TIDMASPL

RNS Number : 8543X

Aseana Properties Limited

28 April 2023

28 April 2023

Aseana Properties Limited

("Aseana" or the "Company")

Full Year Results for the year ended 31 December 2022

Aseana Properties Limited (LSE: ASPL), a property developer in

Malaysia, listed on the Main Market of the London Stock Exchange,

announces its full year results for the year ended 31 December

2022.

For further information:

Grant Thornton UK LLP

Philip Secrett / Samuel Littler +44(0)20 7383 5100

CHAIRMAN'S STATEMENT

Dear Shareholders,

INTRODUCTION

Asia began its recovery from the COVID-19 pandemic from the

middle of 2022 onwards, as both Malaysia and Vietnam (where we used

to own properties) steadily lifted their restrictions on population

movement and international travel. As a result, economic activity,

and most importantly, the movement of first the domestic

populations and then foreign tourists began to accelerate. These

are very important to the Company as our assets comprised a

hospital and development land in Vietnam (which have now been

sold), a 5-star hotel and luxury residential apartments in Kuala

Lumpur, a shopping mall and a hotel in Sandakan and undeveloped

beachfront land in Sabah.

COMMENTARY ON THE YEAR

Our focus has been to minimise operating costs and net cash

outflows at each of our properties whilst our Asset Divestment team

seeks to dispose of them at reasonable prices. The sale of our

Vietnam assets significantly reduced the project debts, reducing

our debt servicing costs.

I am pleased that shareholders are co-operating in the common

aim of selling the Group's assets and returning as much capital as

possible to all shareholders.

ECONOMIC OVERVIEW

In 2022, the Malaysian economy recorded growth of 8.7% (2021:

3.1%) according to the Malaysian government as the economy

rebounded from the easing of COVID-19 restrictions but this

forecast is expected to slow to 4.0% in 2023 according to the World

Bank.

PERFORMANCE REVIEW

During 2022, the Company recorded a net loss after finance costs

and before taxation of US$17.6 million compared to a net loss

before taxation of US$5.8 million (restated) for the previous

financial year. The Net Loss attributable to equity holders was

US$15.9 million for FY 2022, (2021 (restated): US$5.8 million), and

the loss per share was US cents 7.99 (2021 (restated): US cents

2.90).

Our NAV per Share as at 31 December 2022 fell to US cents 37

(2021 (restated): US cents 46).

Our net cash inflow for the year was US$0.1 million (2021

(restated): US$1.7 million) which reflected foreign exchange gain

effect of US$ 2.9 million (2021 (restated): US$1.1 million loss

effect), net cash outflows from operating activities of US$4.5

million (2021 (restated): US$9.8 million) offset by a cash inflow

from investing and financing activities of US$1.7 million (2021

(restated): US$12.7 million).

OUR ASSET DIVESTMENT PROGRAMME

Progress on asset sales had been very difficult during the Covid

restrictions but in March 2022, we completed the sale of our two

assets in Vietnam for a gross price of US$95 million. We received a

gross consideration of US$18.3 million in cash of which US$8.9

million was used to pay down project debts owed in Malaysia. The

balance was used for working capital purposes within the Group.

Although we had to terminate a conditional agreement to sell the

unsold apartments in The RuMa Residences in August 2022, other

potential buyers have since appeared, and progress is being made to

sell these and our other major assets. Announcements will be made

about these when such discussions convert into detailed sale terms

and signed commitments.

DIS-CONTINUATION VOTE IN MAY

The Company is required to hold another dis-continuation vote by

the end of May 2023 so that shareholders can vote on the future of

the Company. The Directors therefore intend to call an

Extraordinary General Meeting on 30 May 2023 and current

expectations are to also hold the Annual General Meeting on the

same date.

ACKNOWLEDGMENTS

Once again, I would like to thank my colleagues on the Company's

Board of Directors, the staff operating at the level of the Group

and the staff working at each of the properties that we own for

their tireless work on behalf of the Group and its shareholders. In

addition, our external advisors and service providers provide

invaluable assistance to the Company.

On 3 March 2023, Hock Chye Tan joined the Board of Directors and

the Audit Committee as an independent non-executive Director based

in Malaysia. He is a corporate and finance professional bringing

valuable expertise as a qualified accountant.

Thank you.

NICHOLAS JOHN PARIS

Chairman

28 April 2023

PROPERTY PORTFOLIO AS AT 31 DECEMBER 2022

Project Type Effective Approximate

Ownership Gross

Floor Approximate

Area Land Area

(sq m) (sq m)

------------------------------ -------------------- ----------- ------------ ------------

Completed projects

------------------------------ -------------------- ----------- ------------ ------------

The RuMa Hotel and Luxury residential

Residences tower and bespoke

Kuala Lumpur, Malaysia hotel 70.0% 40,000 4,000

------------------------------ -------------------- ----------- ------------ ------------

Sandakan Harbour Square Hotel and retail

Sandakan, Sabah, Malaysia mall 100.0% 126,000 48,000

------------------------------ -------------------- ----------- ------------ ------------

Undeveloped projects

------------------------------ -------------------- ----------- ------------ ------------

Land parcel

approved for

development

of: (i) Boutique

resort hotel

and resort

villas

Kota Kinabalu Seafront (ii) Resort

resort & residences homes 80.0% n/a 172,900

------------------------------ -------------------- ----------- ------------ ------------

Divested projects

------------------------------ -------------------- ----------- ------------ ------------

Phase 1: City International

Hospital, International

Healthcare Park, Private general

Ho Chi Minh City, Vietnam hospital 73.04% 48,000 25,000

------------------------------ -------------------- ----------- ------------ ------------

Other developments

in International Healthcare

Park,

Ho Chi Minh City, Vietnam Commercial

(formerly International development

Hi-Tech Healthcare with healthcare

Park) theme 73.04% 972,000 351,000

------------------------------ -------------------- ----------- ------------ ------------

PERFORMANCE SUMMARY

Year ended Year ended

31 December 31 December

2022 2021

------------------------------------------------------------------- ------------- -------------

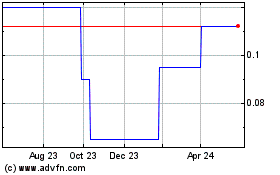

Total Returns since listing

Ordinary share price -86.00% -80.00%

FTSE All-share index 22.31% -26.30%

FTSE 350 Real Estate Index -57.47% -33.88%

One Year Returns

Ordinary share price -30.00% -37.50%

FTSE All-share index -3.16% 14.55%

FTSE 350 Real Estate Index -35.67% 26.19%

Capital Values (2021 restated)

Total assets less current liabilities

(US$ million) 104.24 126.09

Net asset value per share (US$) 0.41 0.45

Ordinary share price (US$) 0.14 0.20

FTSE 350 Real Estate Index 398.93 620.13

Debt-to-equity ratio (2021 restated)

Debt-to-equity ratio (1) 102.21% 92.52%

Net debt-to-equity ratio (2) 91.50% 84.52%

(Loss)/ Earnings Per Share (2021

restated)

Earnings per ordinary share - basic

(US cents) -7.99 -2.90

- diluted (US cents) -7.99 -2.90

Notes:

(1) Debt-to-equity ratio = (Total Borrowings ÷ Total Equity) x

100%

(2) Net debt-to-equity ratio = (Total Borrowings less Cash and

Cash Equivalents ÷ Total Equity) x 100%

FINANCIAL REVIEW

INTRODUCTION

The Group recorded a consolidated comprehensive loss of US$20.4

million for the financial year ended 31 December 2022 (year ended

31 December 2021 (restated): US$12.6 million) , largely due to

impairment provided to inventory and amount due from a related

party.

STATEMENT OF COMPREHENSIVE INCOME

The Group recognised revenue of US$ 1.0 million (2021

(restated): US$0.6 million). Revenue of US$36.4 million has been

deferred until control of sold units in the leaseback program is

passed to the buyer.

The Group recorded a net loss before taxation of US$17.6 million

(2021 (restated): US$5.8 million). The loss was largely due to

impairment provided to inventory and amount due from a related

party.

Net loss attributable to equity holders of the parent company

was US$15.9 million (2021 (restated): US$5.8 million). Tax expenses

for the year was US$ 0.3 million (2021 (restated): US$0.1

million).

The consolidated comprehensive loss was US$ 20.3 million ( 2021

(restated): US$12.6 million), which included a loss of US$ 2.5

million (2021 (restated) : US$3.6 million) attributable to foreign

currency translation differences for foreign operations due to an

appreciation of the US Dollar against the Ringgit, during the

year.

Basic and diluted loss per share were both US cents 7.99 (2021

(restated): US cents 2.90).

STATEMENT OF FINANCIAL POSITION

Total assets were US$ 157.2 million (2021 (restated): US$190.4

million), representing a decrease of US$ 31.9 million. This was

mainly due to disposal of asset held for sale with a carrying

amount of US$14.5 million and a decrease of US$14.5 million in

inventories that includes an impairment of US$8.6 million.

Total liabilities were US$89.4 million (2021 (restated):

US$101.4 million), representing a decrease of US$12.0 million. This

was mainly due to a decrease of US$11.1 million in medium term

notes which was partially repaid during the year.

Net Asset Value per share was US$0.37 (31 December 2021

(restated): US$0.46).

CASH FLOW AND FUNDING

Cash generated from operations before interest and tax paid was

US$1.1 million (2021 (restated): US$6.2 million cash used).

The Group generated net cash flow of US$10.5 million from

investing activities (2021 (restated): US$0.7 million).

Some of the borrowings of the Group were repaid from divestment

proceeds. As at 31 December 2022, the Group's gross borrowings

stood at US$32.9 million (31 December 2021 (restated): US$44.0

million). Net debt-to-equity ratio was 91.50% (31 December 2021

(restated): 84.52%).

Finance income was US$2.0 million for financial year ended 31

December 2022 (2021 (restated): US$2.0 million) which included

accrued income of US$1.5 million (2021 (restated): US$1.3 million).

Finance costs were US$3.3 million (2021 (restated): US$3.6

million), which were mostly incurred by its operating assets.

DIVID

No dividend was declared or paid in the financial years 2022 and

2021.

PRINCIPAL RISKS AND UNCERTAINTIES

A review of the principal risks and uncertainties facing the

Group is set out in the Directors' Report of the Annual Report.

TREASURY AND FINANCIAL RISK MANAGEMENT

The Group undertakes risk assessments and identifies the

principal risks that affect its activities. The responsibility for

the management of each key risk has been clearly identified and has

been managed by the Board of Directors and the Board are closely

involved in the day-to-day operation of the Group.

A comprehensive discussion on the Group's financial risk

management policies is included in the notes to the financial

statements of the Annual Report.

NICHOLAS JOHN PARIS

Director

28 April 2023

CORPORATE SOCIAL RESPONSIBILITY ("CSR")

Aseana Properties is committed to making a positive difference

in the world, whether it is for the local community or whether it

is building a better working environment. The Company believes that

being socially and environmentally responsible is good for people,

the planet and for business. The following six core principles

define the essence of corporate citizenship for the Company.

Managing Corporate Responsibility

The Board of Directors at Aseana Properties has oversight

mechanisms, through corporate-level policies and standards to

ensure an effective CSR programme is delivered in the interest of

its employees, shareholders and the community at large. It is

determined to ensure that its CSR programme acts legally and

responsibly on all matters and that the highest ethical standards

are maintained. The Board recognizes this as a key part of its

risk, management strategy to protect the reputation of Aseana

Properties and shareholders values are enhanced.

Employees

In the current changing economic environment, with competing

demands and stress, the welfare of employees is critical in order

to ensure they are productive, creative and innovative. This is

also in order to achieve the highest standard in the workplace. The

Board works hard to ensure that employees are treated fairly and

with dignity because it is the right thing to do and also to get

the best out of them.

Health and Safety

Aseana Properties considers Health and Safety to be important

because it protects the well-being of employees, visitors and

clients. Looking after Health and Safety makes good business sense

and the Company works hard to provide a healthy workplace

environment for its staff, contractors and visitors.

Some of the organized efforts and procedures for reducing

workplace accidents, risks and hazards, exposure to harmful

solutions include:

-- Paying particular attention to the regular maintenance of

equipment, plant and systems to ensure a safe working

environment.

-- Providing sufficient information, instruction, training and

supervision to enable all employees to avoid hazards and to

contribute positively to their own safety and safe performance at

work.

Stakeholders

Aseana Properties works collaboratively with its stakeholders to

improve services and to ensure client satisfaction. The Company is

committed to meaningful dialogue and encourages stakeholder

participation through stakeholder events, roadshows, briefings,

conference calls and timely release of annual reports. Aseana

Properties also maintains an updated and informative website,

www.aseanaproperties.com that is accessible to stakeholders and

members of the public.

Environmental Management

Aseana Properties believes that any commitment to a more

environmentally sustainable world has to start at home, and to this

end, it challenges itself to work in an environmentally responsible

manner and to find new ways to reduce its carbon footprint. It also

works with consultants such as architects to look at how they can

be more environmentally friendly by incorporating natural elements

such as water, greenery, light and air into its projects.

Maintaining and sustaining local Malaysian heritage is the essence

of the RuMa Hotel so decorative elements like batik prints

throughout are recycled from a local batik factory. The Kelelai (a

type of bamboo) ornaments and ceiling panels at the pool area of

Level 6 of the hotel are cultivated from a dying weaving art by

Kelantanese women.

The RuMa Hotel and Residences have both been separately awarded

the Green Building Index (GBI) Provisional Gold Rating having

successfully met all the GBI Criteria under each category for

Energy Efficiency, Indoor Environment Quality, Sustainable Site

Planning & Management, Materials & Resources, Water

Efficiency and Innovation. The GBI is Malaysia's industry

recognized green rating tool for buildings to promote

sustainability in the building industry.

The bathroom amenities at The RuMa Hotel were designed with

sustainability in mind and incorporated biodegradable materials

such as bamboo, corn starch, and recycled paper for dry amenities

like toothbrushes, cotton swabs, soap dishes, and shower caps.

Additionally, the wet amenities range was created exclusively for

The RuMa Hotel and is both eco-friendly and able to be disposed of

in an environmentally responsible manner. By opting for

biodegradable bathroom amenities, we can contribute to the

protection of our planet and the promotion of a more sustainable

future.

The RuMa Hotel recognizes that promoting gender equality is

crucial to our sustainability efforts, and we have incorporated the

promotion of gender equality in the workplace as a key component of

our sustainability initiatives. Our aim is to foster a more

diverse, inclusive, and equitable work environment by implementing

clear policies and guidelines that promote gender equality, such as

equal pay for equal work, flexible work arrangements, and a

workplace that is free from harassment and discrimination. We are

committed to providing our employees with training and education on

gender equality issues, including unconscious bias and gender

sensitivity, to ensure that everyone in our organization

understands the importance of this initiative.

Community

Aseana Properties understands the importance of community

engagement both for the communities themselves but also for giving

staff more meaningful experiences by tapping into their

professional skills and capabilities.

BOARD OF DIRECTORS

NICHOLAS JOHN PARIS

NON-EXECUTIVE INDEPENT CHAIRMAN

Nicholas (Nick) John Paris was re-appointed as a Non-Executive

Director of Aseana Properties Limited in September 2019 and became

Chairman on 29 July 2020 following the retirement of Gerald Ong. He

had previously been a Non-Executive Director of Aseana from 22 June

2015 to 20 March 2019.

Nick is a fellow of the Institute of Chartered Accountants

England & Wales and a Chartered Alternative Investment

Analyst.

Nick is currently Managing Director of Myanmar Investments

International Limited and a Managing Director of Dolphin Capital

Investors Limited of which both are quoted on the AIM market of the

London Stock Exchange and a Non-Executive Director of Fondul

Proprietatea, a fund listed on the Bucharest and London Stock

Exchanges.

THOMAS HOLLAND

NON-EXECUTIVE INDEPENT DIRECTOR

Thomas (Tom) Holland was appointed as a Non-Executive

Independent Director of Aseana Properties Limited on 23 November

2020. Tom has been based in Asia for 25 years with experience

working in leadership positions in a number of financial firms. Tom

has been active in Vietnam since 2006, having led the investments

in large real estate developments as well as privatising state

owned enterprises. Prior to founding his current platform,

Development Finance Asia, a boutique investment firm, Tom was head

of Asia for Cube Capital and a senior investment manager for Income

Partners Asset Management. Tom has a track record of successfully

managing private investments in Vietnam, Malaysia, China,

Indonesia, Myanmar, Mongolia and Cambodia.

He holds a number of non-executive director roles for financial

services, logistics and consumer companies across Asia.

MONICA LAI VOON HUEY

NON-EXECUTIVE NON-INDEPENT DIRECTOR

Monica Lai was appointed as a Non-Executive Non- Independent

Director of Aseana Properties Limited in September 2019. Monica is

the Group Chief Executive Officer of Eccaz Sdn Bhd which is

involved in property development and urban transportation

solutions.

Monica graduated from City University, London with a Bachelor of

Science (Hons) Degree in Accountancy and Economics and worked for

EY London and KPMG Hong Kong. Her professional qualifications

include The Institute of Chartered Accountants England & Wales,

The Malaysian Institute of Accountants and the Malaysian Institute

of Taxation.

HOCK CHYE TAN

NON-EXECUTIVE INDEPENT DIRECTOR

Hock Chye Tan was appointed as a Non-Executive Independent

Director of Aseana Properties in March 2023. Hock Chye is a

Chartered Global Management Accountant (CGMA) of the Association of

International Certified Professional Accountants, a Fellow Member

(FCMA) of the Chartered Institute of Management Accountants and a

Chartered Accountant (CA(M)) with the Malaysian Institute of

Accountants. He obtained an MBA from Oklahoma City University and

has attended a Harvard Premier Management Program. He also holds a

Diploma in Commerce from the TAR University College.

He has worked in Papua New Guinea, Singapore and Malaysia in

both private and public companies and held senior management and

Board positions. Currently, he is the CFO of SEATech Ventures

Corp., a start-up company listed on the US OTC Pink Market. He is

also the National Assistant Treasurer of SME Association of

Malaysia and Treasurer of the Malaysia Cross Border E-Commerce

Association.

HELEN WONG SIU MING

NON-EXECUTIVE INDEPENT DIRECTOR

Helen Wong Siu Ming was appointed as a Non-Executive Independent

Director of Aseana Properties in June 2019. Helen has over 28 years

of financial and operational experience in the United States and

Asia. She is Chief Executive Officer and founder of LAPIS Global

Limited, a Hong Kong based investment management and advisory firm.

She was formerly the CEO of Cushman & Wakefield Capital Asia

where she established the Asia Investment Management and Investment

Banking platform.

In addition, Helen has held numerous executive positions

including Chief Operating Officer of Lazard Asia Investment

Management HK Limited, Managing Director of IFIL Asia (renamed EXOR

S.p.A), where she was responsible for the Asian direct investment

activities and Chief Financial Officer of the Singapore listed

investment vehicle, Pacific Century Regional Developments

Limited.

Helen also has extensive experience in infrastructure and

transport through her prior roles at the Provisional Airport

Authority, Hong Kong and the Port Authority of New York & New

Jersey.

DIRECTORS' REPORT

The Directors present their report together with the audited

financial statements of Aseana Properties Limited (the "Company")

and its subsidiary undertakings (together with the "Group") for the

year ended 31 December 2022.

Principal Activities

The principal activities of the Group were the development of

upscale residential and hospitality projects in Malaysia and

Vietnam. The Group is now focused on carrying out its divestment

program which consists of selling the Group's remaining Malaysian

assets, repaying its debts and distributing the remaining proceeds

to its shareholders.

Business Review and Future Developments

The consolidated statement of comprehensive income for the year

is set out on page 40. A review of the development and performance

of the business has been set out in the Chairman's Statement and

the Financial Review reports.

Objectives and Strategy

When the Company was launched in 2007, the Board considered it

desirable that Shareholders should have an opportunity to review

the future of the Company at appropriate intervals. The Company

will hold another discontinuation vote at a general meeting in May

2023, meanwhile the Company continues to seek for disposal of its

assets in a measured manner.

To the extent that the Company has not disposed of all of its

assets by May 2023, Shareholders will be provided with an

opportunity to review the future of the Company, which would

include the option for shareholders to vote for the continuation of

the Company.

Principal Risks and Uncertainties

The Group's business was property development in Malaysia and

Vietnam. Since divesting its assets in Vietnam in 2022, its

principal risks are therefore related solely to the property market

in Malaysia. More detailed explanations of these risks and the way

they are managed are contained under the heading of Financial and

Capital Risk Management Objectives and Policies in Note 4.1 to the

financial statements.

Other risks faced by the Group in Malaysia include the

following:

Economic Inflation, economic recessions and movements

in interest rates could affect property

development activities.

Strategic Incorrect strategy, including timing, could

lead to poor returns for shareholders.

----------------------------------------------------

Regulatory Breach of regulatory rules could lead to

suspension of the Company's Stock Exchange

listing and financial penalties.

----------------------------------------------------

Law and regulations Changes in laws and regulations relating

to planning, land use, development standards

and ownership of land could have adverse

effects on the business and returns for

the shareholders.

----------------------------------------------------

Tax regimes Changes in the tax regimes could affect

the tax treatment of the Company and/or

its subsidiaries in these jurisdictions.

----------------------------------------------------

Management and control Changes that cause the management and control

of the Company to be exercised in the United

Kingdom could lead to the Company becoming

liable to United Kingdom taxation on income

and capital gains.

----------------------------------------------------

Operational The COVID-19 pandemic and many related

movement control measurements in Malaysia

lasted until 2022, which continued to affect

our key properties as our hotel suffered

closure and low occupancy rates and our

retail mall was also forced to close; at

times, only food operations were permissible

at our shopping mall. The overall effect

of low occupancy rates and reduced operating

income had a negative impact on our revenues,

costs and valuations. Failure of the Company's

accounting system and disruption to the

business, or to that of third party service

providers, could lead to an inability to

provide accurate reporting and monitoring

leading to a loss of shareholders' confidence.

----------------------------------------------------

Financial Inadequate controls by the Company or third

party service providers could lead to a

misappropriation of assets. Inappropriate

accounting policies or failure to comply

with accounting standards could lead to

misreporting or breaches of regulations

or a qualified audit report.

----------------------------------------------------

Going Concern Failure to sell the assets in a timely

manner may result in inadequate financial

resources to continue operational existence

and to meet financial liabilities and commitments.

----------------------------------------------------

The Board seeks to mitigate and manage these risks through

continual review, policy setting and enforcement of contractual

rights and obligations. It also regularly monitors the economic and

investment environment in Malaysia, its only remaining market.

Details of the Group's internal controls are described on page

29.

LITIGATION

Claim Against Ireka Corporation Bhd ("ICB")

A civil suit was filed in the Malaysian Courts on 21 October

2022 by ASPL M9 Limited, a subsidiary of the Company, against ICB.

The suit relates to the Joint Venture Agreement between ASPL M9

Limited, ICB and Urban DNA Sdn Bhd (an indirect subsidiary of the

Company) for the development and construction of the RuMa Hotel

& Residences.

Claim Against Ireka Engineering & Construction Sdn Bhd

("IECSB")

A civil suit was filed in the Malaysian Courts on 2 August 2022

by Amatir Resources Sdn Bhd ("ARSB", an indirect wholly owned

subsidiary of the Company) against IECSB (a wholly owned subsidiary

of ICB). Since filing the claim, an interim liquidator has been

appointed for IECSB according to the announcement at the Bursa

Malaysia dated 27 March 2023 with reference to a creditor's

voluntary winding up. For details, please refer to the

aforementioned announcement at:

https:/www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3339385

On 19 April 2023, ARSB obtained Judgment in Default against

IECSB for the sum of RM 7,198,890 (approximately US$1.6 million)

and interest thereon at the rate of 8% per annum calculated on a

daily basis from 1st January 2020 to the date of full payment.

Results and Dividends

The results for the year ended 31 December 2022 are set out in

the attached financial statements.

No dividends were declared nor paid during the financial year

under review.

Share Capital

No shares were issued in 2022. Further details on share capital

are stated in Note 23 to the financial statements.

Directors

The following were Directors of Aseana who held office

throughout the financial year and up to the date of this

report:

-- Nicholas John Paris - Chairman

-- Thomas Holland

-- Monica Lai Voon Huey

-- Hock Chye Tan (appointed 3 March 2023)

-- Helen Wong Siu Ming

Directors' Interests

The interests of the directors in the Company's shares as at 31

December 2022 and as at the date of this report were as

follows:

DIRECTOR ORDINARY SHARES OF US$0.05 EACH

As at 31 Dec 2021 As at 31 Dec 2022

Nicholas John Paris 26,644,192 -

Christopher Henry Lovell 48,000 -

Monica Lai Voon Huey 36,628,282 36,628,282

-------------------------- ------------------ ------------------

Notes: Nicholas John Paris is no longer associated with the

holdings of clients of LIM Advisors Limited. Christopher Henry

Lovell ceased to be a director during the year. Monica Lai Voon

Huey is associated with the holdings of Legacy Essence Limited.

None of the other directors in office at the end of the

financial year had any interest in shares in the Company during the

financial year.

Management

The routine operations of the Company are supervised by the

Chairman and the Board with a small team of finance professionals

were directly engaged to run our finances and operations. Ms Helen

Wong was nominated as the Divestment Director with a specific focus

to sell the Company's remaining assets, in line with the Divestment

Policy.

Employees

The Company had no executive Directors during the year, and a

team of four finance professionals were engaged to run our finances

and operations. The subsidiaries of the Group had a total of 239

employees as at 31 December 2022, of which 22 and 213 were employed

by (i) the Sandakan hotel asset and Harbour Mall Sandakan, and (ii)

The RuMa Hotel and Residences in Kuala Lumpur respectively.

going concern

The Company will continue until May 2023 at which time another

continuation vote will be held by shareholders. In connection with,

or at the same time as, the proposal that the Company be wound up

voluntarily the Board shall be entitled to make proposals for the

reconstruction of the Company. Until then, the Company will

continue to seek to dispose of its assets in a measured manner.

As disclosed in Note 2.1 to the financial statements, it refers

to the assumptions made by the Directors including the uncertainty

regarding the divestment of certain assets will be completed as

planned and the loans and borrowing can be discharged in a timely

manner when concluding that it remains appropriate to prepare the

financial statements on the going concern basis.

Creditors Payment Policy

The Group's operating companies are responsible for agreeing on

the terms and conditions under which business transactions with

their suppliers are conducted. It is the Group's policy that

payments to suppliers are made in accordance with all relevant

terms and conditions. Trade creditors at 31 December 2022 amounted

to 349 days (2021: 591 days) of property development cost and

interest expenses accrued by the Group.

Financial Instruments

The Group's principal financial instruments comprise cash

balances, balances with related parties, other payables,

receivables and loans and borrowings that arise in the normal

course of business. The Group's Financial and Capital Risk

Management Objectives and Policies are set out in Note 4.1 to the

financial statements.

Directors' Liabilities

Subject to the conditions set out in the Companies (Jersey) Law

1991 (as amended), the Company has arranged appropriate Directors'

and Officers' liability insurance to indemnify the Directors

against liability in respect of proceedings brought by third

parties. Such provisions remain in force at the date of this

report.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the annual report

and the financial statements in accordance with applicable law and

regulations. Companies (Jersey) Law 1991 requires the Directors to

prepare financial statements for each financial year. Under that

law the Directors are required to prepare the financial statements

in accordance with International Financial Reporting Standards

("IFRSs") as adopted by European Union.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the assets, liabilities, financial position and of the

profit or loss of the Group for that year. In preparing these

financial statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable, relevant and reliable;

-- ensure that the financial statements comply with IFRSs; and

-- prepare the financial statements on the going concern basis,

unless it is inappropriate to presume that the Group and the

Company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's

transactions and disclose with reasonable accuracy at any time the

financial position of the Group and to enable them to ensure that

the financial statements comply with the Companies (Jersey) Law

1991. The Directors are also responsible for safeguarding the

assets of the Group and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

The Directors are also responsible for the maintenance and

integrity of the Company's website on the internet. However,

information is accessible in many different countries where

legislation governing the preparation and dissemination of

financial statements may differ from that applicable in the United

Kingdom and Jersey.

The Directors of the Company confirm that to the best of their

knowledge that:

-- the financial statements have been prepared in accordance

with International Financial Reporting Standards as adopted by the

European Union, give a true and fair view of the assets,

liabilities, financial position and profit or loss of the Group;

and

-- the sections of this Report, including the Chairman's

Statement, Director's Review, Financial Review and Principal Risks

and Uncertainties, which constitute the management report include a

fair review of all information required to be disclosed by the

Disclosure and Transparency Rules 4.1.8 to 4.1.11 issued by the

Financial Services Authority of the United Kingdom.

Disclosure of Information to Auditor

So far as each person who was a Director at the date of

approving this report is aware, there is no relevant audit

information, being information needed by the auditor in connection

with preparing its report, of which the auditor is unaware. Having

made enquiries of fellow Directors, each Director has taken all the

steps that he is obliged to take as a Director in order to have

made himself aware of any relevant audit information and to

establish that the auditor is aware of that information.

Re-appointment of Auditor

The auditor, PKF Littlejohn LLP, has expressed their willingness

to continue in office. A resolution proposing their re-appointment

will be tabled at the forthcoming Annual General Meeting.

Board Committees

Information on the Audit Committee is included in the Corporate

Governance section of the Annual Report on pages 24 to 31.

Annual General Meeting

The tabling of the 2022 Annual Report and Financial Statements

to shareholders will be at an Annual General Meeting ("AGM") that

is currently expected to be held on 30 May 2023.

During the AGM, investors will be given the opportunity to

question the board and to meet with them thereafter. They will be

encouraged to participate in the meeting.

On behalf of the Board

THOMAS HOLLAND

Non-Executive Independent Director

28 April 2023

REPORT OF DIRECTORS' REMUNERATION

Directors' Emoluments

The Company has no executive Directors, solely a few employees

who are mainly focused on the divestment process. The Independent

Directors in the Board of Directors are responsible for setting the

framework and reviewing compensation arrangements for all

non-executive Directors before recommending the same to the Board

for approval. The Independent Directors assess the appropriateness

of the emoluments on an annual basis by reference to comparable

market conditions with the overall objective of ensuring maximum

stakeholder benefit from the retention of a high calibre Board.

During the year, the Directors received the following emoluments

in the form of fees from the Company:

Year ended Year ended

31 December 2022 31 December 2021

Directors (US$) (US$)

------------------------------------ ------------------ ------------------

Nicholas John Paris

(Chairman of the Board) 70,000 70,000

Helen Wong Siu Ming

(Chairman of the Audit Committee) 77,000 77,105

Thomas Holland 48,000 48,058

Monica Lai Voon Huey 48,000 48,000

Christopher Henry Lovell(1) 22,286 48,082

(1) Christopher Lovell was not re-elected at the Company's 2022 Annual

General Meeting on 17 June 2022.

Share Options

The Company did not operate any share option schemes during the

years ended 31 December 2021 and 2022.

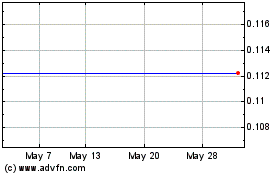

Share Price Information

-- High for the year - US$0.20

-- Low for the year - US$0.12

-- Close for the year - US$0.14

Pension SchemeS

No pension schemes exist in the Company.

Service Contracts

In view of the non-executive nature of the directorships, there

are no service contracts in existence between the Company and any

of the Directors. Each Director was appointed by a letter of

appointment that states his appointment subject to the Articles of

Association of the Company which set out the main terms of his

appointment.

THOMAS HOLLAND

Non-executive Independent Director

28 April 2023

CORPORATE GOVERNANCE STATEMENT

The Financial Conduct Authority requires all companies with a

Premium Listing to comply with The UK Corporate Governance Code

(the "Code"). Aseana Properties is a Jersey incorporated company

with a Standard Listing on the UK Listing Authority's Official List

and is therefore not subject to the Code. The following explains

how the principles of governance are applied to the Company.

THE BOARD

The Company currently has a Board of five non-executive

directors, including the non-executive Chairman.

The brief biographies of the following Directors appear on pages

14 to 15 of this Annual Report:

-- Nicholas John Paris (Non-Executive Chairman)

-- Thomas Holland

-- Monica Lai Voon Huey

-- Hock Chye Tan (appointed 3 March 2023)

-- Helen Wong Siu Ming

The routine operations of the Company are supervised by the

Chairman and the Board and a team of finance professionals were

directly engaged to run our finances and operations. Ms Helen Wong

was nominated as the Divestment Director with a specific focus to

sell the Company's remaining assets, in line with the Divestment

Policy.

Role of the Board of Directors

The Board's role is to provide entrepreneurial leadership to the

Company, within a framework of prudent and effective controls,

enabling risks to be assessed and managed. The Board sets the

Company's strategic objectives, monitors and reviews the Company's

operational and financial performance, ensures the Company has

sufficient funding, and examines and approves disposal of the

Company's assets in a controlled, orderly and timely manner. The

Board also sets the Company's values and standards and ensures that

its obligations to its shareholders and other stakeholders are met.

The Board has adopted a divestment strategy since 2015.

Appropriate level of directors' and officers' liability

insurance is maintained by the Company.

The Board currently has the power to make purchases on behalf of

the Company of its own Ordinary Shares provided up to a maximum

aggregate 29,783,780 Ordinary Shares (representing approximately

14.99 percent of the Company's issued ordinary share capital

(excluding ordinary shares held in treasury)).

Meetings of the Board of Directors

The Board meets at least four (4) times a year and at such other

times as the Chairman shall require. During the year ended 31

December 2022, the Board met ten (10) times and their respective

attendance are as follows:

Name of Directors Attendance

Nicholas John Paris 10/10

Thomas Holland 9/9 *

Monica Lai Voon Huey 9/9 *

Christopher Henry Lovell 5/5

Helen Wong Siu Ming 9/9 *

* Each of Thomas Holland, Monica Lai Voon Huey, Helen Wong Siu

Ming were excused from one of the meetings during the year due to

potential conflicts of interest

Hock Chye Tan was appointed to the Board in March 2023 and

therefore does not appear in the above.

To enable the Board to discharge its duties effectively, all

Directors receive accurate, timely and clear information, in an

appropriate form and quality, including Board papers distributed in

advance of Board meetings. The Board periodically will receive

presentations at Board meetings relating to the Company's business

and operations, significant financial, accounting and risk

management issues. All Directors have access to the advice and

services of the Company Secretary and advisers, who are responsible

to the Board on matters of corporate governance, board procedures

and regulatory compliance.

Board Balance and Independence

Following the resignation of our former Development Manager as

of 30 June 2019, ASEANA has been a self-managed company. The Board

consists solely of non-executive directors of which Nicholas Paris

is the non-executive Chairman. Monica Lai Voon Huey is a

representative of Legacy Essence Limited and she was a

representative of Ireka Corporation Berhad until her resignation

from the latter's Board in November 2021; she is therefore

classified as a Non-Independent Non-Executive Director of the

Company. The Board considers the majority of Directors to be

independent, being independent of management and also having no

business relationships which could interfere materially with the

exercise of their judgement.

The Chairman is responsible for leadership of the Board,

ensuring effectiveness in all aspects of its role and setting its

agenda. Matters referred to the Board are considered by the Board

as a whole and no individual has unrestricted powers of decision.

Together, the Directors bring a wide range of experience and

expertise in business, law, finance and accountancy, which are

required to successfully direct and supervise the business

activities of the Company.

Performance Appraisal

The Board undertakes an annual evaluation of its own performance

and that of its Committees and individual Directors. During 2022,

the evaluation concluded that the performance of the Board, its

Committees and each individual Director was and remains effective

and that all Directors demonstrate full commitment in their

respective roles. The Directors are encouraged to continually

attend training courses at the Company's expense to enhance their

skills and knowledge in matters that are relevant to their role on

the Board. The Directors also receive updates on developments of

corporate governance, the state of economy, management strategies

and practices, laws and regulations, to enable effective

functioning of their roles as Directors.

Re-election of Directors

The Company's Articles of Association states that all Directors

shall submit themselves for election at the first opportunity after

their appointment, and shall not remain in office for longer than

three years since their last election or re-election without

submitting themselves for re-election. At the Annual General

Meeting held on 17 June 2022, Christopher Lovell retired by

rotation and offered himself for re-election by the shareholders.

He was not re-elected at the AGM.

At the forthcoming Annual General Meeting, Hock Chye Tan will be

offering himself for re-election having recently been appointed,

and Nicholas John Paris will be retiring by rotation and offering

himself for re-election.

Board Committees

The Board has established Audit Committees which deals with the

specific aspect of the Company's affairs, under a written term of

reference which is reviewed annually. Necessary recommendations are

then made to the Board for its consideration and decision-making.

No one, other than the committee chairman and members of the

relevant committee, is entitled to be present at a meeting of board

committees, but others may attend at the invitation of the board

committees for presenting information concerning their areas of

responsibility. Copies of the terms of reference are kept by the

Company Secretary and are available on request at the Company's

registered office at Osprey House, Old Street, St. Helier, Jersey,

JE2 3RG, Channel Islands.

Audit Committee

The Audit Committee consists of three members and is currently

chaired by Helen Wong. The other members are Thomas Holland and

Hock Chye Tan (appointed in March 2023). The Committee members have

no links with the Company's external auditor and Helen Wong, Thomas

Holland and Hock Chye Tan are independent Directors. The Board

considers that collectively the Audit Committee has sufficient

recent and relevant financial experience with the ability to

discharge its duties properly, through extensive service on the

Boards and Audit Committees of other listed companies.

Meetings of THE AUDIT COMMITTEE

The Committee meets at least twice a year and at such other

times as the Chairman of the Audit Committee shall require. Any

member of the Audit Committee or the auditor may request a meeting

if they consider that one is necessary. The Committee met two times

during the year and their respective attendance are as follows:

Name Attendance

Helen Wong Siu Ming 2/2

Christopher Henry Lovell (Not re-elected

on 17 June 2022) 1/1

Thomas Holland 2/2

Hock Chye Tan was appointed to the Audit Committee in March 2023

and therefore does not appear in the above.

Representatives of the auditor may attend by invitation.

The Committee is responsible for:

-- monitoring, in discussion with the auditor, the integrity of

the financial statements of the Company, any formal announcements

relating to the Company's financial performance and reviewing

significant financial reporting judgements contained in them;

-- reviewing the Company's internal financial controls and risk management systems;

-- making recommendations to the Board in relation to the

appointment, re-appointment and removal of the external auditor and

approving the remuneration and terms of engagement of the external

auditor to be put to the shareholders for their approval in general

meetings;

-- reviewing and monitoring the external auditor's independence

and objectivity and effectiveness of the audit process, the Audit

Committee recognises that the Code and AIC Code provisions for FTSE

350 companies to put the external audit contract out to tender at

least every 10 years. Though the Company is not a member of the

FTSE 350, the Audit Committee considers this to be best practice

(the current auditor has been the auditor since 2020);

-- developing and implementing policy on engagement of the

external auditor to supply non-audit services; and

-- reporting to the Board any matters in respect of which it

considers that action or improvement is needed and making

recommendations as to the steps to be taken.

Since the start of the financial year ending 31 December 2022,

the Audit Committee performed its duties as set out in the terms of

reference. The main activities carried out by the Audit Committee

encompassed the following:

-- reviewing the audit plan with the Group's Auditor;

-- reviewing and discussing the Audit Committee Report with the Group's Auditor;

-- reviewing the draft Audited Financial Statements as contained

in the draft Annual Report together with the Group's Auditor before

tabling to the Board for consideration and approval;

-- reviewing other published financial information including the

half year results and results announcements before tabling to the

Board for consideration and approval;

-- considering the independence of the auditor; and

-- reviewing the auditor's performance and made a recommendation

for the reappointment of the Group's auditor by shareholders.

The Significant Issues

The Audit Committee considered the following key issues in

relation to the Group's financial statements during the year:

-- valuation of inventory assets - The Audit Committee

considered and discussed the valuation of the Group's inventory

assets as at 31 December 2022 and to identify potential

impairment.

-- impairment of receivables from a related party - The Audit

Committee noted that a related party to the Group, which the Group

maintained receivable balances with, had entered Judicial

Management due to financial distress. Consequently, the

recoverability of the balances was considered doubtful and full

impairment has been made on the balances.

-- going concern - The Audit Committee considered the Company's

financial requirements for the next 12 months and concluded that it

has sufficient resources to meet its commitments and any

outstanding loan covenants. Consequently, the financial statements

have been prepared on a going concern basis.

Nomination & REMUNERATION Committee ("NRC")

The Nomination & Remuneration Committee was chaired by

Christopher Lovell. The other committee members were Monica Lai

Voon Huey and Nicholas Paris. The responsibilities of the NRC are

stated below and upon Christopher Lovell's departure in June 2022

were integrated into the Board's responsibilities. Given the

Company is currently in its divestment phase, all Directors are

non-executive on fixed fees. For the same reason, a specific

diversity and inclusion policy has not been applied. However, it is

considered that the Board has suitable gender balance and is

suitably diverse.

During the year ended 31 December 2022, the Nomination &

Remuneration Committee carried out its functions as set out in its

terms of reference which are summarised below:

-- regularly reviewing the structure, size and composition

(including diversity, skills, knowledge and experience) of the

Board and making recommendations to the Board with regard to any

change;

-- considering succession plans for Directors and the

re-appointment or re-election of any Directors at the conclusion of

their specified term of office or retiring in accordance with the

Company's Articles of Association;

-- identifying and nominating for the approval of the Board,

candidates to fill Board vacancies as and when they arise;

-- considering any matter relating to the continuation in office

of any Director at any time;

-- determining and agreeing with the Board the framework for the

remuneration of the Directors; and

-- setting the remuneration for all Directors albeit since all

Directors are non-executive, the principles of the Code in respect

of executive directors' remuneration are not applicable and as such

there is no policy for executive compensation.

Financial Reporting

The Board aims to present a fair, balanced and understandable

assessment of the Company's position and prospects in all reports

to shareholders, investors and regulatory authorities. This

assessment is primarily provided in the half-yearly report and the

Annual Report through the Chairman's Statement, Financial Review

Statement and Directors' Report.

The Audit Committee has reviewed the significant reporting

issues and judgements made in connection with the preparation of

the Group's financial statements including significant accounting

policies, significant estimates and judgements. The Audit Committee

has also reviewed the clarity, appropriateness and completeness of

disclosures in the financial statements.

Internal Audit

The Board has confirmed that the systems and procedures

employed, provide sufficient assurance that a sound system of risk

management and internal control is maintained. An internal audit

function specific to the Company is therefore considered not

necessary given the Company is in divestment phase of its life.

However, the Directors will continue to monitor if such need is

required.

Auditor

The Audit Committee's responsibilities include monitoring and

reviewing the performance and independence of the Company's

Auditor, PKF Littlejohn LLP who had been re-appointed on 8 December

2022.

Pursuant to audit and ethical standards, the auditor is required

to assess and confirm to the Board their independence, integrity

and objectivity. The Auditor had carried out this assessment and

considered themselves to be independent, objective and in

compliance with the Ethical Standard for Auditors published by the

UK Financial Reporting Council and the Code of Ethics issued by the

Institute of Chartered Accountants in England and Wales.

RISK MANAGEMENT AND Internal Control

The Board is responsible for the effectiveness of the Company's

risk management and internal control systems and is supplied with

information to enable it to discharge its duties. Such systems are

designed to meet the particular needs of the Company and to manage

rather than eliminate the risk of failure to meet business

objectives and can only provide reasonable, and not absolute,

assurance against material misstatement or loss.

During the year, the Board discharged its responsibility for

risk management and internal control through the following key

procedures:

-- clearly defined delegation of responsibilities to employees

of the Company, including authorisation levels for all aspects of

the business;

-- regular and comprehensive information provided to the Board

covering financial performance and key business indicators;

-- a detailed system of budgeting, planning and reporting which

is approved by the Board and monitoring of results against budget

with variances being followed up and action taken, where necessary;

and

-- regular visits to operating units and projects by the Board.

The Board has established frameworks, policies and procedures to

comply with the requirement of the Bribery Act 2010 (the "Bribery

Act") and Market Abuse Regulation ("MAR"). In respect of the

former, the Company has a legal and compliance function for the

purposes of implementing the anti-corruption and anti-bribery

policy. Training and briefing sessions were conducted for the

senior management and employees. Compliance reviews are carried out

as and when required to ensure the effectiveness of the policy. In

respect of dealing by employees and Directors of the Company, the

Company has a Dealing Code which imposes restrictions on dealings

in its securities by Persons Discharging Managerial

Responsibilities ("PDMR") and certain employees who have been told

the clearance procedures apply to them. The Company also has a

Group-Wide Dealing Policy and a Dealing Procedures Manual. These

policies have been designed to ensure that the PDMR and other

employees of the Company and its subsidiaries do not misuse or

place themselves under suspicion of misusing information about the

Group which they

have and which is not public.

Relationship with Shareholders

The Board is committed to maintaining good communications with

shareholders and has designated the Chairman and certain members of

its Board as the principal spokespersons with investors, analysts,

fund managers, the press and other interested parties. The Board is

informed of material information provided to shareholders and is

advised on their feedback. The Board has also developed an

understanding of the views of major shareholders about the Company

through meetings and teleconferences conducted by the financial

adviser. In addition, the Company seeks to regularly update

shareholders through stock exchange announcements, press releases

and participation in roadshows.

To promote effective communication, the Company has a website,

www.aseanaproperties.com through which shareholders and investors

can access relevant information.

Substantial Shareholders

The Board was aware of the following direct and indirect

interests comprising a significant amount of more than 3% issued

share capital of the Company as at 31 December 2022:

NUMBER OF ORDINARY PERCENTAGE OF

SHARES HELD ISSUED SHARE CAPITAL

Ireka Corporation Berhad. 45,837,504 23.07%

Legacy Essence Limited and its related

parties 36,628,282 18.43%

LIM Advisors 26,644,192 13.41%

SIX SIS 18,366,118 9.24%

Progressive Capital Partners 14,393,372 7.24%

Dr. Thong Kok Cheong 12,775,532 6.43%

Credit Suisse 12,024,891 6.05%

Annual General Meeting ("AGM")

The AGM is the principal forum for dialogue with shareholders.

At and after the AGM, investors are given the opportunity to

question the Board and seek clarification on the business and

affairs of the Group. Mr. Nicholas John Paris, non-executive

Chairman and Mr. Christopher Lovell, non-executive independent

director, attended the 2022 AGM, either in person or by telephone,

which was held on 17 June 2022 at the Company's registered

office.

Notices of the AGM and related papers are sent out to

shareholders in good time to allow for full consideration prior to

the AGM. Each item of special business included is accompanied by

an explanation of the purpose and effect of a proposed resolution.

The Chairman declares the number of votes received for, against and

withheld in respect of each resolution after the shareholders and

proxies present have voted on each resolution. An announcement

confirming whether all the resolutions have been passed at the AGM

is made through the London Stock Exchange.

On behalf of the Board

NICHOLAS JOHN PARIS

Chairman

28 April 2023

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF ASEANA PROPERTIES

LIMITED

Opinion

We have audited the financial statements of Aseana Properties

Limited and its subsidiaries (the 'group') for the year ended 31

December 2022 which comprise the Consolidated Statement of

Comprehensive Income, the Consolidated Statement of Financial

Position, the Consolidated Statement of Changes in Equity, the

Consolidated Statement of Cash Flows and notes to the financial

statements, including significant accounting policies. The

financial reporting framework that has been applied in their

preparation is applicable law and International Financial Reporting

Standards (IFRSs) as adopted by the European Union.

In our opinion, the financial statements:

-- give a true and fair view of the state of the group's affairs

as at 31 December 2022 and of its loss for the year then ended;

-- have been properly prepared in accordance with IFRSs as adopted by the European Union; and

-- have been prepared in accordance with the requirements of the Companies (Jersey) Law 1991.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the group

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard as applied to listed public interest

entities, and we have fulfilled our other ethical responsibilities

in accordance with these requirements. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Material uncertainty related to going concern

We draw attention to note 2.1 in the financial statements, which

indicates that the success of the group relies on its ability to

raise sufficient funds through project divestments in order to

finance the operation of the group, as well as the result of the

members' dis-continuation vote to be held at the end of May

2023.

As at 31 December 2022, the group's loans, borrowings and medium

term notes amounted to USD $32.9 million, of which the entirety is

due for repayment by 8 December 2023.

The economic consequences of the global pandemic have continued

to adversely impact the interest of prospective buyers for the

group's remaining assets. Therefore, there is no certainty that the

sale of the remaining assets will be completed as planned and the

loans, borrowings including medium term notes can be repaid in a

timely manner.

As stated in note 2.1, these events or conditions indicate that

a material uncertainty exists that may cast significant doubt on

the group's ability to continue as a going concern.

Our opinion is not modified in respect of this matter.

In auditing the financial statements, we have concluded that the

director's use of the going concern basis of accounting in the

preparation of the financial statements is appropriate. Our

evaluation of the directors' assessment of the group's ability to

continue to adopt the going concern basis of accounting included a

review of management's assessment of the going concern status of

the group, including a cash flow forecast for the twelve months

from the anticipated approval of the group financial statements.

Our audit procedures included challenging the integrity of the

underlying formulas and calculations within the going concern

model; and reviewing the reasonableness of the key assumptions used

by the directors to prepare the cash flow forecast.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Our application of materiality

The scope of our audit was influenced by our application of

materiality. We set certain quantitative thresholds for

materiality. These, together with qualitative considerations,

helped us to determine the scope of our audit and the nature,

timing and extent of our audit procedures on the individual

financial statement line items and disclosures and in evaluating

the effect of misstatements, both individually and in aggregate, on

the financial statements as a whole.

Group financial statements Group financial statements

2022 2021

Overall materiality USD $1,200,000 USD $1,400,000

--------------------------- ---------------------------

Performance materiality USD $720,000 USD $840,000

--------------------------- ---------------------------

Basis of materiality c. 0.7% of gross assets c. 0.7% of gross assets

--------------------------- ---------------------------

Rationale A key determinant of the group's value is property

assets held within inventory. Due to this, the

key area of focus in the audit is the valuation

of inventory. On this basis, we consider gross

assets to be a critical financial performance

measure for the group given that it is a key metric

used by management, investors, analysts and lenders.

--------------------------------------------------------

We use performance materiality to reduce to an appropriately low

level the probability that the aggregate of uncorrected and

undetected misstatements exceeds overall materiality. Specifically,

we use performance materiality in determining the scope of our

audit and the nature and extent of our testing of account balances,

classes of transactions and disclosures, for example in determining

sample sizes.

For each component in the scope of our group audit, we allocated

a materiality that is less than our overall group materiality. The

range of materiality allocated across components was between USD

$5,000 (2021: USD $40,000) and USD $630,000 (2021: USD $720,000).

Certain components were audited to a local statutory audit

materiality that was also less than our overall group

materiality.

We agreed with the Audit Committee that we would report to them

misstatements identified during our audit above USD $60,000 (2021:

USD $70,000) as well as misstatements below those amounts that, in

our view, warranted reporting for qualitative reasons.

Our approach to the audit

As part of designing our audit, we determined materiality and

assessed risk of material misstatement in the financial statements.

In particular, we looked at areas involving significant accounting

estimate and judgment by the directors and considered future events

that are inherently uncertain such as the carrying value of

inventory. We also addressed the risk of management override of

controls, including among other matters consideration of whether

there was evidence of bias that represented a risk of material

misstatement due to fraud.

The group has nine trading companies consolidated within in the

group financial statements, all of which are based in Malaysia. We

identified seven significant components, which were subject to a

full scope of audit. Significant Malaysian components were audited

by the PKF network firm in Malaysia. We reviewed component audit

working papers electronically. In addition to this, significant

components were subject to audits under our direction and

supervision.

Key audit matters

Key audit matters are those matters that, in our professional

judgment, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) we identified, including those which had the greatest effect

on: the overall audit strategy, the allocation of resources in the

audit; and directing the efforts of the engagement team. These

matters were addressed in the context of our audit of the financial

statements as a whole, and in forming our opinion thereon, and we

do not provide a separate opinion on these matters. In addition to

the matter described in the material uncertainty related to going

concern section we have determined the matters described below to

be the key audit matters to be communicated in our report.

Key Audit Matter How our scope addressed this matter

---------------------------------------------------- ------------------------------------------

Carrying value of inventory

------------------------------------------

Refer to note 20 Inventory. We performed testing of the inventory

valuation and critically assessed

The group owns a portfolio of land the key assumptions and estimates

held for property development and made. The procedures performed

completed property units in Malaysia. are summarised below:

The total carrying value of inventory

for the group was USD $132.6 million. We assessed the valuers' qualifications

Inventory amounted to USD $126.2 and expertise and read their terms

million was valued by third party of engagement with the group to

valuers C H Williams Talhar & Wong determine whether there are matters

Sdn Bhd ("CBRE WTW") and Knight that might have affected their

Frank Malaysia Sdn Bhd ("Knight objectivity or may have imposed

Frank"), together "the valuers" limitation of scope upon their

who are engaged by the directors. work. We also considered fees and

other contractual arrangements

The valuation report issued by that might exist between the group

Knight Frank dated 13 February and the valuers. We found no evidence

2023 shows a write down of c. USD to suggest that the objectivity

$13.8 million (2021: c. USD $14.7 of the valuers was compromised.

million) in the carrying value

of Sandakan Harbour Square located We read all valuation reports including

in Malaysia. The valuation report workings which support the net

issued by CBRE WTW dated 23 March realisable value assessment of

2023 shows a write down of c. USD inventory.

$1.8m in the carrying value of

RuMa Hotel (excluding Services Tested the underlying data used

Residences). by the valuers in forming their

valuation including benchmarking,

The directors had been in discussions validating key assumptions to supporting

with a party leading up to the third party evidence or market

year end and on 17 January 2023 activity and considering contrary

the directors of Aseana Properties evidence.

Limited received a signed Letter

of Intent ("LOI") to purchase Sandakan Assessed and challenged the key

Harbour Square and RuMa Hotel & estimates and assumptions used

Services Residences, subject to in the valuation methodology, noted

normal due diligence ("the Offer and performed analysis on changes

Price"). The Offer Price indicated from prior year where relevant.

an impairment of c. USD $8.6 million

to the carrying value of the Sandakan Evaluated a range of key estimates

Harbour Square and no impairment and assumptions used in the valuations

in respect of the RuMa Hotel & and profit and cash flow forecasts.

Services Residences. The directors

are of the opinion that the Offer In addition to the above work on

Price included in the LOI indicates the valuation reports, we reviewed

a fair price and that both parties the signed letter of intent stating

are actively seeking to agree contractual the potential buyer's interest

terms. The directors considered in purchasing Sandakan Harbour

the Offer Price as an appropriate Square and Ruma Hotel and Service

carrying value of the inventory Residences. Further, we assessed

at the year end. Directors do not the buyer's credentials using publicly

plan to dispose any of the inventory available information.

with a price lower that that indicated

by the LOI. As a result, an impairment In respect of the land located

charge of c. USD $8.6 million is in Kota Kinabalu, Sabah in Malaysia

recognised against the carrying with a carrying value of USD $6.3

value of the Sandakan Harbour Square. million as at 31 December 2022

where no third party valuation

At 31 December 2022, goodwill valued has been carried out, our comparison

at USD $578,000 arose from the to recent sales transactions of

acquisition of ICSD Ventures Sdn. land assets of similar characteristics

Bhd (the owner of the Sandakan resulted in the conclusion of no

Harbour Square) in 2009 was not indicator of impairment to the

impaired. Directors are of the year-end carrying value existed.

opinion that the value of goodwill

can be recovered via the disposal Except for the issues identified

of the Sandakan Harbour Square in relation to Sandakan Harbour

despite the impairment charge stated Square, RuMa Hotel and Service

above. Residences as well as the land

located in Kota Kinabalu, Sabah,

A parcel of land located in Kota we concluded that the directors'

Kinabalu, Sabah in Malaysia with year end carrying value is supportable

a carrying value of USD $6.3 million in light of the evidence. We note

as at 31 December 2022 was not that the LOI is not a contractual

valued by any third party valuer. document. Contractual terms (in

In addition to this, and consistent any) may differ materially from

with the market conditions observed, the Offer Price.

we note there continued to be a

higher level of judgement associated

with certain asset valuations,

notably those with a significant

retail and hospitality element.

The continuing economic consequences

of COVID-19 further increased judgment

in relation to assumptions around:

* occupier demand and solvency;

* asset liquidity; and

* the relative impact on the different sectors

including retail, hospitality and leisure.

In determining the carrying value

of inventory, the valuers take

into account property specific

information such as the current

lease agreements and occupancy

rates. They apply assumptions for

yields and expected future income

growth rates, which are influenced

by prevailing market yields and

comparable market transactions,

to arrive at final valuation.

The valuation of inventory requires

significant judgment and estimation

by management and their valuers.

Inaccuracies in inputs or unreasonable

bases used in these judgements

could result in a material misstatement

in the financial statements. There

is also a risk that management

may influence the significant judgments

and estimates in respect of inventory

valuations in order to meet market

expectations.

The significance of the estimates

and judgements involved, coupled

with the fact that only a small

percentage difference in individual

valuations, when aggregated, could

result in a material misstatement,

warranted specific audit focus

in this area.

------------------------------------------