TIDMCEG

RNS Number : 5725B

Challenger Energy Group PLC

05 June 2023

5 June 2023

Challenger Energy Group PLC

("Challenger Energy" or the "Company")

AREA-OFF 3 - URUGUAY

Challenger Energy (AIM: CEG), the Caribbean and Americas focused

oil and gas company, with a range of oil production, development,

appraisal, and exploration assets, is pleased to advise that it has

bid for, and now anticipates being awarded, the AREA OFF-3 licence,

offshore Uruguay.

HIGHLIGHTS

-- CEG has bid for and expects to be awarded the AREA OFF-3 licence, offshore Uruguay.

-- AREA OFF-3 is the sole remaining available block offshore

Uruguay; all other offshore exploration licences are held by energy

majors Shell and Apache and YPF, the Argentinian national oil

company.

-- The AREA OFF-3 licence is 13,252 km(2) , and will increase

CEG's total Uruguay acreage holdings to 2 8,000 km(2) , making CEG

the second largest offshore acreage holder in Uruguay behind

Shell.

-- AREA OFF-3 is located in relatively shallow water, with

existing 2D and 3D seismic coverage. The block has a current

estimated resource potential of up to 500 million barrels of oil

equivalent ("mmboe") and up to 9 trillion cubic feet gas ("TCF"),

from multiple exploration plays.

-- CEG's AREA OFF-3 bid consisted of an initial 4-year

exploration period, with a work program limited to reprocessing and

reinterpretation of 1,000 kms of 2D seismic data.

-- Award of the AREA OFF-3 licence to CEG will represent a

successful expansion of the Company's high quality, frontier play

opportunity in Uruguay - a fast emerging global exploration

"hotspot" - and is consistent with a strategy of targeting high

impact Atlantic margin opportunities.

Eytan Uliel, Chief Executive Officer of Challenger Energy,

said:

"We are delighted to advise that on 2 June 2023, ANCAP publicly

announced the details of Challenger Energy's offer for the AREA

OFF-3 licence, which is the precursor step for the formal award of

the licence to CEG, and which we understand should occur in the

next 3-4 weeks.

AREA OFF-3 possesses identified prospects of material scale, and

our immediate work focus will be a comprehensive technical

reassessment of the block, applying modern 2D seismic re-imaging

and our subsurface knowledge of the Uruguayan offshore margin,

similar to the successful geotechnical de-risking approach we have

applied on AREA OFF-1.

Strategically, the award of this licence will cement CEG's

position as a significant participant in Uruguay, a country that

has fast become one of the world's frontier exploration hotspots.

At the same time, our bid for the AREA OFF-3 block demonstrated the

same disciplined and opportunistic approach we have taken in the

past: acting strategically and nimbly to secure large and promising

acreage, yet with low-cost work obligations, discretionary

expenditure phasing, and no new seismic acquisition or drilling

commitments.

We are especially appreciative of the confidence shown in CEG by

the Uruguayan regulatory authority, ANCAP. Over the next four years

we intend to further grow that confidence by applying our basin

expertise and fully evaluating the licence's potential. We

anticipate that we can create an opportunity of comparable value

and industry interest to what we have thus far identified with AREA

OFF-1, to the benefit of both Challenger and ANCAP."

Overview

As part of the Open Uruguay Round, First Instance of 2023, CEG

submitted a bid for the AREA OFF-3 block, offshore Uruguay. The

Company is pleased to advise that on 2 June 2023, Administración

Nacional de Combustibles Alcohol y Pórtland ("ANCAP"), the

Uruguayan national regulatory agency, published on its website that

CEG 's offer for AREA OFF-3 was received, outlined the terms of

CEG's offer, and noted that there are now no further available

offshore blocks in Uruguay. No other offers for AREA OFF-3 are

referenced in ANCAP's communication.

The Company is advised that this thus represents the precursor

step to formal award of the block to CEG, with the process of

finalising the award expected to take 3-4 weeks. Refer to

https://exploracionyproduccion.ancap.com.uy/innovaportal/file/18158/1/2023-05-rua-first-instance-2023-v3.pdf

The award of AREA OFF-3 will expand the Company's licence

holding in Uruguay to two blocks, in the offshore Punta del Este

and Pelotas sedimentary basins (AREA OFF-1 and AREA OFF-3), and

will position the Company's acreage on either side of Shell's AREA

OFF-2 block.

AREA OFF-3 has many operational and subsurface similarities to

the AREA OFF-1 licence: comparable size acreage in similar water

depths, both exhibit multiple, stratigraphic plays and complement

each other with play diversity while demonstrating similar

exploration upside.

The commercial terms and work program bid by CEG for the AREA

OFF-3 licence are similar to those for the AREA OFF-1 licence,

providing for an initial 4-year exploration period, during which

CEG will be required to reprocess approximately 1,000 kilometres of

legacy 2D seismic and undertake two new geotechnical studies. The

Company expects that the cost of the work program in the initial

4-year exploration period will be approx. US$100,000 per annum.

Apart from the costs of completion of the minimum work program

there are no annual licence fee payments, no seismic acquisition

(2D or 3D) or drilling is required in the initial 4-year period,

and extension into a second exploration period is at CEG's

discretion.

About AREA OFF-3

The AREA OFF-3 licence has a total area of 13,252 km(2) and is

situated in water depths from 20 to 1,000 meters, approximately 100

kilometres off the Uruguayan coast (refer to the map link in

Appendix A). Mapped prospects of interest are in relatively modest

water depths of 250 metres.

There has been considerable prior seismic activity and interest

on the AREA OFF-3 block, comprising 4,000 kms of legacy 2D (various

vintages) and 7,000 kms legacy 3D (2012 proprietary acquisition by

BP and leading seismic vendor PGS). The block was previously held

by BP, but was relinquished in 2016. There are no prior wells on

the block.

Two material-sized prospects have previously been identified and

mapped on AREA OFF-3 (BP & ANCAP), as follows:

-- Amalia: resource estimate (EUR mmboe, gross): P10/50/90

(ANCAP) 2,189 / 980 / 392 - the Amalia prospect straddles the

boundary with Shell's AREA OFF-2, with an estimated 25% of the

Amalia prospect contained within AREA OFF-3, and

-- Morpheus: resource Estimate (EUR TCF, gross): P10/50/90

(ANCAP) - 8.96 / 2.69 / 0.84 - the Morpheus prospect is entirely

contained with AREA OFF-3.

During the initial 4-year exploration period, CEG's technical

focus will be on the re-evaluation of the existing 2D and 3D

seismic data on the block, given the renewed interest in the types

of plays present in Uruguay triggered by the recent conjugate

margin discoveries offshore Southwest Africa. In particular, the

data and enhanced technical understanding provided from recent

activities in Namibia provides greater confidence that the regional

petroleum system charging Venus and Graff (offshore Namibia) is

likely to be present offshore Uruguay. As a result, traps that

exhibit effective sealing mechanisms, and which may previously have

been overlooked or not considered viable, are now potential

exploration targets.

Moreover, AREA OFF-3 has the advantage of the majority of the

block being covered by 3D (2012 vintage, proprietary acquisition by

BP and PGS) that could be reassessed and subjected to the latest

reprocessing technology - both in terms of reviewing existing known

prospects / plays and identifying potential new prospects / plays.

In addition, with the Amalia prospect straddling the border with

AREA OFF-2, it potentially facilitates a joint exploration

assessment with Shell (since May 2022 the AREA OFF-2 licence

holder).

As noted by ANCAP, "with this new offer [to CEG], there are no

more areas available under the Open Uruguay Round". An updated map

indicating the current and proposed licence position in Uruguay, as

published by ANCAP on 2 June 2023, is included in Appendix A.

AREA OFF-3 Licence Terms

The following Table 1 presents a summary of the key AREA OFF-3

licence terms, as bid by CEG. As noted, these are similar to the

terms applicable for AREA OFF-1, apart from the minimum work

commitment obligation and associated cost for the 2D seismic

reprocessing commitment: i.e., 1000 kms for AREA OFF-3 vs 2,000 kms

for AREA OFF-1.

Item Licence Provision Comment

Operator: CEG

-------------------------------------- -----------------------------------

Participating CEG 100%. ANCAP has the right to participate

Interest: ANCAP has the right to (up to 20%) in each commercial

back-in for up to a 20% field that is developed.

Participating Interest. To exercise that right ANCAP

must fund its relevant percentage

share of costs (including

back costs).

No limitation on CEG being

able to farm-down its working

interest.

-------------------------------------- -----------------------------------

Exploration Three exploration phases, No drilling obligation in

Periods and either: initial 4-year exploration

Minimum Work * Option 1: 4+3+3 or period.

Obligations

("MWO"): CEG can elect, but is not

* Option 2: 4+2+3 required, to enter into

Phase 2 or Phase 3 exploration

period.

Both Option 1 and 2 have

an initial 4-year exploration

period. Minimum work obligation

in this period is G&G studies

and reprocessing of 1,000

kms of legacy 2D seismic.

In Option 1 if the operator

elects to move into the

2(nd) exploration period

for 3 years, a single exploration

well is required, but there

is no relinquishment obligation.

Option 2 allows for a shorter

2(nd) exploration period

of 2 years with a 50% relinquishment

obligation and a requirement

to undertake technical

work to an agreed level,

but no drilling obligation.

Both Option 1 and Option

2 thereafter require drilling

of two wells if the operator

elects to move into the

final 3-year exploration

period, with a 30% relinquishment

obligation.

-------------------------------------- -----------------------------------

Minimum cost None specified. CEG estimates the Minimum

of MWO: Work Obligation in Phase

1 will be approximately

US$100,000 per annum.

-------------------------------------- -----------------------------------

Contract 30 years, with right to Development period can be

Term: extend to 40 years. declared at such time as

operator wishes - thus allowing

for development period of

+25 years.

-------------------------------------- -----------------------------------

Fiscal Terms: No royalties, signature An attractive, internationally

bonus, or annual rentals. comparable fiscal regime

Licence regime is based in a stable, well-regulated

on CEG as operator undertaking environment.

work and recovering costs

based on a Cost Oil model,

and thereafter a sharing

of income between CEG and

ANCAP based on a standard

industry "R factor" model

(a revenue/cost ratio model).

CEG net profit is then

taxed at normal Uruguay

corporate income tax rate

(25%).

-------------------------------------- -----------------------------------

Other Costs: The licence mandates annual No annual licence fees.

contributions to various

education and social funds

and initiatives, of approximately

US$50,000 per annum.

-------------------------------------- -----------------------------------

For further information, please contact:

Challenger Energy Group PLC Tel: +44 (0) 1624 647

Eytan Uliel, Chief Executive Officer 882

WH Ireland - Nomad and Joint Broker Tel: +44 (0) 20 7220

Antonio Bossi / Darshan Patel / Enzo 1666

Aliaj

Zeus - Joint Broker Tel: +44 (0) 20 3829

Simon Johnson 5000

Gneiss Energy Limited - Financial Tel: +44 (0) 20 3983

Adviser 9263

Jon Fitzpatrick / Paul Weidman / Doug

Rycroft

CAMARCO Tel: +44 (0) 20 3757

Billy Clegg / James Crothers / Hugo 4980

Liddy

Notes to Editors

Challenger Energy is a Caribbean and Americas focused oil and

gas company, with a range of oil production, development,

appraisal, and exploration assets in the region. The Company's

primary assets are located in Uruguay, where the Company holds high

impact offshore exploration licences, and in Trinidad and Tobago,

where the Company has a number of producing fields and

earlier-stage exploration / appraisal projects.

Challenger Energy is quoted on the AIM market of the London

Stock Exchange.

https://www.cegplc.com

COMPETENT PERSON STATEMENT

In accordance with the AIM Note for Mining and Oil & Gas

Companies, CEG discloses that Mr. Randolph Hiscock is the qualified

person who has reviewed the technical information contained in this

announcement. He has a Masters in Science (Geology) and is a member

of the AAPG & PESGB, and has over 35 years' experience in the

oil and gas industry. Randolph Hiscock consents to the inclusion of

the information in the form and context in which it appears.

ENDS

ANNEXURE: UPDATED URUGUAY OFFSHORE LICENCE HOLDINGS

Source: ANCAP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFZGGVVDRGFZM

(END) Dow Jones Newswires

June 05, 2023 02:00 ET (06:00 GMT)

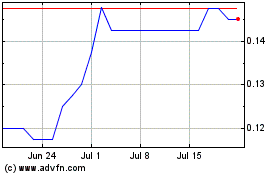

Challenger Energy (AQSE:CEG.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Challenger Energy (AQSE:CEG.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024