3 Top Ranked Sector ETFs for Earnings Season - ETF News And Commentary

08 October 2013 - 11:07PM

Zacks

Though uncertainty over the Fed’s policy as well as the partial

government shutdown are keeping the markets volatile, U.S. equites

are still near their all-time highs. This is primarily thanks to

upbeat labor data, recovering hosing fundamentals and improved

retail data that led to increasing consumer

confidence.

Given this bullish trend, the third quarter earnings season does

not seem too bad with earnings for S&P 500 companies expected

to be up 1.4% from the year-ago quarter, according to the Zacks

Estimate. Further, revenues for these companies are also expected

to increase 2.1% from the same quarter last year.

Meanwhile, some sectors are poised for solid earnings and revenue

growth as the Q3 earnings season has already kick-started with

impressive results from some of the bellweathers such as Adobe

Systems (ADBE), FedEx (FDX) and Oracle (ORCL) in late September

(read: Top Ranked ETFs for Q3 Earnings).

As such, investors should consider some sector ETFs that are

expected to report positive earnings growth in the coming weeks.

Below, we have highlighted three ETFs that could emerge as winners

this earnings season and are expected to outperform the overall

market:

Construction

The homebuilding and construction sector would likely be the major

contributor to both earnings and revenue growth this earnings

season. It is expected to report 22.2% earnings growth and 11.1%

revenue growth on year-over-year basis for the third quarter.

This is because the housing market is showing continued improvement

on the back of higher home prices and better home sales data.

Though rising mortgage rates had put a recovery on hold, the latest

decision by the Fed to continue its bond buying program has fueled

bullishness into the sector (read: Rocky Road Ahead for Homebuilder

ETFs?).

Investors could tap this growing opportunity in the sector with the

iShares Dow Jones US Home Construction Index Fund

(ITB). This fund follows

the Dow Jones US Select Home Builders Index and holds a small

basket of 33 stocks. It is heavily concentrated in its top 10 firms

with 63% of the total assets. Additionally, the product puts more

focus on home construction, indicating that it is a ‘pure play’ on

the space.

The fund is popular and liquid with AUM of just under $2 billion

and average daily volume of nearly six million shares. The ETF

charges 46 bps in fees and expenses. ITB gained over 7% so far this

year and currently has a Zacks ETF Rank of 1 or ‘Strong Buy’ rating

with ‘Medium’ risk outlook.

Transportation

The transport sector is expected to one of the best performers of

Q3 on a reviving U.S. economy and solid results from FedEx (read:

Transport ETFs in Focus on FedEx Earnings Beat). The positive

trends in the economy suggest growing demand for movement of goods

across many economic sectors.

Investors should note that transport is often considered a

barometer of broad economic health as it grows when U.S. economic

activity picks up. Further, the sector has a direct correlation

with retail and manufacturing numbers. The sector is expected to

post 10.7% earnings growth and 5.6% revenue growth.

One way to play this trend is with

iShares Dow Jones

Transportation Average Fund

(IYT). The ETF tracks

the Dow Jones Transportation Average Index, giving investors

exposure to the small basket of 21 securities.

The product puts heavy focus on its top 10 firms at roughly 67%.

Further, from a sector perspective, the fund is tilted toward

railroads at 30% while delivery service sector makes up for nearly

20% share.

The fund has accumulated $644 million in AUM while sees good volume

of trading. It charges 46 bps in fees and expense. IYT delivered

robust return of 26.42% in the year-to-date time frame and has a

Zacks ETF Rank of 1 or ‘Strong Buy’ with a ‘Medium’ risk

outlook.

Financials

Financials in Q3 have been benefited the most from the growing

speculation over the Fed tapering and the resultant interest rate

rise. However, with the Fed now keeping its $85 billion in monthly

QE intact, the financial sector has seen some downside creating a

nice opportunity for investors (read: Financial ETFs Tumble on

Citigroup Warning).

In fact, the finance sector earnings are expected to increase 7.4%

on an annual basis on revenue growth of 7.7% in the third quarter.

This is because the sector is benefiting from growing demand for

some types of trading and its potential for increasing dividends

and buybacks. Notably, financials have accounted for the largest

increase in dividends in the last three years.

Investors could find the ultra-popular

Financial Select

Sector SPDR Fund (XLF)

an exciting pick to benefit from the current trends. The fund

tracks the S&P Financial Select Sector Index and has amassed

over $15 billion in its asset base. Volume is massive, trading in

more than 46 million shares a day. The ETF charges just 0.18% in

expenses (see: all the Financial ETFs here).

The product holds 83 securities in its basket, with moderate

concentration (around 50%) in the top 10 holdings. The ETF is quite

spread across sectors with diversified financial service taking

32.2% share, followed by insurance and commercial banks with at

least 17% share each. XLF is up over 24% YTD. The product currently

has a Zacks ETF Rank of 1 or ‘Strong Buy’ rating with ‘Low’ risk

outlook.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-US HO CO (ITB): ETF Research Reports

ISHARS-TRAN AVG (IYT): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

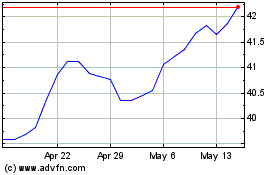

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Jan 2025 to Feb 2025

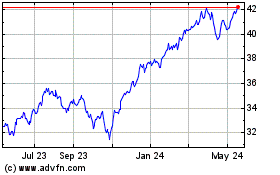

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Feb 2024 to Feb 2025