TIDMASPL

RNS Number : 4914Z

Aseana Properties Limited

15 September 2022

15 September 2022

Aseana Properties Limited

("Aseana", the "Company" or, the "Group")

Half-Year Results for the Six Months Ended 30 June 2022

Aseana Properties Limited (LSE: ASPL), a property developer with

investments in Malaysia and Vietnam listed on the Main Market of

the London Stock Exchange, announces its unaudited half-year

results for the six-month period ended 30 June 2022.

Operational highlights:

-- The COVID-related Movement Control Order ("MCO") in Malaysia

was officially lifted on 3 January 2022 with borders reopening to

non-residents on 1 April 2022. The RuMa Hotel has achieved 32%

occupancy in the first six months of 2022 and continues to improve

its performance. Losses for the period ending 30 June 2022 were

approximately RM 2.0 million due to a slower than expected

recovery.

-- The RuMa Residences achieved approximately 71% sales to date

based on sales completed of the 199 residential units.

-- The Guaranteed Rental Return ("GRR") payment to the hotel

unit owners was reinstated in July 2022. The Group has provisioned

RM 14.2 million for the GRR payment postponed during the period

when the hotel was forced to shut down due to the COVID-related MCO

enforcement.

-- In the first half year of 2022, The Harbour Mall Sandakan

performance has exceeded expectations with occupancy rates at about

96%. Financial performance through 30 June 2022 is on target.

-- On 28 February 2022, the Group completed its sale of its

Vietnam assets comprising the City International Hospital and the

adjacent International Healthcare Park in Ho Chi Minh City.

-- As reported in our Annual Report published 28 April 2022, it

is expected that the Group would be financed via the sale of the

remaining units of residential inventories at The RuMa Hotel &

Residences in West Malaysia, and through the disposal of the

Sandakan hotel asset (formerly Four Points Sheraton Sandakan

Hotel), the Harbour Mall Sandakan and the RuMa Hotel. The

Divestment Team has been actively seeking for potential

purchasers.

Financial highlights:

-- Other Income of US$ 4.0 million (H1 2021 (re-presented):

US$2.1 million)

-- Loss before tax from continuing operations of US$12.5 million

(H1 2021 (re-presented): loss of US$1. 4 million) which includes

certain non-recurring expenses such as the provision of the Ruma

Guaranteed Rental Return of US$3.3 million, a foreign exchange loss

of US$2.7 million due to the appreciation of the US Dollars, a loss

on asset value of the sold Vietnamese assets of US$3.8 million and

operating expenses associated with that divestment of approximately

US$1.1 million.

-- Loss after tax from continuing operations of US$12.8 million

(H1 2021 (re-presented): loss of US$1.4 million)

-- Loss for the period of US$12.8 million (H1 2021

(re-presented): loss of US$3.3 million)

-- Total comprehensive loss of US$14. 5 million (H1 2021

(re-presented): loss of US$6.6 million)

-- Net asset value of US$79.5 million (31 December 2021

(audited): US$92.7 million) or US$0.40 per share (31 December 2021

(audited): US$0.47 per share)

Events After Statement of Financial Position Date:

On 3 August 2022, the Group terminated the conditional agreement

dated 9 September 2021 for the sale of the remaining 58 residential

units at The RuMa Hotel and Residences as a result of certain

conditions in the agreement that had not been met.

Commenting on the results, Nick Paris, Chairman of Aseana,

said:

"The first half results of 2022 reflect the continued

challenging market conditions and the slower than expected recovery

from the negative impact of COVID-19, the economic impacts from the

conflict in Ukraine, the on-going COVID-19 restrictions in China

and monetary tightening across most central banks in the face of

inflationary conditions. Although the MCO was lifted on 3 January,

the Malaysian borders were not reopened to non-residents until 1

April and therefore our hotel operations were negatively impacted.

The Company continues to focus on improving operational performance

of its assets, increasing their value and actively marketing the

assets to potential buyers despite the macro challenges mentioned

above and the illiquid nature of the assets."

For further information:

Aseana Properties Limited Tel: 020 3325 7050

Nick Paris (Chairman) Email: nick.paris@limadvisors.com

Grant Thornton UK LLP Tel: 020 7728 2578

Philip J Secrett Email: philip.j.secrett@uk.gt.com

Notes to Editors:

London-listed Aseana Properties Limited (LSE: ASPL) is a

property developer with investments in Malaysia and Vietnam and is

in the process of divesting its remaining assets.

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report on the results of Aseana Properties

Limited and its Group of companies for the six months ended 30 June

2022.

Interim Results for the Half Year ended 30 June 2022

Our interim results in this period continue to reflect the

significant impact of the COVID-19 virus on our various operating

businesses. Our operating revenues continued to decline and despite

significant ongoing cost cutting initiatives, operating losses and

cash outflows were inevitable due largely to debt service payments.

The loss for the period for Aseana for the half year increased to

US$ 12.8 million (H1 2021 (re-presented): US$3.3 million) as

explained in the Financial Highlights, our net cash used in

operating activities was US$ 0.4 million (H1 2021 (re-presented):

US$3.9 million) and our cash balance at the end of the period was

US$8.9 million (H1 2021 (re-presented): US$9.1 million) after

further paydown of debt service. The loss which we are reporting

for the six months ended 30 June 2022 has reduced our Net Asset

Value per Share from 47 US cents at 31 December 2021 to 40 US cents

(30 June 2021 (re-presented) : 49 US cents).

Our Business Focus and Recent Property Divestments

The business focus for the Group is to continue improving the

operational performance of our remaining assets in order to

preserve our cash balances thereby increasing the value of these

assets in conjunction with the ongoing divestment process.

In Vietnam, the Group completed its sale of its Vietnam assets

comprising the City International Hospital and the adjacent

International Healthcare Park in Ho Chi Minh City, through disposal

of the relevant subsidiaries on 28 February 2022. The majority of

the proceeds were used to pay down debt.

In addition, further sale discussions are underway on some of

our other remaining assets. Our aim continues to be to seek asset

sales in a controlled, orderly and timely manner, to pay down

remaining debts and then to return surplus sale proceeds to our

shareholders. Due to the current difficult economic environment and

the inherent nature of the remaining illiquid assets, the Board

will remain open to assessing all options to meet the debt

obligations.

Acknowledgements

I would like to take this opportunity to thank my colleagues on

the Board and throughout our Group and our external advisors,

bankers and service providers for their tireless efforts on behalf

of the Group and its Shareholders.

This has been another very challenging period in the corporate

life of Aseana but with our recently announced divestments and the

continuous efforts to sell the remaining assets, I believe that we

are heading into the final stages of the life of the Company.

NICK PARIS

Chairman

15 September 2022

PROPERTY PORTFOLIO AS AT 30 JUNE 2022

Project Type Effective Approximate

Ownership Gross

Floor Approximate

Area Land Area

(sq m) (sq m)

---------------------------- -------------------- ----------- ------------ ------------

Completed projects

---------------------------- -------------------- ----------- ------------ ------------

The RuMa Hotel and Luxury residential

Residences tower and bespoke

Kuala Lumpur, Malaysia hotel 70.0% 40,000 4,000

---------------------------- -------------------- ----------- ------------ ------------

Retail lots,

Sandakan Harbour Square hotel and retail

Sandakan, Sabah, Malaysia mall 100.0% 126,000 48,000

---------------------------- -------------------- ----------- ------------ ------------

Undeveloped projects

---------------------------- -------------------- ----------- ------------ ------------

Land parcel

approved for

development

of: (i) Boutique

resort hotel

and resort

villas

Kota Kinabalu Seafront (ii) Resort

resort & residences homes 80.0% n/a 172,900

---------------------------- -------------------- ----------- ------------ ------------

*Shareholding as at 30 June 2022

n/a: Not available/ Not applicable

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2022

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

Notes 30 June 30 June 31 December

2022 2021 2021

Continuing activities US$'000 US$'000 US$'000

Re-presented

---------------------------------- ------ ----------- ------------- -------------

Revenue 3 - 516 595

Cost of sales 5 - (416) (318)

---------------------------------- ------ ----------- ------------- -------------

Gross profit - 100 277

Other income 4,006 2,100 5,677

Administrative expenses (1,833) (357) (1,408)

Foreign exchange (loss)/gain 6 (2,703) 856 345

Loss on disposal of subsidiaries (3,752) - -

Other operating expenses (7,524) (3,168) (6,826)

---------------------------------- ------ ----------- ------------- -------------

Operating loss (11,806) (469) (1,935)

----------- ------------- -------------

Finance income 981 1,398 710

Finance costs (1,718) (2,274) (3,621)

----------- ------------- -------------

Net finance costs (737) (876) (2,911)

Net loss before taxation (12,543) (1,345) (4,846)

Taxation 7 (274) (38) (141)

---------------------------------- ------ ----------- ------------- -------------

Loss for the period/year

from continuing operations (12,817) (1,383) (4,987)

---------------------------------- ------ ----------- ------------- -------------

Discontinued operations

Loss for the period/year

from discontinued operations - (1,875) (3,087)

---------------------------------- ------ ----------- ------------- -------------

Loss for the period/year (12,817) (3,258) (8,074)

---------------------------------- ------ ----------- ------------- -------------

Other comprehensive income/(loss), net of tax

Items that are or may be reclassified subsequently to profit or

loss

Foreign currency translation

differences

for foreign operations (1,647) (3,316) (3,584)

------------------------------- --------- -------- ---------

Total other comprehensive

loss for the period/year (1,647) (3,316) (3,584)

------------------------------- --------- -------- ---------

Total comprehensive loss

for the period/year (14,464) (6,574) (11,658)

------------------------------- --------- -------- ---------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (CONT'D)

FOR THE SIX MONTHSED 30 JUNE 2022

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

Notes 30 June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Re-presented

--------------------------------------- ------- ----------- ------------- -------------

Loss attributable to:

Equity holders of the parent

company

Loss for the period/year

from continuing operations (11,314) (701) (3,850)

Loss for the period/year

from discontinued operations - (1,032) (1,632)

------------------------------------------------ ----------- ------------- -------------

Loss for the period/year attributable

to equity holders of the parent

company (11,314) (1,733) (5,482)

------------------------------------------------ ----------- ------------- -------------

Non-controlling interests

--------------------------------------- ------- ----------- ------------- -------------

Loss for the period/year

from continuing operations (1,503) (682) (1,137)

Loss for the period/year

from discontinued operations - (843) (1,455)

------------------------------------------------ ----------- ------------- -------------

Loss for the period/year attributable

to non-controlling interests (1,503) (1,525) (2,592)

------------------------------------------------ ----------- ------------- -------------

Loss for the period/year (12,817) (3,258) (8,074)

------------------------------------------------ ----------- ------------- -------------

Total comprehensive loss

attributable to:

Equity holders of the parent

company

Total comprehensive loss

from continuing operations (13,145) (2,646) (5,960)

Total comprehensive loss

from discontinued operations - (2,044) (2,719)

------------------------------------------------ ----------- ------------- -------------

Total comprehensive loss attributable

to equity holders of the parent

company (13,145) (4,690) (8,679)

------------------------------------------------ ----------- ------------- -------------

Non-controlling interests

Total comprehensive loss

from continuing operations (1,319) (627) (1,080)

Total comprehensive loss

from discontinued operations - (1,257) (1,899)

------------------------------------------------ ----------- ------------- -------------

Total comprehensive loss attributable

to non-controlling interests (1,319) (1,884) (2,979)

------------------------------------------------ ----------- ------------- -------------

Total comprehensive loss

for the period/year (14,464) (6,574) (11,658)

------------------------------------------------ ----------- ------------- -------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (CONT'D)

FOR THE SIX MONTHSED 30 JUNE 2022

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

Notes 30 June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Re-presented

------------------------------------ ------- ----------- ------------- -------------

Loss per share

Basic and diluted (US cents)

- from continuing operations (5.69) (0.35) (1.94)

- from discontinued operations - (0.52) (0.82)

--------------------------------------------- ----------- ------------- -------------

(5.69) (0.87) (2.76)

-------------------------------------------- ----------- ------------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

Unaudited Unaudited Audited

As at As at As at

Notes 30 June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Re-presented

------------------------------- ------ ---------- ------------- -------------

Non-current assets

Property, plant and equipment 82 106 104

Intangible assets 578 578 578

Right of use - 17 1

Deferred tax assets 4,707 4,944 4,979

------------------------------- ------ ---------- ------------- -------------

Total non-current assets 5,367 5,645 5,662

------------------------------- ------ ---------- ------------- -------------

Current assets

Inventories 140,344 160,715 147,048

Trade and other receivables 13,252 14,289 13,540

Prepayments 498 35 4 496

Current tax assets 476 923 781

Assets held for sale - 108 14,466

Cash and cash equivalents 8,849 9,083 7,114

------------------------------- ------ ---------- ------------- -------------

Total current assets 163,419 185,472 183,445

------------------------------- ------ ---------- ------------- -------------

TOTAL ASSETS 168,786 191,117 189,107

------------------------------- ------ ---------- ------------- -------------

Equity

Share capital 10,601 10,601 10,601

Share premium 208,925 208,925 208,925

Capital redemption reserve 1,899 1,899 1,899

Translation reserve (24,683) (22,612) (22,852)

(102,16 6

Accumulated losses (117,229) ) (105,915)

------------------------------- ------ ---------- ------------- -------------

Shareholders' equity 79,513 96,64 7 92,658

Non-controlling interests (3,871) (8,761) (1,678)

------------------------------- ------ ---------- ------------- -------------

Total equity 75,642 87,88 6 90,980

------------------------------- ------ ---------- ------------- -------------

Non-current liabilities

Trade and other payables 36,246 38,508 38,339

Total non-current liabilities 36,246 38,508 38,339

------------------------------- ------ ---------- ------------- -------------

Current liabilities

Trade and other payables 22,986 6,709 13,824

Amount due to non-controlling

interests 1,169 11,588 1,952

Loans and borrowings 9 1,589 2,978 1,695

Medium term notes 10 31,154 43,448 42,317

Total current liabilities 56,898 64,723 59,788

------------------------------- ------ ---------- ------------- -------------

Total liabilities 93,144 103,231 98,127

------------------------------- ------ ---------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 168,786 191,117 189,107

------------------------------- ------ ---------- ------------- -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2022 - UNAUDITED

Total

Equity

Attributable

to Equity

Redeemable Capital Holders Non-

Ordinary Management Share Redemption Translation Accumulated of the Controlling Total

Shares Shares Premium Reserve Reserve Losses Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

1 January 2022 10,601 - 208,925 1,899 (22,852) (105,915) 92,658 (1,678) 90,980

Loss for the

period - - - - - (11,314) (11,314) (1,503) (12,817)

Total other

comprehensive

loss - - - - (1,831) - (1,831) 184 (1,647)

Total

comprehensive

loss - - - - (1,831) (11,314) (13,145) (1,319) (14,464)

Disposal of

subsidiaries (874) (874)

--------------- ----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

Shareholders'

equity

at 30 June

2022 10,601 -# 208,925 1,899 (24,683) (117,229) 79,513 (3,871) 75,642

=============== =========== =========== ======== =========== ============ ============ ============= ============ =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2021 - UNAUDITED

Total

Equity

Attributable

to Equity

Redeemable Capital Holders Non-

Ordinary Management Share Redemption Translation Accumulated of the Controlling Total

Shares Shares Premium Reserve Reserve Losses Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- ----------- ----------- --------- ----------- ------------ ------------ ------------- ------------ ---------

1 January 2021

(re-presented) 10,601 - 208,925 1,899 (19,655) (100,433) 101,337 (6,877) 94,460

Loss for the

period - - - - - (1,733) (1,733) (1,525) (3,258)

Total other

comprehensive

loss - - - - (2,957) - (2,957) (359) (3,316)

----------- ----------- --------- ----------- ------------ ------------ ------------- ------------ ---------

Total

comprehensive

loss - - - - (2,957) (1,733) (4,690) (1,884) (6,574)

Shareholders'

equity

at 30 June

2021 (22,61 (102,16

(re-presented) 10,601 -# 208,925 1,899 2 ) 6 ) 96,647 (8,761) 87,886

================= =========== =========== ========= =========== ============ ============ ============= ============ =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2021 - audited

Total

Equity

Attributable

to Equity

Redeemable Capital Holders Non-

Ordinary Management Share Redemption Translation Accumulated of the Controlling Total

Shares Shares Premium Reserve Reserve Losses Parent Interests Equity

Consolidated US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- ----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

Balance at 1

January 2020

(re-presented) 10,601 - 208,925 1,899 (21,644) (90,135) 109,646 (3,848) 105,798

Changes in

ownership

interests

in subsidiaries - - - - - (38) (38) 38 -

Non-controlling

interests

contribution - - - - - (10,260) (10,260) (3,256) (13,516)

Loss for the

year - - - - 1,889 - 1,889 189 2,078

----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

Total other

comprehensive

loss for the

year - - - - 1,889 (10,260) (8,371) (3,067) (11,428)

Total

comprehensive

loss for

the year 100 - 100 - 100

----------------- ----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

As at 31

December 2020/

1

January 2021

(re-presented) 10,601 -# 208,925 1,899 (19,655) (100,433) 101,337 (6,877) 94,460

Changes in

ownership

interests

in subsidiaries - - - - - - - (341) (341)

Non-controlling

interests

contribution - - - - - - - 8,519 8,519

Loss for the

year - - - - - (5,482) (5,482) (2,592) (8,074)

Total other

comprehensive

loss for the

year - - - - (3,197) - (3,197) (387) (3,584)

----------- ----------- -------- ----------- ------------ ------------ ------------- ------------ ---------

Total

comprehensive

loss for

the year - - - - (3,197) - (8,679) (2,979) (11,658)

Shareholders'

equity at 31

December 2021 10,601 -# 208,925 1,899 (22,852) (105,915) 92,658 (1,678) 90,980

================= =========== =========== ======== =========== ============ ============ ============= ============ =========

# Represents 2 management shares at US$0.05 each

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2022

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Re-presented

------------------------------------------ ----------- ------------- -------------

Cash Flows from Operating Activities

Loss before taxation

* Continuing operations (12,543) (1,345) (4,846)

* Discontinued operation - (1,875) (3,087)

Finance income (981) (1,399) (710)

Finance costs 1,718 4,311 3,621

Loss on disposal of subsidiaries 3,752 - -

Unrealised foreign exchange gain/(loss) 2,650 853 (346)

Depreciation of property, plant

and equipment and right-of-use asset 30 187 207

Operating (loss)/profit before

changes in working capital (5,374) 732 (5,161)

Changes in working capital:

Decrease/(increase) in inventories 1,643 (753) 4,660

(Increase)/decrease in trade and

other receivables and prepayments (441) 875 (3,341)

Increase/(decrease) in trade and

other payables 5,469 (443) (2,324)

------------------------------------------ ----------- ------------- -------------

Cash generated from/(used in) operations 1,297 411 (6,166)

Interest paid (1,715) (4,299) (3,618)

Tax paid (3) (36) (46)

------------------------------------------ ----------- ------------- -------------

Net cash used in operating activities (421) (3,924) (9,830)

------------------------------------------ ----------- ------------- -------------

Cash Flows from Investing Activities

Purchase of property, plant and

equipment (12) (14) (42)

Proceeds from disposal of subsidiaries 10,045 - -

Finance income received 981 1,399 710

------------------------------------------ ----------- ------------- -------------

Net cash from investing activities 11,014 1,385 668

------------------------------------------ ----------- ------------- -------------

CONSOLIDATED STATEMENT OF CASH FLOWS (CONT'D)

FOR THE SIX MONTHSED 30 JUNE 2022

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Re-presented

-------------------------------------------- ----------- ------------- -------------

Cash Flows From Financing Activities

Advances (from)/to non-controlling

interests (697) 303 121

Issuance of ordinary share of subsidiaries

to non-controlling interests - - 8,519

Repayment of finance lease liabilities (155) (227) (163)

Repayment of loans and borrowings (9,133) - -

Drawdown of loans and borrowings

and Medium Term notes - 5,806 3,559

Net cash (used in)/from financing

activities (9,985) 5,881 12,036

-------------------------------------------- ----------- ------------- -------------

Net changes in cash and cash equivalents

during the period/year 608 3,342 2,874

Effect of changes in exchange rates 1,127 (207) (1,148)

Cash and cash equivalents at the

beginning of the period/year (i) 7,114 5,948 5,388

-------------------------------------------- ----------- ------------- -------------

Cash and cash equivalents at the

end of the period/year (i) 8,849 9,083 7,114

-------------------------------------------- ----------- ------------- -------------

(i) Cash and Cash Equivalents

Cash and cash equivalents included in the consolidated statement

of cash flows comprise the following consolidated statement of

financial position amounts:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

June 30 June 31 December

2022 2021 2021

US$'000 US$'000 US$'000

Re-presented

----------------------------- ----------- ------------- -------------

Cash and bank balances 6,405 6,622 4,644

Short term bank deposits 2,444 2,461 2,470

----------------------------- ----------- ------------- -------------

8,849 9,083 7,114

Less: Deposits pledged (ii) (2,312) (2,174) (2,470)

----------------------------- ----------- ------------- -------------

Cash and cash equivalents 6,537 6,909 4,644

----------------------------- ----------- ------------- -------------

(ii) Included in short term bank deposits and cash and bank

balance is US$2,312,000 (31 December 2021: US$2,470,000; 30 June

2021: US$2,174,000) pledged for loans and borrowings and Medium

Term Notes of the Group.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2022

1 GENERAL INFORMATION

The principal activities of the Group are the sale of

development land and the operation and sale of hotels, and a

shopping mall in Malaysia, and a hospital in Vietnam.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

2.1 BASIS OF PREPARATION

The interim condensed consolidated financial statements for the

six months ended 30 June 2022 have been prepared in accordance with

IAS 34, Interim Financial Reporting.

The interim condensed consolidated financial statements should

be read in conjunction with the annual financial statements for the

year ended 31 December 2021 which have been prepared in accordance

with IFRS.

Taxes on income in the interim period are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The interim results have not been audited nor reviewed and do

not constitute statutory financial statements.

The preparation of financial statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of expenses during

the reporting period. Although these estimates are based on

management's best knowledge of the amount, event or actions, actual

results ultimately may differ from those estimates.

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 31 December 2021 as

described in those annual financial statements.

The interim report and financial statements were approved by the

Board of Directors on 14 September 2022.

3 SEGMENTAL INFORMATION

Segmental information represents the level at which financial

information is reported to the Board of Directors, being the chief

operating decision makers as defined in IFRS 8. The Directors

determine the operating segments based on reports reviewed and used

by their staff for strategic decision making and resource

allocations. For management purposes, the Group is organised into

project units.

The Group's reportable operating segments are as follows:

(i) Investment Holding Companies - investing activities;

(ii) Ireka Land Sdn. Bhd. - developed Tiffani ("Tiffani") by i-ZEN;

(iii) ICSD Ventures Sdn. Bhd. - owns and operates the Harbour

Mall Sandakan ("HMS") and the Sandakan hotel asset ("SHA", formerly

Four Points by Sheraton Sandakan Hotel);

(iv) Amatir Resources Sdn. Bhd. - developed the SENI Mont' Kiara ("SENI");

(v) The RuMa Hotel KL Sdn. Bhd. - operates the RuMa Hotel; and

(vi) Urban DNA Sdn. Bhd. - developed and owns the RuMa Hotel and Residences ("The RuMa")

Other non-reportable segments comprise the Group's other

development projects. None of these segments meets any of the

quantitative thresholds for determining reportable segments in 2022

and 2021.

Information regarding the operations of each reportable segment

is included below. The Board of Directors monitors the operating

results of each segment for the purpose of performance assessments

and making decisions on resource allocation. Performance is based

on segment gross profit/(loss) and profit/(loss) before taxation,

which the Directors believes are the most relevant in evaluating

the results relative to other entities in the industry. Segment

assets presented inclusive of inter-segment balances and

inter-segment pricing is determined on an arm's length basis.

The Group's revenue generating development projects are located

in Malaysia and Vietnam.

3 SegmentAL Information (cont'd)

Operating Segments ended 30 June 2022 - Unaudited

Investment Ireka The RuMa Urban

Holding Land Sdn. ICSD Ventures Amatir Resources Hotel KL DNA

Companies Bhd. Sdn. Bhd. Sdn. Bhd. Sdn. Bhd. Sdn. Bhd. Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

-------------------- ----------- ----------- -------------- ----------------- ----------- ----------- ---------

Segment

(loss)/profit

before

taxation (5,348) (7) (219) 187 (3,784) (1,222) (10,393)

==================== =========== =========== ============== ================= =========== =========== =========

Included in the

measure

of segment

(loss)/profit

are:

Revenue - - - - - - -

Cost of sales - - - - - - -

Revenue from hotel

operations - - - - 2,721 - 2,721

Revenue from mall

operations - - 1,084 - - - 1,084

Expenses from hotel

operations - - (127) - (3,136) - (3,263)

Expenses from mall

operations - - (636) - - - (636)

Depreciation of

property,

plant and

equipment - - (4) - (26) - (30)

Finance costs - - (623) (98) - (976) (1,697)

Finance income 682 - 22 255 - - 959

==================== =========== =========== ============== ================= =========== =========== =========

Segment assets 9,647 60 56,175 2,819 891 89,676 159,268

==================== =========== =========== ============== ================= =========== =========== =========

Segment liabilities 418 3 1,599 2,556 5,647 50,266 60,489

==================== =========== =========== ============== ================= =========== =========== =========

3 SegmentAL Information (cont'd)

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

------------------------------------ ---------

Total loss for reportable segments (10,393)

Other non-reportable segments (2,107)

Finance income 22

Others (65)

Consolidated loss before taxation (12,543)

==================================== =========

3 SegmentAL Information (conT'd)

Operating Segments ended 30 June 2021 - Unaudited

(re-presented)

Continuing operations

----------------------------------------------------------------

The

Ireka ICSD RuMa Urban

Investment Land Ventures Amatir Hotel DNA Total

Holding Sdn. Sdn. Resources KL Sdn. Sdn. continuing Discontinued

Companies Bhd. Bhd. Sdn. Bhd. Bhd. Bhd. operations operations Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ----------- -------- --------- ---------- -------- -------- ----------- ------------- --------

Segment

(loss)/profit

before

taxation (1,665) - (223) 227 (1,128) (1,143) (3,932) (1,875) (5,807)

=============== =========== ======== ========= ========== ======== ======== =========== ============= ========

Included in

the measure

of segment

(loss)/profit

are:

Revenue - - - - - 516 516 - 516

Cost of sales - - - - - (416) (416) - (416)

Revenue from

hotel

operations - - - - 1,005 - 1,005 - 1,005

Revenue from

mall

operations - - 945 - - - 945 - 945

Revenue from

hospital

operations - - - - - - - 5,574 5,574

Expenses from

hotel

operations - - (27) - (1,967) - (1,994) (1,994)

Expenses from

mall

operations - - (636) - - - (636) (636)

Expenses from

hospital

operations - - - - - - - (5,304) (5,304)

Depreciation

of property,

plant and

equipment - - (26) - (139) - (165) (16) (181)

Finance costs - - (585) (102) - (869) (1,556) (2,037) (3,593)

Finance income 356 - 22 336 - 11 725 1 726

=============== =========== ======== ========= ========== ======== ======== =========== ============= ========

Segment assets 5,104 132 58,906 3,192 648 103,929 171,911 86,460 258,371

=============== =========== ======== ========= ========== ======== ======== =========== ============= ========

Segment

liabilities 1,850 3 1,806 2,806 2,091 49,686 58,242 77,443 135,685

=============== =========== ======== ========= ========== ======== ======== =========== ============= ========

3 SegmentAL Information (cont'd)

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

------------------------------------ --------

Total loss for reportable segments (5,807)

Other non-reportable segments 2,515

Finance income 673

Others (601)

Consolidated loss before taxation (3,220)

==================================== ========

3 SegmentAL Information (cont'd)

Operating Segments - Year ended 31 December 2021 - Audited

Continuing operations

----------------------------------------------------------------

The

Ireka ICSD RuMa Urban

Investment Land Ventures Amatir Hotel DNA Total

Holding Sdn. Sdn. Resources KL Sdn. Sdn. continuing Discontinued

Companies Bhd. Bhd. Sdn. Bhd. Bhd. Bhd. operations operations Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ----------- -------- --------- ---------- -------- -------- ----------- ------------- ---------

Segment

(loss)/profit

before

taxation (3,113) (2) (580) 360 (1,637) (2,030) (7,003) (3,087) (10,089)

=============== =========== ======== ========= ========== ======== ======== =========== ============= =========

Included in

the measure

of segment

(loss)/profit

are:

Revenue - - - - - 595 595 - 595

Other income

from hotel

operations - - - - 2,679 - 2,679 - 2,679

Other income

from mall

operations - - 2,007 - - - 2,007 - 2,007

Other income

from hospital

operations - - - - - - - 12,768 12,768

Expenses from

hotel

operations - - (255) - (4,042) - (4,297) - (4,297)

Expenses from

mall

operations - - (1,072) - - - (1,072) - (1,072)

Expenses from

hospital

operations - - - - - - - (11,144) (11,144)

Depreciation

of property,

plant and

equipment - - (43) - (164) - (207) - (207)

Finance costs (172) - (1,290) (203) (2) (1,909) (3,576) (5,358) (8,934)

Finance income - - 45 600 - 20 665 335 1,000

=============== =========== ======== ========= ========== ======== ======== =========== ============= =========

Segment assets 6,837 78 58,322 3,212 703 95,243 164,395 100,812 265,207

=============== =========== ======== ========= ========== ======== ======== =========== ============= =========

Segment

liabilities 3,659 3 1,589 2,785 1,824 44,246 54,106 86,347 140,453

=============== =========== ======== ========= ========== ======== ======== =========== ============= =========

3 Segmental Information (cont'd)

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

------------------------------------ --------

Total loss for reportable segments (7,003)

Other non-reportable segments 2,157

Finance income (45)

Others 45

Consolidated loss before taxation (4,846)

==================================== ========

3 SegmentAL Information (cont'd)

Six months ended 30 June 2022 - Unaudited

Addition

Finance Finance Segment Segment to non-current

US$'000 Revenue Depreciation costs income assets liabilities assets

---------------------- --------- ------------- -------- -------- -------- ------------- ----------------

Total reportable

segment - (30) (1,696) 959 159,268 60,489 12

Other non-reportable

segments - - (22) 22 9,518 32,655 -

---------------------- --------- ------------- -------- -------- -------- ------------- ----------------

Consolidated total - (30) (1,718) 981 168,786 93,144 12

====================== ========= ============= ======== ======== ======== ============= ================

3 SegmentAL Information (cont'd)

Six months ended 30 June 202 1 - Unaudited (Re-presented)

Addition

Finance Finance Segment Segment to non-current

US$'000 Revenue Depreciation costs income assets liabilities assets

---------------------- -------- ------------- -------- -------- -------- ------------- ----------------

Total reportable

segment 516 (165) (1,556) 725 171,911 58,242 15

Other non-reportable

segments - (22) (162) 674 19,206 44,989 -

---------------------- -------- ------------- -------- -------- -------- ------------- ----------------

Consolidated total 516 (187) (1,718) 1,399 191,117 103,231 15

====================== ======== ============= ======== ======== ======== ============= ================

3 SegmentAL Information (cont'd)

Six months ended 31 December 202 1 - Audited

Addition

Finance Finance Segment Segment to non-current

US$'000 Revenue Depreciation costs income assets liabilities assets

---------------------- -------- ------------- -------- -------- -------- ------------- ----------------

Total reportable

segment 595 (207) (3,576) 665 164,395 54,106 42

Other non-reportable

segments - 109 (45) 45 24,712 44,021 -

---------------------- -------- ------------- -------- -------- -------- ------------- ----------------

Consolidated total 595 (98) (3,621) 710 189,107 98,127 42

====================== ======== ============= ======== ======== ======== ============= ================

3 Segmental Information (cont'd)

Geographical Information - six months ended 30 June 2022 -

Unaudited

Malaysia

US$'000

-------------------- ---------

Revenue -

Non-current assets 5,367

======================= =========

Geographical Information - six months ended 30 June 2021 -

Unaudited (re-presented)

Continuing

operations

------------

Total continuing Discontinued

Malaysia operations operation Total

US$'000 US$'000 US$'000 US$'000

-------------------- ------------ ----------------- ------------- --------

Revenue 516 516 - 516

Non-current assets 9,164 9,164 422 9,586

==================== ============ ================= ============= ========

Geographical Information - year ended 31 December 2021 -

Audited

Continuing

operations

------------

Total continuing Discontinued

Malaysia operations operation Consolidated

US$'000 US$'000 US$'000 US$'000

-------------------- ------------ ----------------- ------------- -------------

Revenue 1,329 1,329 - 1,329

Non-current assets 5,970 5,970 3,963 9,933

==================== ============ ================= ============= =============

In the financial period/year ended 30 June 202 2 ; 30 June 202 1

; 31 December 202 1 , no single customer exceeded 10% of the

Group's total revenue.

4 SEASONALITY

The Group's business operations were not materially affected by

seasonal factors for the period under review but was negatively

affected by the MCO in Malaysia resulting from the COVID-19

pandemic.

5 COST OF SALES

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 202 1 202 1

( Re-presented)

US$'000 US$'000 US$'000

Direct costs attributable

to:

Completed Units - 416 318

--------------------------- ----------- ---------------- -------------

6 FOREIGN EXCHANGE (LOSS)/GAIN

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

202 2 202 1 202 1

( Re-presented)

US$'000 US$'000 US$'000

------------------------------ ----------- ---------------- -------------

Foreign exchange gain/(loss)

comprises:

Realised foreign exchange

loss (53) 3 (1)

Unrealised foreign exchange

gain/(loss) (2,650) 853 346

(2,703) 856 345

------------------------------ ----------- ---------------- -------------

7 TAXATION

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

( Re-presented)

US$'000 US$'000 US$'000

Current tax expense 274 38 189

Deferred tax credit - - (48)

---------------------------- ----------- ---------------- --------------

Total tax expense/(income)

for the period/year 274 38 141

---------------------------- ----------- ---------------- --------------

7 Taxation (Cont'd)

The numerical reconciliation between the income tax expense and

the product of accounting results multiplied by the applicable tax

rate is computed as follows:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

( Re-presented)

US$'000 US$'000 US$'000

Net loss before taxation (12,543) (1,345) (4,846)

------------------------------------ ----------- ---------------- -------------

Income tax at rate of 24% (3,010) (323) (1,163)

Add :

Tax effect of expenses not

deductible in determining

taxable profit 2,486 309 1,666

Current year losses and other

tax benefits for which no

deferred tax asset was recognised 590 406 787

Tax effect of different tax

rates in subsidiaries - 361 -

Less :

Tax effect of income not taxable

in determining taxable profit (16) (715) (1,220)

(Under)/over provision in

respect of prior period/year 224 - 71

------------------------------------ ----------- ---------------- -------------

Total tax expense for the

period/year 274 38 141

------------------------------------ ----------- ---------------- -------------

The applicable corporate tax rate in Malaysia is 24%.

The Company is treated as a tax resident of Jersey for the

purpose of Jersey tax laws and is subject to a tax rate of 0%. The

Company is also registered as an International Services Entity so

it does not have to charge or pay local Goods and Services Tax. The

cost for this registration is GBP200 per annum.

The Directors intend to conduct the Group's affairs such that

the central management and control is not exercised in the United

Kingdom and so that neither the Company nor any of its subsidiaries

carries on any trade in the United Kingdom. The Company and its

subsidiaries will thus not be residents in the United Kingdom for

taxation purposes. On this basis, they will not be liable for

United Kingdom taxation on their income and gains other than income

derived from a United Kingdom source.

8 LOSS PER SHARE

Basic and diluted loss per ordinary share

The calculation of basic and diluted loss per ordinary share for

the period/year ended was based on the loss attributable to equity

holders of the parent and a weighted average number of ordinary

shares outstanding, calculated as below:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

(Re-presented)

Loss attributable to equity

holders of the parent ( US$'000)

* continuing operations (11,314) (701) (3,850)

* discontinued operations - (1,032) (1,632)

----------------------------------- ------------------- ------------------- ----------------

(11,314) (1,733) (5,482)

----------------------------------- ------------------- ------------------- ----------------

Weighted average number of

shares 198,691,000 198,691,000 198,691,000

----------------------------------- ------------------- ------------------- ----------------

Loss per share

Basic and diluted (US cents)

- continuing operations (5.69) (0.35) (1.94)

- discontinued operations - (0.52) (0.82)

----------------------------------- ------------------- ------------------- ----------------

(5.69) (0.87) (2.76)

----------------------------------- ------------------- ------------------- ----------------

9 LOANS AND BORROWINGS

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2022 202 1 202 1

US$'000 US$'000 US$'000

(Re-presented)

--------------------------- ---------- --------------- -------------

Current

Bank loans 1,589 2,936 1,681

Finance lease liabilities - 42 14

---------------------------- ---------- --------------- -------------

1,589 2,978 1,695

--------------------------- ---------- --------------- -------------

The effective interest rates on the bank loans and finance lease

arrangement for the period is 12% (30 June 2021 (re-presented):

12%; 31 December 202 1 : 12%) per annum respectively.

Borrowings are denominated in Malaysian Ringgit.

Bank loans are secured by land held for property development,

work-in-progress, operating assets of the Group, pledged deposits

and some by the corporate guarantee of the Company.

Reconciliation of movement of loans and borrowings to cash flows

arising from financing activities:

As at 1 Foreign As at 30

January Drawdown Repayment exchange June

2022 of loan of loan movements 2022

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

------------ --------- --------- ---------- ----------- ---------

Bank loans 1,681 - - (92) 1,589

========= ========= ========== =========== =========

As at 1 As at 30

January June

2021 2021

Foreign

Drawdown Repayment exchange

(Re-presented) of loan of loan movements (Re-presented)

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

------------ ----------------- ---------- ----------- ----------- -----------------

Bank loans 1,742 1,250 - (56) 2,936

================= ========== =========== =========== =================

9 Loans and Borrowings (Cont'd)

As at 1 Foreign As at 31

January Drawdown Repayment exchange December

202 1 of loan of loan movements 202 1

Audited US$'000 US$'000 US$'000 US$'000 US$'000

------------ --------- --------- ---------- ----------- ----------

Bank loans 1,742 1,250 (1,250) (61) 1,681

========= ========= ========== =========== ==========

As at 1 Repayment Foreign As at 30

January of lease Interest exchange June

2022 payment expenses movements 2022

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

------------------- --------- ---------- ---------- ----------- ---------

Lease Liabilities 14 (13) - (1) -

========= ========== ========== =========== =========

As at 30

As at 1

January June

202 1 Repayment 2021

Foreign

of lease Interest exchange

(Re-presented) payment expenses movements (Re-presented)

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

------------------- ----------------- ----------- ---------- ----------- -----------------

Lease Liabilities 181 (227) 12 77 43

================= =========== ========== =========== =================

As at 1 Repayment Foreign As at 31

January of lease Interest exchange December

2021 payment expenses movements 2021

Audited US$'000 US$'000 US$'000 US$'000 US$'000

------------------- --------- ---------- ---------- ----------- ----------

Lease Liabilities 181 (163) 3 (7) 14

========= ========== ========== =========== ==========

10 MEDIUM TERM NOTES

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2022 2021 2021

(Re-presented)

US$'000 US$'000 US$'000

------------------------------- ---------- ---------- ---------------

Outstanding medium term notes 31,154 43,609 42,317

Net transaction costs - (161) -

Less:

Repayment due within twelve

months* (31,154) (43,448) (42,317 )

------------------------------- ---------- ---------- ---------------

Repayment due after twelve - - -

months

------------------------------- ---------- ---------- ---------------

* Nil net transaction costs in relation to medium term notes due

within twelve months. (30 June 2021: US$0.67 million; 31 December

2021: Nil)

10 Medium Term Notes (cont'd)

Reconciliation of movement of medium term notes to cash flows

arising from financing activities:

As at 1 Foreign As at 30

January Drawdown Repayment exchange June

2022 of loan of loan movements 2022

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

--------------- --------- --------- ---------- ----------- ---------

Medium Term

Notes 42,316 - (9,133) (2,029) 31,154

========= ========= ========== =========== =========

As at 30

As at 1

January June

2021 2021

Foreign

Drawdown Repayment exchange

(Re-presented) of loan of loan movements (Re-presented)

Unaudited US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ----------------- ---------- ----------- ----------- -----------------

Medium Term

Notes 40,200 4,556 - (1,308) 43,448

================= ========== =========== =========== =================

As at 1 Foreign As at 31

January Drawdown Repayment exchange December

2021 of loan of loan movements 2021

Audited US$'000 US$'000 US$'000 US$'000 US$'000

--------------- --------- --------- ---------- ----------- ----------

Medium Term

Notes 40,200 3,559 - (1,443) 42,316

========= ========= ========== =========== ==========

The Medium Term Notes ("MTNs") were issued pursuant to a

programme with a tenor of ten (10) years from the first issue date

of the notes. The MTNs were issued by a subsidiary, to fund two

development projects known as Sandakan Harbour Square and Aloft

Kuala Lumpur Sentral ("AKLS") in Malaysia.

Following the completion of the sale of the AKLS by the Group in

2016, the net adjusted price value for the sale of AKLS, which

included the sale of the entire issued share capital of ASPL M3B

Limited and Iringan Flora Sdn. Bhd. (the "Aloft Companies") were

used to redeem the MTN Series 2 and Series 3. Following the

completion of the disposal of AKLS, US$96.25 million (RM394.0

million) of MTN associated with the AKLS (Series 3) and the Four

Points Sheraton Sandakan (Series 2) were repaid on 19 August 2016.

The charge in relation to AKLS was also discharged following the

completion of the disposal.

The Group completed the "roll-over" for the remaining MTNs of

US$24.43 million which is due on 10 December 2020, and 2021; it is

now repayable on 8 December 2022. The MTNs are rated AAA.

Repayment of US$9.13 million (RM39.0 million) was made in the

current financial period.

10 Medium Term Notes (cont'd)

The weighted average interest rate of the MTN was 4.50% per

annum at the statement of financial position date. The effective

interest rates of the MTN and their outstanding amounts are as

follows:

Interest rate

Maturity Dates % per annum US$'000

---------------------- ---------------- -------------- --------

Series 1 Tranche FGI 8 Dec 2022 4.50 7,892

Series 1 Tranche BG 8 Dec 2022 4.50 5,954

13,846

--------------------------------------- -------------- --------

The medium term notes are secured by way of:

(i) bank guarantee from two financial institutions in respect of the BG Tranches;

(ii) financial guarantee insurance policy from Danajamin

Nasional Berhad ("Danajamin") in respect to the FG Tranches;

(iii) a first fixed and floating charge over the present and

future assets and properties of Silver Sparrow Berhad and ICSD

Ventures Sdn. Bhd. by way of a debenture;

(iv) a third party first legal fixed charge over ICSD Ventures Sdn. Bhd.'s assets and

land;

(v) a corporate guarantee by the Company;

(vi) letter of undertaking from the Company to provide financial

and other forms of support to ICSD Ventures Sdn. Bhd. to finance

any cost overruns associated with the development of the Sandakan

Harbour Square;

(vii) assignment of all its present and future rights, interest

and benefits under the ICSD Ventures Sdn. Bhd.'s Put Option

Agreements in favour of Danajamin, Malayan Banking Berhad and OCBC

Bank (Malaysia) Berhad (collectively as "the guarantors") where

once exercised, the sale and purchase of HMS and SHA shall take

place in accordance with the provision of the Put Option Agreement;

and the proceeds from HMS and SHA will be utilised to repay the

MTNs;

(viii) assignment over the disbursement account, revenue

account, operating account, sale proceed account, debt service

reserve account and sinking fund account of Silver Sparrow Berhad;

revenue account of ICSD Venture Sdn. Bhd;

(ix) assignment of all ICSD Ventures Sdn. Bhd's present and

future rights, title, interest and benefits in and under the

insurance policies; and

(x) a first legal charge over all the shares of Silver Sparrow

Berhad, ICSD Ventures Sdn. Bhd. and any dividends, distributions

and entitlements.

10 Medium Term Notes (cont'd)

Potensi Angkasa Sdn Bhd ("PASB"), a subsidiary incorporated on

25 February 2019, has secured a commercial paper and/or medium term

notes programme not exceeding US$21.02 mil (RM90.0 million)

("CP/MTN Programme") to fund a project known as The RuMa Hotel and

Residences. PASB may, from time to time, issue commercial paper

and/or medium term notes ("Notes") whereby the nominal value of

outstanding Notes shall not exceed US$21.02 million (RM90.0

million) at any one time. The details of the drawdown schedule were

as follows:

Initial Issue First Roll-over Second Roll-over

------------------------------ ---------------------------- ----------------------------

Tranche RM Tranche RM Tranche RM

N umber Date ('000) Number Date ('000) Number Date ('000)

---------- -------- -------- --------- ------- -------- --------- ------- --------

Tranche 10 Jun Tranche 10 Jun Tranche 10 Jun

1-23 2019 22,850 63-83 2020 20,950 124-142 2021 19,050

Tranche 30 Sep Tranche 30 Sep Tranche 1 Oct

24-31 2019 9,600 84-91 2020 9,600 143-147 2021 4,750

Tranche 7 Oct Tranche 7 Oct Tranche 8 Oct

32-49 2019 17,100 92-109 2020 17,100 148-165 2021 17,100

Tranche 25 Feb Tranche 25 Feb Tranche 28 Feb

50-62 2020 15,350 110-122 2021 15,350 166-178 2022 15,350

Tranche 9 Jun Tranche 10 Jun

123 2021 20,000 179 2022 20,000

---------- -------- -------- --------- ------- -------- --------- ------- --------

The weighted average interest rate of the loan was 8.9% per

annum at the statement of financial position date. The effective

interest rates of the medium-term notes and their outstanding

amounts were as follows:

Maturity

Interest rate

Maturity Dates % per annum US$'000

----------------- ---------------- -------------- --------

13 Jun 202 2

Tranche 124-142 * 8.5 4,324

Tranche 143-147 3 Oct 202 2 8.5 1,078

Tranche 148-165 11 Oct 202 2 8.5 3,882

Tranche 166-178 1 Mar 2023 8.5 3,484

Tranche 179 11 Jun 2023 10.0 4,540

17,308

---------------------------------- -------------- --------

* Maturity date of Tranche 124-142 was further extended to 12

February 2023.

Security for CP/MTN Programme

(a) A legal charge over the Designated Accounts by the PASB

and/or the Security Party (as defined below) (as the case may be)

and assignment of the rights, titles, benefits and interests of the

PASB and/or the Security Party (as the case may be) thereto and the

credit balances therein on a pari passu basis among all Notes,

subject to the following:

(i) In respect of the 75% of the sale proceeds of a Secured

Asset ("Net Sale Proceeds") arising from the disposal of a Secured

Asset, the Noteholders of the relevant Tranche secured by such

Secured Asset shall have the first ranking security over such Net

Sale Proceeds;

10 Medium Term Notes (cont'd)

(ii) In respect of the insurance proceeds from the Secured

Assets ("Insurance Proceeds"), the Noteholders of the relevant

Tranche secured by such Secured Asset shall have the first ranking

security over such Insurance Proceeds;

(iii) In respect of the sale deposits from the Secured Assets

("Sale Deposits"), the Noteholders of the relevant Tranche secured

by such Secured Asset shall have the first ranking security over

such Sale Deposits;

(iv) In respect of the amount at least equivalent to an amount

payable in respect of any coupon payment of that particular Tranche

for the next six (6) months to be maintained by the Issuer

("Issuer's DSRA Minimum Required Balance"), the Noteholders of the

relevant Tranche shall have the first ranking security over such

Issuer's DSRA Minimum Required Balance;

(v) In respect of the proceeds from the Collection Account ("CA

Proceeds"), the Noteholders of the relevant Tranche shall have the

first ranking security over such CA Proceeds; and

(vi) In respect of any amount deposited by the Guarantor which

are earmarked for the purposes of an early redemption of a

particular Tranche of the Notes and/or principal payment of a

particular Tranche of the Notes ("Deposited Amount"), the

Noteholders of the relevant Tranche shall have the first ranking

security over such Deposited Amount;

(b) An irrevocable and unconditional guarantee provided by the

Urban DNA Sdn Bhd for all payments due and payable under the CP/MTN

Programme ("Guarantee"); and

(c) Any other security deemed appropriate and mutually agreed

between the PASB and the Principal Adviser/Lead Arranger ("PA/LA"),

the latter being Kenanga Investment Bank Berhad.

Security for each medium term note:

Each Tranche shall be secured by assets ("Secured Assets") to be

identified prior to the issue date of the respective Tranche.

Such Secured Assets may be provided by third party(ies), (which,

together with the Guarantor, shall collectively be referred to as

"Security Parties" and each a "Security Party") and/or by the PASB.

Subject always to final identification of the Secured Asset prior

to the issue date of the respective Tranche, the security for any

particular Tranche may include but not limited to the

following:

(a) Legal assignment and/or charge by the PASB and/or the

Security Party (as the case may be) of the Secured Assets;

(b) An assignment over all the rights, titles, benefits and

interests of the PASB and/or the Security Party (as the case may

be) under all the sale and purchase agreements executed by

end-purchasers and any subsequent sale and purchase agreement to be

executed in the future by end-purchaser (if any), in relation to

the Secured Assets;

(i) A letter of undertaking from Aseana Properties Limited to,

amongst others, purchase the Secured Assets ("Letter of

Undertaking"); and/or

10 Medium Term Notes (CONT'D)

(c) Any other security deemed appropriate and mutually agreed

between the Issuer and the PA/LA and/or Lead Manager prior to the

issuance of the relevant Tranche.

The security for each Tranche is referred to as "Tranche

Security".

11 RELATED PARTY TRANSACTIONS

Transactions between the Group with Ireka Corporation Berhad

("ICB") and its group of companies are classified as related party

transactions based on ICB's 23.07% shareholding in the Company.

Related parties also include key management personnel defined as

those persons having authority and responsibility for planning,

directing and controlling the activities of the Group either

directly or indirectly. The key management personnel include all

the Directors of the Group, and certain members of senior

management of the Group.

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

(Re-presented)

US$'000 US$'000 US$'000

---------------------------------- ----------- --------------- -------------

ICB Group of Companies

Accrued interest on shareholders

advance payable by ICB 682 356 122

Accrued interest on a contract

payment by an ICB subsidiary 66 70 -

Hosting and IT support services

charged by an ICB subsidiary - 2 -

Marketing commission charged

by an ICB subsidiary - 7 -

Rental expenses charge by

an ICB subsidiary - 29 -

Key management personnel

Fees and short-term employee

benefits 1,027 271 578

---------------------------------- ----------- --------------- -------------

11 Related Party Transactions (continued)

Transactions between the Group and other significant related

parties are as follows:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

(Re-presented)

US$'000 US$'000 US$'000

--------------------------------- ----------- --------------- -------------

Non-controlling interests

Advances - non-interest bearing (697) 193 121

--------------------------------- ----------- --------------- -------------

The outstanding amounts due from/(to) ICB and its group of

companies as at 30 June 2022, 30 June 2021 and 31 December 2021 are

as follows:

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

202 2 202 1 202 1

(Re-presented)

US$'000 US$'000 US$'000

---------------------------- ---------- ---------------- -------------

Net amount due from an ICB

subsidiary 1,960 1,945 2,005

Net amount due from ICB 3,771 5,109 3,178

---------------------------- ---------- ---------------- -------------

On 29 July 2022, ICB announced that it had submitted an

application for Judicial Management for its subsidiary, Ireka

Engineering & Construction Sdn Bhd ("IECSB"), from which the

Group recognizes a net amount due. No further information is

available at the time of this report, the Group will be monitoring

the situation closely including assessing the potential impact to

the Group's financial position and performance.

The outstanding amounts due from/(to) the other significant

related parties as at 30 June 2022, 30 June 2021 and 31 December

2021 are as follows:

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

202 2 202 1 202 1

(Re-presented)

US$'000 US$'000 US$'000

--------------------------------- ---------- ---------------- -------------

Non-controlling interests

Advances - non-interest bearing (1,169) (11,588) (1,952)

--------------------------------- ---------- ---------------- -------------

Transactions between the parent company and its subsidiaries are

eliminated in these consolidated financial statements.

12 DIVIDENDS

The Company has not paid or declared any dividends during the

financial period ended 30 June 202 2 .

13 INTERIM STATEMENT

Copies of this interim statement are available on the Company's

website www.aseanaproperties.com or from the Company's registered

office at Osprey House, Old Street, St Helier, Jersey JE2 3RG,

Channel Islands.

14 EVENTS AFTER STATEMENT OF FINANCIAL POSITION DATE

On 3 August 2022, the Group terminated the conditional agreement

dated 9 September 2021 for the sale of the remaining 58 residential

units at The RuMa Hotel and Residences as a result of certain

conditions in the agreement that had not been met.

PRINCIPAL RISKS AND UNCERTAINTIES

The Board has overall responsibility for risk management and

internal control. The following have been identified previously as

the areas of principal risk and uncertainty facing the Company, and

they remain relevant in the second half of the year.

-- Economic

-- Strategic

-- Regulatory

-- Law and regulations

-- Tax regimes

-- Management and control

-- Operational

-- Financial

-- Going concern

For greater detail, please refer to page 17 of the Company's

Annual Report for 2021, a copy of which is available on the

Company's website www.aseanaproperties.com .

RESPONSIBILITY STATEMENT

The Directors of the Company confirm that to the best of their

knowledge that:

a) The condensed consolidated financial statements have been

prepared in accordance with IAS 34 (Interim Financial

Reporting);

b) The interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

c) The interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related party

transactions and changes therein).

On behalf of the Board

NICK PARIS

Director

15 September 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BKQBQQBKDCCD

(END) Dow Jones Newswires

September 15, 2022 02:00 ET (06:00 GMT)

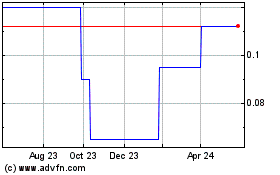

Aseana Prop (AQSE:ASPL.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aseana Prop (AQSE:ASPL.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025