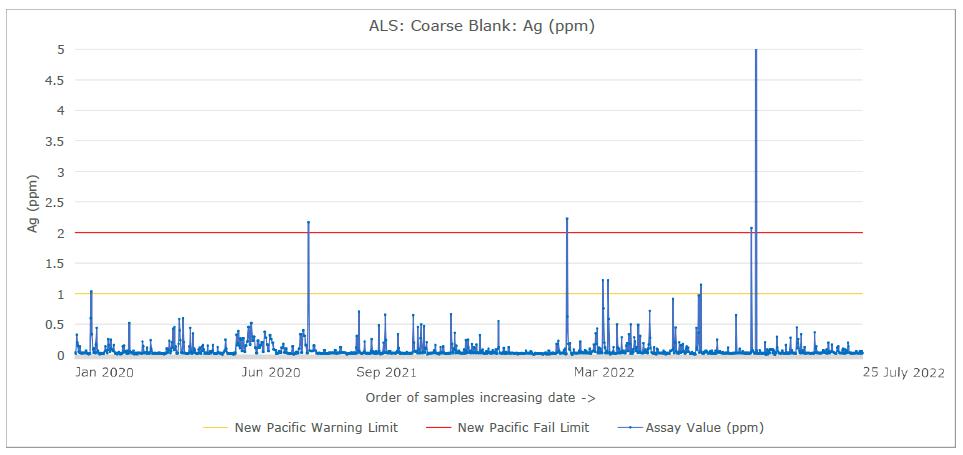

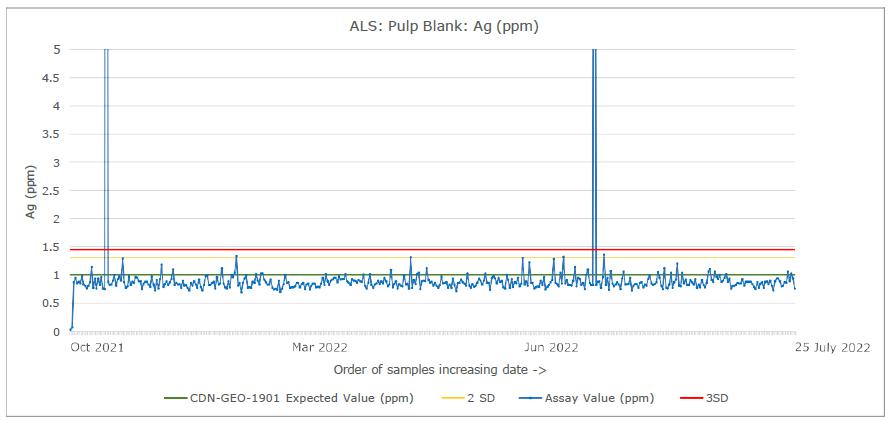

Blank material from two different

quarry sites has been used over time and coarse blanks have been inserted consistently at an acceptable insertion rate. While there have

been some changes in failure criteria, there has been no evidence of systemic contamination and failures are dealt with by a re-assay

protocol. Pulp blank samples have been inserted since 2021, but at a low insertion rate of less than 2.5%. Duplicates are also inserted,

comprising field duplicates, coarse duplicates and pulp duplicates. In 2021 and 2022 they have been consistently included but at a rate

of between 3.65% and 4.07%. Coarse rejects were also submitted to Actlabs Skyline as umpire samples in the 2017 to 2019 period. Actlabs

Skyline is an independent geochemical laboratory certified according to ISO 9001:2015.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

The Qualified Person (QP) has reviewed

the QA/QC procedures used by New Pacific including certified reference materials, blank, duplicate and umpire data and has made some recommendations.

The QP does not consider these to have a material impact on the Mineral Resource estimate and considers the assay database to be adequate

for Mineral Resource estimation. The QP considers sample preparation, security, and analytical procedures employed by New Pacific to be

adequate.

The Mineral Resource estimate

was completed using 556 drillholes on the Property comprising 136,220 m of diamond core and 92,164 assays. Grade interpolation was completed

for silver, lead, zinc, copper, arsenic, and sulphur. Only silver is reported as it is the only economic metal. All estimation utilized

ordinary kriging (OK) except for 127 small domains which were estimated using the inverse distance squared (ID2)

method.

The mineralization domains were

built by New Pacific using Leapfrog Geo 4.0 software. The mineralization domains were reviewed and accepted by the QP with some changes,

including separating the main domain into two areas based on vein orientation.

The QP estimated into these domains

and also estimated a background block model that was combined with the domain mineralization to form the final block model.

New Pacific performed 6,297

bulk density measurements on the core drilled on the Property. As the mineralization is hosted in one rock type, after reviewing the

density data, the QP assigned a single bulk density measurement to the block model of 2.54 t/m3.

The pit-constrained Mineral Resources

are reported for blocks above a conceptual pit shell based on a US$22.50/ounce silver price. There is not a reporting restriction to within

the AMC claim boundary as in the 2020 Technical Report as an agreement has been reached with COMIBOL in regard to the surrounding MPC.

The cut-off applied for reporting

the pit-constrained Mineral Resources is 30 g/t silver. Assumptions made to derive a cut-off grade (COG) included mining costs, processing

costs and recoveries and were obtained from comparable industry situations. The model is depleted for historical mining activities. The

assumptions are shown in Table 1.1.

| Table 1.1 |

Assumptions for pit optimization |

| Input |

Units |

Value |

| Silver price |

$/oz Ag |

22.5 |

| Silver process recovery |

% |

91 |

| Payable silver |

% |

99 |

| Mining recovery factor |

% |

100 |

| Mining cost |

$/t mined |

2.6 |

| Process cost |

$/t minable material > COG |

16 |

| G&A cost |

$/t minable material > COG |

2 |

| Slope angle |

degrees |

44 - 47 |

Notes:

| · | Sustaining capital cost has not

been included. |

| · | Measured, Indicated and Inferred

Mineral Resources included. |

Source: AMC Mining Consultants (Canada) Ltd., 2022.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

The Mineral Resource for the Silver

Sand deposit has been estimated by Ms Dinara Nussipakynova, P.Geo. Principal Geologist of BBA, formerly employed with AMC Consultants,

who takes responsibility for the estimate.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

| Table 1.2 |

Mineral Resource as of 31 October 2022 |

| Resource category |

Tonnes (Mt) |

Ag (g/t) |

Ag (Moz) |

| Measured |

14.88 |

131 |

62.60 |

| Indicated |

39.38 |

110 |

139.17 |

| Measured & Indicated |

54.26 |

116 |

201.77 |

| Inferred |

4.56 |

88 |

12.95 |

Notes:

CIM Definition Standards (2014) were used for

reporting the Mineral Resources.

| · | The QP is Dinara Nussipakynova, P.Geo. of BBA, formerly employed with AMC Consultants. |

| · | Mineral Resources are constrained by optimized pit shells at a metal price

of US$22.50/oz Ag, recovery of 91% Ag, and COG of 30 g/t Ag. |

| · | Drilling results up to 25 July 2022. |

| · | The numbers may not compute exactly due to rounding. |

| · | Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability. |

| Source: AMC Mining Consultants (Canada) Ltd., 2022. |

Open pit life-of-mine (LOM) plans

and resulting open pit Mineral Reserves are determined based on a silver price of US$23.00/oz. Reserves stated in this report are dated

effective as of 19 June 2024. The mine design and Mineral Reserve estimate have been completed to a level appropriate for pre- feasibility

studies.

Ore is converted from Mineral Resource

to Mineral Reserve based primarily on positive cash flow pit optimization results, pit design, and geological classification of Measured

and Indicated resources. The in-situ value is derived from the estimated grade and certain modifying factors.

In the process of estimating the

Mineral Reserves, dilution and mining recovery factors were applied to the Mineral Resource using a block model regularization process.

AMC Consultants regularized the resource model to a uniform size of 5 m x 5 m x 5 m to better reflect the minimum parcel size that can

selectively be mined.

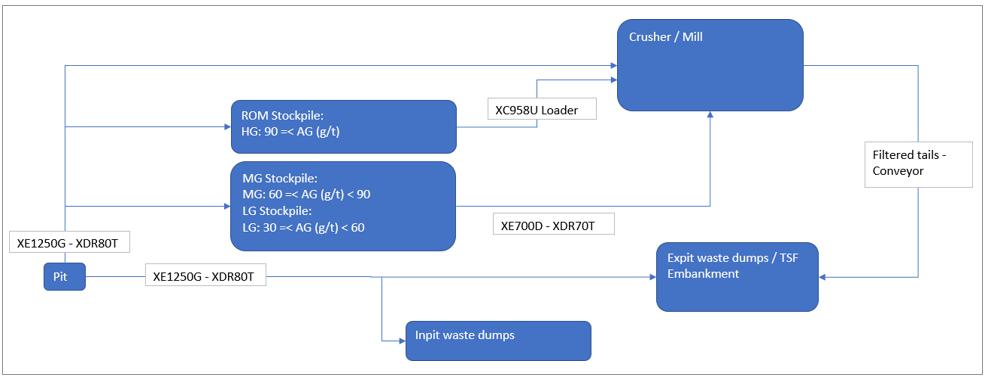

The Silver Sand project will be

mined using a conventional open pit mining method, utilizing 115 t hydraulic backhoe excavators and haulage by off-highway 72 t capacity

rear dump haul trucks. Mining is anticipated to be completed by a contract mining company. The majority of the excavated material will

require drilling and blasting. Drilling and blasting will be performed on 10 m benches. Flitch height is variable depending on the material

being mined. Overburden and waste will be mined in 5 m flitches and ore is to be mined in 3.3 m flitches. Ore will be hauled to a crusher

or to run-of-mine (ROM) stockpiles. Waste will be hauled to external and in-pit waste rock dumps.

The pseudoflow pit optimization

algorithm, as implemented in GEOVIA Whittle software, was used to determine the ultimate pit shell for Silver Sand. The selected pit shells

were then used to produce pit designs and the mining schedule.

The open pit Mineral Reserves are

reported within a pit design based on open pit optimization results. The Mineral Reserves represent the economically mineable part of

Measured and Indicated Mineral Resources and are presented in Table 1.3.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Table 1.3 |

Mineral Reserve estimate as of 19 June 2024 |

| |

Tonnes (Mt) |

Ag (g/t) |

Ag (Moz) |

| Proven |

15.09 |

121 |

58.84 |

| Probable |

36.92 |

98 |

116.58 |

| Proven & Probable |

52.01 |

105 |

175.42 |

Notes:

| · | CIM Definition Standards (2014) were used for reporting the Mineral Reserves. |

| · | The Qualified Person is Wayne Rogers, P.Eng. of AMC Consultants. |

| · | Cut-off

grade of 27 g/t Ag for material inside the AMC, and 29 g/t Ag outside the AMC limit based

on operating costs of 16.71 US$/t of ore, 91% Ag metallurgical recovery, 0.50 US$/oz Ag treatment

and selling costs, 6% royalty within AMC, 12% royalty outside AMC, and 99.00% payable silver. |

| · | Ag price assumed is US$23.00 per troy ounce. |

| · | Base mine unit cost of 2.00 $/t mined plus an incremental mining cost of 0.04 $/t mined per 10 m bench. |

| · | Ore mining costs including a process unit cost of 14.20 $/t milled, TSF 0.65 $/t milled, and G&A

1.86 $/t milled. |

| · | Mineral Reserves include dilution and mining recovery. |

| · | Reserves are converted from Resources through the process of pit optimization,

pit design, production schedule, and supported by a positive cash flow model. |

| · | The totals may not sum due to rounding. |

| · | Probable Mineral Reserves are based on Indicated Mineral Resources only. |

| · | Proven Mineral Reserves are based on Measured Mineral Resources only. |

| · | Ag metal (Moz) represents contained

metal. |

Source: AMC Mining Consultants (Canada) Ltd., 2024.

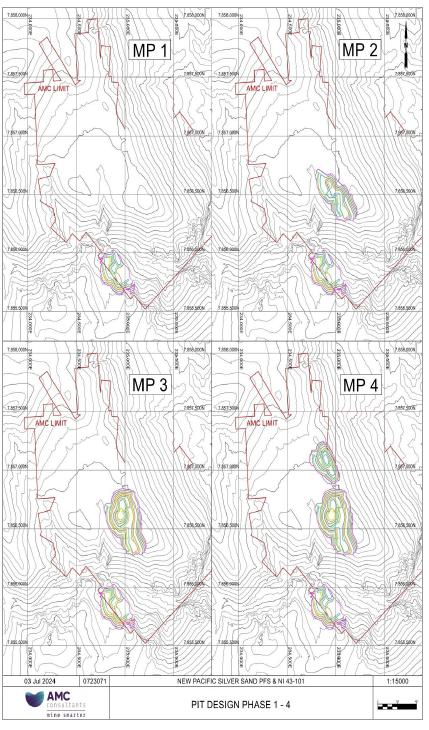

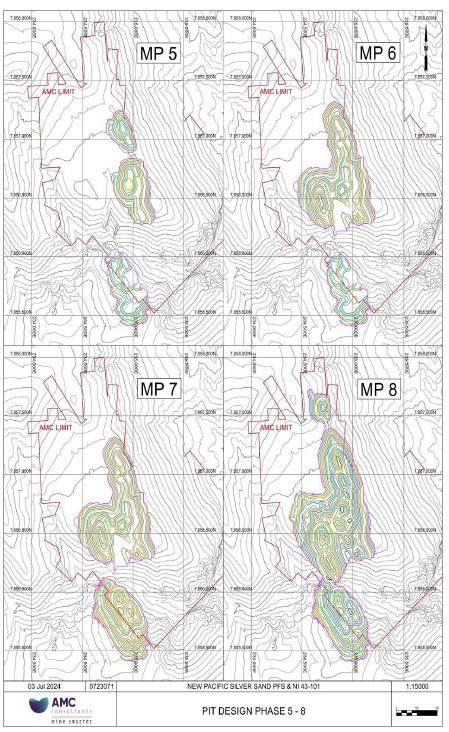

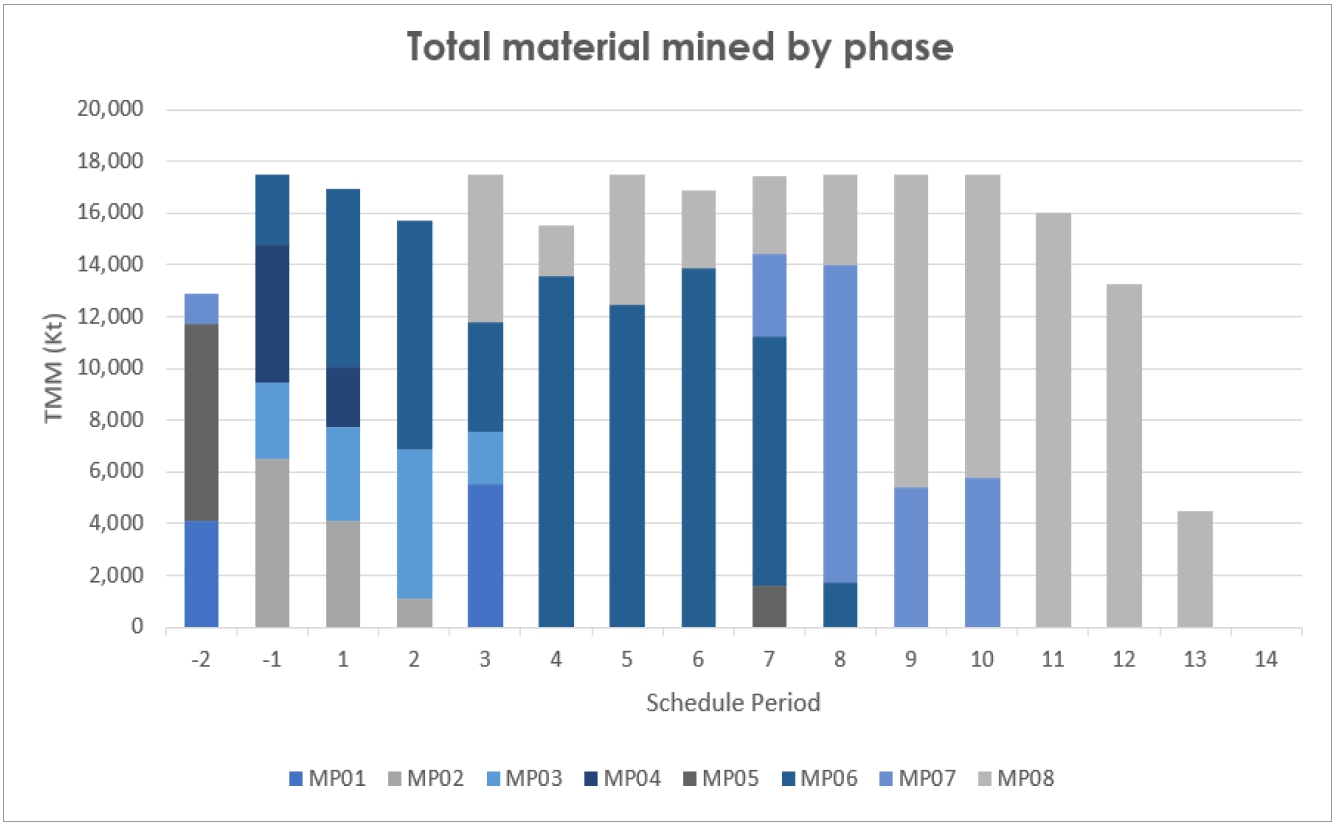

The Silver Sand open pit is comprised

of one main pit that is split into eight sub-phases (MP1-8). It will be mined using a conventional open pit approach of drilling and blasting

ore and waste rock, with material mined by hydraulic excavators loading into off-highway rear dump haul trucks.

The open pit will be dewatered using

horizontally drilled drain holes and pumping from sumps. Where possible, diversion ditches will be built upslope of the pit to divert

non-contact water. The dewatering plan is staged to incorporate additional dewatering measures as the mine plan expands over the life-of-mine

(LOM). Additional work is recommended as part of future studies to improve the understanding of the shallow groundwater system, dewatering

conditions required for major and local fault structures, and the overall hydrogeological system.

For the PFS study, the geological

model, structural models, hydrogeological model, and rock mass characterization have been developed with variable levels of confidence.

The 3D geotechnical model has allowed the geotechnical slope design parameters to be developed. The pit design criteria are appropriate

and comply with industry norms. Methodologies used for the slope design are sound and to international standards. The extent of the weathered

horizon and slope stability under seismic conditions have not been considered in the geotechnical slope design and should be explored

in future studies.

The pit was designed with 20 m high

benches (10 m double benches). Pit ramps were designed with a maximum gradient of 10%, at 21 m wide for double-lane traffic and 12 m wide

for single-lane traffic. The bottom three benches of the pit were designed with single-lane access, with one final sub-excavation bench

(also known as a “goodbye cut”) in the final pit floor. The pit is approximately 2,300 m in length, 350 m to 700 m in width,

and 280 m at its deepest point.

The open pit contains approximately

52.0 Mt of ore with a grade of 105 g/t Ag and 181.9 Mt of waste material, with an overall waste to mineralized material strip ratio of

3.50 to 1.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

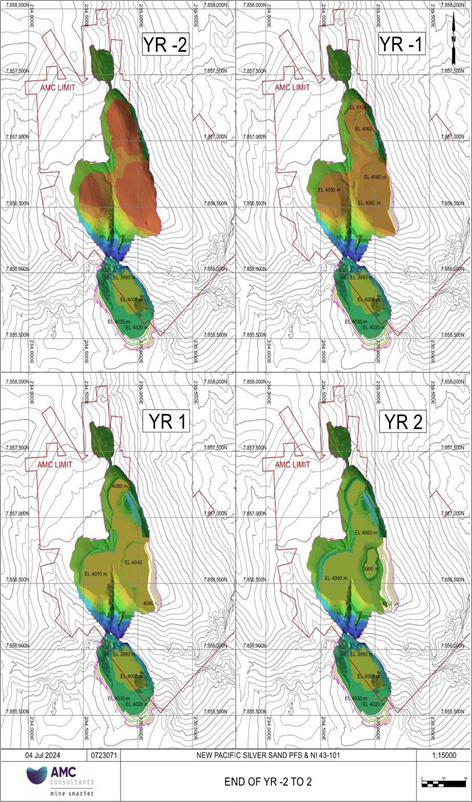

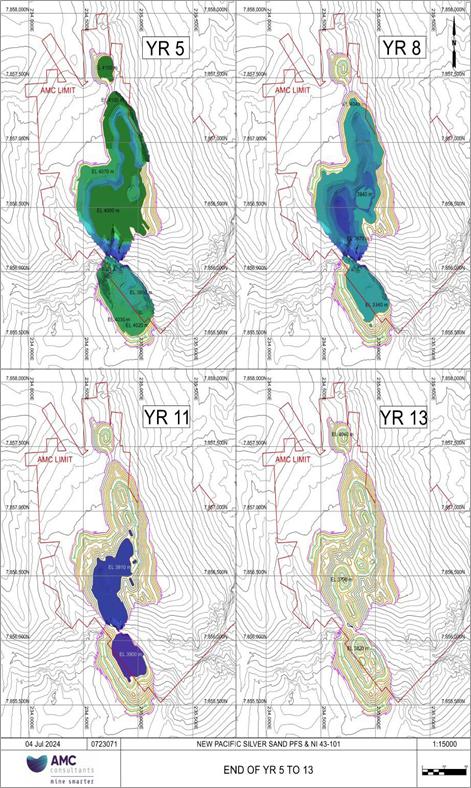

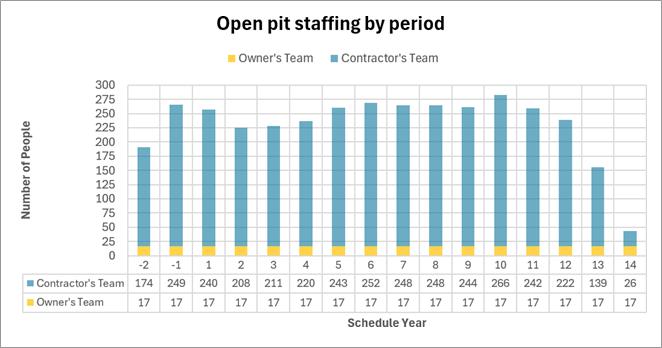

The open pit operation includes

a two-year pre-production period (Years -2 & -1) and 13 years of production.

During the pre-production period,

the schedule is driven predominately by waste stripping to achieve tailings storage facility (TSF) embankment construction requirements.

Other activities during the pre-production period include haul road construction, mine development, and some ore stockpiling.

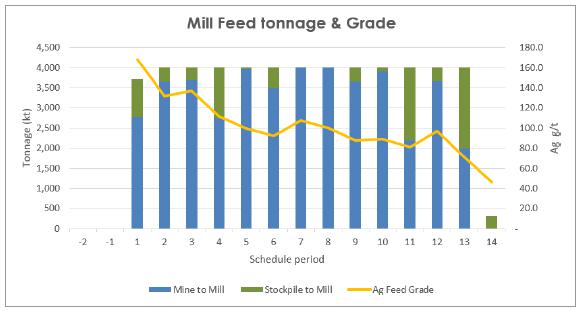

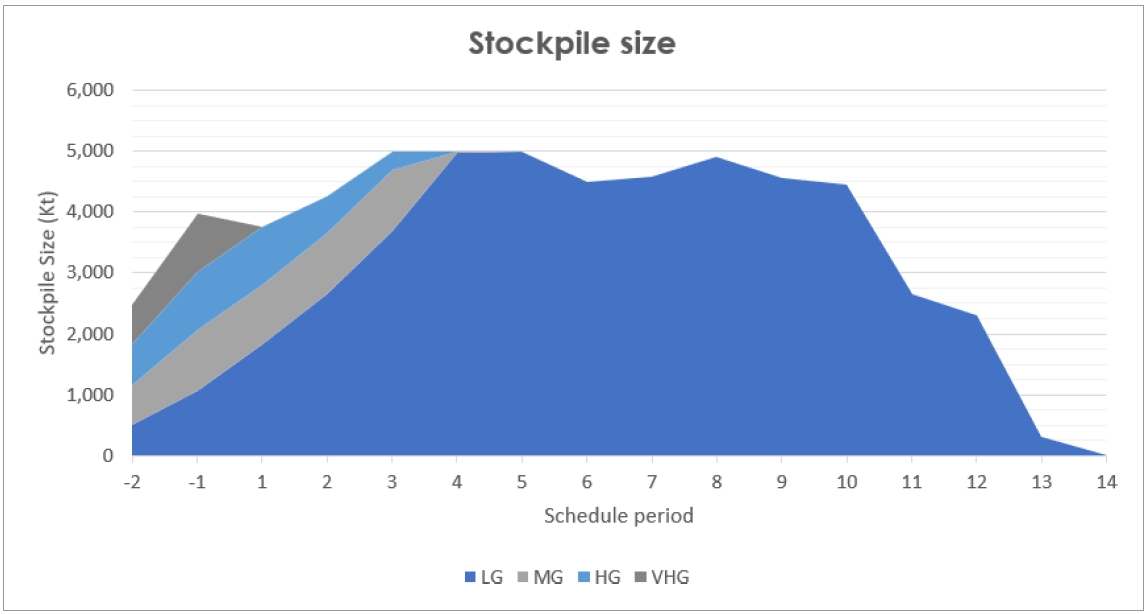

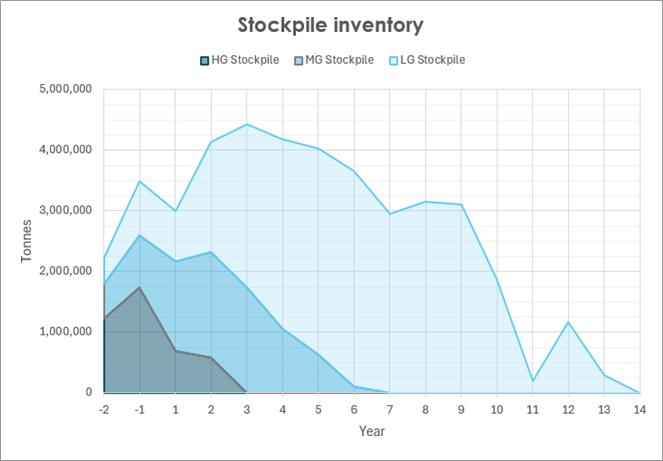

ROM stockpiles will be constructed

near the plant for low-grade, medium-grade, and high-grade ore. The ore stockpiles will be used to allow for blending of the different

grades of ore to provide a constant feed grade to the plant for sustained periods which will assist in maximizing metallurgical recovery.

A maximum long-term stockpile capacity of 4.40 Mt is required.

Six dumping areas for waste material

are planned; these include two in-pit dumps and four external dumps. Upstream of the open pit, a water dam will be constructed in the

Machacamarca Creek valley using waste rock from initial waste stripping. The Valley dump, located north of the water dam, will also be

constructed to establish access to the mining phases north of the creek. Waste material will also be used to construct the embankment

for the TSF. Later in the mine life, waste will be dumped into depleted pits to take advantage of shorter haul distances.

An ex-pit production rate of 18.0

Mtpa is adequate to achieve the plant feed target of 4.0 Mtpa. MP1, MP5, and MP7 are mined first in Year -2 and waste material from these

phases is used to construct the water dam and TSF embankment. Two years of pre-production mining are required to achieve the TSF embankment

and water dam construction requirements. Once the water dam is constructed, higher-value phases MP2, MP3, and MP4 are mined as the mining

schedule targets high-grade and low strip-ratio ore. Mining in MP7 is expedited to take advantage of short-hauling waste from MP8, towards

the end of mining.

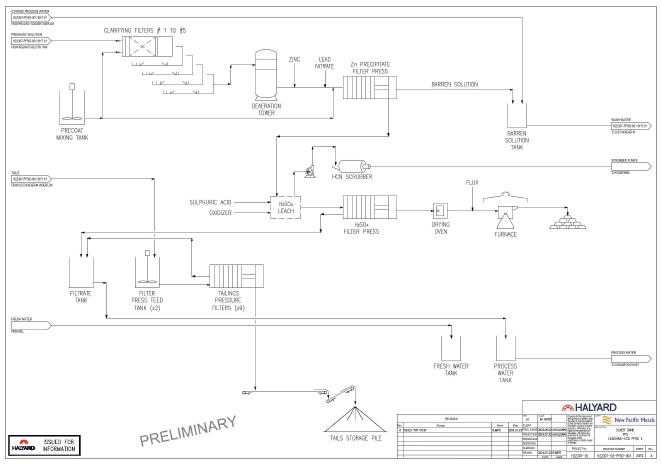

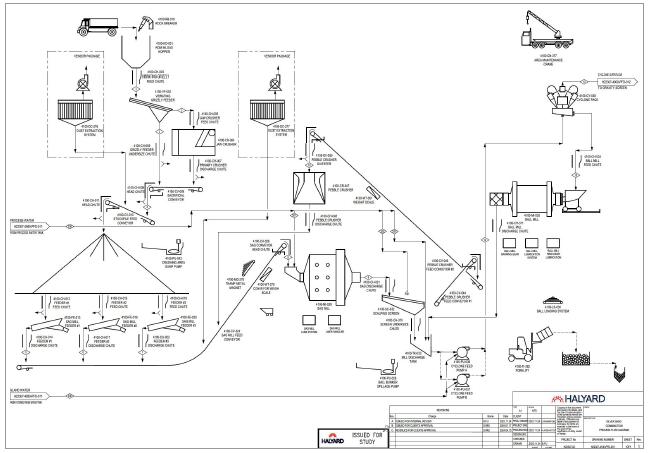

| 1.11 | Processing and metallurgy |

The results of PFS metallurgical

testwork (described in Section 13) have been used together with previous (PEA) testwork to progressively de-risk a straightforward mineral

processing flowsheet for the Silver Sand project. Interpretation of this testwork has been used as the basis for PFS level process design

criteria (PDC), mass / water / metal balances, process flowsheet and equipment specification. The PFS process plant flowsheet is described

in detail in Section 17.

The 2022 PEA conclusions regarding

the process flowsheet and equipment type have been validated by the work completed as part of the PFS. In addition, more comprehensive

sample collection and characterization of these samples have enhanced the metallurgical body of knowledge for the project and allowed

further optimization of input parameters such as grinding size, leaching time, cyanide dosage, and oxygen levels.

Agitated tank cyanidation, followed

by counter current decantation (CCD) and zinc precipitation is still considered the optimum processing route when factors such as updated

metallurgical performance, capital costs, and mine production schedules are considered. Various parameters affecting the performance of

this flowsheet have been adjusted and updated, and the PFS base case represents a further de-risking of the processing aspects of the

project.

The selected flowsheet represents a very conventional, proven

approach to silver extraction that is similar to other operations in Bolivia. The flowsheet consists of the following unit operations:

| · | ROM receiving, single stage (primary) crushing, and crushed rock storage. |

| · | Stockpile discharge, grinding via SAG milling and ball milling. |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| · | SAG mill pebble crushing via SAG mill pebble ports, scalping screen, recycle

conveyors, and cone crusher. |

| · | Pre-leach thickening of the classified mill circuit product, and cyanide

leaching of the thickener underflow using agitated, oxygen sparged tanks. |

| · | Liquid / solid separation using a four-stage CCD circuit. |

| · | Recovery of silver from pregnant leach solution using a zinc precipitation

process followed by drying and smelting with fluxes to produce silver doré bars. |

| · | Thickening and filtration of leach residues. |

| · | Conveying of filter cake and long-term storage at the tailings storage area. |

As copper will be recovered into

solution along with silver, and some dissolved copper is expected to be cemented together with silver, a small copper removal leach circuit

will be required within the refinery to maintain good doré quality and/or reduce circulating copper concentrations.

The PFS flowsheet is projected

to recover an average of 90% silver into a doré product for export to established international markets.

As a greenfield project, the Silver

Sand project will require the development of supporting infrastructure. The Property is accessible from Potosí via a 54 km long

road made up of a 27 km stretch of the paved Bolivia National Highway 5 and an all-season gravel road built for mining in the Colavi District.

The gravel road is currently being widened and upgraded to a paved road by the government.

The Silver Sand

project is estimated to require a power supply of approximately 25 megawatts (MW) of electricity, which will be provided by

Bolivia’s national power supply company, ENDE Transmission S.A (ENDE). A preliminary power supply plan between ENDE and New

Pacific has been agreed upon and the Company has submitted a power supply application to the Bolivia Ministry of Energy.

The new 55 km 115 kV transmission

line will connect the existing ENDE Potosí substation and a new substation that will be constructed at the Silver Sand site. ENDE

has provided a quotation to the Company for the construction of the power line and the substation. Additionally, ENDE will be responsible

for permitting and constructing the transmission line and the substation, which is estimated to take up to two years.

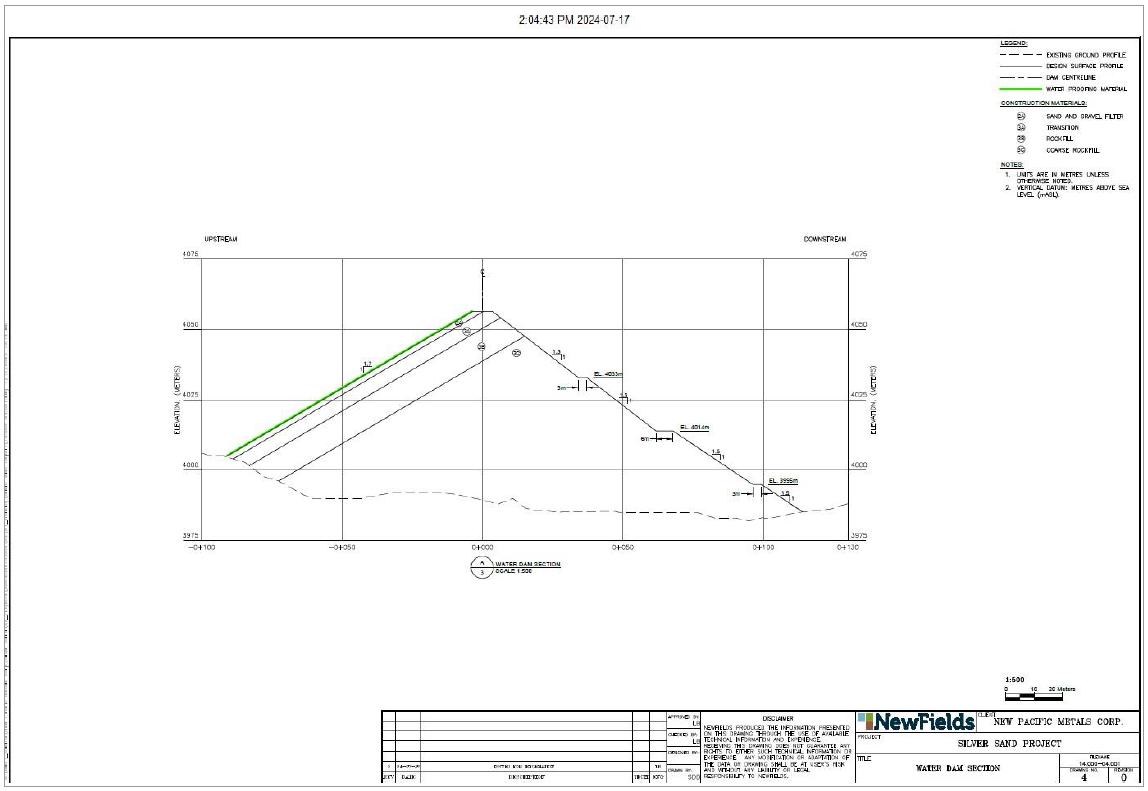

A rockfill water dam with an upstream

geomembrane liner will be built upstream from the mine. The reservoir developed behind the dam will have a maximum capacity of approximately

3.0 million cubic metres and will provide water for the project.

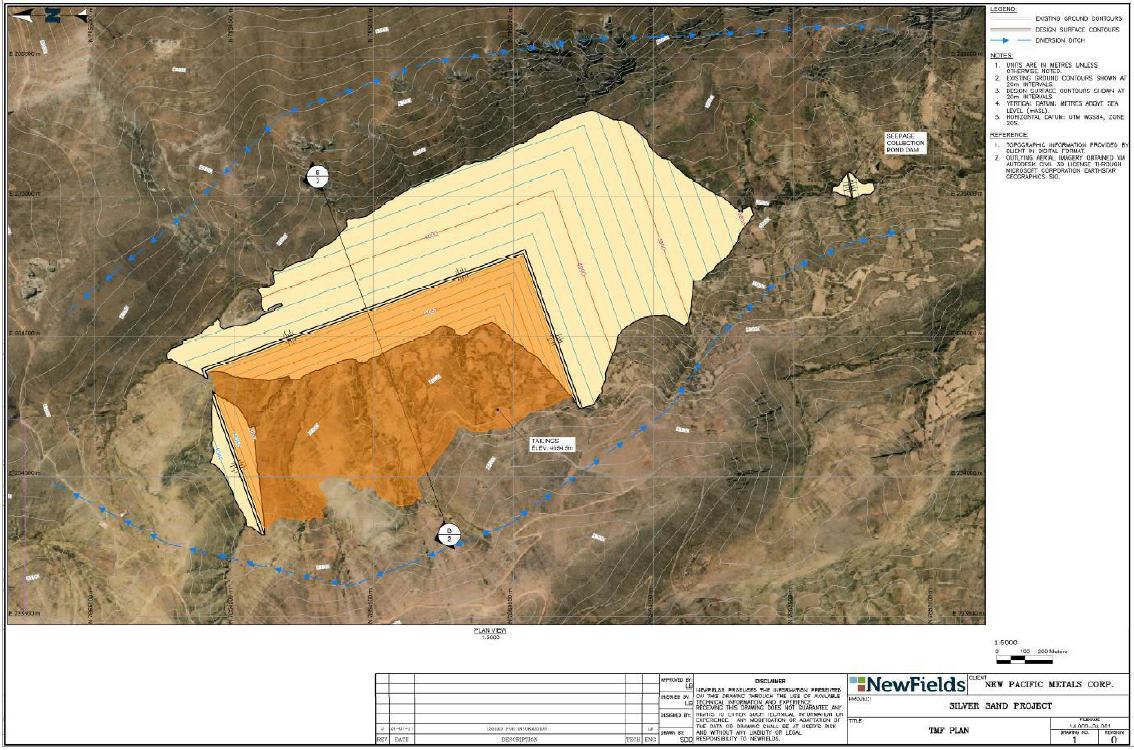

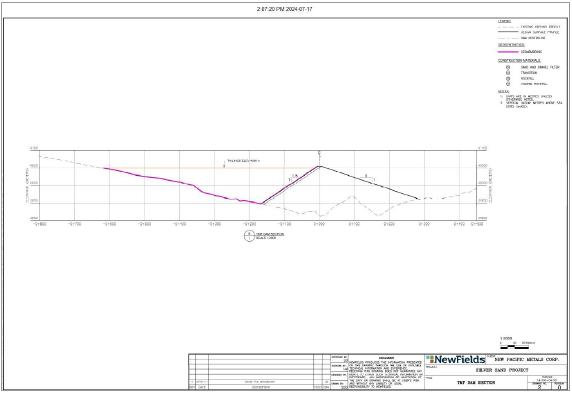

The filtered tailings storage facility

will be integrated within the waste rock storage area and located to the south of the mine and process plant. The TSF will be fully lined

to protect the local surface and groundwater systems. A leachate collection system will be installed below the liner system to collect

any seepage and direct it to the run-off collection ponds.

An initial berm of mine waste rock

will be constructed on the south and east sides of the TSF to provide structural support for the tailings and liner system.

A starter TSF cell will be developed

along the western perimeter of the waste rock storage facility, with sufficient capacity to store tailings from the first year of operations.

The perimeter of the TSF will be raised as waste rock becomes available from mining operations and the liner system is extended over the

operating life of the mine.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

It is expected that most project

employees will commute from Potosí or other nearby communities. However, a camp with capacity for 100 people has been projected

for workers not residing in the local area.

Other infrastructure such as offices,

mobile equipment maintenance shop, fuel storage, warehouse, and laboratory are envisaged to be built close to the processing plant.

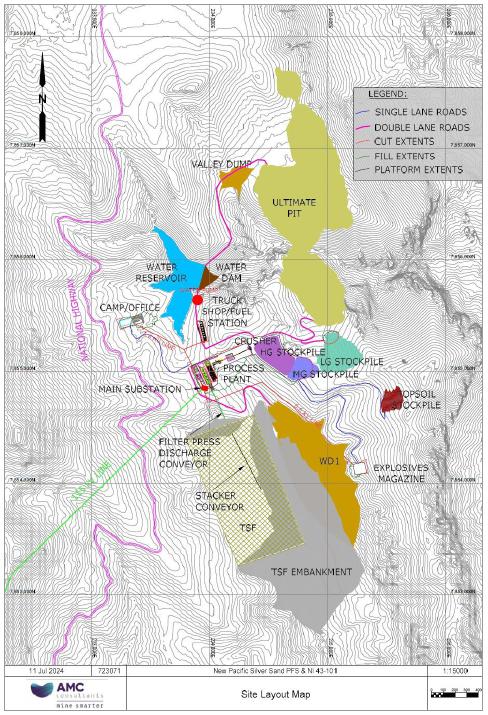

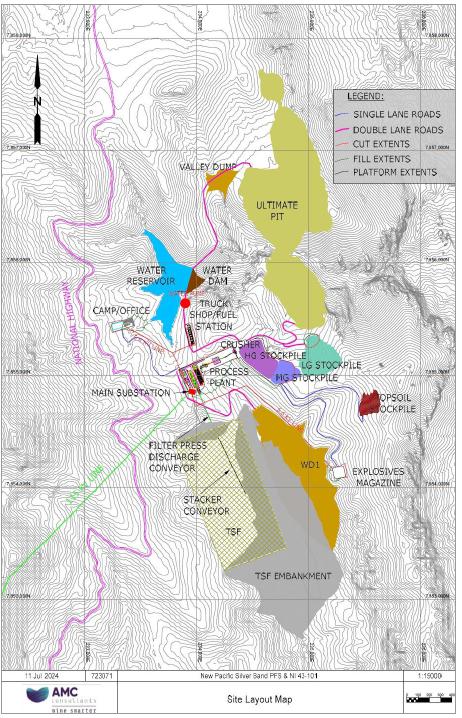

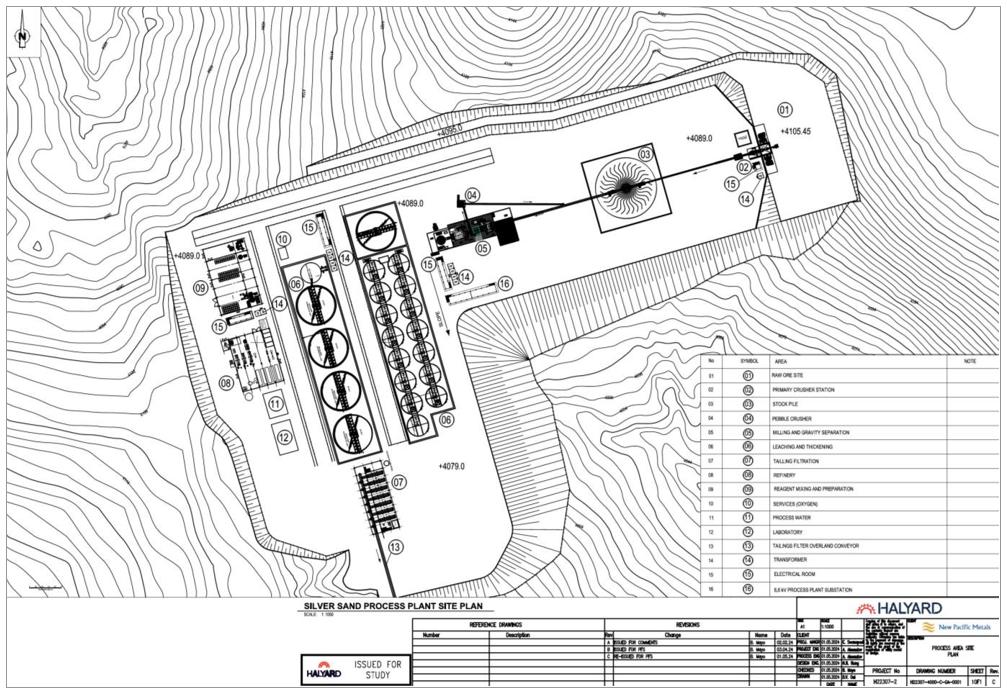

Figure 1.1 shows the proposed site

layout with open pits, waste dumps, process plant, filtered TSF, ore stockpile area, crusher, site access road, and haul roads.

| Figure 1.1 |

Preliminary site infrastructure layout |

Source: AMC

Mining Consultants (Canada) Ltd., 2024.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| 1.13 | Environmental studies, permitting and social or community impact |

To obtain the environmental license

for the Arena de Plata (Silver Sand) mining project in the department of Potosí, New Pacific is preparing studies and activities

that will allow it to provide a comprehensive Analytical Environmental Impact Assessment Study (EEIA-AI) in accordance with the current

environmental legislation in force in the Plurinational State of Bolivia.

Following the completion of the

EEIA-AI, New Pacific will commence the mandatory public consultation process, which occurs late in the Bolivian mine permitting process.

A notarized act is formed as part of the consultation process. It is a legal document that will contain the points and aspects of conformity

and observations of the community on the mining operation in public ponsultation and the socio-environmental impact that it could generate.

The mining law in Bolivia establishes

that a mining operator must establish an accounting provision to cover the cost of closing operations, however, it does not establish

other environmental guarantees as is the case in other countries in the Andean region.

| 1.14 | Capital and operating costs |

All currency is in US dollars (US$)

and cost estimates are based on prices obtained during the second quarter of 2024. Costs for the project have been estimated based on

a hybrid owner- contractor project delivery model.

The responsibility of providing

various capital and operating cost inputs for the project financial model are as follows:

| · | Mining – Costs related to the development

and operation of the open pit mine, surface haul roads, and stockpiles were developed by AMC Consultants. QP Mr W Rogers has relied on

HydroTechnica Ltd. to develop mine dewatering cost but accepts them as reasonable and takes responsibility for them. |

| · | Processing – Costs related to the construction

and operation of mineral processing infrastructure were developed by Halyard Inc. QP Mr A. Holloway takes responsibility for those costs. |

| · | Tailings storage & the water dam –

Costs related to the transportation and storage of tailings and the water dam were developed by NewFields Canada Mining & Environment

ULC. QP Mr L. Botham takes responsibility for those costs. |

| · | Site infrastructure – Costs related to

the deployment of site infrastructure and earthworks to support the on-site camp, mobile maintenance workshop, explosives storage, fuel

storage infrastructure, transmission infrastructure, communications, and network infrastructure were developed by AMC Consultants. QP

Mr M. Molavi takes responsibility for those costs. |

| · | General & Admin – Costs related

to permitting, community compensation and projects, logistics, administration, and labour were developed by New Pacific. QP Mr W Rogers

takes responsibility for those costs. |

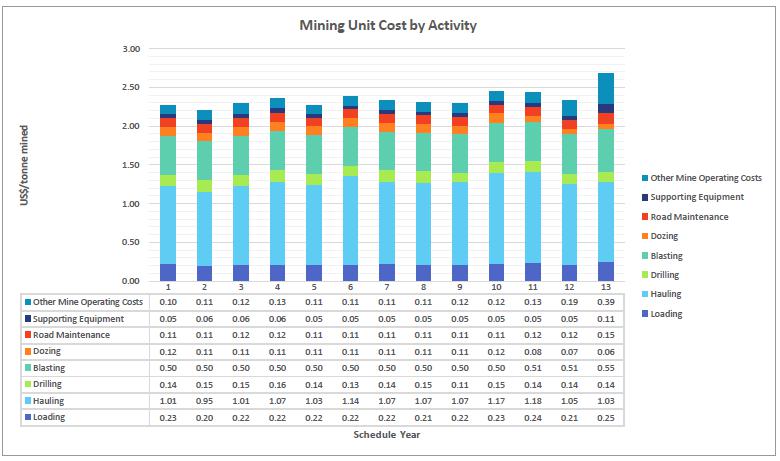

The operating cost estimate allows

for all labour, equipment, supplies, power, consumables, supervision, technical services, as well as general and administrative (G&A)

costs. The total operating cost was estimated at 1,281 US$ million, excluding capitalized operating costs. The estimared average operating

cost over the LOM can be expressed as 8.16 US$/troy oz. of silver produced and as 24.63 US$/tonne milled. An overview of average LOM costs

by activity is presented in Table 1.4.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Table 1.4 |

Average LOM unit operating cost summary |

| Operating cost category |

Total costs |

Cost per payable oz produced |

Cost per tonne |

| US$M |

US$/troy oz |

US$/tonne milled |

| Mining |

482 |

3.07 |

9.28 |

| Processing & tailings |

713 |

4.54 |

13.71 |

| G&A |

86 |

0.54 |

1.65 |

| Total operating cost |

1,281 |

8.16 |

24.63 |

Note: Totals may not add up exactly due

to rounding.

Source: AMC Mining Consultants (Canada) Ltd., 2024.

Initial project development capital

costs for the Silver Sand project are estimated to be $358.3 M and sustaining capital costs are estimated to be $84.7 M, for a total of

$443.0 M. See Table 1.5 for capital costs by category.

| Table 1.5 |

Capital cost summary |

| Capital cost item (US$M) |

Total cost |

Initial capital costs |

Sustaining capital costs |

| Infrastructure |

50.7 |

47.0 |

3.7 |

| Mine development |

76.6 |

76.1 |

0.5 |

| Processing plant |

209.4 |

207.3 |

2.0 |

| Tailings Storage Facility |

70.3 |

6.7 |

63.6 |

| Owner’s capital costs |

21.2 |

21.2 |

|

| Closure costs |

14.9 |

|

14.9 |

| Total |

443.0 |

358.3 |

84.7 |

Note: Includes direct, indirect, and contingency

costs. Totals may not add up exactly due to rounding.

Source: AMC Mining Consultants (Canada) Ltd., 2024.

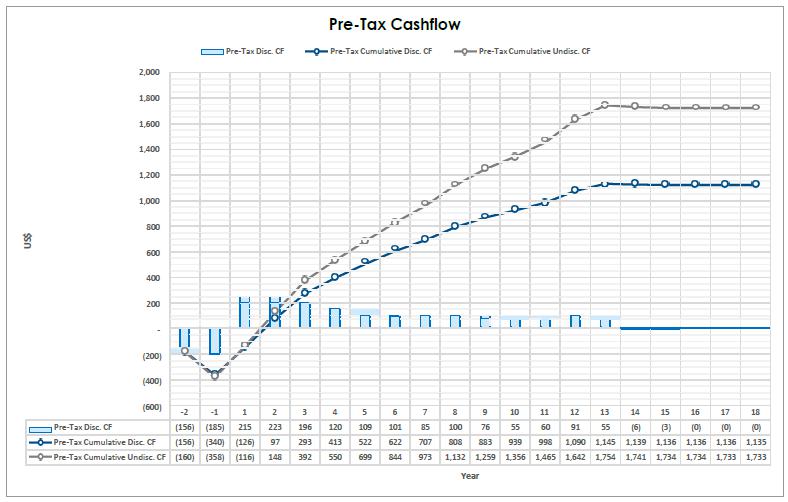

All currency is in US$ unless otherwise

stated. The cost estimate was prepared with a base date of the second half of Year -2 (starting 1 July) and does not include any escalation

beyond this date. For net present value (NPV) estimation, all costs and revenues are discounted at 5% per year from the base date. The

economic model shows the Project under construction for two years (Year -2 and Year -1), which is considered the pre-production development

period, and then in production for the balance of the projected cash flows, which is considered the operating period (Years 1 to 14).

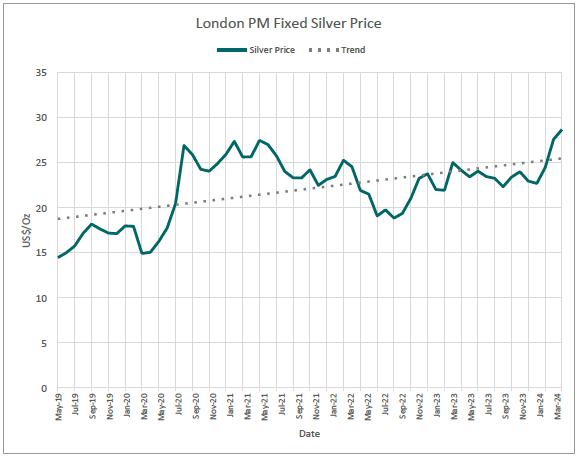

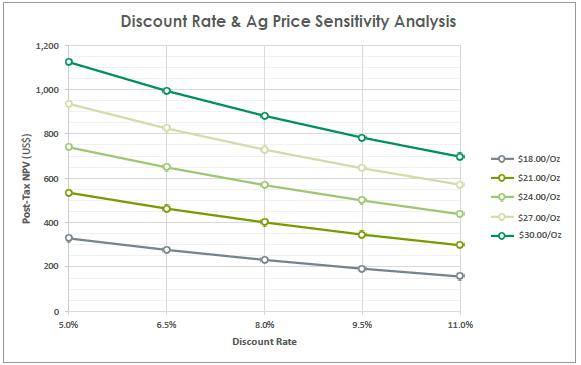

Project revenue is derived from

the sale of silver doré. A metal price of $24.00/troy oz. was selected after discussion with New Pacific and referencing current

markets and forecasts in the public domain. Refer to Section 19 for additional information on the silver price.

Within the AMC area, a royalty of

6.0% of gross revenue is paid to the government. Most of the Mineral Reserves lie within the AMC area. Outside of the AMC area, an additional

6.0% royalty is to be paid to COMIBOL. No other royalties or levies apply to the Project. The selling costs and payability rate, for which

the QP takes responsibiltyn are based on information provided by New Pacific and Halyard. The selling costs for silver doré are

summarized in Table 1.6.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Table 1.6 |

Selling costs and royalties |

| Selling cost item |

Value |

Units |

| Payable silver |

99.50% |

of Ag produced |

| Transportation & insurance costs |

0.25 |

US$/oz |

| Refining charges |

0.20 |

US$/oz |

| Royalty to COMIBOL (outside the AMC limit) |

6.00% |

of gross revenue |

| Royalty to the Bolivian Government |

6.00% |

of gross revenue |

Source: New Pacific Metals

Corp. and Halyard Inc., 2024.

A regular Bolivian corporate income

tax rate of 25% was applied. As a mining property, the Project is subject to an additional tax of 12.5%, with a 5% reduction for companies

that produce pure metal products (as is the case with the Silver Sand project producing silver doré onsite). Corporate income tax

was calculated on taxable income, which also considers operating costs and depreciation.

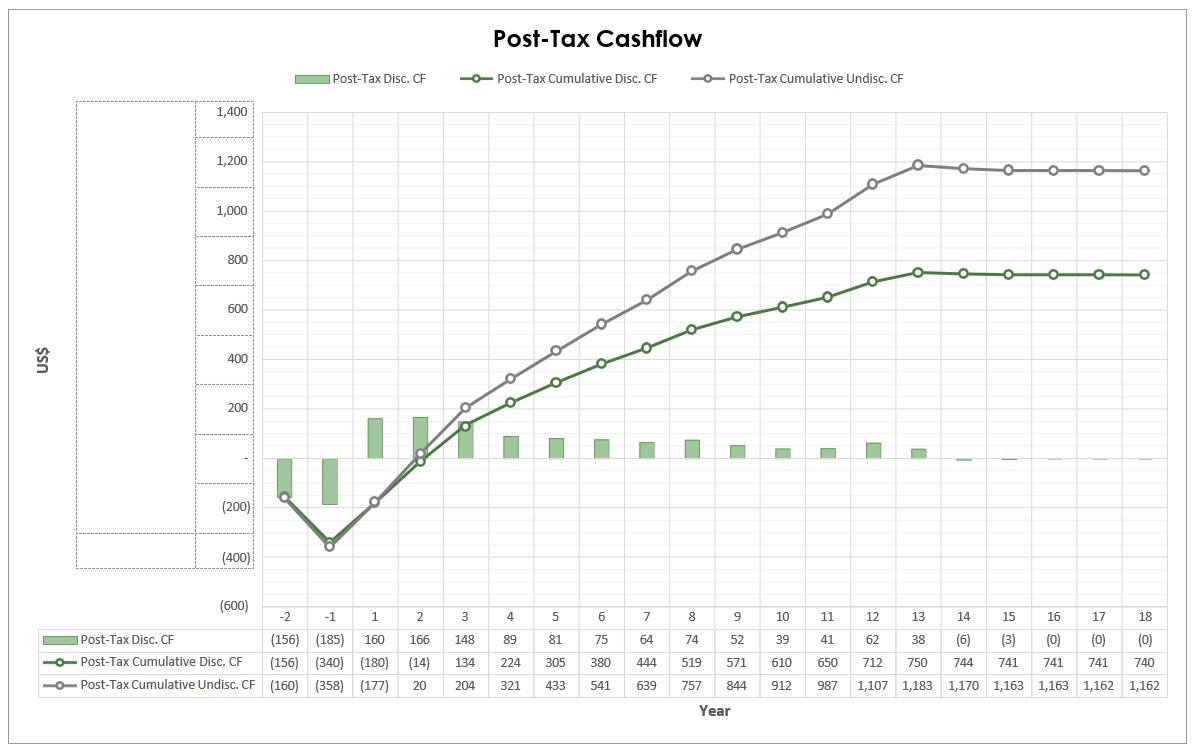

A high-level economic assessment

of the proposed open pit operation of the Silver Sand deposit was conducted. The project is projected to generate a post-tax NPV of $740M

at a discount rate of 5% per year, with post-tax IRR of 37%.

Initial project capital is estimated

at $358M with a payback period of 1.9 years (measured on a post-tax basis from the beginning of production, after construction is completed).

Key assumptions and results of the economics assessments are provided in Table 1.7.

A sensitivity analysis is provided

in Section 22. The results of the sensitivity analysis show that the post-tax NPV is robust and remains positive for the range of sensitivities

evaluated.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Table 1.7 |

Silver Sand deposit – Key economic input assumptions and cost summary |

| Item |

Unit |

Value |

| Total process feed material |

kt |

52,014 |

| Total waste mined |

kt |

181,878 |

| Pre-production waste mined |

kt |

24,261 |

| Production waste mined |

kt |

157,617 |

| Silver feed grade |

g/t |

105 |

| Silver processing recovery rate |

% |

90% |

| Silver selling price |

$/oz |

24.00 |

| Discount rate |

% |

5% |

| Silver payability rate |

% |

99.50% |

| Payable silver metal |

Moz |

157 |

| Gross revenue |

$M |

3,770 |

| Product selling costs & royalties |

$M |

313 |

| Total net revenue |

$M |

3,457 |

| Total capital costs |

$M |

443 |

| Initial capital costs |

$M |

358 |

| Sustaining capital costs |

$M |

85 |

| Total operating costs1 |

$M |

1,281 |

| Mine operating costs1 |

$M |

482 |

| Process and tailings storage operating costs1 |

$M |

713 |

| General and administrative operating costs1 |

$M |

86 |

| Operating cash cost1 (excl. selling costs) |

$/oz Ag |

8.16 |

| Pre-tax all in sustaining cost2 |

$/oz Ag |

10.69 |

| Post-tax payback period3 |

Yrs |

1.9 |

| Post-tax NPV5% |

$M |

740 |

| Post-tax IRR |

% |

37% |

Notes: Values may not sum due to rounding.

| 1. | Does not include capitalized operating costs |

| 2. | Does not include site development (initial) capital costs. |

| 3. | The payback period is measured

from the beginning of production, after construction is completed. |

Source: AMC Mining Consultants (Canada) Ltd., 2024.

| 1.16 | Interpretation and conclusions |

The deposit, as currently defined,

remains open for expansion. Additionally, there has been no modern, district-scale exploration. While it is understood that engineering

work for the feasibility study will be based on the current block model, there are some recommendations for future exploration. Some grade

control drilling may also be required pre-production but has not been quantified at this stage.

The proposed mine plan

has a two-year pre-production period, followed by 13 years of production, at a processing plant throughput rate of 4 Mtpa of ore.

The mine plan includes a stockpiling strategy with low-grade, mid-grade, and high-grade ore stockpiles that will be used to maximize

silver production in the early years of the project. The total annual ex-pit material mined peaks at 18.0 Mtpa, before dropping to

8.0 Mtpa at the end of the open pit mine life. The open pit is planned to be a contractor-run operation with a contractor-provided

mining fleet. A total of 52.0 Mt of ore is anticipated to be mined from open pit operations over the LOM.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

The selected PFS flowsheet consists

of comminution by crushing, followed by semi-autogenous and ball milling, agitated tank leaching with cyanidation over 72 hours, CCD,

and zinc precipitation (Merrill Crowe). The silver precipitate from Merrill Crowe will be treated for copper removal, and then smelted

to produce silver doré.

Thickened tailings from the CCD

circuit will be filtered with pressure filters before being conveyed to the nearby TSF, deposited using a radial stacker and then spread

using tracked dozers. The tailings will be stored behind a fully lined rock-fill embankment. The embankment will be constructed using

waste rock provided from the open pit. Seepage and run-off from the TSF will be collected in a pond which will be located downstream of

the facility. Upon mine closure, it is anticipated that the TSF will be capped with rock and reclaimed topsoil to provide a secure facility.

Process water is expected to be

sourced from the water reservoir adjacent to the process plant and from recycled water from the TSF, supplemented by site runoff as required.

A site-wide water balance model has been developed to maximize water recycling over the LOM.

There is currently no infrastructure

on site apart from access roads. New Pacific has undertaken discussions with the power authorities in Bolivia to arrange for access to

grid power. A water supply can be secured with the construction of a small dam across the Machacamarca Creek to create a reservoir to

supply the process plant and local community.

There is a 54 km long road made

up of a 27 km stretch of the paved Bolivia National Highway 5 and an all-season gravel road built for mining in the Colavi District. The

gravel road is currently being widened and upgraded to paved road by the government.

The main recommendation is to advance

the Silver Sand project to a feasibility study (FS) level. This will require advancing the definition and engineering level of all of

the mining, processing, and infrastructural aspects. While the current block model will form the basis for that study work there is further

geology and exploration work that is recommended.

There are a number of recommendations on all facets

of QA/QC summarized below. These are expanded on in Section 11.

| · | Purchase an additional CRM (Certified Reference Material) at the average

grade of the deposit which has been certified using similar digestion methodology. |

| · | Investigate performance issues with CRMs CDN-ME-1603 and CDN-ME-1605 if

these are to be used in future programs. |

| · | If continue to use ME-MS41 analytical method it is recommended that the

OG46 over-limit threshold be dropped from 100 g/t Ag to a level below the anticipated COG. |

| · | Continue to include blanks in every batch of samples

submitted at a rate of at least one in every 20 samples (5%) and consistently monitor them in real time on a batch-by-batch basis and

ensure that remedial action is taken as issues arise. |

| · | Ensure that all blank sample follow up is recorded. |

| · | Implement investigative work to understand geological variance. |

| · | Ensure that all future programs include 4 - 5% duplicate

samples including field duplicates, coarse (crush) duplicates, and pulp duplicates to enable the various stages of sub-sampling to be

monitored. |

| · | In future programs, submit umpire duplicates, as

was done for the October 2017 – 2019 programs. |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| · | Submit pulp samples (rather than coarse reject) so that umpire samples

only monitor analytical accuracy and variance. |

| · | Include CRMs at the average grade and higher grades in umpire sample submissions. |

For future Mineral Resource modelling, the following should

be considered:

| · | Incorporate geometallurgical attributes into the block model. |

| · | Verify mined-out volumes by surveying historical waste dumps. Conduct structural

analysis of available data and complete initial structural / geotechnical drilling as required. |

| · | Update the 3D geological model to include detailed geology – deposit

oxidation domaining and structures. |

The Silver Sand deposit, as currently

defined, remains open for expansion at depth. While it is understood that engineering work for the PFS will be based on the current block

model, it is recommended that future drilling on the deposit should consider the following:

| · | Infill drilling to upgrade areas of high-grade mineralization

within the current Inferred resource area. |

| · | Additional drilling around the current Mineral Resources,

where the deposit remains open at depth. |

The QP also notes that there has been no modern district-scale

exploration outside of Silver Sand deposit.

| 1.17.2 | Metallurgy & mineral processing |

The PFS metallurgical program included

cyanide leach testing of 18 mineralized samples and demonstrated that cyanide leaching is a technically viable option to recover silver

for the project. The work has incrementally de-risked metallurgical aspects of the project, although opportunities for improvement are

believed to remain. Further metallurgical investigations are warranted to study opportunities to increase silver recovery and to reduce

cyanide consumption. A summary of metallurgical and mineral processing recommendations is as follows. See Section 26.4 for detailed recommendations.

| · | Sample selection and characterization –

The completion of more extensive metallurgical sampling, characterization testing, and performance modelling is recommended as infill

drilling programs continue. |

| · | Gravity concentration – Further testing

is recommended to refine the gravity concentration process and optimize silver recovery. |

| · | Cyanidation – Further cyanidation test

work should continue to focus on leach conditions that include high dissolved oxygen (DO2) levels. The DO2 vs silver recovery relationship

should be defined further to allow for the optimized design of oxygenation equipment in the flowsheet. |

| · | Process water effects – Due to copper

dissolution in process water during the cyanide leach, more detailed metallurgical testing is needed to study the impact of recycled process

solutions. |

| · | Pre-leach thickening – Comparative thickening

testing is needed for the cyanide-leached tailing without prior cyanide destruction. |

| · | Optimization of Merril Crowe – Testing

should be conducted to reduce silver with zinc dust, without the addition of lead nitrate. |

| · | Cyanidation

methods – Cyanide leaching with a mechanically-agitated tank should be tested as

the use of LifterbottleTM rolls

has been demonstrated to improve silver recovery and cyanide consumption. |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| · | Oxygen intake during cyanide leach –

Additional testing for oxygen intake during the cyanide leach should be conducted so that final design parameters for an oxygen sparging

system can be defined. |

| · | Copper removal from Merril Crowe precipitates

– Testing is needed to selectively dissolve copper in the presence of metallic silver while hydrogen peroxide and sulfuric acid

are used. |

| · | Preg-robbing, preg-borrowing, and instability

of silver cyanide complex – A detailed investigation into the preg-robbing or preg-borrowing phenomenon, possible instability

of the silver cyanide complex, possible equipment contamination, and possible unreliable assay procedures is warranted. |

It is recommended that the following aspects are examined

in the next study stage:

| · | Review of drillhole records and geological data for improved conceptual

understanding of the shallow groundwater system. |

| · | Sampling of the springs and wetland to the north and west of the Main Pit. |

| · | Shallow drilling (auger or diamond drilling) to install

shallow piezometers and prove the depth of the colluvial system, and whether it supports a water table upstream of the springs and within

the wetland area. |

| · | Permeability testing of the existing standpipe piezometers. |

| · | Construction of a trial dewatering borehole in the

alluvial deposits of the main river channel to investigate its hydrogeological properties and allow for a targeted dewatering strategy,

if required. |

| · | Construction of at least one trial dewatering borehole

into a major fault structure and surrounding piezometer array to investigate fault properties and surrounding fracture connectivity. |

| · | The installation of multi-level vibrating wire piezometers

is recommended to improve the understanding of the hydrogeological system. The following targets are recommended: |

| ¾ | At least one major and one local fault structure. |

| ¾ | The shallow aquifer system in hill-slope colluvium (further to positive

results from exploratory drilling). |

| ¾ | The Tarapaya Formation (where saturated). |

| ¾ | UH3 orthogonal to the existing standpipe piezometers for triangulation

of groundwater pressure. |

| ¾ | UH3 north and south of the river. |

| · | It is recommended to develop a weathering horizon

model and collect additional geotechnical data as per Section 16.3.4 to increase the geotechnical model reliability. Geotechnical slope

design criteria should be updated when further information is available and pit slope stability should be assessed under static and seismic

conditions. |

| · | The ongoing geotechnical program should be continued

to collect additional data for pit wall angle stability analysis. |

| · | Soil and weathered core samples should be collected for lab testing. |

| · | It is recommended to undertake a detailed bench height

and dilution study. The study should consider lateral block extents, flitch / bench heights, equipment specifications, drill and blast,

mining rates, dilution and grade control strategies, and geotechnical implications. |

Grade control strategies, such

as grade control drilling and blast movement monitoring should also be further evaluated.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| · | It is recommended that quotes from multiple Bolivian

mining contractors are collected to firm up the mining costs estimates for the open pit operations. New Pacific is recommended to acquire

binding (or “firm”) quotes for the primary mining contractor to achieve a higher level of accuracy for the FS. |

| · | Further work should be conducted to identify alternative

dump locations, i.e., in the creek gully, to reduce haul distance. |

| · | The amount of time required for site development and

construction will significantly influence the value of the project. As part of the FS, New Pacific is recommended to prepare an operational

readiness assessment and create a detailed development schedule to ensure the project is fully prepared for operation. |

| · | Location and placement of accommodation camp, waste

dump, crusher, and process plant to be confirmed following civil geotechnical and condemnation drilling. |

| · | Continue to negotiate with power authorities to confirm

the cost estimate, and that sufficient grid capacity can be provided. |

| · | The site requires significant earthworks to construct

the supporting infrastructure. New Pacific to investigate the potential for engaging contractors who are familiar with this type of work

to obtain an accurate and dependable estimate of costs. |

| · | The early years of the mine production schedule are

driven by silver grades and the requirement to produce waste material to be used as rock fill for the tailings storage embankment. As

part of the FS, it is recommended to investigate alternative configurations for tailings storage, to reduce the volume (and cost) of waste

production in the early years of the project. |

| · | Initiate a geotechnical, geological, and hydrogeological

investigations to fully characterize the site conditions in the location of the proposed waste storage facility. |

| · | Initiate detailed geochemical characterization program,

including static and kinetic testing to fully characterize the tailings and waste rock materials to be produced from the mining and processing

operations. |

| · | Potential for formation of Acid Rock Drainage is

not well understood. It is recommended to undertake testing to evaluate the time to acidification and the extent of Acid Rock Drainage

of the waste rock. |

| · | Complete the environmental baseline study, impact analysis, and mitigation

plans. Permitting is required to be advanced. |

| · | New Pacific is recommended to conduct a detailed closure and reclamation

plan as part of the FS. |

| · | Environmental programs have commenced with a reasonable

set of samples characterized. As the project continues to progress towards permitting and construction, a larger set of variability samples

should be submitted to develop the dataset of geochemical behaviour (acid-generation and metals leaching) in plant tailing streams and

waste rock piles. FS level environmental test work should include static tests and kinetic (humidity cell) tests on filtered slurry samples

generated by the most recent test work. These tests would not include cyanide detoxification as this process is no longer included in

the process flowsheet. |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

It is recommended that New Pacific retain a tax specialist

for the FS to investigate the possibility of including tax credits and income tax planning measures, to further improve project value.

The estimated cost of the program to complete a study to

feasibility level is estimated to be $5.53M.

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

Contents

| 1 |

Summary |

ii |

| |

1.1 |

Introduction |

ii |

| |

1.2 |

Property description and ownership |

ii |

| |

1.3 |

Accessibility, climate, local resources, infrastructure and physiography |

iii |

| |

1.4 |

Geological setting and mineralization |

iii |

| |

1.5 |

Exploration |

iv |

| |

1.6 |

Drilling |

v |

| |

1.7 |

Sample preparation, assay, and QA/QC |

vi |

| |

1.8 |

Mineral Resources |

vii |

| |

1.9 |

Mineral Reserves |

viii |

| |

1.10 |

Mining methods |

ix |

| |

1.11 |

Processing and metallurgy |

x |

| |

1.12 |

Infrastructure |

xi |

| |

1.13 |

Environmental studies, permitting and social or community impact |

xiii |

| |

1.14 |

Capital and operating costs |

xiii |

| |

1.15 |

Economic analysis |

xiv |

| |

1.16 |

Interpretation and conclusions |

xvi |

| |

1.17 |

Recommendations |

xvii |

| |

|

1.17.1 |

Geology |

xvii |

| |

|

1.17.2 |

Metallurgy & mineral processing |

xviii |

| |

|

1.17.3 |

Open pit mining |

xix |

| |

|

1.17.4 |

Infrastructure |

xx |

| |

|

1.17.5 |

Tailings storage |

xx |

| |

|

1.17.6 |

Environmental |

xx |

| |

|

1.17.7 |

Financial inputs |

xxi |

| |

|

1.17.8 |

Costs |

xxi |

| |

|

|

|

|

| 2 |

Introduction |

41 |

| |

2.1 |

General and terms of reference |

41 |

| |

2.2 |

The Issuer |

41 |

| |

2.3 |

Report authors |

41 |

| |

2.4 |

Sources of information |

43 |

| |

2.5 |

Other |

43 |

| |

|

|

|

| 3 |

Reliance on other experts |

44 |

| |

|

|

| 4 |

Property description and location |

45 |

| |

4.1 |

Property location |

45 |

| |

4.2 |

Bolivian Regulatory framework |

45 |

| |

|

4.2.1 |

Overview |

45 |

| |

|

4.2.2 |

Exploration and mining rights |

46 |

| |

|

4.2.3 |

Environment protection |

46 |

| |

4.3 |

Mineral tenure |

46 |

| |

|

4.3.1 |

Introduction |

46 |

| |

|

4.3.2 |

100% owned New Pacific tenure |

48 |

| |

|

4.3.3 |

Mining production contract |

48 |

| |

4.4 |

Environmental permits |

49 |

| |

4.5 |

Land holding costs |

49 |

| |

4.6 |

Surface rights |

50 |

| |

4.7 |

Royalties and encumbrances |

50 |

| |

|

|

|

| 5 |

Accessibility, climate, local resources, infrastructure, and physiography |

52 |

| |

5.1 |

Accessibility |

52 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

Tables

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

Figures

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

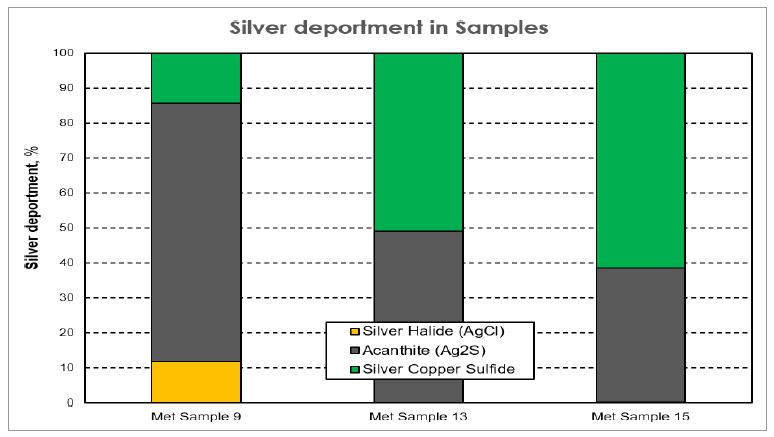

| Figure 13.1 |

Silver deportment in Met Sample 9 (15% oxide + 85% transitional), Met Sample 13 (high-grade sulphide sample), and Met Sample 15 (2020 high-grade sulphide sample) |

139 |

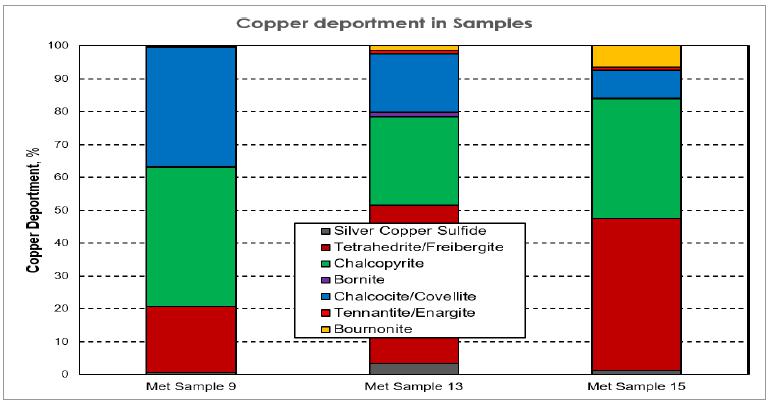

| Figure 13.2 |

Copper deportment in Met Sample 9 (15% oxide + 85% transitional), Met Sample 13 (high-grade sulphide sample), and Met Sample 15 (2020 high-grade sulphide sample) |

139 |

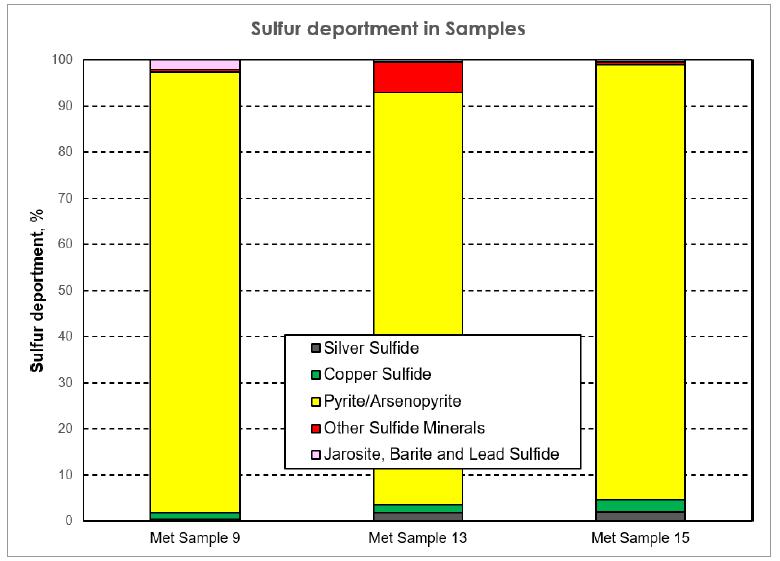

| Figure 13.3 |

Sulphur deportment in Met Sample 9 (15% oxide + 85% transitional), Met Sample 13 (high-grade sulphide sample), and Met Sample 15 (2020 high-grade sulphide sample) |

140 |

| Figure 13.4 |

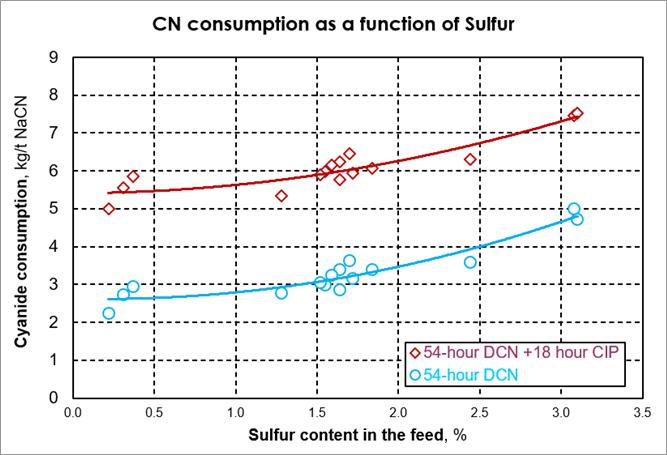

Cyanide consumption as a function of sulphur content in the feed |

147 |

| Figure 13.5 |

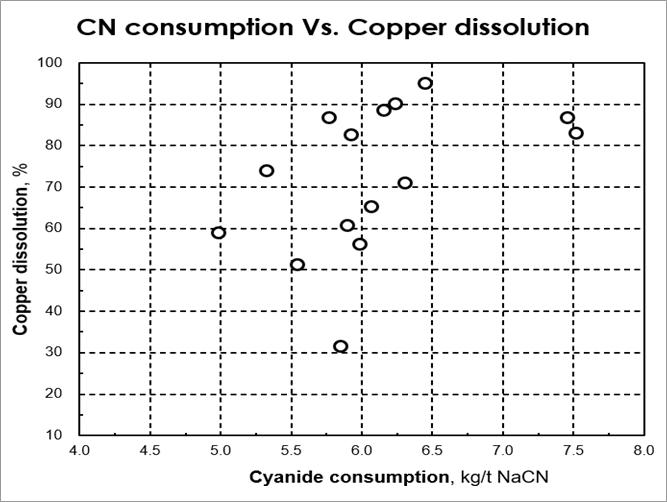

Relationship between copper dissolution and cyanide consumption |

149 |

| Figure 13.6 |

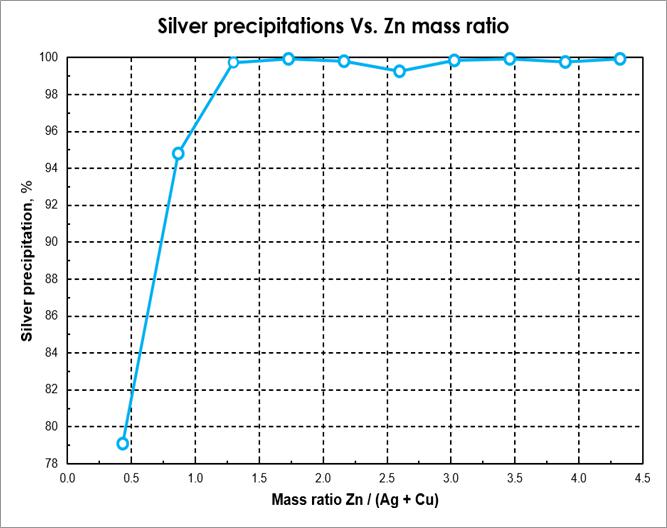

Silver precipitation as a function of the ratio of zinc dust to the combined amount of dissolved silver and copper for Test 2 (JR7712) |

169 |

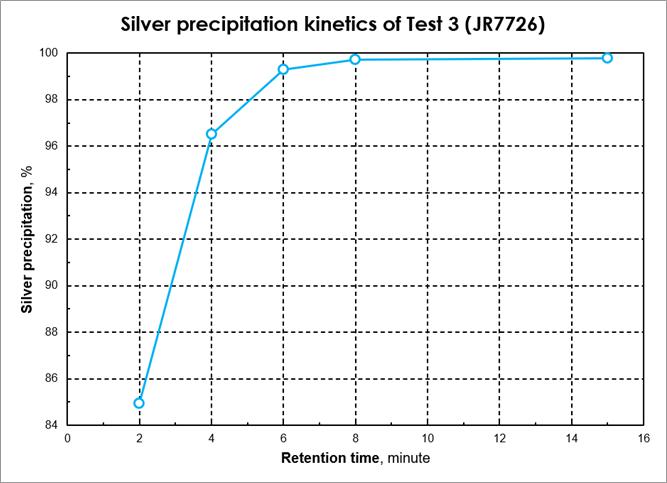

| Figure 13.7 |

Silver precipitation kinetics of Test 3 (JR7726) with single dosage of zinc dust 170 |

170 |

| Figure 13.8 |

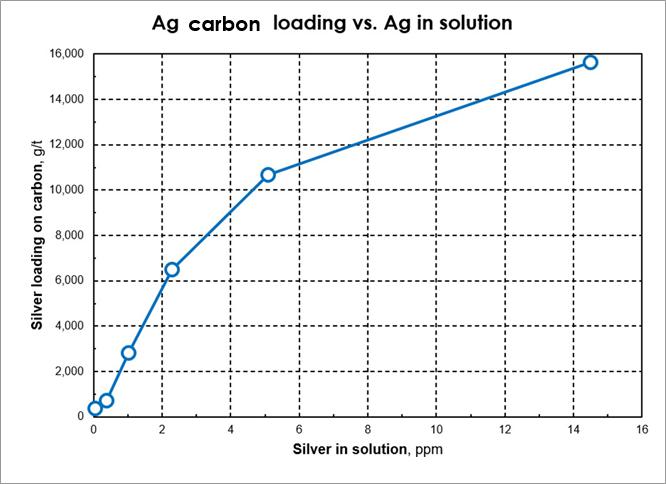

Silver loading on the activated carbon |

171 |

| Figure 13.9 |

Copper loading on activated carbon |

172 |

| Figure 13.10 |

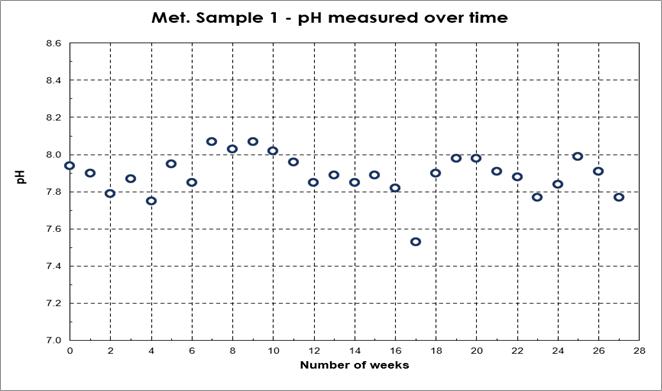

pH reading during humidity cell testing for Met Sample 1 |

182 |

| Figure 13.11 |

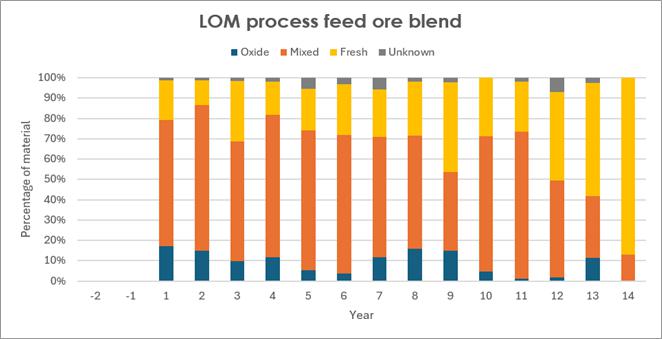

LOM annual ore blends |

183 |

| Figure 14.1 |

Silver Sand drillhole location plan |

187 |

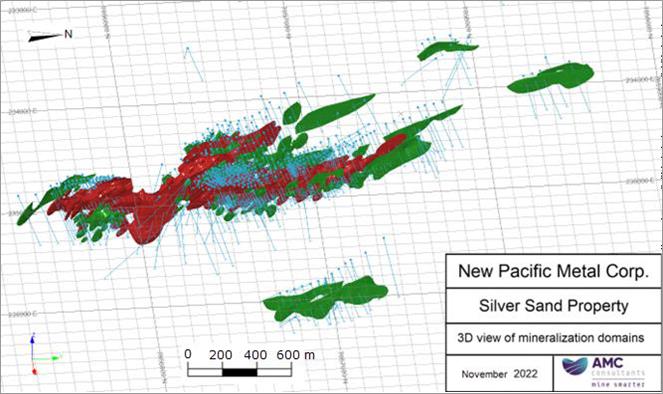

| Figure 14.2 |

3D view of mineralization domains looking north-east |

188 |

| Figure 14.3 |

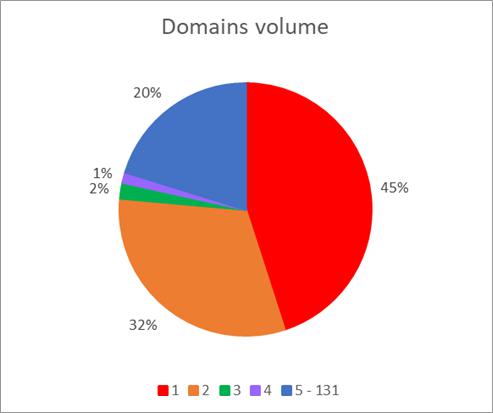

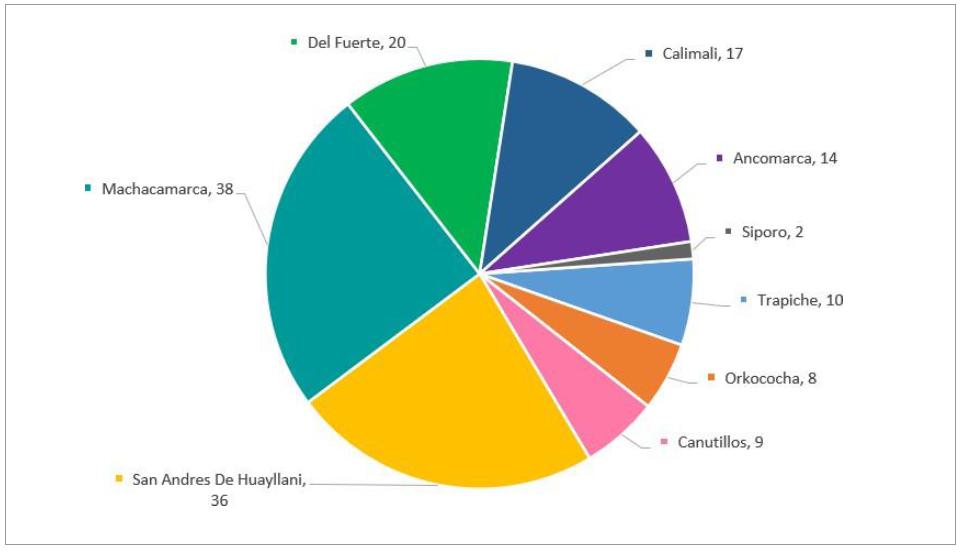

Pie-chart of the percentage volume by domains |

189 |

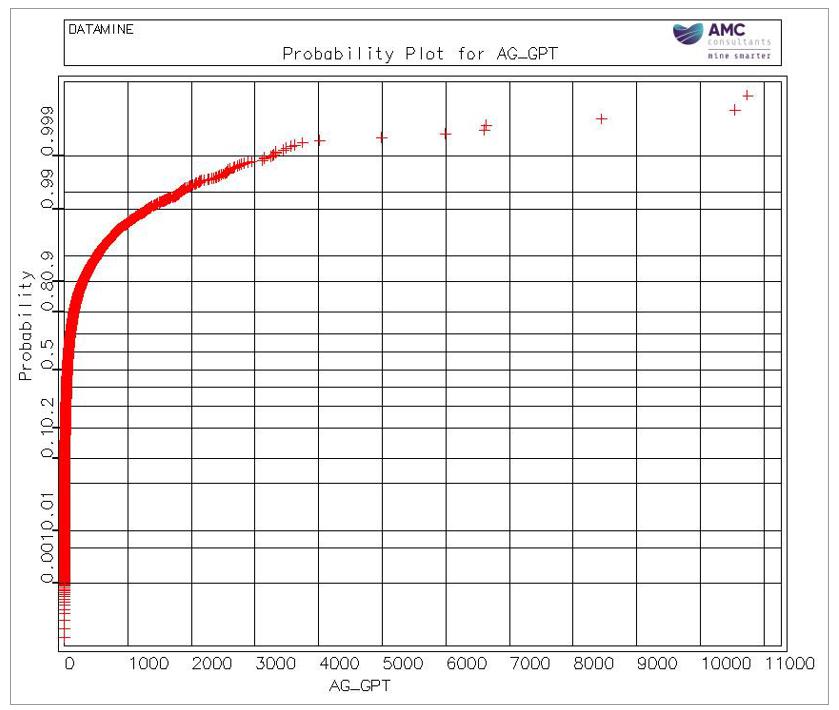

| Figure 14.4 |

Probability plot for Ag |

190 |

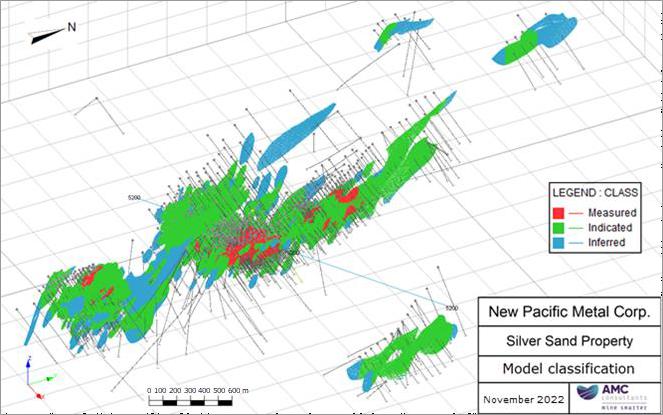

| Figure 14.5 |

3D view of the resource classification |

194 |

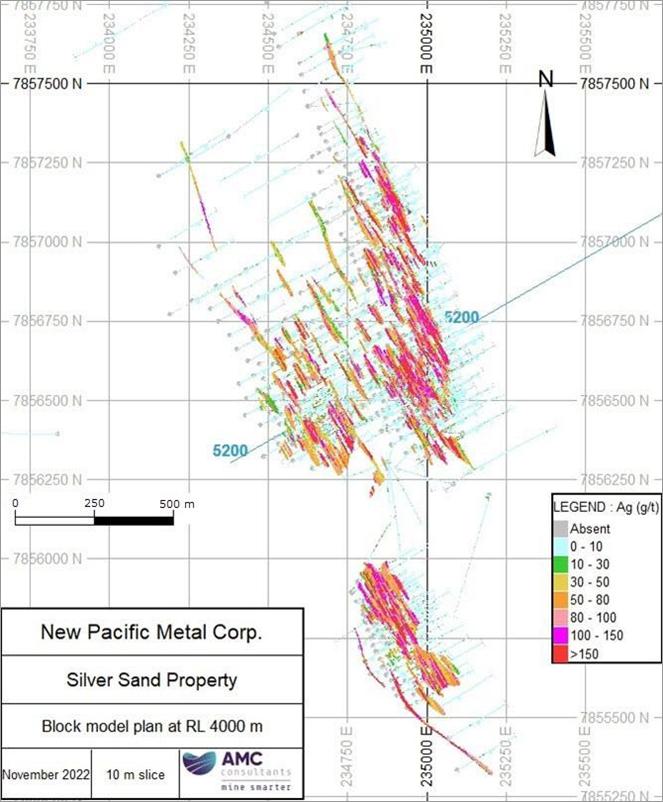

| Figure 14.6 |

Plan view of the block model and drillholes |

195 |

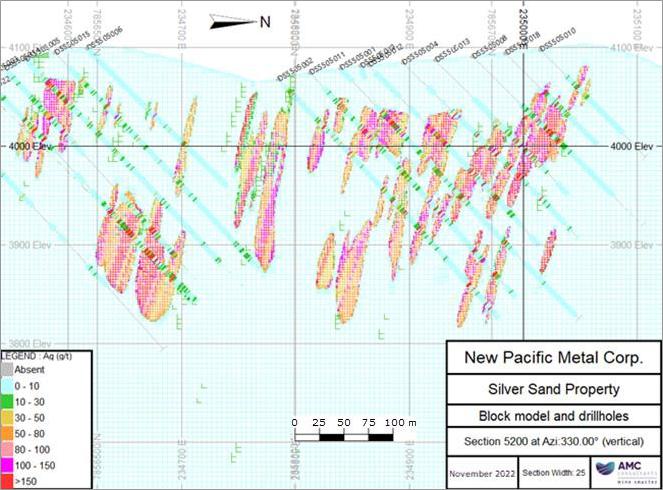

| Figure 14.7 |

Block model versus drillhole grade on Section 5200 |

196 |

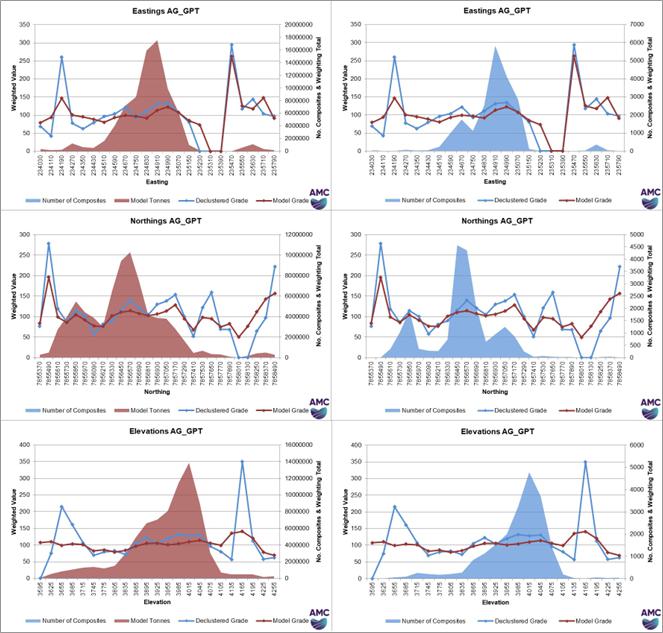

| Figure 14.8 |

All domains swath plot for silver |

197 |

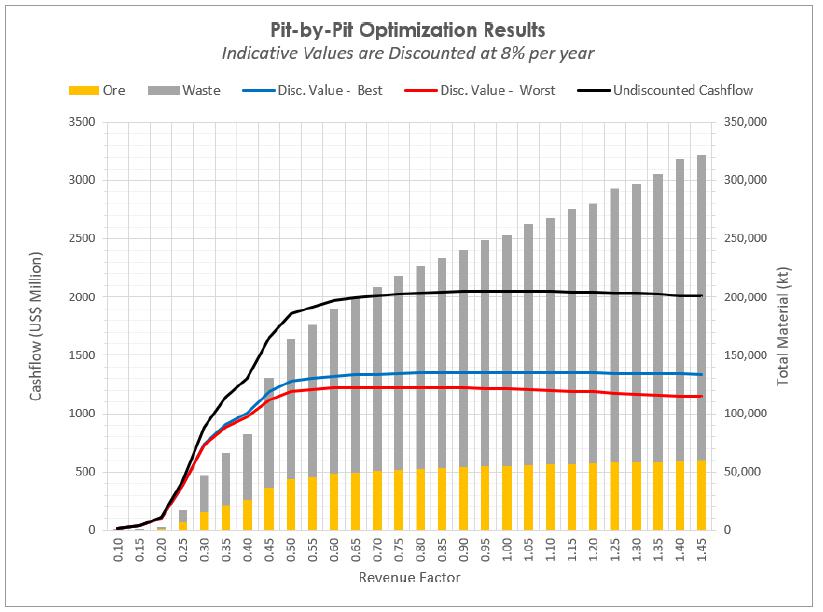

| Figure 15.1 |

Pit optimization results |

207 |

| Figure 15.2 |

Final pit geometry |

208 |

| Figure 16.1 |

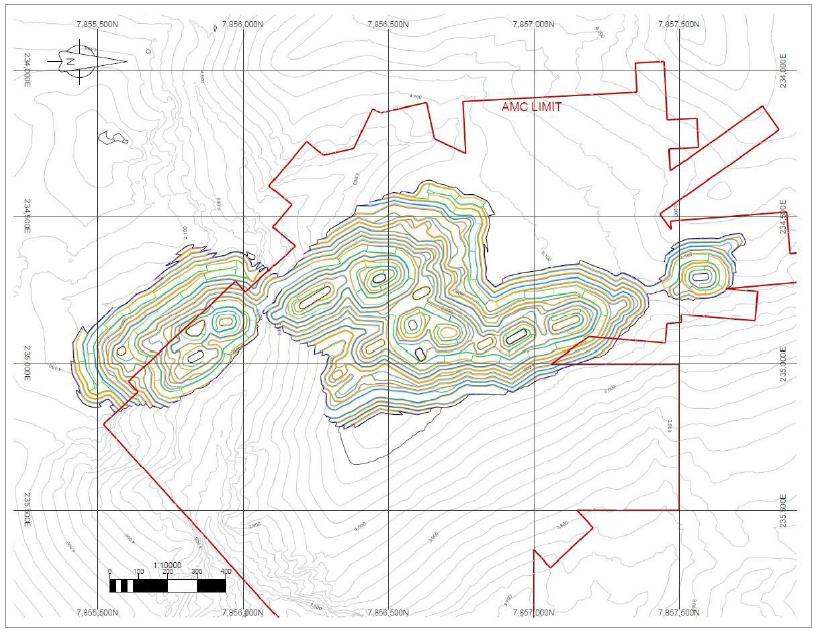

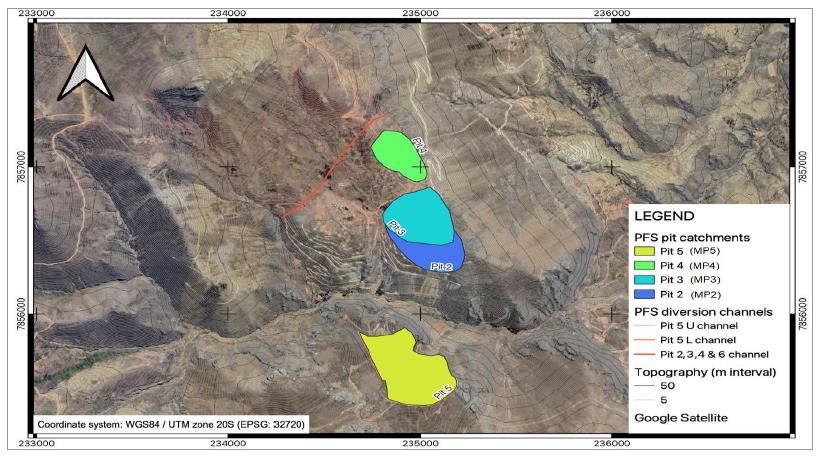

Surface water catchments for MP2, MP3, MP4, and MP5 |

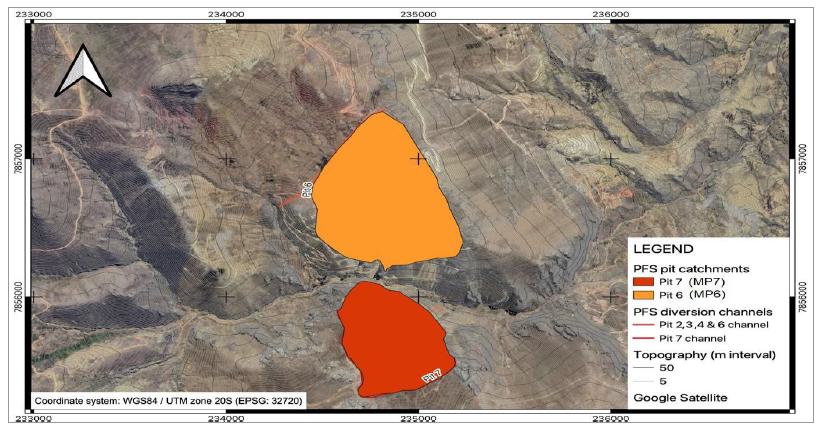

210 |

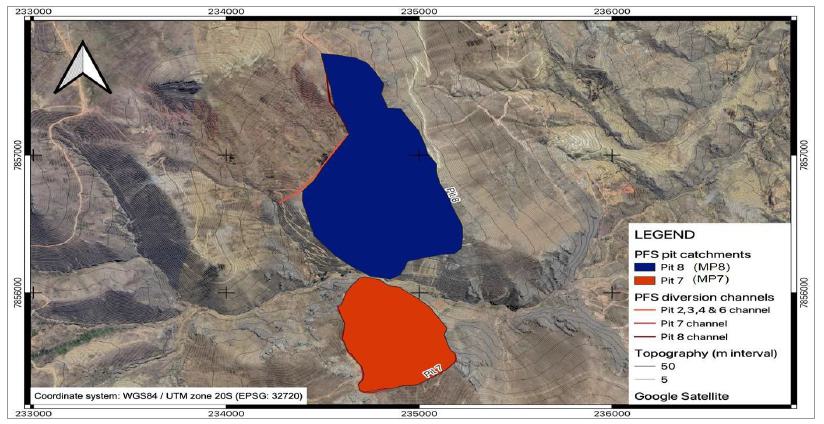

| Figure 16.2 |

Surface water catchments for MP6 and MP7 |

210 |

| Figure 16.3 |

Surface water catchments for MP7 and MP8 |

211 |

| Figure 16.4 |

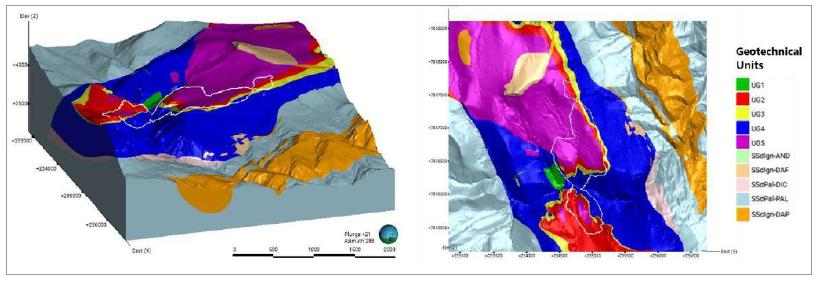

Spatial distribution of the geotechnical domains (left: isotropic view, right: plan view) |

214 |

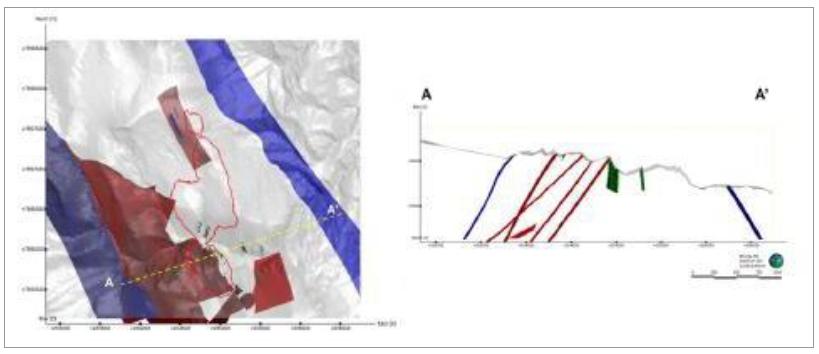

| Figure 16.5 |

Structural model (blue: regional; red: local; green: minor) |

214 |

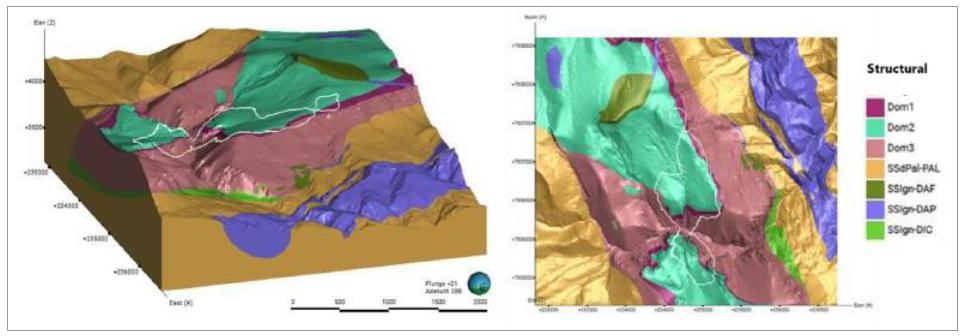

| Figure 16.6 |

Spatial distribution of the structural domains (left: isotropic view, right: plan view) |

215 |

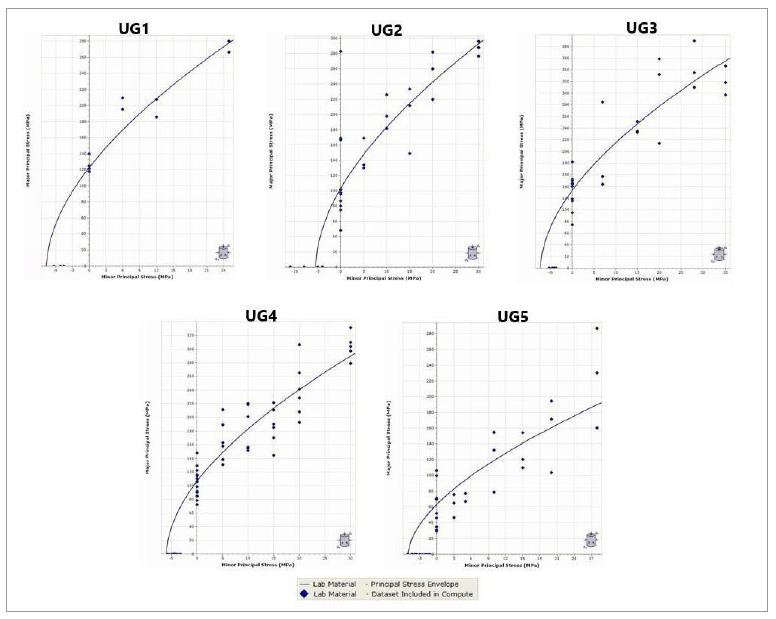

| Figure 16.7 |

Test results and the Hoek-Brown failure envelope for each geotechnical domain |

217 |

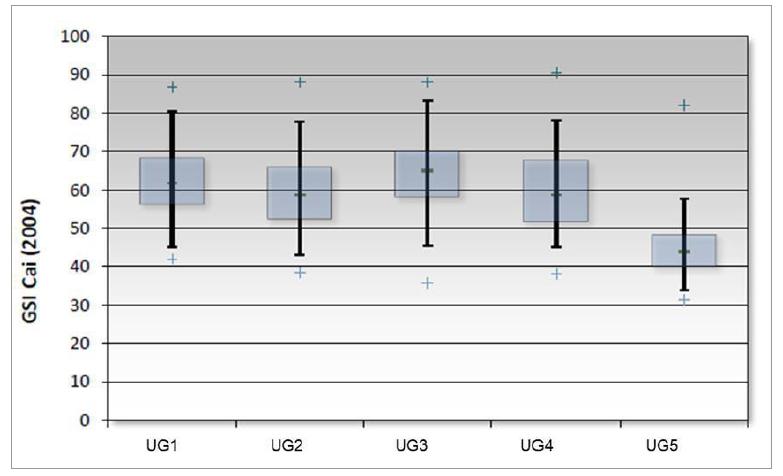

| Figure 16.8 |

Boxplot of GSI or each geotechnical domain |

218 |

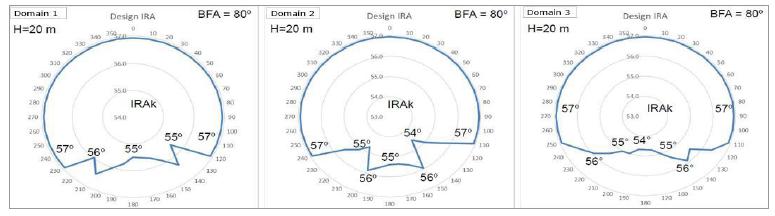

| Figure 16.9 |

Recommended IRAk for each structural domain |

219 |

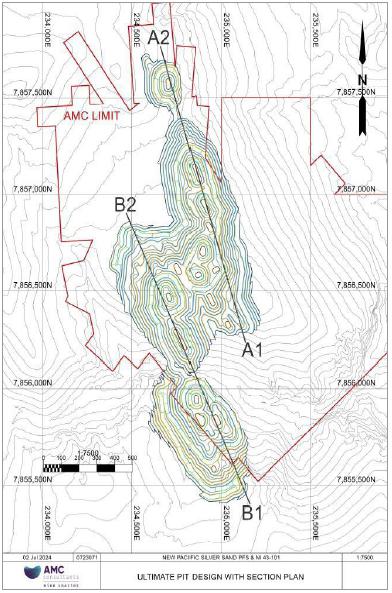

| Figure 16.10 |

Ultimate pit design with long sections |

224 |

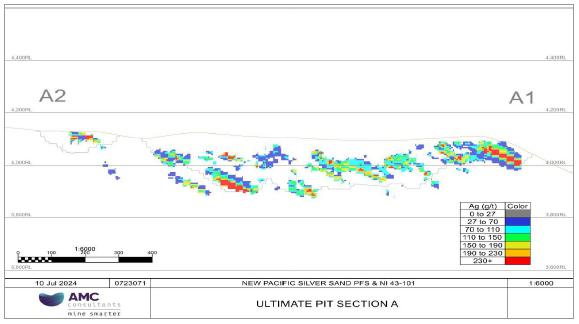

| Figure 16.11 |

Section view A1 - A2 with Ag grade (g/t) |

225 |

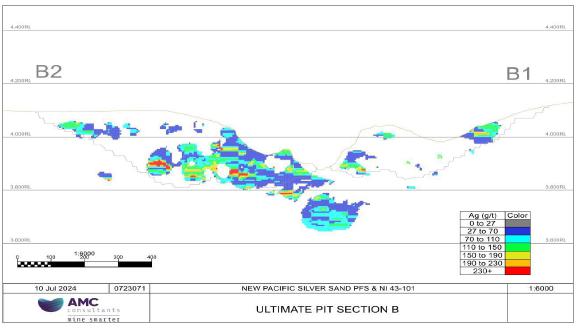

| Figure 16.12 |

Section view B1 - B2 with Ag grade (g/t) |

225 |

| Figure 16.13 |

Main Pit phase designs |

226 |

| Figure 16.14 |

General site layout |

229 |

| Figure 16.15 |

Indicative value by mining area |

233 |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

Distribution

list

1

e-copy to New Pacific Metals Corp.

1

e-copy to AMC Vancouver office

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

Abbreviations

& acronyms

| Abbreviations & acronyms |

Description |

| $ |

United States dollar |

| % |

Percentage |

| ° |

Degree |

| °C |

Degrees Celsius |

| µm |

Micron |

| 3D |

Three-dimensional |

| AACN |

National Competent Environmental Authority (Autoridad Ambiental Competente Nacional) |

| AAS |

Atomic absorption spectroscopy |

| AES |

Atomic Emission Spectroscopy |

| Ag |

Silver |

| AJAM |

Jurisdictional Mining Administrative Authority (Autoridad Jurisdiccional Administrativa Minera) |

| Alcira |

Minera Alcira Sociedad Anónima Alcira S.A. |

| ALS |

ALS laboratories |

| AMC |

Administrative Mining Contract |

| AMC Consultants |

AMC Mining Consultants (Canada) Ltd. |

| ARD |

Acid Rock Drainage |

| As |

Arsenic |

| ATE |

Temporary Special Authorization |

| Au |

Gold |

| BFA |

Bench face angle |

| BOB |

Bolivian Boliviano |

| CaCO3 |

Calcium carbonate |

| CaO |

Calcium oxide |

| Capex |

Capital expenditure |

| CCD |

Counter current decantation |

| CCR |

Crusher Control Room |

| CIM |

Canadian Institute of Mining, Metallurgy and Petroleum |

| cm |

Centimetre |

| CN |

Cyanide |

| COG |

Cut-off grade |

| COMIBOL |

Corporación Minera de Bolivia |

| Congress |

Congress of Bolivia |

| CPE |

Political Constitution of the State (Constitución Política del Estado) |

| CR |

Critically Endangered |

| CRM |

Certified reference material |

| CSA |

Canadian Securities Administrators |

| Cu |

Copper |

| CV |

Coefficient of Variation |

| d |

Day |

| DDH |

Diamond drillhole |

| DIA |

Environmental License |

| DMS |

Dense Media Separation |

| dmtpa |

Dry metric tonnes per annum |

| Silver Sand Project Pre-Feasibility Study |

| | New Pacific Metals Corp. | 0723071 |

| Abbreviations & acronyms |

Description |

| dmtph |

Dry metric tonnes per hour |

| DO2 |

Dissolved oxygen |

| DTM |

Digital Terrain Model |

| DWi |

Drop Weight Index |

| E |

East |

| EEIA-AI |

Analytical Environmental Impact Assessment Study |

| EIA |

Environmental Impact Assessment |

| EN |

Endangered |

| ENE |

East-northeast |

| EP |

Eastern pit |

| EPCM |

Engineering, Procurement and Construction Management |

| Excel |

Microsoft Excel |

| FAO |

Food and Agriculture Organisation |

| FNCA |

Environmental Categorization Form (Formulario de Categorización Ambiental) |

| FOS |

Factor of Safety |

| g |

Gram |

| G&A |

General and Administration |

| g/L |

Grams per litre |

| g/t |

Grams per tonne |

| GEOBOL |

Servicio Geologico de Bolivia |

| GPS |